0001390478FALSE00013904782024-08-132024-08-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): August 13, 2024

SELLAS Life Sciences Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-33958 | | 20-8099512 |

| (State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | |

| | 7 Times Square, Suite 2503 New York, NY 10036 | | |

| | (Address of Principal Executive Offices) (Zip Code) | | |

| | | | |

Registrant’s telephone number, including area code: (646) 200-5278 |

| | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share | SLS | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 13, 2024, SELLAS Life Sciences Group, Inc. (“SELLAS”) issued a press release (the “Press Release”) announcing its financial results for the quarter ended June 30, 2024 and providing a corporate update.

A copy of the Press Release is furnished hereto as Exhibit 99.1 and is incorporated by reference herein. The information contained in this Item 2.02 and in the Press Release furnished as Exhibit 99.1 to this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that Section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the Press Release furnished as Exhibit 99.1 to this Current Report on Form 8-K shall not be incorporated by reference into any filing with the SEC made by SELLAS whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | SELLAS Life Sciences Group, Inc. |

| | | | |

| Date: | | August 13, 2024 | | | | By: | | /s/ John T. Burns |

| | | | | | | Name: | John T. Burns |

| | | | | | | Title: | Senior Vice President, Chief Financial Officer |

Exhibit 99.1

SELLAS Life Sciences Reports Second Quarter 2024 Financial Results and Provides Corporate Update

- Announced Independent Data Monitoring Committee’s (IDMC) Recommendation to Continue the Phase 3 REGAL Study in Patients with Acute Myeloid Leukemia (AML) Without Modifications: Interim Analysis Anticipated by Q4 2024 -

- Reported Positive Preliminary Data from the Phase 2a Trial of SLS009 in r/r AML Demonstrating to Date Overall Response Rate (ORR) of 33%, 50%, and 100% in 60 mg QW, 30 mg BIW and 30mg BIW with ASXL1 Mutation Cohorts Respectively -

- SLS009 Granted EMA Orphan Drug Designations and U.S. FDA Rare Pediatric Disease Designations -

- $21 million of Gross Proceeds from Capital Raise Priced at a Premium to Market in August 2024 -

NEW YORK, NY August 13, 2024 -- SELLAS Life Sciences Group, Inc. (NASDAQ: SLS) (“SELLAS’’ or the “Company”), a late-stage clinical biopharmaceutical company focused on the development of novel therapies for a broad range of cancer indications, today reported financial results for the second quarter ended June 30, 2024, and provided a corporate update.

“We are pleased with our second-quarter performance marked by significant advancements in our development efforts and clinical programs,” said Angelos Stergiou, MD, ScD h.c., President and Chief Executive Officer of SELLAS. “The initial Phase 2a dataset from the SLS009 trial in AML showed early signs of treatment efficacy across all cohorts exceeding the targeted ORR of at least 20% and median overall survival (mOS) of more than 3 months. We observed remarkable responses in patients with ASXL1 mutations and expanded the trial to include two cohorts of patients with ASXL1 and myelodysplasia-related changes other than ASXL1. As SLS009 continues to show promise as a treatment for hematologic malignancies, its potential has been recently recognized by the European Medicines Agency (EMA) with the orphan drug designations for AML and peripheral T-cell lymphomas (PTCL) and FDA with two rare pediatric disease designations for pediatric AML and acute lymphoblastic leukemia (ALL). Furthermore, our recent $21 million capital raise strengthens our financial position and provides sufficient resources to reach several meaningful data readouts.”

Dr. Stergiou continued: “As for our Phase 3 REGAL study of galinpepimut-S (GPS) in AML, we were pleased to report that based on recent efficacy and safety assessment, the IDMC has recommended trial continuation without modifications. The committee projects that the 60 events will occur by the fourth quarter which will trigger the interim analysis. We remain confident in the positive trajectory of both GPS and SLS009 and we look forward to the interim results from the Phase 3 REGAL study, as well as additional data from the Phase 2 trial of SLS009 in AML.”

Pipeline Highlights

Galinpepimut-S (GPS): Wilms Tumor-1 (WT1) targeting immunotherapeutic

Phase 3 REGAL study in AML: The IDMC conducted a prespecified risk-benefit assessment of unblinded data from the study in June and has recommended that the trial continue without modifications. Based on a detailed analysis of all unblinded data, the IDMC projects that the interim analysis (60 events) will occur by the fourth quarter of 2024.

SLS009: highly selective and specific CDK9 inhibitor

Completed Enrollment in Phase 2a Trial of SLS009 in r/r AML: 30 patients relapsed after or refractory to venetoclax-based regiments were enrolled ahead of schedule in 5 centers across the US. Except for one, all patients in this Phase 2a trial had adverse risk AML (97%) and were treated with continued venetoclax-azacytidine combination therapy after having failed it or similar venetoclax-based combinations, often more than once. The expected overall survival in those patients is approximately 2.5 months.

Announced Positive Initial Phase 2 Data of SLS009 in r/r AML: The preliminary data showed the overall response rate (ORR) of 33% and 50% in 60 mg QW and 30 mg BIW cohorts, respectively. The ORR in patients with ASXL1 mutation in the 30 mg BIW reached a remarkable 100% to date. In the safety dose of 45 mg QW, the median overall survival (mOS) was 5.4 months vs 2.5 months with standard of care. The mOS in 60 mg QW and 30 mg BIW has not been reached yet. SLS009 was well-tolerated across all doses.

Additional Phase 2 Cohorts in Venetoclax Combinations in r/r AML Opened for Enrollment: Development of SLS009 continued with the opening of two new cohorts: AML with myelodysplasia-related changes (AML MRC) with ASXL1 mutations and AML with myelodysplasia-related changes other than ASXL1 mutations. These new cohorts are also open for enrollment of certain pediatric patients.

National Institute of Health PIVOT program in Pediatric Tumors: The program in multiple pediatric cancer indications continues in collaboration with the National Cancer Institute (NCI). Initial safety and efficacy data are expected to be reported throughout 2H 2024.

Recently Granted Regulatory Designations for SLS009: The FDA granted Rare Pediatric Disease Designation (RPDD) to SLS009 for the treatment of pediatric ALL in June 2024 and the FDA granted RPDD to SLS009 for the treatment of pediatric AML in July 2024. Also, the EMA granted Orphan Drug Designation for SLS009 in AML and in PTCL in June 2024 and July 2024, respectively. The FDA previously granted SLS009 Orphan Drug Designations in AML and PTCL and Fast Track designations for r/r AML and r/r PTCL.

Financial Results for the Second Quarter 2024:

R&D Expenses: Research and development expenses for the quarter ended June 30, 2024 were $5.2 million, compared to $5.9 million for the same period in 2023. Research and development expenses in the first half of 2024 were $10.3 million, compared to $13.1 million for the same period in 2023. The decrease was primarily due to decreases in consultants, personnel-related expenses due to changes in headcount, and clinical trial expenses.

G&A Expenses: General and administrative expenses for the second quarter of 2024 were $2.4 million, compared to $3.1 million for the same period in 2023. General and administrative expenses in the first half of 2024 were $7.0 million, compared to $7.2 million for the same period in 2023. The decrease was primarily attributed to personnel-related expenses due to changes in headcount and outside services and public company costs.

Net Loss: The net loss was $7.5 million for the second quarter of 2024, or a basic and diluted loss per share of $0.13, as compared to a net loss of $8.8 million for the second quarter of 2023, or a basic and diluted loss per share of $0.31. The net loss was $17.0 million for the first half of 2024, or a basic and diluted loss per share of $0.33, as compared to a net loss of $19.9 million for the first half of 2023, or a basic and diluted loss per share of $0.77.

Cash Position: As of June 30, 2024, cash and cash equivalents totaled approximately $9.1 million. Subsequent to June 30, 2024, the Company consummated a registered direct offering priced at a premium to market, providing gross proceeds to the Company of $21 million, before deducting placement agent fees and related offering expenses.

About SELLAS Life Sciences Group, Inc.

SELLAS is a late-stage clinical biopharmaceutical company focused on the development of novel therapeutics for a broad range of cancer indications. SELLAS’ lead product candidate, GPS, is licensed from Memorial Sloan Kettering Cancer Center and targets the WT1 protein, which is present in an array of tumor types. GPS has the potential as a monotherapy and combination with other therapies to address a broad spectrum of hematologic malignancies and solid tumor indications. The Company is also developing SLS009 (formerly GFH009) - potentially the first and best-in-class differentiated small molecule CDK9 inhibitor with reduced toxicity and increased potency compared to other CDK9 inhibitors. Data suggests that SLS009 demonstrated a high response rate in AML patients with unfavorable prognostic factors including ASXL1 mutation, commonly associated with poor prognosis in various myeloid diseases. For more information on SELLAS, please visit www.sellaslifesciences.com.

Forward-Looking Statements

This press release contains forward-looking statements. All statements other than statements of historical facts are “forward-looking statements,” including those relating to future events. In some cases, forward-looking statements can be identified by terminology such as “plan,” “expect,” “anticipate,” “may,” “might,” “will,” “should,” “project,” “believe,” “estimate,” “predict,” “potential,” “intend,” or “continue” and other words or terms of similar meaning. These statements include, without limitation, statements related to the GPS clinical development program, including the REGAL study and the timing of future milestones related thereto. These forward-looking statements are based on current plans, objectives, estimates, expectations, and intentions, and inherently involve significant risks and uncertainties. Actual results and the timing of events could differ materially from those anticipated in such forward-looking statements as a result of these risks and uncertainties, which include, without limitation, risks and uncertainties with oncology product development and clinical success thereof, the uncertainty of regulatory approval, and other risks and uncertainties affecting SELLAS and its development programs as set forth under the caption “Risk Factors” in SELLAS’ Annual Report on Form 10-K filed on March 28, 2024 and in its other SEC filings. Other risks and uncertainties of which SELLAS is not currently aware may also affect SELLAS’ forward-looking statements and may cause actual results and the timing of events to differ materially from those anticipated. The forward-looking statements herein are made only as of the date hereof. SELLAS undertakes no obligation to update or supplement any forward-looking statements to reflect actual results, new information, future events, changes in its expectations, or other circumstances that exist after the date as of which the forward-looking statements were made.

Investor Contact

Bruce Mackle

Managing Director

LifeSci Advisors, LLC

SELLAS@lifesciadvisors.com

SELLAS LIFE SCIENCES GROUP, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended June 30, | | Six Months Ended June 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| Operating expenses: | | | | | | | | |

| Research and development | | $ | 5,186 | | | $ | 5,923 | | | $ | 10,297 | | | $ | 13,097 | |

| General and administrative | | 2,435 | | | 3,127 | | | 6,969 | | | 7,234 | |

| Total operating expenses | | 7,621 | | | 9,050 | | | 17,266 | | | 20,331 | |

| Loss from operations | | (7,621) | | | (9,050) | | | (17,266) | | | (20,331) | |

| Non-operating income: | | | | | | | | |

| Change in fair value of warrant liability | | — | | | 2 | | | — | | | 4 | |

| Interest income | | 151 | | | 208 | | | 230 | | | 390 | |

| Total non-operating income | | 151 | | | 210 | | | 230 | | | 394 | |

| Net loss | | (7,470) | | | (8,840) | | | $ | (17,036) | | | $ | (19,937) | |

| | | | | | | | |

| Per share information: | | | | | | | | |

| Net loss per common share, basic and diluted | | $ | (0.13) | | | $ | (0.31) | | | $ | (0.33) | | | $ | (0.77) | |

| Weighted-average common shares outstanding, basic and diluted | | 57,630,506 | | | 28,347,920 | | | 51,221,752 | | | 25,961,001 | |

SELLAS LIFE SCIENCES GROUP, INC.

CONSOLIDATED BALANCE SHEETS

(Amounts in thousands, except share and per share data)

(Unaudited)

| | | | | | | | | | | | | | |

| | June 30, 2024 | | December 31, 2023 |

| | |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 9,147 | | | $ | 2,530 | |

| Restricted cash and cash equivalents | | 100 | | | 100 | |

| Prepaid expenses and other current assets | | 3,055 | | | 542 | |

| Total current assets | | 12,302 | | | 3,172 | |

| Operating lease right-of-use assets | | 633 | | | 858 | |

| Goodwill | | 1,914 | | | 1,914 | |

| Deposits and other assets | | 270 | | | 275 | |

| Total assets | | $ | 15,119 | | | $ | 6,219 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 6,331 | | | $ | 5,639 | |

| Accrued expenses and other current liabilities | | 5,183 | | | 7,650 | |

| Operating lease liabilities | | 531 | | | 446 | |

| Total current liabilities | | 12,045 | | | 13,735 | |

| Operating lease liabilities, non-current | | 161 | | | 460 | |

| Total liabilities | | 12,206 | | | 14,195 | |

| Commitments and contingencies | | | | |

| Stockholders’ equity (deficit): | | | | |

| Preferred stock, $0.0001 par value; 5,000,000 shares authorized; Series A convertible preferred stock, 17,500 shares designated; no shares issued and outstanding at June 30, 2024 and December 31, 2023 | | — | | | — | |

| Common stock, $0.0001 par value; 350,000,000 shares authorized, 57,754,928 and 32,132,890 shares issued and outstanding at June 30, 2024 and December 31, 2023, respectively | | 5 | | | 3 | |

| Additional paid-in capital | | 237,188 | | | 209,265 | |

| Accumulated deficit | | (234,280) | | | (217,244) | |

| Total stockholders’ equity (deficit) | | 2,913 | | | (7,976) | |

| Total liabilities and stockholders’ equity (deficit) | | $ | 15,119 | | | $ | 6,219 | |

Cover

|

Aug. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 13, 2024

|

| Entity Registrant Name |

SELLAS Life Sciences Group, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-33958

|

| Entity Tax Identification Number |

20-8099512

|

| Entity Address, Address Line One |

7 Times Square, Suite 2503

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10036

|

| City Area Code |

(646)

|

| Local Phone Number |

200-5278

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

SLS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001390478

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

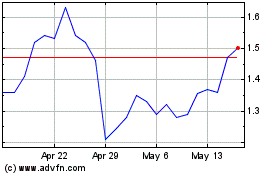

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Mar 2025 to Apr 2025

SELLAS Life Sciences (NASDAQ:SLS)

Historical Stock Chart

From Apr 2024 to Apr 2025