Filing pursuant to Rule 425 under the

Securities Act of 1933, as amended

Deemed filed under Rule 14a-12 under the

Securities Exchange Act of 1934, as amended

Filer: TLGY Acquisition Corporation

Subject Company: TLGY Acquisition Corporation

Filer’s Commission File Number: 001-41101

Date: November 17, 2023

Nasdaq Interview with Jin-Goon Kim & Joe

Paolucci, CEOs of TLGY Acquisition Corp. & Verde Bioresins - November 16, 2023

The following is a full transcript of an interview made available

at:

https://www.youtube.com/watch?v=WtxzrXW5j0Q

Jane King

Verde has partnered with Green Gear Supply Company to launch the eco

shop bag. It's a bio based, reusable, recyclable and landfill degradable product, now used by the Philadelphia Eagles for retail sales

at Lincoln Financial Field. And Verde is expected to become a publicly traded company with the planned business combination with TLGY

Acquisition Corporation. This would be a SPAC with deep roots in private equity and transformational operations.

With me is Jin-Goon Kim, the CEO of TLGY Acquisition Corp., and Joe

Paolucci CEO of Verde Bioresins. So great to have you both here. And let's just start by kind of introducing this partnership you have.

You've recently completed a S-4 filing. You're introducing a fresh perspective to the SPAC landscape with this innovative concept, introducing

a fixed pool of warrants and conversion to common mechanisms. So, explain how this SPAC is structured and what you hope to get from this

new partnership.

Jin-Goon Kim

Sure. Well, the most unique part is the structure itself, but actually

it's the entire approach. If you think about how we ended up here with the SPAC market being obviously not doing fantastic is because

a lot of people went into this business many times more than the market could take with deals that clearly haven't performed, that were

overvalued.

And they had a lot of structures that created overhang after trading.

So, we are actually taking the opposite direction of a lot of the SPACs that actually created those problems. So first we are aligning

the interests of the target sponsors and the shareholders by providing a valuation that we believe is very reasonable compared to the

market comps and having half of that really in the performance of the company as well as the sponsor.

So, I won't go into all the details. So, the performance of a

very high 35% IRR is where you need to be in order to realize that economics. But then at the same time we have a private equity approach

where we believe the deal is a good long-term investment, attractively priced with alignment of interest, but also solving the problem

today of people saying, you know, most of these deSPACs actually don't trade well afterwards.

So why don't I just wait until deSPACs and then pick it up cheap? I

don't have any reason to invest before that. So, what we have created is a unique structure where we are actually taking a big part of

the IPO economics and not really giving it to people who bought an IPO, but only giving it to people who later on actually give us a capital

and not redeem. And the way that we have created is that in an environment of a high redemption, all that pool of economics go to a much

smaller pool of people that actually remain so that it actually protects them without issuing any new dilution for the shareholders. A

form of both upside and downside to the tune of, if we were to have a 90% redemption, then shareholders who don't redeem will be protected

down to around $4 and they will have an upside of just about three times the shareholding.

So, it's a very unique structure that I think is going to be very attractive.

And most importantly, it gives a reason for people to invest people deSPAC because this incentive is only there if you are there investing

before, unlike most other SPACs, where there is no reason to do so.

Jane King

And Joe, let's bring you in. So, you introduced the eco bag. Talk a

little bit about that and share some more details about your partnership and why this makes sense.

Joe Paolucci

Sure. In fact, this was a really unique opportunity for us because

it not only was working with one high visibility partner, but two. Green Gear who currently supplies sustainable products like ponchos

and the eco shop bag to, let's say, sports industry, college teams and even a lot of national parks, national park venues. But more importantly,

that we were able to work with the Philadelphia Eagles on a really high visibility bag program, which up to this point, let's say polyolefin

bags or petrochemical based bags and even paper bags have come under a lot of scrutiny.

So, this allowed us to debut a product through the Eagles in the NFL

that really highlight, as you noted earlier, that are bio based, from this is from renewable plant feedstocks but also durable and reusable.

And that's a key part in today's industry. They don't want single use. The third point was recyclable, and that meant if fans took it

home and used it for a while because it had the Eagles logo and they decided to dispose of it in the recycle bin, it can be recycled with

the number two is and number four is typically collected.

But last but not least, and we need to keep this in mind is a lot of

times not all the municipalities are recycling the products that go into that bin and or people dispose of them in landfill. These products

are designed to biodegrade if they go into the landfill environment. This allowed the Eagles not only to address a product that was renewable

from plant-based feedstocks, but also still recyclable and even biodegradable or landfill degradable, as we call it. And these are all

points that add to what we call their carbon reduction plan, or they call their go green platform. And that platform has existed with

them for years. But it's allowed the Eagles to elevate not just their, let's say, their franchise, but also Lincoln Financial Field to

be recognized as one of the top environmentally sustainable venues out there in the industry.

Also, to the NFL team share a lot of their sustainability achievements

and we're really keeping, let's say, an eye on how well we can support further growth because we anticipate and actually have started

getting calls from additional NFL teams as well as other sports leagues about applying these same type of bags to their retail sales now.

Real quickly, what's really unique about PolyEarthylene is, like I said, we use renewable plant-based feedstocks.

Okay. And what that means, they are typically produced from ethanol

or alcohol, from sugarcane, not petrochemical or what we call fossil-based feedstocks that typically go into plastics like is such as

polyethylene and polypropylene. So, we start out fundamentally as renewable plant based, but like we said, we offer durability, reusability

and all these other benefits around recyclability. And if it goes to landfill, it will biodegrade over time and typically it's in less

than three-year period.

Again, landfill environments may vary a little bit, but typically we

see it in less than three years. The other key point about the products are they're FDA approved for food contact. And we have products

available for several different markets beyond just this film or bag area that go into food packaging like disposable food trays, cups,

caps, enclosures for consumer products, personal care, etc., etc. So, this allows a broad base of, let's say, converters who

are currently producing plastic components from fossil-based polymers into a bio based, more environmentally friendly applications. So,

a big, big benefit for the industry.

Jane King

Well, and the manufacturing process is also efficient. So, can you

explain that and why is that so impactful?

Joe Paolucci

Yeah, I'd say there's a couple of key points there. You know,

first of all, we do take these feedstocks and then use proprietary compounding technology as well as biodegradation technology. And we

make this what we call a single pellet solution that current plastic converters can put into their equipment and produce the same parts

that they're producing today. But now in bio-based, but more importantly, the highly effective manufacturing process that we refer to

is part of our business model.

Unlike some other bio-based polymer producers, they need to build what

we call polymerization units or reactors that can turn some of these bio-based products into a plastic. Those reactors, those situations

can take sometimes four or five, six years and cost hundreds of millions of dollars. The way PolyEarthylene works, in Verde. We actually

are a channel partner of the current producers of these bio-based products.

So, we have take-off partner agreements. We work closely with them,

we're actually a channel to market for them. So, we have a supply source, they have capacity that is currently used to, let's say, produce

petrochemical based products. And that capacity, that equipment can be used to produce the bio-based products as well. So, we don't have

that capital expenditure required on the back end to produce these bio-based.

We take their products and then use our technology to compound it.

So, as we grow, let's say it's a big consumer product or a food company that says, hey, we're utilizing a certain amount today and want

to go up, we don't have to take two, three or four or five years to expand. We add additional compounding or processing lines because

we have the feedstocks coming in and our typical lead time would be six months, maybe ten months to add additional capacity that allows

us to ramp up at a fraction of the cost of some of these other bio-based polymer companies. So, we have a lot of flexibility.

Jane King

So, Mr. Kim, explain to me how you plan for TLGY to work with

Verde and have long term success together.

Jin-Goon Kim

Yeah. So, in my previous career as a TPG partner in Asia, I stepped

in into these companies that we made investments that went through great transformational growth and became very helpful in helping them,

sometimes even as a CEO.

So, our DNA as investors, really as a private equity, is there to support

the management. And we have experience running public companies and private companies. We understand the capital markets. So, you know,

Joe and others who are going to be running the business obviously knows a lot about the sector and the industry and all that. But we have

probably, you know, synergetic experiences around how to take companies from A to Z in terms of having them go through a vast world scale

up journey. So that's where we want to really provide some expertise and advice.

Jane King

Yeah. Well, thank you so much. Congratulations. Best of luck. Mr. Kim

and Joe, a pleasure hearing about the companies and good luck as you pursue the SPAC.

***

About TLGY Acquisition Corporation

TLGY Acquisition Corporation is a blank check company sponsored by

TLGY Sponsors LLC, whose business purpose is to effect a merger, share exchange, asset acquisition, stock purchase, reorganization, or

similar business combination with one or more businesses. TLGY was formed to focus on growth companies through long-term,

private equity style value creation in the biopharma and business-to-consumer (B2C) technology sectors.

For additional

information, please visit www.tlgyacquisition.com.

About Verde Bioresins, Inc.

Verde Bioresins, Inc. is a full-service bioplastics company that

specializes in sustainable product innovation and the manufacturing of proprietary biopolymer resins, providing comprehensive design and

development solutions for companies seeking alternatives to conventional plastics.

For additional

information, please visit www.verdebioresins.com.

Forward-Looking Statements

This communication includes “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”) and Section 21E

of the Exchange Act that are not historical facts, and involve risks and uncertainties that could cause actual results to differ materially

from those expected and projected. All statements, other than statements of historical fact included in this communication regarding TLGY

and the Company’s financial position, business strategy and the plans and objectives of management for future operations, are forward-looking

statements. Words such as “expect,” “believe,” “anticipate,” “intend,” “estimate,”

“seek” and variations and similar words and expressions are intended to identify such forward-looking statements.

Forward-looking statements are predictions, projections and other statements

about future events that are based on current expectations and assumptions and, as a result, are neither promises nor guarantees, but

involve known and unknown risks, uncertainties and other important factors that may cause actual results, performance or achievements

to be materially different from any future results, performance or achievements expressed or implied by forward-looking statements, including

but not limited to: (i) the risk that the proposed business combination may not be completed in a timely manner or at all, which

may adversely affect the price of TLGY’s securities; (ii) the risk that the proposed business combination may not be completed

by TLGY’s business combination deadline and the potential failure to obtain an extension of the business combination deadline sought

by TLGY; (iii) the failure to satisfy the conditions to the consummation of the proposed business combination, including the approval

of the proposed business combination by the shareholders of TLGY; (iv) the effect of the announcement or pendency of the proposed

business combination on the Company’s business relationships, performance, and business generally; (v) risks that the proposed

business combination disrupts current plans of the Company and potential difficulties in the Company employee retention as a result of

the proposed business combination; (vi) the outcome of any legal proceedings that may be instituted against TLGY or the Company related

to the agreement and plan of merger or the proposed business combination; (vii) the ability to maintain the listing of TLGY’s

securities on Nasdaq; (viii) the price of TLGY’s securities, including volatility resulting from changes in the competitive

and highly regulated industries in which the Company operates, variations in performance across competitors, changes in laws and regulations

affecting the Company’s business and changes in the combined capital structure; and (ix) the ability to implement and realize

upon business plans, forecasts, and other expectations after the completion of the proposed business combination, and identify and realize

additional opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the

other risks and uncertainties described in TLGY’s final proxy statement/prospectus to be contained in the Form S-4 registration

statement, including those under “Risk Factors” therein, TLGY’s Annual Report on Form 10-K, Quarterly Reports on

Form 10-Q and other documents filed by TLGY from time to time with the SEC. These filings identify and address other important risks

and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking

statements, and TLGY and the Company assume no obligation and, except as required by law, do not intend to update or revise these forward-looking

statements, whether as a result of new information, future events, or otherwise. Neither TLGY nor the Company gives any assurance that

either TLGY or the Company will achieve its expectations.

Additional Information and Where to Find It / Non-Solicitation

In connection

with the proposed business combination, the Company will become wholly-owned subsidiary of TLGY and TLGY will be renamed to Verde Bioresins, Corp.

as of the closing of the proposed business combination. TLGY filed with the SEC the Registration Statement, including a preliminary proxy

statement/prospectus of TLGY, in connection with the proposed business combination. After the Registration Statement is declared effective,

TLGY will mail a definitive proxy statement/prospectus and other relevant documents to its shareholders. TLGY’s shareholders and

other interested persons are advised to read, when available, the preliminary proxy statement/prospectus, and amendments thereto, and

the definitive proxy statement/prospectus in connection with TLGY’s solicitation of proxies for its shareholders’ meeting

to be held to approve the proposed business combination because the proxy statement/prospectus will contain important information about

TLGY, Verde and the proposed business combination. The definitive proxy statement/prospectus will be mailed to shareholders of TLGY as

of a record date to be established for voting on the proposed business combination. Shareholders will also be able to obtain copies of

the Registration Statement, each preliminary proxy statement/prospectus and the definitive proxy statement/prospectus, without charge,

once available, at the SEC’s website at www.sec.gov. In addition, the documents filed by TLGY may be obtained

free of charge from TLGY at www.tlgyacquisition.com.

Participants in Solicitation

TLGY, the Company and their respective directors, executive officers

and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies

of TLGY’s shareholders in connection with the proposed business combination. Investors and security holders may obtain more detailed

information regarding the names, affiliations and interests of TLGY’s directors and executive officers in TLGY’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on February 21, 2023. Information

regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies of TLGY’s shareholders in

connection with the proposed business combination will be set forth in the proxy statement/prospectus for the proposed business combination

when available. Information concerning the interests of TLGY’s participants in the solicitation, which may, in some cases, be different

than those of TLGY’s equity holders generally, will be set forth in the proxy statement/prospectus relating to the proposed business

combination when it becomes available.

No Offer or Solicitation

This communication is not a proxy statement or solicitation of a proxy,

consent or authorization with respect to any securities or in respect of the potential business combination and shall not constitute an

offer to sell or a solicitation of an offer to buy the securities of TLGY, the Company or the combined company, nor shall there be any

sale of any such securities in any state or jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration

or qualification under the securities laws of such state or jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of the Securities Act.

TLGY Acquisition (NASDAQ:TLGYU)

Historical Stock Chart

From Apr 2024 to May 2024

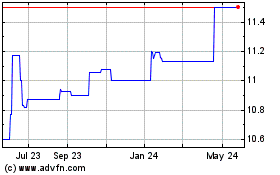

TLGY Acquisition (NASDAQ:TLGYU)

Historical Stock Chart

From May 2023 to May 2024