false

0001855509

0001855509

2024-11-26

2024-11-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D. C. 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES

EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

November 26, 2024

Twin

Vee PowerCats Co.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-40623 |

|

27-1417610 |

(State or other jurisdiction of

incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification Number) |

3101 S. US-1

Ft. Pierce, Florida 34982

(Address of principal

executive offices, including zip code)

(772) 429-2525

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange

on which registered |

| Common

stock, par value $0.001 per share |

|

VEEE |

|

The

Nasdaq Stock Market LLC

(Nasdaq Capital Market) |

Indicate by check mark whether the registrant is an emerging growth company

as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of

1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 2.01. Completion of Acquisition or Disposition

of Assets.

On November 26, 2024 (the “Closing Date”),

pursuant to the terms of the Agreement and Plan of Merger, dated as of August 12, 2024 (the “Merger Agreement”), by and between

Twin Vee PowerCats Co., a Delaware corporation (the “Company” or “Twin Vee”), Twin Vee Merger Sub, Inc., a Delaware

corporation and wholly-owned subsidiary of Twin Vee (“Merger Sub”), and Forza X1, Inc., a Delaware corporation (“Forza”),

Merger Sub was merged with and into Forza (the “Merger”), with Forza surviving the Merger as a wholly-owned subsidiary of

Twin Vee.

The Merger became effective on November 26,

2024, when the certificate of merger with respect to the Merger was filed with the Secretary of State of the State of Delaware (the “Effective

Time”). At the Effective Time, (a) each outstanding share of common stock of Forza , par value $0.001 per share of Forza (the “Forza

Common Stock”) (other than any shares held by Twin Vee) was converted into the right to receive 0.611666275 shares of Twin Vee common

stock, par value $0.001 per share (the “Twin Vee Common Stock”), (b) each outstanding Forza stock option, whether vested or

unvested, that had not previously been exercised prior to the Effective Time was converted into an option to purchase 0.611666275 shares

of Twin Vee Common Stock for each share of Forza Common Stock covered by such option, (c) each outstanding warrant to purchase shares

of Forza Common Stock was assumed by Twin Vee and converted into a warrant to purchase 0.611666275 shares of Twin Vee Common Stock for

each share of Forza Common Stock for which such warrant was exercisable for prior to the Effective Time, and (d) the 7,000,000 shares

of Forza Common Stock held by Twin Vee were cancelled.

The issuance of shares of Twin Vee Common Stock to

the former shareholders of Forza was registered under the Securities Act of 1933, as amended, pursuant to a registration statement

on Form S-4 (File No. 333-281788), as amended, filed by Twin Vee with the Securities and Exchange Commission (the “SEC”) and

declared effective on October 10, 2024 (the “Registration Statement”). The joint proxy statement/prospectus included

in the Registration Statement (the “Joint Proxy Statement/Prospectus”) contains additional information about the Merger, the

Merger Agreement and the transactions contemplated thereby. The foregoing description of the Merger and the Merger Agreement, and transactions

contemplated thereby, does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement,

a copy of which is set forth as Annex A to the Joint Proxy Statement/Prospectus, and is incorporated by reference herein.

Item 5.02. Departure of Directors or Certain Officers;

Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

The information disclosed under Item 2.01 is incorporated

by reference herein.

Appointment of New Director

At the Effective Time, in accordance with the terms

of the Merger Agreement, the size of Twin Vee’s board of directors (the “Board”) was set at five, Joseph Visconti, Preston

Yarborough, Neil Ross and Kevin Schuyler remained as directors of Twin Vee and Marcia Kull was appointed as a director of Twin Vee.

Upon her appointment, Ms. Kull was appointed to serve

on the Board’s Audit Committee, Compensation Committee and Nominating and Corporate Governance Committee. Ms. Kull will participate

in the non-employee director compensation arrangements described under the heading “Twin Vee Director Compensation” contained

in the Joint Proxy Statement/Prospectus and incorporated by reference herein.

Following the Merger, the composition of each class

of the board is as follows: The Class I directors are Neil Ross and Marcia Kull, whose terms will expire at the annual meeting of stockholders

to be held in 2025. The Class II director is Preston Yarborough, whose term will expire at the annual meeting of stockholders to be held

in 2026. The Class III directors are Kevin Schuyler and Joseph Visconti, whose terms will expire at the annual meeting of stockholders

to be held in 2027.

Departure of Directors

In connection with the Merger and effective as of

the Effective Time, Bard Rockenbach and James Melvin resigned as directors of Twin Vee and any committees thereof. The decision to resign

by each of Messrs. Rockenbach and Melvin was not the result, in whole or in part, of any disagreement with Twin Vee, its management team,

or the board of directors of Twin Vee, on any matter relating to Twin Vee operations, policies or practices.

Item 9.01. Financial Statements and Exhibits.

(a) Financial Statements of Businesses Acquired.

(i) The audited balance sheets of Forza as of December

31, 2023 and 2022, and the related statements of operations, stockholders’ equity and cash flows for the fiscal years ended December

31, 2023 and 2022 are set forth under the caption “Index to Financial Statements – Forza Financial Statements” on pages

F-52 through F-65 of the Joint Proxy Statement/Prospectus and are hereby incorporated by reference herein.

(ii) The unaudited balance sheet of Forza as of September

30, 2024 and the related statements of operations, stockholders’ equity and cash flows for the three and nine months ended September

30, 2024 and 2023 beginning on page 4 of Forza’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024 are incorporated

by reference herein.

(b) Pro Forma Financial Information.

The Unaudited Pro Forma Combined Consolidated Financial

Information of Twin Vee and Forza are included as Exhibit 99.1 to this report and incorporated by reference herein.

(d) Exhibits

* Exhibits and schedules have been omitted pursuant to Items

601(a)(5) and 601(b)(2) of Regulation S-K. The Company hereby undertakes to furnish copies of any of the omitted exhibits and schedules

upon request by the Securities and Exchange Commission.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the

Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| Dated:

November 26, 2024 |

Twin

Vee PowerCats Co. |

| |

|

|

| |

By: |

/s/

Joseph C. Visconti |

| |

|

Joseph

C. Visconti |

| |

|

Chief

Executive Officer |

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We hereby consent to the incorporation by refence

in the Registration Statements on Form S-8 (File No.333-278605, 333- 271430, File No. 333-265016 and File No. 333-258129) of our report

dated March 27, 2024, relating to the financial statements of Forza X1, Inc. as of the years ended December 31, 2023 and 2022, included

in the Company’s Form 10-K filed with the Securities and Exchange Commission on March 27, 2024. Our report includes an explanatory

paragraph relating to substantial doubt about Forza X1, Inc.’s ability to continue as a going concern. We also consent to the reference

to our firm under the heading “Experts” appearing therein.

/s/ Grassi & Co., CPAs, P.C.

Jericho, New York

November 26, 2024

Exhibit 99.1

UNAUDITED PRO FORMA COMBINED CONSOLIDATED FINANCIAL

INFORMATION OF TWIN VEE AND FORZA

On November 26, 2024, pursuant to the terms

of the Agreement and Plan of Merger, dated as of August 12, 2024 (the “Merger Agreement”), by and between Twin Vee PowerCats

Co., a Delaware corporation (the “Company” or “Twin Vee”), Twin Vee Merger Sub, Inc., a Delaware corporation and

wholly-owned subsidiary of Twin Vee (“Merger Sub”), and Forza X1, Inc., a Delaware corporation (“Forza”), Merger

Sub was merged with and into Forza (the “Merger”), with Forza surviving the Merger as a wholly-owned subsidiary of Twin Vee.

The Merger became effective on November 26,

2024, when the certificate of merger with respect to the Merger was filed with the Secretary of State of the State of Delaware (the “Effective

Time”). At the Effective Time, (a) each outstanding share of common stock of Forza , par value $0.001 per share of Forza (the “Forza

Common Stock”) (other than any shares held by Twin Vee) was converted into the right to receive 0.611666275 shares (the “Exchange

Ratio”) of Twin Vee common stock, par value $0.001 per share (the “Twin Vee Common Stock”), (b) each outstanding Forza

stock option, whether vested or unvested, that had not previously been exercised prior to the Effective Time was converted into an option

to purchase 0.611666275 shares of Twin Vee Common Stock for each share of Forza Common Stock covered by such option, (c) each outstanding

warrant to purchase shares of Forza Common Stock was assumed by Twin Vee and converted into a warrant to purchase 0.611666275 shares of

Twin Vee Common Stock for each share of Forza Common Stock for which such warrant was exercisable for prior to the Effective Time, and

(d) the 7,000,000 shares of Forza Common Stock held by Twin Vee were cancelled.

The unaudited pro forma condensed combined financial

statements are presented for informational purposes only. The unaudited pro forma condensed combined

balance sheet as of September 30, 2024 assumes that the transaction took place at the beginning of the year and combines the historical

balance sheets of Twin Vee and Forza as of such date. The unaudited pro forma condensed combined statements of operations for the three

months ended September 30, 2024 and the year ended December 31, 2023 assume that the transaction took place as of January 1, 2023, and

combines the historical results of Twin Vee and Forza for each period. The historical financial statements of Twin Vee and Forza have

been adjusted to give pro forma effect to events that are (i) directly attributable to the transaction, (ii) factually supportable, and

(iii) with respect to the unaudited pro forma condensed combined statements of operations, expected to have a continuing impact on the

combined results.

The notes to the unaudited pro forma combined consolidated

financial statements describe the pro forma amounts and adjustments presented below. This pro forma data is not necessarily indicative

of the operating results that Twin Vee would have achieved had it completed the merger as of the beginning of the period presented and

should not be considered as representative of future operations.

The unaudited pro forma combined consolidated financial

information presented below is based on, and should be read together with the following:

| ● | Twin

Vee’s historical audited consolidated financial statements for the years ended December

31, 2023 and 2022 included in its annual report on Form 10-K, for the year ended December

31, 2023, filed with the Commission on March 27, 2024. |

| ● | Twin

Vee’s unaudited consolidated financial statements for the nine months ended September

30, 2024 and 2023, included in its quarterly report on Form 10-Q, for the quarter ending

September 30, 2024, filed with the Commission on November 14, 2024. |

| ● | Forza’s

historical audited consolidated financial statements for the years ended December 31, 2023

and 2022 included in its annual report on Form 10-K for the year ended December 31, 2023,

filed with the Commission on March 27, 2024. |

| ● | Forza’s

unaudited consolidated financial statements for the nine months ended September 30, 2024

and 2023, included in its quarterly report on Form 10-Q, for the quarter ending September

30, 2024, filed with the Commission on November 14, 2024. |

| ● | The

sections entitled “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” included in Twin Vee’s annual report, on Form 10-K,

for the year ended December 31, 2023, and quarterly report, on Form 10-Q, for the quarter

ended September 30, 2024, filed with the Commission on March 27, 2024 and November 14, 2024,

respectively. |

| ● | The

sections entitled “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” included in Forza’s annual report, on Form 10-K, for

the year ended December 31, 2023, and quarterly report, on Form 10-Q, for the quarter ended

September 30, 2024, filed with the Commission on March 27, 2024 and November 14, 2024, respectively. |

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED BALANCE

SHEETS

| | |

Twin Vee Powercats Co. Inc. September 30, 2024 | |

Forza X1, Inc. September 30, 2024 | |

Eliminations & Merger Adjustments | |

| |

Twin Vee Powercats Co. Inc. Pro Forma September 30, 2024 |

| Assets | |

| | | |

| | | |

| | | |

| | | |

| | |

| Current Assets | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 11,144,929 | | |

$ | 7,200,427 | | |

$ | (7,200,427 | ) | |

| A | | |

$ | 11,144,929 | |

| Restricted cash | |

| 212,963 | | |

| — | | |

| — | | |

| | | |

| 212,963 | |

| Accounts receivable | |

| 129,544 | | |

| 125,000 | | |

| (125,000 | ) | |

| | | |

| 129,544 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Inventories, net | |

| 3,343,468 | | |

| 60,645 | | |

| (60,645 | ) | |

| A | | |

| 3,343,468 | |

| Due to/from affiliated companies, net | |

| — | | |

| 87,884 | | |

| (87,884 | ) | |

| A | | |

| — | |

| Prepaid expenses and other current assets | |

| 548,077 | | |

| 80,095 | | |

| (80,095 | ) | |

| A | | |

| 548,077 | |

| Total current assets | |

| 15,378,981 | | |

| 7,554,051 | | |

| (7,554,051 | ) | |

| | | |

| 15,378,981 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Property and equipment, net | |

| 14,217,041 | | |

| 4,388,229 | | |

| (4,388,229 | ) | |

| A | | |

| 14,217,041 | |

| Operating lease right of use asset | |

| 495,744 | | |

| 7,629 | | |

| (7,629 | ) | |

| A | | |

| 495,744 | |

| Security deposit | |

| 48,710 | | |

| 7,517 | | |

| (7,517 | ) | |

| A | | |

| 48,710 | |

| Total Assets | |

$ | 30,140,476 | | |

$ | 11,957,426 | | |

$ | (11,957,426 | ) | |

| | | |

$ | 30,140,476 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liabilities and Stockholders' Equity | |

| | | |

| | | |

| | | |

| | | |

| | |

| Current Liabilities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Accounts payable | |

$ | 1,957,902 | | |

$ | 73,067 | | |

$ | (73,067 | ) | |

| A | | |

$ | 1,957,902 | |

| Accrued liabilities | |

| 1,195,982 | | |

| 9,712 | | |

| (9,712 | ) | |

| A | | |

| 1,195,982 | |

| Contract liabilities – customer deposits | |

| 38,175 | | |

| 6,175 | | |

| (6,175 | ) | |

| A | | |

| 38,175 | |

| Finance lease liability – current portion | |

| 220,103 | | |

| 24,847 | | |

| (24,847 | ) | |

| A | | |

| 220,103 | |

| Operating lease right of use liability – current portion | |

| 431,132 | | |

| — | | |

| — | | |

| A | | |

| 431,132 | |

| Total current liabilities | |

| 3,843,294 | | |

| 113,801 | | |

| (113,801 | ) | |

| | | |

| 3,843,294 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Economic Injury Disaster Loan | |

| 499,900 | | |

| — | | |

| — | | |

| | | |

| 499,900 | |

| Finance lease liability - noncurrent | |

| 2,479,742 | | |

| 67,070 | | |

| (67,070 | ) | |

| A | | |

| 2,479,742 | |

| Operating lease liability - noncurrent | |

| 109,329 | | |

| — | | |

| — | | |

| | | |

| 109,329 | |

| Total Liabilities | |

| 6,932,265 | | |

| 180,871 | | |

| (180,871 | ) | |

| | | |

| 6,932,265 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Stockholders' equity: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Preferred stock: 10,000,000 authorized; $0.001 par value; no shares issued and outstanding | |

| — | | |

| — | | |

| — | | |

| | | |

| — | |

| Common stock: 50,000,000 authorized; $0.001 par value | |

| 9,520 | | |

| 15,784 | | |

| (10,429 | ) | |

| B/C | | |

| 14,875 | |

| Treasury Stock | |

| — | | |

| (21,379 | ) | |

| 21,379 | | |

| B | | |

| — | |

| Additional paid-in capital | |

| 38,871,551 | | |

| 26,697,988 | | |

| (20,885,125 | ) | |

| B/C | | |

| 44,684,414 | |

| Accumulated deficit | |

| (21,491,078 | ) | |

| (14,915,838 | ) | |

| 14,915,838 | | |

| B | | |

| (21,491,078 | ) |

| Equity attributed to stockholders of Twin Vee PowerCats Co, Inc. | |

| 17,389,993 | | |

| 11,776,555 | | |

| (5,958,337 | ) | |

| | | |

| 23,208,211 | |

| Equity attributable to noncontrolling interests | |

| 5,818,218 | | |

| — | | |

| (5,818,218 | ) | |

| B | | |

| — | |

| Total stockholders’ equity | |

| 23,208,211 | | |

| 11,776,555 | | |

| (11,776,555 | ) | |

| | | |

| 23,208,211 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Total Liabilities and Stockholders' Equity | |

$ | 30,140,476 | | |

$ | 11,957,426 | | |

$ | (11,957,426 | ) | |

| | | |

$ | 30,140,476 | |

A - Represents elimination of Forza balances

included in Twin Vee consolidated balance sheet

B - Represents elimination of Forza equity and accumulated deficit and non-controlling interest no longer eliminated post-merger

C - Represents issuance of Twin Vee common stock to non-Twin Vee shareholders of Forza stock and the offset to the elimination of the

Forza non-controlling interest previously eliminated from the Twin Vee balance sheet.

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

| |

|

Twin Vee Powercats Co. Inc. Nine Months Ended September 30, 2024 |

|

Forza X1, Inc. Nine Months Ended September 30, 2024 |

|

Eliminations and Merger Adjustments |

|

Twin Vee Powercats Co. Inc. Nine Months Ended September 30, 2024 Pro Forma |

| Net sales |

|

$ |

12,504,482 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

12,504,482 |

|

| Cost of products sold |

|

|

12,170,486 |

|

|

|

68,335 |

|

|

|

(68,335 |

) |

A |

|

12,170,486 |

|

| Gross profit (loss) |

|

|

333,996 |

|

|

|

(68,335 |

) |

|

|

68,335 |

|

|

|

333,996 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative |

|

|

2,214,670 |

|

|

|

737,269 |

|

|

|

(1,308,175 |

) |

A/B |

|

1,643,764 |

|

| Salaries and wages |

|

|

3,641,185 |

|

|

|

1,479,501 |

|

|

|

(1,479,501 |

) |

A |

|

3,641,185 |

|

| Professional fees |

|

|

1,111,079 |

|

|

|

391,971 |

|

|

|

(593,191 |

) |

A/B |

|

909,859 |

|

| Impairment of property & equipment |

|

|

1,674,000 |

|

|

|

1,674,000 |

|

|

|

(1,674,000 |

) |

A |

|

1,674,000 |

|

| Depreciation and amortization |

|

|

1,300,697 |

|

|

|

184,441 |

|

|

|

(184,441 |

) |

A |

|

1,300,697 |

|

| Research and development |

|

|

583,878 |

|

|

|

587,599 |

|

|

|

(587,599 |

) |

A |

|

583,878 |

|

| Total operating expenses |

|

|

10,525,509 |

|

|

|

5,054,781 |

|

|

|

(5,826,907 |

) |

|

|

9,753,383 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(10,191,513 |

) |

|

|

(5,123,116 |

) |

|

|

5,895,242 |

|

|

|

(9,419,387 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividend income |

|

|

447,571 |

|

|

|

276,862 |

|

|

|

(276,862 |

) |

A |

|

447,571 |

|

| Other income |

|

|

33,442 |

|

|

|

— |

|

|

|

— |

|

|

|

33,442 |

|

| Interest expense |

|

|

(178,922 |

) |

|

|

(7,362 |

) |

|

|

7,362 |

|

A |

|

(178,922 |

) |

| Interest income |

|

|

107,297 |

|

|

|

62,830 |

|

|

|

(62,830 |

) |

A |

|

107,297 |

|

| Unrealized gain(loss) on marketable securities |

|

|

5,204 |

|

|

|

(16,930 |

) |

|

|

16,930 |

|

A |

|

5,204 |

|

| Realized gain on marketable securities |

|

|

35,210 |

|

|

|

35,210 |

|

|

|

(35,210 |

) |

A |

|

35,210 |

|

| Loss on disposal of property & equipment |

|

|

(172,684 |

) |

|

|

(172,684 |

) |

|

|

172,684 |

|

A |

|

(172,684 |

) |

| Gain on sale of R&D assets |

|

|

50,097 |

|

|

|

50,097 |

|

|

|

(50,097 |

) |

A |

|

50,097 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total other income |

|

|

327,215 |

|

|

|

228,023 |

|

|

|

(228,023 |

) |

|

|

327,215 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income tax |

|

|

(9,864,298 |

) |

|

|

(4,895,093 |

) |

|

|

5,667,219 |

|

|

|

(9,092,172 |

) |

| Income taxes provision |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net loss |

|

|

(9,864,298 |

) |

|

|

(4,895,093 |

) |

|

|

5,667,219 |

|

|

|

(9,092,172 |

) |

| Less: Net loss attributable to noncontrolling interests |

|

|

(2,720,204 |

) |

|

|

|

|

|

|

2,720,204 |

|

A |

|

— |

|

| Net loss attributed to stockholders of Twin Vee PowerCats Co, Inc. |

|

$ |

(7,144,094 |

) |

|

$ |

(4,895,093 |

) |

|

$ |

2,947,015 |

|

|

$ |

(9,092,172 |

) |

A - Represents elimination of intercompany revenues

and cost of sales, and non-controlling interests, and Forza amounts included in Twin Vee consolidated results

B - Represents adjustment for public company costs

no longer borne by Forza related to the merger

UNAUDITED PRO FORMA CONDENSED CONSOLIDATED STATEMENTS

OF OPERATIONS

| |

|

Twin Vee Powercats Co. Inc. Year Ended December 31, 2023 |

|

Forza X1, Inc. Year Ended December 31, 2023 |

|

Eliminations and Merger Adjustments |

|

Twin Vee Powercats Co. Inc. Year Ended December 31, 2023 Pro Forma |

| Net sales |

|

$ |

33,425,912 |

|

|

$ |

37,118 |

|

|

$ |

(37,118 |

) |

A |

$ |

33,425,912 |

|

| Cost of products sold |

|

|

23,702,885 |

|

|

|

157,637 |

|

|

|

(157,637 |

) |

A |

|

23,702,885 |

|

| Gross profit (loss) |

|

|

9,723,027 |

|

|

|

(120,519 |

) |

|

|

120,519 |

|

|

|

9,723,027 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Selling, general and administrative |

|

|

3,734,406 |

|

|

|

1,112,920 |

|

|

|

(1,614,657 |

) |

A/B |

|

3,232,669 |

|

| Salaries and wages |

|

|

13,929,580 |

|

|

|

3,279,195 |

|

|

|

(3,279,195 |

) |

A |

|

13,929,580 |

|

| Professional fees |

|

|

1,249,388 |

|

|

|

353,996 |

|

|

|

(634,905 |

) |

A/B |

|

968,479 |

|

| Depreciation and amortization |

|

|

1,353,383 |

|

|

|

185,900 |

|

|

|

(185,900 |

) |

A |

|

1,353,383 |

|

| Research and development |

|

|

1,443,569 |

|

|

|

1,540,903 |

|

|

|

(1,540,903 |

) |

A |

|

1,443,569 |

|

| Total operating expenses |

|

|

21,710,326 |

|

|

|

6,472,914 |

|

|

|

(7,255,560 |

) |

|

|

20,927,680 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

|

|

(11,987,299 |

) |

|

|

(6,593,433 |

) |

|

|

7,376,079 |

|

|

|

(11,204,653 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividend income |

|

|

909,215 |

|

|

|

507,794 |

|

|

|

(507,794 |

) |

A |

|

909,215 |

|

| Other income |

|

|

9,898 |

|

|

|

— |

|

|

|

— |

|

|

|

9,898 |

|

| Interest expense |

|

|

(221,157 |

) |

|

|

(3,694 |

) |

|

|

3,694 |

|

A |

|

(221,157 |

) |

| Interest income |

|

|

48,370 |

|

|

|

1,401 |

|

|

|

(1,401 |

) |

A |

|

48,370 |

|

| Loss on disposal of assets |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Unrealized gain on marketable securities |

|

|

87,781 |

|

|

|

50,878 |

|

|

|

(50,878 |

) |

A |

|

87,781 |

|

| Realized gain on marketable securities |

|

|

103,941 |

|

|

|

103,941 |

|

|

|

(103,941 |

) |

A |

|

103,941 |

|

| Employee Retention Credit income |

|

|

1,267,055 |

|

|

|

— |

|

|

|

— |

|

|

|

1,267,055 |

|

| Total other income |

|

|

2,205,103 |

|

|

|

660,320 |

|

|

|

(660,320 |

) |

|

|

2,205,103 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss before income tax |

|

|

(9,782,196 |

) |

|

|

(5,933,113 |

) |

|

|

6,715,759 |

|

|

|

(8,999,550 |

) |

| Income taxes provision |

|

|

— |

|

|

|

— |

|

|

|

|

|

|

|

— |

|

| Net loss |

|

|

(9,782,196 |

) |

|

|

(5,933,113 |

) |

|

|

6,715,759 |

|

|

|

(8,999,550 |

) |

| Less: Net loss attributable to noncontrolling interests |

|

|

(2,590,020 |

) |

|

|

— |

|

|

|

2,590,020 |

|

A |

|

— |

|

| Net loss attributed to stockholders of Twin Vee PowerCats Co, Inc. |

|

$ |

(7,192,176.00 |

) |

|

$ |

(5,933,113.00 |

) |

|

$ |

4,125,739.32 |

|

|

$ |

(8,999,549.68 |

) |

A - Represents elimination of intercompany revenues

and cost of sales, non-controlling interests and Forza amounts included in Twin Vee consolidated results

B - Represents adjustment for public company costs

no longer borne by Forza related to the merger

Comparative Historical and Unaudited Pro Forma Per Share Data

The information below reflects

the historical net loss and book value per share of Twin Vee Common Stock and the historical net loss and book value per share of Forza

Common Stock in comparison with the unaudited pro forma net loss and book value per share after giving effect to the Merger of Twin Vee

with Forza on a pro forma basis.

You should read the tables

below in conjunction with the following:

| ● | Twin

Vee’s historical audited consolidated financial statements for the years ended December

31, 2023 and 2022 included in its annual report on Form 10-K, for the year ended December

31, 2023, filed with the Commission on March 27, 2024. |

| ● | Twin

Vee’s unaudited consolidated financial statements for the nine months ended September

30, 2024 and 2023, included in its quarterly report on Form 10-Q, for the quarter ending

September 30, 2024, filed with the Commission on November 14, 2024. |

| ● | Forza’s

historical audited consolidated financial statements for the years ended December 31, 2023

and 2022 included in its annual report on Form 10-K for the year ended December 31, 2023,

filed with the Commission on March 27, 2024. |

| ● | Forza’s

unaudited consolidated financial statements for the nine months ended September 30, 2024

and 2023, included in its quarterly report on Form 10-Q, for the quarter ending September

30, 2024, filed with the Commission on November 14, 2024. |

| | |

Twin

Vee Historical | |

Forza

Historical | |

Twin

Vee

Unaudited

Pro Forma Combined

Data | |

Forza

Pro Forma Equivalent

Data (i) |

| | |

| |

| |

| |

|

| Net

loss per share: | |

| | | |

| | | |

| | | |

| | |

| For

the year ended December 31, 2023 | |

| | | |

| | | |

| | | |

| | |

| Basic

and diluted | |

$ | (0.76 | ) | |

$ | (0.44 | ) | |

$ | (0.61 | ) | |

$ | (0.23 | ) |

| For

the nine months ended September 30, 2024 | |

| | | |

| | | |

| | | |

| | |

| Basic

and diluted | |

$ | (0.75 | ) | |

$ | (0.31 | ) | |

$ | (0.61 | ) | |

$ | (0.24 | ) |

| Book

value per share | |

| | | |

| | | |

| | | |

| | |

| As

of December 31, 2023 | |

$ | 3.37 | | |

$ | 1.02 | | |

$ | 2.15 | | |

$ | 0.84 | |

| As

of September 30, 2024 | |

$ | 2.44 | | |

$ | 0.75 | | |

$ | 1.56 | | |

$ | 0.61 | |

(i) The Forza unaudited pro forma equivalent data

was calculated by multiplying the pro forma condensed combined results by the Exchange Ratio.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

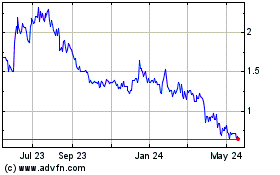

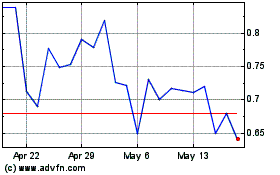

Twin Vee PowerCats (NASDAQ:VEEE)

Historical Stock Chart

From Dec 2024 to Dec 2024

Twin Vee PowerCats (NASDAQ:VEEE)

Historical Stock Chart

From Dec 2023 to Dec 2024