Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

22 May 2024 - 6:57AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of: May 2024

Commission File Number: 000-27663

SIFY TECHNOLOGIES LIMITED

(Translation of registrant’s name into English)

Tidel Park, Second Floor

No. 4, Rajiv Gandhi Salai, Taramani

Chennai 600 113, India

(91) 44-2254-0770

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x

Form 40-F ¨

The Registrant issued a press release on May 21, 2024, a copy of which

is attached hereto as Exhibit 99.1.

EXHIBIT INDEX

Signature

Pursuant to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 21, 2024

| |

For Sify Technologies Limited |

| |

|

|

| |

By: |

/s/ M P Vijay Kumar |

| |

|

Name: M P Vijay Kumar |

| |

|

Title: Chief Financial Officer and

Whole time director |

Exhibit 99.1

| For immediate release |

|

Sify Technologies Ltd.

Announces Key Dates for Rights Offering

Chennai, India, May 21, 2024/PRNewswire/ —

Sify Technologies Ltd. (Nasdaq: Sify) (the “Company”) is a leading integrated information communications technology (or

ICT) Solutions and Services provider in India. The Company’s infrastructure comprises state-of-the-art Data Centers, the largest

MPLS network, partnership with global technology majors, and deep expertise in business transformation solutions modelled on the cloud.

The Company today announced its record date and

expected subscription period for its previously-announced rights offering to issue up to 250,000,000 new equity shares, including equity

shares represented by American Depositary Shares (“ADSs”).

In the rights offering, the Company will distribute,

at no charge, (1) to the holders of its equity shares, transferable rights to subscribe for new equity shares and, (2) through Citibank,

N.A., the depositary for the ADSs (the “Depositary”), to holders of ADSs, transferable rights to subscribe for new equity

shares in the form of ADSs. Holders of ADSs will receive 1.36364 ADS rights for each ADS owned of record at 5:00 p.m. (New York City time)

on May 31, 2024, which is the ADS record date. 0.73 ADS rights will entitle the holder of such rights to subscribe for and purchase

one new ADS at a price of $0.14 per ADS. The ADS Subscription Price includes the Depositary fee of US$0.02 per new ADS subscribed in the

rights offering. Holders of equity shares will receive 1.36364 equity share rights for each equity share owned of record at 6:00 p.m.

(Chennai, India time) on May 31, 2024, which is the equity share record date. 0.73 equity share rights will entitle a holder of such rights

to subscribe for and purchase one new equity share, at a subscription price of Rs. 10 per new equity share, which is the Indian Rupee

equivalent of the U.S. dollar price per new ADS, translated based on the exchange rate in effect as of March 31, 2024, minus the Depositary

fee.

The subscription period for the rights offering

is expected to commence on June 7, 2024, and to terminate on June 21, 2024. The Company will disclose the final results of the rights

offering following the expiration date.

The net proceeds of the Rights Offering are expected

to be utilized for expansion of the business in developing Network centric services, Data Center services and Digital Services and for

general corporate purposes.

Other Important Information

A registration statement relating to these securities

has been filed with the Securities and Exchange Commission but has not yet become effective. These securities may not be sold nor may

offers to buy be accepted prior to the time the registration statement becomes effective. The proposed rights offering will be made pursuant

to such registration statement and a prospectus to be filed with the Securities and Exchange Commission prior to the commencement of the

proposed rights offering. A copy of the prospectus forming a part of the Registration Statement, when available, may be obtained free

of charge at the website maintained by the Securities and Exchange Commission at www.sec.gov or by contacting D.F. King & Co., Inc,

the Company’s information agent for the Rights Offering, located at 48 Wall Street, 22nd Floor, New York, New York 10005 by email

at sify@dfking.com.

| For immediate release |

|

The information herein, including the expected

terms of the proposed rights offering, is not complete and is subject to change. The Company reserves the right to cancel or terminate

the planned rights offering at any time. This press release shall not constitute an offer to sell or the solicitation of an offer to buy

nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior

to the registration or qualification under the securities laws of any such jurisdiction.

Safe Harbor Statement

This release contains certain “forward-looking

statements” relating to the Company and its business. These forward-looking statements are often identified by the use of forward-looking

terminology such as “expects”, “intends”, “will”, or similar expressions. Such forward looking statements

involve known and unknown risks and uncertainties that may cause actual results to be materially different from those described herein

as expected, intended or planned. Investors should not place undue reliance on these forward-looking statements, which speak only as of

the date of this press release. The Company’s actual results could differ materially from those anticipated in these forward-looking

statements as a result of a variety of factors, including those discussed in the Company’s reports that are filed with the Securities

and Exchange Commission and available on its website (www.sec.gov). All forward-looking statements attributable to the Company or to persons

acting on its behalf are expressly qualified in their entirety by these factors other than as required under the securities laws. The

Company does not assume a duty to update these forward-looking statements.

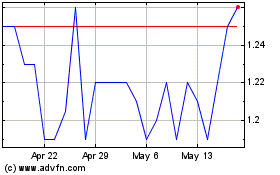

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

From May 2024 to Jun 2024

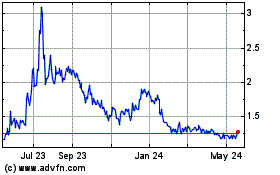

Sify Technologies (NASDAQ:SIFY)

Historical Stock Chart

From Jun 2023 to Jun 2024