false

0001266806

0001266806

2024-07-11

2024-07-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): July 11, 2024

Vivani

Medical, Inc.

(Exact

name of Registrant as Specified in Its Charter)

| Delaware |

|

001-36747 |

|

02-0692322 |

(State

or Other Jurisdiction

of

Incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.) |

1350

S. Loop Road

Alameda,

California 94502

(Address

of principal executive offices, including zip code)

(415)

506-8462

(Telephone

number, including area code, of agent for service)

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ☐ |

|

Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| ☐ |

|

Soliciting material pursuant to Rule 14a-12

under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| ☐ |

|

Pre-commencement communications pursuant to

Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| ☐ |

|

Pre-commencement communications pursuant to

Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| |

|

|

|

|

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on

which registered

|

| Common

Stock, par value $0.0001 per share |

|

VANI |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§

230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events.

On

July 11, 2024, Vivani Medical, Inc. (the “Company”) announced that the Company expects to initiate the first clinical

study in the Company’s NPM-115 program in the fourth quarter of 2024. The Company’s NPM-115 clinical program will

evaluate the investigational 6-month GLP-1 implant for the treatment of patients with obesity or overweight patients with a related

comorbidity. A copy of the press release issued in connection with this announcement is being furnished as Exhibit 99.1 to this

Current Report on Form 8-K.

| Item 9.01 |

Financial Statements and

Exhibits. |

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

|

VIVANI MEDICAL, INC. |

| |

|

|

| Date: July 11, 2024 |

By: |

/s/ Brigid

A. Makes |

| |

Name: |

Brigid A. Makes |

| |

Title: |

Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Vivani

Medical Provides Update on Clinical Development Plans for Miniature, Long-term, GLP-1 Obesity Implant Program, NPM-115

Vivani

expects to initiate the first clinical study supporting the NPM-115 program in the fourth quarter of 2024

The NPM-115

clinical program will consist of a series of studies designed to support the development of Vivani’s miniature, 6-month

GLP-1 (exenatide) NanoPortalTM implant for chronic weight management in obese or overweight patients

ALAMEDA, Calif., July 11, 2024

-- (BUSINESS WIRE) -- Vivani Medical, Inc. (Nasdaq: VANI) (“Vivani” or the “Company”), an innovative,

biopharmaceutical company developing novel, long-term drug implants, today announced that it expects to initiate the first clinical

study in the NPM-115 program in the fourth quarter of 2024 in Australia, pending regulatory clearance in that country. The NPM-115

clinical program will evaluate the investigational 6-month GLP-1 implant for chronic weight management in patients who are either

obese or overweight with a related comorbidity.

“In February, our company

announced that we were re-prioritizing the development of our GLP-1 implants to focus on the treatment of obesity and chronic

weight management in response to the significant medical need and unprecedented market demand,” said Adam Mendelsohn, Ph.D.,

Vivani’s President and Chief Executive Officer. “Today we can report that our first-in-human study, LIBERATE-1, is

expected to enroll patients who are obese or overweight to primarily support NPM-115’s development program. We anticipate

initiating this clinical study in Australia later this year.”

Dr. Mendelsohn continued: “The

results of LIBERATE-1 may support initiation of a subsequent clinical study, pending regulatory clearance, to explore higher and

potentially more effective doses of our exenatide implant on weight and tolerability in obese or overweight patients. Once the

target dose is identified, we intend to study an implant at that dose over the full 6-month duration, over which our implant has

already demonstrated encouraging results in preclinical animal models. Additionally, we believe the results of LIBERATE-1 may

provide clinical validation of our NanoPortal drug delivery technology to support a broader application of the technology in the

treatment of chronic diseases.”

LIBERATE-1 will be a randomized

investigation of the safety, tolerability and pharmacokinetic profile of the exenatide NanoPortal implant in obese or overweight

patients. The study will enroll patients who will be titrated on weekly semaglutide injections (Wegovy®) for 8 weeks (0.25

mg/week for 4 weeks followed by 0.5 mg/week for 4 weeks) before being randomized to receive a single administration of Vivani’s

exenatide implant (n=8), weekly exenatide injections Bydureon BCise® (n=8), or weekly 1 mg semaglutide injections (n=8) for

a 9-week treatment duration. The exenatide implant to be used in LIBERATE-1 is expected to produce comparable exenatide exposure

levels as Bydureon BCise. Changes in weight will be measured. The trial is expected to initiate later this year with data projected

to be available in 2025.

Background

On February 28, 2024, Vivani

announced positive preclinical weight loss data from its exenatide implant in support of its NPM-115 development program which

was comparable to semaglutide injections (the active pharmaceutical ingredient in Ozempic®/Wegovy®) and a strategic shift

to prioritize its obesity portfolio.

On June 13, 2024, Vivani announced

that the U.S. Food and Drug Administration (“FDA”) cleared its Investigational New Drug for its exenatide implant

to be studied in patients with type 2 diabetes in support of the NPM-119 development program. The Company previously announced

an intention to initiate the first study in the NPM-119 program in the second half of this year. As a result of reprioritizing

the focus of its GLP-1 implants on the treatment of obesity and chronic weight management, the Company plans to first pursue the

NPM-115 study. Dr. Mendelsohn noted that the NPM-115 program utilizes the same exenatide implant as NPM-119, and the only difference

is the population to be studied.

Vivani plans to submit an application

to a Human Research Ethics Committee in Australia to support the initiation of the Company’s first in human study supporting

the NPM-115 program in that country. If available, Vivani intends to utilize research and development incentives and rebates from

the Australian government in order to defray a portion of the costs from the trial. Since clinical studies conducted in Australia

comply with the International Conference on Harmonization guidelines and data generated in Australia are acceptable to the FDA

and other regulatory authorities, Vivani anticipates use of relevant clinical data generated in Australia to support regulatory

submissions in other geographies including the US. Additional guidance will be provided as new information becomes available.

Forward-Looking Statements

This press release contains certain

“forward-looking statements” within the meaning of the “safe harbor” provisions of the US Private Securities

Litigation Reform Act of 1995. Forward-looking statements can be identified by words such as: “target,” “believe,”

“expect,” “will,” “may,” “anticipate,” “estimate,” “would,”

“positioned,” “future,” and other similar expressions that in this press release, including statements

regarding our business, products in development, including the therapeutic potential thereof, the planned development therefor,

the initiation of the LIBERATE-1 trial and reporting of trial results, our emerging development plans for NPM-115 and NPM-119

clinical programs. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they

are based only on our current beliefs, expectations, and assumptions. Because forward-looking statements relate to the future,

they are subject to inherent uncertainties, risks and changes in circumstances that are difficult to predict and many of which

are outside of our control. Actual results and outcomes may differ materially from those indicated in the forward-looking statements.

Therefore, you should not rely on any of these forward-looking statements. Important factors that could cause actual results and

outcomes to differ materially from those indicated in the forward-looking statements include, among others, risks related to the

development and commercialization of our products, including those produced from the NPM-115 and NPM-119 clinical programs; delays

and changes in the development of our products, including as a result of applicable laws, regulations and guidelines, potential

delays in submitting and receiving regulatory clearance or approval to conduct our development activities, including our ability

to obtain regulatory clearance to conduct LIBERATE-1 in Australia, commence clinical development; risks related to the initiation,

enrollment and conduct of our planned clinical trials and the results therefrom; our history of losses and our ability to access

additional capital or otherwise fund our business; market conditions and the ability of Cortigent to complete its initial public

offering. There may be additional risks that the Company considers immaterial, or which are unknown. A further list and description

of risks and uncertainties can be found in the Company’s most recent Annual Report on Form 10-K filed with the U.S. Securities

Exchange Commission filed on March 26, 2024, as updated by our subsequent Quarterly Reports on Form 10-Q. Any forward-looking

statement made by us in this press release is based only on information currently available to the Company and speaks only as

of the date on which it is made. The Company undertakes no obligation to publicly update any forward-looking statement, whether

written or oral, that may be made from time to time, whether as a result of added information, future developments or otherwise,

except as required by law.

Company Contact:

Donald Dwyer

Chief Business Officer

info@vivani.com

(415) 506-8462

Investor Relations Contact:

Jami Taylor

Investor Relations Advisor

investors@vivani.com

(415) 506-8462

Media Contact:

Sean Leous

Senior Vice President

ICR Westwicke

Sean.Leous@westwicke.com

(646) 866-4012

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

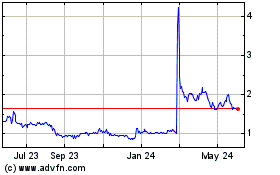

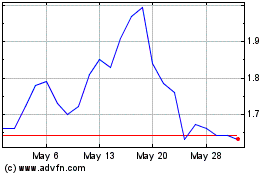

Vivani Medical (NASDAQ:VANI)

Historical Stock Chart

From Oct 2024 to Nov 2024

Vivani Medical (NASDAQ:VANI)

Historical Stock Chart

From Nov 2023 to Nov 2024