Filed by The Shyft Group, Inc.

(Commission File No.: 001-33582)

Pursuant to Rule 425 of the Securities Act of 1933

Subject Company: The Shyft Group, Inc.

(Commission File No.: 001-33582)

Press release

|

Aebi Schmidt Group successfully signs a syndicated loan for 600 million US dollars

|

CH-Frauenfeld, March 11, 2025 – Aebi Schmidt Group is pleased to announce the successful closing of a USD 600 million syndicated loan agreement. The financing was arranged by UBS Switzerland AG and Zürcher Kantonalbank and was significantly oversubscribed. The agreement is a milestone in the success of Aebi Schmidt Group's planned Nasdaq listing.

Barend Fruithof, Group CEO of Aebi Schmidt and designated Group CEO of the new combined company, is very pleased. “I am thrilled and grateful for this successful syndication. It demonstrates the strong support of all involved banks for this transaction and for the new company, which is twice as large as before.”

The syndication was significantly oversubscribed with commitments from 16 Swiss, US and European banks. The signing of the credit agreement, which will come into effect concurrent with the successful closing of the merger with The Shyft Group, follows just three months after the signing of the merger agreement with The Shyft Group on 16 December 2024 and will secure the financing of the new combined group for the next few years. This means that the next milestone on the way to closing has been reached.

The senior secured, multicurrency credit agreement includes a partially amortising credit facility in a total amount of $350 million and a revolving credit facility of $250 million, with a term of five years after the first drawdown.

|

Media contact

Barend Fruithof

CEO Aebi Schmidt Group

barend.fruithof@aebi-schmidt.com

Phone: +41 44 308 58 68

Thomas Schenkirsch

Head Group Strategic Development

thomas.schenkirsch@aebi-schmidt.com

Phone: +41 44 308 58 55

Aebi Schmidt Holding AG

Schulstrasse 4 | 8500 Frauenfeld | Switzerland

|

Further information

https://www.aebi-schmidt.com

https://www.youtube.com/user/AebiSchmidtGroup

https://media.aebi-schmidt.com (pictures, logos)

|

About the Aebi Schmidt Group

The Aebi Schmidt Group is a global leader in intelligent solutions for customers who care for clean and safe infrastructure and cultivate challenging grounds. The unique variety of its range of products comprises its own vehicles as well as innovative attachable and demountable devices for individual vehicle equipment. The products combined with a support and service programme perfectly tailored to sophisticated customer needs offer the appropriate solution to nearly any challenge. The globally active Group with headquarters in Switzerland has generated net sales of over 1 billion EUR in 2024 and has recently announced that it will merge with The Shyft Group and go public on the New York Stock Exchange NASDAQ. It currently employs around 3,000 people in 16 sales organisations and over a dozen production facilities worldwide. The company is represented in a further 90 countries through established dealer partnerships. The portfolio consists of the product brands Aebi, Schmidt, Nido, Arctic, Ladog, Monroe, Towmaster, Swenson, Meyer, MB, ELP – all well-established on the market, some of which have been represented for more than 100 years.

About The Shyft Group

Shyft is the North American market leader in the manufacturing, assembly, and upgrading of specialty vehicles for the commercial, retail, and service vehicle markets. The company has 50 years of experience serving customers, including federal, state, and municipal agencies, craft businesses, and utility and infrastructure companies. The Shyft Group is divided into two core business areas: Shyft Fleet Vehicles and Services™ and Shyft Specialty Vehicles™. Today, the brand family includes Utilimaster®, Blue Arc™ EV Solutions, Royal® Truck Body, DuraMag®, and Magnum®, Strobes-R-Us, Spartan® RV Chassis, Red Diamond™ Aftermarket Solutions, Builtmore Contract Manufacturing™, and Independent Truck Upfitters. The Shyft Group and its brands are market leaders in their respective industries, known for quality, durability, and innovative products. The company employs around 3,000 staff and contractors at 19 locations and operates plants in Arizona, California, Florida, Indiana, Iowa, Maine, Michigan, Missouri, Pennsylvania, Tennessee, Texas, and Saltillo, Mexico. The company reported revenue of USD 786 million in 2024. Learn more on www.TheShyftGroup.com.

*

Forward-Looking Statements

Certain statements in this press release are forward-looking statements. In some cases, forward-looking statements are identified by such words or phrases as “will likely result,” “is confident that,” “expect,” “expects,” “should,” “could,” “may,” “will continue to,” “believe,” “believes,” “anticipates,” “predicts,” “forecasts,” “estimates,” “projects,” “potential,” “intends” or similar expressions identifying “forward-looking statements”, including the negative of those words and phrases. Such forward-looking statements are based on management’s current views and assumptions regarding future events, future business conditions and the outlook for Aebi Schmidt or Shyft based on currently available information. These forward-looking statements may include projections of Aebi Schmidt’s, Shyft’s or the combined company’s future financial performance, their anticipated growth strategies and anticipated trends in their respective businesses. These statements are only predictions based on Aebi Schmidt’s management’s current expectations and projections about future events. These statements involve known and unknown risks, uncertainties and other factors that may cause actual results to be materially different from any results, levels of activity, performance or achievements expressed or implied by any forward-looking statement and may include statements regarding the expected timing and structure of the proposed transaction; the ability of the parties to complete the proposed transaction considering the various closing conditions; the expected benefits of the proposed transaction, such as improved operations, enhanced revenues and cash flow, synergies, growth potential, market profile, business plans, expanded portfolio and financial strength; the competitive ability and position of the combined company following completion of the proposed transaction; and anticipated growth strategies and anticipated trends in Aebi Schmidt’s, Aebi Schmidt’s and, following the completion of the proposed transaction, the combined company’s business.

Additional factors that could cause actual results, level of activity, performance or achievements to differ materially from the results, level of activity, performance or achievements expressed or implied by the forward-looking statements include, among others, the non-satisfaction or non-waiver, on a timely basis or otherwise, of one or more closing conditions to the proposed transaction; the prohibition or delay of the consummation of the proposed transaction by a governmental entity; the risk that the proposed transaction may not be completed in the expected time frame; unexpected costs, charges or expenses resulting from the proposed transaction; uncertainty of the expected financial performance of the combined company following completion of the proposed transaction; failure to realize the anticipated benefits of the proposed transaction, including as a result of delay in completing the proposed transaction or integration; the ability of the combined company to implement its business strategy; difficulties and delays in achieving revenue and cost synergies of the combined company; inability to retain and hire key personnel; negative changes in the relationships with major customers and suppliers that adversely affect revenues and profits; disruptions to existing business operations; the occurrence of any event that could give rise to termination of the proposed transaction; potential litigation in connection with the proposed transaction or other settlements or investigations that may affect the timing or occurrence of the contemplated transaction or result in significant costs of defense, indemnification and liability; risks related to ownership of Aebi Schmidt’s common stock; uncertainty as to the long-term value of the combined company’s common stock; and the diversion of Aebi Schmidt’s and Aebi Schmidt’s management’s time on transaction-related matters. These risks, as well as other risks associated with the businesses of Aebi Schmidt and Shyft, will be more fully discussed in the combined proxy statement/prospectus. Although management believes the expectations reflected in the forward-looking statements are reasonable, Aebi Schmidt cannot guarantee future results, level of activity, performance or achievements. Moreover, neither management, Aebi Schmidt nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. Aebi Schmidt wishes to caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Aebi Schmidt is under no duty to and specifically declines to undertake any obligation to publicly revise or update any of these forward-looking statements after the date of this press release to conform its prior statements to actual results, revised expectations or to reflect the occurrence of anticipated or unanticipated events.

No offer or solicitation

This communication is for informational purposes only and is not intended to and shall not constitute an offer to buy or sell, or the solicitation of an offer to buy or sell, any securities, or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made in the United States absent registration under the U.S. Securities Act of 1933, as amended (“Securities Act”), or pursuant to an exemption from, or in a transaction not subject to, such registration requirements.

Participants in the Solicitation

Aebi Schmidt Holding AG and its affiliates (collectively, “Aebi Schmidt Group”) and certain of their respective directors and executive officers and other members of their respective management and employees may be deemed to be participants in the solicitation of proxies in connection with the proposed transaction. Information regarding the persons who may, under the rules of the Securities and Exchange Commission (“SEC”), be deemed participants in the solicitation of proxies in connection with the proposed transaction, including a description of their direct or indirect interests in the transaction, by security holdings or otherwise, will be set forth in the combined proxy statement/prospectus and other relevant materials when it is filed with the SEC.

Certain Financial Measures

Certain financial measures used herein are not based upon US GAAP. In addition, Adjusted EBITDA is a non-GAAP financial measure that may be different from non-GAAP financial measures used by other companies. Adjusted EBITDA should not be construed as an alternative to net income as an indicator of operating performance or as an alternative to cash flow provided by operating activities as a measure of liquidity.

Certain amounts related to the transaction described herein have been expressed in U.S. dollars or Euros for convenience and, when expressed in U.S. dollars or Euros in the future, such amounts may be different from those set forth herein.

Additional information and where to find it

Aebi Schmidt will file a registration statement on Form S-4 with the SEC in connection with the proposed transaction. The Form S-4 will contain a combined proxy statement/prospectus of Aebi Schmidt and Shyft. Aebi Schmidt and Shyft will prepare and file the combined proxy statement/prospectus with the SEC and Shyft will mail the combined proxy statement/prospectus to its stockholders and file other documents regarding the proposed transaction with the SEC. This communication is not a substitute for any registration statement, proxy statement/prospectus or other documents that may be filed with the SEC in connection with the proposed transaction. INVESTORS SHOULD READ THE COMBINED PROXY STATEMENT/PROSPECTUS WHEN AVAILABLE AND SUCH OTHER DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THE COMBINED PROXY STATEMENT/PROSPECTUS AND SUCH DOCUMENTS, BEFORE THEY MAKE ANY DECISION WITH RESPECT TO THE PROPOSED TRANSACTION, BECAUSE THEY CONTAIN IMPORTANT INFORMATION. The Form S-4, the combined proxy statement/prospectus and all other documents filed with the SEC in connection with the transaction will be available when filed free of charge on the SEC’s web site at www.sec.gov.

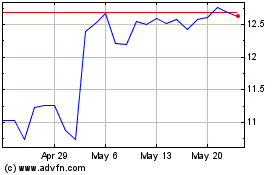

Shyft (NASDAQ:SHYF)

Historical Stock Chart

From Feb 2025 to Mar 2025

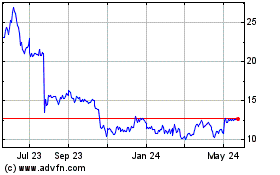

Shyft (NASDAQ:SHYF)

Historical Stock Chart

From Mar 2024 to Mar 2025