Uniti Group Inc. (the “Company,” “Uniti,” or “we”) (Nasdaq: UNIT)

today announced that Uniti Fiber ABS Issuer LLC and Uniti Fiber TRS

Issuer LLC, limited-purpose, bankruptcy remote indirect

subsidiaries of Uniti (collectively, the “Issuers”), completed an

inaugural $589,000,000 fiber securitization notes offering

consisting of $426,000,000 5.9% Series 2025-1, Class A-2 term

notes, $65,000,000 6.4% Series 2025-1, Class B term notes and

$98,000,000 9.0% Series 2025-1, Class C term notes (collectively,

the “Series 2025-1 Term Notes”), each with an anticipated repayment

date in April of 2030. The Series 2025-1 Term Notes have a weighted

average yield of approximately 6.5%. The Series 2025-1 Term Notes

are secured by certain fiber network assets and related customer

contracts in the State of Florida and the Gulf Coast region of

Louisiana, Mississippi and Alabama. Each Issuer and each Issuer’s

direct parent entity and subsidiary are “unrestricted subsidiaries”

under Uniti’s credit agreement and the indentures governing Uniti’s

outstanding senior notes.

The Series 2025-1 Term Notes are not, and will

not be, registered under the Securities Act of 1933, as amended

(the “Securities Act”), or any state securities laws, and may not

be offered or sold in the United States absent registration or an

applicable exemption from registration under the Securities Act or

any applicable state securities laws.

Uniti used a portion of the net proceeds to

repay and terminate its existing ABS bridge facility, and it

intends to use the remainder of the net proceeds to fund the

partial redemption of its 10.50% senior secured notes due 2028 (the

“2028 Notes”) described below and for general corporate purposes,

which may include success-based capital investments.

On February 3, 2025, Uniti issued a notice of

redemption to redeem $125,000,000 aggregate principal amount of its

outstanding 2028 Notes. Uniti will redeem the 2028 Notes called for

redemption on February 14, 2025, at a redemption price of 103% of

the redeemed principal amount plus accrued interest to, but

excluding, the redemption date.

“We are very excited to complete this landmark

transaction, which represents the first true enterprise fiber

securitization. This transaction, combined with the partial

redemption of our secured notes, represent the latest steps in

Uniti’s continued efforts to strengthen its balance sheet and lower

its cost of capital,” commented Paul Bullington, Senior Vice

President, Chief Financial Officer & Treasurer.

This press release does not constitute an offer

to sell, or a solicitation of an offer to buy, nor shall there

beany sale of Series 2025-1 Term Notes in any state or jurisdiction

in which such an offer, solicitation or sale would be unlawful

prior to registration or qualification under the securities laws of

any such state or jurisdiction. In addition, this press release

does not constitute a notice of redemption with respect to the 2028

Notes.

ABOUT UNITI GROUP INC.

Uniti, an internally managed real estate

investment trust, is engaged in the acquisition and construction of

mission critical communications infrastructure, and is a leading

provider of fiber and other wireless solutions for the

communications industry. As of September 30, 2024, Uniti owns

approximately 144,000 fiber route miles, 8.7 million fiber strand

miles, and other communications real estate throughout the United

States. Additional information about Uniti can be found on its

website at www.uniti.com.

FORWARD-LOOKING STATEMENTS

Certain statements in this press release may

constitute forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995, as amended from

time to time. Those forward-looking statements include all

statements that are not historical statements of fact.

Words such as "anticipate(s)," "expect(s),"

"intend(s)," “plan(s),” “believe(s)," "may," "will," "would,"

"could," "should," "seek(s)" and similar expressions, or the

negative of these terms, are intended to identify such

forward-looking statements. These statements are based on

management's current expectations and beliefs and are subject to a

number of risks and uncertainties that could lead to actual results

differing materially from those projected, forecasted or expected.

Although we believe that the assumptions underlying the

forward-looking statements are reasonable, we can give no assurance

that our expectations will be attained. Factors which could have a

material adverse effect on our operations and future prospects or

which could cause actual results to differ materially from our

expectations include, but are not limited to the Company’s and

Windstream’s ability to consummate our merger with Windstream on

the expected terms or according to the anticipated timeline, the

risk that our merger agreement with Windstream (the “Merger

Agreement”) may be modified or terminated, that the conditions to

our merger with Windstream may not be satisfied or the occurrence

of any event, change or other circumstances that could give rise to

the termination of the Merger Agreement, the effect of the

announcement of our merger with Windstream on relationships with

our customers, suppliers, vendors, employees and other

stakeholders, our ability to attract employees and our operating

results and the operating results of Windstream, the risk that the

restrictive covenants in the Merger Agreement applicable to us and

our business may limit our ability to take certain actions that

would otherwise be necessary or advisable, the diversion of

management’s time on issues related to our merger with Windstream,

the risk that we fail to fully realize the potential benefits, tax

benefits, expected synergies, efficiencies and cost savings from

our merger with Windstream within the expected time period (if all

all), legal proceedings that may be instituted against Uniti or

Windstream following announcement of the merger, if the merger is

completed, the risk associated with Windstream’s business, adverse

impacts of inflation and higher interest rates on our employees,

our business, the business of our customers and other business

partners and the global financial markets, the ability and

willingness of our customers to meet and/or perform their

obligations under any contractual arrangements entered into with

us, including master lease arrangements, the ability and

willingness of our customers to renew their leases with us upon

their expiration, our ability to reach agreement on the price of

such renewal or ability to obtain a satisfactory renewal rent from

an independent appraisal, and the ability to reposition our

properties on the same or better terms in the event of nonrenewal

or in the event we replace an existing tenant, the availability of

and our ability to identify suitable acquisition opportunities and

our ability to acquire and lease the respective properties on

favorable terms or operate and integrate the acquired businesses,

or to integrate our business with Windstream’s as a result of the

merger, our ability to generate sufficient cash flows to service

our outstanding indebtedness and fund our capital funding

commitments, our ability to access debt and equity capital markets,

the impact on our business or the business of our customers as a

result of credit rating downgrades and fluctuating interest rates,

our ability to retain our key management personnel, changes in the

U.S. tax law and other federal, state or local laws, whether or not

specific to real estate investment trusts, covenants in our debt

agreements that may limit our operational flexibility, the

possibility that we may experience equipment failures, natural

disasters, cyber-attacks or terrorist attacks for which our

insurance may not provide adequate coverage, the risk that we fail

to fully realize the potential benefits of or have difficulty in

integrating the companies we acquire, other risks inherent in the

communications industry and in the ownership of communications

distribution systems, including potential liability relating to

environmental matters and illiquidity of real estate investments;

and additional factors described in our reports filed with the U.S.

Securities and Exchange Commission.

Uniti expressly disclaims any obligation to

release publicly any updates or revisions to any of the

forward-looking statements set forth in this press release to

reflect any change in its expectations or any change in events,

conditions or circumstances on which any such statement is

based.

INVESTOR AND MEDIA CONTACTS:

Paul Bullington, 251-662-1512Senior Vice President, Chief

Financial Officer & Treasurerpaul.bullington@uniti.com

Bill DiTullio, 501-850-0872Senior Vice President, Investor

Relations & Treasurybill.ditullio@uniti.com

This press release was published by a CLEAR® Verified

individual.

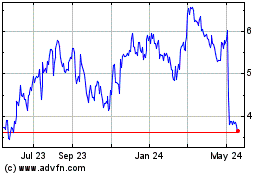

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Jan 2025 to Feb 2025

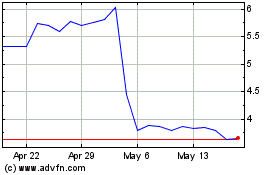

Uniti (NASDAQ:UNIT)

Historical Stock Chart

From Feb 2024 to Feb 2025