As filed with the Securities and Exchange

Commission on July 16, 2024

Registration No. 333-280628

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

AMENDMENT NO. 1

TO

FORM F-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SCIENJOY HOLDING CORPORATION

(Exact Name of Registrant as Specified in Its Charter)

Not Applicable

(Translation of Registrant’s Name Into English)

| British Virgin Islands |

|

Not Applicable |

(State or Other Jurisdiction of

Incorporation or Organization) |

|

(I.R.S. Employer

Identification No.) |

RM 1118, 11th Floor, Building

3, No. 99 Wangzhou Rd., Liangzhu St.

Yuhang District, Hangzhou, Zhejiang Province, 311113,

China

Telephone: (86) 0571 8858 6668

(Address and Telephone Number of Registrant’s

Principal Executive Offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

(Name, Address and Telephone Number of Agent For

Service)

With copies to:

Richard I. Anslow, Esq.

Lijia Sanchez, Esq.

1345 Avenue of the Americas

New York, NY 10105

Phone: (212) 370-1300

Fax: (212) 370-7889

Approximate date of commencement of proposed sale to the public: From

time to time after the effective date of this registration statement.

If the only securities being registered on this

form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on

this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following

box. ☒

If this form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

The Registrant hereby amends this registration

statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may

determine.

| † | The term “new or revised financial accounting standard”

refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

EXPLANATORY NOTE

Pursuant to Rule 429 under

the Securities Act, the prospectus included in this Registration Statement is a combined prospectus relating to (i) Registration Statement

(No. 333-274441) previously filed by the Registrant on Form F-1 on September 8, 2023 and declared effective by the Securities and Exchange

Commission (the “SEC”) on September 28, 2023 (the “First Registration Statement”) and (ii) a new Registration

Statement on Form F-3 that the Registrant files herein (the “Second Registration Statement”).

The First Registration Statement

covered the offering and sale by the selling securityholders identified in the prospectus of up to 11,495,061 of Class A ordinary shares.

The Second Registration Statement covers the offering, issuance and sale by us of up to $250,000,000 of our Class A ordinary shares, preferred

shares, debt securities, warrants, subscriptions rights and/or units.

This Post-Effective Amendment

to Form F-1 on Form F-3 constitutes a Post-Effective Amendment No. 1 to the First Registration Statement and is being filed by the Registrant

to (x) convert the First Registration Statement into a registration statement on Form F-3 and (y) update the First Registration Statement

to incorporate by reference the Registrant’s Annual Report on Form 20-F for the fiscal year ended December 31, 2023 (the “Annual

Report”), which was filed with the SEC on April 26, 2024. This Registration Statement contains an updated prospectus relating to

the offering and sale of the securities that were registered (i) for resale on the First Registration Statement and (ii) for issuance

on the Second Registration Statement. Such post-effective amendments shall hereafter become effective concurrently with the effectiveness

of this Registration Statement in accordance with Section 8(c) of the Securities Act.

All filing fees payable

in connection with the registration of the shares registered by the First Registration Statement were paid by the Registrant at the time

of the filing of the First Registration Statement.

The

information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not

soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT

TO COMPLETION, DATED JULY 16, 2024

SCIENJOY HOLDING CORPORATION

Up to US$250,000,000 of

Class A Ordinary Shares

Preferred Shares

Debt Securities

Warrants

Subscription Rights

Units

11,495,061 Class A Ordinary

Shares Offered by the Selling Shareholders

We may offer, issue and sell from time to time

up to $250,000,000 of our Class A ordinary shares, preferred shares, debt securities, warrants, subscription rights and a combination

of such securities, separately or as units, in one or more offerings. The securities offered pursuant to this prospectus are collectively

referred to in this prospectus as the “securities.” This prospectus provides a general description of offerings of these securities

that we may undertake.

In addition, selling shareholders named in this

prospectus or their transferees may, from time to time in one or more offerings, offer and sell up to 11,495,061 of our Class A ordinary

shares. We will not receive any proceeds from the sale of our Class A ordinary shares by selling shareholders, but we may pay certain

registration and offering fees and expenses associated with the registration and sale of those securities. See “Selling Shareholders.”

Investors are cautioned that the securities

may be offered under this prospectus are securities of Scienjoy Holding Corporation, our British Virgin Islands holding company, which

is not a Chinese operating company nor does it have any substantive business operations. Scienjoy Holding Corporation conducts business

in China through the consolidated variable interest entities, or the “VIEs”, and the VIE’s subsidiaries.

This prospectus describes the general terms of

these securities and the general manner in which these securities will be offered. Each time we sell our securities pursuant to this prospectus,

we will provide the specific terms of such offering in a supplement to this prospectus. The prospectus supplement may also add, update,

or change information contained in this prospectus. You should read this prospectus, the applicable prospectus supplement, together with

the additional information described under the heading “Where You Can Find More Information,” before you make your investment

decision.

We may, from time to time, sell the securities,

directly or through underwriters, agents or dealers, on or off The Nasdaq Stock Market LLC, or Nasdaq, at prevailing market prices or

at privately negotiated prices. If any underwriters, agents or dealers are involved in the sale of any of these securities, the applicable

prospectus supplement will set forth the names of the underwriters, agents or dealers and any applicable fees, commissions or discounts.

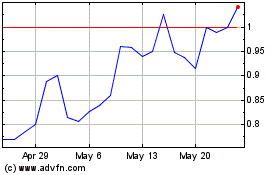

Our Class A ordinary shares are listed on

the Nasdaq Capital Market under the symbol “SJ.” On July 10, 2024, the closing price of the Class A ordinary shares on Nasdaq

was US$0.935 per share.

As of June 7, 2024, the aggregate market value

of our issued and outstanding Class A ordinary shares held by non-affiliates, or public float, was approximately US$34.8 million, which

was calculated based on 31,368,252 Class A ordinary shares issued and outstanding held by non-affiliates and a per share price of US$1.11

as reported on the Nasdaq Capital Market on such date. We have not offered any securities pursuant to General Instruction I.B.5.of Form

F-3 during the prior 12-calendar-month period that ends on and includes the date of this prospectus. Pursuant to General Instruction I.B.5.

of Form F-3, in no event will we sell securities registered on this registration statement with a value exceeding one-third of our public

float in any 12-month period so long as our public float remains below US$75 million.

Investing in these securities

involves a high degree of risk. Please carefully consider the risks discussed under “Risk Factors” in this prospectus beginning

on page 15, in our reports filed with the Securities and Exchange Commission that are incorporated by reference in this prospectus, and

in any applicable prospectus supplement.

Scienjoy Holding Corporation is not a Chinese

operating company but a British Virgin Islands holding company with operations conducted by its subsidiaries and through contractual arrangements

with the variable interest entities, or “VIEs,” based in China. Scienjoy Holding Corporation currently operates majority of

the businesses in China through Zhihui Qiyuan (Beijing) Technology, Co. Ltd. (“Zhihui Qiyuan”), Sixiang Qiyuan (Hangzhou)

Culture Technology Co., Ltd. (“Sixiang Qiyuan”) and their respective subsidiaries, which are collectively referred to as the

“VIEs” in this prospectus. “Our PRC subsidiaries” refer to our wholly foreign owned entities (the “WFOEs”),

Sixiang Wuxian (Beijing) Technology Co., Ltd. (“WXBJ”), Sixiang Wuxian (Zhejiang) Culture Technology Co., Ltd. (“WXZJ”)

and their respective subsidiaries. We may in the future commence or acquire businesses that are subject to the restrictions with respect

to value-added telecommunications services as set out in the Negative List (2021 Version) promulgated by the Ministry of Commerce, or

MOFCOM, and the National Development and Reform Commission, or the NDRC. A series of contractual agreements, including equity interest

pledge agreement, exclusive call option agreement, exclusive business cooperation agreement, power of attorney and financial support undertaking

letters, have been entered into by and among our WFOEs, the VIE and its shareholders. For more details of these contractual arrangements,

see “Item 4. Information on the Company — C. Organizational Structure — Contractual Arrangements among WFOEs, the

VIEs and the Shareholders of the VIEs” in our most recent Annual Report on Form 20-F, which is incorporated by reference in

this prospectus. Unless otherwise indicated or the context otherwise requires, references in this prospectus to “we,” “us,”

“our,” or “the Company” are to Scienjoy Holding Corporation, its subsidiaries, and, in the context of describing

our consolidated financial information, include the affiliated entities.

The VIE structure is used to provide contractual

exposure to foreign investment in China-based companies where the PRC law prohibits or restricts direct foreign investment in the operating

companies. Neither the investors nor we ourselves have an equity ownership in, direct foreign investment in, or control of, through such

ownership or investment, the VIEs. Instead, we receive the economic benefits of the VIEs’ business operation through a series of

contractual agreements with the VIEs and these agreements have not been tested in court. Because of these contractual arrangements, we

are the primary beneficiary of the VIEs for accounting purposes and able to consolidate the financial results of the VIEs and its subsidiaries

with ours only if we meet the conditions for consolidation under U.S. GAAP. However, our contractual arrangements with the VIEs are not

equivalent of an investment in the VIEs. The VIE structure involves unique risks to investors. Investors are purchasing equity securities

of our ultimate British Virgin Islands holding company rather than purchasing equity securities of the VIEs, and investors may never hold

equity interests in the VIEs.

Our corporate structure is subject to risks associated

with our contractual arrangements with the VIEs. These contractual arrangements have not been properly tested in a court of law and the

PRC regulatory authorities could disallow the VIE structure at any time. If the PRC government finds that the agreements that establish

the structure for operating our business do not comply with PRC laws and regulations, or if these regulations or their interpretations

change in the future, we could be subject to severe penalties or be forced to relinquish our interests in those operations, our ability

to treat the VIEs and its subsidiaries as the consolidated affiliated entities under U.S. GAAP may be restricted, and our ability to develop

e-commerce business through the VIEs and the prospect of our company may be materially and adversely affected. For details, see “Item

3. Key Information — D. Risk Factors — Risks Related to Doing Business in China” and “Item 3. Key Information

— D. Risk Factors — Risks Related to Our Corporate Structure” in our most recent Annual Report on Form 20-F, which

is incorporated by reference in this prospectus.

We and the VIEs face various legal and operational

risks and uncertainties related to being based in and having significant operations in China. For example, we and our affiliated entities

face risks and uncertainties associated with the fact that the PRC government has significant authority in regulating a China-based company

and may influence or intervene its operations at any time. The PRC government has recently issued statements and regulatory actions relating

to areas such as regulatory approvals of offshore offerings by, and foreign investment in, China-based issuers, anti-monopoly regulatory

actions, and oversight on data security, which may impact our ability to conduct certain businesses, accept foreign investments, or list

on U.S. or other foreign exchanges. Potential actions taken by the PRC government could significantly limit or completely hinder our ability

to offer securities to investors and cause the value of such securities to significantly decline or in extreme cases, become worthless.

For further details, see “Item 3. Key Information — D. Risk Factors — Risks Related to Doing Business in China”

in our most recent Annual Report on Form 20-F, which is incorporated by reference in this prospectus.

On February 17, 2023, the China Securities Regulatory

Commission, or the CSRC, promulgated Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies,

or the Overseas Listing Trial Measures, and five supporting guidelines, which became effective on March 31, 2023. According to the Overseas

Listing Trial Measures, PRC domestic companies that seek to offer and list securities in overseas markets, either in direct or indirect

means, which also includes VIE structure, are required to fulfill the filing procedure with the CSRC and report relevant information.

Any future offering pursuant to a prospectus supplement to this prospectus will be subject to the Overseas Listing Trial Measures, and

we are required to file for record through our major operating entity incorporated in the PRC with the CSRC within three business days

after the completion of the initial offering pursuant to a prospectus supplement to this prospectus and make a summary report to the CSRC

after the completion of offerings under this prospectus. There can be no assurance that we can complete the filing procedures, obtain

the approvals or authorizations, or complete required procedures or other requirements in a timely manner, or at all. Any failure of us

to fully comply with the regulatory requirements may subject us to regulatory actions, such as warnings and fines, which may limit our

operating privileges in China, delay or restrict the repatriation of the proceeds from offshore fund- raising activities into the PRC

or take other actions that could materially adversely affect our business, financial condition, results of operations, reputation and

prospects, as well as the trading price of our Class A ordinary shares. For further details, see “Item 3. Key Information —

D. Risk Factors — Risks Related to Doing Business in China” in our most recent Annual Report on Form 20-F, which is incorporated

by reference in this prospectus.

Our PRC subsidiaries and the VIEs receive substantially

all of their revenue in Renminbi. Renminbi is not freely convertible into other currencies. As a result, any restriction on currency exchange

may limit the ability of our PRC subsidiaries to use their potential future Renminbi revenues to pay dividends to us. The Chinese government

imposes controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China.

Shortages in availability of foreign currency may then restrict the ability of our PRC subsidiaries to remit sufficient foreign currency

to our offshore entities for our offshore entities to pay dividends or make other payments or otherwise to satisfy our foreign-currency-denominated

obligations. The Renminbi is currently convertible under the “current account,” which includes dividends, trade and service-related

foreign exchange transactions, but not under the “capital account,” which includes foreign direct investment and foreign currency

debt. Currently, our PRC subsidiaries may purchase foreign currency for settlement of “current account transactions,” including

payment of dividends to us, without the approval of the State Administration of Foreign Exchange of China (“SAFE”) by complying

with certain procedural requirements. However, the relevant Chinese governmental authorities may limit or eliminate our ability to purchase

foreign currencies in the future for current account transactions. The Chinese government may continue to strengthen its capital controls,

and additional restrictions and substantial vetting processes may be instituted by SAFE for cross-border transactions falling under both

the current account and the capital account. Any existing and future restrictions on currency exchange may limit our ability to utilize

revenue generated in Renminbi to fund our business activities outside of China or pay dividends in foreign currencies to holders of our

securities. Foreign exchange transactions under the capital account remain subject to limitations and require approvals from, or registration

with, SAFE and other relevant Chinese governmental authorities. This could affect our ability to obtain foreign currency through debt

or equity financing for our subsidiaries. For further details, see “Item 3. Key Information — D. Risk Factors —

Risks Related to Doing Business in China—We may rely on dividends and other distributions on equity paid by our Chinese subsidiaries

to fund any cash and financing requirements we may have, and any limitation on the ability of our Chinese subsidiaries to make payments

to us could have a material and adverse effect on our ability to conduct our business” in our most recent Annual Report

on Form 20-F, which is incorporated by reference in this prospectus. In addition, shareholders may potentially be subject to Chinese taxes

on dividends paid by us in the event we are deemed a Chinese resident enterprise for Chinese tax purposes.

As of the date of this prospectus, the VIEs have

not made any dividends or distributions to the holding company, and no dividends or distributions have been made by the Company. Cashflow

between us and the VIEs primarily consists of transfers from us to the VIEs for supplemental working capital, which is mainly used in

payment of operating expenses and investments. For the years ended December 31, 2021, 2022 and 2023, cash transferred from WFOEs and its

subsidiaries to the VIEs was RMB296.0 million, RMB273.2 million and RMB154.8 million, respectively. Cash transferred from the VIEs to

WFOEs and its subsidiaries mainly consisted of repayment of the working capital loans. For the years ended December 31, 2021, 2022 and

2023, cash transferred from the VIEs to WFOEs and its subsidiaries was RMB253.1 million. RMB201.3 million and RMB171.7 million, respectively.

For the years ended December 31, 2021, 2022 and 2023, cash transferred from Scienjoy Holding Corporation to the offshore subsidiaries

was RMB562,000, RMB1.6 million and RMB29.1 million, respectively. For the years ended December 31, 2021, 2022 and 2023, cash transferred

from offshore subsidiaries to Scienjoy Holding Corporation was RMB260,000, RMB36.2 million and RMB70.3 million, respectively. For the

year ended December 31, 2021, cash transferred from offshore subsidiaries to WFOEs and its Subsidiaries was capital contribution of RMB6.4

million. For the year ended December 31, 2023, cash transferred from offshore subsidiaries to WFOEs and its Subsidiaries was working capital

loans of RMB63.4 million. For the year ended December 31, 2021, cash transferred from WFOEs and its subsidiaries to offshore subsidiaries

was dividend of RMB7.0 million. For the year ended December 31, 2022, cash transferred from WFOEs and its subsidiaries to offshore subsidiaries

mainly consisted of repayment of working capital loans of RMB2.1 million and dividend of RMB6.3 million. The source of funds is the capital

retained from the Business Combination transaction and revenues generated by our PRC subsidiaries, and there is no tax consequence on

the intercompany’ s short-term working capital loans. In the future, cash proceeds raised from overseas financing activities, including

this offering, may be transferred by us to our PRC subsidiaries and the VIEs via capital contribution or shareholder loans, as the case

may be.

To date, except for the above cash transferred

between us and the VIEs, there are no other assets transferred between us and the VIEs. To date, the VIEs have not made any dividends

or distributions to our WFOEs and our WFOEs have not made any dividends or distributions to its shareholders or Scienjoy Holding Corporation.

As of the date of this prospectus, Scienjoy Holding Corporation has not paid dividends or made distributions to our investors of Class

A ordinary shares.

Pursuant to the Holding Foreign Companies

Accountable Act, or the HFCAA, if the U.S. Securities and Exchange Commission, or the SEC, determines that we have filed audit

reports issued by a registered public accounting firm that has not been subject to inspections by the Public Company Accounting

Oversight Board, or the PCAOB, for two consecutive years, the SEC will prohibit our shares or the ADSs from being traded on a

national securities exchange or in the over-the-counter trading market in the United States. On June 22, 2021, the U.S. Senate

passed the Accelerating Holding Foreign Companies Accountable Act, and on December 29, 2022, legislation entitled

“Consolidated Appropriations Act, 2023” (the “Consolidated Appropriations Act”) was signed into law by

President Biden, which contained, among other things, an identical provision to the Accelerating Holding Foreign Companies

Accountable Act and amended the HFCAA by requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock

exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead of three, thus reducing the time

period for triggering the delisting of our Company and the prohibition of trading in our securities if the PCAOB is unable to

inspect our accounting firm at such future time.

On December 16, 2021, the PCAOB issued a report

to notify the SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms

headquartered in mainland China and Hong Kong. On December 15, 2022, the PCAOB issued a report that vacated its December 16, 2021 determination

and removed mainland China and Hong Kong from the list of jurisdictions where it is unable to inspect or investigate completely registered

public accounting firms. Each year, the PCAOB will determine whether it can inspect and investigate completely audit firms in mainland

China and Hong Kong, among other jurisdictions. Our current auditor, OneStop Assurance PAC, is headquartered in Sinapore, a jurisdiction

where the PCAOB is able to conduct inspection and investigation completely. Given the foregoing, we do not expect to be identified by

the SEC again as a “commission- identified issuer” following the filing of our Annual Report for the year ended December 31,

2023. However, if our future audit reports are prepared by auditors headquartered in one of the jurisdictions that cannot be completely

inspected by the PCAOB, we would be identified as a “commission-identified issuer” following the filing of the annual report

on Form 20-F for the relevant fiscal year. There can be no assurance that we would not be identified as a “commission-identified

issuer” for any future fiscal year, and if we were so identified for two consecutive years, we would become subject to the prohibition

on trading under the HFCAA. For details of risks related to the HFCAA, see “Risk Factors — Risks Relating to Doing Business

in China — Our shares may be delisted and prohibited from being traded under the Holding Foreign Companies Accountable Act if the

PCAOB is unable to inspect our auditors for two consecutive years. The delisting and the cessation of trading of our shares, or the threat

of their being delisted and prohibited from being traded, may materially and adversely affect the value of your investment.”

in our most recent Annual Report on Form 20-F, which is incorporated by reference in this prospectus.

This prospectus may not be used to offer or sell any securities unless

accompanied by a prospectus supplement.

Neither the SEC nor any state securities commission

has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the

contrary is a criminal offense.

The date of this prospectus is , 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement

on Form F-3 that we filed with the SEC, (i) utilizing a “shelf” registration process and (ii) relating to the resale by the

selling shareholders of the registered shares. We may offer and sell the securities described in this prospectus from time to time in

one or more offerings on a continuous or delayed basis. The selling shareholders referred to in this prospectus may from time to time

sell the Class A ordinary shares described in this prospectus in one or more offerings or otherwise as described under “Plan of

Distribution.” We will not receive any proceeds from the sale by such selling shareholders of the securities offered by them described

in this prospectus.

Neither we nor the selling shareholders have

authorized anyone to give any information or to make any representation other than those contained or incorporated by reference in this

prospectus. You must not rely upon any information or representation not contained or incorporated by reference in this prospectus (as

supplemented or amended). We and the selling shareholders are offering to sell, and seeking offers to buy, securities only in jurisdictions

where it is lawful to do so.

This prospectus does not constitute an offer

to sell or the solicitation of an offer to buy any securities other than the registered shares to which they relate, nor does this prospectus

constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful

to make such offer or solicitation in such jurisdiction.

You should not assume that the information contained

in this prospectus (as supplemented or amended) is accurate on any date subsequent to the date set forth on the front of the document

or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by

reference, even though this prospectus (as supplemented or amended) is delivered, or securities are sold, on a later date.

This prospectus and the information incorporated

herein by reference contain summaries of certain provisions contained in some of the documents described herein, but reference is made

to the actual documents for complete information. All of the summaries are qualified in their entirety by the actual documents. Copies

of some of the documents referred to herein have been filed, will be filed or will be incorporated by reference as exhibits to the registration

statement of which this prospectus is a part, and you may obtain copies of those documents as described below under the heading “Where

You Can Find More Information.”

In this prospectus, unless otherwise indicated or unless the context

otherwise requires:

| ● | “affiliated entities” refers to, collectively, the

VIEs and its subsidiaries; |

| ● | “Business Combination” refers to the Company’s

acquisition of Scienjoy Inc. on May 7, 2020 and related transactions; |

| | | |

| | ● | “Class

A ordinary shares” refers to our Class A ordinary shares of no par value; |

| ● | “Class B ordinary shares” refers to our Class B ordinary shares of no par value; |

| ● | “China” or “PRC” refers to the People’s Republic of China, including Hong Kong and Macau; |

| ● | “HFCAA” refers to Holding Foreign Companies Accountable Act, as amended; |

| ● | “ordinary shares” or “shares” refer to our ordinary shares comprising Class A ordinary shares, no par value

and/or Class B ordinary shares, no par value; |

| ● | “our PRC subsidiaries” refer to our WFOEs, i.e. Sixiang Wuxian (Beijing) Technology Co., Ltd. (“WXBJ”), and

Sixiang Wuxian (Zhejiang) Culture Technology Co., Ltd. (“WXZJ”) and their respective subsidiaries. WXBJ’s subsidiaries

include Sixiang Zhihui (Beijing) Technology Co., Ltd. (“ZH”), Sixiang Yingyue (Shanghai) Technology Co., Ltd. (“SXYY”),

Holgus Sixiang Information Technology Co., Ltd. (“Holgus X”), Kashgar Sixiang Times Internet Technology Co., Ltd. (“Kashgar

Times”), Kashgar Sixiang LeHong Information Technology Co., Ltd. (“Kashgar Lehong”), Sixiang ZhiHui (HaiNan) Investment

(“ZHHN”), and Holgus Sixiang Haohan Internet Technology Co., Ltd. (“Holgus H”), WXZJ’s subsidiary includes

Sixiang Zhihui (Zhejiang) Culture Technology Co., Ltd. (“ZHZJ”); |

| ● | “RMB” or “Renminbi” refers to the legal currency of China; |

| ● | “Share Exchange Agreement” refers to the Share Exchanged Agreement, dated October 28, 2019, by and among Scienjoy Inc.,

Wealthbridge Acquisition Limited (“Wealthbridge”), Lavacano Holdings Limited (“Lavacano”), and WBY Entertainment

Holdings Ltd. (“WBY”); |

| ● | “US$,” “U.S. dollars,” “$” or “dollars” refers to the legal currency of the United

States of America; |

| ● | “VIE” refers to Zhihui Qiyuan (Beijing) Technology, Co. Ltd. (“Zhihui Qiyuan”), Sixiang Qiyuan (Hangzhou)

Culture Technology Co., Ltd., (“Sixiang Qiyuan”) and their respective subsidiaries; and |

| ● | “we,” “us,” “our,” or “our Company” refers to Scienjoy Holding Corporation, its subsidiaries,

and, in the context of describing our consolidated financial information, includes the VIEs and its subsidiaries. |

Unless otherwise noted, all translations from

Renminbi to U.S. dollars in this prospectus were made at the exchange rate of RMB7.0999 to US$1.00, the exchange rate in effect as of

December 31, 2023 set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System. We make no representation

that any Renminbi or U.S. dollar amounts could have been, or could be, converted into U.S. dollars or Renminbi, as the case may be, at

any particular rate, or at all.

For investors outside the United States: Neither

we nor the selling shareholders have done anything that would permit the offering or possession or distribution of this prospectus in

any jurisdiction where action for that purpose is required, other than in the United States. Persons outside the United States who come

into possession of this prospectus must inform themselves about, and observe any restrictions relating to, the offering of the securities

described herein and the distribution of this prospectus outside the United States.

PROSPECTUS SUMMARY

Investors are cautioned that the securities

may be offered under this prospectus are securities of Scienjoy Holding Corporation, our British Virgin Islands holding company, which

is not a Chinese operating company nor does it have any substantive business operations. Scienjoy Holding Corporation conducts business

in China through the consolidated VIEs and the VIEs’ subsidiaries.

The following summary highlights information

contained elsewhere in this prospectus or incorporated by reference in this prospectus and does not contain all of the information that

you need to consider in making your investment decision. We urge you to read this entire prospectus (as supplemented or amended), including

our consolidated financial statements, notes to the consolidated financial statements and other information incorporated by reference

in this prospectus from our other filings with the SEC, before making an investment decision.

Company Overview

We were originally a blank check company incorporated

on May 2, 2018 for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, recapitalization, reorganization

or similar business combination with one or more target businesses. On May 7, 2020, we consummated our business combination pursuant to

the Share Exchange Agreement and acquired 100% issued and outstanding equity interests of Scienjoy Inc., which resulted in Scienjoy Inc.

becoming our wholly-owned subsidiary.

Following our Business Combination, we changed

our name from Wealthbridge Acquisition Limited to “Scienjoy Holding Corporation” and continued the listing of our ordinary

shares (which have been reclassified as Class A ordinary shares on November 10, 2021) on Nasdaq under the symbol “SJ.”

The securities registered in this prospectus

are securities of our British Virgin Islands holding company. As a holding company with no material operations of our own, we conduct

our operations mainly through the VIEs in PRC, and to a lesser extent, through our PRC subsidiaries. Neither we nor our subsidiaries own

any equity interest in the VIEs. Instead, we control and receive the economic benefits of the business operations of the VIEs through

a series of contractual arrangements, which are referred as the VIE agreements in this prospectus. We have evaluated the guidance in FASB

ASC 810 and concluded that we are the primary beneficiary of the VIEs because of these contractual arrangements. Accordingly, under U.S.

GAAP, the financial statements of the VIEs are consolidated as part of our financial statements.

Business Overview

We are a leading provider of mobile live streaming

platforms in China and focuses on interactive show live streaming from broadcasters to users. The VIEs traditionally operate on three

primary platforms (Showself Live Streaming, Lehai Live Streaming, and Haixiu Live Streaming), each using our own mobile applications and

providing live streaming entertainment from professional “broadcasters” to the end-user. In September 2020, we acquired two

additional mobile live streaming platforms, namely the BeeLive Chinese (MiFeng) and the BeeLive International. BeeLive Chinese (MiFeng)

became a subsidiary of the VIEs and BeeLive International became our wholly owned subsidiary. BeeLive International operates mobile live

streaming platforms in the Middle East and Thailand. In December 2021, through an acquisition of Beijing Weiliantong Technology Co., Ltd.

(“WLT”), we acquired one additional mobile live streaming platform, namely the Hongle.tv. Together with the acquisition of

WLT, we also acquired Golden Shield Enterprises Limited (“Golden Shield”), which operates a NFT business. WLT became a subsidiary

of the VIEs under Zhihui Qiyuan and Golden Shield became a subsidiary of Scienjoy, Inc.

In June 2022, we entered into a series of contracts

with Sixiang Qiyuan VIEs, which has commenced its operations in Hangzhou.

In September 2023, we announced our strategic

investment of US$3 million to acquire a 30% equity interest in DVCC TECHNOLOGY L.L.C, a Dubai-based metaverse company dedicated to transforming

entertainment through innovation. This pivotal move signifies our unwavering commitment to metamorphosing its business transformation

strategy from mobile entertainment to metaverse lifestyle, catalyzed by global expansion starting from the dynamic Middle East and North

Africa (MENA) region.

We operate a mobile live streaming business by

which it provides live streaming entertainment from professional “broadcasters” to the end-users, allowing for operation of

live social video communities. Using our mobile applications, users can select broadcasters and enter real time video rooms to interact

with them. In addition to the real-time interaction, users can also view photos posted by broadcasters in their personal pages, leave

comments, and engage in private chats with broadcasters when such broadcasters are not streaming. In addition, users can also play simple,

fun games using virtual currencies within the video rooms while watching live streaming of a broadcaster.

While users have free access to all real time

video rooms, revenue is primarily generated through sales of our virtual currency. Users can purchase virtual currency on our platforms

and can use such virtual currency to buy virtual items for broadcasters to show their support. We share revenues generated on the platforms

with talents agencies, which in turn share revenues with broadcasters. Under the leadership of our experienced management team, we continue

to invest in technology advancement and industry collaboration to expand its user base and improve its content. We are dedicated to achieving

sustainable development and transforming the industry through its bold and creative live streaming philosophy.

Our Corporate Structure and Contractual Arrangements with the VIE

and its Shareholders

We are a British Virgin Islands holding company

and conduct our operations in China through contractual arrangements with the VIEs, including Zhihui Qiyuan, Sixiang Qiyuan and their

subsidiaries, and our WFOEs and the wholly owned subsidiaries of WFOEs. Through our Hong Kong subsidiary Scienjoy International Limited,

we own a direct equity interest in WXBJ and WXZJ. WXBJ, Zhihui Qiyuan and Zhihui Qiyuan’s registered shareholders are parties to

certain VIE agreements, pursuant to which the profits of Zhihui Qiyuan and its subsidiaries, each such company formed under PRC Law, are

directly or indirectly payable to WXBJ. WXZJ, Sixiang Qiyuan and Sixiang Qiyuan’s registered shareholders are parties to certain

VIE agreements, pursuant to which the profits of Sixiang Qiyuan and its subsidiaries, each such company formed under PRC Law, are directly

or indirectly payable to WXZJ.

For more details of these contractual arrangements, see “Item

4. Information on the Company — C. Organizational Structure — Contractual Arrangements among WFOEs, the VIEs and the Shareholders

of the VIEs” in our most recent Annual Report on Form 20-F, which is incorporated by reference in this prospectus. For more

details of risks related to our VIE structure, see “Item 3. Key Information — D. Risk Factors — Risks Related to

Doing Business in China” and “Item 3. Key Information — D. Risk Factors — Risks Related to Our Corporate

Structure” in our most recent Annual Report on Form 20-F, which is incorporated by reference in this prospectus.

The following diagram illustrates our simplified

corporate structure, including our principal subsidiaries, the VIE and its subsidiaries, as of the date of this prospectus:

Contractual Arrangements

among WFOEs, the VIEs and the Shareholders of the VIEs

Current PRC laws and regulations impose certain

restrictions or prohibitions on foreign ownership of companies that engage in value-added telecommunication services, and certain other

business. We are a company registered in the British Virgin Islands. To comply with PRC laws and regulations, we primarily conduct our

business in China through (i) our PRC subsidiaries and (ii) the VIEs based on a series of contractual arrangements by and among the WFOEs,

the VIEs and the shareholders of the VIEs. We have evaluated the guidance in FASB ASC 810 and concluded that we are the primary beneficiary

of the VIEs because of these contractual arrangements. Accordingly, under U.S. GAAP, the financial statements of the VIEs are consolidated

as part of our financial statements. The following is a summary of all the VIE arrangements that enable us to receive substantially all

of the economic benefits from the VIEs’ operations and be the primary beneficiary of the VIEs for accounting purposes.

Contracts between the Company and the Zhihui

Qiyuan VIEs

Exclusive Option Agreement.

Pursuant to the exclusive option agreement (including

its amendment or supplementary agreements, if any) amongst WXBJ, Zhihui Qiyuan and the registered shareholders who collectively owned

all of Zhihui Qiyuan, the registered shareholders irrevocably granted WXBJ or its designated party, an exclusive option to purchase all

or part of the equity interests held by the registered shareholders in Zhihui Qiyuan, when and to the extent permitted under PRC law,

at an amount equal to the lowest permissible purchase price as set by PRC law. Zhihui Qiyuan cannot declare any profit distributions,

or create any encumbrances in any form without the prior written consent of WXBJ. The registered shareholders must remit in full any funds

received from Zhihui Qiyuan to WXBJ, in the event any distributions are made by the VIE pursuant to any written consents of WXBJ.

The Exclusive Option Agreement shall remain effective

for twenty (20) years and shall be automatically extended for an additional period of one (1) year. The additional period automatically

enters the renewal extension of one (1) year at the end of each extended additional period. WXBJ has the right to terminate this agreement

at any time after giving a thirty (30) days’ prior termination notice.

Power of Attorney Agreements.

Each registered shareholders of Zhihui Qiyuan

entered into a power of attorney agreement (including its amendment or supplementary agreements, if any) whereby such registered shareholders

granted an irrevocable proxy of the voting rights underlying their respective equity interests in Zhihui Qiyuan to WXBJ, which includes,

but are not limited to, all the shareholders’ rights and voting rights empowered to such registered shareholders by the PRC company

law and Zhihui Qiyuan’s Article of Association. The power of attorney remains irrevocable and continuously valid from the date of

execution so long as each such shareholder remains as a shareholder of Zhihui Qiyuan.

Share Pledge Agreement.

Pursuant to the share pledge agreement (including

its amendment or supplementary agreements, if any) among WXBJ, Zhihui Qiyuan and the registered shareholders of Zhihui Qiyuan, such registered

shareholders have pledged all their equity interests in Zhihui Qiyuan to guarantee the respective performance of Zhihui Qiyuan and such

shareholders obligations under the Exclusive Option Agreement, Exclusive Business Cooperation Agreement and Power of Attorney Agreement,

as applicable.

If Zhihui Qiyuan or any of its shareholders breaches

its contractual obligations under any of other VIE agreements, WXBJ, as pledgee, will be entitled to certain rights, including the right

to sell the pledged equity interests. The registered shareholders of Zhihui Qiyuan agreed not to transfer, sell, pledge, dispose of or

otherwise create any new encumbrance on their equity interests in Zhihui Qiyuan without the prior written consent of WXBJ. The Share Pledge

Agreement shall be continuously valid until all obligations under the VIE agreements have been fulfilled, or the VIE agreements are terminated,

or the secured debts has been fully executed.

Contracts that enable us to receive substantially

all of the economic benefits from the Zhihui Qiyuan VIEs

Exclusive Business Cooperation Agreements

Pursuant to the exclusive business cooperation

agreement (including its amendment or supplementary agreements, if any) between WXBJ and Zhihui Qiyuan, WXBJ is to provide exclusive business

support, technical and consulting services related to all technologies needed for its business in return for fees. The service fees may

be adjusted by WXBJ based on the following factors:

| ● | complexity and difficulty of the

services pursuant to the business cooperation agreement to Zhihui Qiyuan during the month (the “Monthly Services”); |

| |

● |

the number of WXBJ’s employees who provided the Monthly Services and the qualifications of the employees; |

| |

● |

the number of hours WXBJ’s employees spent to provide the Monthly Services; |

| |

● |

nature and value of the Monthly Services; |

| |

● |

market reference price; and |

| |

● |

Zhihui Qiyuan’ operating conditions for the month. |

The term of the Exclusive Business Cooperation

Agreement is twenty (20) years and shall be automatically extended for an additional period of one (1) year. The additional period automatically

enters the renewal extension of one (1) year at the end of each extended additional period. Besides, WXBJ has the right to terminate this

agreement at any time after giving a thirty (30) days’ prior termination notice.

Based on the foregoing VIE arrangements, which

obligate WXBJ to absorb all of the risk of loss from their activities and enable WXBJ to receive all of their expected residual returns,

the Company accounts for Zhihui Qiyuan as a VIE. Accordingly, the Company consolidates the accounts of Zhihui Qiyuan for the periods presented

herein, in accordance with Regulation S-X-3A-02 promulgated by the SEC and Accounting Standards Codification (“ASC”) 810-10,

Consolidation.

Contractual Arrangements among WXZJ, Sixiang

Qiyuan, and the Shareholders of Sixiang Qiyuan.

Exclusive Option Agreement

Pursuant to the exclusive option agreement (including

any supplementary agreement thereto, if any) entered into by and among WXZJ, Sixiang Qiyuan and all the shareholders of Sixiang Qiyuan,

the shareholders of Sixiang Qiyuan hereby irrevocably grant to WXZJ or its designee, to the extent permitted by the laws of the People’s

Republic of China, the exclusive right to purchase all or part of the equity interest held by such shareholders at the lowest purchase

price permitted by the laws of the People’s Republic of China. Without the written consent of WXZJ, Sixiang Qiyuan may not distribute

any profits or create any encumbrance in any manner. If Sixiang Qiyuan makes the profit distribution with WXZJ’s written consent,

Sixiang Qiyuan’s shareholders shall pay all of any funds received by them to WXZJ.

The term of the exclusive option agreement is

twenty years and will be automatically renewed for one year. Upon the expiration of each renewed term, the exclusive option agreement

will be automatically renewed for one year. In the meantime, WXZJ shall have the right to terminate the exclusive option agreement at

any time by giving a three days’ prior notice.

Power of Attorney Agreements.

WXZJ has entered into a power of attorney agreement

(the “Power of Attorney,” including any supplementary agreements, if any) with each shareholder of Sixiang Qiyuan, pursuant

to which each such shareholder grants the proxy rights to WXZJ in connection with his equity interest in Sixiang Qiyuan, including, without

limitation, all the shareholders’ beneficial rights and voting rights conferred by the Company Law of the People’s Republic

of China and the Articles of Association of Sixiang Qiyuan. Each power of attorney agreement shall be irrevocable from the date of execution

and shall continue to be valid until the relevant shareholder no longer holds Sixiang Qiyuan’s equity interest.

Share Pledge Agreement

Pursuant to the share pledge contract (including

any supplementary agreement thereto, if any) entered into by and among WXZJ, Sixiang Qiyuan and each of the shareholders of Sixiang Qiyuan,

each shareholder of Sixiang Qiyuan has pledged all of Sixiang Qiyuan’s equity interest held by such shareholder to guarantee the

respective performance of Sixiang Qiyuan and such shareholder under the exclusive option contract, the exclusive business cooperation

agreement and the power of attorney agreement, as applicable.

If Sixiang Qiyuan or any of its shareholders breaches

its contractual obligations under any VIE agreements, WXZJ, as the pledgee, will have certain rights, including the sale of the pledged

equity interest. The shareholders agree that, without the prior written consent of WXZJ, they shall not transfer, sell, pledge, dispose

of or in any other manner create any new encumbrance upon their equity interest in Sixiang Qiyuan. The share pledge agreement shall remain

effective until all obligations under the VIE agreements have been performed, or the VIE agreements have been terminated, or all obligations

under the VIE agreements have been fully performed.

Contracts that enable us to receive substantially

all of the economic benefits from the Sixiang Qiyuan VIEs

Exclusive Business

Cooperation Agreement

In accordance with the exclusive business cooperation

agreement between WXZJ and Sixiang Qiyuan (including supplementary agreements thereto, if any), WXZJ will provide Sixiang Qiyuan with

exclusive business support and all business-related technologies and consulting services in order to obtain the fees equal to the consolidated

net income of Xiuli (Zhejiang) Culture Tech Co., Ltd., Leku (Zhejiang) Culture Tech Co., Ltd., Haifan (Zhejiang) Culture Tech Co., Ltd.,

Xiangfeng (Zhejiang) Culture Tech Co., Ltd. and Hongren (Zhejiang) Culture Tech Co., Ltd. after deducting losses of the previous year

(if any). WXZJ may adjust the service fees according to the following factors:

| |

● |

Quarterly based on the complexity and difficulty of the services provided pursuant to the exclusive business cooperation agreement during such quarter (“Quarterly Services”); |

| |

● |

the number of WXZJ’s employees who provided the Quarterly Services and the qualifications of these employees; |

| |

● |

The number of hours WXZJ’s employees spent to provide the Quarterly Services; |

| |

● |

The nature and value of the Quarterly Services; |

| |

● |

market reference price; and |

| |

● |

Sixiang Qiyuan’s operating conditions. |

The term of the exclusive business cooperation

agreement is twenty years and is automatically renewable for one year. Upon the expiration of each renewal term, the agreement can be

automatically renewed for one year. In addition, WXZJ shall have the right to terminate this agreement at any time by giving a three-day

notice on the termination of this Agreement.

We have been advised by Beijing Feng Yu Law Firm (“Feng Yu Law

Firm”), our PRC legal counsel:

| |

● |

based on its understanding of the relevant laws and regulations, is of the opinion that, subject to the judicial interpretations of the PRC laws or legislative interpretation of the PRC laws by PRC government authority, each of the VIE contracts among WXBJ, Zhihui Qiyuan and its registered shareholders is valid, binding and enforceable in accordance with its terms and does not violate current effective applicable PRC Laws. |

| |

|

|

| |

● |

based on its understanding of the relevant laws and regulations, is of the opinion that, subject to the judicial interpretations of the PRC laws or legislative interpretation of the PRC laws by PRC government authority, each of the VIE contracts among WXZJ, Sixiang Qiyuan and its registered shareholders is valid, binding and enforceable in accordance with its terms and does not violate current effective applicable PRC Laws. |

However, our PRC legal counsel has advised that

there are substantial uncertainties regarding the interpretation and application of current and future PRC laws, rules and regulations.

Accordingly, the PRC regulatory authorities may in the future take a view that is contrary to the opinion of our PRC legal counsel. Our

PRC legal counsel has further advised that if the PRC government finds that the agreements that establish the structure for operating

our Internet related value-added business do not comply with PRC government restrictions on foreign investment in the aforesaid business

we and the VIEs engage in, we and the VIEs could be subject to severe penalties including being prohibited from continuing operations.

See “Risk Factors—Risks Factors Related to Our Corporate Structure.” and “Risk Factors—Risk Factors

Related to Doing Business in China” in our most recent Annual Report on Form 20-F, which is incorporated by reference in this prospectus.

The Holding Foreign Companies Accountable Act

Pursuant to the HFCAA, if the SEC determines

that we have filed audit reports issued by a registered public accounting firm that has not been subject to inspections by PCAOB for two

consecutive years, the SEC will prohibit our shares from being traded on a national securities exchange or in the over- the-counter trading

market in the United States. On June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, and

on December 29, 2022, the Consolidated Appropriations Act was signed into law, which contained, among other things, an identical provision

to the Accelerating Holding Foreign Companies Accountable Act and amended the HFCAA by requiring the SEC to prohibit an issuer’s

securities from trading on any U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive years instead

of three, thus reducing the time period for triggering the delisting of our Company and the prohibition of trading in our securities if

the PCAOB is unable to inspect our accounting firm at such future time. On December 16, 2021, the PCAOB issued a report to notify the

SEC of its determination that the PCAOB was unable to inspect or investigate completely registered public accounting firms headquartered

in mainland China and Hong Kong, including our auditor. On October 6, 2022, we were conclusively identified by the SEC under the HFCAA

due to the fact that our previous auditor was located in mainland China and could not be inspected by the PCAOB. On December 15, 2022,

the PCAOB issued a report that vacated its December 16, 2021 determination and removed mainland China and Hong Kong from the list of jurisdictions

where it is unable to inspect or investigate completely registered public accounting firms. Each year, the PCAOB will determine whether

it can inspect and investigate completely audit firms in mainland China and Hong Kong, among other jurisdictions.

Our current Singapore-based auditor, OneStop

Assurance PAC is not among the PCAOB-registered public accounting firms headquartered in Mainland China or Hong Kong that are subject

to PCAOB’s determination on December 16, 2021 of having been unable to inspect or investigate completely. However, we could still

face the risk of delisting and cease of trading of our securities from a stock exchange or an over-the-counter market in the United States

under the Holding Foreign Companies Accountable Act and the securities regulations promulgated thereunder, if the PCAOB determines in

the future that it is unable to completely inspect or investigate our auditor.

In addition, if our future audit reports are

prepared by auditors headquartered in one of the jurisdictions that cannot be completely inspected by the PCAOB, we would be identified

as a “commission-identified issuer” following the filing of the annual report on Form 20-F for the relevant fiscal year. There

can be no assurance that we would not be identified as a “commission-identified issuer” for any future fiscal year, and if

we were so identified for two consecutive years, we would become subject to the prohibition on trading under the HFCAA. For details of

risks related to the HFCAA, see “Risk Factors — Risks Relating to Doing Business in China — Our shares may be delisted

and prohibited from being traded under the Holding Foreign Companies Accountable Act if the PCAOB is unable to inspect our auditors for

two consecutive years. The delisting and the cessation of trading of our shares, or the threat of their being delisted and prohibited

from being traded, may materially and adversely affect the value of your investment.” in our most recent Annual Report on Form

20-F, which is incorporated by reference in this prospectus.

Permissions Required from the PRC Authorities for Our Operations

and Securities Offerings

Scienjoy Holding Corporation is a company incorporated

in the British Virgin Islands, and WFOEs, our PRC subsidiaries, are foreign-invested enterprises under PRC laws. We do not have any substantive

business operations on our own, and we conduct our business in China through the VIEs and its subsidiaries, and may in the future commence

or acquire businesses that are subject to the restrictions with respect to value-added telecommunications services as set out in the Negative

List (2021 Version) promulgated by the MOFCOM and the NDRC.

We and the VIEs face various legal and

operational risks and uncertainties related to being based in and having significant operations in China. The PRC government has

significant authority to exert influence on the ability of a China-based company, such as us and the affiliated entities, to conduct

its business, accept foreign investments or list on U.S. or other foreign exchanges. For example, we and the affiliated entities

face risks associated with regulatory approvals of offshore offerings, oversight on cybersecurity and data privacy, as well as the

historical lack of inspection on our auditors by the PCAOB. Such risks could result in a material change in our operations and/or

the value of the Class A ordinary shares or could significantly limit or completely hinder our ability to offer Class A ordinary

shares and/or other securities to investors and cause the value of such securities to significantly decline or be worthless. The PRC

government also has significant discretion over the conduct of the business of us and the affiliated entities and may intervene with

or influence our operations or the development of the value-added telecommunications service industry as it deems appropriate to

further regulatory, political and societal goals. Furthermore, the PRC government has recently indicated an intent to exert more

oversight and control over overseas securities offerings and foreign investment in China-based companies like us. Any such action,

once taken by the PRC government, could significantly limit or completely hinder our ability to offer securities to investors and

cause the value of such securities to significantly decline or in extreme cases, become worthless. For further details, see

“Item 3. Key Information — D. Risk Factors — Risks Related to Our Corporate Structure” and

“Item 3. Key Information — D. Risk Factors — Risks Related to Doing Business in China” in our most

recent Annual Report on Form 20-F, which is incorporated by reference in this prospectus.

Our operations in China are governed by PRC laws

and regulations, our subsidiaries in China and the affiliated entities are required to obtain licenses, permits, filings, or approvals

for the functions and services of our respective platforms. As of the date of this prospectus, we believe our subsidiary in China and

the affiliated entities have obtained all the licenses, permits, filings, or approvals for our current operations in China. Because the

Company’s business is constantly evolving, and due to the uncertainties of interpretation and implementation of relevant laws and

regulations, the enforcement practice by government authorities in the PRC, and the complexity of relevant laws and regulations in China

that may change or introduce new requirements in the future, we cannot assure you that our subsidiary in China and the affiliated entities

have obtained all the permits or licenses required for conducting our and the affiliated entities’ business in China, or that we

and the affiliated entities will be able to renew existing licenses and permits in the future. For more detailed information, see “Item

3. Key Information — D. Risk Factors — Risks Related to Doing Business in China — If we fail to obtain or maintain the

required licenses and approvals or if we fail to comply with laws and regulations applicable to our industry, our business, results of

operations, and financial condition may be materially and adversely affected” in our most recent Annual Report on Form 20-F,

which is incorporated by reference in this prospectus.

On December 28, 2021, the NDRC and several other

agencies jointly adopted and published the new Measures for Cybersecurity Review (the “New Cybersecurity Measures”), effective

from February 15, 2022. The New Cybersecurity Measures reiterate that, if an operator of critical information infrastructure who purchases

network products or services that affects or may affect national security, or if a network platform operator who possesses the personal

information of more than 1 million users intends to list in a foreign country, they shall file with the Office of Cybersecurity Review

for cybersecurity review. The New Cybersecurity Measures further elaborate the factors to be considered when assessing the national security

risks of the relevant activities, including, among others, (i) the risk of core data, important data or a large amount of personal information

being stolen, leaked, destroyed, and illegally used or exited the country; and (ii) the risk of critical information infrastructure, core

data, important data or a large amount of personal information being affected, controlled, or maliciously used by foreign governments

after listing abroad.

As advised by our PRC legal counsel, we

believe that we and our PRC subsidiaries and the VIEs are not required to apply for a cyber security review with Cyberspace

Administration of China (CAC), since we listed our Class A ordinary shares on the Nasdaq before the effective date of the New

Cybersecurity Measures, and our PRC subsidiaries and the VIEs as the “network platform operators” will not be subject to

CAC’s review or approval regarding data cyber security under other current-effective CAC rules, since that, (a) all of

collection and processing of any personal information or other data in the ordinary course of business are conducted by our PRC

subsidiaries and the VIEs within the territory of PRC, (b) none of our PRC subsidiaries or the VIEs provides any personal

information or operational data outside the territory of PRC, (c) such personal information or operational data handled by our PRC

subsidiaries and the VIEs will not be construed as important data threatening China’s national security, and (d) none of our

PRC subsidiaries or the VIEs will fell under the “critical information infrastructure operators”, which are subject to

direct and more strict regulatory supervision under CAC rules. However, the New Cybersecurity Measures do not provide any

explanation or interpretation of “overseas listing” or “affect or may affect national security,” and Chinese

government may have broad discretion in interpreting and enforcing these laws and regulations, which may also require the Company to

make filings or obtain approval from CAC or other competent authorities with respect to its further offerings in overseas public

markets. We cannot predict the impact of the review measures, if any, at this stage, and we will closely monitor and assess the

statutory developments in this regard. In the opinion of Feng Yu Law Firm, our PRC legal counsel, as of the date of this prospectus,

we, our PRC subsidiary and the affiliated entities are not required to obtain any approval or permission from the CSRC for us to

file this registration statement on Form F-3 under any currently effective PRC laws, regulations, and regulatory rules. However,

according to the Overseas Listing Trial Measures and supporting guidelines, PRC domestic companies that seek to offer and list

securities in overseas markets, either directly or indirectly, are required to fulfill the filing procedure with the CSRC and report

relevant information. Companies that had already been listed overseas as of March 31, 2023, are required to file with the CSRC

within three business days after the completion of subsequent securities offerings in the same overseas market where its securities

were previously offered and listed. Any future offering pursuant to the Prospectus will be subject to the Overseas Listing Trial

Measures, and we should, through our major operating entities incorporated in the PRC, file for record with the CSRC within three

business days after the completion of the subsequent initial offering and make a summary report to the CSRC after the completion of

offerings pursuant to the Prospectus.

In the event, we had inadvertently concluded

that such approvals, permits, registrations or filings were not required, or if applicable laws, regulations or interpretations

change in a way that requires us to obtain approval, permits, registrations or filings in the future for our operations and overseas

listing and securities offerings, we and the VIEs may be unable to obtain such necessary approvals, permits, registrations or

filings in a timely manner. Any such circumstance may subject us to fines and other regulatory, civil or criminal liabilities, and

we may be ordered by the PRC government authorities to suspend relevant operations, which will materially and adversely affect our

business operation. Furthermore, we may be subject to regular inspections, examinations, inquiries or audits by regulatory

authorities, and an adverse outcome of such inspections, examinations, inquiries or audits may result in the loss or non-renewal of

the relevant licenses and approvals. Moreover, the criteria used in reviewing applications for, or renewals of licenses and

approvals may change from time to time, and there can be no assurance that we will be able to meet new criteria that may be imposed

to obtain or renew the necessary licenses and approvals. Many of such licenses and approvals are material to the operation of our

business, and if we fail to maintain or renew material licenses and approvals, our ability to conduct our business could be

materially impaired.

For more detailed information, see “Risk

Factors — Risks Related to Doing Business in China — The filling of the CSRC will be required and approval and/or other requirements

from other PRC governmental authorities may be required in connection with an offering under PRC rules, regulations or policies, and,

if required, we cannot predict whether or how soon we will be able to complete such filing or obtain such approval” in our most

recent Annual Report on Form 20-F, which is incorporated by reference in this prospectus.

Dividend Distribution and Transfer of Cash

Under our current corporate structure, Scienjoy Holding Corporation,

the British Virgin Islands holding company, may rely on dividend payments from our PRC subsidiaries for cash and financing requirements

we may have, including the funds necessary to pay dividends and other cash distributions to our shareholders or to service any debt we

may incur. Our WFOEs receive payments from the VIEs pursuant to the VIE agreements. WFOEs also receives payments from its PRC operating

subsidiaries. WFOEs may make distribution of such payments to Scienjoy International Limited, our Hong Kong subsidiary, then further distribute

the funds to Scienjoy Holding Corporation through its fully owned subsidiary, Scienjoy Inc.

Cashflow between us and the VIEs primarily consists of transfers from

us to the VIEs for supplemental working capital, which is mainly used in payment of operating expenses and investments. For the years

ended December 31, 2021, 2022 and 2023, cash transferred from WFOEs and its subsidiaries to the VIEs was RMB296.0 million, RMB273.2 million

and RMB154.8 million, respectively. Cash transferred from the VIEs to WFOEs and its subsidiaries mainly consisted of repayment of the

working capital loans. For the years ended December 31, 2021, 2022 and 2023, cash transferred from the VIEs to WFOEs and its subsidiaries

was RMB253.1 million. RMB201.3 million and RMB171.7 million, respectively. For the years ended December 31, 2021, 2022 and 2023, cash

transferred from Scienjoy Holding Corporation to the offshore subsidiaries was RMB562,000, RMB1.6 million and RMB29.1 million, respectively.

For the years ended December 31, 2021, 2022 and 2023, cash transferred from offshore subsidiaries to Scienjoy Holding Corporation was

RMB260,000, RMB36.2 million and RMB70.3 million, respectively. For the year ended December 31, 2021, cash transferred from offshore subsidiaries

to WFOEs and its Subsidiaries was capital contribution of RMB6.4 million. For the year ended December 31, 2023, cash transferred from

offshore subsidiaries to WFOEs and its Subsidiaries was working capital loans of RMB63.4 million. For the year ended December 31, 2021,

cash transferred from WFOEs and its subsidiaries to offshore subsidiaries was dividend of RMB7.0 million. For the year ended December

31, 2022, cash transferred from WFOEs and its subsidiaries to offshore subsidiaries mainly consisted of repayment of working capital loans

of RMB2.1 million and dividend of RMB6.3 million. The source of funds is the capital retained from the Business Combination transaction

and revenues generated by our PRC subsidiaries, and there is no tax consequence on the intercompany’ s short-term working capital

loans. In the future, cash proceeds raised from overseas financing activities, including this offering, may be transferred by us to our

PRC subsidiaries and the VIEs via capital contribution or shareholder loans, as the case may be.

To date, except for the above cash transferred between us and the VIEs,

there are no other assets transferred between us and the VIEs. To date, the VIEs have not made any dividends or distributions to our WFOEs

and our WFOEs have not made any dividends or distributions to its shareholders or Scienjoy Holding Corporation. As of the date of this

prospectus, Scienjoy Holding Corporation has not paid dividends or made distributions to our investors of Class A ordinary shares.

Under British Virgin Islands law, a British Virgin Islands company

may authorize a dividend or distribution, provided that in no circumstances may a distribution be made if this would result in the company

being unable to satisfy a solvency test. The Company satisfies the solvency test if (i) the value of the Company’s assets exceeds

its liabilities; and (ii) the Company is able to pay its debts as they fall due. We intend to keep any future earnings to re-invest

in and finance the expansion of our business, and we do not anticipate that any cash dividends will be paid in the foreseeable future.

According to the Foreign Investment Law of the People’s Republic

of China and its implementing rules, which jointly established the legal framework for the administration of foreign-invested companies,

a foreign investor may, in accordance with other applicable laws, freely transfer into or out of China its contributions, profits, capital

earnings, income from asset disposal, intellectual property rights, royalties acquired, compensation or indemnity legally obtained, and

income from liquidation, made or derived within the territory of China in RMB or any foreign currency, and any entity or individual shall

not illegally restrict such transfer in terms of the currency, amount and frequency. According to the Company Law of the People’s

Republic of China and other Chinese laws and regulations, our PRC subsidiaries may pay dividends only out of their respective accumulated

profits as determined in accordance with Chinese accounting standards and regulations. In addition, each of our PRC subsidiaries is required

to set aside at least 10% of its accumulated after-tax profits, if any, each year to fund a certain statutory reserve fund, until the

aggregate amount of such fund reaches 50% of its registered capital. Where the statutory reserve fund is insufficient to cover any loss

a PRC subsidiary incurred in the previous financial year, its current financial year’s accumulated after-tax profits shall first

be used to cover the loss before any statutory reserve fund is drawn therefrom. Such statutory reserve funds and the accumulated after-tax

profits that are used for covering the loss cannot be distributed to us as dividends. At their discretion, our PRC subsidiaries may allocate

a portion of their after-tax profits based on Chinese accounting standards to a discretionary reserve fund.

Our PRC subsidiaries and the VIEs receive substantially all of their

revenue in Renminbi. Renminbi is not freely convertible into other currencies. As result, any restriction on currency exchange may limit

the ability of our PRC subsidiaries to use their potential future Renminbi revenues to pay dividends to us. The Chinese government imposes

controls on the convertibility of Renminbi into foreign currencies and, in certain cases, the remittance of currency out of China. Shortages

in availability of foreign currency may then restrict the ability of our PRC subsidiaries to remit sufficient foreign currency to our

offshore entities for our offshore entities to pay dividends or make other payments or otherwise to satisfy our foreign-currency-denominated

obligations. The Renminbi is currently convertible under the “current account,” which includes dividends, trade and service-related