UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-K/A

(Amendment

No. 2)

(Mark One)

☒ ANNUAL

REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For The Fiscal Year Ended December 31, 2022

☐ TRANSITION

REPORT PURSUANT TO SECTION 13 or 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

Commission File No. 001-41000

TG Venture Acquisition Corp.

(Exact name of issuer as specified in its charter)

| Delaware |

|

86-1985947 |

| (State or Other Jurisdiction of Incorporation) |

|

(I.R.S. Employer Identification No.) |

| 1390 Market Street, Suite 200 San Francisco, California 94102 |

|

(628) 251-1369 |

| (Address of Principal Executive Offices) |

|

(Registrant’s Telephone Number) |

Securities registered under Section 12(b) of

the Exchange Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one share of Class A Common Stock and one Redeemable Warrant |

|

TGVC.U |

|

Nasdaq Global Market |

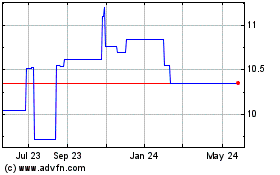

| Class A Common Stock, par value $0.0001 per share |

|

TGVC |

|

Nasdaq Global Market |

| Warrants, each exercisable for one share Class A Common Stock for $11.50 per share |

|

TGVC.W |

|

Nasdaq Global Market |

Securities registered under Section 12(g) of

the Exchange Act: None.

Indicate by check mark if the registrant is

a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

No ☒

Indicate by check mark if the registrant is not

required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes

☐ No ☒

Indicate by check mark whether the registrant

(1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding

12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such

filing requirements for the past 90 days. Yes☒ No ☐

Indicate by check mark whether the registrant

has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§

232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit

such files). Yes☒ No ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ☐ |

Accelerated filer ☐ |

| Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

Emerging growth company ☒ |

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant

has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial

reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared

or issued its audit report. ☐

If securities are registered pursuant to Section 12(b)

of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of

an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error

corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s

executive officer during the relevant recovery period pursuant to Section 249.10D-1(b). ☐

Indicate by check mark whether the registrant

is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐

No ☒

The aggregate market value of the voting and

non-voting common equity held by non-affiliates of the registrant on June 30, 2022 (the last business day of the registrant’s

most recently completed second fiscal quarter) was approximately $0. The aggregate market value was computed by reference to the

last sale price ($0 price per share) of such common equity as of that date.

As of March 29, 2023, the registrant

had 1,335,696 shares of Class A common stock (1,335,696 of which are subject to possible redemption) and 2,889,149 shares

of Class B common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

INTRODUCTORY NOTE

“TGV”, “TG Venture”,

“the Company”, “we”, “us” and “our” refer to TG Venture Acquisition Corp., a Delaware

corporation, unless the context otherwise requires.

Special Note Regarding Forward-Looking

Statements

This report contains forward-looking statements

and information that are based on the beliefs of our management as well as assumptions made by and information currently available

to us. Such statements should not be unduly relied upon. Forward-looking statements include statements about our expectations,

beliefs, plans, objectives, intentions, assumptions and other statements that are not historical facts or that are not present

facts or conditions. Forward-looking statements and information can generally be identified by the use of forward-looking terminology

or words, such as “anticipate,” “approximately,” “believe,” “continue,” “estimate,”

“expect,” “forecast,” “intend,” “may,” “ongoing,” “pending,”

“perceive,” “plan,” “potential,” “predict,” “project,” “seeks,”

“should,” “views” or similar words or phrases or variations thereon, or the negatives of those words or

phrases, or statements that events, conditions or results “can,” “will,” “may,” “must,”

“would,” “could” or “should” occur or be achieved and similar expressions in connection with

any discussion, expectation or projection of future operating or financial performance, costs, regulations, events or trends. The

absence of these words does not necessarily mean that a statement is not forward-looking.

Forward-looking statements and information

are based on management’s current expectations and assumptions, which are inherently subject to uncertainties, risks and

changes in circumstances that are difficult to predict. These statements reflect our current view concerning future events and

are subject to risks, uncertainties and assumptions. There are important factors that could cause actual results to vary materially

from those described in this report as anticipated, estimated or expected, as well as general conditions in the economy, petrochemicals

industry and capital markets, Securities and Exchange Commission (the “SEC”) regulations which affect trading

in the securities of “penny stocks,” and other risks and uncertainties. Except as required by law, we assume no obligation

to update any forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated

in any forward-looking statements, even if new information becomes available in the future. Depending on the market for our stock

and other conditional tests, a specific safe harbor under the Private Securities Litigation Reform Act of 1995 may be available.

Notwithstanding the above, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and

Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), expressly state that the

safe harbor for forward-looking statements does not apply to companies that issue penny stock. Because we may from time to time

be considered to be an issuer of penny stock, the safe harbor for forward-looking statements may not apply to us at certain times.

Explanatory Note

This Amendment (this “Amendment”)

to the annual report on Form 10-K (File No.001-41000), initially filed on March 29, 2023 and amended on August 14, 2023 (the “Original

10-K”), is being filed to update disclosure in response to comments from the Securities and Exchange Commission, most of

which pertain to our sponsor being based in Hong Kong.

This Amendment may not reflect events occurring after

the filing of the Original 10-K, nor does it modify or update those disclosures in the items not described in the above paragraph of

this Explanatory Note. Accordingly, this Amendment should be read in conjunction with the Original 10-K and our other reports filed with

the SEC subsequent to the filing of our Original 10-K, including any amendments to those filings.

In addition, pursuant to Rule 12b-15 under the

Securities Exchange Act of 1934, as a result of this Amendment, the certifications pursuant to Section 302 and Section 906

of the Sarbanes-Oxley Act of 2002, filed and furnished, respectively, as exhibits to the Original 10-K have been re-executed and re-filed

as of the date of this Amendment and are included as exhibits hereto.

TABLE OF CONTENTS

PART I

ITEM 1. DESCRIPTION OF BUSINESS.

Overview

TG Venture Acquisition

Corp. (the “Company” or “TG Venture”) is a blank check company whose business purpose is to effect a merger,

capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses,

which we refer to as our initial business combination. We have not selected any specific business combination target and we have

not, nor has anyone on our behalf, engaged in any substantive discussions, directly or indirectly, with any business combination

target with respect to an initial business combination with us. Our efforts to identify a prospective target business will not

be limited to a particular industry or geographic region, although we intend to initially focus our search on identifying a prospective

target business in the technology industries in the United States and other developed countries, with a special focus within the

space technology, financial technology, technology, media and telecom (“TMT”) industries

and related sectors. Though our sponsor is a Hong Kong company, a majority of our management are located outside of the People’s

Republic of China (the “PRC”) (including Hong Kong and Macau) and we will not undertake our initial

business combination with any entity that conducts a majority of its business or is headquartered in the PRC (including Hong Kong

and Macau).

THERE

ARE LEGAL AND OPERATIONAL RISKS ASSOCIATED WITH TGVC’S SPONSOR BEING BASED IN HONG KONG. SUCH RISKS COULD RESULT IN A MATERIAL

CHANGE IN TGVC’S OPERATIONS AND ITS ABILITY TO CONSUMMATE A BUSINESS COMBINATION. FOR EXAMPLE, RELEVANT ORGANIZATIONS OF

MAINLAND CHINA’S GOVERNMENT HAVE MADE RECENT STATEMENTS OR RECENTLY TAKEN REGULATORY ACTIONS RELATED TO CYBERSECURITY, DATA

SECURITY, ANTI-MONOPOLY, AND OVERSEAS LISTINGS OF MAINLAND CHINA-BASED BUSINESSES. IN ADDITION, RELEVANT MAINLAND CHINA GOVERNMENT

AGENCIES HAVE RECENTLY TAKEN ANTI-TRUST ENFORCEMENT ACTION AGAINST CERTAIN MAINLAND CHINA-BASED BUSINESSES. IF THE MAINLAND CHINA

GOVERNMENT WERE TO EXPAND THE SCOPE OF SUCH ACTIONS TO REGULATE NON-MAINLAND CHINA-BASED COMPANIES, SUCH REGULATION COULD IMPACT

TGVC’S ABILITY TO CONDUCT ITS BUSINESS AND ACCEPT FOREIGN INVESTMENT.

ALTHOUGH

TGVC DOES NOT HAVE SUBSIDIARIES OR OPERATIONS IN MAINLAND CHINA, GIVEN HONG KONG IS A SPECIAL ADMINISTRATIVE REGION OF THE PRC

AND GIVEN THE MAINLAND CHINA GOVERNMENT’S SIGNIFICANT OVERSIGHT OVER THE CONDUCT OF BUSINESS OPERATIONS IN THE PRC, THE

LEGAL AND OPERATIONAL RISKS ASSOCIATED WITH OPERATING IN MAINLAND CHINA ALSO APPLY TO OPERATIONS IN HONG KONG.

Corporate Information

TG Venture was incorporated

in Delaware in 2021. Our principal executive offices are located at 1390 Market Street, Suite 200 San Francisco, CA 94102. Our

corporate website is https://tgventureacquisition.com/

IPO

On

November 5, 2021, TG Venture consummated its initial public offering (the “IPO”) of 11,500,000 units (the “Units”),

which included 1,500,000 Units upon a full exercise of the underwriters’ over-allotment option. Each Unit consists of one

share of Class A common stock of the Company, par value $0.0001 per share (“Class A Common Stock”), and one

redeemable warrant of the Company (each whole warrant, a “Warrant”), with each Warrant entitling the holder

thereof to purchase one share of Class A Common Stock for $11.50 per share. The Units were sold at a price of $10.00 per Unit,

generating gross proceeds to the Company of $115,000,000.

On

November 5, 2021, simultaneously with the consummation of the IPO, the Company completed the private sale (the “Private

Placement”) of an aggregate of 5,500,000 Warrants (the “Private Placement Warrants”) to Tsangs Group

Holdings Limited (the “Sponsor”) at a purchase price of $1.00 per Private Placement Warrant, generating gross

proceeds to the Company of $5,500,000. Each of the Private Placement Warrants are exercisable to purchase one share of Class A

Common Stock at a price of $11.50 per share.

A

total of $117,300,000 of the proceeds from the IPO and the sale of the Private Placement Warrants was placed in a U.S.-based trust

account at J.P. Morgan Chase Bank, N.A., maintained by Continental Stock Transfer & Trust Company, acting as trustee.

We

initially filed a registration statement for the IPO on a Registration Statement on Form S-1 with the SEC on August 13, 2021, as amended,

and it was declared effective on November 2, 2021 (File No. 333-258773) (the “IPO Registration Statement”); the “IPO

Prospectus” filed in connection with our IPO pursuant to Rule 424(b)(4) was filed with the SEC on November 3, 2021.

Business Combination Agreement

On

December 5, 2022, the Company entered into a Business Combination Agreement (the “Business Combination Agreement”)

by and among (i) The Flexi Group Limited, a business company with limited liability incorporated under the laws of the British

Virgin Islands (the “Flexi”), (ii) The Flexi Group Holdings, Ltd., a business company with limited liability

incorporated under the laws of the British Virgin Islands and a direct wholly owned subsidiary of Flexi (“PubCo”

and, together with Flexi, the “Flexi Group”), (iii) The Flexi Merger Co. Ltd., a business company with

limited liability incorporated under the laws of the British Virgin Islands and a direct wholly owned subsidiary of PubCo (“Merger

Sub 1”), and (iv) Flexi Merger Co. LLC, a Delaware limited liability company and a direct wholly owned subsidiary

of PubCo (“Merger Sub 2” and, Merger Sub 2, PubCo and Merger Sub 1, each, individually, an “Acquisition

Entity”).

Capitalized

terms used in this section, but not otherwise defined herein have the meanings given to them in the Business Combination Agreement.

Pursuant

to the Business Combination Agreement, subject to the terms and conditions set forth therein, (i) Merger Sub 1 will merge

with and into Flexi (the “Initial Merger”), whereby the separate existence of Merger Sub 1 will cease

and Flexi will be the surviving entity of the Initial Merger and become a wholly owned subsidiary of PubCo, and (ii) following

confirmation of the effective filing of the documents required to implement the Initial Merger, Merger Sub 2 will merge with and

into TGVC (the “SPAC Merger” and together with the Initial Merger, the “Mergers”),

the separate existence of Merger Sub 2 will cease and the Company will be the surviving entity of the SPAC Merger and a direct

wholly owned subsidiary of PubCo.

As

a result of the Mergers, among other things, (i) each outstanding Flexi Ordinary Share will be cancelled in exchange for the right

to receive such number of PubCo Ordinary Shares that is equal to the Company Exchange Ratio, (ii) each outstanding SPAC Unit will

be automatically detached and the holder thereof will be deemed to hold one share of SPAC Class A Common Stock and one SPAC Warrant,

(iii) each outstanding share of SPAC Class B Common Stock will automatically convert into SPAC Class A Common Stock, (iv) each

outstanding share of SPAC Class A Common Stock will be cancelled in exchange for the right to receive such number of PubCo Ordinary

Shares that is equal to the SPAC Exchange Ratio, and (v) each outstanding SPAC Warrant will be assumed by PubCo and converted into

a warrant to purchase PubCo Ordinary Shares (each, an “Assumed SPAC Warrant”).

Earnout

The

Business Combination Agreement, subject to the terms and conditions set forth therein, provides that Flexi shareholders as of the

Initial Merger will have the right to receive up to an aggregate of 2,900,000 additional PubCo Ordinary Shares based on the total

annual revenues of PubCo in each of the two fiscal years following the Closing Date.

On August 10, 2023, we entered into an amendment (the “First

Amendment”) to the Business Combination Agreement. The First Amendment revises the earnout periods set forth in the Business

Combination Agreement to provide that Flexi shareholders may receive earnout shares based on PubCo revenue targets achieved during the

first two full fiscal years following the closing of the business combination to be effected pursuant thereto.

Representations, Warranties and Covenants

The

Business Combination Agreement contains customary representations and warranties of the parties, which will not survive the Closing.

Many of the representations and warranties are qualified by materiality or Company Material Adverse Effect (with respect to Flexi)

or SPAC Material Adverse Effect (with respect to the Company). “Material Adverse Effect” as used in the Business Combination

Agreement means with respect to Flexi or the Company, as applicable, any event, state of facts, development, change, circumstance,

occurrence or effect that has had, or would reasonably be expected to have, individually or in the aggregate, a material adverse

effect on (i) the business, assets and liabilities, results of operations or financial condition of the applicable party and its

subsidiaries, taken as a whole or (ii) the ability of such party or any of its subsidiaries to consummate the Transactions, in

each case subject to certain customary exceptions. Certain of the representations are subject to specified exceptions and qualifications

contained in the Business Combination Agreement or in information provided pursuant to certain disclosure schedules to the Business

Combination Agreement.

The

Business Combination Agreement also contains pre-closing covenants of the parties, including obligations of the parties to operate

their respective businesses in the ordinary course consistent with past practice, and to refrain from taking certain specified

actions without the prior written consent of the other applicable parties, in each case, subject to certain exceptions and qualifications.

Additionally, the parties have agreed not to solicit, negotiate or enter into competing transactions, as further provided in the

Business Combination Agreement. The covenants do not survive the Closing (other than those that are to be performed after the Closing).

As

promptly as practicable after the execution of the Business Combination Agreement, the Company and PubCo have agreed to prepare

and file with the SEC, a Registration Statement on Form F-4 (as amended, the “F-4 Registration Statement”)

in connection with the registration under the Securities Act of 1933, as amended (the “Securities Act”),

of the offer and issuance of the PubCo Ordinary Shares and Assumed SPAC Warrants to be issued pursuant to the Business Combination

Agreement The F-4 Registration Statement will contain a proxy statement/prospectus for the purpose of (i) the Company soliciting

proxies from its shareholders to approve the Business Combination Agreement, the Transactions and related matters (the “the

Company Shareholder Approval”) at a special meeting of the Company shareholders (the “Shareholder Meeting”),

(ii) providing the Company’s shareholders an opportunity, in accordance with its organizational documents and initial public

offering prospectus, to redeem their shares of SPAC Class A Common Stock (collectively, the “Redemptions”),

and (iii) PubCo’s offering and issuance of the PubCo Ordinary Shares and Assumed Warrants in connection with the Transactions.

PubCo

agreed to take all action within its power so that effective at the Closing, the board of directors of PubCo will consist of no

less than five individuals, two of whom may be designated by the Sponsor, and a majority of whom shall be independent directors

in accordance with Nasdaq requirements, and which shall comply with all diversity requirements under applicable Law.

In

addition, prior to Closing, PubCo agreed to amend and restate its Memorandum of Association and Articles of Association (the “PubCo

Governing Documents”). The PubCo Governing Documents will include customary provisions for a memorandum of association

and articles of association of a British Virgin Islands publicly traded company that is traded on Nasdaq.

Conditions to the Parties’ Obligations

to Consummate the Mergers

Under

the Business Combination Agreement, the parties’ obligations to consummate the Transactions are subject to a number of customary

conditions for special purpose acquisition companies, including, among others, the following: (i) the approval of the Mergers and

the other shareholder proposals required to approve the Transactions by the Company’s and Flexi’s shareholders, (ii)

all specified approvals or consents (including governmental and regulatory approvals) have been obtained and all waiting, notice,

or review periods have expired or been terminated, as applicable, (iii) the effectiveness of the F-4 Registration Statement, (iv)

PubCo’s initial listing application with Nasdaq shall have been conditionally approved and, immediately following the Closing,

PubCo shall satisfy any applicable initial and continuing listing requirements of Nasdaq and PubCo shall not have received any

notice of non-compliance therewith, and (v) the PubCo Ordinary Shares and Assumed SPAC Warrants having been approved for listing

on Nasdaq, subject to round lot holder requirements.

In

addition to these customary closing conditions, the Company must also hold net tangible assets of at least $5,000,001 immediately

prior to Closing, net of Redemptions and liabilities (including the Company’s transaction expenses).

The

obligations of the Company to consummate the Transactions are also subject to, among other things (i) the representations and warranties

of Flexi and of each Acquisition Entity being true and correct, subject to the materiality standards contained in the Business

Combination Agreement, (ii) material compliance by Flexi and each Acquisition Entity with its pre-closing covenants, and (iii)

the absence of a Company Material Adverse Effect.

In

addition, the obligations of Flexi to consummate the Transactions are also subject to, among other things (i) the representations

and warranties of the Company being true and correct, subject to the materiality standards contained in the Business Combination

Agreement, (ii) material compliance by the Company with its pre-closing covenants, and (iii) the absence of a SPAC Material Adverse

Effect.

Termination Rights

The

Business Combination Agreement contains certain termination rights, including, among others, the following: (i) upon the mutual

written consent of the Company and Flexi, (ii) if the consummation of the Transactions is prohibited by governmental order, (iii)

if the Closing has not occurred on or before May 5, 2023, (iv) in connection with a breach of a representation, warranty, covenant

or other agreement by Flexi or the Company which is not capable of being cured or is not cured within 30 days after receipt of

notice of such breach, (v) by either the Company or Flexi if the board of directors of the other party publicly changes its recommendation

with respect to the Business Combination Agreement and Transactions and related shareholder approvals under certain circumstances

detailed in the Business Combination Agreement, (vi) by either the Company or Flexi if the Shareholder Meeting is held and the

Company Shareholder Approval is not received, (vii) by the Company if the requisite Company Audited Financial Statements and PCAOB-compliant

unaudited financials of Flexi for the first, second and third quarters of 2022 (to the extent required in accordance with the Business

Combination Agreement) have not been delivered by January 4, 2023, with respect to the first and second quarters, and January 16,

2023, with respect to the third quarter, or (viii) by the Company if Flexi does not receive the written consent of its shareholders

to the Business Combination Agreement and related approvals within five business days after the F-4 Registration Statement has

become effective.

None

of the parties to the Business Combination Agreement are required to pay a termination fee or reimburse any other party for its

expenses as a result of a termination of the Business Combination Agreement. However, each party will remain liable for willful

and material breaches of the Business Combination Agreement prior to termination.

Trust Account Waiver

Flexi

and each Acquisition Entity agreed that it and its affiliates will not have any right, title, interest or claim of any kind in

or to any monies in the Company’s trust account held for its public shareholders, and agreed not to, and waived any right

to, make any claim against the trust account (including any distributions therefrom).

The

Business Combination Agreement is filed as Exhibit 2.1 to this Annual Report on Form 10-K and the foregoing description thereof

is qualified in its entirety by reference to the full text of the Business Combination Agreement. The Business Combination Agreement

provides investors with information regarding its terms and is not intended to provide any other factual information about the

parties. In particular, the assertions embodied in the representations and warranties contained in the Business Combination Agreement

were made as of the execution date of the Business Combination Agreement only and are qualified by information in confidential

disclosure schedules provided by the parties to each other in connection with the signing of the Business Combination Agreement.

These disclosure schedules contain information that modifies, qualifies, and creates exceptions to the representations and warranties

set forth in the Business Combination Agreement. Moreover, certain representations and warranties in the Business Combination Agreement

may have been used for the purpose of allocating risk between the parties rather than establishing matters of fact. Accordingly,

you should not rely on the representations and warranties in the Business Combination Agreement as characterizations of the actual

statements of fact about the parties.

Shareholder Support Agreement

Contemporaneously

with the execution of the Business Combination Agreement, PubCo, Flexi and certain Flexi shareholders entered into a Shareholder

Support Agreement, pursuant to which, among other things, certain Flexi shareholders agreed (i) to vote their Flexi shares in favor

of the Business Combination Agreement (including by execution of a written consent), the Mergers and the other Transactions, (ii)

to waive any rights to seek appraisal or rights of dissent in connection with the Business Combination Agreement, the Mergers and

the transactions contemplated thereby; and (iii) to consent to the termination of all shareholder agreements with Flexi (with certain

exceptions), effective at Closing, subject to the terms and conditions contemplated by the Shareholder Support Agreement. Flexi

shareholders party to the Shareholder Support Agreement collectively have a sufficient number of votes to approve the Business

Combination Agreement, the Mergers and the other Transactions.

The

Shareholder Support Agreement and all of its provisions will terminate and be of no further force or effect upon the earlier of

the Closing and termination of the Business Combination Agreement pursuant to its terms. Upon such termination of the Shareholder

Support Agreement, all obligations of the parties under the Shareholder Support Agreement will terminate; provided, however,

that such termination will not relieve any party thereto from liability arising in respect of any breach of the Shareholder Support

Agreement prior to such termination.

Sponsor Support Agreement

Contemporaneously

with the execution of the Business Combination Agreement, the Company entered into a Sponsor Support Agreement with the Sponsor,

PubCo, Flexi, and certain members of the Company’s board of directors and management team (the “Holders”),

pursuant to which, among other things, the Sponsor and the Holders agreed to vote their the Company shares in favor of the Business

Combination Agreement (including by execution of a written consent), the Mergers and the other Transactions, subject to the terms

and conditions contemplated by the Sponsor Support Agreement.

The

Sponsor Support Agreement and all of its provisions will terminate and be of no further force or effect upon the earlier to occur

of Closing and termination of the Business Combination Agreement pursuant to its terms.

Lock-Up Agreement

Concurrently

with the execution of the Business Combination Agreement, the Company and PubCo entered into separate Lock-Up Agreements (each

a “Lock-Up Agreement”) with Sponsor, certain members of the Company’s board of directors and management

team, and certain Flexi shareholders, pursuant to which 95% of the PubCo Ordinary Shares to be received by such shareholders will

be locked-up and subject to transfer restrictions for a period of time following the Closing, as described below, subject to certain

exceptions. That portion of the securities held by such shareholders will be locked-up until the earliest of: (i) the six month

anniversary of the date of the Closing, (ii) subsequent to the Business Combination, if the last sale price of PubCo Ordinary Shares

equals or exceeds $12.00 per share (adjusted for stock splits, stock dividends, reorganizations, recapitalizations and the like),

for any 20 trading days within any 30-trading day period commencing at least 150 days after the date of the Business Combination,

and (iii) the date after the Closing on which PubCo completes a liquidation, merger, capital stock exchange, reorganization or

other similar transaction which results in all of PubCo’s shareholders having the right to exchange their equity holdings

in PubCo for cash, securities or other property.

Registration Rights Agreement

Concurrently

with the execution of the Business Combination Agreement, PubCo entered into a Registration Rights Agreement (the “Registration

Rights Agreement”) with Sponsor and certain Flexi shareholders pursuant to which, among other things, PubCo agreed

to provide Sponsor and such shareholders with certain rights relating to the registration for resale under the Securities Act of

the PubCo Ordinary Shares and Assumed Warrants that they received in the Mergers.

Forms

of the foregoing agreements related to the Business Combination Transaction are filed as exhibits to this Annual Report, and the

foregoing description thereof is qualified in its entirety by reference to the full text of the respective agreement.

The

transaction is expected to be completed in the second quarter of 2023, subject to regulatory approvals and other customary closing

conditions. After closing, The Flexi Group’s ordinary shares are expected to trade on the Nasdaq Stock Market LLC under ticker

symbol FLXG.

Nasdaq Listing

On June

22, 2023, the Company received a letter from the Listing Qualifications Department of The Nasdaq Stock Market LLC (“Nasdaq”)

indicating that, based upon the closing bid price of the Company’s Class A common stock for the last 30 consecutive business days

and its number of publicly held shares, the Company no longer meets Nasdaq Listing Rule 5450(b)(3)(C), which requires listed companies

to maintain a minimum market value of publicly held shares (“MVPHS”) of at least $15 million.

Nasdaq

Listing Rule 5810(c)(3)(D) provides a compliance period of 180 calendar days, or until December 19, 2023 (the “First Compliance

Date”), in which to regain compliance with this requirement. If the Company’s market value of publicly held shares is $15

million or more for a minimum of 10 consecutive business days during the 180-day compliance period, Nasdaq will provide written notice

of compliance to the Company. If the Company fails to regain compliance with the Nasdaq continued listing standards, Nasdaq will provide

notice that the Company’s class A common stock will be subject to delisting. The Company would then be entitled to appeal that determination

to a Nasdaq hearings panel.

On August 11, 2023, the

Company received a written notice from Nasdaq indicating that the Company is no longer in compliance with the minimum Market Value of

Listed Securities (“MVLS”) of $50,000,000 required for continued listing on The Nasdaq Global Market, as set forth in Nasdaq

Listing Rule 5450(b)(2)(A) (the “MVLS Requirement”). The Notice has no effect at this time on the listing of the Company’s

securities on Nasdaq.

In accordance with Nasdaq

Listing Rule 5810(c)(3)(C), the Company has a period of 180 calendar days, or until February 7, 2024 (the “Second Compliance

Date,” together with the First Compliance Date, the “Compliance Dates”), to regain compliance with the MVLS Requirement.

To regain compliance, the Company’s MVLS must close at $50,000,000 or more for a minimum of 10 consecutive business days prior

to the Compliance Date. In the event the Company does not regain compliance with the MVLS Requirement prior to the Compliance Date, Nasdaq

will notify the Company that its securities are subject to delisting, at which point the Company may appeal the delisting determination

to a Nasdaq hearings panel.

The notifications

have no immediate effect on the listing of the Company’s Class A common stock on Nasdaq Global Market. The Company intends to actively

monitor its MVPHS and MVLS between now and the respective Compliance Dates, and may, if appropriate, evaluate available options including

applying for a transfer to The Nasdaq Capital Market to resolve the deficiency and regain compliance with the requirements. While the

Company is exercising diligent efforts to maintain the listing of its securities on Nasdaq Global, there can be no assurance that the

Company will be able to regain or maintain compliance with Nasdaq Global listing standards or satisfy the requirements necessary to transfer

the listing of its securities to The Nasdaq Capital Market.

PRC

Limitations and Concerns

Our

company is a Delaware corporation with no subsidiaries in mainland China. We do not maintain operations in mainland China, do not generate

revenues from mainland China, and do not provide services or conduct sales or marketing activities in mainland China or to residents

in mainland China. We have committed not to undertake our initial business combination with any entity

that is based in, located in or has its principal business operations in China (including Hong Kong and Macau), and have conducted a

target search outside of China. We will not conduct an initial business combination with any target company that conducts operations

through variable interest entities (“VIEs”), which are a series of contractual arrangements used to provide the economic

benefits of foreign investment in Chinese-based companies where Chinese law prohibits direct foreign investment in the operating companies.

As of the date of this filing, we have not been contacted by any Chinese authorities in connection

with our operations or the consummation of our initial business combination.

The

Sponsor is not incorporated in mainland China and none of its subsidiaries are incorporated in mainland China.

It does not maintain operations in mainland China, does not generate revenues from mainland China, and does not provide services

or conduct sales or marketing activities in mainland China or to residents in mainland China. As of the date of this filing, the

Sponsor has not been contacted by any Chinese authorities in connection with the operation of TGVC’s business or consummation

of the Business Combination. However, we have significant ties to China, because the Sponsor is a Hong Kong company.

As of the date of this filing,

we have not been contacted by any Chinese authorities in connection with our operations or consummation of the Business Combination.

Our PRC legal counsel, Han Kun Law Offices, has advised that, as of the date of this filing, neither TGVC nor the Sponsor is required

to obtain permissions or approvals from the CSRC, the CAC, or any other PRC governmental agency to operate our business or to consummate

the Business Combination. TGVC’s Hong Kong legal counsel, DLA Piper Hong Kong, has advised that, as of the date of this filing,

neither TGVC nor the Sponsor is required to obtain permissions or approvals from any Hong Kong governmental agency to operate TGVC’s

business or to consummate the Business Combination.

If

the Sponsor (i) fails to receive or maintain any required permissions or approvals, (ii) inadvertently concludes that such permissions

or approvals are not required, or (iii) applicable laws, regulations, or interpretations change and the Sponsor is required to

obtain such permissions or approvals in the future, it may result in additional costs and expenses incurred by the Sponsor and/or

us to ensure compliance or to pay applicable fines or sanctions, or to comply with other orders or regulatory actions, and we

and/or the Sponsor may no longer be permitted to continue their current business operations, which could adversely affect their

financial condition and results of operations, or even our ability to consummate the Business Combination. In addition, if any

or all of the foregoing were to occur, this could significantly limit or completely hinder the post Business Combination entity’s

ability to offer or continue to offer securities to investors and cause the value of such securities to significantly decline

or become worthless.

Given

the risks and uncertainties of doing business in China discussed elsewhere in this report, the location and ties of the Sponsor to China

may make us a less attractive partner to a target company not based in China, which may thus increase the likelihood that we will not

consummate a business combination. Our ties to the PRC may make us less likely to consummate a business combination with any target company

outside of the PRC, which may result in non-PRC target businesses having increased leverage over us in negotiating an initial business

combination knowing that if we do not complete our initial business combination within a certain timeframe, we may be unable to complete

our initial business combination with any target business. If we fail to complete an initial business combination in the prescribed timeframe,

we will cease all our operations and would redeem our public shares and liquidate, in which case our public shareholders may receive only

$10.83 per share, or less than such amount in certain circumstances, based on the amount available in our trust account on a per share

basis, and our warrants will expire worthless. See

“Risk Factors — We may not be able to consummate our initial business combination within the required time period, in which

case we would cease all operations except for the purpose of winding up and we would redeem our public shares and liquidate.” on

page 30.

Hong

Kong is a Special Administrative Region of the PRC and enjoys its own limited autonomy as defined by the Basic

Law, which is a national law of the PRC and the constitutional document for Hong Kong. Hong Kong’s legal system, which is

different from that of the PRC, is based on common law and has its own laws and regulations.

Pursuant

to the Basic Law, national laws of the PRC shall not be applied in Hong Kong, except for those relating to defense, foreign affairs

and other matters outside the autonomy of Hong Kong, which may be listed in Annex III of the Basic Law and applied locally by

promulgation or local legislation. While the National People’s Congress of the People’s Republic of China (the “National

People’s Congress”) has the power to amend the Basic Law, the Basic Law expressly provides that no amendment to the

Basic Law shall contravene the established basic policies of the PRC regarding Hong Kong. As a result, national laws of the PRC

not listed in Annex III of the Basic Law (and any regulatory notices issued pursuant to those national laws) do not apply in Hong

Kong. Nonetheless, the legal and operations risks associated with operating in mainland China apply to companies with operations

in Hong Kong.

Since

our Sponsor is based in Hong Kong, a Special Administrative Region of China, there is no guarantee that certain existing or future

laws of the PRC will not become applicable to a company such as us. For more information, see “Risk Factors—Risks

Related to Acquiring or Operating Businesses in the PRC, including Hong Kong - We may, in the future, face legal or operational

risks associated with our Sponsor being based in Hong Kong, which could result in a material change in our operations and jeopardize

our ability to consummate a business combination.”

Given

the PRC government’s significant oversight over the conduct of business operations in mainland China

and in Hong Kong, and in light of (a) China’s recent extension of authority into Hong Kong and (b) the fact that rules and

regulations in China can change quickly with little or no advance notice, there are risks and uncertainties that we and the Sponsor

cannot foresee at this time. For example, (i) the government of Hong Kong may (x) enact similar laws and regulations to those in

mainland China, which may seek to exert control over business combinations conducted by Hong Kong-based entities or sponsors or

(y) implement laws on such business activities to be more aligned with mainland China, and (ii) certain PRC laws and regulations

may become applicable in Hong Kong in the future. To the extent that any PRC laws and regulations become applicable to us or the

Sponsor, we or the Sponsor may be subject to the risks and uncertainties associated with the evolving laws and regulations of the

PRC, their interpretation and implementation, and the legal and regulatory system in the PRC more generally, including with respect

to the enforcement of laws and the possibility of changes of rules and regulations with little or no notice. If certain PRC laws

and regulations, including existing laws and regulations and those enacted or promulgated in the future, were to become applicable

to companies such as us or the Sponsor in the future, the application of such laws and regulations may have a material adverse

impact on our business, financial condition, results of operations, and prospects, our ability to consummate the Business Combination

and our ability to offer securities to investors, any of which may, in turn, cause the value of our securities to significantly

decline or become worthless.

Relevant

organizations of the PRC government have made recent statements or recently taken regulatory actions related to cybersecurity,

data security, anti-monopoly, and overseas listings of PRC-based businesses. For example, in addition to the Data Security Law

of the People’s Republic of China (the “Data Security Law”) and the Measures for Cybersecurity Review issued

by the Cyberspace Administration of China (“CAC”) that became effective on February 15, 2022 (the “Cybersecurity

Review Measures”), relevant PRC government agencies have recently taken anti-trust enforcement action against certain PRC-based

businesses. Our management understands that such enforcement action was taken pursuant to the PRC Anti-Monopoly Law that applies

to monopolistic activities in domestic economic activities in mainland China and monopolistic activities outside mainland China

that eliminate or restrict market competition in mainland China. In addition, in July 2021, the PRC government provided new guidance

on PRC-based companies raising capital outside of the PRC, including through arrangements called VIEs. In light of such developments,

the SEC has imposed enhanced disclosure requirements on PRC-based companies seeking to register securities with the SEC. To date,

the Cybersecurity Review Measures have not impacted our ability to conduct our business, accept foreign investment or list our

securities on the Nasdaq because neither we nor the Sponsor are PRC-based businesses and because neither we nor the Sponsor engage

in the types of activities regulated by the Cybersecurity Review Measures. However, if the PRC government were to expand the scope

of the Cybersecurity Review Measures to regulate non- PRC-based companies, such regulation could impact our ability to conduct

our business and accept foreign investment.

Additionally,

on February 17, 2023, the China Securities Regulatory Commission (the “CSRC”) published the Trial Administrative

Measures of the Overseas Securities Offering and Listing by Domestic Companies and several supporting guidelines (collectively, the

“Overseas Listing Filing Rules”), which became effective on March 31, 2023 and regulate both direct and indirect

overseas offering and listing of PRC-based companies by adopting a filing-based regulatory regime. According to the Overseas Listing

Filing Rules, if the issuer meets both of the following criteria ( “Criteria for CSRC Filing”), the overseas securities

offering and listing conducted by such issuer shall be deemed as an indirect overseas offering and listing: (i) 50% or more of the

issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial

statements for the most recent accounting year is accounted for by domestic companies; and (ii) the main parts of the issuer’s

business activities are conducted in mainland China, or its main places of business are located in mainland China, or the senior

managers in charge of its business operation and management are mostly Chinese citizens or domiciled in mainland China. As of the

date of this filing, neither TGVC nor the Sponsor meet the Criteria for CSRC Filing above.

Changes in the policies,

regulations, rules and the enforcement of laws of the PRC government may be made quickly with little or no advance notice. Recent

statements by the PRC government have indicated an intent of that government to exert more oversight and control over offerings

that are conducted overseas and/or foreign investment in PRC-based issuers. The PRC government may intervene or influence the

operations of PRC-based issuers at any time, and may exert more control over offerings conducted overseas and/or foreign investment

in PRC-based issuers.

If

the PRC government determines that we or the Sponsor is a PRC-based issuer, if the PRC government takes any other actions to exert more

oversight and control over offerings that are conducted overseas, if the PRC rules and regulations become applicable in Hong Kong, or

if the PRC government’s statements and regulatory actions otherwise apply to us or the Sponsor, the PRC government would be able

to intervene in and influence our or the Sponsor’s operations at any time and such governmental or regulatory interference could

result in a material change in TGVC’s operations and its ability to consummate the Business Combination and/or the value of our

securities. To date, the Cybersecurity Review Measures have not impacted our ability to conduct our business, accept foreign investment

or list its securities on the Nasdaq because neither we nor the Sponsor are mainland PRC-based businesses and because neither we nor

the Sponsor engage in the types of activities regulated by the Cybersecurity Review Measures. However, if the PRC government were to

expand the scope of the Cybersecurity Review Measures to regulate non-mainland PRC-based companies, such regulation could impact our

ability to conduct our business and accept foreign investment.

Further our Sponsor currently

owns approximately 39.95% of our issued and outstanding shares. As a result, we may be considered a “foreign person” under

rules promulgated by the Committee on Foreign Investment in the United States (“CFIUS”) and may not be able to complete an

initial business combination with a U.S. target company since such initial business combination may be subject to U.S. foreign investment

regulations and review by a U.S. government entity such as CFIUS, or ultimately prohibited. As a result, the pool of potential targets

with which we could complete an initial business combination may be limited. See “Risk Factors — We may not be able to

complete an initial business combination with a U.S. target company if such initial business combination is subject to U.S. foreign investment

regulations and review by a U.S. government entity such as the Committee on Foreign Investment in the United States (CFIUS), or ultimately

prohibited.” on page 31.

Although

we are a Delaware corporation, the Sponsor is a Hong Kong company and certain of our directors and officers are nationals or residents

of jurisdictions other than the United States and most of their assets are located outside of the United States. As a result,

it may be difficult or impossible for our stockholders to effect service of process upon the Sponsor, us or our managements inside

China, or to obtain swift and equitable enforcement of laws that do exist or to obtain enforcement of the judgment of one court

by a court of another jurisdiction. See “Risk Factors

— Risks Related to Acquiring or Operating Businesses in the PRC” under the subheading “Our

Stockholders may experience difficulties in effecting service of legal process in the U.S. and enforcing civil liabilities in

mainland China or Hong Kong against us, the Sponsor and certain of their directors and officers.” on page

35 and the section “Enforceability of Civil Liabilities” on page 51.

Our

PRC legal counsel, Han Kun Law Offices, has advised that, as of the date of this filing, neither we nor the Sponsor is required to obtain

permissions or approvals from the CSRC, the CAC, or any other PRC governmental agency to operate TGVC’s business and to consummate

our initial business combination. This conclusion is based on the fact that: (i)we are a Delaware corporation without subsidiaries, operations

and revenues in mainland China, and have committed not to undertake our initial business combination with any entity that is based in,

located in or has its principal business operations in China (including Hong Kong and Macau), and it has conducted a target search outside

of China, (ii) the Sponsor is a Hong Kong company without subsidiaries, operations and revenues in mainland China, (iii) Flexi is

a British Virgin Islands company without subsidiaries, operations and revenues in mainland China, and only some of Flexi’s business

operations are conducted in Hong Kong through its Hong Kong subsidiary, and (iv) pursuant to the Basic Law, national laws of the PRC shall

not be applied in Hong Kong except for those listed in Annex III of the Basic Law (which is confined to laws relating to defense and foreign

affairs, as well as other matters outside the autonomy of Hong Kong). However, since the PRC governmental agencies have certain discretion

in administration, interpretation and enforcement of the laws and regulations of the PRC, and in light of the recent statements and regulatory

actions by the PRC governmental agencies, such as those related to the administration over illegal securities activities and the supervision

on overseas listings by PRC-based companies, we and the Sponsor may become subject to the risks of the uncertainty of any future regulatory

actions of the PRC governmental agencies. In addition, Flexi and PubCo may also become subject to the laws and regulations of the PRC

to the extent that it commences business and customer facing operations in mainland China as a result of any future partnership, acquisition,

expansion, or organic growth. Furthermore, our Hong Kong legal counsel, DLA Piper Hong Kong,

has advised that, as of the date of this filing, neither TGVC nor the Sponsor is required to obtain permissions or approvals from any

Hong Kong governmental agency to operate our business or to consummate the Business Combination.

Neither

we nor the Sponsor have relied, and do not expect to rely, on dividends or other distributions on equity from any of our subsidiaries

for our cash requirements. Although we have no plans to declare cash dividends, if we determine to pay cash dividends to the our stockholders

in the future, it may depend on receipt of funds from one or more subsidiaries.

If,

in the future, (i) we were to have any PRC-based subsidiaries or (ii) we were to be considered by the PRC government to be a PRC-based

subsidiary of the Sponsor, such subsidiaries, or us, as applicable, would be subject to certain restrictions on their ability to pay

dividends under PRC laws and regulations. In particular, any PRC subsidiaries may pay dividends only out of their respective accumulated

after-tax profits after making up losses as determined in accordance with PRC accounting standards and regulations. In addition, any

PRC subsidiaries would be required to set aside at least 10% of its accumulated after-tax profits each year, if any, to fund a statutory

reserve fund, until the aggregate amount of such fund reaches 50% of its registered capital. Such reserve funds would not be permitted

to be distributed to TGVC as dividends. At its discretion, any PRC subsidiaries would be permitted to allocate a portion of its after-tax

profits based on PRC accounting standards to a discretionary common reserve.

Any

future PRC subsidiaries would likely generate a portion of their revenue in Renminbi, which is not freely convertible into other currencies.

As a result, any restriction on currency exchange may limit the ability of any such PRC subsidiaries to use their Renminbi revenues to

pay dividends to us. In addition, the PRC Enterprise Tax Law (“EIT Law”) and its implementation rules provide that a withholding

tax rate of up to 10% will be applicable to dividends payable by Chinese companies to non-PRC-resident enterprises unless otherwise exempted

or reduced according to treaties or arrangements between the PRC central government and governments of other countries or regions where

the non-PRC-resident enterprises are incorporated.

Furthermore,

if certain procedural requirements are satisfied, the payment of current account items, as defined in the relevant PRC laws and regulations,

including profit distributions and trade and service related foreign exchange transactions, can be made in foreign currencies without

prior approval from the PRC’s State Administration of Foreign Exchange (“SAFE”) or its local branches. However, where

Renminbi is to be converted into foreign currency and remitted out of mainland China to pay capital expenses, such as the repayment of

loans denominated in foreign currencies, approval from or registration with competent government authorities or their authorized banks

is required. The PRC government may take measures at its discretion from time to time to restrict access to foreign currencies for current

account or capital account transactions. To the extent we desire to use funds from any future PRC subsidiaries to fund our operations,

the foreign exchange control system could prevent us from obtaining sufficient foreign currencies to satisfy our foreign currency demands,

and we may not be able to pay dividends in foreign currencies to any offshore intermediate holding companies or ultimate parent company,

or to our shareholders or investors. Further, we cannot assure you that new regulations or policies will not be promulgated in the future,

which may further restrict the remittance of Renminbi into or out of the PRC. We cannot assure you, in light of the restrictions in place,

or any amendment to be made from time to time, that our future PRC subsidiaries, if any, will be able to satisfy their respective payment

obligations that are denominated in foreign currencies, including the remittance of dividends outside of the PRC.

For

a detailed description of risks associated with the cash transfer through

the post combination organization, see “Transfers of Cash to and from our Post Business Combination Subsidiaries” on page

33 and “Risk Factors — Risks Related to Acquiring or Operating Businesses in the PRC” under the subheadings “Cash-Flow

Structure of a Post-Acquisition Company Based in China” on page 33 and “Exchange controls that exist in the PRC may limit

our ability to utilize our cash flow effectively following our initial business combination” on page 34. To date, we have not pursued

an initial business combination with a PRC-based entity and there have not been any capital contribution or shareholder loans by us to

any PRC entities, we do not yet have any subsidiaries, and we have not received, declared or made any dividends or distributions.

Pursuant

to the Holding Foreign Companies Accountable Act (“HFCA Act”), the Public Company Accounting Oversight Board (United States)

(the “PCAOB”) issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate

completely registered public accounting firms headquartered in (1) mainland China of the PRC because of a position taken by one or more

authorities in mainland China and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken

by one or more authorities in Hong Kong. In addition, the PCAOB’s report identified the specific registered public accounting firms

which are subject to these determinations.

In

December 2020, Congress enacted the HFCA Act, and the SEC released interim final amendments that begin to address the components of this

Act. In November 2021, the SEC approved PCAOB Rule 6100, which establishes a process for determining which registered public accounting

firms the board is unable to inspect or investigate completely. In December 2021, the SEC adopted amendments to finalize its rules under

the HFCA Act that set forth submission and disclosure requirements for commission-identified issuers identified under the Act, specify

the processes by which the SEC will identify and notify Commission-Identified Issuers, and implement trading prohibitions after three

consecutive years of identification.

In

December 2022, Congress passed the omnibus spending bill and the President signed it into law. This spending bill included the enactment

of provisions to accelerate the timeline for implementation of trading prohibitions from three years to two years. Separately, on December

15, 2022, the PCAOB published its determination that in 2022, the PCAOB was able to inspect and investigate completely registered public

accounting firms headquartered in mainland China and Hong Kong. This determination reset the now two-year clock for compliance with the

trading prohibitions for identified issuers audited by these firms. The amendment had originally been passed by the U.S. Senate in June

2021, as the “Accelerating Holding Foreign Companies Accountable Act.”

Our auditor, Marcum LLP, is a United States

accounting firm and is subject to regular inspection by the PCAOB. Marcum LLP is headquartered in New York, NY, not mainland China or

Hong Kong and was not identified as a firm subject to the PCAOB’s Determination Report announced on December 16, 2021. As a result,

we do not believe that HFCA Act and related regulations will affect us. Nevertheless, trading in our securities may be prohibited under

the HFCA Act if the PCAOB determines that it cannot inspect or fully investigate our auditor, and that as a result an exchange may determine

to delist our securities. Moreover, on August 26, 2022, the PCAOB signed a Statement of Protocol with the China Securities Regulatory

Commission and the Ministry of Finance of the People’s Republic of China – the first step toward opening access for the PCAOB

to inspect and investigate registered public accounting firms headquartered in mainland China and Hong Kong completely, consistent with

U.S. law. The Statement of Protocol is intended to grant to the PCAOB complete access to the audit work papers, audit personnel, and

other information it needs to inspect and investigate any firm it chooses, with no loopholes and no exceptions.

PROPOSED BUSINESS

We are a newly organized

blank check company incorporated on February 8, 2021 as a Delaware corporation whose business purpose is to effect a merger, capital

stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses,

which we refer to as our initial business combination. To date, our efforts have been limited to organizational activities as well

as activities related to the IPO. Though our sponsor is a Hong Kong company, a majority of our management are located outside of

China (including Hong Kong and Macau) and we will not undertake our initial business combination with any entity that conducts

a majority of its business or is headquartered in China (including Hong Kong and Macau). We have not selected any specific business

combination target and we have not, nor has anyone on our behalf, engaged in any substantive discussions, directly or indirectly,

with any business combination target with respect to an initial business combination with us. We have generated no operating revenues

to date and we do not expect that we will generate operating revenues until we consummate our initial business combination.

The Company plans to take

a differentiated approach compared to the recent plethora of special purpose acquisition company (“SPAC”) issuances

by focusing its initial business combination search on the following industry segments:

| |

● |

Artificial Intelligence (“AI”) and Machine Learning |

| |

|

|

| |

● |

Robotic Process Automation (“RPA”) |

| |

|

|

| |

● |

Edge Computing |

| |

|

|

| |

● |

Quantum Computing |

| |

|

|

| |

● |

Virtual Reality (“VR”) |

| |

|

|

| |

● |

Augmented Reality |

| |

|

|

| |

● |

Blockchain |

| |

|

|

| |

● |

Space Exploration |

| |

|

|

| |

● |

Internet of Things |

| |

|

|

| |

● |

5G Data and Telecommunications |

| |

|

|

| |

● |

Cybersecurity |

| |

|

|

| |

● |

AI Powered Drug Discovery |

| |

|

|

| |

● |

Hydrogen Energy |

| |

|

|

| |

● |

Electrical Vehicle Charging Infrastructure |

| |

|

|

| |

● |

Financial Technology |

| |

|

|

| |

● |

Technology, media and telecom TMT |

We will not be limited to

any particular industry, sector or geographic region in our identification and acquisition of a business combination target, except

that we will not undertake our initial business combination with any entity that conducts a majority of its business or is headquartered

in China (including Hong Kong and Macau). However, we believe that we have created a significant competitive advantage compared

to other SPACs that have chosen to pursue potential business combinations with a much wider targeted mandate. With nearly 420 active

SPACs as of June 11, 2021 still searching for a business combination, target companies have never had more choices nor do they

necessarily know which SPACs to approach. By assembling a management team and board of directors with highly successful operating

and investing track records in the industries we seek to pursue, we believe that we will be the preferred SPAC partner for the

highest quality assets within our focus areas. In addition, our management team and board of directors have vast experience both

investing in and leading various organizations, both public and private, and domestic and international government agencies. This

experience base affords us the opportunity to leverage our robust network of contacts to execute our focused strategy across the

globe.

We also intend to concentrate

our efforts on identifying businesses with enterprise values less than $1.25 billion. We believe that this segment of the

market is underserved and has greater valuation arbitrage opportunities and more favorable competitive dynamics compared to many

SPACs that are targeting assets with enterprise values greater than $2 billion. In 2020, the average SPAC initial public offering

raised gross proceeds of $336 million. Raising less capital in our IPO will enable us to offer target companies at our preferred

valuation range a more compelling transaction structure versus larger SPACs that may be seeking a similar asset. In addition, we

can maintain a higher degree of agility and flexibility should we choose to pursue a business with an enterprise value greater

than $1.25 billion by leveraging our public stock as additional currency for the merger consideration.

We believe we have the right

team, strategy and market opportunity to identify, acquire and manage a “best-in-class” business with the ultimate

mandate of delivering an attractive return to all stakeholders.

Our co-Founders, Pui Lan

Patrick Tsang (Chairman and CEO) and Philip Rettger (CFO and Director), are industry pioneers, visionary investors, serial entrepreneurs

and deeply experienced operators with an extensive deal-making history. Over the course of their careers, Mr. Tsang and Mr. Rettger

have founded, controlled, assembled and financed enterprises across various segments and industries, including cable, broadcast,

cellular, fiber, satellite, communications technologies, wireless broadband, energy and technology invention and project development.

As pioneering investors, they have brought value and profits to stockholders of numerous businesses through rollups, acquisitions,

mergers, both independently and in partnerships with other public corporations, and private equity firms.

Mr. Tsang and Mr. Rettger

have shown repeated foresight in identifying and investing in key trends that have shaped the global space technology, financial

technology and TMT markets. In bringing vision into reality, they

have consistently built cohesive executive teams and culture-led organizations to execute within competitive markets.

Mr. Tsang currently serves

as Chairman of Tsangs Group, a fourth-generation Single-Family Office. Tsangs Group

has made concentrated investments in companies, businesses and assets across multiple sectors, and currently has operations in

over 50 countries spanning 6 continents. In most circumstances, Tsangs Group prefers to make investments in a project of early

stage in a particular sector and subsequently seek to make complementary investments in that sector to achieve improved economies

of scale, market penetration and operating efficiencies.

The co-Founders have proven

their extensive deal-making abilities throughout their careers and created significant stockholder value across numerous high-profile

transactions including:

Tsangs Group became the

early-stage investor and strategic advisor to Pulse Evolution Group in 2018, which subsequently acquired the German listed Nexway

Group, and the combined group rebranded as FaceBank Group in 2018. On April 2020, FaceBank Group completed the merger with fuboTV,

the largest vMVPD streaming platform in the US with primary focus on channels that distribute live sports including NFL, MLB, NBA,

NHL and international soccer. fuboTV became successfully listed on the New York Stock Exchange in October 2020 (FUBO:US). When

comparing with the valuation at the time when Tsangs Group came in, the share price of fuboTV reached $62 at the end of December

2020; Tsangs Group achieved an approximately 300 times return in 2 years on this investment.

Under the leadership of

Patrick Tsang (Chairman of our sponsor), the Original IPO Opportunities SP1 (formerly known as OX Global Fund SPC-OX Global Fund

IPO Opportunities SP1), managed by Original Asset Management Limited (wholly owned by Patrick Tsang and a SFC regulated company)

has been actively involved in the sourcing and investment in the highly sought-after IPO investment opportunities in Asia, Japan,

Korea and the US. The performance of the Fund in 2020 was quite promising with a return of 42.89% for the year then ended.

Patrick Tsang founded Vale

International Group Limited, which changed its name to Fragrant Prosperity Holdings Limited. It was established to undergo acquisitions

of businesses in the financial and technology sectors in Europe and Asia. It has been listed on the London Stock Exchange since

September 2016. Patrick came in as GBP0.0233 per share and the share price was GBP0.07 on April 10, 2021, achieving a return of

200%.

Tsangs Group was an investor

of Live Company Group (“LVCG”), a leading Live Events and Entertainment company. LVCG was founded in 2017 and is trading

on the AIM market of the London Stock Exchange. LVCG acquired BRICKLIVE Group and the Parallel Live Group. BRICKLIVE holds events

that have received widespread acclaim of partner-driven shows designed to showcase the benefits of LEGO-brand toys as an educational

tool worldwide. During the very short period of 9 months, Tsangs Group achieved a total return of 33%.

No Permission Required from the Chinese Authorities for the Business Combination

We are a Delaware corporation with no subsidiaries in the PRC. We

do not maintain operations in the PRC, do not generate revenues from the PRC, and do not provide services or conduct sales or marketing

activities in the PRC or to residents in the PRC. We have committed not to undertake our initial

business combination with any entity that is based in, located in or has its principal business operations in China (including

Hong Kong and Macau), and we have conducted a target search outside of China. As of the date of this filing, we have not

been contacted by any Chinese authorities in connection with our operations or consummation of the Business Combination.

We

have committed not to undertake our initial business combination with any entity that is based in, located in or has its principal

business operations in the PRC, and we have conducted a target search outside of the PRC.

The

Sponsor is not incorporated in mainland China and none of its subsidiaries are incorporated in mainland China. It does not maintain

operations in mainland China, does not generate revenues from mainland China, and does not provide services or conduct sales or

marketing activities in mainland China or to residents in mainland China. None of the Sponsor’s officers and directors are

located in mainland China. As of the date of this filing, the Sponsor has not been contacted by any Chinese authorities in connection

with the operation of our business or the consummation of the Business Combination.

Flexi

is a British Virgin Islands company. Cash of the surviving entity of the business combination with Flexi (“PubCo”)is

expected to be primarily held by that entity and its subsidiaries located in Hong Kong, Singapore, Malaysia, Australia and Vietnam,

and it does not believe that there are any significant restrictions on its ability to distribute these funds to PubCo from their

respective distributable profits or other distributable reserves in accordance with applicable laws. While PubCo does not currently

have any mainland China subsidiaries, there would be restrictions on the ability of any future mainland China subsidiaries to

pay dividends under mainland China laws and regulations. In particular, any of PubCo’s future mainland China subsidiaries

would be permitted to pay dividends only out of their respective accumulated after-tax profits after making up losses as determined

in accordance with mainland China accounting standards and regulations. In addition, any of PubCo’s future mainland China

subsidiaries would be required to set aside at least 10% of its accumulated after-tax profits each year, if any, to fund a statutory

reserve fund, until the aggregate amount of such fund reaches 50% of its registered capital. Such reserve funds could not be distributed

to PubCo as dividends. At its discretion, any future mainland China subsidiary could allocate a portion of its after-tax profits

based on mainland China accounting standards to a discretionary common reserve.are incorporated in mainland China. It does not

maintain operations in mainland China, does not generate revenues from mainland China, and does not provide services or conduct

sales or marketing activities in mainland China or to residents in mainland China. As of the date of this filing, Flexi has not

been contacted by any Chinese authorities in connection with consummation of the Business Combination.

On

February 17, 2023, the CSRC published the Overseas Listing Filing Rules, which became effective on March 31, 2023 and regulate

both direct and indirect overseas offering and listing of mainland China-based companies by adopting a filing-based regulatory

regime. According to the Overseas Listing Filing Rules, if the issuer meets the Criteria for CSRC Filing, the overseas securities

offering and listing conducted by such issuer shall be deemed as an indirect overseas offering and listing: (i) 50% or more of

the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated financial

statements for the most recent accounting year is accounted for by domestic companies; and (ii) the main parts of the issuer’s

business activities are conducted in mainland China, or its main places of business are located in mainland China, or the senior

managers in charge of its business operation and management are mostly Chinese citizens or domiciled in mainland China. As of

the date of this filing, none of the Company, the Sponsor or Flexi, whether prior to or after the consummation

of the Business Combination, meet the Criteria for CSRC Filing.

As

of the date of this filing, neither our operations nor our ability to consummate the Business Combination are affected by the

Sponsor being based in Hong Kong because our operations do not consist of prohibited activities under the applicable Hong Kong

laws and are generally not restricted.

On

December 28, 2021, CAC, together with certain other mainland China government authorities, jointly released the revised Measures

for Cybersecurity Review, which took effect on February 15, 2022. Pursuant to the revised Measures for Cybersecurity Review, (i)

operators of critical information infrastructure (“CIIO”), that intend to purchase network products