Nasdaq Glitch Hits ETF Market Too - ETF News And Commentary

24 August 2013 - 1:00AM

Zacks

After a series of trading glitches impacting major U.S.

exchanges, it appears as though the Nasdaq was the next in line for

issues. The all-electronic trading platform experienced a huge

technical problem which kept their market shutdown for roughly

three hours in Thursday trading.

The shutdown hit the roughly 2,700 stocks that are traded on the

platform, including a number of technology behemoths such as

Apple (AAPL), Facebook (FB), and

Google (GOOG). The halt also impacted options

trading, leaving investors in the dark on updates prices for much

of the session (see 3 Tech ETFs Still Going Strong).

Trading was finally restored in the last half hour or so of

trading, and fortunately, many shares move higher after the

shutdown. Nasdaq’s own shares, NDAQ, weren’t as

lucky, as investors sold off the company, pushing down shares by

3.4% following the issues. In fact, NDAQ actually saw volume that

was above average for the day, even with the long cutout in the

middle of the session.

ETF Impact

The shutdown also hit a number of ETFs, as more than 100 funds

trade on the Nasdaq. This includes a variety of products from a

number of issuers—including several ultra-popular funds—so the

impact was pretty widespread for ETF investors on the day. Below,

we highlight a few of the most popular funds that were impacted by

this trading blackout and how they held up after service was

restored:

Easily the most popular—and most obviously impacted—was the

PowerShares QQQ ETF (QQQ). This fund tracks the

Nasdaq 100 index and generally does volume of about 30 million

shares a day (see all the Large Cap ETFs).

Thanks to the trading halt though, volume came in just above 16

million shares for the day, roughly half a normal session. However,

prices appeared to be unaffected as QQQ finished the day up roughly

1%.

Meanwhile, some leveraged counterparts for the Nasdaq 100 Index,

such as TQQQ and SQQQ also were

unaffected from a performance perspective. However, these two saw

volumes that were roughly 50% of a normal session too (see all the

Leveraged Equity ETFs here).

International-focused Nasdaq-listed ETFs also saw uncertain

trading in Thursday’s session. This was led by two relatively

popular iShares products, ACWI and

ACWX. Both of these products saw volume that was

far less than normal with big gaps in between bursts of volume

throughout the day.

Finally, arguably one of the most popular sector focused ETFs

trading on the Nasdaq, IBB, also saw a plunge in

trading volume for the day. The popular ETF which has roughly $3.7

billion in assets saw volume that was roughly half a normal day,

though other products like BBH did see some

sluggish volume thanks to a large number of underlying securities

trading on the Nasdaq (see 3 Impressive Biotech ETFs Crushing the

Market).

NDAQ Impact

Investors should also note that NDAQ takes the biggest spot in

the iShares US Broker Dealers ETF (IAI). For this

fund, NDAQ makes up roughly 4.3% of assets, making it important but

not vital for the ETF’s overall return.

Based on this, it is safe to say that NDAQ’s slump didn’t have a

very big impact on the rest of the industry, though the trend is

certainly troubling. Investors should definitely keep an eye on

this space going forward though, as a series of major issues with

the exchanges could result in new rules or regulation, possibly

spurring a further sell-off in the future for this ETF.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

MKT VEC-BIOTECH (BBH): ETF Research Reports

ISHARS-US BR-D (IAI): ETF Research Reports

ISHARES NDQ BIO (IBB): ETF Research Reports

NASDAQ OMX GRP (NDAQ): Free Stock Analysis Report

NASDAQ-100 SHRS (QQQ): ETF Research Reports

PRO-ULS QQQ (SQQQ): ETF Research Reports

PRO-ULT QQQ (TQQQ): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

ProShares UltraPro QQQ (NASDAQ:TQQQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

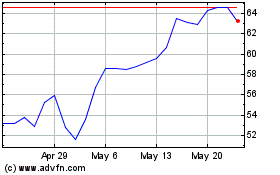

ProShares UltraPro QQQ (NASDAQ:TQQQ)

Historical Stock Chart

From Dec 2023 to Dec 2024