Upwork Inc. (Nasdaq: UPWK) (“Upwork” or the “Company”), the world’s

work marketplace that connects businesses with independent talent

across the globe, today announced a more streamlined organizational

structure and operational changes to continue the Company’s

profitable trajectory, increase efficiency, and accelerate

innovation for its customers.

“We are making ourselves a more streamlined and efficient

organization, continuing our successful focus on durable,

profitable growth and delivering value for our customers and

shareholders,” said Hayden Brown, president and CEO, Upwork. “This

is a continuation of our ongoing strategy to invest in growth

levers that are high-return and high-potential while demonstrating

proactive cost discipline.”

“Over the past year and a half, we made significant strides in

reaching our 5-year profitability target, achieving record-high 22%

adjusted EBITDA margin1 in our preliminary results for the third

quarter of 2024,” Brown added. “We are confident that these actions

will further our rapid progress toward our profitability goals,

fuel our outperformance of hiring and staffing industry peers, and

strengthen our ability to win in a dynamic macro environment.”

As part of the announced actions, Upwork is:

- Streamlining

organizational structure to further reduce costs

and accelerate decision-making that empowers teams to deliver

better outcomes for customers. The announced changes reduce

Upwork’s total workforce by 21% and are expected to generate

approximately $60 million in annualized cost savings. The Company

is flattening team structures and leveraging more automation and

third-party services to simplify processes and operate more

efficiently at scale.

- Optimizing R&D spend, as previously

indicated, on a portfolio of high-return and high-potential product

investments, along with rebalancing product and engineering

resources to enable teams to more effectively serve customer

needs.

- Sharpening Enterprise strategy, which remains

a key pillar of the Company’s growth plans, by aligning clients

with the right service offerings and driving a focus on

profitability through lower cost to acquire and serve customers.

This strategy leverages insights from successful pricing and

packaging work underway for the past several quarters to introduce

new client plans for both Marketplace and Enterprise that help

high-value customers grow with Upwork. Ernesto Lamaina has been

appointed as Upwork’s general manager of Enterprise and will lead

the execution and expansion of this strategy. Lamaina has been at

Upwork for more than a year and has deep experience building

enterprise products and leading business units within traditional

staffing providers. Lamaina previously served as CEO of Adia, a

joint program between Adecco and Infosys, where he led the creation

and commercialization of a tech-enabled staffing solution.

Preliminary Third Quarter 2024 Financial and Operating

Results“We are pleased to announce preliminary results for

the third quarter that exceed the top end of our guidance. These

results demonstrate our commitment to execution on both top and

bottom lines, driven by disciplined cost management and continuous

improvement in operational efficiency,” said Erica Gessert, CFO,

Upwork. “We remain relentlessly focused on executing our strategic

plan, growing our highly profitable business, and increasing

shareholder value.”

The announced actions are part of Upwork’s long-term strategy

that the Company has been successfully executing over many

quarters. Management’s focus on driving profitable growth has

resulted in the following to date:

- Industry-leading revenue growth: Upwork has

reported consistently higher revenue growth than competitors and

the broader staffing industry.2

- Sustainable margin expansion: Upwork has

delivered on margin expansion and continues the march toward its

5-year profitability target of 35% adjusted EBITDA margin. Upwork

has aggressively expanded margins by 21 points in the span of seven

quarters, from 1% in Q4 2022 to preliminary reported adjusted

EBITDA margin of 22% in Q3 2024.

Today, Upwork provided the following select estimated

preliminary financial and operating results for the third quarter

of 2024:

|

|

Preliminary Q3 2024 Results |

Original Q3 2024 Guidance |

|

GSV |

$998 million |

N/A |

|

Revenue |

$194 million |

$179 million to $184 million |

|

Net Income |

$28 million |

N/A |

|

Adjusted EBITDA1 |

$43 million |

$36 million to $39 million |

These unaudited preliminary results are based on management’s

initial analysis of operations for the quarter ended September 30,

2024. As such, these preliminary financial and operating results

are estimates and subject to the completion of the Company’s normal

quarter-end closing and other review procedures and execution of

the Company’s internal control over financial reporting for the

quarter ended September 30, 2024. Accordingly, actual financial and

operating results that will be reflected in the Company’s Quarterly

Report on Form 10-Q for the three months ended September 30, 2024,

including its condensed consolidated financial statements when they

are completed and publicly disclosed, may differ materially from

these preliminary results.

Third Quarter 2024 Financial Results

Conference Call and WebcastUpwork announced that it will

report its full financial results for the third quarter of 2024 on

Wednesday, November 6, 2024, after market close. The Company will

host a Q&A conference call to discuss these results at 2:00

p.m. Pacific Time (5:00 p.m. Eastern Time) on the same day.

A live webcast of the call will be available on the Upwork

Investor Relations website at investors.upwork.com. An audio replay

of the conference call will be available for one week following the

call and will be archived via webcast on the Upwork Investor

Relations website for approximately one year.

About Upwork

Upwork is the world’s work marketplace that connects businesses

with independent talent from across the globe. We serve everyone

from one-person startups to large, Fortune 100 enterprises with a

powerful, trust-driven platform that enables companies and talent

to work together in new ways that unlock their potential. Our

talent community earned over $3.8 billion on Upwork in 2023 across

more than 10,000 skills in categories including website & app

development, creative & design, data science & analytics,

customer support, finance & accounting, consulting, and

operations. Learn more at upwork.com and join us on LinkedIn,

Facebook, Instagram, TikTok and X.

SAFE HARBOR

This press release of Upwork contains "forward-looking"

statements within the meaning of the federal securities laws.

Forward-looking statements include all statements other than

statements of historical fact, including any statements regarding

our estimated preliminary financial and operating results for the

third quarter 2024, future operating results and financial

position, information or predictions concerning the future of our

business or strategy, anticipated events and trends, potential

growth or growth prospects, competitive position, technological and

market trends, the expected impact of cost-saving initiatives, and

other future conditions.

We have based these forward-looking statements largely on our

current expectations and projections as of the date hereof about

future events and trends that we believe may affect our financial

condition, results of operations, business strategy, short-term and

long-term business operations and objectives, and financial needs.

As such, they are subject to inherent uncertainties, known and

unknown risks, and changes in circumstances that are difficult to

predict and in many cases outside our control, and you should not

rely on such forward-looking statements as predictions of future

events. We make no representation that the projected results will

be achieved or that future events and circumstances will occur, and

actual results may differ materially and adversely from our

expectations. The forward-looking statements are made as of the

date hereof, and we do not undertake, and expressly disclaim, any

obligation to update or revise any forward-looking statements, to

conform these statements to actual results, or to make changes in

our expectations, except as required by law. Additional information

regarding the risks and uncertainties that could cause actual

results to differ materially from our expectations is included

under the caption "Risk Factors" in our Quarterly Report on Form

10-Q filed with the SEC on August 7, 2024, and in our other SEC

filings, which are available on our Investor Relations website at

investors.upwork.com and on the SEC’s website at www.sec.gov.

Non-GAAP Financial Measures

To supplement our financial measures prepared in accordance with

accounting principles generally accepted in the United States

(“GAAP”), we present certain non-GAAP financial measures in this

press release, including adjusted EBITDA and adjusted EBITDA

margin.

We define adjusted EBITDA as net income adjusted for stock-based

compensation expense; depreciation and amortization; other income

(expense), net, which includes interest expense; income tax benefit

(provision); and, if applicable, certain other gains, losses,

benefits, or charges that are non-cash or are significant and the

result of isolated events or transactions that have not occurred

frequently in the past and are not expected to occur regularly in

the future.

We use non-GAAP financial measures in conjunction with financial

measures prepared in accordance with GAAP for planning purposes,

including the preparation of our annual operating budget, as a

measure of our core operating results and the effectiveness of our

business strategy, and in evaluating our financial performance.

These non-GAAP financial measures provide consistency and

comparability with past financial performance, facilitate

period-to-period comparisons of our core operating results, and

also facilitate comparisons with other peer companies, many of

which use similar non-GAAP financial measures to supplement their

GAAP results. In addition, adjusted EBITDA is widely used by

investors and securities analysts to measure a company’s operating

performance without regard to certain items that can vary

substantially from company to company.

Investors are cautioned that there are material limitations

associated with the use of non-GAAP financial measures as

analytical tools, and investors should not consider them in

isolation or as a substitute for the most directly comparable

financial measures prepared in accordance with GAAP. In particular,

(1) adjusted EBITDA excludes stock-based compensation expense,

which has recently been, and will continue to be for the

foreseeable future, a significant recurring expense for our

business and an important part of our compensation strategy, (2)

although depreciation and amortization expense are non-cash

charges, the assets subject to depreciation and amortization may

have to be replaced in the future, and adjusted EBITDA does not

reflect cash capital expenditure requirements for such replacements

or for new capital expenditure requirements, and (3) adjusted

EBITDA does not reflect: (a) changes in, or cash requirements for,

our working capital needs; (b) interest expense, or the cash

requirements necessary to service interest or principal payments on

our debt, which reduces cash available to us; or (c) tax payments

that may represent a reduction in cash available to us. In

addition, the non-GAAP measures we use may be different from

non-GAAP financial measures used by other companies, including

companies in our industry, limiting their usefulness for comparison

purposes. We compensate for these limitations by providing specific

information regarding the GAAP items excluded from the non-GAAP

financial measures that we present. Reconciliations of the non-GAAP

financial measures presented in this press release to their most

directly comparable GAAP financial measures have been provided

below, and investors are encouraged to review the reconciliations

and not rely on any single financial measure to evaluate our

business.

UPWORK

INC.RECONCILIATION OF GAAP TO NON-GAAP

RESULTS(in thousands, except for

percentages)(preliminary)

|

|

Three Months Ended September 30, |

|

Nine Months Ended September

30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net income |

$ |

27,758 |

|

|

$ |

16,337 |

|

|

$ |

68,420 |

|

|

$ |

29,513 |

|

| Add back (deduct): |

|

|

|

|

|

|

|

| Stock-based compensation

expense |

|

18,578 |

|

|

|

17,811 |

|

|

|

54,758 |

|

|

|

56,148 |

|

| Depreciation and

amortization |

|

3,668 |

|

|

|

1,763 |

|

|

|

10,443 |

|

|

|

5,641 |

|

| Other income, net3 |

|

(8,091 |

) |

|

|

(5,766 |

) |

|

|

(20,433 |

) |

|

|

(52,748 |

) |

| Income tax provision |

|

1,126 |

|

|

|

895 |

|

|

|

3,636 |

|

|

|

3,547 |

|

| Other4 |

|

188 |

|

|

|

188 |

|

|

|

563 |

|

|

|

563 |

|

| Adjusted EBITDA |

$ |

43,227 |

|

|

$ |

31,228 |

|

|

$ |

117,387 |

|

|

$ |

42,664 |

|

| Profit margin |

|

14 |

% |

|

|

9 |

% |

|

|

12 |

% |

|

|

6 |

% |

| Adjusted EBITDA margin |

|

22 |

% |

|

|

18 |

% |

|

|

20 |

% |

|

|

8 |

% |

| |

|

|

|

|

|

|

|

Contacts

Media:Rachel Durfee, VP of Communicationspress@upwork.com

Investors:Samuel Meehan, VP of Investor

Relationsinvestor@upwork.com

1 Adjusted EBITDA and adjusted EBITDA margin are non-GAAP

financial measures and are presented for supplemental purposes

only, and should not be considered in isolation or as substitutes

for financial information presented in accordance with GAAP. An

explanation of non-GAAP financial measures and reconciliations to

their most directly comparable GAAP financial measures can be found

in the “Non-GAAP Financial Measures” section at the end of this

press release. 2 In 2023, Upwork grew revenues +11% year-over-year

compared to overall staffing industry revenue decline of (5)%

year-over-year. In the first half of 2024, Upwork grew revenues

+17% year-over-year compared to overall staffing industry declines

of (8)% year-over-year. 3 During the nine months ended September

30, 2023, we recognized a gain of $38.9 million on the early

extinguishment of a portion of our 0.25% convertible senior notes

due 2026, which is included in other income, net.4 During the three

and nine months ended September 30, 2024 and 2023, we incurred $0.2

million and $0.6 million, respectively, of expenses related to our

Tides Foundation warrant.

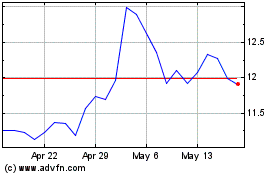

Upwork (NASDAQ:UPWK)

Historical Stock Chart

From Oct 2024 to Nov 2024

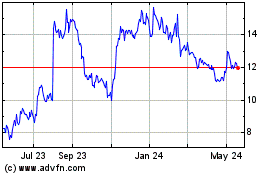

Upwork (NASDAQ:UPWK)

Historical Stock Chart

From Nov 2023 to Nov 2024