Form 424B5 - Prospectus [Rule 424(b)(5)]

17 June 2024 - 10:11PM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(5)

Registration No. 333-266589

PROSPECTUS SUPPLEMENT

(To the Prospectus Supplement Dated August 16, 2022

and the Prospectus Dated August 16, 2022)

| | |

|

Up to $536,250 Common Stock |

This prospectus supplement amends and supplements the information in the prospectus, dated August 16, 2022 (the “Prospectus”) filed with the Securities and Exchange Commission as a part of our registration statement on Form S-3 (File No. 333-266589), as supplemented by our prospectus supplement, dated August 16, 2022 (the “Prior Supplement” and together with the Prospectus, the “Prior Prospectus”), relating to the offer and sale of shares of our common stock through Ladenburg Thalmann & Co. Inc. (“Ladenburg”), as sales agent for an “at-the-market offering” program (the “ATM Program”). In accordance with the terms of the At The Market Offering Agreement, dated February 5, 2021 (the “Sales Agreement”), we may offer and sell shares of our common stock from time to time through Ladenburg as our sales agent. Sales of our common stock, if any, under this prospectus supplement may be made in sales deemed to be “at-the-market offerings” as defined in Rule 415 promulgated under the Securities Act of 1933, as amended. This prospectus supplement should be read in conjunction with the Prior Prospectus, and is qualified by reference thereto, except to the extent that the information herein amends or supersedes the information contained in the Prior Prospectus. This prospectus supplement is not complete without, and may only be delivered or utilized in connection with, the Prior Prospectus, and any future amendments or supplements thereto.

The Prior Prospectus registered the issuance of up to $2,200,000 of shares of our common stock under the Sales Agreement. Through the date hereof, we have sold shares of our common stock through Ladenburg under the Sales Agreement pursuant to the Prior Prospectus for an aggregate purchase price of $1,663,750, which leaves us with $536,250 of our common stock that remains available under the Prior Prospectus. We are filing this prospectus supplement to amend the Prior Prospectus to update the amount of shares we are eligible to sell under General Instruction I.B.6 of Form S-3, which limits the amounts that we may sell under the registration statement of which this prospectus supplement and the Prior Prospectus are a part. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell shares pursuant to this prospectus supplement with a value of more than one-third of the aggregate market value of our common stock held by non-affiliates in any 12-month period, so long as the aggregate market value of our common stock held by non-affiliates is less than $75,000,000. As a result of these limitations and the current public float of our common stock, and in accordance with the terms of the Sales Agreement, we may offer and sell shares of our common stock having an aggregate offering price of up to $837,970 from time to time through Ladenburg. Pursuant to this Prospectus Supplement, we are registering the offer and sale of up to $536,250 of shares of our common stock, which is the full amount remaining under the Prior Prospectus.

Our common stock is listed on The Nasdaq Stock Market LLC under the symbol “SLRX.” As of June 14, 2024, the aggregate market value of our outstanding common stock held by non-affiliates, or the public float, was $2,513,912 which was calculated based on 586,267 (on a post-reverse stock split basis) shares of our outstanding common stock held by non-affiliates at a price of $4.288 (on a post reverse stock split basis) per share, the closing price of our common stock on May 1, 2024, a date that is within 60 days of filing this prospectus supplement. As of the date hereof, we have not offered or sold any securities pursuant to General Instruction I.B.6 of Form S-3 during the prior 12 calendar month period that ends on and includes the date hereof.

Investing in our common stock involves a high degree of risk. See “Risk Factors” contained in the documents we incorporate by reference in this prospectus supplement to read about factors you should consider before investing in our securities.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement and the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Ladenburg Thalmann

The date of this prospectus supplement is June 17, 2024.

The prospectus supplement to which this exhibit is attached is a final prospectus for the related offering. The maximum aggregate offering price of that offering is $50,000,000.

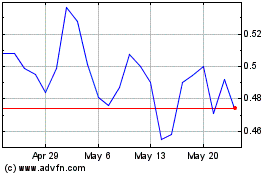

Salarius Pharmaceuticals (NASDAQ:SLRX)

Historical Stock Chart

From May 2024 to Jun 2024

Salarius Pharmaceuticals (NASDAQ:SLRX)

Historical Stock Chart

From Jun 2023 to Jun 2024