Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

06 November 2024 - 8:30AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2024

Commission File Number: 001-41181

Tokyo Lifestyle Co., Ltd.

Harumi Building, 2-5-9 Kotobashi

Sumida-ku, Tokyo, 130-0022

Japan

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form

40-F ☐

Changes in Registrant’s Certifying Accountant

On October 21, 2024, the board of directors

of Tokyo Lifestyle Co., Ltd., formerly known as Yoshitsu Co., Ltd (the “Company”) approved the dismissal of Marcum Asia

CPAs LLP (“Marcum Asia”), an independent registered public accounting firm effective October 25, 2024 (the

“Dismissal Date”), and approved the engagement of Wei, Wei & Co., LLP (“Wei, Wei & Co”) to serve as

the independent registered public accounting firm of the Company for the fiscal year ended March 31, 2025.

Marcum Asia’s audit report on the

Company’s financial statements for the fiscal years ended March 31, 2024 and 2023 did not contain an adverse opinion or

disclaimer of opinion, nor were they qualified or modified as to uncertainty, audit scope, or accounting principles. Furthermore,

during the Company’s two most recent fiscal years and in the subsequent interim period through the Dismissal Date, there were

no disagreements with Marcum Asia on any matter of accounting principles or practices, financial statement disclosure, or auditing

scope or procedure, which disagreements, if not resolved to Marcum Asia’s satisfaction, would have caused Marcum Asia to make

reference to the subject matter of the disagreement in connection with its report on the Company’s financial statements for

such periods. During the Company’s two most recent fiscal years and in the subsequent interim period through the Dismissal

Date, there were no “reportable events” as that term is described in Item 16F(a)(1)(v) of Form 20-F, other than the

following material weaknesses of the Company in maintaining (i) sufficient in-house personnel in the Company’s accounting

department with sufficient knowledge of the U.S. generally accepted accounting principles and the U.S. Securities and Exchange

Commission (the “Commission”) reporting rules, and (ii) proper control of IT system logical access security, IT

operations and service organization management reported by management under Item 15 of the Company’s annual report

on Form 20-F for the fiscal year ended March 31, 2024 and the annual report on Form 20-F for the fiscal year

ended March 31, 2023, as filed with the Commission on July 16, 2024 and July 31, 2023, respectively.

The Company has provided Marcum Asia with a

copy of the above disclosure and requested that Marcum Asia furnish a letter addressed to the Commission stating whether or not it

agrees with the above statements. A copy of Marcum Asia’s letter is filed hereto as Exhibit 16.1.

During the two most recent fiscal years and any

subsequent interim periods prior to the engagement of Wei, Wei & Co, neither the Company, nor someone on behalf of the Company, has

consulted Wei, Wei & Co regarding either the application of accounting principles to a specified transaction, whether completed or

proposed, or the type of audit opinion that might be rendered on the Company’s consolidated financial statements. Neither a written

report was provided to the Company nor was any oral advice provided that Wei, Wei & Co concluded was an important factor considered

by the Company in reaching a decision as to the accounting, auditing, or financial reporting issue. Additionally, neither the Company,

nor anyone on behalf of it, has consulted Wei, Wei & Co regarding any matter that was the subject of a disagreement as defined in

Item 16F(a)(1)(iv) of Form 20-F and related instructions to Item 16F of Form 20-F, or any reportable events as described in Item 16F(a)(1)(v)

of Form 20-F.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 5, 2024

| |

Tokyo Lifestyle Co., Ltd. |

| |

|

| |

By: |

/s/ Mei Kanayama |

| |

Name: |

Mei Kanayama |

| |

Title: |

Representative Director and Director

(Principal Executive Officer) |

EXHIBIT INDEX

3

Exhibit 16.1

November 5, 2024

Securities and Exchange Commission

100 F Street N.E.

Washington, D.C. 20549

Commissioners:

We have read the statements made by Tokyo Lifestyle Co., Ltd., formerly

known as Yoshitsu Co., Ltd of its Form 6-K dated November 5, 2024. We agree with the statements concerning our Firm in such Form 6-K;

we are not in a position to agree or disagree with other statements of Tokyo Lifestyle Co., Ltd. contained therein.

Very truly yours,

|

/s/ Marcum Asia CPAs LLP |

|

| Marcum Asia CPAs LLP |

|

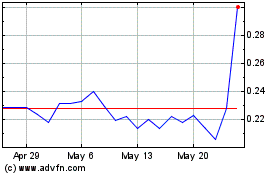

Tokyo Lifestyle (NASDAQ:TKLF)

Historical Stock Chart

From Jan 2025 to Feb 2025

Tokyo Lifestyle (NASDAQ:TKLF)

Historical Stock Chart

From Feb 2024 to Feb 2025