0001647639true00016476392025-02-112025-02-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

February 11, 2025

Date of Report (Date of earliest event reported)

Upstart Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware | 001-39797 | 46-4332431 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

2950 S. Delaware Street, Suite 410

San Mateo, CA 94403

(Address of principal executive offices, including zip code)

(833) 212-2461

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | UPST | | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On February 11, 2025, Upstart Holdings, Inc. (the “Company”) furnished a Current Report on Form 8-K that included a press release reporting its financial results for the fiscal quarter and full fiscal year ended December 31, 2024 (the “Original Form 8-K”). This Current Report on Form 8-K/A amends the Original 8-K solely for the purpose of correcting an error with respect to the Company’s diluted adjusted net income per share and diluted weighted-average common shares outstanding for the fiscal quarter ended December 31, 2024. The Company previously reported a diluted adjusted net income per share of $0.26 and diluted weighted-average common shares outstanding of 116,330,130 for the fiscal quarter ended December 31, 2024. The corrected diluted adjusted net income per share is $0.29 and the corrected diluted weighted-average common shares outstanding is 103,118,327 for the fiscal quarter ended December 31, 2024.

This correction has no impact on the Company’s expectation for basic weighted-average share count or diluted weighted-average share count included in the Company’s financial outlook for Q1 of 2025.

A copy of the corrected press release is attached as Exhibit 99.1 to this Current Report on Form 8-K/A and is incorporated herein by reference. The information in this Current Report on Form 8-K/A and the exhibit attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, except as shall be expressly set forth by specific reference in such filing.

Other than correction of the error discussed in this Current Report on Form 8-K/A, no other changes have been made to the Original Form 8-K or the press release furnished therewith.

Item 7.01. Regulation FD Disclosure.

On February 13, 2025, the Company posted a corrected investor presentation on its investor relations website at www.ir.upstart.com.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (Cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Upstart Holdings, Inc. |

Dated: February 13, 2025 | By: | /s/ Scott Darling |

| | Scott Darling |

| | Chief Legal Officer |

Exhibit 99.1

Upstart Announces Fourth Quarter and Full Year 2024 Results

SAN MATEO, Calif. – February 11, 2025 – Upstart Holdings, Inc. (NASDAQ: UPST), the leading artificial intelligence (AI) lending marketplace, today announced financial results for the quarter and full year ended December 31, 2024. Upstart will host a conference call and webcast at 1:30 p.m. Pacific Time today. An earnings presentation and link to the webcast are available at ir.upstart.com.

“In Q4 of 2024, our business grew dramatically across all product categories, delivered Adjusted EBITDA at levels not seen since the first quarter of 2022, and came within a whisker of returning to GAAP profitability,” said Dave Girouard, co-founder and CEO of Upstart. “We launched into 2025 with unparalleled energy and optimism for the future of Upstart AI lending and the mission we’re on together.”

Fourth Quarter 2024 Financial Highlights

•Total Revenue was $219 million, up 56% year-over-year ("YoY") and up 35% quarter-over-quarter ("QoQ"). Total fee revenue was $199 million, an increase of 30% YoY, and up 19% QoQ.

•Transaction Volume and Conversion Rate: 245,663 loans were originated, totaling $2.1 billion, up 68% YoY and up 33% QoQ. Our Conversion Rate was 19.3%, up from 11.6% in Q4 2023.

•Income (Loss) from Operations was ($4.8) million, up from ($47.5) million in Q4 2023.

•Net Income (Loss) and EPS: GAAP net income (loss) was ($2.8) million, up from ($42.4) million in Q4 2023. Adjusted net income (loss) was $29.9 million, up from ($9.7) million in Q4 2023. Accordingly, GAAP diluted earnings per share was ($0.03), and diluted adjusted earnings per share was $0.29 based on the weighted-average common shares outstanding during the quarter.

•Contribution Profit was $122 million in the fourth quarter of 2024, up 28% YoY, with a Contribution Margin of 61% compared to 63% in Q4 2023.

•Adjusted EBITDA was $38.8 million, up from $0.6 million in the same quarter of the prior year. Adjusted EBITDA Margin was 18% of total revenue, up from 0% in Q4 2023.

Fiscal Year 2024 Financial Highlights

•Total Revenue was $637 million, up 24% YoY. Total fee revenue was $635 million, up 13% YoY.

•Transaction Volume and Conversion Rate: 697,092 loans were originated, totaling $5.9 billion, up 28% YoY. Our Conversion Rate was 16.5% in 2024, up from 9.7% in 2023.

•Income (Loss) from Operations was ($173) million, up from ($257) million in 2023.

•Net Income (Loss) and EPS: GAAP net income (loss) was ($129) million, up from ($240) million in 2023. Adjusted net income (loss) was ($17.8) million, up from ($46.9) million in 2023. Accordingly, GAAP diluted earnings per share was ($1.44), and diluted adjusted earnings per share was ($0.20) based on the weighted-average common shares outstanding during the year.

•Contribution Profit was $382 million in 2024, up 8% YoY, with a Contribution Margin of 60% compared to 63% in 2023.

•Adjusted EBITDA was $10.6 million, up from ($17.2) million in 2023. 2024 Adjusted EBITDA Margin was 2% of total revenue, up from (3)% in 2023.

Key Operating Metrics

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended

December 31, |

| | 2023 | | 2024 | | 2023 | | 2024 |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Transaction Volume, Dollars(1) | | $ | 1,253,223 | | $ | 2,107,473 | | $ | 4,645,669 | | $ | 5,930,029 |

Transaction Volume, Number of Loans(2) | | 129,664 | | 245,663 | | 437,659 | | 697,092 |

| Conversion Rate | | 11.6% | | 19.3% | | 9.7% | | 16.5% |

| Percentage of Loans Fully Automated | | 89% | | 91% | | 87% | | 91% |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1)Dollars in thousands

(2)Transaction Volume, Number of Loans is shown in ones for the periods presented.

Financial Outlook

For the first quarter of 2025, Upstart expects:

•Revenue of approximately $200 million

◦Revenue From Fees of approximately $185 million

◦Net Interest Income (Loss) of approximately $15 million

•Contribution Margin of approximately 57%

•GAAP Net Income (Loss) of approximately ($20) million

•Adjusted Net Income (Loss) of approximately $16 million

•Adjusted EBITDA of approximately $27 million

•Basic Weighted-Average Share Count of approximately 95 million shares

•Diluted Weighted-Average Share Count of approximately 105 million shares

For full year 2025, Upstart expects:

•Revenue of approximately $1 billion

◦Revenue From Fees of approximately $920 million

◦Net Interest Income (Loss) of approximately $80 million

•Adjusted EBITDA Margin of approximately 18%

•GAAP Net Income to be at least breakeven

Upstart AI Day

Upstart will host “Upstart AI Day” on May 14, 2025 in New York City where members of the leadership team will discuss the Company’s technology along with its business model and strategy. A live audio webcast and presentation slides will be posted on the day of the event to the Company’s investor relations website at https://ir.upstart.com/.

Key Operating Metrics and Non-GAAP Financial Measures

For a description of our key operating measures, please see the section titled “Key Operating Metrics” below.

Reconciliations of non-GAAP financial measures to the most directly comparable financial results as determined in accordance with GAAP are included at the end of this press release following the accompanying financial data. For a description of these non-GAAP financial measures, including the reasons management uses each measure, please see the section titled "About Non-GAAP Financial Measures” below.

Conference Call and Webcast

•Live Conference Call and Webcast at 1:30 p.m. PT on February 11, 2025. To access the call in the United States and Canada: +1 888-394-8218, conference code 1025998. To access the call outside of the United States and Canada: +1 313-209-4906, conference code 1025998. A webcast is available at ir.upstart.com.

•Event Replay. A webcast of the event will be archived for one year at ir.upstart.com.

About Upstart

Upstart (NASDAQ: UPST) is the leading AI lending marketplace, connecting millions of consumers to more than 100 banks and credit unions that leverage Upstart’s AI models and cloud applications to deliver superior credit products. With Upstart AI, lenders can approve more borrowers at lower rates across races, ages, and genders, while delivering the exceptional digital-first experience customers demand. More than 80% of borrowers are approved instantly, with no human involvement required by the Company. Founded in 2012, Upstart’s platform includes personal loans, automotive retail and refinance loans, home equity lines of credit, and small-dollar “relief” loans. Upstart is based in San Mateo, California, and also has offices in Columbus, Ohio, New York, New York, and Austin, Texas.

Press

Tom Brennan

press@upstart.com

Investors

Sonya Banerjee

ir@upstart.com

Forward-Looking Statements

This press release contains forward-looking statements, including but not limited to, statements regarding our outlook for the first quarter of 2025 and the full fiscal year, continuing to strengthen our position as the fintech leader in artificial intelligence, and our growth expectations. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as "anticipate", "estimate", "expect", "project", "plan", "intend", “target”, “aim”, "believe", "may", "will", "should", “becoming”, “look forward”, “could”, "can have", "likely" and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events. Forward-looking statements give our current expectations and projections relating to our financial condition; macroeconomic factors; plans; objectives; product development; growth opportunities; assumptions; risks; future performance; business; investments; and results of operations, including revenue (including revenue from fees and net interest income (loss)), contribution margin, net income (loss), non-GAAP adjusted net income (loss), Adjusted EBITDA, basic weighted-average share count and diluted weighted-average share count. Neither we nor any other person assumes responsibility for the accuracy and completeness of any of these forward-looking statements. The forward-looking statements included in this press release and on the related conference call and webcast relate only to events as of the date hereof. Upstart undertakes no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

All forward-looking statements are subject to risks and uncertainties that may cause actual results to differ materially from those that we expected. More information about factors that could affect our results of operations and risks and uncertainties are provided in our public filings with the Securities and Exchange Commission (the "SEC"), copies of which may be obtained by visiting our investor relations website at www.upstart.com or the SEC’s website at www.sec.gov. These risks and uncertainties include, but are not limited to, our ability to manage the adverse effects of macroeconomic conditions and disruptions in the banking sector and credit markets, including inflation and related changes in interest rates and monetary policy; our ability to access sufficient loan funding, including through securitizations, committed capital and other co-investment arrangements, whole loan sales, and warehouse credit facilities; the effectiveness of our credit decisioning models and risk management efforts, including reflecting the impact of macroeconomic conditions on borrowers' credit risk; our ability to retain existing, and attract new, lending partners; our future growth prospects and financial performance; our ability to manage risks associated with the loans on our balance sheet; our ability to improve and expand our platform and products; and our ability to operate successfully in a highly-regulated industry.

Key Operating Metrics

We review a number of operating metrics, including transaction volume, dollars; transaction volume, number of loans; and conversion rate to evaluate our business, measure our performance, identify trends affecting our business, formulate business plans and make strategic decisions.

We define “transaction volume, dollars” as the total principal of loan originations (or committed amounts for HELOCs) facilitated on our marketplace during the periods presented. We define “transaction volume, number of loans” as the number of loan originations (or commitments issued for HELOCs) facilitated on our marketplace during the periods presented. We believe these metrics are good proxies for our overall scale and reach as a platform.

We define “conversion rate” as the transaction volume, number of loans in a period divided by the number of rate inquiries received that we estimate to be legitimate, which we record when a borrower requests a loan offer on our platform. We track this metric to understand the impact of improvements to the efficiency of our borrower funnel on our overall growth.

About Non-GAAP Financial Measures

In addition to our results determined in accordance with generally accepted accounting principles in the United States (“GAAP”), we believe the non-GAAP measures of Contribution Profit, Contribution Margin, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income (Loss), and Adjusted Net Income (Loss) Per Share are useful in evaluating our operating performance. Certain of these non-GAAP measures exclude stock-based compensation and certain payroll tax expense, expense on convertible notes, depreciation, amortization, as well as certain items that are not related to core business and ongoing operations, such as gain on debt extinguishment, net gain on lease modification, and reorganization expenses. We exclude stock-based compensation, expense on convertible notes and other non-operating expenses because they are non-cash in nature and are excluded in order to facilitate comparisons to other companies’ results.

We believe non-GAAP information is useful in evaluating the operating results, ongoing operations, and for internal planning and forecasting purposes. We also believe that non-GAAP financial measures provide consistency and comparability with past financial performance and assist investors with comparing Upstart to other companies, some of which use similar non-GAAP financial measures to supplement their GAAP results. However, non-GAAP financial measures are presented for supplemental informational purposes only and should not be considered a substitute for, or superior to, financial information presented in accordance with GAAP and may be different from similarly titled non-GAAP financial measures used by other companies.

Key limitations of our non-GAAP financial measures include:

• Contribution Profit and Contribution Margin are not GAAP financial measures of, nor do they imply, profitability. Even if our revenue exceeds variable expenses over time, we may not be able to achieve or maintain profitability, and the relationship of revenue to variable expenses is not necessarily indicative of future performance;

• Contribution Profit and Contribution Margin do not reflect all of our variable expenses and involve some judgment and discretion around what costs vary directly with loan volume. Other companies that present contribution profit and contribution margin may calculate it differently and, therefore, similarly titled measures presented by other companies may not be directly comparable to ours;

• Although depreciation expense is a non-cash charge, the assets being depreciated may have to be replaced in the future, and Adjusted EBITDA and Adjusted EBITDA Margin do not reflect cash capital expenditure requirements for such replacements or for new capital expenditure requirements;

• Adjusted EBITDA and Adjusted EBITDA Margin exclude stock-based compensation expense and certain employer payroll taxes on employee stock transactions. Stock-based compensation expense has been, and will continue to be for the foreseeable future, a significant recurring expense for our business and an important part of our compensation strategy. The amount of employer payroll tax-related expense on

employee stock transactions is dependent on our stock price and other factors that are beyond our control and which may not correlate to the operation of the business;

• Adjusted EBITDA and Adjusted EBITDA Margin do not reflect: (1) changes in, or cash requirements for, our working capital needs; (2) interest expense, or the cash requirements necessary to service interest or principal payments on our debt, which reduces cash available to us; or (3) tax payments that may represent a reduction in cash available to us; and

• The expenses and other items that we exclude in our calculation of Adjusted EBITDA and Adjusted EBITDA Margin may differ from the expenses and other items, if any, that other companies may exclude from adjusted EBITDA and adjusted EBITDA margin when they report their operating results.

Reconciliation tables of the most comparable GAAP financial measures to the non-GAAP financial measures used in this press release are included below. Upstart has not reconciled the forward-looking non-GAAP measures to comparable forward-looking GAAP measures because of the potential variability and uncertainty of incurring these costs and expenses in the future. Accordingly, a reconciliation is not available without unreasonable effort.

UPSTART HOLDINGS, INC.

CONSOLIDATED BALANCE SHEETS

(In Thousands, Except Share and Per Share Data)

| | | | | | | | | | | |

| December 31, | | December 31, |

| 2023 | | 2024 |

| Assets | | | |

| Cash and cash equivalents | $ | 368,405 | | | $ | 788,422 | |

| Restricted cash | 99,382 | | | 187,841 | |

Loans (at fair value)(1) | 1,156,413 | | | 806,304 | |

| | | |

| Property, equipment, and software, net | 42,655 | | | 39,013 | |

| Operating lease right of use assets | 54,694 | | | 43,455 | |

| Beneficial interest assets (at fair value) | 41,012 | | | 176,848 | |

| Non-marketable equity securities | 41,250 | | | 41,250 | |

| Goodwill | 67,062 | | | 67,062 | |

Other assets (includes $48,897 and $107,627 at fair value as of December 31, 2023 and December 31, 2024, respectively) | 146,227 | | | 216,763 | |

| Total assets | $ | 2,017,100 | | | $ | 2,366,958 | |

| Liabilities and Stockholders’ Equity | | | |

| Liabilities: | | | |

| | | |

| Payable to investors | $ | 53,580 | | | $ | 60,173 | |

| Borrowings | 1,040,424 | | | 1,402,168 | |

| Payable to securitization note holders (at fair value) | 141,416 | | | 87,321 | |

| | | |

Accrued expenses and other liabilities (includes $10,510 and $15,883 at fair value as of December 31, 2023 and December 31, 2024, respectively) | 84,051 | | | 133,800 | |

| Operating lease liabilities | 62,324 | | | 50,278 | |

| Total liabilities | 1,381,795 | | | 1,733,740 | |

| | | |

| | | |

| Stockholders’ equity: | | | |

Common stock, $0.0001 par value; 700,000,000 shares authorized; 86,330,303 and 93,469,721, shares issued and outstanding as of December 31, 2023 and December 31, 2024, respectively | 9 | | | 9 | |

| Additional paid-in capital | 917,872 | | | 1,044,366 | |

| Accumulated deficit | (282,576) | | | (411,157) | |

| | | |

| | | |

| Total stockholders’ equity | 635,305 | | | 633,218 | |

| Total liabilities and stockholders’ equity | $ | 2,017,100 | | | $ | 2,366,958 | |

(1)Includes $179.1 million and $102.9 million of loans, at fair value, contributed as collateral for the consolidated securitization as of December 31, 2023 and December 31, 2024, respectively.

UPSTART HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS and COMPREHENSIVE LOSS

(In Thousands, Except Share and Per Share Data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Year Ended

December 31, |

| | | 2023 | | 2024 | | 2023 | | 2024 |

| Revenue: | | | | | | | | | |

Revenue from fees, net(2) | | | $ | 152,846 | | | $ | 199,276 | | | $ | 560,431 | | | $ | 635,466 | |

| Interest income, interest expense, and fair value adjustments, net: | | | | | | | | | |

Interest income(1) | | | 52,073 | | | 41,461 | | | 168,996 | | | 186,360 | |

Interest expense(1) | | | (14,066) | | | (7,431) | | | (34,894) | | | (40,433) | |

Fair value and other adjustments(1) | | | (50,541) | | | (14,342) | | | (180,971) | | | (144,865) | |

| Total interest income, interest expense, and fair value adjustments, net | | | (12,534) | | | 19,688 | | | (46,869) | | | 1,062 | |

| Total revenue | | | 140,312 | | | 218,964 | | | 513,562 | | | 636,528 | |

| Operating expenses: | | | | | | | | | |

| Sales and marketing | | | 38,772 | | | 55,463 | | | 127,143 | | | 166,800 | |

| Customer operations | | | 36,117 | | | 40,602 | | | 150,418 | | | 157,996 | |

| Engineering and product development | | | 57,152 | | | 67,222 | | | 280,138 | | | 253,653 | |

| General, administrative, and other | | | 55,772 | | | 60,427 | | | 212,388 | | | 230,935 | |

| Total operating expenses | | | 187,813 | | | 223,714 | | | 770,087 | | | 809,384 | |

| Loss from operations | | | (47,501) | | | (4,750) | | | (256,525) | | | (172,856) | |

| Other income, net | | | 6,345 | | | 6,136 | | | 21,206 | | | 18,793 | |

| Expense on convertible notes | | | (1,179) | | | (4,030) | | | (4,706) | | | (7,694) | |

Gain on debt extinguishment | | | — | | | — | | | — | | | 33,361 | |

Net loss before income taxes | | | (42,335) | | | (2,644) | | | (240,025) | | | (128,396) | |

Provision for income taxes | | | 63 | | | 111 | | | 107 | | | 185 | |

| | | | | | | | | |

| | | | | | | | | |

Net loss | | | $ | (42,398) | | | $ | (2,755) | | | $ | (240,132) | | | $ | (128,581) | |

| | | | | | | | | |

Net loss per share, basic | | | $ | (0.50) | | | $ | (0.03) | | | $ | (2.87) | | | $ | (1.44) | |

Net loss per share, diluted | | | $ | (0.50) | | | $ | (0.03) | | | $ | (2.87) | | | $ | (1.44) | |

| Weighted-average number of shares outstanding used in computing net loss per share, basic | | | 85,569,351 | | | 92,174,306 | | | 83,765,896 | | | 89,450,038 | |

| Weighted-average number of shares outstanding used in computing net loss per share, diluted | | | 85,569,351 | | | 92,174,306 | | | 83,765,896 | | | 89,450,038 | |

(1)Balances for the three months ended December 31, 2023 include $9.6 million of interest income, ($3.0) million of interest expense, and ($5.9) million of fair value and other adjustments, net related to the consolidated securitization. Balances for the three months ended December 31, 2024 include $5.9 million of interest income, ($2.1) million of interest expense, and ($3.8) million of fair value and other adjustments, net related to the consolidated securitization. Balances for the year ended December 31, 2023 include $19.7 million of interest income, ($6.7) million of interest expense, and ($5.5) million of fair value and other adjustments, net related to the consolidated securitization. Balances for the year ended December 31, 2024 include $29.0 million of interest income, ($9.6) million of interest expense, and ($29.4) million of fair value and other adjustments, net related to the consolidated securitization.

UPSTART HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS and COMPREHENSIVE LOSS

(In Thousands, Except Share and Per Share Data)

(Unaudited)

(2)The following table presents revenue from fees disaggregated by type of service for the periods presented as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Year Ended

December 31, |

| | 2023 | | 2024 | | 2023 | | 2024 |

| Revenue from fees, net: | | | | | | | | |

| Platform and referral fees, net | | $ | 118,261 | | | $ | 165,758 | | | $ | 414,120 | | | $ | 502,411 | |

| Servicing and other fees, net | | 34,585 | | | 33,518 | | | 146,311 | | | 133,055 | |

| Total revenue from fees, net | | $ | 152,846 | | | $ | 199,276 | | | $ | 560,431 | | | $ | 635,466 | |

UPSTART HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

| | | | | | | | | | | | | | |

| Year Ended December 31, | |

| 2023 | | | | 2024 | |

| Cash flows from operating activities | | | | | | |

| Net loss | $ | (240,132) | | | | | $ | (128,581) | | |

| Adjustments to reconcile net loss to net cash provided by (used in) operating activities: | | | | | | |

| | | | | | |

| Change in fair value of loans | 190,320 | | | | | 125,002 | | |

| Change in fair value of servicing assets | 22,171 | | | | | 16,490 | | |

| Change in fair value of servicing liabilities | (2,013) | | | | | (1,246) | | |

| Change in fair value of beneficial interest assets | 21,672 | | | | | 5,151 | | |

| Change in fair value of beneficial interest liabilities | 4,817 | | | | | 12,568 | | |

| Change in fair value of other financial instruments | (2,145) | | | | | 4,130 | | |

| Stock-based compensation | 175,039 | | | | | 133,400 | | |

| Gain on loan servicing rights, net | (13,713) | | | | | (15,449) | | |

| Gain on debt extinguishment | — | | | | | (33,361) | | |

| Depreciation and amortization | 24,903 | | | | | 20,549 | | |

| | | | | | |

| Loan premium amortization | (3,869) | | | | | (17,021) | | |

| Non-cash interest expense and other | 3,057 | | | | | 3,217 | | |

| Net changes in operating assets and liabilities: | | | | | | |

| | | | | | |

| | | | | | |

| Purchases of loans held-for-sale | (3,006,510) | | | | | (4,309,268) | | |

| | | | | | |

| Proceeds from sale of loans held-for-sale | 2,514,627 | | | | | 4,101,937 | | |

| Principal payments received for loans held-for-sale | 189,746 | | | | | 192,889 | | |

| Principal payments received for loans held by consolidated securitization | 24,832 | | | | | 47,997 | | |

| Payments on beneficial interest liabilities | (596) | | | | | (6,700) | | |

| Other assets | (8,932) | | | | | (8,690) | | |

| Operating lease liability and right-of-use asset | (6,822) | | | | | (807) | | |

| | | | | | |

Payable to investors for beneficial interest assets(1) | 5,792 | | | | | — | | |

| Accrued expenses and other liabilities | (3,956) | | | | | 44,124 | | |

| Net cash provided by (used in) operating activities | (111,712) | | | | | 186,331 | | |

| | | | | | |

| Cash flows from investing activities | | | | | | |

| | | | | | |

| Purchases and originations of loans held-for-investment | (157,223) | | | | | (323,096) | | |

| Proceeds from sale of loans held-for-investment | 972 | | | | | — | | |

| Principal payments received for loans held-for-investment | 102,446 | | | | | 145,266 | | |

| Principal payments received for notes receivable and repayments of residual certificates | 4,328 | | | | | 5,917 | | |

| Settlements of beneficial interest assets | — | | | | | (4,469) | | |

| Purchases of property and equipment | (1,527) | | | | | (837) | | |

| Capitalized software costs | (10,559) | | | | | (9,153) | | |

| Acquisition of beneficial interest assets | (56,892) | | | | | (63,284) | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Proceeds from beneficial interest assets | — | | | | | 11,930 | | |

| | | | | | |

| Net cash used in investing activities | (118,455) | | | | | (237,726) | | |

| | | | | | |

| Cash flows from financing activities | | | | | | |

| | | | | | |

| Proceeds from warehouse borrowings | 626,910 | | | | | 387,281 | | |

UPSTART HOLDINGS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In Thousands)

| | | | | | | | | | | | | | |

| Year Ended December 31, | |

| 2023 | | | | 2024 | |

| Proceeds from convertible notes issuance, net of debt issuance costs paid to lender | — | | | | | 913,440 | | |

| Payment of debt issuance costs to third party | — | | | | | (3,945) | | |

| Repayments of warehouse borrowings | (575,937) | | | | | (357,352) | | |

| Payments for repurchases of convertible notes | — | | | | | (325,344) | | |

| Purchase of capped calls | — | | | | | (40,883) | | |

| Settlement of capped calls | — | | | | | 580 | | |

| | | | | | |

| | | | | | |

| Principal payments made on securitization notes | (23,320) | | | | | (55,368) | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Payable to investors(1) | (48,781) | | | | | 12,385 | | |

| Proceeds from issuance of securitization notes | 165,318 | | | | | — | | |

| Proceeds from issuance of common stock under employee stock purchase plan | 8,431 | | | | | 7,685 | | |

| Proceeds from exercise of stock options | 12,881 | | | | | 21,414 | | |

| Taxes paid related to net share settlement of equity awards | (15) | | | | | (22) | | |

| | | | | | |

| | | | | | |

| Net cash provided by financing activities | 165,487 | | | | | 559,871 | | |

| Change in cash, cash equivalents and restricted cash | (64,680) | | | | | 508,476 | | |

| Cash, cash equivalents and restricted cash | | | | | | |

| Cash, cash equivalents and restricted cash at beginning of year | 532,467 | | | | | 467,787 | | |

| Cash, cash equivalents and restricted cash at end of year | $ | 467,787 | | | | | $ | 976,263 | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

(1)During the year ended December 31, 2024, the Company elected to change the presentation of changes in payable to investors balance on the consolidated statement of cash flows. Under the new presentation, a portion of the payable to investors balance related to fiduciary cash was reclassified from operating to financing activities.

UPSTART HOLDINGS, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In Thousands, Except Share and Per Share Data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | | | Year Ended December 31, |

| 2023 | | 2024 | | | | 2023 | | 2024 |

| Revenue from fees, net | $ | 152,846 | | | $ | 199,276 | | | | | $ | 560,431 | | | $ | 635,466 | |

| Loss from operations | (47,501) | | | (4,750) | | | | | (256,525) | | | (172,856) | |

| Operating Margin | (31) | % | | (2) | % | | | | (46) | % | | (27) | % |

Sales and marketing, net of borrower acquisition costs(1) | $ | 10,614 | | | $ | 11,231 | | | | | $ | 36,626 | | | $ | 41,783 | |

Customer operations, net of borrower verification and servicing costs(2) | 7,024 | | | 7,456 | | | | | 33,798 | | | 29,080 | |

| Engineering and product development | 57,152 | | | 67,222 | | | | | 280,138 | | | 253,653 | |

| General, administrative, and other | 55,772 | | | 60,427 | | | | | 212,388 | | | 230,935 | |

Interest income, interest expense, and fair value adjustments, net | 12,534 | | | (19,688) | | | | | 46,869 | | | (1,062) | |

| Contribution Profit | $ | 95,595 | | | $ | 121,898 | | | | | $ | 353,294 | | | $ | 381,533 | |

| Contribution Margin | 63 | % | | 61 | % | | | | 63 | % | | 60 | % |

(1)Borrower acquisition costs were $28.2 million and $44.2 million for the three months ended December 31, 2023 and 2024, respectively, and $90.5 million and $125.0 million for year ended December 31, 2023 and 2024, respectively. Borrower acquisition costs consist of our sales and marketing expenses adjusted to exclude costs not directly attributable to attracting a new borrower, such as payroll-related expenses for our business development and marketing teams, as well as other operational, brand awareness and marketing activities. These costs do not include reorganization expenses.

(2)Borrower verification and servicing costs were $29.1 million and $33.1 million for the three months ended December 31, 2023 and 2024, respectively, and $116.6 million and $128.9 million for year ended December 31, 2023 and 2024. Borrower verification and servicing costs consist of payroll and other personnel-related expenses for personnel engaged in loan onboarding, verification and servicing, as well as servicing system costs. It excludes payroll and personnel-related expenses and stock-based compensation for certain members of our customer operations team whose work is not directly attributable to onboarding and servicing loans. These costs do not include reorganization expenses.

UPSTART HOLDINGS, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In Thousands, Except Share and Per Share Data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

December 31, | | | | Year Ended

December 31, |

| | | 2023 | | 2024 | | | | 2023 | | 2024 |

| Total revenue | | | $ | 140,312 | | | $ | 218,964 | | | | | $ | 513,562 | | | $ | 636,528 | |

| Net loss | | | (42,398) | | | (2,755) | | | | | (240,132) | | | (128,581) | |

| Net Loss Margin | | | (30) | % | | (1) | % | | | | (47) | % | | (20) | % |

| Adjusted to exclude the following: | | | | | | | | | | | |

Stock-based compensation and certain payroll tax expenses(1) | | | $ | 33,409 | | | $ | 32,087 | | | | | $ | 178,400 | | | $ | 139,726 | |

| Depreciation and amortization | | | 9,103 | | | 4,699 | | | | | 24,903 | | | 20,549 | |

| Reorganization expenses | | | — | | | 603 | | | | | 15,536 | | | 4,382 | |

| Expense on convertible notes | | | 1,179 | | | 4,030 | | | | | 4,706 | | | 7,694 | |

| Gain on debt extinguishment | | | — | | | — | | | | | — | | | (33,361) | |

| Net gain on lease modification | | | (737) | | | — | | | | | (737) | | | — | |

| Provision for income taxes | | | 63 | | | 111 | | | | | 107 | | | 185 | |

| Adjusted EBITDA | | | $ | 619 | | | $ | 38,775 | | | | | $ | (17,217) | | | $ | 10,594 | |

| Adjusted EBITDA Margin | | | — | % | | 18 | % | | | | (3) | % | | 2 | % |

| | | | | | | | | | | |

(1)Payroll tax expenses include the employer payroll tax-related expense on employee stock transactions, as the amount is dependent on our stock price and other factors that are beyond our control and do not correlate to the operation of our business.

UPSTART HOLDINGS, INC.

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES

(In Thousands, Except Share and Per Share Data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended

December 31, | | | | Year Ended

December 31, |

| | | 2023 | | 2024 | | | | 2023 | | 2024 |

| Net loss | | | $ | (42,398) | | | $ | (2,755) | | | | | $ | (240,132) | | | $ | (128,581) | |

| Adjusted to exclude the following: | | | | | | | | | | | |

Stock-based compensation and certain payroll tax expenses(1) | | | 33,409 | | | 32,087 | | | | | 178,400 | | | 139,726 | |

| Reorganization expenses | | | — | | | 603 | | | | | 15,536 | | | 4,382 | |

| Gain on debt extinguishment | | | — | | | — | | | | | — | | | (33,361) | |

| Net gain on lease modification | | | (737) | | | — | | | | | (737) | | | — | |

Adjusted Net Income (Loss) | | | $ | (9,726) | | | $ | 29,935 | | | | | $ | (46,933) | | | $ | (17,834) | |

| Net loss per share: | | | | | | | | | | | |

| Basic | | | $ | (0.50) | | | $ | (0.03) | | | | | $ | (2.87) | | | $ | (1.44) | |

| Diluted | | | $ | (0.50) | | | $ | (0.03) | | | | | $ | (2.87) | | | $ | (1.44) | |

Adjusted Net Income (Loss) Per Share: | | | | | | | | | | | |

| Basic | | | $ | (0.11) | | | $ | 0.32 | | | | | $ | (0.56) | | | $ | (0.20) | |

| Diluted | | | $ | (0.11) | | | $ | 0.29 | | | | | $ | (0.56) | | | $ | (0.20) | |

| Weighted-average common shares outstanding: | | | | | | | | | | | |

| Basic | | | 85,569,351 | | | 92,174,306 | | | | | 83,765,896 | | | 89,450,038 | |

| Diluted | | | 85,569,351 | | | 103,118,327 | | | | | 83,765,896 | | | 89,450,038 | |

(1)Payroll tax expenses include the employer payroll tax-related expense on employee stock transactions, as the amount is dependent on our stock price and other factors that are beyond our control and do not correlate to the operation of our business.

v3.25.0.1

Cover Page

|

Feb. 11, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K/A

|

| Document Period End Date |

Feb. 11, 2025

|

| Entity Registrant Name |

Upstart Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39797

|

| Entity Tax Identification Number |

46-4332431

|

| Entity Address, Address Line One |

2950 S. Delaware Street

|

| Entity Address, Address Line Two |

Suite 410

|

| Entity Address, City or Town |

San Mateo

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94403

|

| City Area Code |

833

|

| Local Phone Number |

212-2461

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

UPST

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001647639

|

| Amendment Flag |

true

|

| Amendment Description |

On February 11, 2025, Upstart Holdings, Inc. (the “Company”) furnished a Current Report on Form 8-K that included a press release reporting its financial results for the fiscal quarter and full fiscal year ended December 31, 2024 (the “Original Form 8-K”). This Current Report on Form 8-K/A amends the Original 8-K solely for the purpose of correcting an error with respect to the Company’s diluted adjusted net income per share and diluted weighted-average common shares outstanding for the fiscal quarter ended December 31, 2024.

|

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

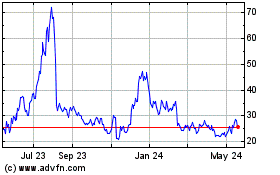

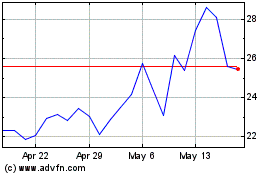

Upstart (NASDAQ:UPST)

Historical Stock Chart

From Jan 2025 to Feb 2025

Upstart (NASDAQ:UPST)

Historical Stock Chart

From Feb 2024 to Feb 2025