false

--12-31

0001837686

0001837686

2024-05-21

2024-05-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

May 21, 2024

VIMEO,

INC.

(Exact name of registrant as specified in

its charter)

| Delaware |

|

001-40420 |

|

85-4334195 |

| (State

or other jurisdiction |

|

(Commission |

|

(I.R.S.

Employer |

| of

incorporation) |

|

File

No.) |

|

Identification

No.) |

| 330

West 34th Street, 5th Floor, New York,

NY |

|

10001 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s telephone

number, including area code: (212) 524-8791

(Former name or former address,

if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR

240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR

240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| (Title

of each class) |

|

(Trading

Symbol(s)) |

|

(Name

of each exchange on which

registered) |

| Common

Stock, par value $0.01 |

|

VMEO |

|

The Nasdaq

Stock Market LLC

(Nasdaq Global Select Market) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change

in Fiscal Year.

As described under Item 5.07 below, Vimeo, Inc. (“Vimeo”

or the “Company”) held its 2024 Annual Meeting of Stockholders (the “Annual Meeting”) on May 21, 2024. At

the Annual Meeting, upon the recommendation of the Board of Directors of the Company (the “Board”), the Company’s stockholders

approved an amendment and restatement of the Company’s Amended and Restated Certificate of Incorporation to limit the liability

of certain officers of Vimeo as permitted pursuant to recent amendments to the Delaware General Corporation Law (the “Amended Charter”).

The Amended Charter was previously approved by the Board, subject to stockholder approval.

The Amended Charter was filed with the Secretary of State of the State

of Delaware on May 22, 2024 and was effective as of such date. The foregoing description of the Amended Charter is qualified in its

entirety by reference to the full text of the Amended Charter, which is attached as Exhibit 3.1 hereto and is incorporated by reference

into this Item 5.03.

Item 5.07. Submission of Matters

to a Vote of Security Holders.

At the Annual Meeting, stockholders of the Company voted on the proposals

set forth below. The final voting results on each of the matters submitted to a vote of the Company’s stockholders at the Annual

Meeting are set forth below.

As of the close of business on March 25, 2024, the record date

for the Annual Meeting, there were 159,423,442 shares of Vimeo common stock (entitled to one vote per share) and 9,399,250 shares of Vimeo

Class B common stock (entitled to ten votes per share) outstanding and entitled to vote. Vimeo common stock and Class B common

stock are collectively referred to as Vimeo capital stock.

| 1. |

A proposal to elect eight members of Vimeo’s Board of

Directors, each to hold office until the next succeeding annual meeting of stockholders or until such director’s successor shall

have been duly elected and qualified (or, if earlier, such director’s removal or resignation from the Vimeo Board of Directors).

The stockholders elected each of the nominees to the Vimeo Board of Directors on the basis of the following voting results. |

Elected by

holders of Vimeo common stock voting as a separate class:

| |

|

FOR |

|

|

WITHHELD |

|

|

BROKER

NON-VOTES |

|

| Jay Herratti |

|

|

110,794,225 |

|

|

644,059 |

|

|

11,657,794 |

|

| Ida Kane |

|

|

110,819,334 |

|

|

618,950 |

|

|

11,657,794 |

|

Elected by

holders of Vimeo capital stock voting as a single class:

| |

|

FOR |

|

|

WITHHELD |

|

|

BROKER

NON-VOTES |

|

| Adam Gross |

|

|

204,787,533 |

|

|

643,251 |

|

|

11,657,794 |

|

| Alesia J. Haas |

|

|

135,226,388 |

|

|

70,204,396 |

|

|

11,657,794 |

|

| Mo Koyfman |

|

|

135,208,735 |

|

|

70,222,049 |

|

|

11,657,794 |

|

| Philip Moyer |

|

|

204,751,046 |

|

|

679,738 |

|

|

11,657,794 |

|

| Glenn H. Schiffman |

|

|

197,360,400 |

|

|

8,070,384 |

|

|

11,657,794 |

|

| Alexander von Furstenberg |

|

|

200,037,767 |

|

|

5,393,017 |

|

|

11,657,794 |

|

| 2. |

A proposal to ratify the appointment of Ernst & Young LLP as Vimeo’s independent registered public accounting firm for the 2024 fiscal year. The proposal was approved by the holders of Vimeo capital stock on the basis of the following voting results: |

| FOR |

|

|

AGAINST |

|

|

ABSTAIN |

| 216,934,133 |

|

|

102,710 |

|

|

51,735 |

| 3. |

A proposal to approve the Amended Charter. The proposal was approved by the holders of Vimeo capital stock on the basis of the following voting results: |

| FOR |

|

|

AGAINST |

|

|

ABSTAIN |

|

|

BROKER NON-VOTES |

|

| 147,556,073 |

|

|

57,838,910 |

|

|

35,801 |

|

|

11,657,794 |

|

| 4. |

A non-binding advisory vote on the compensation of our named executive officers. Holders of Vimeo capital stock voted to approve the compensation of our named executive officers, on the basis of the following voting results: |

| FOR |

|

|

AGAINST |

|

|

ABSTAIN |

|

|

BROKER NON-VOTES |

|

| 202,162,899 |

|

|

3,217,319 |

|

|

50,566 |

|

|

11,657,794 |

|

Item

9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VIMEO, INC. |

| |

|

| |

By: |

/s/ Jessica Tracy |

| |

Name: |

Jessica Tracy |

| |

Title: |

General Counsel & Secretary |

Date: May 22, 2024

Exhibit 3.1

AMENDED AND RESTATED

CERTIFICATE OF INCORPORATION OF

VIMEO, INC.

Vimeo, Inc. (hereinafter called the “Corporation”),

a corporation organized and existing under and by virtue of the General Corporation Law of the State of Delaware, does hereby certify:

1. The name of the Corporation is: Vimeo, Inc.

Vimeo, Inc. was originally incorporated under the name Vimeo Holdings, Inc., and the original Certificate of Incorporation was filed with

the Secretary of State of the State of Delaware on December 15, 2020 and subsequently amended on May 21, 2021 and amended and restated

effective as of 12:01a.m., Eastern time, on May 25, 2021 and subsequently further amended and restated on May 21, 2024.

2. This Amended and Restated Certificate of Incorporation

has been duly adopted by the Board of Directors in accordance with the provisions of Sections 141 and 242 of the General Corporation Law

of the State of Delaware and was approved by the holders of the requisite number of shares of stock of the Corporation and submitted to

the Secretary of State of the State of Delaware in accordance with Sections 103, 242 and 245 of the General Corporation Law of the State

of Delaware and is to become effective upon filing.

3. The text of the Certificate of Incorporation

of the Corporation is hereby amended and restated to read in its entirety as follows:

ARTICLE I

The name of the Corporation is Vimeo, Inc.

ARTICLE II

The address

of the Corporation’s registered office in the State of Delaware is c/o The Corporation Trust Company, Corporation Trust Center,

1209 Orange Street in the City of Wilmington, County of New Castle, State of Delaware 19801. The name of the Corporation’s registered

agent at such address is The Corporation Trust Company.

ARTICLE III

The purpose of the Corporation is to engage in

any lawful act or activity for which a corporation may be organized under the Delaware General Corporation Law.

ARTICLE IV

The Corporation shall have the authority to issue

one billion six hundred million (1,600,000,000) shares of $0.01 par value Common Stock, four hundred million (400,000,000) shares of $0.01

par value Class B Common Stock, and one hundred million (100,000,000) shares of $0.01 par value Preferred Stock.

A statement of the designations of each class and

the powers, preferences and rights, and qualifications, limitations or restrictions thereof is as follows:

(1) The holders of the Common Stock shall be entitled

to receive, share for share with the holders of shares of Class B Common Stock, such dividends if, as and when declared from time to time

by the Board of Directors.

(2) In the event of the voluntary or involuntary

liquidation, dissolution, distribution of assets or winding-up of the Corporation, the holders of the Common Stock shall be entitled to

receive, share for share with the holders of shares of Class B Common Stock and any other class or series of stock entitled to share therewith,

all the assets of the Corporation of whatever kind available for distribution to stockholders, after the rights of the holders of the

Preferred Stock have been satisfied.

(3) Each holder of Common Stock shall be entitled

to vote one vote for each share of Common Stock held as of the applicable date on any matter that is submitted to a vote or to the consent

of the holders of the Common Stock. Except as otherwise provided herein or by the General Corporation Law of the State of Delaware, the

holders of Common Stock and the holders of Class B Common Stock and any other class or series entitled to vote with the Common Stock and

Class B Common Stock as a class shall at all times vote on all matters (including the election of directors) together as one class.

(1) The holders of the Class B Common Stock shall

be entitled to receive, share for share with the holders of shares of Common Stock, such dividends if, as and when declared from time

to time by the Board of Directors.

(2) In the event of the voluntary or involuntary

liquidation, dissolution, distribution of assets or winding-up of the Corporation, the holders of the Class B Common Stock shall be entitled

to receive, share for share with the holders of shares of Common Stock and any other class or series of stock entitled to share therewith,

all the assets of the Corporation of whatever kind available for distribution to stockholders, after the rights of the holders of the

Preferred Stock have been satisfied.

(3) Each holder of Class B Common Stock shall be

entitled to vote ten votes for each share of Class B Common Stock held as of the applicable date on any matter that is submitted to a

vote or to the consent of the holders of the Class B Common Stock. Except as otherwise provided herein or by the General Corporation Law

of the State of Delaware, the holders of Common Stock and the holders of Class B Common Stock and any other class or series entitled to

vote with the Common Stock and Class B Common Stock as a class shall at all times vote on all matters (including the election of directors)

together as one class.

| C. |

OTHER MATTERS AFFECTING SHAREHOLDERS OF COMMON STOCK AND CLASS B COMMON STOCK |

(1) In no event shall any stock dividends or stock

splits or combinations of stock be declared or made on Common Stock or Class B Common Stock unless the shares of Common Stock and Class

B Common Stock at the time outstanding are treated equally and identically.

(2) Shares of Class B Common Stock shall be convertible

into shares of the Common Stock of the Corporation at the option of the holder thereof at any time on a share for share basis. Such conversion

ratio shall in all events be equitably preserved in the event of any recapitalization of the Corporation by means of a stock dividend

on, or a stock split or combination of, outstanding Common Stock or Class B Common Stock, or in the event of any merger, consolidation

or other reorganization of the Corporation with another corporation.

(3) Upon the conversion of Class B Common Stock

into shares of Common Stock, the Corporation shall take all necessary action so that said shares of Class B Common Stock shall be retired

and shall not be subject to reissue.

(4) Notwithstanding anything to the contrary in

this Certificate of Incorporation, the holders of Common Stock, acting as a single class, shall be entitled to elect twenty-five percent

(25%) of the total number of directors, and in the event that twenty-five percent (25%) of the total number of directors shall result

in a fraction of a director, then the holders of the Common Stock, acting as a single class, shall be entitled to elect the next higher

whole number of directors.

The Board of Directors is authorized, by resolution,

to designate the voting powers, preferences, rights and qualifications, limitations and restrictions of the Preferred Stock and any class

or series thereof. Pursuant to subsection 242(b) of the Delaware General Corporation Law, the number of authorized shares of Preferred

Stock or any class or series thereof may be increased or decreased (but not below the number of shares thereof then outstanding) by the

affirmative vote of the holders of a majority of the voting power of the Corporation entitled to vote irrespective of such subsection.

ARTICLE V

The Board of Directors of the Corporation is expressly

authorized to make, alter or repeal By-Laws of the Corporation, but the stockholders may make additional By-Laws and may alter or repeal

any By-Law whether adopted by them or otherwise.

ARTICLE VI

Elections of directors need not be by written ballot

except and to the extent provided in the By-Laws of the Corporation.

ARTICLE VII

The Corporation is to have perpetual existence.

ARTICLE VIII

Each person who is or was or had agreed to become

a director or officer of the Corporation, or each such person who is or was serving or had agreed to serve at the request of the Board

of Directors or an officer of the Corporation as an employee or agent of the Corporation or as a director, officer, employee or agent

of another corporation, partnership, joint venture, trust or other enterprise (including the heirs, executors, administrators or estate

of such person), shall be indemnified by the Corporation, in accordance with the By-Laws of the Corporation, to the full extent permitted

from time to time by the General Corporation Law of the State of Delaware as the same exists or may hereafter be amended (but, in the

case of any such amendment, only to the extent that such amendment permits the Corporation to provide broader indemnification rights than

said law permitted the Corporation to provide prior to such amendment) or any other applicable laws as presently or hereinafter in effect.

Without limiting the generality or the effect of the foregoing, the Corporation may enter into one or more agreements with any person

that provide for indemnification greater or different than that provided in this Article VIII. Any amendment or repeal of this Article

VIII shall not adversely affect any right or protection existing hereunder immediately prior to such amendment or repeal.

ARTICLE IX

A director or officer of the Corporation shall

not be personally liable to the Corporation or its stockholders for monetary damages for breach of fiduciary duty as a director or officer,

respectively, except for liability (i) for any breach of the director’s or officer’s duty of loyalty to the Corporation or

its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law,

(iii) under Section 174 of the General Corporation Law of the State of Delaware (with respect to directors only), (iv) for any transaction

from which the director or officer derived an improper personal benefit, or (v) for any action by or in the right of the Corporation (with

respect to officers only). Any amendment or repeal of this Article IX shall not adversely affect any right or protection of a director

or officer of the Corporation existing immediately prior to such amendment or repeal. The liability of a director or officer shall be

further eliminated or limited to the full extent permitted by Delaware law, as it may hereafter be amended.

ARTICLE X

Meetings of stockholders may be held within or

without the State of Delaware, as determined by the Board of Directors. The books of the Corporation may be kept (subject to any provision

contained in the Delaware General Corporation Law) outside the State of Delaware at such place or places as may be designated from time

to time by the Board of Directors or in the By-Laws of the Corporation.

ARTICLE XI

The Corporation reserves the right to amend, alter,

change or repeal any provision contained in this Certificate of Incorporation, in the manner now or hereafter prescribed by the Delaware

General Corporation Law, and all rights conferred upon stockholders herein are granted subject to this reservation except that under no

circumstances may such amendment be adopted except as prescribed by Article IV, above, and provided further that the rights of the Class

B Common Stock may not be amended, altered, changed or repealed without the approval of the holders of the requisite number of said shares

of Class B Common Stock.

ARTICLE XII

The number of directors of the Corporation shall

be such number as shall be determined from time to time by resolution of the Board of Directors.

ARTICLE XIII

| A. |

COMPETITION AND CORPORATE OPPORTUNITIES |

(1) To the extent provided in the following sentence,

the Corporation renounces any interest or expectancy of the Corporation or any of its Affiliated Companies in, or in being offered an

opportunity to participate in, any Expedia Dual Opportunity about which an Expedia Dual Role Person acquires knowledge. An Expedia Dual

Role Person shall have no duty to communicate or offer to the Corporation or any of its Affiliated Companies any Expedia Dual Opportunity

that such Expedia Dual Role Person has communicated or offered to Expedia, shall not be prohibited from communicating or offering any

Expedia Dual Opportunity to Expedia, and shall not be liable to the Corporation or its stockholders for breach of any fiduciary duty as

a stockholder, director or officer of the Corporation, as the case may be, resulting from (i) the failure to communicate or offer to the

Corporation or any of its Affiliated Companies any Expedia Dual Opportunity that such Expedia Dual Role Person has communicated or offered

to Expedia or (ii) the communication or offer to Expedia of any Expedia Dual Opportunity, so long as (x) the Expedia Dual Opportunity

does not become known to the Expedia Dual Role Person in his or her capacity as a director or officer of the Corporation, and (y) the

Expedia Dual Opportunity is not presented by the Expedia Dual Role Person to any party other than Expedia, Match or IAC and the Expedia

Dual Role Person does not pursue the Expedia Dual Opportunity individually.

(2) To the extent provided in the following sentence,

the Corporation renounces any interest or expectancy of the Corporation or any of its Affiliated Companies in, or in being offered an

opportunity to participate in, any Match Dual Opportunity about which a Match Dual Role Person acquires knowledge. A Match Dual Role Person

shall have no duty to communicate or offer to the Corporation or any of its Affiliated Companies any Match Dual Opportunity that such

Match Dual Role Person has communicated or offered to Match, shall not be prohibited from communicating or offering any Match Dual Opportunity

to Match, and shall not be liable to the Corporation or its stockholders for breach of any fiduciary duty as a stockholder, director or

officer of the Corporation, as the case may be, resulting from (i) the failure to communicate or offer to the Corporation or any of its

Affiliated Companies any Match Dual Opportunity that such Match Dual Role Person has communicated or offered to Match or (ii) the communication

or offer to Match of any Match Dual Opportunity, so long as (x) the Match Dual Opportunity does not become known to the Match Dual Role

Person in his or her capacity as a director or officer of the Corporation, and (y) the Match Dual Opportunity is not presented by the

Match Dual Role Person to any party other than Match, Expedia or IAC and the Match Dual Role Person does not pursue the Match Dual Opportunity

individually.

(3) To the extent provided in the following sentence,

the Corporation renounces any interest or expectancy of the Corporation or any of its Affiliated Companies in, or in being offered an

opportunity to participate in, any IAC Dual Opportunity about which an IAC Dual Role Person acquires knowledge. An IAC Dual Role Person

shall have no duty to communicate or offer to the Corporation or any of its Affiliated Companies any IAC Dual Opportunity that such IAC

Dual Role Person has communicated or offered to IAC, shall not be prohibited from communicating or offering any IAC Dual Opportunity to

IAC, and shall not be liable to the Corporation or its stockholders for breach of any fiduciary duty as a stockholder, director or officer

of the Corporation, as the case may be, resulting from (i) the failure to communicate or offer to the Corporation or any of its Affiliated

Companies any IAC Dual Opportunity that such IAC Dual Role Person has communicated or offered to IAC or (ii) the communication or offer

to IAC of any IAC Dual Opportunity, so long as (x) the IAC Dual Opportunity does not become known to the IAC Dual Role Person in his or

her capacity as a director or officer of the Corporation, and (y) the IAC Dual Opportunity is not presented by the IAC Dual Role Person

to any party other than IAC, Expedia or Match and the IAC Dual Role Person does not pursue the IAC Dual Opportunity individually.

| B. |

CERTAIN MATTERS DEEMED NOT CORPORATE OPPORTUNITIES |

In addition to and notwithstanding the foregoing

provisions of this Article XIII, the Corporation renounces any interest or expectancy of the Corporation or any of its Affiliated Companies

in, or in being offered an opportunity to participate in, any business opportunity that the Corporation is not financially able or contractually

permitted or legally able to undertake. Moreover, nothing in this Article XIII shall amend or modify in any respect any written contractual

agreement between Expedia, Match or IAC on the one hand and the Corporation or any of its Affiliated Companies on the other hand.

For purposes of this Article XIII:

“Affiliate” means with respect

to any Person, any other Person directly or indirectly controlling, controlled by or under common control with such Person. For purposes

of the foregoing definition, the term “controls,” “is controlled by,” or “is under common control with”

means the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities,

by contract or otherwise.

“Affiliated Company” means (i)

with respect to the Corporation, any Person controlled by the Corporation, (ii) with respect to Expedia, any Person controlled by Expedia,

(iii) with respect to Match, any Person controlled by Match, and (iv) with respect to IAC, any Person controlled by IAC.

“Expedia” means Expedia Group,

Inc., a Delaware corporation, and its Affiliated Companies.

“Expedia Dual Opportunity” means

any potential transaction or matter which may be a corporate opportunity for both Expedia, on the one hand, and the Corporation or any

of its Affiliated Companies, on the other hand.

“Expedia Dual Role Person” means

any individual who is an officer or director of both the Corporation and Expedia.

“IAC” means IAC/InterActiveCorp,

a Delaware corporation, and its Affiliated Companies.

“IAC Dual Opportunity” means

any potential transaction or matter which may be a corporate opportunity for both IAC, on the one hand, and the Corporation or any of

its Affiliated Companies, on the other hand.

“IAC Dual Role Person” means

any individual who is an officer or director of both the Corporation and IAC.

“Match” means Match Group, Inc.,

a Delaware corporation originally incorporated on July 28, 1986 under the name Silver King Broadcasting Company, Inc., and its Affiliated

Companies.

“Match Dual Opportunity” means

any potential transaction or matter which may be a corporate opportunity for both Match, on the one hand, and the Corporation or any of

its Affiliated Companies, on the other hand.

“Match Dual Role Person” means

any individual who is an officer or director of both the Corporation and Match.

“Person” means an individual,

a partnership, a corporation, a limited liability company, an association, a joint stock company, a trust, a joint venture, an unincorporated

organization and a governmental entity or any department, agency or political subdivision thereof.

The provisions of this Article XIII shall have

no further force or effect (i) with respect to Expedia Dual Role Persons or Expedia Dual Opportunities at such time as (a) the Corporation

and Expedia are no longer Affiliates and (b) none of the directors and officers of Expedia serve as directors or officers of the Corporation

and its Affiliated Companies, (ii) with respect to Match Dual Role Persons and Match Dual Opportunities at such time as (a) the Corporation

and Match are no longer Affiliates and (b) none of the directors and officers of Match serve as directors or officers of the Corporation

and its Affiliated Companies and (iii) with respect to IAC Dual Role Persons and IAC Dual Opportunities at such time as (a) the Corporation

and IAC are no longer Affiliates and (b) none of the directors and officers of IAC serve as directors or officers of the Corporation and

its Affiliated Companies; provided, however, that any such termination shall not terminate the effect of such provisions with respect

to any agreement, arrangement or other understanding between the Corporation or an Affiliated Company thereof on the one hand, and Expedia,

Match or IAC, on the other hand, as applicable, that was entered into before such time or any transaction entered into in the performance

of such agreement, arrangement or other understanding, whether entered into before or after such time.

Any person or entity purchasing or otherwise acquiring

or obtaining any interest in any capital stock of the Corporation shall be deemed to have notice and to have consented to the provisions

of this Article XIII.

The invalidity or unenforceability of any particular

provision, or part of any provision, of this Article XIII shall not affect the other provisions or parts hereof, and this Article XIII

shall be construed in all respects as if such invalid or unenforceable provisions or parts were omitted.

4. This Amended and Restated Certificate of Incorporation

shall become effective upon filing.

* * * * * *

IN WITNESS WHEREOF, the Corporation has caused

this Amended and Restated Certificate of Incorporation to be duly executed and acknowledged by its duly authorized officer this 21st day

of May, 2024.

| |

By: |

/s/ Jessica Tracy |

| |

|

Name: Jessica Tracy |

| |

|

Title: General Counsel and Secretary |

v3.24.1.1.u2

Cover

|

May 21, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 21, 2024

|

| Current Fiscal Year End Date |

--12-31

|

| Entity File Number |

001-40420

|

| Entity Registrant Name |

VIMEO,

INC.

|

| Entity Central Index Key |

0001837686

|

| Entity Tax Identification Number |

85-4334195

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

330

West 34th Street

|

| Entity Address, Address Line Two |

5th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10001

|

| City Area Code |

212

|

| Local Phone Number |

524-8791

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, par value $0.01

|

| Trading Symbol |

VMEO

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

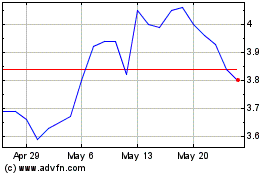

Vimeo (NASDAQ:VMEO)

Historical Stock Chart

From Dec 2024 to Jan 2025

Vimeo (NASDAQ:VMEO)

Historical Stock Chart

From Jan 2024 to Jan 2025