false

0001855509

0001855509

2024-05-15

2024-05-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 15, 2024

Twin

Vee PowerCats Co.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40623 |

|

27-1417610 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

3101

S. US-1

Ft. Pierce, Florida 34982

(Address

of principal executive offices)

(772) 429-2525

(Registrant’s

telephone number, including area code)

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered

pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

stock, par value $0.001 per share |

|

VEEE |

|

The

Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial

Condition.

On May 15, 2024, Twin Vee PowerCats Co. (the “Company”)

issued a press release announcing its financial results for the quarter ended March 31, 2024. A copy of the press release is furnished

as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02 and in the press

release attached as Exhibit 99.1 to this Current Report on Form 8-K shall not be deemed to be “filed” for purposes of Section

18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2)

of the Securities Act of 1933, as amended. The information contained in this Item 2.02 and in the press release attached as Exhibit 99.1

to this Current Report on Form 8-K shall not be incorporated by reference into any filing with the U.S. Securities and Exchange Commission

made by the Company, whether made before or after the date hereof, regardless of any general incorporation language in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as

amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: May 15, 2024 |

TWIN VEE POWERCATS CO.

(Registrant) |

| |

|

| |

By: |

|

/s/ Joseph Visconti |

| |

Name: |

|

Joseph Visconti |

| |

Title: |

|

Chief Executive Officer and President |

EXHIBIT 99.1

Twin Vee PowerCats Co. Reports Results for First

Quarter 2024 Operations

FORT PIERCE, FLORIDA, May 15, 2024 –

Twin Vee PowerCats Co. (Nasdaq: VEEE) (“Twin Vee” or the “Company”), a designer, manufacturer and distributor

of recreational and commercial power boats, today reported operational highlights and financial results for three months ended March 31,

2024.

Highlights for three months ended March 31, 2024:

(All comparisons are to the three months ended March 31, 2023 unless otherwise noted)

| ● | Revenue for the three months ending March 31, 2024, decreased by 41% to $5,276,000 from $8,877,000 in

the corresponding period of the previous year. |

| ● | Twin Vee’s Gas-Powered boat segment adjusted net loss for the quarter ending March 31, 2024, was

$669,500. |

| ● | Consolidated net loss for the three months ended March 31, 2024 was $2,335,000 which includes the net

loss of Forza X1 of $1,168,000. |

| ● | The Company experienced a decline in demand for its products, compounded by higher interest rates, which

deterred buyers of recreational vehicles and boats. |

| ● | Proactive measures were taken to mitigate economic challenges, including lowering production numbers,

tightened financial controls, and a reduction in workforce. As a result, the revenue generated per direct labor employee increased; the

per employee revenue for the first quarter of 2024 was approximately $103,000 compared to approximately $72,000 in the first quarter of

2003. |

| ● | On March 31, 2024, Twin Vee’s consolidated holdings of cash, cash equivalents, restricted cash,

and marketable securities totaled $17,381,000, a decrease from $21,218,000 on December 31, 2023. |

| ● | The decrease in cash reserves was primarily due to the Forza X1’s R&D spend and the funds allocated

by Twin Vee to develop new products such as the 400 GFX, 280 GFX DC, 240 CC, and 280 AquaSport Superboat, in addition to operational cash

losses from reduced revenue in the first quarter of 2024. |

| ● | Twin Vee’s gas-powered boat segment reported $7,409,000 in cash, cash equivalents, restricted cash,

and marketable securities on March 31, 2024, down from $8,396,000 on December 31, 2023. |

| ● | As of March 31, 2024, Twin Vee’s consolidated total assets were valued at $36,454,000, while Forza’s

assets totaled $15,531,000. |

“The general economic landscape and high interest

rate environment have continued to put downward pressure on customer demand across all our brands,” explained Joseph Visconti, CEO

and President of Twin Vee PowerCats Co. “During the first quarter we took steps to right-size the labor force while also tightly

controlling operating costs. At the same time, we are using this slower period to lay the groundwork for the next market upswing. Twin

Vee is investing in exciting new models like our Generation 2 GFX boats that we announced in April. Additionally, we are expanding our

Fort Pierce, FL manufacturing facility to increase production capacity and create a more efficient factory layout. We are also streamlining

our manufacturing process by adding a state-of-the-art CNC machine that enables us to bring the tooling of our brand-new boat models in

house. This will save on costs associated with outsourcing and enhance the quality of the boat molds we use to build our products. We

are committed to reducing cash burn while making smart investments in infrastructure, product development, and other revenue generating

opportunities for the Company.”

Twin Vee reported a 41% decline in consolidated revenue

for the three months ended March 31, 2024, to $5,276,343 as compared to $8,877,215 in the same period in 2023. For the three months ended

March 31, 2024, Twin Vee had a consolidated net loss of $2,335,194, as compared to a net loss of $1,828,465

in the prior year. Included in the Twin Vee net loss was a net loss attributable to Forza X1 of $1,167,837 and $2,005,132 for the three

months ended March 31, 2024 and 2023, respectively. The gas-powered segment had a combined net loss of $1,163,957 for the three

months ended March 31, 2024 compared to net income of $181,849 in the comparable prior year period.

Forza X1, Inc. (NASDAQ: FRZA), the electric boat and

development subsidiary in which Twin Vee has a 44.43% controlling interest, had a net loss of $1,167,837 for the three months ended March

31, 2024 compared to a net loss of $2,005,132 for the comparable period in 2023. The consolidated net loss attributed to stockholders

of Twin Vee was $1,686,229 for the three months ended March 31, 2024 compared to a consolidated net loss attributed to stockholders of

Twin Vee of $1,166,772 for the comparable period in 2023. Generally Accepted Accounting Principles (“GAAP”) require Twin Vee

to file consolidated financial statements based on Twin Vee’s controlling ownership interest in Forza X1, Inc. (Nasdaq: FRZA).

Twin Vee, net of Forza X1, had cash, cash equivalents,

restricted cash, and marketable securities of $7,427,882 as of December 31, 2023.

Conference Call

Joseph Visconti, CEO and President, will hold a conference call today,

Wednesday May 15, 2024, at 12:00 p.m. (Eastern). To listen to the conference call, interested parties should dial-in 1-877-407-3982 and

use Conference ID 13746470. All callers should dial-in approximately 10 minutes prior to the scheduled start time and ask to join the

Twin Vee conference call.

The conference call will also be available through a live audio webcast

that can be accessed at the LINK HERE.

The Company’s complete financial statements are being filed today

with the Securities and Exchange Commission and can be accessed via https://ir.twinvee.com/sec-filings.

About Twin Vee PowerCats Co.

Twin Vee is a designer, manufacturer, distributor,

and marketer of power sport catamaran boats. The Company located in Fort Pierce, Florida, has been building and selling boats for nearly

30 years. Learn more at twinvee.com. Twin Vee is one of the most recognizable brand names in the catamaran sport boat category and is

known as the “Best Riding Boats on the Water™”.

Forward Looking Statements

This press release contains certain forward-looking

statements within the meaning of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements

are identified by the use of the words “could,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “may,” “continue,” “predict,” “potential,” “project”

and similar expressions that are intended to identify forward-looking statements and include statements regarding taking steps to right-size

the Company’s labor force while tightly controlling operating costs, using this slower period to lay the groundwork for the next

market upswing, expanding the Fort Pierce, FL manufacturing facility to increase production capacity and create a more efficient factory

layout, adding a state-of-the-art CNC to bring the tooling of brand-new boat models in house, saving costs associated with outsourcing

and enhancing the quality of the boat molds the Company uses to build its products and reducing cash burn while making smart investments

in infrastructure, product development and other revenue generating opportunities. These forward-looking statements are based on management’s

expectations and assumptions as of the date of this press release and are subject to a number of risks and uncertainties, many of which

are difficult to predict, that could cause actual results to differ materially from current expectations and assumptions from those set

forth or implied by any forward-looking statements. Important factors that could cause actual results to differ materially from current

expectations include, among others, the Company’s ability to lay the groundwork for the next market upswing and reduce cash burn

while continuing to invest in infrastructure, product development and other revenue generating investments, and the risk factors described

in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, and the Company’s subsequent filings with

the SEC, including subsequent periodic reports on Forms 10-Q and 8-K. The information in this release is provided only as of the date

of this release, and the Company undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result

of new information, future events or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated

events, except as required by law.

CONTACT:

Glenn Sonoda

investor@twinvee.com

SOURCE: Twin Vee PowerCats Co.

(Tables Follow)

| | |

March 31, | |

December 31, | |

| |

|

| | |

2024 | |

2023 | |

Change | |

% Change |

| Cash and cash equivalents | |

$ | 16,137,920 | | |

$ | 16,497,703 | | |

$ | (359,783 | ) | |

| (2.2 | %) |

| Restricted cash | |

$ | 260,107 | | |

$ | — | | |

$ | 260,107 | | |

| — | |

| Current assets | |

$ | 21,778,752 | | |

$ | 26,646,318 | | |

$ | (4,867,566 | ) | |

| (18.3 | %) |

| Current liabilities | |

$ | 2,896,963 | | |

$ | 4,216,345 | | |

$ | (1,319,383 | ) | |

| (31.3 | %) |

| Working capital | |

$ | 18,881,789 | | |

$ | 22,429,972 | | |

$ | (3,548,183 | ) | |

| (15.8 | %) |

| | |

March 31, | |

December 31, | |

| |

|

| Balance Sheet Data: | |

2024 | |

2023 | |

Change | |

% Change |

| Cash | |

$ | 16,137,920 | | |

$ | 16,497,703 | | |

$ | (359,783 | ) | |

| (2 | %) |

| Total assets | |

$ | 36,454,352 | | |

$ | 39,846,713 | | |

$ | (3,392,361 | ) | |

| (9 | %) |

| Total liabilities | |

$ | 6,313,649 | | |

$ | 7,797,098 | | |

$ | (1,483,449 | ) | |

| (19 | %) |

| Stockholder’s equity | |

$ | 22,251,246 | | |

$ | 23,511,193 | | |

$ | (1,259,947 | ) | |

| (5 | %) |

| | |

Three Months Ended March 31, | |

| |

|

| | |

2024 | |

2023 | |

$ Change | |

% Change |

| Net sales | |

$ | 5,276,343 | | |

$ | 8,877,215 | | |

$ | (3,600,872 | ) | |

| (41 | %) |

| Cost of products sold | |

$ | 4,999,030 | | |

$ | 7,267,657 | | |

$ | (2,268,627 | ) | |

| (31 | %) |

| Gross profit | |

$ | 277,314 | | |

$ | 1,609,558 | | |

$ | (1,332,244 | ) | |

| (83 | %) |

| Operating expenses | |

$ | 2,820,520 | | |

$ | 3,979,081 | | |

$ | (1,158,561 | ) | |

| (29 | %) |

| Loss from operations | |

$ | (2,543,206 | ) | |

$ | (2,369,523 | ) | |

$ | (173,683 | ) | |

| 7 | % |

| Other expense | |

$ | (208,012 | ) | |

$ | (541,058 | ) | |

$ | 333,046 | | |

| (62 | %) |

| Net loss | |

$ | (2,335,194 | ) | |

$ | (1,828,465 | ) | |

$ | (506,729 | ) | |

| 28 | % |

| | |

Three Months Ended March 31, | |

| |

|

| | |

2024 | |

2023 | |

Change | |

% Change |

| Cash used in operating activities | |

$ | (1,749,920 | ) | |

$ | (2,232,650 | ) | |

$ | 482,730 | | |

| 22 | % |

| Cash provided by (used in) investing activities | |

$ | 1,476,448 | | |

$ | (243,007 | ) | |

$ | (1,719,455 | ) | |

| (708 | %) |

| Cash provided by (used in) financing activities | |

$ | (83,735 | ) | |

$ | (2,835 | ) | |

$ | (80,900 | ) | |

| 2,854 | % |

| Net Change in Cash | |

$ | (357,207 | ) | |

$ | (2,478,491 | ) | |

$ | 2,121,284 | | |

| (86 | %) |

The following table shows information by reportable

segments for three months ended March 31, 2024 and 2023, respectively:

| | |

Gas-Powered Boats | |

Franchise | |

Electric Boat and Development | |

Total |

| Net sales | |

$ | 5,276,343 | | |

$ | — | | |

$ | — | | |

$ | 5,276,343 | |

| Cost of products sold | |

| 4,969,458 | | |

| — | | |

| 29,572 | | |

| 4,999,030 | |

| Operating expense | |

| 1,533,981 | | |

| 772 | | |

| 1,285,767 | | |

| 2,820,520 | |

| Loss from operations | |

| (1,227,096 | ) | |

| (772 | ) | |

| (1,315,339 | ) | |

| (2,543,207 | ) |

| Other income (expense) | |

| 63,139 | | |

| (2,629 | ) | |

| 147,502 | | |

| 208,012 | |

| Net income (loss) | |

$ | (1,163,957 | ) | |

$ | (3,401 | ) | |

$ | (1,167,837 | ) | |

$ | (2,335,194 | ) |

| For the Three Months Ended 31, 2023 | |

| |

| |

|

| | |

Gas-Powered Boats | |

Franchise | |

Electric Boat and Development | |

Total |

| Net sales | |

$ | 8,877,215 | | |

$ | — | | |

$ | — | | |

$ | 8,877,215 | |

| Cost of products sold | |

| 7,217,716 | | |

| — | | |

| 49,941 | | |

| 7,267,657 | |

| Operating expense | |

| 1,898,151 | | |

| 1,121 | | |

| 2,079,809 | | |

| 3,979,081 | |

| Loss from operations | |

| (238,652 | ) | |

| (1,121 | ) | |

| (2,129,750 | ) | |

| (2,369,523 | ) |

| Other income (expense) | |

| 420,501 | | |

| (4,062 | ) | |

| 124,619 | | |

| 541,058 | |

| Net income (loss) | |

$ | 181,849 | | |

$ | (5,183 | ) | |

$ | (2,005,131 | ) | |

$ | (1,828,465 | ) |

Non-GAAP Financial Measures

We have presented a supplemental non-GAAP financial measure in this earnings

release. We believe that this supplemental information is useful to investors because it allows for an evaluation of the company with

a focus on the performance of its core operations, including more meaningful comparisons of financial results to historical periods. Adjusted

Net Loss is a non-GAAP financial measure which excludes certain non-cash expenses. Our executive management team uses these same non-GAAP

measures internally to assess the ongoing performance of the Company. Adjusted Net

(Loss) is not intended to be a substitute for any GAAP financial measures, and, as calculated, may not be comparable to other similarly

titled measures of performance of other companies in other industries or within the same industry.

Below is a reconciliation of Adjusted Net loss to GAAP net loss for

the three months ended March 31, 2024 and 2023, respectively:

| | |

Gas-Powered Boats | |

Fix My Boat | |

Electric Boat and Development |

| | |

Three Months Ended | |

Three Months Ended | |

Three Months Ended |

| | |

March 31, | |

March 31, | |

March 31, |

| | |

2024 | |

2023 | |

2024 | |

2023 | |

2024 | |

2023 |

| Net loss | |

$ | (1,163,957 | ) | |

$ | 181,849 | | |

$ | (3,401 | ) | |

$ | (5,183 | ) | |

$ | (1,167,837 | ) | |

$ | (2,005,132 | ) |

| Stock based compensation | |

| 133,142 | | |

| 141,801 | | |

| — | | |

| — | | |

| 293,141 | | |

| 341,163 | |

| Loss on disposal of assets | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Depreciation and amortization | |

| 369,336 | | |

| 182,580 | | |

| — | | |

| — | | |

| 55,945 | | |

| 35,696 | |

| Change of right-of-use asset and lease liabilities | |

| (6,641 | ) | |

| (1,003 | ) | |

| — | | |

| — | | |

| (338 | ) | |

| 339 | |

| Net change in marketable securities | |

| (1,382 | ) | |

| (8,034 | ) | |

| — | | |

| — | | |

| 16,930 | | |

| — | |

| Change in inventory reserve | |

| — | | |

| — | | |

| — | | |

| — | | |

| 113,252 | | |

| — | |

| Government grant income | |

| | | |

| (329,573 | ) | |

| — | | |

| — | | |

| — | | |

| — | |

| Adjusted net income (loss) | |

$ | (669,502 | ) | |

$ | 167,620 | | |

$ | (3,401 | ) | |

$ | (5,183 | ) | |

$ | (688,907 | ) | |

$ | (1,627,934 | ) |

| | |

Three Months Ended |

| | |

March 31, |

| | |

2024 | |

2023 |

| Net sales | |

$ | 5,276,343 | | |

$ | 8,877,215 | |

| Cost of products sold | |

$ | 4,999,030 | | |

$ | 7,267,657 | |

| Gross profit | |

$ | 277,314 | | |

$ | 1,609,558 | |

| Operating expenses | |

$ | 2,820,520 | | |

$ | 3,979,081 | |

| Income from operations | |

$ | (2,543,206 | ) | |

$ | (2,369,523 | ) |

| Other expense | |

$ | 208,012 | | |

$ | 541,058 | |

| Net (loss) | |

$ | (2,335,194 | ) | |

$ | (1,828,465 | ) |

| Basic and dilutive loss per share of common stock | |

$ | (0.18 | ) | |

$ | (0.12 | ) |

| Weighted average number of shares of common stock outstanding | |

| 9,520,000 | | |

| 9,520,000 | |

| | |

Adjusted Net Loss |

| | |

Three Months Ended |

| | |

March 31, |

| | |

2024 | |

2023 |

| Net loss | |

$ | (2,335,194 | ) | |

$ | (1,828,465 | ) |

| Stock based compensation | |

| 426,283 | | |

| 482,964 | |

| Depreciation and amortization | |

| 425,281 | | |

| 218,276 | |

| Change of right-of-use asset and lease liabilities | |

| (6,979 | ) | |

| (1,003 | ) |

| Net change in marketable securities | |

| 15,548 | | |

| (8,034 | ) |

| Change in inventory reserve | |

| 113,252 | | |

| — | |

| Government grant income | |

| — | | |

| (329,573 | ) |

| Adjusted net (loss) | |

$ | (1,361,809 | ) | |

$ | (1,465,835 | ) |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

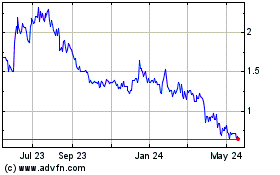

Twin Vee PowerCats (NASDAQ:VEEE)

Historical Stock Chart

From Dec 2024 to Jan 2025

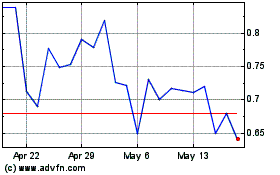

Twin Vee PowerCats (NASDAQ:VEEE)

Historical Stock Chart

From Jan 2024 to Jan 2025