Victory Capital Shareholders Approve All Ballot Proposals at Special Meeting of Stockholders

14 October 2024 - 11:00PM

Business Wire

Victory Capital Holdings, Inc. (NASDAQ: VCTR) (“Victory Capital”

or the “Company”) today announced that the Company’s stockholders

voted to approve all proposals related to the previously announced

contribution agreement between Victory Capital and Amundi at the

Company’s Special Meeting held on October 11, 2024.

David Brown, Chairman and Chief Executive Officer said: “I would

like to thank our shareholders for their ongoing support as we

execute on our growth strategy. This is another significant

milestone as we advance toward completing the transaction with

Amundi, which we anticipate will close in the first quarter of

2025. Integration is progressing as planned. We are also

reaffirming our guidance of $100 million in expense synergies that

are expected to be fully realized within two years with the

majority achieved within the first year.”

The transaction remains subject to customary closing conditions,

including regulatory approvals and consents of Amundi US

clients.

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements within

the meaning of applicable U.S. federal and non-U.S. securities

laws. These statements may include, without limitation, any

statements preceded by, followed by or including words such as

“target,” “believe,” “expect,” “aim,” “intend,” “may,”

“anticipate,” “assume,” “budget,” “continue,” “estimate,” “future,”

“objective,” “outlook,” “plan,” “potential,” “predict,” “project,”

“will,” “can have,” “likely,” “should,” “would,” “could” and other

words and terms of similar meaning or the negative thereof and

include, but are not limited to, statements regarding the proposed

transaction and the outlook for Victory Capital’s or Amundi’s

future business and financial performance. Such forward-looking

statements involve known and unknown risks, uncertainties and other

important factors beyond Victory Capital’s and Amundi’s control and

could cause Victory Capital’s and Amundi’s actual results,

performance or achievements to be materially different from the

expected results, performance or achievements expressed or implied

by such forward-looking statements.

Although it is not possible to identify all such risks and

factors, they include, among others, the following: risks that

conditions to closing will fail to be satisfied and that the

transaction will fail to close on the anticipated timeline, if at

all; risks associated with the expected benefits, or impact on the

Victory Capital’s and Amundi’s respective businesses, of the

proposed transaction, including the ability to achieve any expected

synergies; and other risks and factors relating to Victory

Capital’s and Amundi’s respective businesses contained in their

respective public filings.

About Victory Capital

Victory Capital is a diversified global asset management firm

with total assets under management of $176.1 billion, and $181.1

billion in total client assets, as of September 30, 2024. The

Company employs a next-generation business strategy that combines

boutique investment qualities with the benefits of a fully

integrated, centralized operating and distribution platform.

Victory Capital provides specialized investment strategies to

institutions, intermediaries, retirement platforms and individual

investors. With 11 autonomous Investment Franchises and a Solutions

Business, Victory Capital offers a wide array of investment

products and services, including mutual funds, ETFs, separately

managed accounts, alternative investments, third-party ETF model

strategies, collective investment trusts, private funds, a 529

Education Savings Plan, and brokerage services.

Victory Capital is headquartered in San Antonio, Texas, with

offices and investment professionals in the U.S. and around the

world. To learn more please visit www.vcm.com or follow Victory

Capital on Facebook, Twitter, and LinkedIn.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241014687237/en/

Investors: Matthew Dennis, CFA Chief of Staff Director,

Investor Relations 216-898-2412 mdennis@vcm.com

Media: Jessica Davila Director of Global Communications

210-694-9693 Jessica_davila@vcm.com

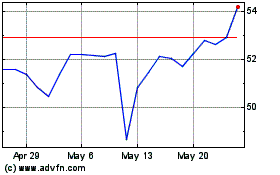

Victory Capital (NASDAQ:VCTR)

Historical Stock Chart

From Dec 2024 to Jan 2025

Victory Capital (NASDAQ:VCTR)

Historical Stock Chart

From Jan 2024 to Jan 2025