Form 425 - Prospectuses and communications, business combinations

17 December 2024 - 9:02AM

Edgar (US Regulatory)

Filed by The Shyft Group, Inc.

(Commission File No.: 001-33582)

Pursuant to Rule 425 of the Securities Act of 1933

Subject Company: The Shyft Group, Inc.

(Commission File No.: 001-33582)

The following communication was posted on LinkedIn by The Shyft

Group, Inc. (“Shyft”) on December 16, 2024 regarding Shyft’s proposed merger with Aebi Schmidt Holding AG (“Aebi

Schmidt”):

No offer or solicitation

This communication is for informational purposes only and is not intended

to and shall not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell, any securities, or a solicitation

of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities

shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended (“Securities Act”),

or pursuant to an exemption from, or in a transaction not subject to, such registration requirements.

Participants in the Solicitation

Shyft, Aebi Schmidt and certain of their respective directors and executive

officers and other members of their respective management and employees may be deemed to be participants in the solicitation of proxies

in connection with the proposed transaction. Information regarding the persons who may, under the rules of the Securities and Exchange

Commission (“SEC”), be deemed participants in the solicitation of proxies in connection with the proposed transaction,

including a description of their direct or indirect interests in the transaction, by security holdings or otherwise, will be set forth

in the combined proxy statement/prospectus and other relevant materials when it is filed with the SEC. Information regarding the directors

and executive officers of Shyft is contained in the sections entitled “Election of Directors” and “Ownership

of Securities” included in Shyft’s proxy statement for the 2024 annual meeting of stockholders, which was filed with the

SEC on April 3, 2024 (and which is available at https://www.sec.gov/ix?doc=/Archives/edgar/data/743238/000114036124017592/ny20010675x1_def14a.htm)

and in the section entitled “Directors, Executive Officers and Corporate Governance” included in Shyft’s Annual

Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on February 22, 2024 (and which is available at

https://www.sec.gov/ix?doc=/Archives/edgar/data/743238/000143774924005136/shyf20231231c_10k.htm), and certain of its Current Reports

filed on Form 8-K. These documents can be obtained free of charge from the sources indicated below.

Additional information and where to find it

Aebi Schmidt will file a registration statement on Form S-4 with the

SEC in connection with the proposed transaction. The Form S-4 will contain a combined proxy statement/prospectus of Shyft and Aebi Schmidt.

Aebi Schmidt and Shyft will prepare and file the combined proxy statement/prospectus with the SEC and Shyft will mail the combined proxy

statement/prospectus to its stockholders and file other documents regarding the proposed transaction with the SEC. This communication

is not a substitute for any registration statement, proxy statement/prospectus or other documents that may be filed with the SEC in connection

with the proposed transaction. INVESTORS SHOULD READ THE COMBINED PROXY STATEMENT/PROSPECTUS WHEN AVAILABLE AND SUCH OTHER DOCUMENTS FILED

OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THE COMBINED PROXY STATEMENT/PROSPECTUS

AND SUCH DOCUMENTS, BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, BECAUSE THEY CONTAIN IMPORTANT INFORMATION.

The Form S-4, the combined proxy statement/prospectus and all other documents filed with the SEC in connection with the transaction will

be available when filed free of charge on the SEC’s web site at www.sec.gov. Copies of documents filed with the SEC by Shyft will

be made available free of charge on Shyft’s investor relations website at https://theshyftgroup.com/investor-relations/.

Forward-Looking Statements

Certain statements in this Current Report on Form 8-K are forward-looking

statements. In some cases, Shyft has identified forward-looking statements by such words or phrases as “will likely result,”

“is confident that,” “expect,” “expects,” “should,” “could,” “may,”

“will continue to,” “believe,” “believes,” “anticipates,” “predicts,” “forecasts,”

“estimates,” “projects,” “potential,” “intends” or similar expressions identifying “forward-looking

statements”, including the negative of those words and phrases. Such forward-looking statements are based on management’s

current views and assumptions regarding future events, future business conditions and the outlook for Shyft based on currently available

information. These forward-looking statements may include projections of Shyft’s future financial performance, Shyft’s anticipated

growth strategies and anticipated trends in Shyft’s business. These statements are only predictions based on management’s

current expectations and projections about future events. These statements involve known and unknown risks, uncertainties and other factors

that may cause actual results to be materially different from any results, levels of activity, performance or achievements expressed or

implied by any forward-looking statement and may include statements regarding the expected timing and structure of the proposed transaction;

the ability of the parties to complete the proposed transaction considering the various closing conditions; the expected benefits of the

proposed transaction, such as improved operations, enhanced revenues and cash flow, synergies, growth potential, market profile, business

plans, expanded portfolio and financial strength; the competitive ability and position of the combined company following completion of

the proposed transaction; and anticipated growth strategies and anticipated trends in Shyft’s, Aebi Schmidt’s and, following

the completion of the proposed transaction, the combined company’s business.

Additional factors that could cause actual results, level of activity,

performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied

by the forward-looking statements include, among others, the non-satisfaction or non-waiver, on a timely basis or otherwise, of one or

more closing conditions to the proposed transaction; the prohibition or delay of the consummation of the proposed transaction by a governmental

entity; the risk that the proposed transaction may not be completed in the expected time frame; unexpected costs, charges or expenses

resulting from the proposed transaction; uncertainty of the expected financial performance of the combined company following completion

of the proposed transaction; failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in

completing the proposed transaction or integration; the ability of the combined company to implement its business strategy; difficulties

and delays in achieving revenue and cost synergies of the combined company; inability to retain and hire key personnel; negative changes

in the relationships with major customers and suppliers that adversely affect revenues and profits; disruptions to existing business operations;

the occurrence of any event that could give rise to termination of the proposed transaction; potential litigation in connection with the

proposed transaction or other settlements or investigations that may affect the timing or occurrence of the contemplated transaction or

result in significant costs of defense, indemnification and liability; risks related to ownership of Aebi Schmidt common stock; uncertainty

as to the long-term value of the combined company’s common stock; and the diversion of Shyft’s and Aebi Schmidt’s management’s

time on transaction-related matters. These risks, as well as other risks associated with the businesses of Shyft and Aebi Schmidt, will

be more fully discussed in the combined proxy statement/prospectus. Although management believes the expectations reflected in the forward-looking

statements are reasonable, Shyft cannot guarantee future results, level of activity, performance or achievements. Moreover, neither management,

Shyft nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Shyft

wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Shyft

is under no duty to and specifically declines to undertake any obligation to publicly revise or update any of these forward-looking statements

after the date of this communication to conform its prior statements to actual results, revised expectations or to reflect the occurrence

of anticipated or unanticipated events.

Additional information concerning these and other factors that may impact

Shyft’s and Aebi Schmidt’s expectations and projections can be found in Shyft’s periodic filings with the SEC, including

Shyft’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, and any subsequent Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K. Shyft’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

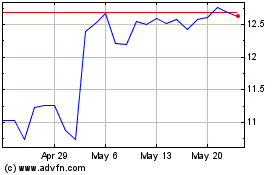

Shyft (NASDAQ:SHYF)

Historical Stock Chart

From Nov 2024 to Dec 2024

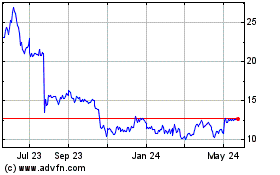

Shyft (NASDAQ:SHYF)

Historical Stock Chart

From Dec 2023 to Dec 2024