false

--12-31

0001851484

0001851484

2024-08-12

2024-08-12

0001851484

dei:FormerAddressMember

2024-08-12

2024-08-12

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported)

August 12, 2024

Citius Oncology, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41534 |

|

99-4362660 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

11 Commerce Drive, 1st Floor, Cranford, NJ |

|

07016 |

|

| |

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant’s telephone number, including

area code: (908) 967-6677

TenX Keane Acquisition

420 Lexington Avenue, Suite 2446

New York, NY 10170

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

| Common Stock |

|

CTOR |

|

Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Introductory Note

As used in this Current Report

on Form 8-K, unless otherwise stated or the context clearly indicates otherwise, the terms the “Company,” “Registrant,”

“we,” “us” and “our” refer to the entity formerly named TenX Keane Acquisition, a Cayman Islands exempted

company (“TenX”), as renamed Citius Oncology, Inc. in connection with the Domestication (as defined below), and after giving

effect to the Business Combination (as defined below).

On August 12, 2024 (the “Closing

Date”), the Company completed the previously announced business combination (the “Closing”) pursuant to that certain

Agreement and Plan of Merger and Reorganization, dated as of October 23, 2023 (the “Merger Agreement”), by and among Citius

Pharmaceuticals, Inc., a Nevada corporation (“Citius Pharma”), Citius Oncology, Inc., a Delaware corporation (now known as

Citius Oncology Sub, Inc., “SpinCo”), TenX (now Citius Oncology, Inc., a Delaware corporation) and TenX Merger Sub, Inc.,

a Delaware corporation and wholly-owned subsidiary of TenX (“Merger Sub”), and the related transaction documents described

therein (the “Business Combination”).

As contemplated by the Merger

Agreement and described in the section entitled “Proposal 1 — The Business Combination Proposal” beginning on

page 111 of the final proxy statement/prospectus supplement (File No. 333-275506) (the “Final Prospectus”), filed on July

12, 2024, with the Securities and Exchange Commission (the “SEC”), on or prior to the Closing Date the following occurred:

| i. | Effective August 5, 2024, TenX’s jurisdiction of incorporation was changed by its deregistering

as an exempted company in the Cayman Islands and continuing and domesticating as a corporation incorporated under the laws of the State

of Delaware (the “Domestication”). In connection with the consummation of the Domestication, TenX changed its name to “Citius

Oncology, Inc.” pursuant to the filing of a certificate of incorporation (the “Company Charter”) and adopted bylaws

(the “Company Bylaws”). |

| ii. | As a result of and upon the effective time of the Domestication, (i) each then-issued and outstanding

ordinary share, par value $0.0001 per share, of TenX (“TenX Ordinary Shares”), converted automatically, on a one-for-one basis,

into shares of common stock, par value $0.0001 per share, of the Company (“Company Common Stock”); (ii) each then-issued and

outstanding right to receive two-tenths of one share of TenX Ordinary Shares (“TenX Rights”) converted automatically into

a right to receive two-tenths of one share of Company Common Stock (“Company Rights”); and (iii) each then-issued and outstanding

unit of TenX (“TenX Units”) was canceled and each holder was entitled to one share of Company Common Stock and one Company

Right. For further details, see “Proposal No. 2 — The Domestication Proposal” beginning on page 154

of the Final Prospectus. |

| iii. | Following the above steps, Merger Sub merged with and into SpinCo (the “Merger”), with SpinCo

continuing as the surviving company in the Merger and a wholly-owned subsidiary of the Company. As a result of the Merger, the existing

common stock of SpinCo, par value $0.0001 per share (“SpinCo Common Stock”), automatically converted into the right to receive

shares of Company Common Stock in accordance with an exchange ratio described below. |

| iv. | Upon Closing, Citius Pharma (formerly SpinCo’s sole shareholder) received 65,627,262 shares of Company

Common Stock. In addition, upon Closing, Maxim Group received 1,872,738 shares of Company Common Stock and Newbridge Securities received

50,000 shares of Company Common Stock, in each case as payment of financial advisory fees. All options to purchase shares of SpinCo Common

Stock (“SpinCo Options”) were converted into options to purchase shares of Company Common Stock (“Company Options”). |

| v. | All closing conditions as referenced in the Merger Agreement have either been met or waived by the parties. Certain closing conditions

that were waived by the parties, pursuant to the Merger Agreement, include, but are not limited to: (i) Section 7.18(a) and 7.18(b), which

(a) required Citius Pharma to transfer the LYMPHIRTM (denileukin diftitox) trademark to the Company prior to Close and (b)

required Citius Pharma to send a letter notifying the FDA that all ownership rights of the BLA and IND will transfer from the Citius Pharma

to the Company within five business days of Citius Pharma’s receipt of the Notice of Approval for LYMPHIR from the U.S. Food &

Drug Administration, which transfers will instead occur within 60 days following the Closing, and (ii) Section 2.3(f), which waiver provided

that the $10,000,000 in cash Citius Pharma contributed to the Company was to be comprised of $3,800,111

in working capital of SpinCo post-Closing, funding $6,199,889 of transaction expenses of the parties to the Merger Agreement, and $1,077,026

for the purchase of TenX rights prior to the Closing of the transaction (which converted into 422,353 shares of Company Common Stock at

Closing) (in the aggregate, the “Capital Contribution”). |

| vi. | Pursuant to the Merger Agreement and the Sponsor Support Agreement entered into concurrently with the

execution of the Merger Agreement, the Company issued 119,500 shares of Company Common Stock to the Sponsor (as defined below) for amounts

outstanding under the promissory notes TenX issued to the Sponsor on July 18, 2023 and October 18, 2023. Both of the promissory notes

issued to the Sponsor evidenced deposits into the Trust Account (as defined in the Merger Agreement) to extend the timeline to complete

a business combination. |

| vii. | Immediately after the Closing, the Company issued a promissory note to the Sponsor, dated August 12, 2024,

for $1,288,532 of transaction expenses, which automatically converted into 128,854 shares of Company Common Stock on August 13, 2024. |

After the Closing, Citius

Pharma continues to control a majority of the voting power for the election of directors of the Company, owning approximately 92.6% of

the outstanding shares of Company Common Stock. As a result, the Company is a “controlled company” within the meaning of the

rules of The Nasdaq Stock Market LLC (‘‘Nasdaq’’) and may elect not to comply with certain corporate governance

standards. While the Company does not presently intend to rely on these exemptions, the Company may opt to utilize these exemptions in

the future as long as it remains a controlled company.

As of the open of trading

on August 13, 2024, the Company Common Stock began trading on The Nasdaq Capital Market as “CTOR”. The Company does not have

units or rights traded following the completion of the Business Combination.

Immediately

following the Business Combination, the Company’s ownership was as follows:

| ● | TenX’s

former public shareholders owned approximately 1.3% of the outstanding shares of Company Common Stock; |

| ● | Citius

Pharma owned approximately 92.6% of the outstanding shares of Company Common Stock; and |

| ● | 10XYZ

Holdings LP, a Delaware limited partnership and shareholder of TenX (the “Sponsor”) and related parties collectively owned

approximately 3.1% of Company Common Stock. |

These percentages exclude all Company Options

that may be exercisable for shares of Company Common Stock.

Certain terms used in this

Current Report on Form 8-K have the same meaning as set forth in the Final Prospectus. This Current Report on Form 8-K contains summaries

of the material terms of various agreements executed in connection with the transactions described herein. The summaries of these agreements

are subject to, and are qualified in their entirety by, reference to these agreements, which are filed as exhibits hereto and incorporated

herein by reference.

Item 1.01. Entry into a Material Definitive Agreement.

The information set forth in the “Introductory Note” above

is incorporated into this Item 1.01 by reference.

Amended &Restated Registration Rights Agreement

On August 12, 2024, in connection

with the Closing and as contemplated by the Merger Agreement, the Company, Sponsor Equityholders and the Legacy Citius Oncology Equityholder

(each defined therein) entered into the Amended and Restated Registration Rights Agreement (the “A&R Registration Rights Agreement”).

The material terms of the A&R Registration Rights Agreement are described in the section entitled “Proposal No. 1 —

The Business Combination Proposal — Summary of the Ancillary Agreements — Amended & Restated Registration Rights Agreement”

beginning on page 131 of the Final Prospectus. In addition, in a term agreed to in connection with the Closing, the Company agreed to

use its commercially reasonable efforts to file a registration statement for the resale of any or all of an individual holder’s

registrable securities, as requested in writing by such holder, within 120 days of the date of the A&R Registration Rights Agreement.

The description of the A&R Registration Rights Agreement herein is qualified in its entirety by the text of the A&R Registration

Rights Agreement, which is included as Exhibit 10.1 to this Report and is incorporated herein by reference.

Amended & Restated Shared Services Agreement

On August 12, 2024, in connection

with the Closing and as contemplated by the Merger Agreement, SpinCo and Citius Pharma entered into the Amended and Restated Shared Services

Agreement (the “A&R Shared Services Agreement”). The material terms of the A&R Shared Services Agreement are described

in the section entitled “Proposal No. 1 — The Business Combination Proposal — Summary of the Ancillary Agreements

— Amended & Restated Shared Services Agreement” beginning on page 131 of the Final Prospectus. Such description is

qualified in its entirety by the text of the A&R Shared Services Agreement, which is included as Exhibit 10.2 to this Report and is

incorporated herein by reference.

Letter Agreement to the Merger Agreement

On August 12, 2024, in connection

with the Closing, the parties to the Merger Agreement entered into a letter agreement waiving certain closing conditions of the Merger

Agreement (the “Letter Agreement”). The material terms of the Letter Agreement are set forth in the “Introductory Note”

above and are incorporated into this Item 1.01 by reference. The foregoing description of the Letter Agreement does not purport to be

complete and is qualified in its entirety by the text of the Letter Agreement, which is incorporated by reference to this Current Report

on Form 8-K as Exhibit 10.8.

Promissory Note between the Company and Citius

Pharma

On August 12, 2024, Citius

Pharma made the Capital Contribution to the Company, as set forth in the “Introductory Note” above. Such Capital Contribution

is evidenced by an unsecured promissory note (the “Note”) issued by the Company, dated August 16, 2024, in the principal amount

of $3,800,111 to Citius Pharma. The Note bears no interest and is repayable in full upon a financing of at least $10 million by the Company,

per the terms of the Note. The foregoing description of the Note does not purport to be complete and is qualified in its entirety by the

text of the Note, which is incorporated by reference to this Current Report on Form 8-K as Exhibit 10.9.

Item 2.01. Completion of Acquisition or Disposition of Assets.

The information set forth

in the “Introductory Note” above is incorporated into this Item 2.01 by reference. TenX held a special meeting of stockholders

on August 2, 2024, to approve, among other things, the Business Combination (the “Special Meeting”). The stockholders approved

the Business Combination at the Special Meeting, and the Business Combination was completed on August 12, 2024.

As a result of the

Closing (after giving effect to the Domestication), among other things, (i) all outstanding shares of capital stock of SpinCo, other

than Treasury Shares, were canceled in exchange for the right to receive, in the aggregate, 67,500,000 shares of Company Common

Stock and (ii) all outstanding SpinCo Options were assumed by the Company and converted into Company Options. The Treasury Shares

were canceled and ceased to exist, and no stock or other consideration was issued in respect of the Treasury Shares. Specifically,

each share of SpinCo Common Stock was canceled and converted into the right to receive a number of shares of Company Common Stock

equal to the Base Exchange Ratio, which is the quotient obtained by dividing (x) 67,500,000 by (y) 67,500,000, the aggregate number

of shares of SpinCo Common Stock outstanding as of immediately prior to the effective time. Each outstanding SpinCo Option was

exchanged for a number of Company Options (rounded down to the nearest whole share) equal to the number of shares of SpinCo Common

Stock subject to such option, multiplied by the Base Exchange Ratio, and the exercise price per share was the exercise price in

effect immediately prior to the effective time, divided by the Base Exchange Ratio (rounded up to the nearest full cent).

In addition, at the Closing,

every five outstanding Company Rights automatically converted into one share of Company Common Stock.

In connection with the Domestication,

(i) each then-issued and outstanding TenX Ordinary Share, converted automatically, on a one-for-one basis, into a share of Company Common

Stock; (ii) each then-issued and outstanding TenX Right converted into a Company Right; and (iii) each then-issued and outstanding TenX

Unit was canceled and the holder thereof was issued one share of Company Common Stock and one Company Right.

In connection with the Business

Combination, Holders of 4,297,828 TenX Ordinary Shares sold in TenX’s initial public

offering properly exercised their rights to have such shares redeemed for a pro rata portion of the trust account holding the proceeds

from TenX’s initial public offering, or approximately $11.47 per share and $49,296,087.16

in the aggregate. The remaining balance immediately prior to the Closing of approximately $163,498.89 remained in the trust account,

which was used to pay certain expenses in connection with the Business Combination.

Upon the Closing, 71,304,049

shares of Company Common Stock were issued and outstanding. After the Closing Date, the TenX Ordinary

Shares, TenX Units and TenX Rights ceased trading on The Nasdaq Global Market under the symbols “TENK,” “TENKU”

and “TENKR” respectively, and Company Common Stock commenced trading on The Nasdaq Capital Market under the symbol “CTOR”

on August 13, 2024.

The material terms and conditions

of the Merger Agreement are described in the section entitled “Proposal No. 1 — The Business Combination Proposal — Consideration”

beginning on page 111 of the Final Prospectus and are incorporated herein by reference.

FORM 10 INFORMATION

Item 2.01(f) of Form 8-K provides that if the predecessor

registrant was a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended

(the “Exchange Act”)), as TenX was immediately before the Business Combination, then the registrant must disclose the information

that would be required if the registrant were filing a general form for registration of securities on Form 10. As a result of the consummation

of the Business Combination, and as discussed below in Item 5.06 of this Report, the Company has ceased to be a shell company. Accordingly,

the Company is providing the information below that would be included in a Form 10 if it were to file a Form 10. Please note that the

information provided below relates to the combined company after the consummation of the Business Combination, unless otherwise specifically

indicated or the context otherwise requires.

Forward-Looking Statements

Some of the information

contained in this Current Report on Form 8-K, or incorporated herein by reference, contains forward-looking statements. The words

“anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “would” and similar

expressions may identify forward-looking statements, but the absence of these words does not mean that a statement is not

forward-looking. All statements other than statements of historical fact contained in or incorporated by reference into this Report,

including the expected benefits of the Business Combination, the U.S. federal income tax consequences of the Business Combination,

the Company’s future results of operations, financial position and business strategy and its expectations regarding the

application of, and the commercialization of and market for LYMPHIRTM and any future product candidates, the potential

for and timing of any milestones and royalties under the Company’s license agreements with partners, are forward-looking

statements.

The forward-looking statements

contained in this Form 8-K and in any document incorporated by reference are based on current expectations and beliefs concerning future

developments and their potential effects on the Company. There can be no assurance that future developments affecting the Company will

be those that the Company has anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are

beyond the control of the Company) or other assumptions that may cause actual results or performance to be materially different from

those expressed or implied by these forward-looking statements. These risks and uncertainties include, but are not limited to, those

factors described under the heading “Risk Factors”

and the following:

| ● | the

inability of the Company to recognize the anticipated benefits of the Business Combination,

which may not be realized fully, if at all, or may take longer to realize than expected; |

| ● | the

Company’s need for substantial additional funds; |

| ● | the

historical combined financial data and pro forma financial statements included herein may

not be representative of the results the Company would have achieved as a standalone company

and may not be a reliable indicator of its future results; |

| ● | the

ability of the Company to commercialize LYMPHIR; |

| ● | the

ability of LYMPHIR or any of our future product candidates to impact the quality of life

of our target patient populations; |

| ● | the

estimated markets for LYMPHIR or any of our future product candidates and the acceptance

thereof by any market; |

| ● | risks

relating to the results of research and development activities, including those from our

existing and any new pipeline assets; |

| ● | our

ability to obtain, perform under and maintain financing and strategic agreements and relationships; |

| ● | the

Company’s operating results and financial performance; |

| ● | uncertainties

relating to preclinical and clinical testing, approval and commercialization of any future

product candidates by the Company; |

| ● | our

ability to procure cGMP commercial-scale supply; |

| ● | our

dependence on third-party suppliers; |

| ● | the

Company’s ability to manage and grow its business and execution of its business and

growth strategies; |

| ● | risks

arising from changes in the fields in which LYMPHIR and any of our future product candidates,

if approved, may compete; |

| ● | the

competitive environment in the life sciences and biotechnology industry; |

| ● | failure

to maintain, protect and defend the Company’s intellectual property rights; |

| ● | changes

in government laws and regulations, including laws governing intellectual property, and the

enforcement thereof affecting the Company’s business; |

| ● | changes

in general economic conditions, geopolitical risk, including as a result of any pandemic

or international conflict, including in the Middle East and between Russia and Ukraine; |

| ● | the

outcome of any litigation related to or arising out of the Business Combination, or any adverse

developments therein or delays or costs resulting therefrom; |

| ● | the

effect of the transactions on the Company’s business relationships, operating results,

and businesses generally; |

| ● | the

ability of the Company to meet Nasdaq’s continued listing standards following the Business

Combination; and |

| ● | the

volatility in the price of the Company’s securities due to a variety of factors, including

the Company’s inability to implement their business plans or meet or exceed its financial

projections. |

Should

one or more of these risks or uncertainties materialize, or should any of the Company’s assumptions prove incorrect, actual results

may vary in material respects from those projected in these forward-looking statements. The Company does not undertake any obligation

to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except

as may be required under applicable securities laws. You should not place undue reliance on any forward-looking statements, which are

based only on information currently available to the Company.

Business

The information set forth

in the section entitled “Information About the SpinCo Business” beginning on page 192 of the Final Prospectus is incorporated

herein by reference.

Risk Factors

The information set forth

in the section entitled “Risk Factors and Risk Factor Summary” beginning on page 59 of the Final Prospectus is incorporated

herein by reference.

Financial Information

Reference

is made to the disclosure set forth in Item 9.01 of this Current Report on Form 8-K concerning the financial information of

the Company and such information is incorporated herein by reference.

Management’s Discussion and Analysis of Financial Condition

and Results of Operations and Quantitative and Qualitative Disclosures About Market Risk

The disclosure contained in the Final Prospectus in the section entitled

“SpinCo Management’s Discussion and Analysis of Financial Condition and Results of Operations” beginning on page 204

of the Final Prospectus is incorporated herein by reference.

Description of Property

Pursuant to the shared services

agreement, during the nine months ended June 30, 2024, the Company paid Citius Pharma for the use of shared office space located at 11

Commerce Drive, First Floor, Cranford, New Jersey 07016. The lease held by Citius Pharma runs until October 31, 2025.

Security Ownership of Certain Beneficial Owners and Management

The following table and accompanying

footnotes set forth information regarding beneficial ownership of Company Common Stock following the consummation of the Business Combination

by:

| |

● |

each person known by us to be the beneficial owner of more than 5% of outstanding Company Common Stock; |

| |

|

|

| |

● |

each of our executive officers and directors; and |

| |

|

|

| |

● |

all our executive officers and directors as a group. |

Beneficial ownership for the

purposes of the following table is determined in accordance with the rules and regulations of the SEC. A person is a “beneficial

owner” of a security if that person has or shares “voting power,” which includes the power to vote or to direct the

voting of the security, or “investment power,” which includes the power to dispose of or to direct the disposition of the

security or has the right to acquire such powers within 60 days of August 13, 2024.

Unless otherwise noted in the

footnotes to the following table, and subject to applicable community property laws, the persons and entities named in the table have

sole voting and investment power with respect to their beneficially owned Company Common Stock. The

beneficial ownership of the Company after the Business Combination is based on 71,304,049 Company

Common Stock issued and outstanding after the Closing.

| Name and Address of Beneficial Owner(1) | |

Number of

Shares | | |

% of

Ownership | |

| Directors and executive officers of the Company | |

| | |

| |

| Myron Holubiak(2) | |

| 500,000 | | |

| 1.70 | % |

| Leonard Mazur(3) | |

| 1,233,333 | | |

| * | |

| Jaime Bartushak(4) | |

| 466,667 | | |

| * | |

| Myron Czuczman(5) | |

| 466,667 | | |

| * | |

| Suren Dutia(6) | |

| 150,000 | | |

| * | |

| Eugene Holuka(7) | |

| 150,000 | | |

| * | |

| Joel Mayersohn | |

| – | | |

| – | |

| Dennis McGrath(8) | |

| 150,000 | | |

| * | |

| Robert Smith | |

| – | | |

| – | |

| Carol Webb(9) | |

| 150,000 | | |

| * | |

| All directors and executive officers of New Citius Oncology after consummation of the Business Combination, as a group (ten individuals) | |

| 3,266,667 | | |

| 4.4 | % |

| | |

| | | |

| | |

| 5% Holders | |

| | | |

| | |

| Citius Pharmaceuticals, Inc. | |

| 66,049,615 | | |

| 92.6 | % |

| (1) | The business address of each of the following entities or individuals

is c/o of the Company, 11 Commerce Drive, 1st Floor, Cranford, New Jersey 07016. |

| (2) | Consists of 500,000 shares of New Citius Oncology Common Stock

Mr. Holubiak has the right to acquire pursuant to outstanding options that are exercisable within 60 days of August 13, 2024. |

| (3) | Consists of 1,233,333 shares of New Citius Oncology Common

Stock Mr. Mazur has the right to acquire pursuant to outstanding options that are exercisable within 60 days of August 13, 2024. |

| (4) | Consists of 466,667 shares of New Citius Oncology Common Stock

Mr. Bartushak has the right to acquire pursuant to outstanding options that are exercisable within 60 days of August 13, 2024. |

| (5) | Consists of 466,667 shares of New Citius Oncology Common Stock Mr. Czuczman has the right to acquire

pursuant to outstanding options that are exercisable within 60 days of August 13, 2024. |

| (6) | Consists of 150,000 shares of New Citius Oncology Common Stock

Mr. Dutia has the right to acquire pursuant to outstanding options that are exercisable within 60 days of August 13, 2024. |

| (7) | Consists of 150,000 shares of New Citius Oncology Common Stock

Dr. Holuka has the right to acquire pursuant to outstanding options that are exercisable within 60 days of August 13, 2024. |

| (8) | Consists of 150,000 shares of New Citius Oncology Common Stock

Mr. McGrath has the right to acquire pursuant to outstanding options that are exercisable within 60 days of August 13, 2024. |

| (9) | Consists of 150,000 shares of New Citius Oncology Common Stock

Ms. Webb has the right to acquire pursuant to outstanding options that are exercisable within 60 days of August 13, 2024. |

Directors and Executive Officers

Information with respect to

the Company’s directors and executive officers immediately after the Closing is set forth in the section entitled “Management

of New Citius Oncology After the Business Combination” beginning on page 213 in the Final Prospectus and Item 5.02 of this Current

Report on Form 8-K and is incorporated herein by reference.

The size of the Company’s

board of directors is eight members. Each of Mr. Myron Holubiak (Class I), Mr. Joel Mayersohn (Class I), Dr. Eugene Holuka (Class II),

Mr. Robert Smith (Class II), Ms. Carol Webb (Class II), Mr. Suren Dutia (Class III), Mr. Leonard Mazur (Class III and Chairman) and Mr.

Dennis McGrath (Class III) were elected to serve as directors of the Company. In accordance with the Certificate of Incorporation of the

Company, each was elected to serve in staggered terms until the 2025 (Class I), 2026 (Class II) and 2027 (Class III) annual meetings of

stockholders, as applicable, or until their respective successors are duly elected or until their earlier death, resignation, retirement

or removal for cause.

The Board appointed Messrs.

McGrath, Dutia and Smith to serve on the Audit and Risk Committee, with Mr. McGrath serving as its chair. The Board appointed Mr. Dutia,

Dr. Holuka and Ms. Webb to serve on the Compensation Committee, with Mr. Dutia serving as its chair. The Board appointed Dr. Holuka, Mr.

McGrath and Ms. Webb to serve on the Nominating and Corporate Governance Committee, with Dr. Holuka serving as its chair.

In connection with the completion

of the Business Combination, Mr. Mazur was appointed to serve as the Company’s Chief Executive Officer and Chair of the board of

directors, Mr. Bartushak was appointed to serve as the Company’s Chief Financial Officer, Mr. Holubiak was appointed to serve as

the Company’s Secretary and Treasurer and Mr. Czuczman was appointed to serve as the Company’s Chief Medical Officer.

Executive and Director Compensation

The information set forth

in the section entitled “Executive and Director Compensation of SpinCo” beginning on page 210 of the Final Prospectus,

which includes the executive compensation information of SpinCo, is incorporated herein by reference.

Certain Relationships and Related Transactions

The information set forth

in the section entitled “Certain Relationships and Related Party Transactions” beginning on page 223 of the Final Prospectus

is incorporated herein by reference.

Director Independence

After review of all relevant

transactions or relationships between each nominee for director, or any of his or her family members, and the Company, its senior management

and Wolf & Company, P.C., its independent registered public accounting firm, the board of directors has determined that all directors

of the Company are independent within the meaning of the applicable Nasdaq listing standards, except Leonard Mazur, the Chief Executive

Officer and Chairman, Myron Holubiak, the Executive Vice President and Joel Mayersohn.

Because Citius Pharma continues

to control a majority of the voting power of the outstanding shares of Company Common Stock, the Company qualifies as a “controlled

company” within the meaning of the corporate governance standards of the Nasdaq. Under these rules, a listed company of which more

than 50% of the voting power is held by an individual, group or another company is a “controlled company” and may elect not

to comply with certain corporate governance requirements, including the requirements that (i) a majority of the Board consist of “independent

directors” as defined under Nasdaq listing rules, (ii) we have a compensation committee composed entirely of independent directors

and (iii) we have a nominating/corporate governance committee composed entirely of independent directors.

The Company does not intend

to rely on these exemptions, but may opt to utilize these exemptions in the future as long as it remains a controlled company. Accordingly,

Company stockholders may not have the same protections afforded to stockholders of companies that are subject to all of the corporate

governance requirements of Nasdaq.

If the Company ceases to be

a “controlled company” in the future, it will be required to comply with the Nasdaq Listing Rules, which may require replacing

a number of its directors and may require development of certain other governance-related policies and practices. These and any other

actions necessary to achieve compliance with such rules may increase the Company’s legal and administrative costs, will make some

activities more difficult, time-consuming, and costly and may also place additional strain on the Company’s personnel, systems and

resources.

Legal Proceedings

There is no material litigation,

arbitration or governmental proceeding currently pending against the Company or any members of the Company’s management team in

their capacity as such, and the Company and the members of the Company’s management team have not been subject to any such proceeding

in the twelve (12) months preceding the date of this filing.

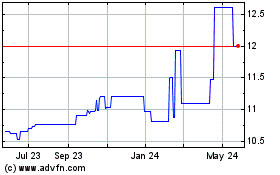

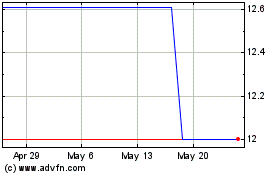

Market Price of and Dividends on the Registrant’s Common Equity

and Related Stockholder Matters

Market Information and Market Price

Prior to the Closing Date, the

TenX Units, TenX Ordinary Shares, and TenX Rights were each traded on The Nasdaq Global Market under the symbols “TENKU,”

“TENK” and “TENKR” respectively. Upon the Closing, the Company’s Common Stock began trading on the Nasdaq

Capital Market under the symbol “CTOR”. As of August 13,

2024, following the completion of the Business Combination, there were 71,304,049 shares

of Company Common Stock issued and outstanding.

Holders

As of August 14, 2024, there

were six holders of record of Company Common Stock. The Company does not have any outstanding units or rights following the Business Combination.

Dividends

The Company has not paid

any cash dividends on shares of its common stock to date and does not intend to for the foreseeable future as it focuses on the

development and commercialization of its product candidates. The payment of cash dividends by the Company in the future will be

dependent upon its revenues and earnings, if any, capital requirements and general financial conditions. The payment of any cash

dividends is within the discretion of the Company Board.

Additional

information set forth in the section entitled “Market Price and Dividend Information” beginning on page 49 of

the Final Prospectus is incorporated herein by reference.

Recent Sales of Unregistered Securities

The information set forth

under Item 3.02 of this Current Report on Form 8-K is incorporated herein by reference.

Description of Registrant’s Securities

The description of the Company’s

securities is contained in the section entitled “Description of Combined Company Securities” beginning on page 227

of the Final Prospectus and is incorporated herein by reference.

Indemnification of Directors and Officers

Information

about the indemnification of the Company’s directors and officers is set forth in the section entitled “Description of

Combined Company Securities — Limitations of Liability and Indemnification Matters” on page 232 of the Final Prospectus

and is incorporated herein by reference.

Financial Statements, Supplementary Data and Exhibits

The information set forth

under Item 9.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 3.02 Unregistered Sales of Equity Securities.

As described in the Introductory

Note above, pursuant to the Merger Agreement and the Sponsor Support Agreement and in connection with the closing of the Business Combination,

on August 13, 2024, the Company issued 119,500 shares of Common Stock to the Sponsor for amounts outstanding under the promissory notes

TenX issued to the Sponsor on July 18, 2023 ($660,000) and October 18, 2023 ($535,000). The promissory notes issued to the Sponsor on

July 18, 2023 and October 18, 2023 evidenced deposits into the Trust Account (as defined in the Merger Agreement) to extend the timeline

to complete a business combination.

In connection with the closing

of the Business Combination, Citius Pharma issued a promissory note to the Sponsor for the reimbursement of $1,288,532 in transaction

and other expenses. Pursuant to its terms, the note converted automatically on August 13, 2024, the day after the closing, into 128,854

shares of Company Common Stock.

The issuances of shares of

Common Stock to the Sponsor described herein were made pursuant to the exemption from registration contained in Section 4(a)(2) of the Securities

Act of 1933, as amended.

Item 3.03 Material Modification to Rights of Security Holders.

On the Closing Date, in connection

with the consummation of the Business Combination, TenX adopted the Company Charter and the Company Bylaws. The material terms of each

of the Company Charter and the Company Bylaws and the general effect upon the rights of holders of TenX’s capital stock are included

in the sections entitled “Proposal No. 3 — The Organizational Documents Proposal” beginning on page 156 and “Comparison

of Corporate Governance and Shareholder Rights” beginning on page 234 of the Final Prospectus and are incorporated herein by

reference.

The

foregoing description of the Company Charter and Company Bylaws is not complete and is qualified in its entirety by reference to the text

of the Company Charter and Company Bylaws, which are included as Exhibit 3.1 and Exhibit 3.2, respectively, to this Current Report on

Form 8-K, and are incorporated herein by reference.

Item 4.01. Changes in Registrant’s Certifying Accountant.

(a) Effective August 13, 2024,

Marcum LLP (“Marcum”), TenX’s independent registered public accounting firm prior to the Business Combination, was dismissed

and replaced as the Company’s independent registered public accounting firm.

Marcum’s report on TenX’s

consolidated balance sheets as of December 31, 2023 and 2022, the related consolidated statements of operations, changes in shareholders’

equity (deficit) and cash flows for each of the two years in the period ended on December 31, 2023, and the related notes (collectively

referred to as the “financial statements”) did not contain any adverse opinion or disclaimer of opinion, nor were they qualified

or modified as to uncertainty, audit scope or accounting principles, except for the substantial doubt about the Company’s ability

to continue as a going concern.

During

the period from March 1, 2021 (inception), through December 31, 2023, and subsequent

interim periods through August 12, 2024, there were no disagreements between TenX and Marcum

on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements,

if not resolved to the satisfaction of Marcum, would have caused Marcum to make reference to the subject matter of the disagreement in

connection with its report covering such period or “reportable events” (as that term is defined in Item 304(a)(1)(v) of Regulation

S-K), except that Marcum concurred with the Company’s assessment of a material weakness related to the Company’s internal

controls over financial reporting, due to material weaknesses in internal control over financial reporting that existed relating to accounting

for accruals and advances from related parties and accounting for complex financial instruments.

The

Company provided Marcum with a copy of the disclosures made by the Company in response to this Item 4.01 and requested that Marcum furnish

the Company with a letter addressed to the SEC stating whether it agrees with the statements made by the Company in response to this Item

4.01 and, if not, stating the respects in which it does not agree. The letter from Marcum is included as Exhibit 16.1 to this Current

Report.

(b) Effective August 13, 2024,

Wolf & Company, P.C. (“Wolf”) was engaged as the Company’s independent registered public accounting firm to audit

the Company’s consolidated financial statements as of and for the year ending September 30, 2024. Wolf has served as the independent

registered public accounting firm of the Citius Pharma prior to the Business Combination. During the years ended September 30, 2023 and

2022, and subsequent interim period through August 12, 2024, the Company did not consult with Wolf with respect to (i) the application

of accounting principles to a specified transaction, either completed or proposed, the type of audit opinion that might be rendered on

its financial statements, and neither a written report nor oral advice was provided to the Company that Wolf concluded was an important

factor considered by the Company in reaching a decision as to any accounting, auditing or financial reporting issue, or (ii) any other

matter that was the subject of a disagreement or a reportable event (each as defined above).

Item 5.01. Changes in Control of Registrant.

The information set forth

under in the section entitled “Proposal No. 1 — The Business Combination Proposal” beginning on page 111 of the

Final Prospectus and “Introductory Note” and Item 2.01 in this Current Report on Form 8-K is incorporated herein by reference.

There are no known arrangements

which may at a subsequent date result in a further change in control of the Company.

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Election of Directors and Appointment of Officers

Information with respect

to the Company’s directors and executive officers immediately after the Closing is set forth in the section entitled

“Management of New Citius Oncology After the Business Combination” beginning on page 213 in the Final Prospectus

and Item 5.02 of this Current Report on Form 8-K and is incorporated herein by reference. The

information contained in Item 1.01 and Item 2.01 of this Current Report on Form 8-K is also incorporated herein by

reference.

Biographical information with

respect to each such director and officer is set forth in the section entitled “Management of PubCo After the Business Combination”

beginning on page 213 of the Final Prospectus and is incorporated herein by reference.

Departure of Directors and Certain Officers

In connection with the Business

Combination, effective as of the Closing, each of Xiaofeng Yuan, Taylor Zhang, Cathy Jiang and Brian Hartzband resigned as directors and

executive officers of TenX. Xiaofeng Yuan resigned as Chief Executive Officer and Chairman of the Board, Taylor Zhang resigned as Chief

Financial Officer and a director and each of Cathy Jiang and Brian Hartzband resigned as directors. Mr. Mayersohn will continue as a Class

I Director of the Company.

2024 Omnibus Stock Incentive Plan

On August 12, 2024, the Citius

Oncology, Inc. 2024 Omnibus Stock Incentive Plan (the “2024 Plan”) became effective. The 2024 Plan was approved by TenX’s

stockholders at the Special Meeting on August 2, 2024.

The information set forth

in the section entitled “Proposal No. 6 — The Incentive Plan Proposal” beginning on page 164 of the Final Prospectus

is incorporated herein by reference. The foregoing description of the 2024 Plan and the information incorporated by reference in the preceding

sentence does not purport to be complete and is qualified in its entirety by the terms and conditions of the 2024 Plan, which is incorporated

by reference to this Current Report on Form 8-K as Exhibit 10.3.

Item 5.03. Amendments to Memorandum and

Articles of Association; Change in Fiscal Year.

The information contained

in Item 3.03 of this Current Report on Form 8-K is incorporated in this Item 5.03 by reference.

In connection with the Closing

of the Business Combination, the Company changed its fiscal year end from December 31 to September 30, the fiscal year end of SpinCo prior

to the Business Combination.

Item 5.06. Change in Shell Company Status.

As a result of the Business

Combination, TenX ceased being a shell company. The material terms of the Business Combination are described in the section entitled “Proposal

No. 1 — The Business Combination Proposal” beginning on page 111 of the Final Prospectus, in the information set forth

under “Introductory Note” and in the information set forth under Item 2.01 in this Current Report on Form 8-K, each of which

is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(a) Financial statements of businesses acquired

The

unaudited financial statements of SpinCo as of and for the six months ended March 31, 2024 and 2023 are set forth in the Final Prospectus,

beginning on page F-37 and are incorporated herein by reference.. SpinCo’s audited financial statements are set forth

in the Final Prospectus beginning on page F-47 and are incorporated herein by reference.

(b) Pro Forma Financial Information

The

unaudited pro forma condensed combined financial information of the Company for the six months ended March 31, 2024 and the year

ended December 31, 2023 are set forth in the section entitled “Unaudited Pro Forma Condensed Combined Financial Information”

beginning on page 50 of the Final Prospectus and is herein by reference.

(d) Exhibits.

| Exhibit

No. |

|

Document |

|

Filed

Herewith |

|

Form |

|

Exhibit |

|

Filing

Date |

| 2.1* |

|

Agreement and Plan of Merger and Reorganization, dated as of October 23, 2023, by and among Citius Pharmaceuticals, Inc., Citius Oncology, Inc., TenX Keane Acquisition and TenX Merger Sub, Inc. |

|

|

|

8-K |

|

2.1 |

|

10/24/2023 |

| 3.1 |

|

Certificate of Incorporation of Citius Oncology, Inc. |

|

X |

|

|

|

|

|

|

| 3.2 |

|

Bylaws of Citius Oncology, Inc. |

|

X |

|

|

|

|

|

|

| 4.1 |

|

Specimen Common Stock Certificate of Citius Oncology, Inc. |

|

|

|

S-4 |

|

4.5 |

|

07/11/2024 |

| 10.1 |

|

Amended and Restated Registration Rights Agreement, dated as of August 12, 2024 by and between Citius Oncology, Inc. and the signatories thereto. |

|

X |

|

|

|

|

|

|

| 10.2 |

|

Amended and Restated Shared Services Agreement, dated as of August 12, 2024, by and among Citius Oncology, Inc. and Citius Pharmaceuticals, Inc. |

|

X |

|

|

|

|

|

|

| 10.3† |

|

2024 Omnibus Stock Incentive Plan. |

|

|

|

8-K |

|

10.5 |

|

8/5/2024 |

| 10.4* |

|

Asset Purchase Agreement, dated as of September 1, 2021, between Dr. Reddy’s Laboratories S.A. and Citius Pharmaceuticals, Inc. |

|

|

|

S-4 |

|

10.15 |

|

11/13/2023 |

| 10.5* |

|

Amended and Restated License, Development and Commercialization Agreement, dated as of February 26, 2018, between Eisai, Ltd. and Dr. Reddy’s Laboratories S.A. |

|

|

|

S-4 |

|

10.16 |

|

11/13/2023 |

| 10.6* |

|

Amendment No. 1 to Amended and Restated License, Development and Commercialization Agreement, dated as of August 9, 2018, between Eisai, Ltd. and Dr. Reddy’s Laboratories S.A. |

|

|

|

S-4 |

|

10.17 |

|

11/13/2023 |

| 10.7* |

|

Amendment No. 2 to Amended and Restated License, Development and Commercialization Agreement, dated as of August 31, 2021, between Eisai, Ltd. and Dr. Reddy’s Laboratories S.A. |

|

|

|

S-4 |

|

10.18 |

|

11/13/2023 |

| 10.8 |

|

Side Letter Agreement, dated August 12, 2024, by and by and among Citius Pharmaceuticals, Inc., Citius Oncology, Inc., TenX Keane Acquisition and TenX Merger Sub, Inc. |

|

X |

|

|

|

|

|

|

| 10.9 |

|

Promissory Note, dated August 16, 2024, by and between Citius Oncology, Inc. and Citius Pharmaceuticals, Inc. |

|

X |

|

|

|

|

|

|

| 16.1 |

|

Letter from Marcum LLP to the Securities and Exchange Commission, dated August 16, 2024. |

|

x |

|

|

|

|

|

|

| 21.1 |

|

Subsidiaries of Citius Oncology, Inc. |

|

X |

|

|

|

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

|

x |

|

|

|

|

|

|

| * | Certain of the exhibits

and schedules to this exhibit have been omitted in accordance with Regulation S-K Item 601(b)(2) or 601(a)(5), as applicable. TenX agrees

to furnish supplementally a copy of all omitted exhibits and schedules to the SEC upon its request. |

| † | Indicates management contract or compensatory plan. |

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: August 16, 2024

| |

CITIUS ONCOLOGY, INC. |

| |

|

|

| |

By: |

/s/ Leonard Mazur |

| |

Name: |

Leonard Mazur |

| |

Title: |

Chief Executive Officer |

| |

|

(Principal Executive Officer) |

14

Exhibit 3.1

CERTIFICATE OF INCORPORATION

OF

CITIUS Oncology, Inc.

August 5, 2024

The undersigned, for the purpose of forming a corporation

under the provisions of and subject to the requirements of the General Corporation Law of the State of Delaware (the “DGCL”),

hereby certifies as follows:

I. NAME

The name of the corporation is Citius Oncology, Inc. (the “Company”).

II. REGISTERED OFFICE AND AGENT

The address of the Company’s registered office in the State of

Delaware is 3500 South DuPont Highway, in the City of Dover, Kent County, Delaware 19901. The name of its registered agent at such address

is Incorporating Services, Ltd.

III. PURPOSE

The purpose of the Company is to engage in any lawful act or activity

for which corporations may be organized under the DGCL.

IV. CAPITAL STOCK

| A. | The total number of shares of capital stock which may be issued by the Company is 110,000,000, of which

100,000,000 shares shall be common stock of the par value of $0.0001 per share (the “Common Stock”) and 10,000,000

shares shall be preferred stock of the par value of $0.0001 per share (the “Preferred Stock”). |

| B. | Each holder of Common Stock, as such, shall be entitled to one vote for each share of Common Stock held

of record by such holder on all matters on which stockholders generally are entitled to vote; provided, however, that, except as otherwise

required by law, holders of Common Stock, as such, shall not be entitled to vote on any amendment to this Certificate of Incorporation

(this “Certificate”) (including any Preferred Stock Designation (as hereinafter defined)) that relates solely

to the terms of one or more outstanding classes or series of Preferred Stock if the holders of such affected classes or series are entitled,

either separately or together with the holders of one or more other such classes or series, to vote thereon pursuant to this Certificate

(including any Preferred Stock Designation) or pursuant to the DGCL. |

| C. | The Preferred Stock may be issued from time to time in one or more series pursuant to a resolution or

resolutions providing for such issue duly adopted by the Board of Directors and by filing a certificate pursuant

to applicable law of the State of Delaware (hereinafter referred to as a “Preferred Stock Designation”) pursuant

to the DGCL; and in such resolution or resolutions and Preferred Stock Designation providing for the issue of shares of each particular

series, the Board of Directors is expressly authorized to fix the annual rate or rates of dividends for the particular series; the dividend

payment dates for the particular series and the date from which dividends on all shares of such series issued prior to the record date

for the first dividend payment date shall be cumulative; the redemption price or prices for the particular series; the voting powers for

the particular series; the rights, if any, of holders of the shares of the particular series to convert the same into shares of any other

series or class or other securities of the Company, with any provisions for the subsequent adjustment of such conversion rights; and to

classify or reclassify any unissued preferred shares by fixing or altering from time to time any of the foregoing rights, privileges and

qualifications. All shares of the Preferred Stock of any one series shall be identical with each other in all respects, except that shares

of any one series issued at different times may differ as to the dates from which dividends thereon shall be cumulative; and all shares

of Preferred Stock shall be of equal rank, regardless of series, and shall be identical in all respects except as to the particulars fixed

by the Board of Directors as hereinabove provided or as fixed herein. |

V. BOARD OF DIRECTORS

| A. | Except as otherwise provided by applicable law or this Certificate, the business and affairs of the Company

shall be managed by or under the direction of the Board of Directors. |

| B. | The total number of directors shall be as determined from time to time exclusively by the Board of Directors;

provided that, at any time Citius Pharmaceuticals, Inc. (together with its Affiliates (as defined below), subsidiaries, successors and

assigns (other than the Company and its subsidiaries), “Citius Pharmaceuticals, Inc.”) beneficially owns, in

the aggregate, at least 50% in voting power of the then-outstanding shares of stock of the Company entitled to vote generally in the election

of directors, the stockholders may also fix the number of directors by resolution adopted by the stockholders, in each case, subject to

the rights of any holders of Preferred Stock to elect directors pursuant to any Preferred Stock Designation. Election of directors need

not be by written ballot unless the bylaws of the Company (as the same may be amended and/or restated from time to time, the “Bylaws”)

shall so require. |

As used in this Certificate, the term

“Affiliate” means a Person that directly, or indirectly through one or more intermediaries, controls, is controlled

by, or is under common control with, another Person, except that, with respect to Citius Pharmaceuticals, Inc., the term “Affiliate”

shall not include (a) the Company, and (b) any entity that is controlled by the Company (including its direct and indirect subsidiaries).

As used in this Certificate, the term “Person” means any individual, corporation, general or limited partnership,

limited liability company, joint venture, trust, association or any other entity.

| C. | Subject to the rights of the holders of any series of Preferred Stock to elect additional directors under

specified circumstances, the Board of Directors of the Company shall be divided into three classes designated

as Class I, Class II and Class III, respectively. The Board of Directors may assign members of the Board of Directors already in office

to such classes. To the extent practicable, the Board of Directors shall assign an equal number of directors to Class I, Class II and

Class III. At the first annual meeting of stockholders after the filing of this Certificate, the terms of the Class I directors shall

expire, and Class I directors shall be elected for a full term of office to expire at the third succeeding annual meeting of stockholders

after their election. At the second annual meeting of stockholders, the terms of the Class II directors shall expire, and Class II directors

shall be elected for a full term of office to expire at the third succeeding annual meeting of stockholders after their election. At the

third annual meeting of stockholders, the terms of the Class III directors shall expire, and Class III directors shall be elected for

a full term of office to expire at the third succeeding annual meeting of stockholders after their election. At each succeeding annual

meeting of stockholders, directors elected to succeed the directors of the class whose terms expire at such meeting shall be elected for

a full term of office to expire at the third succeeding annual meeting of stockholders after their election. If the number of directors

is changed, any increase or decrease shall be apportioned among the classes so as to maintain the number of directors in each class as

nearly equal as practicable, and any additional director of any class elected to fill a vacancy resulting from an increase in such class

shall hold office for a term that shall coincide with the remaining term of that class. No decrease in the number of directors constituting

the Board of Directors shall shorten the term of any incumbent director. |

| D. | Except as otherwise required by law or this Certificate, any vacancy resulting from the death, resignation,

removal or disqualification of a director or other cause, or any newly created directorship in the Board of Directors, may be filled by

a majority of the directors then in office, although less than a quorum, by the sole remaining director, or by the stockholders of the

Company; provided, however, that from and after the Trigger Event (as defined below), any vacancy resulting from the death, resignation,

removal or disqualification of a director or other cause, or any newly created directorship in the Board of Directors, shall be filled

only by a majority of the directors then in office, although less than a quorum, or by the sole remaining director, and shall not be filled

by the stockholders of the Company, in each case, subject to the rights of the holders of any series of Preferred Stock. Except as otherwise

provided by this Certificate, a director elected to fill a vacancy or newly created directorship shall hold office until the annual meeting

of stockholders for the election of directors of the class to which he or she has been appointed and until his or her successor has been

duly elected and qualified, subject, however, to such director’s earlier death, resignation, retirement, removal or disqualification. |

For purposes of this Certificate, “Trigger

Event” means, following the receipt by Citius Pharmaceuticals, Inc. of the shares of Common Stock to which it is entitled

under that certain Agreement and Plan of Merger and Reorganization, dated as of October 23, 2023, by and among Citius Pharmaceuticals,

Inc., Citius Oncology, Inc., TenX Keane Acquisition and TenX Merger Sub, Inc., the time that Citius Pharmaceuticals, Inc. and its Affiliates

first cease to beneficially own more than 50% in voting power of the then-outstanding shares of stock of the Company entitled to vote

generally in the election of directors.

| E. | Except as otherwise required by law or this Certificate, and subject to the rights of the holders of any

series of Preferred Stock, directors may be removed with or without cause by the affirmative vote of the holders of a majority in voting

power of the then-outstanding shares of stock of the Company entitled to vote generally in the election of such directors; provided, however,

that, from and after the Trigger Event any such director or all such directors may be removed only for cause and only by the affirmative

vote of the holders of at least 66 2/3% in voting power of all the then-outstanding shares of stock of the Company entitled to vote thereon,

voting together as a single class. |

VI. CONSENT OF STOCKHOLDERS IN LIEU OF MEETING;

SPECIAL MEETINGS OF

STOCKHOLDERS

| A. | Any action required or permitted to be taken by stockholders must be effected at a duly called annual

or special meeting of stockholders; provided, that prior to the Trigger Event, any action required or permitted to be taken

at any annual or special meeting of stockholders of the Company may be taken without a meeting, without prior notice and without a vote,

if a consent or consents, setting forth the action so taken, is signed by or on behalf of the holders of record of outstanding stock having

not less than the minimum number of votes that would be necessary to authorize or take such action at a meeting at which all shares entitled

to vote thereon were present and voted, is delivered to the Company in accordance with the DGCL, in each case, subject to the rights of

the holders of any series of Preferred Stock with respect to such series of Preferred Stock. |

| | | |

| B. | Special meetings of stockholders for the transaction of such business as may properly come before the

meeting may only be called by order of the Chairman of the Board of Directors, the Board of Directors (pursuant to a resolution adopted

by the affirmative vote of a majority of the authorized number of directors constituting the Board of Directors, whether or not there

exist any vacancies or other unfilled seats in previously authorized directorships) or the Chief Executive Officer of the Company; provided, however,

that at any time prior to the Trigger Event, special meetings of the stockholders of the Company for any purpose or purposes shall also

be called by or at the direction of the Board of Directors or the Chairman of the Board of Directors at the request of Citius Pharmaceuticals,

Inc., in each case, subject to the rights of the holders of any series of Preferred Stock with respect to such series of Preferred Stock.

Any such special meeting of stockholders shall be held at such date, time, and place, within or without the State of Delaware, as may

be specified by such order. The Board of Directors may, in its sole discretion, determine that special meetings of stockholders shall

not be held at any place but may instead be held solely by means of remote communication as authorized by Section 211(a)(2) of the DGCL.

If such order fails to fix such place, the meeting shall be held at the principal executive offices of the Company. |

VII. LIMITATION OF LIABILITY

To the fullest

extent permitted by the DGCL as the same exists or as may hereafter be amended, no present or former director of the Company shall

be personally liable to the Company or its stockholders for monetary damages for breach of fiduciary duty as a director. Neither any

amendment nor repeal of this Article, nor the adoption of any provision of this Certificate of Incorporation inconsistent with this

Article, shall eliminate or reduce the effect of this Article in respect of any matter occurring, or any cause of action, suit or

claim that, but for this Article, would accrue or arise, prior to such amendment, repeal or adoption of an inconsistent

provision.

VIII. CORPORATE OPPORTUNITIES AND COMPETITION

| A. | In recognition and anticipation that (i) certain directors, officers, principals, partners, members, managers,

employees, agents and/or other representatives of Citius Pharmaceuticals, Inc. and its Affiliates may serve as directors, officers or

agents of the Company and its Affiliates, and (ii) Citius Pharmaceuticals, Inc. and its Affiliates may now engage and may continue to

engage in the same or similar activities or related lines of business as those in which the Company and Affiliates, directly or indirectly,

may engage and/or other business activities that overlap with or compete with those in which the Company and its Affiliates, directly

or indirectly, may engage, the provisions of this Article VIII are set forth to regulate and define the conduct of certain affairs of

the Company and its Affiliates with respect to certain classes or categories of business opportunities as they may involve Citius Pharmaceuticals,

Inc. and its Affiliates and any person or entity who, while a stockholder, director, officer or agent of the Company or any of its Affiliates,

is a director, officer, principal, partner, member, manager, employee, agent and/or other representative of Citius Pharmaceuticals, Inc.

and its Affiliates (each, an “Identified Person”), on the one hand, and the powers, rights, duties and

liabilities of the Company and its Affiliates and its and their respective stockholders, directors, officers and agents in connection

therewith, on the other. |

| B. | To the fullest extent permitted by law (including, without limitation, the DGCL), and notwithstanding

any other duty (contractual, fiduciary or otherwise, whether at law or in equity), each Identified Person (i) shall have the right to,

and shall have no duty (contractual, fiduciary or otherwise, whether at law or in equity) not to, directly or indirectly engage in and

possess interests in other business ventures of every type and description, including those engaged in the same or similar business activities

or lines of business as the Company or any of its Affiliates or deemed to be competing with the Company or any of its Affiliates, on its

own account, or in partnership with, or as a direct or indirect equity holder, controlling person, stockholder, director, officer, employee,

agent, Affiliate (including any portfolio company), member, financing source, investor, director or indirect manager, general or limited

partner or assignee of any other person or entity with no obligation to offer to the Company or its subsidiaries or other Affiliates the

right to participate therein and (ii) shall have the right to invest in, or provide services to, any person that is engaged in the same

or similar business activities as the Company or its Affiliates or directly or indirectly competes with the Company or any of its Affiliates.

To the fullest extent permitted by applicable law, but subject to the immediately preceding sentence, neither the Company nor any of its

subsidiaries shall have any rights in any business interests, activities or ventures of any Identified Person, and the Company hereby

waives and renounces any interest or expectancy therein, except with respect to opportunities offered solely and expressly

to officers of the Company in their capacity as such. |

IX. EXCLUSIVE FORUM

| A. | Unless the Company consents in writing to the selection of an alternative forum, the Court of Chancery

of the State of Delaware (or, if and only if the Court of Chancery of the State of Delaware lacks subject matter jurisdiction,

any state court located within the State of Delaware or, if and only if all such state courts lack subject matter jurisdiction, the federal

district court for the District of Delaware) and any appellate court therefrom, shall, to the fullest extent permitted by law, be the

sole and exclusive forum for (i) any derivative action or proceeding brought on behalf of the Company, (ii) any action asserting a claim

of breach of a fiduciary duty owed by any current or former director, officer, employee or stockholder of the Company to the Company or

the Company’s stockholders, (iii) any action asserting a claim against the Company or any current or former director, officer, employee

or stockholder of the Company arising pursuant to any provision of the DGCL or of this Certificate or the Bylaws (as either may be amended

and/or restated from time to time), (iv) any claim or cause of action seeking to interpret, apply, enforce or determine the validity of

this Certificate or the Bylaws (each as may be amended from time to time, including any right, obligation or remedy thereunder), (v) any

action or proceeding asserting a claim against the Company or any current or former director, officer, employee or stockholder of the

Company as to which the DGCL confers jurisdiction to the Court of Chancery of the State of Delaware, or (vi) any action asserting an “internal

corporate claim,” as that term is defined in Section 115 of the DGCL. This Article IX.A. shall not apply to claims arising under

the Securities Exchange Act of 1934, as amended, or any other claim for which the federal courts have exclusive jurisdiction. |

| B. | Unless the Company consents in writing to the selection of an alternative forum, to the fullest extent

permitted by law, the federal district courts of the United States of America shall be the exclusive forum for the resolution of any complaint

asserting a cause of action arising under the Securities Act of 1933. |

| C. | Any person or entity purchasing or otherwise acquiring any interest in shares of stock of the Company

shall be deemed to have notice of and, to the fullest extent permitted by law, to have consented to the provisions of this Article IX. |

X. SECTION 203 OF THE DGCL

The Company hereby expressly elects not to be

governed by Section 203 of the DGCL until the occurrence of a Trigger Event; whereupon, the Company shall immediately and automatically,

without further action on the part of the Company or any holder of stock of the Company, become governed by Section 203 of the DGCL, except

that the restrictions on business combinations of Section 203 of the DGCL will not apply to Citius Pharmaceuticals, Inc. or its current

or future Affiliates regardless of the percentage of ownership of the total voting power of all the then-outstanding shares of capital

stock of the Company entitled to vote generally in the election of directors beneficially owned by them.

XI. AMENDMENT OF CERTIFICATE OF INCORPORATION AND BYLAWS

| A. | The Company reserves the right to amend, alter, change or repeal any provision contained in this Certificate,

in the manner now or hereafter prescribed by this Certificate and the DGCL, and all rights, preferences and privileges herein conferred

upon stockholders by and pursuant to this Certificate in its current form or as hereafter amended are granted subject to the rights reserved

in this Article XI. Notwithstanding the foregoing, from and after the occurrence of the Trigger Event, notwithstanding any other provisions

of this Certificate or any provision of law that might otherwise permit a lesser vote or no vote, but in addition to any greater or additional

vote or consent required hereunder (including any vote of the holders of any particular class or classes or series of stock required by

law or by this Certificate or any Preferred Stock Designation), the affirmative vote of the holders of at least 66 2/3% of the voting

power of the then-outstanding shares of stock entitled to vote thereon, voting together as a single class, shall be required to alter,

amend or repeal Articles V (Board of Directors), VI (Consent of Stockholders in Lieu of Meeting; Special Meetings of Stockholders), VII

(Limitation of Liability), VIII (Corporate Opportunities and Competition), IX (Exclusive Forum), X (Section 203 of the DGCL) and this

Article XI, and no other provision may be adopted, amended or repealed that would have the effect of modifying or permitting the circumvention

of the provisions set forth in any of such Articles. |

| B. | In furtherance and not in limitation of the powers conferred by the laws of the State of Delaware, the

Board of Directors is expressly authorized to make, alter and repeal the Bylaws without the consent or vote of the stockholders in any

manner not inconsistent with the laws of the State of Delaware or this Certificate. Any adoption, amendment or repeal of the Bylaws of

the Company by the Board of Directors shall require the approval of a majority of the total authorized number of directors. From and after

the occurrence of the Trigger Event, notwithstanding any other provisions of this Certificate or any provision of law that might otherwise

permit a lesser vote or no vote, but in addition to any additional or greater vote or consent required hereunder (including any vote of

the holders of any particular class or classes or series of stock required by law or by this Certificate or any Preferred Stock Designation),

the affirmative vote of the holders of at least 66 2/3% of the voting power of the then-outstanding shares of stock entitled to vote thereon,

voting together as a single class, shall be required in order for the stockholders of the Company to alter, amend or repeal, in whole

or in part, any provision of the Bylaws or to adopt any provision inconsistent therewith. |

XII. INCORPORATOR

The name and mailing address of the

incorporator is as follows:

Dahe Zhang

420 Lexington Avenue

Suite 2446

New York NY 10170

I, THE UNDERSIGNED, being the incorporator,

for the purpose of forming a corporation pursuant to the DGCL, do make this Certificate of Incorporation, hereby acknowledging, declaring,

and certifying that the foregoing Certificate of Incorporation is my act and deed and that the facts herein stated are true, and have

accordingly hereunto set my hand this 5th day of August 2024.

| |

/s/ Dahe Zhang |

| |

Dahe Zhang |

| |

Sole Incorporator |

6

Exhibit 3.2

BYLAWS

OF

Citius

ONCOLOGY, INC.

I.

CORPORATE OFFICES

The registered office of Citius

Oncology, Inc. (the “Company”) in the State of Delaware shall be 3500 Dupont Hwy. City of Dover, County of Kent,

Delaware 19901. The name of the registered agent of the Company at such location is Incorporating Services, Ltd.

The Company may at any time

establish other offices at any place or places within or without the State of Delaware as the Board of Directors of the Company (the “Board”)

may from time to time determine, or as the affairs of the Company may require.

II.

MEETINGS OF STOCKHOLDERS

| 2.1 | Place of Meetings; Remote Communication Meetings |

All meetings of the stockholders

shall be held at such place, if any, either within or without the State of Delaware, as shall be designated from time to time by the Board