ThredUp Completes Divestiture of European Business

04 December 2024 - 1:00AM

Business Wire

ThredUp Inc. (Nasdaq: TDUP, LTSE: TDUP), one of the largest

online resale platforms for apparel, shoes, and accessories,

announced today that it entered into a binding agreement to divest

its European business, Remix, in a management buyout led by Florin

Filote, the General Manager of Remix. The divestiture closed

simultaneously with the signing of the agreement. ThredUp retains a

minority interest in the Remix business and prior to the closing of

the transaction, Remix received a final cash investment of $2

million from ThredUp to help fund operations as Remix continues its

fundraising process independently. This strategic transaction

allows both ThredUp and Remix to focus on their respective core

markets and strengths.

“This is a mutually beneficial outcome for both ThredUp and

Remix,” said ThredUp Co-Founder and CEO James Reinhart. “We are

confident that Remix will thrive under Florin Filote’s leadership

and the team’s expertise. This transaction will allow ThredUp to

focus on our core U.S. business and continue to innovate and evolve

our marketplace.”

“We are excited to embark on this new chapter as an independent

company,” said Florin Filote, General Manager of Remix. “We have a

strong foundation and a talented team, and we are committed to

continuing to provide our customers with a best-in-class resale

experience. We believe that this transaction will enable us to

accelerate our growth and expand our presence in the European

market.”

Further details of the transaction, including unaudited pro

forma financial information, will be included in a Current Report

on Form 8-K that the Company will file with the Securities and

Exchange Commission.

About ThredUp

ThredUp is transforming resale with technology and a mission to

inspire the world to think secondhand first. By making it easy to

buy and sell secondhand, ThredUp has become one of the world's

largest online resale platforms for apparel, shoes and accessories.

Sellers love ThredUp because we make it easy to clean out their

closets and unlock value for themselves or for the charity of their

choice while doing good for the planet. Buyers love shopping value,

premium and luxury brands all in one place, at up to 90% off

estimated retail price. Our proprietary operating platform is the

foundation for our managed marketplace and consists of distributed

processing infrastructure, proprietary software and systems and

data science expertise. With ThredUp’s Resale-as-a-Service, some of

the world's leading brands and retailers are leveraging our

platform to deliver customizable, scalable resale experiences to

their customers. ThredUp has processed over 200 million unique

secondhand items from 60,000 brands across 100 categories. By

extending the life cycle of clothing, ThredUp is changing the way

consumers shop and ushering in a more sustainable future for the

fashion industry.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws, which are statements

that involve substantial risks and uncertainties. Forward-looking

statements generally relate to future events or our future

financial or operating performance. In some cases, you can identify

forward-looking statements because they contain words such as

“may,” “will,” “shall,” “should,” “expects,” “plans,”

“anticipates,” “could,” “intends,” “target,” “projects,”

“contemplates,” “believes,” “estimates,” “predicts,” “potential”,

“looking ahead”, “seeking” or “continue” or the negative of these

words or other similar terms or expressions that concern our

expectations, strategy, plans or intentions. Forward-looking

statements in this release include, but are not limited to,; the

expected outcomes of the Company’s exit from the European market

and the divestiture of its European business; and statements about

future operating results, capital expenditures and other

developments in our business and our long term growth and the focus

of the Company’s resources and attention in the United States;

trends, consumer demand and growth in the global and U.S. online

resale markets; the momentum of our business; our investments in

technology and infrastructure, including with respect to AI

technologies such as AI enabled search features; our ability to

successfully integrate and realize the benefits of our past or

future strategic acquisitions, investments or reorganization

activities, including our intention to reshape ThredUp into an

AI-powered resale company our ability to attract new Active Buyers

and legal and regulatory developments.

Forward-looking statements are neither historical facts nor

assurances of future performance. Forward-looking statements

involve substantial risks and uncertainties that may cause actual

results to differ materially from those that we expect. These risks

and uncertainties include, but are not limited to: the expected

outcomes of our divestment of our European business; our ability to

attract new users and convert users into buyers and Active Buyers;

our ability to achieve profitability; the sufficiency of our cash,

cash equivalents and capital resources to meet our liquidity needs;

our ability to effectively manage or sustain our growth and to

effectively expand our operations; risks from an intensely

competitive market; our ability to effectively deploy new and

evolving technologies, such as artificial intelligence and machine

learning, in our offerings; risks arising from economic and

industry trends, including the effects of foreign currency exchange

rate fluctuations, inflationary pressures, increased interest

rates, changing consumer habits, climate change and general global

economic uncertainty; our ability to comply with applicable laws

and regulations; and our ability to successfully integrate and

realize the benefits of our past or future strategic acquisitions

or investments. More information on these risks and other potential

factors that could affect the Company’s business, reputation,

results of operations, financial condition, and stock price is

included in the Company’s filings with the Securities and Exchange

Commission (“SEC”), including in the “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” sections of the Company’s most recently

filed periodic reports on Form 10-K and Form 10-Q and subsequent

filings. The forward-looking statements in this release are based

on information available to us as of the date hereof, and we

disclaim any obligation to update any forward-looking statements,

except as required by law. These forward-looking statements should

not be relied upon as representing ThredUp’s views as of any date

subsequent to the date of this press release.

Additional information regarding these and other factors that

could affect ThredUp's results is included in ThredUp’s SEC

filings, which may be obtained by visiting our Investor Relations

website at ir.thredup.com or the SEC's website at www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241203133119/en/

Laura Hogya Media@thredup.com

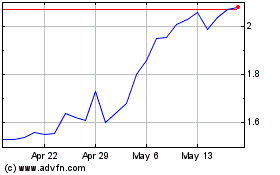

ThredUp (NASDAQ:TDUP)

Historical Stock Chart

From Jan 2025 to Feb 2025

ThredUp (NASDAQ:TDUP)

Historical Stock Chart

From Feb 2024 to Feb 2025