via NewMediaWire – Utah Medical Products, Inc. [Nasdaq: UTMD]

achieved second calendar quarter (2Q) and first half (1H) 2023

financial results consistent with those anticipated in its

beginning of year projections.

Currencies in this release are denoted as $ or USD

= U.S. Dollars; AUD = Australia Dollars; £ or GBP = UK Pound

Sterling; C$ or CAD = Canadian Dollars; and € or EUR = Euros.

Currency amounts throughout this report are in thousands, except

per share amounts and where noted. Because of the relatively short

span of time, results for any given three-month period in

comparison with a previous three-month period may not be indicative

of comparative results for the year as a whole.

Overview of Results

In brief, consolidated total 1H 2023 revenues were

only $366 lower compared to 1H 2022 despite $630 lower

biopharmaceutical OEM sales post COVID-pandemic, which was

anticipated at the beginning of the year. Despite the lower sales,

and combined with continued supply chain disruption challenges,

UTMD’s 1H gross profit margin improved, yielding total gross profit

almost the same for the first half of the year. Operating Income,

however, declined $715 (7.5%) as a result of unusual litigation

expenses related to yet unresolved Filshie clip product liability

claims in the U.S. However, because UTMD realized $1,236 higher

interest income on its cash balances, Net Income for 1H 2023 was up

10% compared to 1H 2022. The following is an income statement line

item comparison of 2Q and 1H 2023 with 2Q and 1H 2022, according to

U.S. Generally Accepted Accounting Principles (US GAAP):

| |

2Q |

1H |

| |

(April – June) |

(January-June) |

| Revenues

(Sales): |

-4% |

-1% |

| Gross Profit

(GP): |

-5% |

-1% |

| Operating Income

(OI): |

-12% |

-7% |

| Income Before Tax

(EBT): |

-1% |

6% |

| Net Income

(NI): |

2% |

10% |

| Earnings Per

Share (EPS): |

3% |

11% |

Profit margins in 2Q and 1H 2023 compared to 2Q and 1H 2022

follow:

|

|

2Q 2023 |

2Q 2022 |

1H 2023 |

1H 2022 |

|

(Apr – Jun) |

(Apr – Jun) |

(Jan – Jun) |

(Jan – Jun) |

| Gross Profit

Margin (GP/ sales): |

60.10% |

60.70% |

61.40% |

60.90% |

| Operating

Income Margin (OI/ sales): |

34.40% |

37.70% |

34.90% |

37.20% |

| Income B4 Tax

Margin (EBT/ sales): |

40.20% |

38.70% |

40.50% |

37.80% |

| Net Income

Margin (NI/ sales): |

32.60% |

30.60% |

33.10% |

29.70% |

| |

|

|

|

|

The lower consolidated revenues were primarily

attributable to a decline in sales to UTMD’s biopharmaceutical OEM

customer, although the Company was also not able to meet certain

direct U.S. demand due to lack of raw materials and third-party

sterilization capacity constraints. Outside the U.S. (OUS) revenues

were higher despite a stronger USD which reduced 1H 2023 foreign

currency sales $188 in USD terms. UTMD was able to achieve its

targeted GP margins with the help of recent price increases. The

dilution in OI margin was due to $463 higher 1H 2023 litigation

costs which are included in Operating Expense per US GAAP. However,

higher interest income included in non-operating income more than

offset the litigation costs, and allowed an expansion in EBT. The

additional expansion in NI and EPS was due to a lower estimated

income tax provision rate and fewer diluted shares due to share

repurchases during 2Q 2022. Please see the income statements on the

last page of this report.

UTMD’s June 30, 2023 Balance Sheet continued

strong, with no debt. Ending Cash and Investments were $84.6

million on June 30, 2023 compared to $75.1 million on December 31,

2022. The June 30, 2023 cash balance resulted after paying $2.1

million in cash dividends to stockholders, increasing non-cash

working capital by $0.1 million (including inventories by $1.3

million) and making $0.4 million in capital expenditures during 1H

2023. Please see the balance sheets on the last page of this

report.

Revenues (sales) -2Q 2023

Total consolidated 2Q 2023 UTMD worldwide (WW)

sales in USD terms were $562 (4.2%) lower than in 2Q 2022.

In 2Q 2023, OUS sales growth continued to

outperform domestic sales growth. In 2Q 2023 compared to 2Q 2022,

OUS sales were $250 (+4.5%) higher and U.S. domestic sales were

$812 (10.4%) lower. $445 of the $562 lower total 2Q sales were

sales of pressure monitoring devices and accessories to UTMD’s

largest OEM customer, shipped from both the U.S. and Ireland. WW 2Q

Filshie device sales were $94 (+3.1%) higher.

The portion of OUS sales invoiced in foreign

currencies in USD terms were 33% of total WW consolidated 2Q 2023

sales compared to 29% in 2Q 2022. An average lower USD foreign

currency exchange (FX) rate added $35 (+0.3%) for 2Q sales invoiced

in foreign currencies. Actually, a stronger EUR by itself added

$70. The GBP was about the same, and both the CAD and AUD were

weaker. FX rates for income statement purposes are

transaction-weighted averages. The average FX rates from the

applicable foreign currency to USD during 2Q 2023 and 2Q 2022 for

revenue purposes follow:

2Q

2023 2Q 2022

Change

GBP

1.2531

1.2525 -

EUR

1.0845

1.0571 +2.6%

AUD

0.6700

0.7178 ( 6.7%)

CAD

0.7449

0.7847 ( 5.1%)

The $35 weighted average favorable impact on 2Q

2023 foreign currency OUS sales was 0.8%. In constant currency

terms, foreign currency sales in 2Q 2023 were 3.8% higher than in

2Q 2022. “Constant currency” sales means exchanging foreign

currency sales into USD-denominated sales at the same FX rate as

was in the previous period of time being compared. With a weaker

USD in converting 2Q EUR foreign currency sales, WW constant

currency sales were $597 lower (4.4%) than in 2Q 2022, which was

the second highest sales quarter of 2022.

Total OUS sales in 2Q 2023 were $5,849 compared to

$5,599 in 2Q 2022. OUS sales invoiced in foreign currencies are due

to direct end-user sales in Ireland, the UK, France, Canada,

Australia and New Zealand, and to shipments to OUS distributors of

products manufactured by UTMD subsidiaries in Ireland and the UK.

Export sales from the U.S. to OUS distributors are invoiced in USD.

Direct to end-user OUS 2Q 2023 sales in USD terms (including the

impact of FX rate differences) were 13% higher in Ireland with the

EUR FX rate up about 3%, 18% lower in Canada with the CAD FX rate

down 5%, 10% higher in the UK with the GBP FX rate about the same,

19% lower in Australia/New Zealand with the AUD FX rate down 7%,

and 3% higher in France with the EUR FX rate up 3%. USD-denominated

sales to OUS distributors were 8% higher in 2Q 2023 than in 2Q

2022.

Domestic U.S. sales in 2Q 2023 were $7,017

compared to $7,829 in 2Q 2022. Domestic sales are invoiced in USD

and not subject to FX rate fluctuations. The components of domestic

sales include 1) “direct non-Filshie device sales” of UTMD’s

medical devices to user facilities (and med/surg stocking

distributors for hospitals), 2) “OEM sales” of components and other

products manufactured by UTMD for other medical device and

non-medical device companies, and 3) “domestic Filshie device

sales”. UTMD separates domestic Filshie device sales from other

medical device sales direct to medical facilities because UTMD is

simply a distributor for Femcare in the U.S. Direct non-Filshie

device sales, representing 52% of total domestic sales, were $326

(8.1%) lower in 2Q 2023 than in 2Q 2022. Direct U.S. sales,

particularly for NICU devices, were hindered by continuing supply

chain disruption on the availability of raw materials and a lack of

third party sterilization capacity. Domestic OEM sales,

representing 31% of total domestic sales, were $525 (19.6%) lower.

Domestic Filshie device sales, representing 17% of total domestic

sales, were $38 (+3.3%) higher in 2Q 2023 compared to 2Q 2022.

Sales -1H 2023

Total consolidated 1H 2023 UTMD WW sales in USD

terms were $366 (1.4%) lower than in 1H 2022. Because an average

stronger USD reduced 1H foreign currency sales by $188 (0.7%),

constant currency 1H 2023 consolidated total sales were just $178

(0.7%) lower. Combined sales of pressure monitoring devices and

accessories to UTMD’s largest OEM customer, shipped from the U.S.

and Ireland were $630 lower in 1H 2023 compared to 1H 2022, more

than accounting for the lower total sales. WW 1H 2023 Filshie

device sales were $407 (+6.7%) higher.

In 1H 2023, OUS sales growth continued to

outperform domestic sales growth. In 1H 2023 compared to 1H 2022,

OUS sales were $1,245 (+12.5%) higher and U.S. domestic sales were

$1,611 (10.2%) lower.

Total OUS sales in 1H 2023 were $11,184 compared

to $9,938 in 1H 2022. The portion of OUS sales invoiced in foreign

currencies in USD terms were 31% of total WW consolidated 1H 2023

sales compared to 26% in 1H 2022. FX rates for income statement

purposes are transaction-weighted averages. The average FX rates

from the applicable foreign currency to USD during 1H 2023 and 1H

2022 for revenue purposes follow:

1H

2023 1H 2022

Change

GBP

1.2329

1.2886 ( 4.3%)

EUR

1.0819

1.0852 ( 0.3%)

AUD

0.6774

0.7206 ( 6.0%)

CAD

0.7419

0.7866 ( 5.7%)

The weighted-average FX rate negative impact on 1H

2023 foreign currency OUS sales was 2.4%. In constant currency

terms, foreign currency sales in 1H 2023 were 18.2% higher than in

1H 2022. In constant currency terms, 1H 2023 OUS total sales were

up 14.4%.

Direct to end-user OUS 1H 2023 sales in USD terms

(including the impact of FX rate differences) were about the same

in Ireland with the EUR FX rate also about the same, 10% lower in

Canada with the CAD FX rate down 6%, 24% higher in the UK with the

GBP FX rate down 4%, 11% lower in Australia/New Zealand with the

AUD FX rate down 6%, and 10% higher in France with the EUR FX rate

about the same as in 1H 2022. USD-denominated sales to OUS

distributors were 15% higher in 1H 2023 than in 1H 2022.

Domestic U.S. sales in 1H 2023 were $14,202

compared to $15,813 in 1H 2022. Direct non-Filshie device sales,

representing 51% of total domestic sales, were $698 (8.7%) lower in

1H 2023 than in 1H 2022, led by a $567 decline in domestic neonatal

device sales due to continued supply chain disruption. Domestic OEM

sales, representing 32% of total domestic sales, were $900 (16.8%)

lower. Domestic Filshie device sales, representing 17% of total

domestic sales, were $13 (0.5%) lower in 1H 2023 compared to 1H

2022.

Gross Profit (GP)

GP results from subtracting the cost of goods sold

(CGS), comprised of costs of production, manufacturing engineering,

depreciation of equipment, maintenance and repairs, quality

assurance including regulatory compliance, and purchasing including

freight for receiving materials from suppliers, from revenues. CGS

is divided into three categories: direct labor, raw materials and

manufacturing overhead. Direct labor and raw materials are

predominantly variable costs, i.e. vary directly with revenues. MOH

contains predominantly fixed costs relative to the Company’s

infrastructure, for example, supervision and engineering

personnel.

UTMD’s 2Q 2023 GP was $412 (5.1%) lower than in 2Q

2022 due to a lower GP margin (GP divided by sales, GPM) on 4.2%

lower sales. The 2Q 2023 GPM was 60.1% compared to 60.7% in 2Q

2022. 1H 2023 GP was just $102 (0.7%) lower than in 1H 2022,

although sales were 1.4% lower, because UTMD’s GPM was higher in 1H

2023 than in 1H 2022. The 1H 2023 GPM was 61.4% compared to 60.9%

in 1H 2022. UTMD’s 2023 GPMs remained consistent with long-term

profitability goals.

Higher MOH costs with lower sales was the primary

reason for the 2Q 2023 lower GPM, as a result of adding production

supervision, engineering and management personnel, in addition to

two cost-of-living increases for all manufacturing employees since

the end of 2Q 2022. Incoming freight costs stabilized. Direct labor

productivity was consistent with past periods of time, despite the

cost-of-living increases due to price increases. Purchases of

higher quantities of raw materials helped keep incremental raw

material costs under relative control.

Operating Income (OI)

OI results from subtracting Operating Expenses

(OE) from GP. OE are comprised of Sales and Marketing (S&M)

expenses, General and Administrative (G&A) expenses and Product

Development (R&D) expenses.

OI in 2Q 2023 of $4,425 was $632 (12.5%) lower

compared to 2Q 2022 OI of $5,057. The $632 lower OI can be

explained by $412 lower GP combined with $115 higher litigation

expense (captured in the G&A OE category) and $125 higher

salaries included in WW OE categories (including payroll taxes and

medical plan expense) for about the same number of people as in 2Q

2022. UTMD’s 2Q 2023 OI Margin (OI as a percentage of sales)

remained a healthy 34.4%.

OI in 1H 2023 was $8,864 compared to $9,579 in 1H

2022, a decrease of $715 (7.5%), representing a healthy 1H 2023 OI

margin of 34.9%. The decrease in 1H 2023 OI can be explained by

$102 lower GP combined with $463 higher litigation expense and $207

higher salaries included in WW OE categories for about the same

number of people as in 1H 2022. The higher salaries were from

cost-of-living adjustments necessary to mitigate high

inflation.

The following table summarizes OE in 2Q and 1H

2023 compared to the same periods in 2022 by OE category:

| OE

Category |

2Q 2023 |

% of sales |

2Q 2022 |

% of sales |

1H 2023 |

% of sales |

1H 2022 |

% of

sales |

|

S&M: |

$ |

405 |

3.2 |

$ |

357 |

2.7 |

$ |

792 |

3.1 |

$ |

693 |

2.7 |

|

G&A: |

|

2,775 |

21.6 |

|

2,602 |

19.3 |

|

5,648 |

22.3 |

|

5,153 |

20.0 |

|

R&D: |

|

133 |

1.0 |

|

135 |

1.0 |

|

277 |

1.1 |

|

258 |

1.0 |

| Total

OE: |

|

3,313 |

25.8 |

|

3,094 |

23.0 |

|

6,717 |

26.5 |

|

6,104 |

23.7 |

An average stronger USD helped decrease foreign

currency OE when converted to USD by $4 in 2Q 2023 and $85 in 1H

2023, which were relatively minor impacts The following table

summarizes “constant currency” OE in 2Q and 1H 2023 compared to the

same periods in 2022 by OE category:

| OE

Category |

2Q 2023 const FX |

|

2Q 2022 |

|

1H 2023 const FX |

|

1H 2022 |

|

|

S&M: |

$ |

406 |

|

$ |

357 |

|

$ |

799 |

|

$ |

693 |

|

|

G&A: |

|

2,778 |

|

|

2,602 |

|

|

5,725 |

|

|

5,153 |

|

|

R&D: |

|

133 |

|

|

135 |

|

|

278 |

|

|

258 |

|

| Total

OE: |

|

3,317 |

|

|

3,094 |

|

|

6,802 |

|

|

6,104 |

|

G&A expenses dominate UTMD’s OE, largely

because of non-cash expenses from the amortization of Identifiable

Intangible Assets (IIA) associated with the Filshie Clip System,

which were about 57% of G&A expenses in 2023. A segmentation of

USD-denominated G&A expenses by subsidiary follows:

| G&A Exp

Category |

2Q 2023 |

% of sales |

2Q 2022 |

% of sales |

1H 2023 |

% of sales |

1H 2022 |

% of

sales |

| IIA Amort-

UK: |

$ |

498 |

3.9 |

$ |

498 |

3.7 |

$ |

981 |

3.9 |

$ |

1,030 |

4.0 |

| IIA Amort–

CSI: Other– UK: U.S. Litigation Other– US: IRE: AUS: CAN: Total

G&A: |

|

1,105 163 280 588 69 35 37 2,775 |

8.6 21.6 |

|

1,105 142 165 528 85 42 37 2,602 |

8.2 19.3 |

|

2,210 327 689 1,150 153 69 69 5,648 |

8.7 22.2 |

|

2,210 296 226 1,082 152 85 72 5,153 |

8.6

20.0 |

OUS G&A expenses were $802 in 2Q 2023 compared

to $804 in 2Q 2022. OUS G&A expenses were $1,599 in 1H 2023

compared to $1,635 in 1H 2022. A stronger USD reduced OUS G&A

expenses by$2 in 2Q 2023 and by $76 in 1H 2023. The table below

identifies “constant currency” OUS G&A expenses for 2Q and 1H

2023 compared to the same periods in 2022:

| G&A Exp

Category |

2Q 2023 const FX |

|

2Q 2022 |

|

1H 2023 const FX |

|

1H 2022 |

|

| IIA Amort-

UK: |

$ |

498 |

|

$ |

498 |

|

$ |

1,030 |

|

$ |

1,030 |

|

| Other– UK:

IRE: AUS: CAN: Total G&A: |

|

163

67 37 39 804 |

|

|

142

85 42 37 804 |

|

|

344

155 73 73 1,675 |

|

|

296

152 85 72 1,635 |

|

S&M OE were $48 and $99 higher in 2Q 2023 and

1H 2023 compared to the same periods in 2022 respectively. The

differences were due to one additional S&M person in the U.S.

together with cost-of-living adjustments, offset slightly by $1 and

$7 lower OUS S&M expenses in 2Q 2023 and 1H 2023 respectively

due to a stronger USD.

Period to period product development (R&D)

expenses varied slightly depending on specific project costs. Since

almost all R&D is being carried out in the U.S., there was

negligible FX rate impact.

Income Before Tax (EBT)

EBT results from subtracting net non‑operating

expense (NOE) or adding net non-operating income (NOI) from or to,

as applicable, OI. Consolidated 2Q 2023 EBT was $5,172 (40.2% of

sales) compared to $5,199 (38.7% of sales) in 2Q 2022. Consolidated

1H 2023 EBT was $10,291 (40.5% of sales) compared to $9,729 (37.8%

of sales) in 1H 2022.

NOE/NOI includes the combination of 1) expenses

from loan interest and bank fees; 2) expenses or income from losses

or gains from remeasuring the value of EUR cash bank balances in

the UK, and GBP cash balances in Ireland, in USD terms on June 30,

2023; and 3) income from rent of underutilized property, investment

income and royalties received from licensing the Company’s

technology. Negative NOE is NOI. Net NOI in 2Q 2023 was $747

compared to $142 net NOI in 2Q 2022. Net NOI in 1H 2023 was $1,427

compared to $150 net NOI in 1H 2022. With higher cash balances and

higher interest rates in 2023 compared to 2022, UTMD received more

interest income.

EBITDA is a non-US GAAP metric that measures

profitability performance without factoring in effects of

financing, accounting decisions regarding non-cash expenses,

capital expenditures or tax environments. Management believes that

this operating performance metric provides meaningful supplemental

information to both management and investors and confirms UTMD’s

ongoing excellent financial operating performance, as well as its

ability to sustain performance during a challenging economic

time.

Excluding the noncash effects of depreciation,

amortization of intangible assets and stock option expense, 2Q 2023

consolidated EBT excluding the remeasured bank balance currency

gain or loss (“adjusted consolidated EBITDA”) was $6,996 compared

to $7,005 in 2Q 2022. Adjusted consolidated EBITDA at $13,916 in 1H

2023 was 4% higher compared to $13,376 in 1H 2022. Adjusted

consolidated trailing twelve months’ (TTM) EBITDA was $28,431 as of

June 30, 2023.

UTMD’s adjusted consolidated EBITDA as a

percentage of sales (EBITDA margin) was 54.4% in 2Q 2023 compared

to 52.2% in 2Q 2022. UTMD’s EBITDA margin was 54.8% in 1H 2023

compared to 51.9% in 1H 2022. The higher 2023 EBITDA margins

reflect that the increase in interest income on cash balances

(non-operating income) was substantially higher than the increase

in litigation expenses (G&A OE). Management believes that

current EBITDA margins demonstrate continued outstanding operating

performance.

UTMD’s non-US GAAP adjusted consolidated EBITDA is

the sum of the elements in the following table, each element of

which is a US GAAP number:

| |

2Q 2023 |

2Q 2022 |

1H 2023 |

1H 2022 |

|

|

| EBT |

$ |

5,172 |

$ |

5,199 |

$ |

10,291 |

$ |

9,729 |

|

|

| Depreciation

Expense |

|

155 |

|

153 |

|

310 |

|

302 |

|

|

| Femcare IIA

Amortization Expense |

|

498 |

|

498 |

|

981 |

|

1,030 |

|

|

| CSI IIA

Amortization Expense |

|

1,105 |

|

1,105 |

|

2,211 |

|

2,211 |

|

|

| Other

Non-Cash Amortization Expense |

|

8 |

|

8 |

|

16 |

|

16 |

|

|

| Stock Option

Compensation Expense Interest Expense |

50 - |

40 - |

100 - |

83 - |

|

|

|

Remeasured Foreign Currency Balances |

|

8 |

|

2 |

|

7 |

|

5 |

|

|

|

UTMD non-US GAAP EBITDA: |

$ |

6,996 |

$ |

7,005 |

$ |

13,916 |

$ |

13,376 |

|

|

Net Income (NI)

Despite slightly lower EBT, NI in 2Q 2023 of

$4,200 (32.6% of sales) was 2.3% higher than the NI of $4,103

(30.6% of sales) in 2Q 2022. The higher NI was due to a greater

proportion of UTMD’s EBT generated in Ireland with the lowest

corporate income tax rate and a portion of U.S. non-operating

income being federally tax-exempt, offset by a higher UK corporate

tax rate beginning with 2Q 2023. The average consolidated income

tax provision rate (as a % of the same period EBT) in 2Q 2023 was

18.8% compared to 21.1% in 2Q 2022.

Because 1H 2023 EBT was 5.8% higher than in 1H

2022, 1H 2023 NI of $8,414 (33.1% of sales) obtained further

leverage yielding 10.2% higher NI than the NI of $7,638 (29.7% of

sales) in 1H 2022. The average consolidated income tax provision

rate (as a % of the same period EBT) in 1H 2023 was 18.2% compared

to 21.5% in 1H 2022.

The consolidated income tax provision rate varies

as the mix in taxable income among U.S. and foreign subsidiaries

with differing income tax rates differs from period to period.

Except for the UK, in which the corporate income tax rate changed

to 25% from 19% on April 1, 2023, the basic corporate income tax

rates in each of the sovereignties were the same as in the prior

year.

Earnings per share (EPS)

Diluted EPS in 2Q 2023 were $1.154 compared to

diluted EPS of $1.124 in 2Q 2022, a 2.7% increase. Diluted EPS in

1H 2023 were $2.313 compared to diluted EPS of $2.088 in 1H 2022, a

10.8% increase. The increases in EPS were higher than the increases

in NI as a result of fewer diluted shares.

Diluted shares were 3,638,566 in 2Q 2023 compared

to 3,650,242 in 2Q 2022. Diluted shares were 3,637,715 in 1H 2023

compared to 3,657,864 in 1H 2022. The lower diluted shares in both

periods of 2023 were the result of shares repurchased during 2Q

2022, offset by employee options exercised and a slightly higher

dilution factor for unexercised options. The number of shares added

as a dilution factor in 2Q 2023 was 10,288 compared to 7,375 in 2Q

2022. The number of shares added as a dilution factor in 1H 2023

was 9,660 compared to 9,069 in 1H 2022.

The number of shares used for calculating EPS was

higher than period-ending outstanding shares because of a

time-weighted calculation of average outstanding shares plus

dilution from unexercised employee and director options.

Outstanding shares at the end of 2Q 2023 were 3,628,988 compared to

3,627,767 at the end of calendar year 2022. The difference was due

to 1,221 shares added from employee option exercises during 1H

2023. For comparison, outstanding shares were 3,624,932 at the end

of 2Q 2022. The total number of outstanding unexercised employee

and outside director options at June 30, 2023 was 66,025 at an

average exercise price of $73.78, including shares awarded but not

yet vested. This compares to 50,408 unexercised option shares at

the end of 2Q 2022 at an average exercise price of $69.07/ share,

including shares awarded but not vested. Option awards totaling

20,600 shares were made to 40 employees in October 2022 at an

exercise price of $82.60. No options have been awarded in 2023.

UTMD paid $1,070 ($0.295/share) in dividends to

stockholders in 2Q 2023 compared to $1,060 ($0.290/ share) paid in

2Q 2022. The dividends paid to stockholders during 2Q 2023 were 25%

of NI. UTMD paid $2,140 ($0.295/share) in dividends to stockholders

in 1H 2023 compared to $1,060 ($0.290/ share) paid in 1H 2022. The

dividends paid to stockholders during 1H 2023 were also 25% of NI.

The 1H 2022 dividend total excluded a dividend normally paid in

January. A special dividend of $7,309 ($2.00/share) was paid in

December 2021 in lieu of January 2022.

UTMD has not repurchased its shares since 2Q 2022.

In 2Q 2022, UTMD repurchased 30,105 shares for $2,495, an average

cost of $82.88/ share. Those were the only share repurchases in

2022. The Company retains the strong desire and financial ability

for repurchasing its shares at a price it believes is attractive

for remaining stockholders. UTMD’s closing share price at the end

of 2Q 2023 was $93.20, down 1.7% from the closing price of $94.77

at the end of 1Q 2023, and down 7.3% from the closing price of

$100.53 at the end of 2022. The closing share price one year ago at

the end of 2Q 2022 was $85.90.

Balance Sheet.

At June 30, 2023 compared to the end of 2022,

UTMD’s cash and investments increased $9,567 to $84,619 as a result

of 1H 2023 NP of $8,414 less $2,140 use of cash for dividends to

stockholders, coupled in particular with a $1,935 reduction in

receivables. At June 30, 2023, net Intangible Assets decreased to

16.2% of total consolidated assets from 19.2% on December 31, 2022.

UTMD’s strong 19.2 current ratio at June 30, 2023 was higher than

the 15.1 current ratio at December 31, 2022 as a result of higher

cash and inventory balances together with $933 lower accrued

liabilities. The average age of trade receivables was 25 days from

date of invoice at June 30, 2023 compared to 37 days at December

31, 2022, based on the most recent calendar quarter of sales.

Average inventory turns declined to 2.0 in 2Q 2023 compared to 2.5

for the last quarter of 2022 due to continued increases in safety

stocks of raw material.

Foreign currency exchange (FX) rates for Balance

Sheet purposes are the applicable rates at the end of each

reporting period. The FX rates from the applicable foreign currency

to USD for assets and liabilities at the end of 2Q 2023 compared to

the end of calendar year 2022 and the end of 2Q 2022 were

| |

6-30-23 |

12-31-22 |

Change |

6-30-22 |

Change |

| GBP |

1.27084 |

1.20771 |

5.2 |

% |

1.21601 |

4.5 |

% |

| EUR |

1.09178 |

1.06940 |

2.1 |

% |

1.04657 |

4.3 |

% |

| AUD |

0.66614 |

0.68050 |

(

2.1 |

%) |

0.69042 |

(

3.5 |

%) |

| CAD |

0.75547 |

0.73899 |

2.2 |

% |

0.77691 |

(

2.8 |

%) |

Financial ratios as of June 30, 2023 which may be

of interest to stockholders follow:

1) Current Ratio =

19.2

2) Days in Trade

Receivables (based on 2Q 2023 sales activity) = 25

3) Average Inventory

Turns (based on 2Q 2023 CGS) = 2.0

4) 2023 YTD ROE

(before dividends) = 14%

Investors are cautioned that this press release

contains forward looking statements and that actual events may

differ from those projected. Risk factors that could cause results

to differ materially from those projected include global economic

conditions, market acceptance of products, regulatory approvals of

products, regulatory intervention in current operations, government

intervention in healthcare and the economy in general, tax reforms,

the Company’s ability to efficiently manufacture, market and sell

products, cybersecurity and foreign currency exchange rates, among

other factors that have been and will be outlined in UTMD’s public

disclosure filings with the SEC.

Utah Medical Products, Inc., with particular

interest in health care for women and their babies, develops,

manufactures and markets a broad range of disposable and reusable

specialty medical devices recognized by clinicians in over one

hundred countries around the world as the standard for obtaining

optimal long term outcomes for their patients. For more information

about Utah Medical Products, Inc., visit UTMD’s website at

www.utahmed.com.

Utah Medical Products, Inc.

INCOME STATEMENT, Second Quarter (three months

ended June 30)

(in thousands except earnings per share):

| |

2Q 2023 |

2Q 2022 |

Percent Change |

|

|

| Net

Sales |

$ |

12,866 |

$ |

13,428 |

(4.2 |

%) |

|

|

|

Gross Profit |

|

7,739 |

|

8,151 |

(5.1 |

%) |

|

|

|

Operating Income |

|

4,425 |

|

5,057 |

(12.5 |

%) |

|

|

|

Income Before Tax |

|

5,172 |

|

5,199 |

(0.5 |

%) |

|

|

|

Net Income |

|

4,200 |

|

4,103 |

+ 2.3 |

% |

|

|

|

Earnings Per Share |

$ |

1.154 |

$ |

1.124 |

+ 2.7 |

% |

|

|

|

Shares Outstanding (diluted) |

|

3,639 |

|

3,650 |

|

|

|

INCOME STATEMENT, First Half (six months ended

June 30)

(in thousands except earnings per share):

| |

1H 2023 |

1H 2022 |

Percent Change |

|

|

| Net

Sales |

$ |

25,386 |

$ |

25,752 |

(1.4 |

%) |

|

|

|

Gross Profit |

|

15,581 |

|

15,683 |

(0.7 |

%) |

|

|

|

Operating Income |

|

8,864 |

|

9,579 |

(7.5 |

%) |

|

|

|

Income Before Tax |

|

10,291 |

|

9,729 |

+ 5.8 |

% |

|

|

|

Net Income |

|

8,414 |

|

7,638 |

+ 10.2 |

% |

|

|

|

Earnings Per Share |

$ |

2.313 |

$ |

2.088 |

+ 10.8 |

% |

|

|

|

Shares Outstanding (diluted) |

|

3,637 |

|

3,658 |

|

|

|

BALANCE SHEET

| (in

thousands) |

(unaudited) JUN 30,

2023 |

(unaudited) MAR 31,

2023 |

(audited) DEC 31,

2022 |

(unaudited) JUN 30,

2022 |

| Assets |

|

|

|

|

| Cash &

Investments |

$ |

84,619 |

$ |

80,912 |

$ |

75,052 |

$ |

66,224 |

| Accounts

& Other Receivables, Net |

|

3,603 |

|

3,818 |

|

5,538 |

|

4,938 |

|

Inventories |

|

10,118 |

|

9,940 |

|

8,814 |

|

7,338 |

| Other

Current Assets |

|

467 |

|

442 |

|

515 |

|

453 |

| Total

Current Assets |

|

98,807 |

|

95,112 |

|

89,919 |

|

78,953 |

| Property

& Equipment, Net |

|

10,541 |

|

10,241 |

|

10,224 |

|

10,591 |

| Intangible

Assets, Net |

|

21,127 |

|

22,417 |

|

23,731 |

|

26,605 |

| Total

Assets |

$ |

130,475 |

$ |

127,770 |

$ |

123,874 |

$ |

116,149 |

| Liabilities

& Stockholders’ Equity |

|

|

|

|

| Accounts

Payable |

|

1,336 |

|

1,027 |

|

1,218 |

|

818 |

| REPAT Tax

Payable |

|

419 |

|

419 |

|

419 |

|

220 |

| Other

Accrued Liabilities |

|

3,389 |

|

4,628 |

|

4,323 |

|

3,401 |

| Total

Current Liabilities |

$ |

5,144 |

$ |

6,074 |

$ |

5,960 |

$ |

4,439 |

| Deferred Tax

Liability – Intangible Assets |

|

1,370 |

|

1,456 |

|

1,513 |

|

1,707 |

| Long Term

Lease Liability Long Term REPAT Tax Payable |

|

315

1,256 |

|

328

1,256 |

|

341

1,256 |

|

368

1,675 |

| Deferred

Revenue and Income Taxes |

|

628 |

|

638 |

|

549 |

|

489 |

|

Stockholders’ Equity |

|

121,762 |

|

118,018 |

|

114,255 |

|

107,471 |

| Total

Liabilities & Stockholders’ Equity |

$ |

130,475 |

$ |

127,770 |

$ |

123,874 |

$ |

116,149 |

Contact: Brian Koopman (801) 566-1200

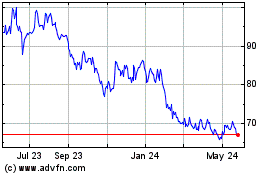

Utah Medical Products (NASDAQ:UTMD)

Historical Stock Chart

From Jan 2025 to Feb 2025

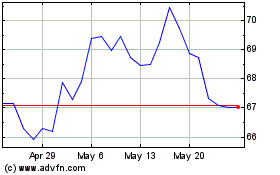

Utah Medical Products (NASDAQ:UTMD)

Historical Stock Chart

From Feb 2024 to Feb 2025