Protara Announces Proposed Public Offering

10 December 2024 - 8:01AM

Protara Therapeutics, Inc. (Nasdaq: TARA) (“Protara”), a

clinical-stage company developing transformative therapies for the

treatment of cancer and rare diseases, today announced that it has

commenced an underwritten public offering of shares of its common

stock or, in lieu of issuing common stock to certain investors,

pre-funded warrants to purchase shares of its common stock. All of

the shares of common stock and pre-funded warrants to be sold in

the proposed offering will be offered by Protara. In addition,

Protara expects to grant the underwriters a 30-day option to

purchase additional shares of common stock at the public offering

price, less underwriting discounts and commissions. The proposed

offering is subject to market and other conditions, and there can

be no assurance as to whether or when the offering may be

completed, or the actual size or terms of the offering. Protara

intends to use the net proceeds received from the offering to fund

the clinical development of TARA-002, as well as the development of

other clinical programs. Protara may also use the net proceeds from

the offering for working capital and other general corporate

purposes.

TD Cowen, Cantor, LifeSci Capital, Oppenheimer & Co. and

Scotiabank are acting as joint book-running managers of the

proposed offering.

The shares of common stock and the pre-funded warrants will be

issued pursuant to a shelf registration statement on Form S-3 (File

No. 333-275290) that was declared effective on November 14, 2023 by

the U.S. Securities and Exchange Commission (the “SEC”). The

offering is being made only by means of a preliminary prospectus

supplement and the accompanying prospectus. A preliminary

prospectus supplement and the accompany prospectus relating to the

offering will be filed with the SEC and will be available on the

SEC’s website at www.sec.gov. Copies of the preliminary prospectus

supplement and the accompany prospectus relating to the offering,

when available, may be obtained from the offices of TD Securities

(USA) LLC, 1 Vanderbilt Avenue, New York, New York 10017, by email

at TD.ECM_Prospectus@tdsecurities.com or by telephone at (855)

495-9846; Cantor Fitzgerald & Co., 110 East 59th Street, 6th

Floor, New York, New York 10022, Attention: Capital Markets, or by

email at prospectus@cantor.com; or LifeSci Capital LLC, 1700

Broadway, 40th Floor, New York, New York 10019, or by email at

compliance@lifescicapital.com.

Before investing in the offering, interested parties should read

the preliminary prospectus supplement and related prospectus for

this offering, the documents incorporated by reference therein and

the other documents Protara has filed with the Securities and

Exchange Commission. The final terms of the offering will be

disclosed in a final prospectus supplement to be filed with the

Securities and Exchange Commission.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy any of these securities, nor shall

there be any sale of these securities in any state or jurisdiction

in which such an offer, solicitation or sale would be unlawful

prior to registration or qualification under the applicable

securities laws of such state or jurisdiction.

Forward-Looking Statements

Statements contained in this press release

regarding matters that are not historical facts are “forward

looking statements” within the meaning of the Private Securities

Litigation Reform Act of 1995. Protara may, in some cases, use

terms such as “predicts,” “believes,” “potential,” “proposed,”

“continue,” “designed,” “estimates,” “anticipates,” “expects,”

“plans,” “intends,” “may,” “could,” “might,” “will,” “should” or

other words or expressions referencing future events, conditions or

circumstances that convey uncertainty of future events or outcomes

to identify these forward-looking statements. Such forward-looking

statements include but are not limited to, statements regarding the

timing, size and completion of the proposed public offering as well

as the expected use of proceeds related thereto are not guarantees

of future performance or results and involve substantial risks and

uncertainties. Actual results, developments and events may differ

materially from those in the forward-looking statements as a result

of various factors including: Protara’s ability to complete the

offering on the proposed terms, or at all, changes in market

conditions, and Protara’s expectations related to the use of

proceeds from the proposed offering. Additional important factors

to be considered in connection with forward-looking statements,

including additional risks and uncertainties, are described more

fully under the caption “Risk Factors” and elsewhere in Protara’s

filings and reports with the Securities and Exchange Commission.

All forward-looking statements contained in this press release

speak only as of the date on which they were made. Protara

undertakes no obligation to update any forward-looking statements,

whether as a result of the receipt of new information, the

occurrence of future events or otherwise, except as required by

law.

Company Contact:

Justine O'MalleyProtara

TherapeuticsJustine.OMalley@protaratx.com646-817-2836

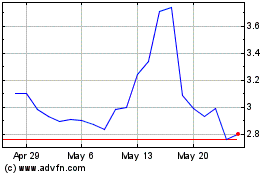

Protara Therapeutics (NASDAQ:TARA)

Historical Stock Chart

From Jan 2025 to Feb 2025

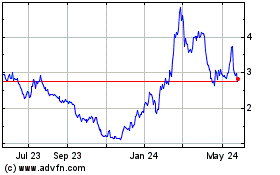

Protara Therapeutics (NASDAQ:TARA)

Historical Stock Chart

From Feb 2024 to Feb 2025