Sandia Area Federal Credit Union Selects Upstart for Personal Lending

09 January 2025 - 1:00AM

Business Wire

Sandia Area Federal Credit Union (Sandia Area), a leading New

Mexico credit union with nearly 90,000 members and over $1.2

billion in assets, has announced its partnership with Upstart

(NASDAQ: UPST), the leading artificial intelligence (AI) lending

marketplace, to offer personal loans to more consumers.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20250108508814/en/

“Sandia Area Federal Credit Union is committed to improving the

financial well-being of our members and community by providing them

with the best value, convenience and loan products,” said Brian

Griffith, Chief Lending Officer at Sandia Area Federal Credit

Union. “By partnering with Upstart, we’re able to scale our

personal loan offering while providing online access to affordable

credit to more new and existing members across New Mexico.”

Sandia Area started lending as a partner on the Upstart Referral

Network in April 2024. With the Upstart Referral Network, qualified

personal loan applicants on Upstart.com who meet Sandia Area’s

credit policies will receive tailored offers as they seamlessly

transition into a Sandia Area-branded experience to complete the

online member application and closing process.

“We are proud to partner with Sandia Area Federal Credit Union

to help them expand their membership and diversify their loan

portfolio across New Mexico,” said Michael Lock, Senior Vice

President of Lending Partnerships at Upstart. “Through its

partnership with Upstart, Sandia Area is able to onboard more

personal loans and more members who can now benefit from Sandia

Area’s other high-quality products and services.”

To learn more about Upstart for Credit Unions and the Upstart

Referral Network, please watch this video.

About Upstart

Upstart (NASDAQ: UPST) is the leading AI lending marketplace,

connecting millions of consumers to more than 100 banks and credit

unions that leverage Upstart’s AI models and cloud applications to

deliver superior credit products. With Upstart AI, lenders can

approve more borrowers at lower rates across races, ages, and

genders, while delivering the exceptional digital-first experience

customers demand. More than 80% of borrowers are approved

instantly, with zero documentation to upload. Founded in 2012,

Upstart’s platform includes personal loans, automotive retail and

refinance loans, home equity lines of credit, and small-dollar

“relief” loans. Upstart is based in San Mateo, California, and also

has offices in Columbus, Ohio and Austin, Texas.

About Sandia Area Federal Credit Union

Sandia Area was founded in 1956 as a member-owned full-service

financial institution and has since grown to serve nearly 90,000

members throughout the thriving cities of Albuquerque, Rio Rancho,

Corrales and Santa Fe as well as the counties of Bernalillo,

Sandoval, Santa Fe, Valencia, Torrance, Cibola, Dona Ana, Rio

Arriba, Mora, San Miguel and Los Alamos. Sandia Area, New Mexico’s

fourth largest credit union with assets totaling more than $1.2

billion, helps members thrive by offering members access to

high-quality banking, loans, investment services, business banking

and lending, and more. Sandia Area is dedicated to the well-being

of their members, their community, and their environment. Learn

more about Sandia Area at Sandia.org.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250108508814/en/

Press Contact press@upstart.com

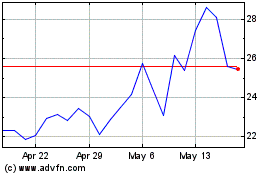

Upstart (NASDAQ:UPST)

Historical Stock Chart

From Dec 2024 to Jan 2025

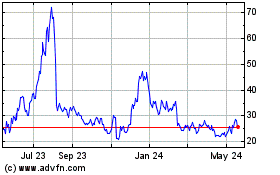

Upstart (NASDAQ:UPST)

Historical Stock Chart

From Jan 2024 to Jan 2025