Sonnet BioTherapeutics Holdings, Inc. (the "Company" or "Sonnet")

(NASDAQ:SONN), a clinical-stage company developing targeted

immunotherapeutic drugs, announced today that it has entered into a

definitive agreement with institutional investors for the purchase

and sale of an aggregate of 1,085,325 shares of its common stock

(or common stock equivalents in lieu thereof) (the “Registered

Direct Shares”) and warrants to purchase up to an aggregate of

1,085,325 shares of common stock (the “Registered Direct

Warrants”), in a registered direct offering. Each share of common

stock (or pre-funded warrant in lieu thereof) is being sold in the

registered direct offering together with one common warrant at a

combined offering price of $2.23, priced at-the-market under the

rules of the Nasdaq Stock Market. The Registered Direct Warrants

will have an exercise price of $2.10 per share, are immediately

exercisable and will expire five years from the date of issuance.

The Company has also entered into a definitive agreement with an

existing investor, in a concurrent private placement, for the

purchase and sale of an aggregate of 673,000 shares of its common

stock (or common stock equivalents in lieu thereof) (the “PIPE

Shares”) and warrants to purchase up to an aggregate of 673,000

shares of common stock (the “PIPE Warrants”). Each share of common

stock (or pre-funded warrant in lieu thereof) is being sold in the

private placement offering together with one common warrant at a

combined offering price of $2.23, priced at-the-market under the

rules of the Nasdaq Stock Market. The PIPE Warrants will have an

exercise price of $2.10 per share, are immediately exercisable and

will expire five years from the date of issuance.

The closing of the registered direct offering

and the concurrent private placement is expected to occur on or

about December 10, 2024, subject to the satisfaction of customary

closing conditions.

Chardan is acting as the exclusive placement

agent for the registered direct offering and the concurrent private

placement.

The gross proceeds to the Company from the

registered direct offering and the concurrent private placement are

expected to be approximately $3.9 million, before deducting the

placement agent's fees and other offering expenses payable by the

Company. The Company intends to use the net proceeds for research

and development, including clinical trials, working capital and

general corporate purposes.

The Registered Direct Shares are being offered

and sold by the Company in a registered direct offering pursuant to

a "shelf" registration statement on Form S-3 (File No. 333-251406)

that was originally filed with the Securities and Exchange

Commission (the "SEC") on December 22, 2023, and declared effective

on January 4, 2024. The offering of such securities in the

registered direct offering is being made only by means of a

prospectus supplement that forms a part of the effective

registration statement. A final prospectus supplement and the

accompanying base prospectus relating to the registered direct

offering will be filed with the SEC and will be available on the

SEC's website at www.sec.gov. Electronic copies of the final

prospectus supplement and the accompanying base prospectus may also

be obtained, when available, from Chardan Capital Markets, LLC, 17

State Street, Suite 2130, New York, New York 10004, at (646)

465-9000, or by email at vdealwis@chardan.com.

The PIPE Shares, the PIPE Warrants and the

Registered Direct Warrants and the shares underlying the PIPE

Warrants and the Registered Direct Warrants described above are

being offered in a private placement under Section 4(a)(2) of the

Securities Act of 1933, as amended (the "Act"), and Regulation D

promulgated thereunder and have not been registered under the Act,

or applicable state securities laws. Accordingly, the PIPE Shares,

the PIPE Warrants, the Registered Direct Warrants and the shares of

common stock underlying the PIPE Warrants and the Registered Direct

Warrants may not be offered or sold in the United States except

pursuant to an effective registration statement or an applicable

exemption from the registration requirements of the Act and such

applicable state securities laws.

This press release does not constitute an offer

to sell or the solicitation of an offer to buy any of the

securities described herein, nor shall there be any sale of these

securities in any state or other jurisdiction in which such an

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such state or

other jurisdiction.

About Sonnet BioTherapeutics Holdings, Inc.

Sonnet is an oncology-focused biotechnology

company with a proprietary platform for innovating biologic drugs

of single or bifunctional action. Known as FHAB (Fully Human

Albumin Binding), the technology utilizes a fully human single

chain antibody fragment (scFv) that binds to and "hitch-hikes" on

human serum albumin (HSA) for transport to target tissues. Sonnet's

FHAB was designed to specifically target tumor and lymphatic

tissue, with an improved therapeutic window for optimizing the

safety and efficacy of immune modulating biologic drugs. FHAB is

the foundation of a modular, plug-and-play construct for

potentiating a range of large molecule therapeutic classes,

including cytokines, peptides, antibodies, and vaccines.

Forward-Looking Statements

This press release contains certain

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934 and Private Securities Litigation Reform Act, as

amended, including those relating to the closing of the registered

direct offering and the concurrent private placement and the

expected use of proceeds, the outcome of the Company’s clinical

trials, the Company's cash runway, the Company's product

development, clinical and regulatory timelines, market opportunity,

competitive position, possible or assumed future results of

operations, business strategies, potential growth opportunities and

other statements that are predictive in nature. These

forward-looking statements are based on current expectations,

estimates, forecasts and projections about the industry and markets

in which we operate and management's current beliefs and

assumptions.

These statements may be identified by the use of

forward-looking expressions, including, but not limited to,

"expect," "anticipate," "intend," "plan," "believe," "estimate,"

"potential,” "predict," "project," "should," "would" and similar

expressions and the negatives of those terms. These statements

relate to future events or our financial performance and involve

known and unknown risks, uncertainties, and other factors which may

cause actual results, performance or achievements to be materially

different from any future results, performance or achievements

expressed or implied by the forward-looking statements. Such

factors include those set forth in the Company's filings with the

Securities and Exchange Commission. Prospective investors are

cautioned not to place undue reliance on such forward-looking

statements, which speak only as of the date of this press release.

The Company undertakes no obligation to publicly update any

forward-looking statement, whether as a result of new information,

future events or otherwise.

Investor Relations Contact:JTC Team, LLCJenene

Thomas908.824.0775SONN@jtcir.com

Source: Sonnet BioTherapeutics Holdings, Inc.

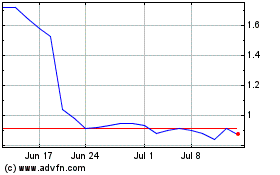

Sonnet BioTherapeutics (NASDAQ:SONN)

Historical Stock Chart

From Jan 2025 to Feb 2025

Sonnet BioTherapeutics (NASDAQ:SONN)

Historical Stock Chart

From Feb 2024 to Feb 2025