0001061027falseViracta Therapeutics, Inc.00010610272024-11-132024-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 13, 2024 |

VIRACTA THERAPEUTICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

000-51531 |

94-3295878 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

2533 S. Coast Hwy. 101, Suite 210 |

|

Cardiff, California |

|

92007 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (858) 400-8470 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

VIRX |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 13, 2024, Viracta Therapeutics, Inc. issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

All of the information furnished in this Item 2.02 and the press release attached hereto as Exhibit 99.1 shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Viracta Therapeutics, Inc |

|

|

|

|

Date: |

November 13, 2024 |

By: |

/s/ Michael Faerm |

|

|

|

Michael Faerm

Chief Financial Officer

(Principal Financial and Accounting Officer) |

Viracta Therapeutics Reports Third Quarter 2024 Financial Results and Provides Business Update

- Reprioritized resources to reduce costs and enhance focus on Nana-val’s development program in relapsed or refractory EBV-positive peripheral T-cell lymphoma (PTCL) -

- On track to report data from expansion phase of the Phase 2 NAVAL-1 clinical trial of Nana-val in the first half of 2025 -

- Determined recommended Phase 2 dose of Nana-val in patients with advanced EBV-positive solid tumors-

SAN DIEGO, November 13, 2024 – Viracta Therapeutics, Inc. (Nasdaq: VIRX), a clinical-stage precision oncology company focused on the treatment and prevention of virus-associated cancers that impact patients worldwide, today reported financial results for the third quarter of 2024 and provided a business update.

“Last quarter, based on productive feedback from FDA, we announced a sharpened focus on the second-line EBV-positive PTCL subpopulation in the NAVAL-1 trial’s expansion phase, which is ongoing,” said Mark Rothera, President and Chief Executive Officer of Viracta. “To optimally support both the NAVAL-1 trial as well as a randomized controlled trial that we are planning for the second half of next year and reduce cash burn, we recently announced a reprioritization of resources intended to right-size our organization and further reduce our operating expenses. With a clearly defined regulatory path forward for Nana-val, we believe this will allow us to be efficient while we work toward the possible submission of a New Drug Application in 2026 and seek to introduce the first EBV-targeted therapy for lymphoma patients, subject to obtaining requisite funding.”

“We are pleased to have determined a recommended Phase 2 dose for Nana-val in patients with advanced EBV-positive solid tumors,” said Darrel P. Cohen, M.D., Ph.D., Chief Medical Officer of Viracta.

“Although the EBV-positive solid tumor program has been paused, clinical development in this patient population is ready for Phase 2, with additional financing or with a partner, using nanatinostat and valganciclovir doses that were well tolerated with evidence of antitumor activity.”

Clinical Trial Updates and Anticipated Milestones

Phase 1b/2 trial of Nana-val (nanatinostat in combination with valganciclovir) in patients with recurrent/metastatic (R/M) Epstein-Barr virus-positive (EBV+) nasopharyngeal carcinoma (NPC) and other advanced EBV+ solid tumors (Study 301)

Clinical Trial Update:

•In October, determined the recommended Phase 2 dose in patients with advanced EBV+ solid tumors.

Phase 2 NAVAL-1 trial of Nana-val (nanatinostat in combination with valganciclovir) in patients with relapsed or refractory (R/R) Epstein-Barr virus-positive (EBV+) lymphoma

Clinical Trial Updates:

•In August, announced positive combined Stage 1 and Stage 2 data (n=21) in the R/R EBV+ PTCL cohort of patients treated with nanatinostat (20 mg orally once daily, 4 days/week) in combination with valganciclovir (900 mg orally once daily, 7 days/week) across the first two stages of the study.

oCombined data from Stages 1 and 2 demonstrated Nana-val’s substantial antitumor activity and generally well-tolerated safety profile with a median duration of response (DOR) that has not yet been reached.

•In August, announced that a productive FDA meeting was held to align on a potential regulatory path forward for Nana-val in patients with R/R EBV+ PTCL.

oBased on feedback from the FDA and the particularly robust response rates observed in the second-line treatment setting, and to target its resources, Viracta will focus the primary analysis on the second-line EBV+ PTCL subpopulation in the ongoing NAVAL-1 trial’s expansion phase.

oThe Company plans to begin a randomized controlled trial (RCT) of Nana-val in the second-line treatment of EBV+ PTCL patients in the second half of 2025, subject to obtaining financing.

Anticipated Milestones

Viracta plans to deliver on the following milestones, subject to obtaining financing:

•Meet with the FDA to finalize the proposed RCT design in the second-line treatment of patients with EBV+ PTCL in the first half of 2025.

oInitiate the RCT in the second half of 2025.

•Report preliminary data from the expansion phase of the NAVAL-1 trial in second-line EBV+ PTCL patients in the first half of 2025.

•Report Stage 1 data from patients with R/R EBV+ diffuse large B-cell lymphoma (DLBCL) in the first half of 2025.

•Present interim analysis outcomes from the NAVAL-1 trial’s expansion phase in second-line EBV+ PTCL patients in 2026.

•File NDA for accelerated approval in 2026 based on interim analysis of the NAVAL-1 trial’s expansion cohort.

Business Updates

•Announced on November 6th a reprioritization of resources intended to enhance focus on the Company’s lead program, reduce cash burn, and drive shareholder value:

oIncluded a reduction in force affecting approximately 42% of the Company’s employees.

oAlso reduced the size of its Board of Directors from 10 to 6 seats following voluntary resignations from 4 directors.

Third Quarter 2024 Financial Results

•Cash position – Cash, cash equivalents, and short-term investments totaled approximately $21.1 million as of September 30, 2024, which Viracta expects will be sufficient to fund operations late into the first quarter of 2025.

•Research and development expenses – Research and development expenses were approximately $7.2 million and $23.7 million for the three and nine months ended September 30, 2024, respectively, compared to approximately $8.2 million and $24.0 million for the same periods in 2023. The decrease in research and development expenses for the three months ended September 30, 2024 compared to the same period in 2023, was driven by decreases in costs incurred to support the advancement and expansion of our clinical development programs, including incremental costs to support NAVAL-1, our Phase 2 trial of Nana-val in patients with R/R EBV+ lymphomas and personnel-related costs. The decrease in research and development expenses for the nine months ended September 30, 2024 compared to the same period in 2023, was largely due to decreases in costs incurred related to our clinical development programs and personnel-related costs, partially offset by a non-cash adjustment for insurance costs related to the February 2021 reverse merger with Sunesis Pharmaceuticals of $1.8 million.

•General and administrative expenses – General and administrative expenses were approximately $3.0 million and $10.0 million for the three and nine months ended September 30, 2024, respectively, compared to $4.3 million and $13.2 million for the same periods in 2023. The decrease in general and administrative expenses was largely due to decreases in personnel-related costs, corporate liability insurance premiums and consulting and legal costs.

•Net loss – Net loss was approximately $10.6 million, or $0.27 per share (basic and diluted), for the quarter ended September 30, 2024, compared to a net loss of $12.6 million, or $0.33 per share (basic and diluted), for the same period in 2023. This change was primarily the result of decreases in research and development expenses and personnel-related costs. Net loss was approximately $29.5 million, or $0.75 per share, (basic and diluted) for the nine months ended September 30, 2024, compared to a net loss of $37.3 million, or $0.97 per share, (basic and diluted) for the same period in 2023. This change was primarily the result of $5.0 million of other income received related to the monetization of a pre-commercialization, event-based milestone from Day One Biopharmaceuticals, Inc. in March 2024, and decreases in costs related to our clinical development programs and personnel-related costs, partially offset by the non-cash adjustment for insurance costs related to the February 2021 merger of $1.8 million.

About the NAVAL-1 Trial

NAVAL-1 (NCT05011058) is a global, multicenter, clinical trial of Nana-val in patients with relapsed or refractory (R/R) Epstein-Barr virus-positive (EBV+) lymphoma. This trial employs a Simon two-stage design where, in Stage 1, participants are enrolled into one of three indication cohorts based on EBV+ lymphoma subtype. If two objective responses are achieved within a lymphoma subtype in Stage 1 (n=10), then additional patients will be enrolled in Stage 2 for a total of 21 patients. EBV+ lymphoma subtypes demonstrating promising antitumor activity in Stage 2 may be further expanded following discussion with regulators to potentially support registration.

About Nana-val (Nanatinostat and Valganciclovir)

Nanatinostat is an orally available histone deacetylase (HDAC) inhibitor being developed by Viracta. Nanatinostat is selective for specific isoforms of Class I HDACs, which are key to inducing viral genes that are epigenetically silenced in Epstein-Barr virus (EBV)-associated malignancies. Nanatinostat is currently

being investigated in combination with the antiviral agent valganciclovir as an all-oral combination therapy, Nana-val, in various subtypes of EBV-associated malignancies. Ongoing trials include a potentially registrational, global, multicenter, open-label Phase 2 basket trial in multiple subtypes of relapsed or refractory (R/R) EBV+ lymphoma (NAVAL-1) as well as a multinational Phase 1b/2 clinical trial in patients with recurrent or metastatic (R/M) EBV+ NPC and other advanced EBV+ solid tumors.

About Peripheral T-Cell Lymphoma

T-cell lymphomas comprise a heterogeneous group of rare and aggressive malignancies, including peripheral T-cell lymphoma not otherwise specified (PTCL-NOS) and angioimmunoblastic T-cell lymphoma (AITL). There are approximately 5,600 newly diagnosed T-cell lymphoma patients and approximately 2,600 newly diagnosed PTCL-NOS and AITL patients in the U.S. annually. Approximately 70% of these patients are either refractory to first-line therapy, or eventually experience relapse of their disease. Clinical trials are currently recommended for all lines of PTCL therapy, and most patients with R/R PTCL have poor outcomes, with median progression-free survival and median overall survival times reported to be 3.7 and 6.5 months, respectively. Approximately 40% to 65% of PTCL is associated with EBV, the incidence of EBV+ PTCL varies by geography, and reported outcomes for patients with EBV+ PTCL are inferior to those whose disease is EBV-negative. There is no approved targeted treatment specific for EBV+ PTCL, and therefore this represents a high unmet medical need.

About EBV-Associated Cancers

Approximately 90% of the world's adult population is infected with EBV. Infections are commonly asymptomatic or associated with mononucleosis. Following infection, the virus remains latent in a small subset of cells for the duration of the patient's life. Cells containing latent virus are increasingly susceptible to malignant transformation. Patients who are immunocompromised are at an increased risk of developing EBV-positive (EBV+) lymphomas. EBV is estimated to be associated with approximately 2% of the global cancer burden including lymphoma, nasopharyngeal carcinoma (NPC), and gastric cancer.

About Viracta Therapeutics, Inc.

Viracta is a clinical-stage precision oncology company focused on the treatment and prevention of virus-associated cancers that impact patients worldwide. Viracta’s lead product candidate is an all-oral combination therapy of its proprietary investigational drug, nanatinostat, and the antiviral agent valganciclovir (collectively referred to as Nana-val). Nana-val is currently being evaluated in multiple ongoing clinical trials, including a potentially registrational, global, multicenter, open-label Phase 2 basket trial for the treatment of multiple subtypes of relapsed or refractory (R/R) Epstein-Barr virus-positive (EBV+) lymphoma (NAVAL-1), as well as a multinational, open-label Phase 1b/2 clinical trial for the treatment of patients with recurrent or metastatic (R/M) EBV+ nasopharyngeal carcinoma (NPC) and other advanced EBV+ solid tumors. Viracta is also pursuing the application of its “Kick and Kill” approach in other virus-related cancers.

For additional information, please visit www.viracta.com.

Forward-Looking Statements

This communication contains "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, without limitation, statements regarding: the details, timeline and expected progress for Viracta's ongoing and anticipated clinical trials and updates regarding the same, Viracta’s clinical focus and strategy, the Company’s expectations related to the FDA submission process and timelines, expectations regarding the Company’s target patient populations, and expectations regarding the Company’s cash runway and ability to fund continued operations and

development. Risks and uncertainties related to Viracta that may cause actual results to differ materially from those expressed or implied in any forward-looking statement include, but are not limited to: Viracta’s ability to continue as a going concern; Viracta's ability to successfully enroll patients in and complete its ongoing and planned clinical trials; Viracta's plans to develop and commercialize its product candidates, including all oral combinations of nanatinostat and valganciclovir; the timing of initiation of Viracta's planned clinical trials; the timing of the availability of data from Viracta's clinical trials; previous preclinical and clinical results may not be predictive of future clinical results; the timing of any planned investigational new drug application or new drug application; Viracta's plans to research, develop, and commercialize its current and future product candidates; the clinical utility, potential benefits, and market acceptance of Viracta's product candidates; Viracta's ability to manufacture or supply nanatinostat, valganciclovir, and pembrolizumab for clinical testing; and Viracta's estimates regarding its ability to fund ongoing operations into 2025, future expenses, capital requirements, and need for additional financing in the future.

If any of these risks materialize or underlying assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. Additional risks and uncertainties that could cause actual outcomes and results to differ materially from those contemplated by the forward-looking statements are included under the caption "Risk Factors" and elsewhere in Viracta's reports and other documents that Viracta has filed, or will file, with the SEC from time to time and available at www.sec.gov.

The forward-looking statements included in this communication are made only as of the date hereof. Viracta assumes no obligation and does not intend to update these forward-looking statements, except as required by law or applicable regulation.

Investor Relations Contact:

Michael Faerm

Chief Financial Officer

Viracta Therapeutics, Inc.

ir@viracta.com

SOURCE Viracta Therapeutics, Inc.

-- Financial tables attached –

|

|

|

|

|

|

|

|

|

|

Viracta Therapeutics, Inc. |

|

Selected Balance Sheet Highlights |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

|

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

(Unaudited) |

|

|

|

|

|

Cash, cash equivalents and short-term investments |

$ |

|

21,132 |

|

|

$ |

|

53,691 |

|

Total assets |

$ |

|

21,958 |

|

|

$ |

|

56,692 |

|

Total liabilities |

$ |

|

28,575 |

|

|

$ |

|

38,373 |

|

Stockholders' equity (deficit) |

$ |

|

(6,617 |

) |

|

$ |

|

18,319 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Viracta Therapeutics, Inc. |

|

Condensed Consolidated Statement of Operations and Comprehensive Loss |

|

(in thousands except share and per share data) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

$ |

|

7,181 |

|

|

$ |

|

8,158 |

|

|

$ |

|

23,685 |

|

|

$ |

|

23,962 |

|

General and administrative |

|

|

3,004 |

|

|

|

|

4,317 |

|

|

|

|

9,966 |

|

|

|

|

13,170 |

|

Total operating expenses |

|

|

10,185 |

|

|

|

|

12,475 |

|

|

|

|

33,651 |

|

|

|

|

37,132 |

|

Loss from operations |

|

|

(10,185 |

) |

|

|

|

(12,475 |

) |

|

|

|

(33,651 |

) |

|

|

|

(37,132 |

) |

Total other income (expense) |

|

|

(368 |

) |

|

|

|

(125 |

) |

|

|

|

4,127 |

|

|

|

|

(161 |

) |

Net loss |

|

|

(10,553 |

) |

|

|

|

(12,600 |

) |

|

|

|

(29,524 |

) |

|

|

|

(37,293 |

) |

Unrealized gain on short-term investments |

|

|

14 |

|

|

|

|

50 |

|

|

|

|

- |

|

|

|

|

113 |

|

Comprehensive loss |

|

|

(10,539 |

) |

|

|

|

(12,550 |

) |

|

|

|

(29,524 |

) |

|

|

|

(37,180 |

) |

Net loss per share, basic and diluted |

$ |

|

(0.27 |

) |

|

$ |

|

(0.33 |

) |

|

$ |

|

(0.75 |

) |

|

$ |

|

(0.97 |

) |

Weighted-average common shares

outstanding, basic and diluted |

|

|

39,574,070 |

|

|

|

|

38,683,858 |

|

|

|

|

39,434,846 |

|

|

|

|

38,568,515 |

|

v3.24.3

Document And Entity Information

|

Nov. 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 13, 2024

|

| Entity Registrant Name |

Viracta Therapeutics, Inc.

|

| Entity Central Index Key |

0001061027

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

000-51531

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

94-3295878

|

| Entity Address, Address Line One |

2533 S. Coast Hwy. 101, Suite 210

|

| Entity Address, City or Town |

Cardiff

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92007

|

| City Area Code |

(858)

|

| Local Phone Number |

400-8470

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

VIRX

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

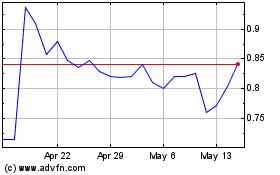

Viracta Therapeutics (NASDAQ:VIRX)

Historical Stock Chart

From Nov 2024 to Dec 2024

Viracta Therapeutics (NASDAQ:VIRX)

Historical Stock Chart

From Dec 2023 to Dec 2024