false0000933034NASDAQ00009330342024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): May 9, 2024

STRATTEC SECURITY CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

Wisconsin |

|

0-25150 |

|

39-1804239 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

3333 West Good Hope Road, Milwaukee, Wisconsin 53209

(Address of Principal Executive Offices, and Zip Code)

(414) 247-3333

Registrant’s Telephone Number, Including Area Code

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

Common Stock, $.01 par value |

|

STRT |

|

The Nasdaq Global Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

DOCPROPERTY "DocID" * MERGEFORMAT 51150435

Section 2 – Financial Information

Item 2.02. Results of Operations and Financial Condition.

On May 9, 2024, STRATTEC SECURITY CORPORATION (the “Company”) issued a press release (the “Press Release”) announcing results for the fiscal third quarter ended March 31, 2024. A copy of the Press Release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Pursuant to General Instruction B.2 of Current Report on Form 8-K, the information in this Item 2.02 and Exhibit 99.1 is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section. Furthermore, the information in this Item 2.02 and Exhibit 99.1 shall not be deemed to be incorporated by reference into the filings of STRATTEC under the Securities Act of 1933, as amended (the “Securities Act”), except as may be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

As described in “Item 2.02 Results of Operations and Financial Condition” above, on May 9, 2024, the Company issued a press release announcing earnings results for the fiscal third quarter ended March 31, 2024. The full text of the press release issued in connection with the announcement is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Pursuant to General Instruction B.2 of Current Report on Form 8-K, the information in this Item 7.01 and Exhibit 99.1 is being furnished and shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section. Furthermore, the information in this Item 7.01 and Exhibit 99.1 shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act, except as may be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Exhibit

Number Description

99.1 Press Release of STRATTEC SECURITY CORPORATION, issued May 9, 2024.

104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

DOCPROPERTY "DocID" * MERGEFORMAT 51150435

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

STRATTEC SECURITY CORPORATION

By: /s/ Dennis P. Bowe

Dennis P. Bowe, Vice President and

Chief Financial Officer

Date: May 9, 2024

DOCPROPERTY "DocID" * MERGEFORMAT 51150435

Exhibit 99.1

STRATTEC SECURITY CORPORATION REPORTS FISCAL 2024 THIRD QUARTER

OPERATING RESULTS

May 9, 2024

Third Fiscal Quarter earnings per share $0.37 vs $0.57 loss, an improvement driven by customer pricing increases and higher sales

Milwaukee, Wisconsin – STRATTEC SECURITY CORPORATION (NASDAQ:STRT) is a market leader of a comprehensive range of "Smart" Vehicle Power Access and Electronic and Security Solutions, serving the global automotive industry.

Third Quarter Fiscal 2024 Financial Highlights

•Diluted earnings per share of $0.37 versus $0.57 loss last year

•Gross Margins expanded to 10.4% compared with 7.9% last year

•Revenues increased by 10.7%, driven by pricing increases and new product sales

STRATTEC Interim CEO Rolando Guillot said, “This quarter we continued to make progress on our financial performance due to improved pricing and new product introductions that are expanding STRATTEC’s offerings to our customers. We will continue to focus on addressing persistent cost challenges and the opportunities we have to optimize our working capital and a strong balance sheet.”

Third Quarter Fiscal 2024 Financial Summary

|

|

|

|

|

|

|

|

|

Third Quarter Ending |

|

|

Mar 31, 2024 |

|

Apr. 2, 2023 |

|

Inc (Dec) |

(Dollars in thousands, except per share data) |

|

|

|

|

|

|

Net Sales |

|

$ 140,773 |

|

$ 127,183 |

|

$ 13,590 |

Gross Profit |

|

$ 14,684 |

|

$ 10,001 |

|

$ 4,683 |

Gross Margin |

|

10.4% |

|

7.9% |

|

|

Operating Expenses |

|

$ 12,725 |

|

$ 12,485 |

|

$ 240 |

Operating Income (Loss) from Operations |

|

$ 1,959 |

|

$ (2,484) |

|

$ 4,443 |

Net Income (Loss) |

|

$ 1,506 |

|

$ (2,256) |

|

$ 3,762 |

Diluted Earnings (Loss) Per Share |

|

$ 0.37 |

|

$ (0.57) |

|

$ 0.94 |

Revenue growth was driven by $7.0 million of price increases to our major customers and $6.6 million of higher sales associated with the launch of new product programs, the latter representing a 5.2% growth in sales from prior year. The growth in new product sales primarily stems from additional content of our latch and power access product lines on a major truck platform.

Gross margin improvement was driven by pricing increases, higher sales, lower raw material costs, lower warranty costs and $384,000 of workforce and production efficiencies realized from our Mexican operations. Offsetting those positive trends were unfavorable absorption of labor and overhead costs with inventory reductions, $2.1 million of unfavorable U.S. dollar to Mexican peso exchange rate effects, $1.8 million of wage increases due to a mandatory Mexican minimum wage-increase, $1.2 million higher prices paid to certain suppliers and $778,000 of increased freight costs primarily related to the launch of new programs.

Operating expenses increased primarily due to a $817,000 expense associated with the company’s annual incentive bonus plan, which was partially offset with lower new product development costs compared with the prior year period. Net Income was $1.5 million compared to a loss of $2.3 million last year. Fully diluted earnings per share were $0.37 compared with a loss of $0.57 last year.

Balance Sheet & Cash Flow

As of March 31, 2024, the Company’s cash and cash equivalents on hand totaled $9.6 million. Total debt as of March 31, 2024 was $13.0 million, which was all held by the ADAC-STRATTEC LLC joint venture.

For the third quarter of fiscal 2024, operating cash flow was negative $309,000, compared to the prior year quarter operating cash flow of negative $1.2 million. The negative operating cash flow for the current quarter was driven by a temporary increase in working capital, specifically in accounts receivable related to higher sales in the quarter, partially offset by a $10.8 million reduction in inventory. Capital expenditures in the third quarter of fiscal 2024 were $1.7 million, compared with $4.2 million for the third quarter of fiscal 2023.

About STRATTEC

STRATTEC designs, develops, manufactures and markets automotive Access Control Products, including mechanical locks and keys, electronically enhanced locks and keys, steering column and instrument panel ignition lock housings, latches, power sliding side door systems, power lift gate systems, power deck lid systems, power tailgate systems for trucks, door handles and related products. These products are provided to customers in North America, and on a global basis through a unique strategic relationship with WITTE Automotive of Velbert, Germany and ADAC Automotive of Grand Rapids, Michigan. Under this relationship, STRATTEC, WITTE and ADAC market each company’s products to global customers as cooperating partners of the “VAST Automotive Group” brand name. STRATTEC’s history in the automotive business spans over 110 years.

Caution on Forward-Looking Statements

Certain statements contained in this release contain “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements may be identified by the use of forward-looking words or phrases such as “anticipate,” “believe,” “could,” “expect,” “intend,” “may,” “planned,” “potential,” “should,” “will,” and “would.” Such forward-looking statements in this release are inherently subject to many uncertainties in the Company’s operations and business environment. These uncertainties include general economic conditions, in particular, relating to the automotive industry, consumer demand for the Company’s and its customers’ products, competitive and technological developments, customer purchasing actions, changes in warranty provisions and customer product recall policies, work stoppages at the Company or at the location of its key customers as a result of labor disputes, foreign currency fluctuations, uncertainties stemming from U.S. trade policies, tariffs and reactions to same from foreign countries, the volume and scope of product returns, adverse business and operational issues resulting from the continuing effects of the coronavirus (COVID-19) pandemic, matters adversely impacting the timing and availability of component parts and raw materials needed for the production of our products and the products of our customers and fluctuations in our costs of operation (including fluctuations in the cost of raw materials). Shareholders, potential investors and other readers are urged to consider these factors carefully in evaluating the forward-looking statements and are cautioned not to place undue reliance on such forward-looking statements. The forward-looking statements made herein are only made as of the date of this press release and the Company undertakes no obligation to publicly update such

forward-looking statements to reflect subsequent events or circumstances occurring after the date of this release. In addition, such uncertainties and other operational matters are discussed further in the Company’s quarterly and annual filings with the Securities and Exchange Commission.

Contact: Dennis Bowe

Vice President and

Chief Financial Officer

414-247-3399

www.strattec.com

STRATTEC SECURITY CORPORATION

Condensed Results of Operations

(In Thousands except per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

March 31, 2024 |

|

April 2, 2023 |

|

March 31, 2024 |

|

April 2, 2023 |

|

|

|

|

|

|

|

|

Net Sales |

$ 140,773 |

|

$ 127,183 |

|

$ 394,711 |

|

$ 360,727 |

|

|

|

|

|

|

|

|

Cost of Goods Sold |

126,089 |

|

117,182 |

|

347,810 |

|

330,843 |

|

|

|

|

|

|

|

|

Gross Profit |

14,684 |

|

10,001 |

|

46,901 |

|

29,884 |

|

|

|

|

|

|

|

|

Engineering, Selling &

Administrative Expenses |

12,725 |

|

12,485 |

|

38,778 |

|

37,266 |

|

|

|

|

|

|

|

|

Income (Loss) from Operations |

1,959 |

|

(2,484) |

|

8,123 |

|

(7,382) |

|

|

|

|

|

|

|

|

Interest Expense |

(222) |

|

(266) |

|

(661) |

|

(591) |

Interest Income |

143 |

|

- |

|

337 |

|

- |

|

|

|

|

|

|

|

|

Other (Expense) Income, net |

(208) |

|

(404) |

|

759 |

|

470 |

|

|

|

|

|

|

|

|

Income (Loss) Before Provision

for Income Taxes and Non-

Controlling Interest |

1,672 |

|

(3,154) |

|

8,558 |

|

(7,503) |

|

|

|

|

|

|

|

|

Provision (Benefit) for Income

Taxes |

546 |

|

133 |

|

2,197 |

|

(1,638) |

|

|

|

|

|

|

|

|

Net Income (Loss) |

1,126 |

|

(3,287) |

|

6,361 |

|

(5,865) |

|

|

|

|

|

|

|

|

Net Loss Attributable

to Non-Controlling Interest |

(380) |

|

(1,031) |

|

(332) |

|

(1,895) |

|

|

|

|

|

|

|

|

Net Income (Loss) Attributable

to STRATTEC SECURITY

CORPORATION |

$ 1,506 |

|

$ (2,256) |

|

$ 6,693 |

|

$ (3,970) |

|

|

|

|

|

|

|

|

Earnings (Loss) Per Share: |

|

|

|

|

|

|

|

Basic |

$ 0.38 |

|

$ (0.57) |

|

$ 1.69 |

|

$ (1.01) |

Diluted |

$ 0.37 |

|

$ (0.57) |

|

$ 1.67 |

|

$ (1.01) |

|

|

|

|

|

|

|

|

Average Basic Shares

Outstanding |

3,988 |

|

3,928 |

|

3,971 |

|

3,918 |

|

|

|

|

|

|

|

|

Average Diluted Shares

Outstanding |

4,017 |

|

3,928 |

|

3,996 |

|

3,918 |

|

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

|

Capital Expenditures |

$1,672 |

|

$ 4,247 |

|

$ 6,065 |

|

$ 13,724 |

Depreciation |

$4,059 |

|

$ 4,347 |

|

$ 12,774 |

|

$ 13,145 |

STRATTEC SECURITY CORPORATION

Condensed Balance Sheet Data

(In Thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

March 31, 2024 |

|

July 2, 2023 |

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

Current Assets: |

|

|

|

|

|

Cash and Cash Equivalents |

$ 9,594 |

|

$ 20,571 |

|

|

Receivables, net |

97,524 |

|

89,811 |

|

|

Inventories, net |

78,612 |

|

77,597 |

|

|

Customer Tooling in Progress, net |

25,505 |

|

20,800 |

|

|

Value Added Tax Recoverable |

19,272 |

|

7,912 |

|

|

Other Current Assets |

10,423 |

|

9,091 |

|

|

|

Total Current Assets |

240,930 |

|

225,782 |

|

Other Long-term Assets |

19,309 |

|

20,702 |

|

Property, Plant and Equipment, net |

88,310 |

|

94,446 |

|

|

|

|

$ 348,549 |

|

$ 340,930 |

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

|

|

|

Current Liabilities: |

|

|

|

|

|

Accounts Payable |

$ 50,582 |

|

$ 57,927 |

|

|

Value Added Tax Payable |

8,906 |

|

6,499 |

|

|

Borrowings Under Credit Facility - Current |

13,000 |

|

- |

|

|

Other |

48,284 |

|

44,560 |

|

|

|

Total Current Liabilities |

120,772 |

|

108,986 |

|

Accrued Pension and Postretirement Obligations |

2,463 |

|

2,363 |

|

Borrowings Under Credit Facility - Long-Term |

- |

|

13,000 |

|

Other Long-term Liabilities |

5,200 |

|

5,557 |

|

Shareholders' Equity |

342,521 |

|

334,683 |

|

Accumulated Other Comprehensive Loss |

(13,205) |

|

(14,194) |

|

Less: Treasury Stock |

(135,489) |

|

(135,526) |

|

|

Total STRATTEC SECURITY |

|

|

|

|

|

|

CORPORATION Shareholders' Equity |

193,827 |

|

184,963 |

|

|

Non-Controlling Interest |

26,287 |

|

26,061 |

|

Total Shareholders' Equity |

220,114 |

|

211,024 |

|

|

|

|

$ 348,549 |

|

$ 340,930 |

STRATTEC SECURITY CORPORATION

Condensed Cash Flow Statement Data

(In Thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

|

|

|

|

|

March 31, 2024 |

|

April 2, 2023 |

|

March 31, 2024 |

|

April 2, 2023 |

Cash Flows from Operating Activities: |

|

|

|

|

|

|

|

Net Income (Loss) |

$ 1,126 |

|

$ (3,287) |

|

$ 6,361 |

|

$ (5,865) |

Adjustments to Reconcile Net Income (Loss) to Cash (Used in) Provided by Operating Activities: |

|

|

Depreciation |

4,059 |

|

4,347 |

|

12,774 |

|

13,145 |

|

|

Equity (Earnings) Loss in Joint Ventures |

- |

|

(819) |

|

269 |

|

(1,934) |

|

|

Foreign Currency Transaction Loss |

475 |

|

1,529 |

|

126 |

|

2,114 |

|

|

Unrealized Loss (Gain) on Peso Forward Contracts |

222 |

|

70 |

|

(604) |

|

93 |

|

|

Loss on Settlement of Pension Obligation |

- |

|

217 |

|

- |

|

217 |

|

|

Stock Based Compensation Expense |

240 |

|

265 |

|

1,224 |

|

1,139 |

|

|

Change in Operating Assets/Liabilities |

(6,676) |

|

(3,665) |

|

(27,775) |

|

(1,767) |

|

Other, net |

245 |

|

120 |

|

402 |

|

370 |

|

|

|

|

|

|

|

|

|

|

|

Net Cash (Used in) Provided by Operating Activities |

(309) |

|

(1,223) |

|

(7,223) |

|

7,512 |

Cash Flows from Investing Activities: |

|

|

|

|

|

|

|

|

Proceeds from sale of interest in VAST LLC |

- |

|

- |

|

2,000 |

|

- |

|

Investment in Joint Ventures |

- |

|

(133) |

|

- |

|

(237) |

|

Additions to Property, Plant & Equipment |

(1,672) |

|

(4,247) |

|

(6,065) |

|

(13,724) |

|

Proceeds on Sales of Property, Plant & Equipment |

- |

|

11 |

|

- |

|

15 |

|

|

|

|

|

|

|

|

|

|

|

Net Cash Used in Investing Activities |

(1,672) |

|

(4,369) |

|

(4,065) |

|

(13,946) |

Cash Flows from Financing Activities: |

|

|

|

|

|

|

|

|

Borrowings on Line of Credit Facility |

- |

|

4,000 |

|

2,000 |

|

13,000 |

|

Payments on Line of Credit Facility |

- |

|

- |

|

(2,000) |

|

(3,000) |

|

Dividends Paid to Non-Controlling Interest of Subsidiary |

- |

|

- |

|

- |

|

(600) |

|

Exercise of Stock Options and Employee Stock Purchases |

18 |

|

18 |

|

55 |

|

164 |

|

|

|

|

|

|

|

|

|

|

|

Net Cash Provided by Financing Activities |

18 |

|

4,018 |

|

55 |

|

9,564 |

Effect of Foreign Currency Fluctuations on Cash |

(18) |

|

82 |

|

256 |

|

182 |

Net (Decrease) Increase in Cash & Cash Equivalents |

(1,981) |

|

(1,492) |

|

(10,977) |

|

3,312 |

Cash & Cash Equivalents: |

|

|

|

|

|

|

|

|

Beginning of Period |

11,575 |

|

13,578 |

|

20,571 |

|

8,774 |

|

End of Period |

$ 9,594 |

|

$ 12,086 |

|

$ 9,594 |

|

$ 12,086 |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

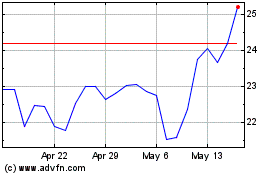

Strattec Security (NASDAQ:STRT)

Historical Stock Chart

From Apr 2024 to May 2024

Strattec Security (NASDAQ:STRT)

Historical Stock Chart

From May 2023 to May 2024