Highlights:

· Preliminary

fiscal year 2013 second quarter earnings per common share (diluted)

reported at $.72, down from $.95 in the year ago period, as average

fully-diluted common shares outstanding increased from 2.7 million

in the year ago period to 3.4 million in the current quarter, and

net income available to common shareholders decreased to $2.4

million, as compared to $2.6 million in the year ago period.

The increase in average shares outstanding was a result of the

common stock offering completed in November 2011. Earnings

per common share (diluted) were up $.01, as compared to the $.71

earned in the first quarter of fiscal 2013, the linked quarter.

· For the second

quarter of fiscal 2013, the Company generated an annualized return

on average assets of 1.32% and an annualized return on average

common equity of 12.5%, as compared to 1.44% and 17.1%,

respectively, for the same period of the prior year. In the

first quarter of fiscal 2013, the linked quarter, the annualized

return on average assets was 1.41%, and the annualized return on

average common equity was 12.6%.

· Net interest

margin for the second quarter of fiscal 2013 was 4.17%, up from the

4.12% reported for the year ago period, but down from the net

interest margin of 4.30% for the first quarter of fiscal 2013, the

linked quarter.

· Noninterest

income was up 24.3% for the second quarter of fiscal 2013, compared

to the year ago period, and up 5.5% from the first quarter of

fiscal 2013, the linked quarter.

· Noninterest

expense was up 14.3% for the second quarter of fiscal 2013,

compared to the year ago period, and up 7.6% from the first quarter

of fiscal 2013, the linked quarter.

· The Company

posted loan growth of $36.0 million, or 6.2%, during the first six

months of fiscal 2013; deposits increased $21.6 million, or

3.7%. Investment balances were up slightly, and cash balances

decreased.

· Non-performing

assets and non-performing loans increased in the first six months

of fiscal 2013, but were down from totals reported for at September

30, 2012, as the Company worked through the resolution process of

several previously classified credits.

Southern Missouri Bancorp, Inc. ("Company") (NASDAQ: SMBC), the

parent corporation of Southern Bank ("Bank"), today announced

preliminary net income available to common shareholders for the

second quarter of fiscal 2013 of $2.4 million, a decrease of

$122,000, or 4.8%, as compared to $2.6 million in net income

available to common shareholders earned during the same period of

the prior fiscal year. The decrease was attributable

primarily to an increase in noninterest expense and an increase in

provision for loan losses, partially offset by decreases in

provisions for income taxes and increases in noninterest income and

net interest income. Preliminary net income available to

common shareholders was $.72 per fully diluted common share for the

second quarter of fiscal 2013, a decrease of 24.2%, as compared to

the $.95 per fully diluted common share earned during the same

period of the prior fiscal year. The decrease was primarily the

result of higher average fully diluted common shares outstanding

following the common stock offering completed in November

2011. Before the dividend on preferred shares of $50,000,

preliminary net income for the first quarter of fiscal 2013 was

$2.5 million, a decrease of $194,000, or 7.2%, as compared to the

same period of the prior fiscal year.

Dividend Declared:

The Company is pleased to announce that the Board of Directors,

on January 22, 2013, declared its 75th consecutive quarterly

dividend on common stock since the inception of the Company.

The cash dividend of $.15 per common share will be paid on February

28, 2013, to common stockholders of record at the close of business

on February 15, 2013. The Board of Directors

and management believe the payment of a quarterly cash dividend

enhances shareholder value and demonstrates our commitment to and

confidence in our future prospects.

Conference Call:

The Company will host a conference call to review the

information provided in this press release on Tuesday, January 29,

2013, at 3:30 p.m., CST (4:30 p.m., EST). The call will be

available live to interested parties by calling 1-888-317-6016 in

the United States (Canada: 1-855-669-9657, international:

1-412-317-6016). Following the call, telephone playback will

be available one hour following the conclusion of the call, until

8:00 a.m., CST, on February 13, 2013. The playback may be

accessed by dialing 1-877-344-7529 (international: 1-412-317-0088),

and using the conference passcode 10024377.

Balance Sheet Summary:

The Company experienced balance sheet growth in the first six

months of fiscal 2013, with total assets increasing $31.0 million,

or 4.2%, to $770.2 million at December 31, 2012, as compared to

$739.2 million at June 30, 2012. Balance sheet growth was

primarily due to growth in loan balances, funded by deposit growth,

reductions in cash equivalent balances, and by increases in

securities sold under agreements to repurchase.

Available-for-sale investments increased $2.5 million, or 3.3%,

to $77.6 million at December 31, 2012, as compared to $75.1 million

at June 30, 2012. Increases in US agency obligations and

municipal obligations were partially offset by decreases in

mortgage-backed securities. Cash and equivalents were down

$16.3 million, redeployed into earning assets, primarily loans.

Loans, net of the allowance for loan losses, increased $36.0

million, or 6.2%, to $619.4 million at December 31, 2012, as

compared to $583.5 million at June 30, 2012. Loan balances

were up due primarily to increases in commercial real estate and

residential (primarily multifamily) real estate loans, partially

offset by decreases in equipment and operating lines for

agricultural and commercial borrowers, as well as decreases in

construction loan balances. The decrease in agricultural

operating lines is primarily seasonal and would be expected to

continue through the March 31 quarter.

Non-performing loans were $2.2 million, or 0.35% of gross loans,

at December 31, 2012, as compared to $2.4 million, or 0.41% of

gross loans, at June 30, 2012; non-performing assets were $5.9

million, or 0.77% of total assets, at December 31, 2012, as

compared to $4.0 million, or 0.54% of total assets, at June 30,

2012. Our allowance for loan losses at December 31, 2012, totaled

$7.9 million, representing 1.26% of gross loans and 359% of

non-performing loans, as compared to $7.5 million, or 1.27% of

gross loans, and 312% of non-performing loans, at June 30,

2012. The increase in non-performing assets was due primarily

to a single relationship which accounted for $2.4 million in

foreclosed real estate balances at December 31, 2012; the majority

of the foreclosed property value is commercial real estate.

(The loan relationship had migrated from classified to non-accrual

status during the quarter ended September 30, 2012.) For all

impaired loans, the Company has measured impairment under ASC

310-10-35, and management believes the allowance for loan losses at

September 30, 2012, is adequate, based on that measurement.

Total liabilities increased $26.8 million to $671.3 million at

December 31, 2012, an increase of 4.2% as compared to $644.5

million at June 30, 2012. This growth was primarily the

result of an increase in deposit accounts and securities sold under

agreements to repurchase.

Deposits increased $21.6 million, or 3.7%, to $606.4 million at

December 31, 2012, as compared to $584.8 million at June 30,

2012. Of the increase, $7.8 million was attributable to

public unit funds, and was somewhat seasonal in nature.

Increased balances were noted in interest-bearing checking,

noninterest checking, and certificate of deposit balances,

partially offset by a decline in savings accounts. The

average loan-to-deposit ratio for the second quarter of fiscal 2013

was 105.8%, as compared to 94.6% for the same period of the prior

fiscal year.

FHLB advances were $24.5 million at December 31, 2012, unchanged

in comparison to June 30, 2012; however, overnight FHLB advances

were utilized during the first six months of fiscal 2013 (the

average amount of overnight borrowings was $11.5 million).

Securities sold under agreements to repurchase totaled $30.9

million at December 31, 2012, as compared to $25.6 million at June

30, 2012, an increase of 20.7%, attributable mostly to seasonal

inflows from public units. At both dates, the full balance of

repurchase agreements was held by local small business and

government counterparties.

The Company's stockholders' equity increased $4.2 million, or

4.4%, to $98.9 million at December 31, 2012, from $94.7 million at

June 30, 2012. The increase was due primarily to retention of

net income, partially offset by cash dividends paid on common and

preferred stock.

Income Statement Summary:

The Company's net interest income for the three-month period

ended December 31, 2012, was $7.3 million, an increase of $9,000,

or 0.1%, as compared to the same period of the prior fiscal

year. For the six-month period ended December 31, 2012, net

interest income was $14.8 million, a decrease of $49,000, or 0.3%,

as compared to the same period of the prior fiscal year. For

the three-month period, the increase, as compared to the prior

fiscal year, was attributable to an increase in net interest

margin, from 4.12% to 4.17%, partially offset by a 1.1% decline in

the average balance of interest-earning assets. For the

six-month period, the decrease, as compared to the prior fiscal

year, was attributable to a decline in the net interest margin,

from 4.27% to 4.23%, partially offset by a 0.4% increase in average

interest-earning assets. In December 2010, the Company

acquired from the FDIC, as receiver, most of the assets and

substantially all of the liabilities of the former First Southern

Bank (the Acquisition). Accretion of fair value discount on

loans and amortization of fair value premiums on time deposits

related to the Acquisition declined from $1.0 million in the second

quarter of fiscal 2012 to $366,000 in the second quarter of fiscal

2013. The change in this component reduced net interest

income by $637,000 and net interest margin by 36 basis points for

the current quarter as compared to the year ago period.

Accretion of fair value discount on loans and amortization of fair

value premiums on time deposits related to the Acquisition declined

from $2.2 million in the first six months of fiscal 2012 to

$895,000 in the first six months of fiscal 2013. The change

in this component reduced net interest income by $1.3 million and

net interest margin by 36 basis points for the current fiscal year

to date as compared to the year ago period. The Company

expects the impact of the fair value discount accretion to continue

to decline, over time, as the assets acquired at a discount

continue to mature or prepay.

The provision for loan losses for the three- and six-month

periods ended December 31, 2012, was $462,000 and $1.1 million,

respectively, as compared to $345,000 and $862,000, respectively,

in the same periods of the prior fiscal year. As a percentage

of average loans outstanding, provision for the current three-and

six-month periods represented annualized charges of 0.30% and

0.35%, respectively, as compared to 0.25% and 0.31%, respectively,

for the same periods of the prior fiscal year. The increase

in provision for the three- and six-month periods ended December

31, 2012, as compared to the same periods of the prior fiscal year,

was attributed to higher net charge offs, strong loan growth, and

an increase in nonperforming credits. Net charge offs for the

six-month period ended December 31, 2012, were 0.21% of average

loans, as compared to 0.09% for the same period of the prior fiscal

year.

The Company's noninterest income for the three- and six-month

periods ended December 31, 2012, was $1.1 million and $2.2 million,

respectively, increases of $219,000, or 24.3%, and $162,000, or

8.1%, respectively, as compared to the same periods of the prior

fiscal year. The increase was attributed primarily to

increased deposit account charges and fees (resulting from

transaction account growth and increased NSF activity), increases

in the cash value of bank-owned life insurance (resulting from an

additional investment in such policies in March 2012), and higher

bank card network interchange revenues (resulting from additional

bank card transaction volume). The three-month period

comparison was additionally improved as a result of better

secondary market loan sales, while the six-month period comparison

was less favorable as a result of inclusion in the prior period's

result of the settlement of a legal claim obtained in the

Acquisition.

Noninterest expense for the three- and six-month periods ended

December 31, 2012, was $4.4 million and $8.6 million, respectively,

increases of $557,000, or 14.3%, and $912,000, or 11.9%,

respectively, as compared to the same periods of the prior fiscal

year. The increases were primarily attributable to higher

compensation and occupancy expenses, additional expenses related to

foreclosed property, and smaller gains on the sale of foreclosed

property, partially offset by a decline in the cost of providing

internet and mobile banking services. The efficiency ratio

for the three- and six-month periods ended December 31, 2012, was

52.6% and 50.7%, respectively, as compared to 47.2% and

45.6%, respectively, for the same periods of the prior fiscal

year. The deterioration for the three- and six-month ratios

resulted from increases of 14.3% and 11.9%, respectively, in

expenses, partially offset by increases of 2.8% and 0.7%,

respectively, in revenues.

The income tax provision for the three- and six-month periods

ended December 31, 2012, was $1.1 million and $2.2 million,

respectively, decreases of $252,000, or 19.1%, and $556,000, or

20.1%, respectively, as compared to the same periods of the prior

fiscal year. The declines were attributed primarily to a

decrease in pre-tax income, as well as a decline in the effective

tax rate, from 33.0% and 33.3%, respectively, in the three-

and six-month periods ended December 31, 2011, to 30.0% and 30.3%,

respectively, in the three- and six-month periods ended December

31, 2012. The decreases in the effective tax rates were

attributed to continued investments in tax-advantaged assets, and

the lower level of pre-tax income.

Forward-Looking Information:

Except for the historical information contained herein, the

matters discussed in this press release may be deemed to be

forward-looking statements that are subject to known and unknown

risks, uncertainties, and other factors that could cause the actual

results to differ materially from the forward-looking statements,

including: the strength of the United States economy in general and

the strength of the local economies in which we conduct operations;

fluctuations in interest rates and in real estate values; monetary

and fiscal policies of the Board of Governors of the Federal

Reserve System and the U.S. Government and other governmental

initiatives affecting the financial services industry; the risks of

lending and investing activities, including changes in the level

and direction of loan delinquencies and write-offs and changes in

estimates of the adequacy of the allowance for loan losses; our

ability to access cost-effective funding; the timely development of

and acceptance of our new products and services and the perceived

overall value of these products and services by users, including

the features, pricing and quality compared to competitors' products

and services; expected cost savings, synergies and other benefits

from the Company's merger and acquisition activities might not be

realized within the anticipated time frames or at all, and costs or

difficulties relating to integration matters, including but not

limited to customer and employee retention, might be greater than

expected; fluctuations in real estate values and both residential

and commercial real estate market conditions; demand for loans and

deposits in our market area; legislative or regulatory changes that

adversely affect our business; results of examinations of us by our

regulators, including the possibility that our regulators may,

among other things, require us to increase our reserve for loan

losses or to write-down assets; the impact of technological

changes; and our success at managing the risks involved in the

foregoing. Any forward-looking statements are based upon

management's beliefs and assumptions at the time they are made. We

undertake no obligation to publicly update or revise any

forward-looking statements or to update the reasons why actual

results could differ from those contained in such statements,

whether as a result of new information, future events or otherwise.

In light of these risks, uncertainties and assumptions, the

forward-looking statements discussed might not occur, and you

should not put undue reliance on any forward-looking

statements.

| Southern Missouri

Bancorp, Inc. |

|

| UNAUDITED CONDENSED

CONSOLIDATED FINANCIAL INFORMATION |

|

| |

|

|

|

|

|

|

| Summary Balance Sheet Data as

of: |

|

|

|

|

December 31,

2012 |

June 30,

2012 |

|

| |

|

|

|

|

|

|

|

| Cash and equivalents |

|

|

|

|

$

18,452,000 |

$

34,694,000 |

|

| Available for sale securities |

|

|

|

|

77,635,000 |

75,127,000 |

|

| Membership stock (1) |

|

|

|

|

3,019,000 |

3,019,000 |

|

| Loans receivable, gross |

|

|

|

|

627,330,000 |

590,957,000 |

|

| Allowance for loan losses |

|

|

|

|

7,920,000 |

7,492,000 |

|

| Loans receivable, net |

|

|

|

|

619,410,000 |

583,465,000 |

|

| Bank-owned life insurance |

|

|

|

|

16,212,000 |

15,957,000 |

|

| Intangible assets |

|

|

|

|

1,249,000 |

1,458,000 |

|

| Premises and equipment |

|

|

|

|

15,302,000 |

11,347,000 |

|

| Other assets |

|

|

|

|

18,913,000 |

14,122,000 |

|

| Total assets |

|

|

|

|

$

770,192,000 |

$

739,189,000 |

|

| |

|

|

|

|

|

|

|

| Interest-bearing deposits |

|

|

|

|

$

544,951,000 |

$

530,001,000 |

|

| Noninterest-bearing deposits |

|

|

|

|

61,454,000 |

54,813,000 |

|

| Securities sold under agreements to

repurchase |

|

|

|

|

30,945,000 |

25,642,000 |

|

| FHLB advances |

|

|

|

|

24,500,000 |

24,500,000 |

|

| Other liabilities |

|

|

|

|

2,200,000 |

2,288,000 |

|

| Subordinated debt |

|

|

|

|

7,217,000 |

7,217,000 |

|

| Total liabilities |

|

|

|

|

671,267,000 |

644,461,000 |

|

| |

|

|

|

|

|

|

|

| Preferred stock |

|

|

|

|

20,000,000 |

20,000,000 |

|

| Common stockholders' equity |

|

|

|

|

78,925,000 |

74,728,000 |

|

| Total stockholders' equity |

|

|

|

|

98,925,000 |

94,728,000 |

|

| |

|

|

|

|

|

|

|

| Total liabilities and

stockholders' equity |

|

|

|

|

$

770,192,000 |

$

739,189,000 |

|

| |

|

|

|

|

|

|

|

| Equity to assets ratio |

|

|

|

|

12.84% |

12.82% |

|

| Common shares outstanding |

|

|

|

|

3,254,000 |

3,248,000 |

|

| Book value per common share |

|

|

|

|

$

24.25 |

$

23.01 |

|

| Closing market price |

|

|

|

|

22.45 |

21.50 |

|

| |

|

|

|

|

|

|

|

| Nonperforming asset data as

of: |

|

|

|

|

December 31,

2012 |

June 30,

2012 |

|

| |

|

|

|

|

|

|

|

| Nonaccrual loans |

|

|

|

|

$

2,191,000 |

$

2,398,000 |

|

| Accruing loans 90 days or more past due |

|

|

|

|

18,000 |

- |

|

| Nonperforming troubled debt restructurings

(2) |

|

|

|

|

- |

- |

|

| Total nonperforming loans |

|

|

|

|

2,209,000 |

2,398,000 |

|

| Other real estate owned (OREO) |

|

|

|

|

3,462,000 |

1,426,000 |

|

| Personal property repossessed |

|

|

|

|

114,000 |

9,000 |

|

| Nonperforming investment securities |

|

|

|

|

125,000 |

125,000 |

|

| Total nonperforming assets |

|

|

|

|

$

5,910,000 |

$

3,958,000 |

|

| |

|

|

|

|

|

|

|

| Total nonperforming assets to total

assets |

|

|

|

|

0.77% |

0.54% |

|

| Total nonperforming loans to gross loans |

|

|

|

|

0.35% |

0.41% |

|

| Allowance for loan losses to nonperforming

loans |

|

|

|

|

358.53% |

312.43% |

|

| Allowance for loan losses to gross loans |

|

|

|

|

1.26% |

1.27% |

|

| |

|

|

|

|

|

|

|

| Performing troubled debt restructurings |

|

|

|

|

$

3,515,000 |

$

3,138,000 |

|

| |

|

|

|

|

|

|

|

(1) Federal Home Loan Bank and Federal Reserve Bank of St. Louis

membership stock |

|

|

|

(2) reported here only if not otherwise listed as nonperforming

(i.e., nonaccrual or 90+ days past due) |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

For the

three-month period ended |

|

For the six-month

period ended |

| Average Balance Sheet

Data: |

|

December 31,

2012 |

December 31,

2011 |

|

December 31,

2012 |

December 31,

2011 |

| |

|

|

|

|

|

|

| Interest-bearing cash equivalents |

|

$

8,350,000 |

$

80,800,000 |

|

$

10,129,000 |

$

62,540,000 |

| Available for sale securities and

membership

stock |

|

77,466,000 |

70,080,000 |

|

76,257,000 |

68,429,000 |

| Loans receivable, gross |

|

617,495,000 |

559,925,000 |

|

610,245,000 |

562,946,000 |

| Total interest-earning

assets |

|

703,311,000 |

710,805,000 |

|

696,631,000 |

693,915,000 |

| Other assets |

|

50,471,000 |

30,801,000 |

|

47,714,000 |

29,328,000 |

| Total assets |

|

$

753,782,000 |

$

741,606,000 |

|

$

744,345,000 |

$

723,243,000 |

| |

|

|

|

|

|

|

| Interest-bearing deposits |

|

$

527,902,000 |

$

550,620,000 |

|

$

524,331,000 |

$

541,335,000 |

| Securities sold under agreements to

repurchase |

|

26,858,000 |

27,087,000 |

|

25,713,000 |

26,438,000 |

| FHLB advances |

|

37,918,000 |

33,500,000 |

|

36,024,000 |

33,500,000 |

| Subordinated debt |

|

7,217,000 |

7,217,000 |

|

7,217,000 |

7,217,000 |

| Total interest-bearing

liabilities |

|

599,895,000 |

618,424,000 |

|

593,285,000 |

608,490,000 |

| Noninterest-bearing deposits |

|

55,519,000 |

41,382,000 |

|

53,816,000 |

39,175,000 |

| Other noninterest-bearing liabilities |

|

358,000 |

1,996,000 |

|

336,000 |

3,205,000 |

| Total liabilities |

|

655,772,000 |

661,802,000 |

|

647,437,000 |

650,870,000 |

| |

|

|

|

|

|

|

| Preferred stock |

|

20,000,000 |

20,000,000 |

|

20,000,000 |

18,682,000 |

| Common stockholders' equity |

|

78,010,000 |

59,804,000 |

|

76,908,000 |

53,691,000 |

| Total stockholders' equity |

|

98,010,000 |

79,804,000 |

|

96,908,000 |

72,373,000 |

| |

|

|

|

|

|

|

| Total liabilities and

stockholders'

equity |

|

$

753,782,000 |

$

741,606,000 |

|

$

744,345,000 |

$

723,243,000 |

| |

|

For the

three-month period ended |

|

For the six-month

period ended |

| Summary Income Statement

Data: |

|

December 31,

2012 |

December 31,

2011 |

|

December 31,

2012 |

December 31,

2011 |

| |

|

|

|

|

|

|

| Interest income: |

|

|

|

|

|

|

| Cash equivalents |

|

$

11,000 |

$

52,000 |

|

$

30,000 |

$

81,000 |

| Available for

sale securities and

membership

stock |

|

457,000 |

634,000 |

|

945,000 |

1,263,000 |

| Loans receivable |

|

8,730,000 |

9,257,000 |

|

17,584,000 |

18,813,000 |

| Total interest

income |

|

9,198,000 |

9,943,000 |

|

18,559,000 |

20,157,000 |

| Interest expense: |

|

|

|

|

|

|

| Deposits |

|

1,497,000 |

2,163,000 |

|

3,076,000 |

4,446,000 |

| Securities sold under agreements

to repurchase |

|

54,000 |

59,000 |

|

102,000 |

119,000 |

| FHLB advances |

|

259,000 |

339,000 |

|

513,000 |

679,000 |

| Subordinated debt |

|

58,000 |

60,000 |

|

117,000 |

114,000 |

| Total interest

expense |

|

1,868,000 |

2,621,000 |

|

3,808,000 |

5,358,000 |

| Net interest income |

|

7,330,000 |

7,322,000 |

|

14,751,000 |

14,799,000 |

| Provision for loan losses |

|

462,000 |

345,000 |

|

1,073,000 |

862,000 |

| Noninterest income |

|

1,118,000 |

899,000 |

|

2,178,000 |

2,016,000 |

| Noninterest expense |

|

4,440,000 |

3,884,000 |

|

8,579,000 |

7,667,000 |

| Income taxes |

|

1,065,000 |

1,317,000 |

|

2,206,000 |

2,761,000 |

| Net income |

|

2,481,000 |

2,675,000 |

|

5,071,000 |

5,525,000 |

| Less: effective dividend on

preferred

shares |

|

50,000 |

122,000 |

|

245,000 |

352,000 |

| Net income

available to

common shareholders |

|

$

2,431,000 |

$

2,553,000 |

|

$

4,826,000 |

$

5,173,000 |

| |

|

|

|

|

|

|

| Basic earnings per common share |

|

$

0.75 |

$

0.98 |

|

$

1.49 |

$

2.21 |

| Diluted earnings per common

share |

|

0.72 |

0.95 |

|

1.43 |

2.12 |

| Dividends per common share |

|

0.15 |

0.12 |

|

0.30 |

0.24 |

| Average common shares

outstanding: |

|

|

|

|

|

|

| Basic |

|

3,249,000 |

2,595,000 |

|

3,249,000 |

2,345,000 |

| Diluted |

|

3,383,000 |

2,687,000 |

|

3,382,000 |

2,434,000 |

| |

|

|

|

|

|

|

| Return on average assets |

|

1.32% |

1.44% |

|

1.36% |

1.53% |

| Return on average common

shareholders'

equity |

|

12.5% |

17.1% |

|

12.6% |

19.3% |

| |

|

|

|

|

|

|

| Net interest margin |

|

4.17% |

4.12% |

|

4.23% |

4.27% |

| Net interest spread |

|

3.98% |

3.90% |

|

4.05% |

4.05% |

| |

|

|

|

|

|

|

| Efficiency ratio |

|

52.6% |

47.2% |

|

50.7% |

45.6% |

CONTACT: Matt Funke 573-778-1800

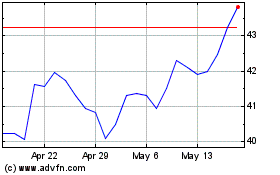

Southern Missouri Bancorp (NASDAQ:SMBC)

Historical Stock Chart

From Jun 2024 to Jul 2024

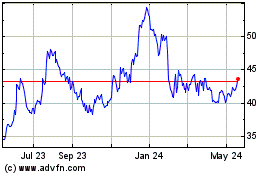

Southern Missouri Bancorp (NASDAQ:SMBC)

Historical Stock Chart

From Jul 2023 to Jul 2024