Filing pursuant to Rule 425 under the

Securities Act of 1933, as amended

Deemed filed under Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Filer: TLGY Acquisition Corporation

Subject Company: TLGY Acquisition Corporation

Filer’s Commission File Number: 001-41101

Date: October 6, 2023

Sustainability In NextGen Packaging Materials

- September 26, 2023

Bret Parker and Brian Gordon

The following is a full transcript of an interview made available

at:

https://www.packagingstrategies.com/videos/6337867390112?bctid=6337867390112

Presentation

transcript:

Bret Parker

Hi, I'm Bret Parker, multimedia specialist for packaging Strategies

magazine. Today we're focusing on sustainability and next gen packaging materials. And here to discuss this with us is Brian Gordon, President

and COO of Verde Bioresins Inc. Brian, thank you so much for joining us today.

Brian Gordon

It's my pleasure to be here. Thank you very much, Bret.

Bret Parker

Now, what crucial sustainability steps have been taken with packaging

materials within the last five years?

Brian Gordon

So packaging companies and hence strategic thinkers have been looking

at the four corners. And that's the first is to reduce the amount of material in packaging. The second is to reuse the packaging if possible.

The third is recyclability. And of course, the fourth is really rethinking the materials used to create the packaging like Verde’s

PolyEartheleneTM resin, which is bio based, generally curbside recyclable and landfill biodegradable.

Bret Parker

What are some of the biggest challenges companies face in making packaging

materials more versatile?

Brian Gordon

Sure. So, when you go to the rethinking section looking at bio based

and biodegradable materials, the biggest challenges become costs and functionality. Many of the bio based, biodegradable products are

very expensive, and some tend to be brittle and temperature sensitive. So, you've got to look at over those overall functions and determine

from a cost standpoint. The question becomes, can I use existing manufacturing facilities to convert from product or do I have to create

an entirely new infrastructure to enable that to happen?

Bret Parker

Could you describe some outdated packaging strategies you feel have

been left behind in the name of progress?

Brian Gordon

So unfortunately, the utilization of glass and metals, which are recyclable

and reusable, have really fallen behind, and that's primarily a function of cost and a function of the weight related to those products.

It's lighter. The lighter weight products are easier to ship.

They're less expensive overall. We use less materials. While glass

and metal are great products from a sustainability function, they're just too costly.

Bret Parker

What is the most crucial innovation you've witnessed recently in packaging

sustainability?

Brian Gordon

So, for me, we've developed our PolyEartheleneTM resins to enable us

to replace traditional plastics in the market for polyethylene and polypropylene, which represent roughly half of the 800 billion pounds

of plastic used each year. And we've been able to achieve that on drop-in basis. So, every national brand, every converter, they can use

the existing products and meaning they can use the existing equipment and just basically take our products and drop them in instead of

traditional plastics. So, to me, in terms of an interim and a long-term solution, it's huge. And that's what we've been trying to achieve.

Bret Parker

Are there sustainability goals that haven't been reached yet that you

feel will be accomplished in the near future? And how do you plan on achieving that?

Brian Gordon

So, there are really two ways of looking at renewable products. One

is the recyclability of products. So, plastics that can be recycled are circular, as well as bio-based, biodegradable products are circular,

with the with the favorable end of life, and ultimately at Verde we’ve started with creating bio-based products that are biodegradable.

So, if they end up in a landfill and in the United States, 85% of all products effectively end up in the landfill of plastics, then they’ll

biodegrade. If they end up in a recycling stream, then they'll be recycled with traditional plastic. But there's a tremendous emphasis

on recycling in the United States, which is admirable. And as a result of that, we're working on some additional products that include

post-consumer recycled plastic as well. And we think that that'll be a great offering for the market too.

Bret Parker

Well, that's all the time that we have for today. Brian Gordon, president

and COO of Verde Bioresins Inc., thank you so much for your time. We really appreciate it.

Brian Gordon

It's my pleasure. Thank you, Bret.

Bret Parker

And thank you all for joining us today.

***

About TLGY Acquisition Corporation

TLGY Acquisition Corporation is a blank check company sponsored by

TLGY Sponsors LLC, whose business purpose is to effect a merger, share exchange, asset acquisition, stock purchase, reorganization, or

similar business combination with one or more businesses. TLGY was formed to focus on growth companies through long-term,

private equity style value creation in the biopharma and business-to-consumer (B2C) technology sectors.

For

additional information, please visit www.tlgyacquisition.com.

About Verde Bioresins, Inc.

Verde Bioresins, Inc. is a full-service bioplastics company that

specializes in sustainable product innovation and the manufacturing of proprietary biopolymer resins, providing comprehensive design and

development solutions for companies seeking alternatives to conventional plastics.

For

additional information, please visit www.verdebioresins.com.

Forward-Looking Statements

This communication includes “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E

of the Exchange Act that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially

from those expected and projected. All statements, other than statements of historical fact included in this communication regarding TLGY

and the Company’s financial position, business strategy and the plans and objectives of management for future operations, are forward-looking

statements. Words such as “expect,” “believe,” “anticipate,” “intend,” “estimate,”

“seek” and variations and similar words and expressions are intended to identify such forward-looking statements.

Forward-looking statements are predictions, projections and other statements

about future events that are based on current expectations and assumptions and, as a result, are neither promises nor guarantees, but

involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements, including

but not limited to: (i) the risk that the proposed business combination may not be completed in a timely manner or at all, which

may adversely affect the price of TLGY’s securities; (ii) the risk that the proposed business combination may not be completed

by TLGY’s business combination deadline and the potential failure to obtain an extension of the business combination deadline sought

by TLGY; (iii) the failure to satisfy the conditions to the consummation of the proposed business combination, including the approval

of the proposed business combination by the shareholders of TLGY; (iv) the effect of the announcement or pendency of the proposed

business combination on the Company’s business relationships, performance, and business generally; (v) risks that the proposed

business combination disrupts current plans of the Company and potential difficulties in the Company employee retention as a result of

the proposed business combination; (vi) the outcome of any legal proceedings that may be instituted against TLGY or the Company related

to the agreement and plan of merger or the proposed business combination; (vii) the ability to maintain the listing of TLGY’s

securities on Nasdaq; (viii) the price of TLGY’s securities, including volatility resulting from changes in the competitive

and highly regulated industries in which the Company operates, variations in performance across competitors, changes in laws and regulations

affecting the Company’s business and changes in the combined capital structure; and (ix) the ability to implement and realize

upon business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize

additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the

other risks and uncertainties described in TLGY’s final proxy statement/prospectus to be contained in the Form S-4 registration

statement, including those under “Risk Factors” therein, TLGY’s Annual Report on Form 10-K, Quarterly Reports on

Form 10-Q and other documents filed by TLGY from time to time with the SEC. These filings identify and address other important risks

and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

statements, and TLGY and the Company assume no obligation and, except as required by law, do not intend to update or revise these forward-looking

statements, whether as a result of new information, future events, or otherwise. Neither TLGY nor the Company gives any assurance that

either TLGY or the Company will achieve its expectations.

Additional Information and Where to Find It / Non-Solicitation

In

connection with the proposed business combination, the Company will become wholly-owned subsidiary of TLGY and TLGY will be renamed to

Verde Bioresins, Corp. as of the closing of the proposed business combination. TLGY filed with the SEC the Registration Statement,

including a preliminary proxy statement/prospectus of TLGY, in connection with the proposed business combination. After the Registration

Statement is declared effective, TLGY will mail a definitive proxy statement/prospectus and other relevant documents to its shareholders.

TLGY’s shareholders and other interested persons are advised to read, when available, the preliminary proxy statement/prospectus,

and amendments thereto, and the definitive proxy statement/prospectus in connection with TLGY’s solicitation of proxies for its

shareholders’ meeting to be held to approve the proposed business combination because the proxy statement/prospectus will contain

important information about TLGY, Verde and the proposed business combination. The definitive proxy statement/prospectus will be mailed

to shareholders of TLGY as of a record date to be established for voting on the proposed business combination. Shareholders will also

be able to obtain copies of the Registration Statement, each preliminary proxy statement/prospectus and the definitive proxy statement/prospectus,

without charge, once available, at the SEC’s website at www.sec.gov. In addition, the documents filed by TLGY

may be obtained free of charge from TLGY at www.tlgyacquisition.com.

Participants in Solicitation

TLGY, the Company and their respective directors, executive officers

and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies

of TLGY’s shareholders in connection with the proposed business combination. Investors and security holders may obtain more detailed

information regarding the names, affiliations and interests of TLGY’s directors and executive officers in TLGY’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on February 21, 2023. Information

regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of TLGY’s shareholders in

connection with the proposed business combination will be set forth in the proxy statement/prospectus for the proposed business combination

when available. Information concerning the interests of TLGY’s participants in the solicitation, which may, in some cases, be different

than those of TLGY’s equity holders generally, will be set forth in the proxy statement/prospectus relating to the proposed business

combination when it becomes available.

No Offer or Solicitation

This communication is not a proxy statement or solicitation of a proxy,

consent or authorization with respect to any securities or in respect of the potential business combination and shall not constitute an

offer to sell or a solicitation of an offer to buy the securities of TLGY, the Company or the combined company, nor shall there be any

sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of the Securities Act.

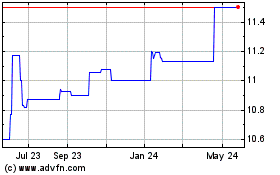

TLGY Acquisition (NASDAQ:TLGYU)

Historical Stock Chart

From Apr 2024 to May 2024

TLGY Acquisition (NASDAQ:TLGYU)

Historical Stock Chart

From May 2023 to May 2024