false

0001565228

0001565228

2024-05-15

2024-05-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 15, 2024

Vislink

Technologies, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-35988 |

|

20-5856795 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

No.) |

350

Clark Drive, Suite 125

Mt.

Olive, NJ 07828

(Address

of principal executive offices)

Registrant’s

telephone number, including area code: (908)-852-3700

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, par value $0.00001 per share |

|

VISL |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Conditions.

On

May 15, 2024, Vislink Technologies, Inc. (the “Company” or “Vislink”) issued a press release, a copy of which

is furnished herewith as Exhibit 99.1, announcing the Company’s financial results for the quarter ended March 31, 2024 (the “Press

Release”).

The

information contained in Item 2.02 of this Current Report on Form 8-K, including the Press Release, shall not be deemed “filed”

for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liability of that section

or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended. In addition, this information shall not be deemed incorporated

by reference into any of the Company’s filings with the Securities and Exchange Commission, except as shall be expressly set forth

by specific reference in any such filing.

Cautionary

Note Regarding Forward-Looking Statements

Certain

statements in this communication and the Press Release are forward-looking statements that involve substantial risks and uncertainties

for purposes of the safe harbor provided by the Private Securities Litigation Reform Act of 1995.

The

Press Release contains forward-looking statements that involve substantial risks and uncertainties for purposes of the safe harbor provided

by the Private Securities Litigation Reform Act of 1995. Any statements, other than statements of historical fact included in the Press

Release, including those regarding the Company’s strategy, future operations, future financial position, effects of any contemplated

cost-savings measures, changes to its product offerings or changes to its lines of business, projected expenses, prospects, plans, objectives

of management, new product launches, expected contract values, and expected market opportunities across the Company’s operating

segments, the sufficiency of the Company’s capital resources to fund the Company’s operations and any statements regarding

future results are forward-looking statements. Vislink may not actually achieve the plans, carry out the intentions or meet the expectations

or projections disclosed in any forward-looking statements such as the foregoing and you should not place undue reliance on such forward-looking

statements. Such statements are based on management’s current expectations and involve risks and uncertainties, including those

discussed in Vislink’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the SEC on April 3, 2024.

The

statements made in this Current Report on Form 8-K and the Press Release speak only as of the date stated herein, and subsequent events

and developments may cause the Company’s expectations and beliefs to change. While the Company may elect to update these forward-looking

statements publicly at some point in the future, the Company specifically disclaims any obligation to do so, whether as a result of new

information, future events or otherwise, except as required by law. These forward-looking statements should not be relied upon as representing

the Company’s views as of any date after the date stated herein.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VISLINK

TECHNOLOGIES, INC. |

| Date:

May 15, 2024 |

|

| |

|

| |

By: |

/s/

Carleton M. Miller |

| |

Name: |

Carleton

M. Miller |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

Vislink

Reports First Quarter 2024 Financial and Operational Results

Total

Revenue Increased 20% to $8.6 Million Driven by Surge in Sales to MilGov Customers

New

Product Sales and Enhanced Operating Efficiency Fuel Significant Profitability Improvements

Mt.

Olive, NJ — May 15, 2024 — Vislink Technologies, Inc. (“Vislink”

or the “Company”) (Nasdaq: VISL), a global technology leader in the capture, delivery, and management of high-quality,

live video and associated data in the media and entertainment, public safety, and defense markets, today reported results for the first

quarter ended March 31, 2024.

First

Quarter 2024 Financial Results

| ● | Revenue

increased 20% to $8.6 million, up from $7.2 million in the prior year period. The increase

in revenue resulted from a jump in sales to military and government customers. |

| ● | Gross

margin increased to 59%, up from 54% in the prior year period. The year-over-year

improvement in gross margin reflects greater operating efficiency and a higher mix of software

and service revenue. |

| ● | Net

loss improved to $(0.9) million, or $(0.39) per share, from $(1.8) million, or

$(0.80) per share, in the prior year period. |

| ● | Cash

and short-term investments were $13.8 million at March 31, 2024, compared to $14.2 million

at December 31, 2023. Working capital was $31.2 million at the end of the first quarter.

The Company expects to continue enhancing working capital performance by optimizing inventory

management and accelerating customer acceptance of new products. |

First

Quarter 2024 and Recent Operational Highlights

| ● | Sales

to MilGov customers experienced a substantial increase in the first quarter of 2024. Market

acceptance of the leading AeroLink platform is driving upgrades from existing customers and

new customer orders. |

| ● | Service/software

revenue increased to 16% of total revenue, with our continued focus on leveraging

the infrastructure platform to drive recurring revenues through the LinkMatrix platform. |

| ● | Launched

Air-to-Anywhere™ within the Company’s AVDS platform, enabling high-resolution,

ultralow-latency real-time video distribution and management to any device, anywhere. This

advancement will include the Company’s roadmap initiatives to leverage AI for enhanced

analytics and is expected to pave new avenues to develop recurring revenue via in-depth data

insights. |

| ● | Unveiled

DragonFly V, the world’s smallest HEVC HDR COFDM/5G transmitter designed to

enhance live video capture from dynamic perspectives, including body-worn and covert applications.

This product launch marks a significant advancement in video capture technology, offering

high-definition, ultra-low latency, real-time video transmission capabilities. |

| ● | Positioned

to grow with global Aerospace OEMs – successfully demonstrated design, manufacturing,

and operations processes and capabilities and received “Approved Supplier” status

from three global aerospace Original Equipment Manufacturers (OEMs). |

| ● | Enhanced

presence in the expanding drone command and control market, boosting revenue and

customer relationships and leveraging the Company’s resilient radio, channel bonding,

and antenna technologies roadmap to offer unique capabilities to address real-world tactical

applications. |

Management

Commentary

“The

first quarter of 2024 demonstrated substantial financial and operational gains, directly resulting from the continued execution of our

strategic plan we implemented two years ago to increase operating leverage,” stated Mickey Miller, CEO of Vislink. “Our revenue

climbed by 20% to $8.6 million, primarily fueled by our expanding presence in the MilGov markets. This growth has been bolstered by enhanced

sales opportunities following the acquisition of BMS assets and increased governmental investment due to recent geopolitical events.

“We

are carrying this momentum into the second quarter as we continue to roll out newer products such as Cliq, LiveLink, and DragonFly V.

These products fulfill needs across our target markets and facilitate opportunities to increase our software and services revenue, which

grew to 16% of total revenue in the first quarter. This strategic shift is steering our revenue mix towards more predictable, higher-margin

streams. Our strengthened sales channels and go-to-market strategies have resulted in the largest weighted sales pipeline since the pandemic,

valued at $48 million entering the second quarter. In addition, we are extending our reach in the Drone Command and Control (Drone C2)

area, another developing use case for our current solutions, as we engage in encouraging discussions with key industry leaders.

“We

are on track to achieve cash flow neutrality by the end of 2024 and aim to be cash flow positive in 2025. Our operations are continually

evolving as we actively identify areas for further operational enhancements and cost-saving measures. These ongoing improvements are

crucial as we work to drive further revenue growth and enhance profitability.”

Conference

Call

Management

will host a conference call today, May 15, 2024, at 8:30 a.m. Eastern Time to discuss its financial results for the first quarter ended

March 31, 2024.

Vislink

management will host the presentation, followed by a question-and-answer period.

Toll-Free

Number: 1-833-953-2432

International

Number: 1-412-317-5761

Webcast:

Click here to register

Please

register online at least 10 minutes before the start time (although you may register, dial in, or access the webcast anytime during the

call). If you have difficulty registering or connecting to the conference call, please contact Gateway Group at 949-574-3860.

The

conference call will be broadcast live here and available for replay via the Investor Relations section of Vislink’s website.

A

replay of the conference call will be available after 11:30 a.m. Eastern Time on the same day through Wednesday, May 28, 2024.

Toll-Free

Replay Number: 1-877-344-7529

International

Replay Number: 1-412-317-0088

Replay

ID: 4822215

Non-GAAP

Financial Measure: EBITDA

To

supplement our financial results presented in accordance with Generally Accepted Accounting Principles (GAAP), we are presenting EBITDA

in this earnings release and the related earnings conference call. EBITDA is a non-GAAP financial measure that is not based on any standardized

methodology prescribed by GAAP and is not necessarily comparable to similarly titled measures presented by other companies. We define

EBITDA as our net income (loss), excluding the impact of depreciation and amortization expense and interest income and tax). We have

presented EBITDA because it is a key measure used by our management and board of directors to understand and evaluate our operating performance,

establish budgets, and develop operational goals for managing our business. In particular, we believe that excluding the impact of these

expenses in calculating EBITDA can provide a useful measure for period-to-period comparisons of our core operating performance. A reconciliation

of non-GAAP EBITDA to GAAP net loss appears in the financial tables accompanying this press release as set forth below.

Note

on Forward-looking Statements

Certain

statements in this press release are forward-looking statements that involve substantial risks and uncertainties for purposes of the

safe harbor provided by the Private Securities Litigation Reform Act of 1995. This press release contains forward-looking statements

that involve substantial risks and uncertainties for purposes of the safe harbor provided by the Private Securities Litigation Reform

Act of 1995. Any statements, other than statements of historical fact included in this press release, including those regarding the Company’s

strategy, future operations, future revenues, growth, profitability results, and financial position, risks of supply chain constraints

and inflationary pressures, projected expenses, prospects, plans including footprint and technology asset consolidations, objectives

of management, new capabilities, product and solutions launches including AI-assisted and 5G streaming technologies, expected contract

values, projected pipeline sales opportunities and transactions in our sales pipeline, backlog realization, and order acquisitions integration

including the recently acquired BMS assets, cost savings, and expected market opportunities across the Company’s operating segments

including the live event production, AVDS and MilGov markets, the sufficiency of the Company’s capital resources to fund the Company’s

operations and any statements regarding future results are forward-looking statements. Vislink may not actually achieve the plans, carry

out the intentions or meet the expectations or projections disclosed in any forward-looking statements such as the foregoing, and you

should not place undue reliance on such forward-looking statements. Such statements are based on management’s current expectations

and involve risks and uncertainties, including those discussed in Vislink’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, filed with the Securities and Exchange Commission (“SEC”) on April 3, 2024, and in subsequent filings

with, or submissions to, the SEC from time to time.

The

statements made in this press release speak only as of the date stated herein, and subsequent events and developments may cause the Company’s

expectations and beliefs to change. While the Company may elect to update these forward-looking statements publicly at some point in

the future, the Company specifically disclaims any obligation to do so, whether as a result of new information, future events, or otherwise,

except as required by law. These forward-looking statements should not be relied upon as representing the Company’s views as of

any date after the date stated herein.

About

Vislink Technologies, Inc.

Vislink

Technologies is a global technology leader in capturing, delivering, and managing high-quality live video and associated data. With a

renowned heritage in video communications encompassing over 50 years, Vislink has revolutionized live video communications by delivering

the highest-quality video from the scene, even in the most challenging transmission conditions—enabling broadcasters and public

safety agencies to capture and share live video seamlessly and securely. Through its Mobile Viewpoint product lines, Vislink also provides

live streaming solutions using bonded cellular, 5G, and AI-driven technologies for automated news and sports productions. Vislink’s

shares of common stock are publicly traded on the Nasdaq Capital Market under the ticker symbol “VISL.” For more information,

visit www.vislink.com.

Media

Contact:

Adrian

Lambert

Adrian.lambert@vislink.com

Investor

Relations Contact:

Alec Wilson and Matt Glover

Gateway

Group, Inc.

VISL@gateway-grp.com

-Financial

Tables to Follow-

VISLINK

TECHNOLOGIES, INC. AND SUBSIDIARIES

CONDENSED

CONSOLIDATED BALANCE SHEETS

(IN

THOUSANDS EXCEPT SHARE AND PER SHARE DATA)

| | |

March 31, 2024 | | |

December 31, 2023 | |

| | |

(unaudited) | | |

| |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash | |

$ | 7,959 | | |

$ | 8,482 | |

| Accounts receivable, net | |

| 9,015 | | |

| 8,680 | |

| Inventories, net | |

| 14,866 | | |

| 14,029 | |

| Investments held to maturity | |

| 5,799 | | |

| 5,731 | |

| Prepaid expenses and other current assets | |

| 1,726 | | |

| 1,560 | |

| Total current assets | |

| 39,365 | | |

| 38,482 | |

| Right of use assets, operating leases | |

| 1,134 | | |

| 742 | |

| Property and equipment, net | |

| 1,912 | | |

| 1,902 | |

| Intangible assets, net | |

| 3,579 | | |

| 3,866 | |

| Total assets | |

$ | 45,990 | | |

$ | 44,992 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 3,533 | | |

$ | 3,183 | |

| Accrued expenses | |

| 1,403 | | |

| 1,578 | |

| Operating lease obligations, current | |

| 728 | | |

| 463 | |

| Customer deposits and deferred revenue | |

| 2,546 | | |

| 1,490 | |

| Total current liabilities | |

| 8,210 | | |

| 6,714 | |

| Operating lease obligations, net of current portion | |

| 847 | | |

| 755 | |

| Deferred tax liabilities | |

| 490 | | |

| 546 | |

| Total liabilities | |

| 9,547 | | |

| 8,015 | |

| Commitments and contingencies (See Note 11) | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Series A Preferred stock, $0.00001 par value per share: -0- shares authorized on March 31, 2024, and December 31, 2023, respectively; -0- shares issued and outstanding on March 31, 2024, and December 31, 2023, respectively. | |

| — | | |

| — | |

| Common stock, $0.00001 par value per share, 100,000,000 shares authorized on March 31, 2024, and December 31, 2023, respectively: Common stock, 2,452,482 and 2,439,923 were issued, and 2,452,349 and 2,439,790 were outstanding on March 31, 2024, and December 31, 2023, respectively. | |

| — | | |

| — | |

| Additional paid-in capital | |

| 348,131 | | |

| 347,507 | |

| Accumulated other comprehensive loss | |

| (1,237 | ) | |

| (1,027 | ) |

| Treasury stock, at cost – 133 shares as of March 31, 2024, and December 31, 2023, respectively | |

| (277 | ) | |

| (277 | ) |

| Accumulated deficit | |

| (310,174 | ) | |

| (309,226 | ) |

| Total stockholders’ equity | |

| 36,443 | | |

| 36,977 | |

| Total liabilities and stockholders’ equity | |

$ | 45,990 | | |

$ | 44,992 | |

VISLINK

TECHNOLOGIES, INC. AND SUBSIDIARIES

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND

OTHER COMPREHENSIVE LOSS

(IN THOUSANDS EXCEPT NET LOSS PER SHARE DATA)

| | |

For the Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Revenue, net | |

$ | 8,598 | | |

$ | 7,188 | |

| Cost of revenue and operating expenses | |

| | | |

| | |

| Cost of components and personnel | |

| 3,555 | | |

| 3,314 | |

| Inventory valuation adjustments | |

| 201 | | |

| 129 | |

| General and administrative expenses | |

| 5,294 | | |

| 5,028 | |

| Research and development expenses | |

| 799 | | |

| 767 | |

| Amortization and depreciation | |

| 347 | | |

| 298 | |

| Total cost of revenue and operating expenses | |

| 10,196 | | |

| 9,536 | |

| Loss from operations | |

| (1,598 | ) | |

| (2,348 | ) |

| Other income (expense) | |

| | | |

| | |

| Unrealized gain (loss) on investments in debt securities | |

| 63 | | |

| (28 | ) |

| Other income | |

| 375 | | |

| 341 | |

| Dividend income | |

| 66 | | |

| 91 | |

| Interest income, net | |

| 91 | | |

| 133 | |

| Total other income (expense) | |

| 595 | | |

| 537 | |

| Net loss before income taxes | |

| (1,003 | ) | |

| (1,811 | ) |

| Income taxes | |

| | | |

| | |

| Deferred tax benefits | |

| 55 | | |

| 55 | |

| Net loss | |

$ | (948 | ) | |

$ | (1,756 | ) |

| Basic and diluted loss per share | |

$ | (0.39 | ) | |

$ | (0.74 | ) |

| Weighted average number of shares outstanding: | |

| | | |

| | |

| Basic and diluted | |

| 2,444 | | |

| 2,375 | |

| Comprehensive loss: | |

| | | |

| | |

| Net loss | |

$ | (948 | ) | |

$ | (1,756 | ) |

| Unrealized gain (loss) on currency translation adjustment | |

| (210 | ) | |

| 155 | |

| Comprehensive loss | |

$ | (1,158 | ) | |

$ | (1,601 | ) |

Reconciliation

of GAAP to Non-GAAP Results

VISLINK

TECHNOLOGIES, INC.

RECONCILIATION OF GAAP to NON-GAAP RESULTS

QUARTER ENDING March 31, 2024

(IN THOUSANDS)

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Reconciliation of net income to EBITDA | |

| | | |

| | |

| Net loss | |

$ | (948 | ) | |

$ | (1,756 | ) |

| Amortization and depreciation | |

| 347 | | |

| 298 | |

| Dividend income | |

| (66 | ) | |

| (91 | ) |

| Interest income, net | |

| (91 | ) | |

| (133 | ) |

| Tax | |

| (55 | ) | |

| (55 | ) |

| EBITDA | |

$ | (813 | ) | |

$ | (1,737 | ) |

| Stock-based compensation | |

| 464 | | |

| 921 | |

| Severance | |

| — | | |

| 349 | |

| EBITDA Non-GAAP Adjusted | |

$ | (349 | ) | |

$ | (467 | ) |

v3.24.1.1.u2

Cover

|

May 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 15, 2024

|

| Entity File Number |

001-35988

|

| Entity Registrant Name |

Vislink

Technologies, Inc.

|

| Entity Central Index Key |

0001565228

|

| Entity Tax Identification Number |

20-5856795

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

350

Clark Drive

|

| Entity Address, Address Line Two |

Suite 125

|

| Entity Address, City or Town |

Mt.

Olive

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

07828

|

| City Area Code |

(908)

|

| Local Phone Number |

852-3700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.00001 per share

|

| Trading Symbol |

VISL

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

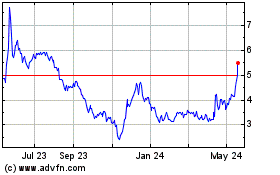

Vislink Technologies (NASDAQ:VISL)

Historical Stock Chart

From Jan 2025 to Feb 2025

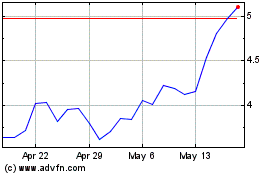

Vislink Technologies (NASDAQ:VISL)

Historical Stock Chart

From Feb 2024 to Feb 2025