false

0001554859

0001554859

2024-07-31

2024-07-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 8-K/A

(Amendment No. 1)

______________________

CURRENT REPORT

Pursuant to Section 13

OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 31, 2024

______________________

SEMLER SCIENTIFIC, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36305 |

|

26-1367393 |

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

2340-2348 Walsh Avenue, Suite 2344

Santa Clara, CA |

|

95051 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant's telephone number, including area code: (877) 774-4211

______________________

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

|

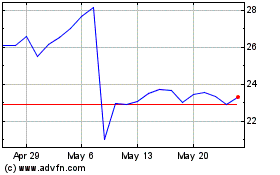

Common Stock, $0.001 par value per share

|

|

SMLR |

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 8.01. Other Events.

On May 28, 2024, we announced a new bitcoin treasury strategy

and the initial purchase of 581 bitcoins for an aggregate amount of $40.0 million, inclusive of fees and expenses, and on June 6,

2024, we announced the purchase of an additional 247 bitcoins for an aggregate amount of $17.0 million, inclusive of fees and expenses

as of such date.

We are filing updated information regarding our new bitcoin

strategy for the purpose of supplementing and updating our business section disclosures and our risk factor disclosures contained in

our prior public filings, including those discussed under the headings “Item 1. Business” and “Item 1A. Risk

Factors” in our annual

report on Form 10-K for the year ended December 31, 2023, filed with the Securities and Exchange Commission, or SEC, on

March 7, 2024, and to supersede our prior updated disclosures included in our

current reports on Form 8-K filed with the SEC on June 6, 2024 and July 11, 2024. The supplemental business section and risk

factor disclosures are filed herewith as Exhibit 99.1 and are incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly

authorized.

| |

SEMLER SCIENTIFIC, INC. |

| |

|

| Date: July 31, 2024 |

By: |

/s/ Renae Cormier |

| |

|

Name: |

Renae Cormier |

| |

|

Title: |

Chief Financial Officer |

| |

|

(Principal Financial Officer and Principal Accounting Officer) |

Exhibit 99.1

Bitcoin Strategy Related Supplemental Disclosures

Bitcoin Treasury Strategy

WE ARE NOT REGISTERED AS AN INVESTMENT

COMPANY UNDER THE INVESTMENT COMPANY ACT OF 1940 AND STOCKHOLDERS DO NOT HAVE THE PROTECTIONS ASSOCIATED WITH OWNERSHIP OF SHARES IN A

REGISTERED INVESTMENT COMPANY NOR THE PROTECTIONS AFFORDED BY THE COMMODITIES EXCHANGE ACT.

Summary

This section summarizes our current acquisition strategy

for bitcoin, including our historical purchases, trading execution, custody, storage, and accounting considerations. We reserve the right

to update and alter our acquisition strategy from time to time. We view bitcoin as a reliable store of value and a compelling investment.

We believe it has unique characteristics as a scarce and finite asset that can serve as a reasonable inflation hedge and safe haven amid

global instability. Bitcoin is often compared to gold, which has been viewed as a dependable store of value throughout history. Gold’s

value has appreciated substantially over time. For example, 25 years ago, the price of gold was approximately $500 per ounce. In 2024,

the price of gold has traded higher than $2,400 per ounce. As of July 2024, the total market capitalization of gold was approximately

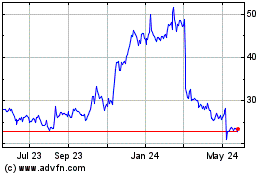

$16.1 trillion compared to approximately $1.1 trillion for bitcoin. Bitcoin is a highly volatile asset that has traded below $26,000 per

bitcoin and above $70,000 per bitcoin on Coinbase in the 12 months preceding the date of the current report on Form 8-K to which this supplement is filed as an Exhibit. While highly volatile, bitcoin’s

price has also appreciated significantly since bitcoin’s inception in January 2009 (at zero per bitcoin). We believe that a

substantial portion of bitcoin’s appreciation is attributable to the view that bitcoin is or will become a reliable store of value.

Like gold, bitcoin is also viewed as a scarce asset; the ultimate supply of bitcoin is limited to 21 million coins and approximately 94%

of its supply already exists. We believe that bitcoin’s finite, digital and decentralized nature as well as its architectural resilience

make it preferable to gold, which, as noted above, has a market capitalization 16 times higher than the market capitalization of bitcoin

as of July 2024. Given our belief that bitcoin is a comparable and possibly better store of value than gold, we believe that bitcoin

has the potential to approach or exceed the value of gold over time. Given the substantial gap in value between gold and bitcoin based

on current market capitalization, we believe that bitcoin has the potential to generate outsize returns as it gains increasing acceptance

as “digital gold.” We believe that the growing global acceptance and “institutionalization” of bitcoin support

our view that bitcoin is a reliable store of value. We believe that bitcoin’s unique attributes discussed above not only differentiate

it from fiat money, but also from other cryptocurrency assets, and for that reason, we have no plans to purchase cryptocurrency assets

other than bitcoin.

Institutionalization of Bitcoin

We are encouraged by the growing global acceptance and “institutionalization”

of bitcoin – reflected by the January 2024 Securities and Exchange Commission, or SEC, approval of 11 bitcoin exchange-traded

funds. These funds have reported billions of dollars of net inflows, with investments from a large number of institutions, including global

banks, pensions, endowments and registered investment advisors. It is currently estimated that more than 10% of all bitcoins are now held

by institutions.

Our Decision to Adopt Bitcoin as Our Primary Reserve Strategy

Our board of directors and senior management have been examining

potential uses of cash, including acquisitions and stock repurchases. After studying various alternatives, we decided that investing in

bitcoin is currently the best use of our cash. Bitcoin will be our principal treasury holding on an ongoing basis, subject to market conditions

and our anticipated cash needs. As we embark on our new acquisition strategy, our board intends to proactively evaluate our use of cash,

ensuring we maintain adequate working capital.

Other than acquiring bitcoin with our liquid assets that

exceed working capital requirements, our bitcoin treasury strategy also involves issuing debt or equity securities or engaging in other

capital raising transactions with the objective of using the proceeds to purchase bitcoin from time to time, and subject to market conditions.

We view bitcoin as a core holding and expect to continue to accumulate bitcoin. We have not set any specific target for the amount of

bitcoin we seek to hold, and we will continue to monitor market conditions in determining whether to engage in financings to purchase

additional bitcoin. This overall strategy also contemplates that we may (i) periodically sell bitcoin for general corporate purposes,

including to generate cash for treasury management (which may include debt repayment, if appropriate at such time), for acquisitions,

or for strategies that generate tax benefits in accordance with applicable law, (ii) enter into additional capital raising transactions

that are collateralized by our bitcoin holdings, and (iii) pursue strategies to create income streams or otherwise generate funds

using our bitcoin holdings. At this time, we do not have a specific policy governing the percentage of our treasury holdings that will

be bitcoin.

Historical Bitcoin Acquisitions

In May 2024, we announced our initial purchases of an

aggregate 581 bitcoins for an aggregate purchase price of $40.0 million, and have subsequently acquired additional bitcoins. As of June 6,

2024, we held an aggregate 828 bitcoins, which we acquired for an aggregate purchase price of $57.0 million, inclusive of fees and expenses.

Accounting

Bitcoin accounting guidance has been evolving. According

to the American Institute of Certified Public Accountants’ “Accounting for and auditing of Digital Assets practice aid,”

bitcoin would satisfy the definition of an indefinite-lived intangible asset and would be accounted for under ASC 350, Intangibles

— Goodwill and Other issued by Financial Accounting Standards Board, or FASB. Under these guidelines, bitcoin holdings would be

accounted for initially at cost and subject to impairment losses if their fair value fell below carrying value. In December 2023,

the FASB issued Accounting Standards Update No. 2023-08, Accounting for and Disclosure of Crypto Assets (ASU 2023-08), which revised

bitcoin accounting treatment. Under this new guidance, the valuation of bitcoin is to be measured based on fair value.

Hedging Strategy

We do not currently intend to hedge our bitcoin holdings

and have not adopted a hedging strategy with respect to bitcoin. However, we may from time to time engage in hedging strategies as part

of our treasury management operations if deemed appropriate.

Overview of the Bitcoin Industry and Market

Bitcoin is a digital asset that is issued by and transmitted

through an open-source protocol, known as the bitcoin protocol, collectively maintained by a peer-to-peer network of decentralized user

nodes. This network hosts a public transaction ledger, known as the bitcoin blockchain, on which bitcoin holdings and all validated transactions

that have ever taken place on the bitcoin network are recorded. Balances of bitcoin are stored in individual “wallet” functions,

which associate network public addresses with one or more “private keys” that control the transfer of bitcoin. The bitcoin

blockchain can be updated without any single entity owning or operating the network.

Creation of New Bitcoin and Limits on Supply

New bitcoin is created and allocated by the bitcoin protocol

through a “mining” process that rewards users that validate transactions in the bitcoin blockchain. Validated transactions

are added in “blocks” approximately every 10 minutes. The mining process serves to validate transactions and secure the bitcoin

network. Mining is a competitive and costly operation that requires a large amount of computational power to solve complex mathematical

algorithms. This expenditure of computing power is known as “proof of work.” To incentivize miners to incur the costs of mining

bitcoin, the bitcoin protocol rewards miners that successfully validate a block of transactions with newly generated bitcoin.

The bitcoin protocol limits the total number of bitcoin that

can be generated over time to 21 million. As part of bitcoin's coin issuance, miners are rewarded a certain amount of bitcoins whenever

a block is produced. When bitcoin first started, 50 bitcoins per block were given as a reward to miners. After every 210,000 blocks are

mined (approximately every four years), the block reward halves and will keep on halving until the block reward per block becomes 0 (approximately

by year 2140). The block reward as of April 2024 is 3.125 coins per block and will decrease to 1.5625 coins per block post halving.

Modifications to the Bitcoin Protocol

Bitcoin is an open-source network that has no central authority,

so no one person can unilaterally make changes to the software that runs the network. However, there is a core group of developers that

maintain the code for the bitcoin protocol as well as various bitcoin end-user software, and they can propose changes to the source code

and release periodic updates and other changes. Unlike most software that has a central entity that can push updates to users, bitcoin

is a peer-to-peer network in which individual network participants, called miners or nodes, decide whether to upgrade the software and

accept the new changes. As a practical matter, a modification becomes part of the bitcoin protocol only if the proposed changes are accepted

by participants collectively having the most processing power, known as hash rate, on the network. If a certain percentage of the nodes

reject the changes, then a “fork” takes place and participants can choose the version of the software they want to run.

Forked or Airdropped Asset Policy

We intend to recognize forked and airdropped assets consistent

with our custodians. We may not immediately or ever have the ability to withdraw a forked or airdropped bitcoin by virtue of bitcoins

that we hold with our custodians. Future forks may occur at any time. A fork can lead to a disruption of networks and our information

technology systems, cybersecurity attacks, replay attacks, or security weaknesses, any of which can further lead to temporary or even

permanent loss of our and our assets.

Forms of Attack Against the Bitcoin Network and Wallets

Blockchain technology has many built-in security features

that make it difficult for hackers and other malicious actors to corrupt the protocol or blockchain. However, as with any computer network,

the bitcoin network may be subject to certain attacks. Some forms of attack include unauthorized access to wallets that hold bitcoin and

direct attacks on the network, like “51% attacks” or “denial-of-service attacks” on the bitcoin protocol.

Bitcoin is designed to be controllable only by the possessor

of both the unique public key and private key(s) relating to the local or online digital wallet in which the bitcoin is held. Private

keys used to access bitcoin balances are not widely distributed and are typically held on hardware (which can be physically controlled

by the holder or by a third party such as a custodian) or via software programs on third-party servers. One form of obtaining unauthorized

access to a wallet occurs following a phishing attack where the attacker deceives the victim and manipulates them into sharing their private

keys for their digital wallet or other sensitive information. Other similar attacks may also result in the loss of private keys and the

inability to access, and effective loss of, the corresponding bitcoin. See “Supplemental Risk Factors—Risks Related to Our

Bitcoin Treasury Strategy and Holdings—We face risks relating to the custody of our bitcoin, including the loss or destruction of

private keys required to access our bitcoin and cyberattacks or other data loss relating to our bitcoin” elsewhere in this supplement.

A “51% attack” may occur when a group of miners

attain more than 50% of the bitcoin network’s mining power, thereby enabling them to control the bitcoin network and protocol and

manipulate the blockchain. A “denial-of-service attack” occurs when legitimate users are unable to access information systems,

devices, or other network resources due to the actions of a malicious actor flooding the network with traffic until the network is unable

to respond or crashes. The bitcoin network has been, and can be in the future, subject to denial-of-service attacks, which can result

in temporary delays in block creation and in the transfer of bitcoin. See “Supplemental Risk Factors—Risks Related to Our

Bitcoin Treasury Strategy and Holdings—Bitcoin and other digital assets are novel assets, and are subject to significant legal,

commercial, regulatory and technical uncertainty” elsewhere in this supplement.

Bitcoin Industry Participants

The primary bitcoin industry participants are miners, investors

and traders, digital asset exchanges and service providers, including custodians, brokers, payment processors, wallet providers and financial

institutions.

Miners.

Miners range from bitcoin enthusiasts to professional mining operations that design and build dedicated mining machines and data centers,

including mining pools, which are groups of miners that act cohesively and combine their processing power to mine bitcoin blocks. See

“—Creation of New Bitcoin and Limits on Supply” above.

Investors

and Traders. Bitcoin investors and traders include individuals and institutional investors who, directly or indirectly, purchase,

hold, and sell bitcoin or bitcoin-based derivatives. On January 10, 2024, the SEC issued an order approving several applications

for the listing and trading of shares of spot bitcoin exchange-traded products, or ETPs on U.S. national securities exchanges. While the

SEC had previously approved exchange-traded funds where the underlying assets were bitcoin futures contracts, this order represents the

first time the SEC has approved the listing and trading of ETPs that acquire, hold and sell bitcoin directly. ETPs can be bought and sold

on a stock exchange like traditional stocks, and provide investors with another means of gaining economic exposure to bitcoin through

traditional brokerage accounts.

Digital

Asset Exchanges. Digital asset exchanges provide trading venues for purchases and sales of bitcoin in exchange for fiat or

other digital assets. Bitcoin can be exchanged for fiat currencies, such as the U.S. dollar, at rates of exchange determined by market

forces on bitcoin trading platforms, which are not regulated in the same manner as traditional securities exchanges. In addition to these

platforms, over-the-counter markets and derivatives markets for bitcoin also exist. The value of bitcoin within the market is determined,

in part, by the supply of and demand for bitcoin in the global bitcoin market, market expectations for the adoption of bitcoin as a store

of value, the number of merchants that accept bitcoin as a form of payment, and the volume of peer-to-peer transactions, among other factors.

For a discussion of risks associated with digital asset exchanges, see “Supplemental Risk Factors—Risks Related to Our Bitcoin

Treasury Strategy and Holdings—Due to the currently unregulated nature and lack of transparency surrounding the operations of many

bitcoin trading venues, bitcoin trading venues may experience greater fraud, security failures or regulatory or operational problems than

trading venues for more established asset classes, which may result in a loss of confidence in bitcoin trading venues and adversely affect

the value of our bitcoin” elsewhere in this supplement.

Service

providers. Service providers offer a multitude of services to other participants in the bitcoin industry, including custodial

and trade execution services, commercial and retail payment processing, loans secured by bitcoin collateral, and financial advisory services.

If adoption of the bitcoin network continues to materially increase, we anticipate that service providers may expand the currently available

range of services and that additional parties will enter the service sector for the bitcoin network.

Other Digital Assets

As of the date of the current report on Form 8-K to

which this supplement is filed as an Exhibit, bitcoin was the largest digital asset by market capitalization. However, there are numerous

alternative digital assets and many entities, including consortia and financial institutions, are researching and investing resources

into private or permissioned blockchain platforms or digital assets that do not use proof-of-work mining like the bitcoin network. For

example, in late 2022, the ethereum network transitioned to a “proof-of-stake” mechanism for validating transactions that

requires significantly less computing power than proof-of-work mining. Other alternative digital assets that compete with bitcoin in certain

ways include “stablecoins,” which are designed to maintain a peg to a reference price because of their issuers’ promise

to hold high-quality liquid assets (such as U.S. dollar deposits and short-term U.S. treasury securities) equal to the total value of

stablecoins in circulation. Stablecoins have grown rapidly as an alternative to bitcoin and other digital assets as a medium of exchange

and store of value, particularly on digital asset trading platforms. As of March 31, 2024, two of the seven largest digital assets

by market capitalization are U.S. dollar-backed stablecoins.

Additionally, central banks in some countries have started

to introduce digital forms of legal tender. For example, China’s central bank digital currency, or CBDC, project was made available

to consumers in January 2022, and governments including the United States and the European Union have been discussing the potential

creation of new CBDCs. For a discussion of risks relating to the emergence of other digital assets, see “Supplemental Risk Factors

—Risks Related to Our Bitcoin Treasury Strategy and Holdings—The emergence or growth of other digital assets, including those

with significant private or public sector backing, could have a negative impact on the price of bitcoin and adversely affect our financial

condition and results of operations” elsewhere in this supplement.

Execution of Bitcoin Transactions

We have

purchased bitcoin through multiple bitcoin trade execution, or liquidity, providers, who may also serve as custodians of our bitcoin,

and expect to continue to do so in the future. We may also in the future acquire or dispose of bitcoin via trade orders executed on exchanges

such as Coinbase. Our liquidity providers and custodians, or our BTC Service Providers, are regulated and licensed entities that operate

under high security, regulatory, audit and governance standards. We transact with multiple BTC Service Providers for both trade execution

and custodial services to spread our risk and to limit our exposure to any single service provider or counterparty.

In selecting

our liquidity providers, we evaluate regulatory status, pricing, annual trading volume, security and customer service. We also leverage

the due diligence we conduct in connection with our custodial arrangements when conducting due diligence on our liquidity providers. Our

current agreements with our liquidity providers are non-exclusive, may be terminated by us at any time, do not impose any requirements

for minimum purchases or volumes with such providers, and generally provide that we are responsible for the costs associated with transfers

of bitcoin.

To date,

our liquidity providers, acting as our agents, have executed trades of bitcoin on our behalf using time-weighted average price over a

prearranged time period, or TWAP, pricing and purchasing methodology, and we expect them to continue to do so in the future. The prearranged

periods over which trades may be executed vary in length depending on the amount of bitcoin to be purchased and other factors, and are

selected because they are expected to have lower price volatility and higher market liquidity, thereby limiting cost and pricing risks.

Our liquidity providers use TWAP in their trading algorithms to execute large orders of bitcoin, without significantly affecting market

price, by breaking large orders into several smaller orders that are independently traded at different time intervals in a generally

linear fashion across different trading venues our liquidity providers select. Our liquidity providers execute trades based on the best

possible terms reasonably available, taking into consideration all relevant facts and circumstances. As our agents, our liquidity providers

use their discretion to select the counterparties to the transactions as well as the trading venues and platforms on which they execute

trades on our behalf, and they may execute trades via cryptocurrency exchanges or in over-the-counter transactions. Our liquidity providers

may calculate time-weighted average price using any number of resources, including various trading platforms. Our liquidity providers

have policies and procedures pursuant to which they conduct trades with institutions that possess licenses or registrations to the extent

required by their activities and have been AML/KYC approved pursuant to our liquidity providers’ internal programs. We may in the

future utilize TWAP pricing or another pricing methodology in connection with the execution of our bitcoin trades.

Custody of our Bitcoin

We currently

hold and intend to continue to hold all of our bitcoin in custodial accounts at U.S.-based, institutional-grade custodians (who may hold

our bitcoin in the United States or other territories) that have demonstrated records of regulatory compliance and information security.

Our custodians may also serve as liquidity providers. As of July 31, 2024, we have entered into custodial agreements with Coinbase Custody

Trust Company, LLC, or Coinbase Custody, a subsidiary of Coinbase Global, Inc., or Coinbase, and NYDIG Trust Company LLC, or NYDIG, a

subsidiary of New York Digital Investment Group LLC. Our agreements with these custodians are filed as exhibits to the registration statement

of which this prospectus forms a part. As we further execute on our strategy, we intend to include additional custodians.

We carefully

select our custodians after undertaking a due diligence process pursuant to which we evaluate, among other things, the quality of their

security protocols, including the multifactor and other authentication procedures designed to safekeep our bitcoin that they may employ,

as well as other security, regulatory, audit and governance standards. Our custodians are required to hold our bitcoin in trust for our

benefit in segregated accounts which are not commingled with their assets or the assets of their affiliates or other clients. Should we

enter into custodial agreements with additional custodians, such agreements may not prohibit such custodians from commingling our bitcoin

with the digital assets of others. Our custodial agreement with NYDIG provides that NYDIG will store our bitcoin in offline, or “cold”

storage, and our custodial agreement with Coinbase Custody provides that Coinbase Custody will hold our bitcoin in an online “hot”

wallet until it receives an instruction from us to effectuate a transfer of our bitcoin into cold storage. Cold storage is designed to

mitigate risks that a system may be susceptible to when connected to the internet, including the risks associated with unauthorized network

access and cyberattacks.

Our custodians

have access to the private key information associated with our bitcoin, or private keys, and they deploy security measures to secure our

bitcoin holdings such as advanced encryption technologies, multi-factor identification, and a policy of storing our private keys in redundant,

secure and geographically dispersed facilities. We never store, view or directly access our private keys. The operational procedures of

our custodians are reviewed periodically by third-party advisors. All movement of our bitcoin by our custodians is coordinated, monitored

and audited. Our custodians’ procedures to prove control over the digital assets they hold in custody are also examined by their

auditors. Additionally, we periodically verify our bitcoin holdings by reconciling our custodial service ledgers to the public blockchain.

Our custodial agreements are terminable by us at any time, for any or no reason, upon advance notice given to the custodian.

Risk Mitigation Practices Related to Our Liquidity

and Custodial Arrangements

We believe

that our primary counterparty risk with respect to our bitcoin holdings is performance obligations under our various custody arrangements.

We intend to custody our bitcoin with multiple custodians to diversify our potential risk exposure to any one custodian. Our custodial

services contracts do not restrict our ability to reallocate our bitcoin among our custodians or require us to hold a minimum amount of

bitcoin with any particular custodian. Our bitcoin holdings may be concentrated with a single custodian from time to time, particularly

as we negotiate new arrangements or move our assets among our various service providers.

As regulated

entities, our BTC Service Providers have policies, procedures and controls designed to comply with the Bank Secrecy Act, as amended by

the USA PATRIOT Act, the implementing regulations of the U.S. Treasury Department’s FinCEN, the Executive Orders and economic sanctions

regulations administered by the U.S. Treasury Department’s Office of Foreign Assets Control, or OFAC, as well as state Anti-Money

Laundering, or AML laws. Pursuant to these policies, procedures and controls, our BTC Service Providers use information systems developed

in-house and by third-party vendors to conduct know your customer, or KYC, identification verification, background checks and other due

diligence on counterparties and customers, and on the affiliates, related persons and authorized representatives of their customers, and

to screen these parties against published sanctions lists. These checks may, where appropriate, assess financial strength, reputation,

trading capabilities and other risks that may be associated with a given customer or counterparty. Our BTC Service Providers perform these

checks and screenings during initial onboarding or in advance of a transaction, as applicable, and periodically thereafter, particularly

when the sanctions lists that they monitor are updated. Our BTC Service Providers also utilize systems that monitor and screen blockchain

transactions and digital wallet addresses in their efforts to detect and report suspicious or unlawful activity.

Our due

diligence process when selecting BTC service providers involves giving consideration to their reputation and security level, confirming

their internal compliance with applicable laws and regulations and ensuring their undertakings of contractual obligations on compliance.

With respect to our custodians, we also conduct due diligence reviews during the custodial relationship to monitor the safekeeping of

our bitcoin. As part of our process, we obtain and review our custodians’ services organization controls reports if available. We

are also contractually entitled to review our custodians’ relevant internal controls through a variety of methods. We have in the

past conducted, and expect to conduct in the future, supplemental due diligence when we believe it is warranted by market circumstances

or otherwise. For example, we obtained supporting documentation to verify certain factual information, including documentation and analysis

regarding financial solvency, exposure to troubled exchanges, regulatory compliance, security protocols and our ownership of our bitcoin.

We negotiate

liability provisions in our custodial contracts pursuant to which our custodians are held liable for their failure to safekeep our bitcoin.

For example, our custodial agreement with Coinbase Custody provides that Coinbase Custody will be liable to us for up to an amount equal

to the greater of the aggregate amount of fees paid in the 12 month period preceding a liability event or the value, at the time of a

liability event, of the supported digital assets in our vault account that are directly affected by the liability event, in either case

subject to a cap of $100 million. Our custodial agreement with NYDIG provides that NYDIG will be liable to us for up to an amount equal

to the greater of the fair market value of the custodied assets at the time the events giving rise to such liability occurred and the

fair market value of the custodied assets at the time we are notified or otherwise have actual knowledge of the events giving rise to

such liability. In addition to custodial arrangements, we also intend to utilize affiliates of our bitcoin custodians to execute bitcoin

acquisition and disposition transactions on our behalf (who may be our liquidity providers discussed elsewhere).

We also

negotiate specific contractual terms and conditions with our custodians that we believe will help establish, under existing law, that

our property interest in the bitcoin held by our custodians is not subject to the claims of the custodian’s creditors in the event

the custodian enters bankruptcy, receivership or similar insolvency proceedings. Our current custodians, and intended future custodians,

are U.S.-based and are subject to U.S. regulatory regimes intended to protect customers in the event that a custodian enters bankruptcy,

receivership or similar insolvency proceedings. Our custodians are required to comply with the Bank Secrecy Act, as amended by the USA

PATRIOT Act, the implementing regulations of the U.S. Treasury Department’s FinCEN, the Executive Orders and economic sanctions

regulations administered by the OFAC, as well as state AML laws. However, applicable insolvency law is not fully developed with respect

to the holding of digital assets in custodial accounts. If our custodially-held bitcoin were nevertheless considered to be the property

of our custodians’ estates in the event that any such custodians were to enter bankruptcy, receivership or similar insolvency proceedings,

we could be treated as a general unsecured creditor of such custodians, inhibiting our ability to exercise ownership rights with respect

to such bitcoin and this may ultimately result in the loss of the value related to some or all of such bitcoin. Even if we are able to

prevent our bitcoin from being considered the property of a custodian’s bankruptcy estate as part of an insolvency proceeding, it

is possible that we would still be delayed or may otherwise experience difficulty in accessing our bitcoin held by the affected custodian

during the pendency of the insolvency proceedings. Additionally, the bitcoin we hold with our custodians and transact with our trade execution

partners does not enjoy the same protections as are available to cash or securities deposited with or transacted by institutions subject

to regulation by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation.

Regardless

of efforts we have made to securely store and safeguard assets, there can be no assurance that our crypto assets will not be subject

to loss or other misappropriation. Although our custodians carry insurance policies with policy limits ranging from $320 million to

$500 million to cover losses for commercial crimes such as asset theft and other covered losses, such policy limits would be shared

among all of their affected customers and subject to various limitations and exclusions (such as if a loss arises due to our failure

to protect our login credentials and devices). As such, the insurance that covers losses of our bitcoin holdings may cover only a

small fraction of the value of the entirety of our bitcoin holdings, and there can be no guarantee that our custodians will maintain

such insurance policies or that such policies will cover any or all of our losses with respect to our bitcoin. For a discussion of

risks relating to the custody of our bitcoin, see “Supplemental Risk Factors—Risks Related to Our Bitcoin Treasury

Strategy and Holdings—Our bitcoin treasury strategy exposes us to various risks associated with bitcoin,” and

“—Our bitcoin treasury strategy exposes us to risk of non-performance by counterparties” elsewhere in this

supplement.

Potential Advantages and Disadvantages of Holding Bitcoin

We believe that bitcoin is an attractive asset because it

can serve as a store of value, supported by a robust and public open-source architecture, that is untethered to sovereign monetary policy.

We also believe that, due to its limited supply, bitcoin offers the potential to serve as a hedge against inflation in the long-term and,

if its adoption increases, the opportunity for appreciation in value.

Bitcoin exists entirely in electronic form, as virtually

irreversible public transaction ledger entries on the blockchain, and transactions in bitcoin are recorded and authenticated not by a

central repository, but by a decentralized peer-to-peer network. This decentralization mitigates the risks of certain threats common to

centralized computer networks, such as denial-of-service attacks, and reduces the dependency of the bitcoin network on any single system.

The decentralization of user nodes and miners also mitigates the risk of a 51% attack, which would be very costly and difficult to execute

with respect to bitcoin because the bitcoin network is open source and widely distributed, and transactions on the blockchain require

significant computing power to be validated. However, while the bitcoin network as a whole is decentralized, the private keys used to

access bitcoin balances are not widely distributed and are susceptible to phishing and other attacks designed to obtain sensitive information

or gain access to password-protected systems. Loss of such private keys can result in an inability to access, and effective loss of, the

corresponding bitcoin. Consequently, bitcoin holdings are susceptible to all of the risks inherent in holding any electronic data, such

as power failure, data corruption, security breach, communication failure and user error, among others. These risks, in turn, make bitcoin

substantially more susceptible to theft, destruction, or loss of value from hackers, corruption, viruses and other technology-specific

factors as compared to conventional fiat currency or other conventional financial assets. See “Supplemental Risk Factors—Risks

Related to Our Bitcoin Treasury Strategy and Holdings—If we or our third-party service providers experience a security breach or

cyberattack and unauthorized parties obtain access to our bitcoin, or if our private keys are lost or destroyed, or other similar circumstances

or events occur, we may lose some or all of our bitcoin and our financial condition and results of operations could be materially adversely

affected” elsewhere in this supplement.

In addition, the bitcoin network relies on open-source developers

to maintain and improve the bitcoin protocol. Accordingly, bitcoin may be subject to protocol design changes, governance disputes such

as “forked” protocols, competing protocols, and other open source-specific risks that do not affect conventional proprietary

software. Unless and until a forked asset is deemed by our custodians to be an eligible asset, we may not immediately or ever have the

ability to withdraw a forked asset.

We believe that in the context of the economic uncertainty

precipitated by escalating geopolitical tensions and central banks having adopted inflationary measures at various times in recent history,

as well as the breakdown of trust in and between political institutions and political parties in the United States and globally, bitcoin

represents an attractive store of value, and that opportunity for appreciation in the value of bitcoin exists in the event that such factors

lead to more widespread adoption of the use and acceptance of bitcoin and the adoption of bitcoin as a treasury reserve alternative by

institutions.

Government Regulation

The laws and regulations applicable to bitcoin and digital

assets are evolving and subject to interpretation and change.

Governments around the world have reacted differently to

digital assets; certain governments have deemed them illegal, and others have allowed their use and trade without restriction, while in

some jurisdictions, such as the U.S., digital assets are subject to overlapping, uncertain and evolving regulatory requirements.

As digital assets have grown in both popularity and market

size, the U.S. Executive Branch, Congress and a number of U.S. federal and state agencies, including the Financial Crimes Enforcement

Network, the CFTC, the SEC, the Financial Industry Regulatory Authority, the Consumer Financial Protection Bureau, the Department of Justice,

the Department of Homeland Security, the Federal Bureau of Investigation, the IRS and state financial regulators, have been examining

the operations of digital asset networks, digital asset users and digital asset exchanges, with particular focus on the extent to which

digital assets can be used to violate state or federal laws, including to facilitate the laundering of proceeds of illegal activities

or the funding of criminal or terrorist enterprises, and the safety and soundness and consumer-protective safeguards of exchanges or other

service-providers that hold, transfer, trade or exchange digital assets for users. Many of these state and federal agencies have issued

consumer advisories regarding the risks posed by digital assets to investors. In addition, federal and state agencies, and other countries

have issued rules or guidance regarding the treatment of digital asset transactions and requirements for businesses engaged in activities

related to digital assets.

Depending on the regulatory characterization of bitcoin,

the markets for bitcoin in general, and our activities in particular, our business and our bitcoin acquisition strategy may be subject

to regulation by one or more regulators in the United States and globally. Ongoing and future regulatory actions may alter, to a materially

adverse extent, the nature of digital assets markets, the participation of industry participants, including service providers and financial

institutions in these markets, and our ability to pursue our bitcoin strategy. Additionally, U.S. state and federal and foreign regulators

and legislatures have taken action against industry participants, including digital assets businesses, and enacted restrictive regimes

in response to adverse publicity arising from hacks, consumer harm, or criminal activity stemming from digital assets activity. U.S. federal

and state energy regulatory authorities are also monitoring the total electricity consumption of cryptocurrency mining, and the potential

impacts of cryptocurrency mining to the supply and dispatch functionality of the wholesale grid and retail distribution systems. Many

state legislative bodies have passed, or are actively considering, legislation to address the impact of cryptocurrency mining in their

respective states.

The CFTC takes the position that some digital assets, including

bitcoin, fall within the definition of a “commodity” under the Commodities Exchange Act of 1936, as amended, or CEA. Under

the CEA, the CFTC has broad enforcement authority to police market manipulation and fraud in spot digital assets markets in which we may

transact. Beyond instances of fraud or manipulation, the CFTC generally does not oversee cash or spot market exchanges or transactions

involving digital asset commodities that do not utilize margin, leverage, or financing. In addition, CFTC regulations and CFTC oversight

and enforcement authority apply with respect to futures, swaps, other derivative products and certain retail leveraged commodity transactions

involving digital asset commodities, including the markets on which these products trade.

The SEC and its staff have taken the position that certain

other digital assets fall within the definition of a “security” under the U.S. federal securities laws. Public statements

made by senior officials and senior members of the staff at the SEC indicate that the SEC does not consider bitcoin to be a security under

the federal securities laws, and the approval of the spot bitcoin ETPs support this view. However, such statements are not official policy

statements by the SEC and reflect only the speakers’ views, which are not binding on the SEC or any other agency or court and cannot

be generalized to any other digital assets.

In addition, because transactions in bitcoin provide a degree

of anonymity, they are susceptible to misuse for criminal activities, such as money laundering. This misuse, or the perception of such

misuse, could lead to greater regulatory oversight of bitcoin and bitcoin platforms, and there is the possibility that law enforcement

agencies could close bitcoin platforms or other bitcoin-related infrastructure with little or no notice and prevent users from accessing

or retrieving bitcoin held via such platforms or infrastructure. For example, in her January 2021 nomination hearing before the Senate

Finance Committee, Treasury Secretary Janet Yellen noted that cryptocurrencies have the potential to improve the efficiency of the financial

system but that they can be used to finance terrorism, facilitate money laundering, and support activities that threaten U.S. national

security interests and the integrity of the U.S. and international financial systems. The OFAC has issued updated advisories regarding

the use of virtual currencies, added a number of digital asset exchanges and service providers to the Specially Designated Nationals and

Blocked Persons list and engaged in several enforcement actions, including a series of enforcement actions that have either shut down

or significantly curtailed the operations of several smaller digital asset exchanges associated with Russian and/or North Korean nationals.

As noted above, activities involving bitcoin and other digital

assets may fall within the jurisdiction of more than one financial regulator and various courts and such laws and regulations are rapidly

evolving and increasing in scope. On March 9, 2022, President Biden signed an executive order relating to cryptocurrencies. While

the executive order did not mandate the adoption of any specific regulations, it instructed various federal agencies to consider potential

regulatory measures, including the evaluation of the creation of a U.S. CBDC. On September 16, 2022, the White House released a framework

for digital asset development, based on reports from various government agencies, including the U.S. Department of Treasury, the Department

of Justice, and the Department of Commerce. Among other things, the framework encourages regulators to pursue enforcement actions, issue

guidance and rules to address current and emergent risks, support the development and use of innovative technologies by payment providers

to increase access to instant payments, consider creating a federal framework to regulate nonbank payment providers, and evaluate whether

to call upon Congress to amend the Bank Secrecy Act and laws against unlicensed money transmission to apply explicitly to digital asset

service providers. There have also been several bills introduced in Congress that propose to establish additional regulation and oversight

of the digital asset markets.

Supplemental Risk Factors

Risks Related to Our Bitcoin Treasury Strategy and Holdings

Our bitcoin treasury strategy exposes us to various

risks associated with bitcoin.

Our bitcoin treasury strategy exposes us to various risks

associated with bitcoin, including the following:

Bitcoin

is a highly volatile asset. Bitcoin is a highly volatile asset that has traded below $26,000 per bitcoin and above $70,000

per bitcoin on the Coinbase exchange in the 12 months preceding the date of the current report on Form 8-K to which this supplement

is filed as an Exhibit. The trading price of bitcoin significantly decreased during prior periods, and such declines may occur again in

the future. Notwithstanding this volatility, we do not currently intend to hedge our bitcoin holdings and have not adopted a hedging strategy

with respect to bitcoin. However, we may from time to time engage in hedging strategies as part of our treasury management operations

if deemed appropriate.

Bitcoin

does not pay interest or dividends. Bitcoin does not pay interest or other returns and we can only generate cash from our bitcoin

holdings if we sell our bitcoin or implement strategies to create income streams or otherwise generate cash by using our bitcoin holdings.

Even if we pursue any such strategies, we may be unable to create income streams or otherwise generate cash from our bitcoin holdings,

and any such strategies may subject us to additional risks.

Our

bitcoin holdings may significantly impact our financial results and the market price of our common stock. Our bitcoin holdings

may significantly affect our financial results and if we continue to increase our overall holdings of bitcoin in the future, they will

have an even greater impact on our financial results and the market price of our common stock. See “—Our historical financial

statements do not reflect the potential variability in earnings that we may experience in the future relating to our bitcoin holdings”

below.

Our

bitcoin treasury strategy has not been tested over an extended period of time or under different market conditions. We only

recently adopted our bitcoin treasury strategy and will need to continually examine the risks and rewards of this new strategy. This new

strategy has not been tested over an extended period of time or under different market conditions. For example, although we believe bitcoin,

due to its limited supply, has the potential to serve as a hedge against inflation in the long term, the short-term price of bitcoin declined

in recent periods during which the inflation rate increased. Some investors and other market participants may disagree with our bitcoin

treasury strategy or actions we undertake to implement it. If bitcoin prices were to decrease or our bitcoin treasury strategy otherwise

proves unsuccessful, our financial condition, results of operations, and the market price of our common stock could be materially adversely

affected.

We

are subject to counterparty risks, including in particular risks relating to our custodians. Although we have implemented various

measures that are designed to mitigate our counterparty risks, including by storing substantially all of the bitcoin we own in custody

accounts at U.S.-based, institutional-grade custodians and negotiating contractual arrangements intended to establish that our property

interest in custodially-held bitcoin is not subject to claims of our custodians’ creditors, applicable insolvency law is not fully

developed with respect to the holding of digital assets in custodial accounts. If our custodially-held bitcoin were nevertheless considered

to be the property of our custodians’ estates in the event that any such custodians were to enter bankruptcy, receivership or similar

insolvency proceedings, we could be treated as a general unsecured creditor of such custodians, inhibiting our ability to exercise ownership

rights with respect to such bitcoin and this may ultimately result in the loss of the value related to some or all of such bitcoin. Even

if we are able to prevent our bitcoin from being considered the property of a custodian’s bankruptcy estate as part of an insolvency

proceeding, it is possible that we would still be delayed or may otherwise experience difficulty in accessing our bitcoin held by the

affected custodian during the pendency of the insolvency proceedings. Any such outcome could have a material adverse effect on our financial

condition and the market price of our common stock.

The

broader digital assets industry is subject to counterparty risks, which could adversely impact the adoption rate, price, and use of bitcoin.

A series of recent high-profile bankruptcies, closures, liquidations, regulatory enforcement actions and other events relating

to companies operating in the digital asset industry, including the filings for bankruptcy protection by Three Arrows Capital, Celsius

Network, Voyager Digital, FTX Trading and Genesis Global Capital, the closure or liquidation of certain financial institutions that provided

lending and other services to the digital assets industry, including Signature Bank and Silvergate Bank, SEC enforcement actions against

Coinbase, Inc. and Binance Holdings Ltd., the placement of Prime Trust, LLC into receivership following a cease-and-desist order

issued by Nevada’s Department of Business and Industry, and the filing and subsequent settlement of a civil fraud lawsuit by the

New York Attorney General against Genesis Global Capital, its parent company Digital Currency Group, Inc., and former partner Gemini

Trust Company, have highlighted the counterparty risks applicable to owning and transacting in digital assets. Although these bankruptcies,

closures, liquidations and other events have not resulted in any loss or misappropriation of our bitcoin, nor have such events adversely

impacted our access to our bitcoin, they have, in the short-term, likely negatively impacted the adoption rate and use of bitcoin. Additional

bankruptcies, closures, liquidations, regulatory enforcement actions or other events involving participants in the digital assets industry

in the future may further negatively impact the adoption rate, price, and use of bitcoin, limit the availability to us of financing collateralized

by bitcoin, or create or expose additional counterparty risks.

Changes

in our ownership of bitcoin could have accounting, regulatory and other impacts. While we currently own or will own bitcoin

directly, we may investigate other potential approaches to owning bitcoin, including indirect ownership (for example, through ownership

interests in a fund that owns bitcoin). If we were to own all or a portion of our bitcoin in a different manner, the accounting treatment

for our bitcoin, our ability to use our bitcoin as collateral for additional borrowings, and the regulatory requirements to which we are

subject, may correspondingly change. For example, the volatile nature of bitcoin may force us to liquidate our holdings to use it as collateral,

which could be negatively effected by any disruptions in the crypto market, and if liquidated, the value of the collateral would not reflect

potential gains in market value of bitcoin, all of which could negatively affect our business and implementation of our bitcoin strategy.

Changes

in the accounting treatment of our bitcoin holdings could have significant accounting impacts, including increasing the volatility of

our results. In December 2023, the FASB issued ASU 2023-08, which upon our adoption will require us to measure in-scope

crypto assets (including our bitcoin holdings) at fair value in our statement of financial position, and to recognize gains and losses

from changes in the fair value of our bitcoin in net income each reporting period. ASU 2023-08 will also require us to provide certain

interim and annual disclosures with respect to our bitcoin holdings. The standard is effective for our interim and annual periods beginning

January 1, 2025. Early adoption is permitted in any interim or annual period for which our financial statements have not been issued

as of the beginning of the annual reporting period and we plan to early adopt. Due in particular to the volatility in the price of bitcoin,

we expect the adoption of ASU 2023-08 to have a material impact on our financial results in future periods, increase the volatility of

our financial results, and affect the carrying value of our bitcoin on our balance sheet, and could have adverse tax consequences, which

in turn could have a material adverse effect on our financial results and the market price of our common stock.

The broader digital assets industry, including the technology

associated with digital assets, the rate of adoption and development of, and use cases for, digital assets, market perception of digital

assets, and the legal, regulatory, and accounting treatment of digital assets are constantly developing and changing, and there may be

additional risks in the future that are not possible to predict.

Bitcoin is a highly volatile asset, and fluctuations

in the price of bitcoin are likely to influence our financial results and the market price of our common stock.

Bitcoin is a highly volatile asset, and fluctuations in the

price of bitcoin are likely to influence our financial results and the market price of our common stock. Our financial results and the

market price of our common stock would be adversely affected, and our business and financial condition would be negatively impacted, if

the price of bitcoin decreased substantially (as it has in the past, such as during 2022), including as a result of:

| · | decreased user and investor confidence in bitcoin, including due to the various factors described herein; |

| · | investment and trading activities, such as (i) trading activities of highly active retail and institutional users, speculators,

miners and investors, (ii) actual or expected significant dispositions of bitcoin by large holders, and (iii) actual or perceived

manipulation of the spot or derivative markets for bitcoin or spot bitcoin ETPs; |

| · | negative publicity, media or social media coverage, or sentiment due to events in or relating to, or perception of, bitcoin or the

broader digital assets industry, for example, (i) public perception that bitcoin can be used as a vehicle to circumvent sanctions,

including sanctions imposed on Russia or certain regions related to the ongoing conflict between Russia and Ukraine, or to fund criminal

or terrorist activities, such as the purported use of digital assets by Hamas to fund its terrorist attack against Israel in October 2023;

(ii) expected or pending civil, criminal, regulatory enforcement or other high profile actions against major participants in the

bitcoin ecosystem, including the SEC’s enforcement actions against Coinbase, Inc. and Binance Holdings Ltd.; (iii) additional

filings for bankruptcy protection or bankruptcy proceedings of major digital asset industry participants, such as the bankruptcy proceeding

of FTX Trading and its affiliates; and (iv) the actual or perceived environmental impact of bitcoin and related activities, including

environmental concerns raised by private individuals, governmental and non-governmental organizations, and other actors related to the

energy resources consumed in the bitcoin mining process; |

| · | changes in consumer preferences and the perceived value or prospects of bitcoin; |

| · | competition from other digital assets that exhibit better speed, security, scalability, or energy efficiency, that feature other more

favored characteristics, that are backed by governments, including the U.S. government, or reserves of fiat currencies, or that represent

ownership or security interests in physical assets; |

| · | a decrease in the price of other digital assets, including stablecoins, or the crash or unavailability of stablecoins that are used

as a medium of exchange for bitcoin purchase and sale transactions, such as the crash of the stablecoin Terra USD in 2022, to the extent

the decrease in the price of such other digital assets or the unavailability of such stablecoins may cause a decrease in the price of

bitcoin or adversely affect investor confidence in digital assets generally; |

| · | the identification of Satoshi Nakamoto, the pseudonymous person or persons who developed bitcoin, or the transfer of substantial amounts

of bitcoin from bitcoin wallets attributed to Mr. Nakamoto or other “whales” that hold significant amounts of bitcoin; |

| · | disruptions, failures, unavailability, or interruptions in service of trading venues for bitcoin, such as, for example, the announcement

by the digital asset exchange FTX Trading that it would freeze withdrawals and transfers from its accounts and subsequent filing for bankruptcy

protection and the recent SEC enforcement action brought against Binance Holdings Ltd., which initially sought to freeze all of its assets

during the pendency of the enforcement action; |

| · | the filing for bankruptcy protection by, liquidation of, or market concerns about the financial viability of digital asset custodians,

trading venues, lending platforms, investment funds, or other digital asset industry participants, such as the filing for bankruptcy protection

by digital asset trading venues FTX Trading and BlockFi and digital asset lending platforms Celsius Network and Voyager Digital Holdings

in 2022, the ordered liquidation of the digital asset investment fund Three Arrows Capital in 2022, the announced liquidation of Silvergate

Bank in 2023, the government-mandated closure and sale of Signature Bank in 2023, the placement of Prime Trust, LLC into receivership

following a cease-and-desist order issued by the Nevada Department of Business and Industry in 2023, and the exit of Binance Holdings

Ltd. from the U.S. market as part of its settlement with the Department of Justice and other federal regulatory agencies; |

| · | regulatory, legislative, enforcement and judicial actions that adversely affect the price, ownership, transferability, trading volumes,

legality or public perception of bitcoin, or that adversely affect the operations of or otherwise prevent digital asset custodians, trading

venues, lending platforms or other digital assets industry participants from operating in a manner that allows them to continue to deliver

services to the digital assets industry; |

| · | further reductions in mining rewards of bitcoin, including block reward halving events, which are events that occur after a specific

period of time that reduce the block reward earned by “miners” who validate bitcoin transactions, or increases in the costs

associated with bitcoin mining, including increases in electricity costs and hardware and software used in mining, that may cause a decline

in support for the Bitcoin network; |

| · | transaction congestion and fees associated with processing transactions on the bitcoin network; |

| · | macroeconomic changes, such as changes in the level of interest rates and inflation, fiscal and monetary policies of governments,

trade restrictions, and fiat currency devaluations; |

| · | developments in mathematics or technology, including in digital computing, algebraic geometry and quantum computing, that could result

in the cryptography used by the bitcoin blockchain becoming insecure or ineffective; and |

| · | changes in national and international economic and political conditions, including, without limitation, the adverse impact attributable

to the economic and political instability caused by the current conflict between Russia and Ukraine and the economic sanctions adopted

in response to the conflict, and the potential broadening of the Israel-Hamas conflict to other countries in the Middle East. |

Bitcoin and other digital assets are novel assets,

and are subject to significant legal, commercial, regulatory and technical uncertainty.

Bitcoin and other digital assets are relatively novel and

are subject to significant uncertainty, which could adversely impact their price. The application of state and federal securities laws

and other laws and regulations to digital assets is unclear in certain respects, and it is possible that regulators in the United States

or foreign countries may interpret or apply existing laws and regulations in a manner that adversely affects the price of bitcoin.

The U.S. federal government, states, regulatory agencies,

and foreign countries may also enact new laws and regulations, or pursue regulatory, legislative, enforcement or judicial actions, that

could materially impact the price of bitcoin or the ability of individuals or institutions such as us to own or transfer bitcoin. For

example, the U.S. executive branch, SEC, the European Union’s Markets in Crypto Assets Regulation, among others have been active

in recent years, and in the U.K., the Financial Services and Markets Act 2023, or FSMA 2023 became law. It is not possible to predict

whether, or when, any of these developments will lead to Congress granting additional authorities to the SEC or other regulators, or whether,

or when, any other federal, state or foreign legislative bodies will take any similar actions. It is also not possible to predict the

nature of any such additional authorities, how additional legislation or regulatory oversight might impact the ability of digital asset

markets to function or the willingness of financial and other institutions to continue to provide services to the digital assets industry,

nor how any new regulations or changes to existing regulations might impact the value of digital assets generally and bitcoin specifically.

The consequences of increased regulation of digital assets and digital asset activities could adversely affect the market price of bitcoin

and in turn adversely affect the market price of our common stock.

Moreover, the risks of engaging in a bitcoin treasury strategy

are relatively novel and have created, and could continue to create, complications due to the lack of experience that third parties have

with companies engaging in such a strategy, such as increased costs of director and officer liability insurance or the potential inability

to obtain such coverage on acceptable terms in the future.

The growth of the digital assets industry in general, and

the use and acceptance of bitcoin in particular, may also impact the price of bitcoin and is subject to a high degree of uncertainty.

The pace of worldwide growth in the adoption and use of bitcoin may depend, for instance, on public familiarity with digital assets, ease

of buying, accessing or gaining exposure to bitcoin, institutional demand for bitcoin as an investment asset, the participation of traditional

financial institutions in the digital assets industry, consumer demand for bitcoin as a means of payment, and the availability and popularity

of alternatives to bitcoin. Even if growth in bitcoin adoption occurs in the near or medium-term, there is no assurance that bitcoin usage

will continue to grow over the long-term.

Because bitcoin has no physical existence beyond the record

of transactions on the bitcoin blockchain, a variety of technical factors related to the bitcoin blockchain could also impact the price

of bitcoin. For example, malicious attacks by miners, inadequate mining fees to incentivize validating of bitcoin transactions, hard “forks”

of the bitcoin blockchain into multiple blockchains, and advances in digital computing, algebraic geometry, and quantum computing could

undercut the integrity of the bitcoin blockchain and negatively affect the price of bitcoin. The liquidity of bitcoin may also be reduced

and damage to the public perception of bitcoin may occur, if financial institutions were to deny or limit banking services to businesses

that hold bitcoin, provide bitcoin-related services or accept bitcoin as payment, which could also decrease the price of bitcoin. Similarly,

the open-source nature of the bitcoin blockchain means the contributors and developers of the bitcoin blockchain are generally not directly

compensated for their contributions in maintaining and developing the blockchain, and any failure to properly monitor and upgrade the

bitcoin blockchain could adversely affect the bitcoin blockchain and negatively affect the price of bitcoin.

Recent actions by U.S. banking regulators have reduced the

ability of bitcoin-related services providers to gain access to banking services and liquidity of bitcoin may also be impacted to the

extent that changes in applicable laws and regulatory requirements negatively impact the ability of exchanges and trading venues to provide

services for bitcoin and other digital assets.

Our historical financial statements do not reflect

the potential variability in earnings that we may experience in the future relating to our bitcoin holdings.

Our historical financial statements do not reflect the potential

variability in earnings that we may experience in the future from holding or selling significant amounts of bitcoin.

The price of bitcoin has historically been subject to dramatic

price fluctuations and is highly volatile. We expect to determine the fair value of our bitcoin based on quoted (unadjusted) prices on

the Coinbase exchange, and following early adoption of ASU 2023-08, will be required to measure our bitcoin holdings at fair value in

our statement of financial position, and to recognize gains and losses from changes in the fair value of our bitcoin in net income each

reporting period, which may create significant volatility in our reported earnings and decrease the carrying value of our digital assets,

which in turn could have a material adverse effect on the market price of our common stock. Conversely, any sale of bitcoins at prices

above our carrying value for such assets creates a gain for financial reporting purposes even if we would otherwise incur an economic

or tax loss with respect to such transaction, which also may result in significant volatility in our reported earnings.

Due in particular to the volatility in the price of bitcoin,

we expect our early adoption of ASU 2023-08 to increase the volatility of our financial results and it could significantly affect the

carrying value of our bitcoin on our balance sheet. As of June 6, 2024, we held an aggregate 828 bitcoins, which we acquired for

$57.0 million, inclusive of fees and expenses, compared to a carrying of no digital assets at March 31, 2024 and $62.9 million in

cash and cash equivalents.

Because we intend to purchase additional bitcoin in future

periods and increase our overall holdings of bitcoin, we expect that the proportion of our total assets represented by our bitcoin holdings

will increase in the future. As a result, and in particular with respect to the quarterly periods and full fiscal year with respect to

which ASU 2023-08 will apply, and for all future periods, volatility in our earnings may be significantly more than what we experienced

in prior periods.

The availability of spot bitcoin ETPs may adversely

affect the market price of our common stock.

Although bitcoin and other digital assets have experienced

a surge of investor attention since bitcoin was invented in 2008, until recently investors in the United States had limited means to gain

direct exposure to bitcoin through traditional investment channels, and instead generally were only able to hold bitcoin through “hosted”

wallets provided by digital asset service providers or through “unhosted” wallets that expose the investor to risks associated

with loss or hacking of their private keys. Given the relative novelty of digital assets, general lack of familiarity with the processes

needed to hold bitcoin directly, as well as the potential reluctance of financial planners and advisers to recommend direct bitcoin holdings

to their retail customers because of the manner in which such holdings are custodied, some investors have sought exposure to bitcoin through

investment vehicles that hold bitcoin and issue shares representing fractional undivided interests in their underlying bitcoin holdings.

These vehicles, which were previously offered only to “accredited investors” on a private placement basis, have in the past

traded at substantial premiums to net asset value, or NAV, possibly due to the relative scarcity of traditional investment vehicles providing

investment exposure to bitcoin.

On January 10, 2024, the SEC approved the listing and

trading of spot bitcoin ETPs, the shares of which can be sold in public offerings and are traded on U.S. national securities exchanges.

The approved ETPs commenced trading directly to the public on January 11, 2024, with a trading volume of approximately $4.6 billion

on the first trading day. To the extent investors view our common stock as providing exposure to bitcoin, it is possible that the value

of our common stock may also have included a premium over the value of our bitcoin due to the prior scarcity of traditional investment

vehicles providing investment exposure to bitcoin, and that the value declined due to investors now having a greater range of options

to gain exposure to bitcoin and investors choosing to gain such exposure through ETPs rather than our common stock.

Although we are an operating company providing technology

solutions to improve the clinical effectiveness and efficiency of healthcare providers, and we believe we offer a different value proposition

than a passive bitcoin investment vehicle such as a spot bitcoin ETP, investors may nevertheless view our common stock as an alternative

to an investment in an ETP, and choose to purchase shares of a spot bitcoin ETP instead of our common stock. They may do so for a variety

of reasons, including if they believe that ETPs offer a “pure play” exposure to bitcoin that is generally not subject to federal

income tax at the entity level as we are, or the other risk factors applicable to an operating business, such as ours. Additionally, unlike

spot bitcoin ETPs, we (i) do not seek for our shares of common stock to track the value of the underlying bitcoin we hold before

payment of expenses and liabilities, (ii) do not benefit from various exemptions and relief under the Securities Exchange Act of

1934, as amended, or the Exchange Act, including Regulation M, and other securities laws, which enable spot bitcoin ETPs to continuously

align the value of their shares to the price of the underlying bitcoin they hold through share creation and redemption, (iii) are

a Delaware corporation rather than a statutory trust, and do not operate pursuant to a trust agreement that would require us to pursue

one or more stated investment objectives, and (iv) are not required to provide daily transparency as to our bitcoin holdings or our

daily NAV. Furthermore, recommendations by broker-dealers to buy, hold, or sell complex products and non-traditional ETPs, or an investment

strategy involving such products, may be subject to additional or heightened scrutiny that would not be applicable to broker-dealers making

recommendations with respect to our common stock. Based on how we are viewed in the market relative to ETPs, and other vehicles that offer

economic exposure to bitcoin, such as bitcoin futures ETFs and leveraged bitcoin futures ETFs, any premium or discount in our common stock

relative to the value of our bitcoin holdings may increase or decrease in different market conditions.

As a result of the foregoing factors, availability of spot

bitcoin ETPs on U.S. national securities exchanges could have a material adverse effect on the market price of our common stock.