Versus Systems, Inc. (NASDAQ: VS) (the “Company”) announced today

the execution of two significant agreements with Aspis Cyber

Technologies, Inc. (“ASPIS”), a cloud-based mobile endpoint

cybersecurity technology firm.

ASPIS is affiliated with Cronus Equity Capital

Group, LLC, which holds approximately 39.5% of the Company’s

outstanding common stock. A significant shareholder of Cronus is

also a shareholder of ASPIS, reinforcing the strategic alignment

between the entities. In addition, a director of the Company is

also a director of ASPIS and owns an equity interest in ASPIS.

The first agreement, a Business Funding Agreement (the “Funding

Agreement”), provides for ASPIS to invest $2.5 million in Versus

Systems. Under the Funding Agreement, ASPIS has initially invested

$500,000, and on or before November 15, 2024, ASPIS will invest the

balance of $2,000,000. In exchange for the investment, the Company

has issued ASPIS an unsecured convertible promissory note with a

principal balance of $2,500,000 (or such lesser amount if less is

funded) (the “Note”).The Note is convertible into units with each

unit comprised of one common share and one warrant to purchase one

half of one common share at an exercise price of $4.00 per share.

The Note may also be paid in cash at the option of ASPIS. The Note

will not be convertible by the holder unless and until the Company

obtains approval from its shareholders of the issuance of the

equity under the Note and of the Company’s redomiciling to

Delaware. The conversion price for the Note will be at least $1.16

but will be determined by the greater of (1) the 5-day

volume-weighted average price, including the date prior to the

initial funding, and (2) $1.16. The Company anticipates that it

will hold its annual meeting to seek shareholder approval in

December 2024. The Note is a senior note and will bear simple

interest on the amounts funded at the rate of ten percent (10%) per

annum.

The second agreement, a Technology Licensing and Software

Development Agreement (the “License Agreement”), enables ASPIS to

license Versus Systems’ gamification, engagement, and QR code

technology for integration into its cybersecurity offerings,

particularly in sectors such as government, finance, gaming, and

social media in exchange for a monthly license fee paid to the

Company. ASPIS will also compensate the Company for any updates or

innovations related to this technology.

These agreements form the foundation of the Company’s compliance

plan, submitted to Nasdaq on October 7, 2024, to address the

Company’s requirement to maintain a minimum of $2.5 million in

shareholders’ equity for continued listing on The Nasdaq Capital

Market, as outlined in Nasdaq Listing Rule 5550(b)(1). Through

these agreements, Versus Systems aims to exceed the required

minimum shareholders’ equity, ensuring compliance until at least

September 30, 2025. The Company cannot provide any guarantee or

assurances, however, that it will exceed or continue to meet the

minimum shareholders’ equity requirement.

“Partnering with ASPIS Cyber Technologies marks a pivotal moment

for Versus Systems,” said Curtis Wolfe, Interim CEO of Versus

Systems. “This collaboration not only strengthens our financial

position but also enhances our technological capabilities, allowing

us to provide cutting-edge solutions in cybersecurity.”

Under the terms of the agreements, assuming the Company receives

shareholder approval of the issuance of equity under the Note and

the Company’s redomiciling to Delaware, ASPIS could receive upon

conversion of the Note and exercise of the warrants (assuming the

final price is $1.16), 2,155,172 shares of common stock and

warrants to purchase an additional 1,077,586 shares. Upon

conversion of the Note, ASPIS would hold approximately 45.8% of the

outstanding common stock of the Company. This percentage does not

account for shares issuable upon exercise of the warrants or

ASPIS’s option under the Note to convert any accrued and unpaid

cash interest on the Note into units, which would result in

additional shares issuable to ASPIS.

The License Agreement stipulates a monthly fee of $165,000 to be

paid by ASPIS starting in January 2025, while also granting ASPIS a

license to use any modifications made to the licensed technology

for cybersecurity purposes.

Nasdaq will review the Company’s plan, and should the plan not

be accepted, or if compliance is not achieved by February 18, 2025,

Nasdaq may initiate delisting proceedings. In such cases, Versus

Systems reserves the right to request a hearing for an additional

extension.

About Versus Systems

Versus Systems, Inc. has developed a proprietary in-game prizing

and promotions engine that allows game developers and publishers to

offer real-world rewards inside their games. Players can choose

from a variety of rewards that match their interests, including

merchandise, events, and digital goods. Versus Systems is

headquartered in Los Angeles, California.

For more information, please

visit www.versussystems.com.

About Aspis Cyber Technologies, Inc.

ASPIS is a Cloud Based Mobile Endpoint Cyber Security Technology

Company for Anti Tapping, Antihacking within the Government,

Finance, Gaming and Social Media sectors that provides

cybersecurity technology for clients that include governments,

municipalities, commercial entities, and consumers.

For media inquiries, please contact:

Cody Slach, Gateway Group, Inc.949-574-3860IR@versussystems.com

orpress@versussystems.com

Forward-Looking Statements

This news release contains “forward-looking statements”.

Statements in this news release which are not purely historical are

forward-looking statements and include any statements regarding

beliefs, plans, outlook, expectations or intentions regarding the

future, including statements regarding the Company’s plans to

regain compliance. It is important to note that actual outcomes and

the Company’s actual results could differ materially from those in

such forward-looking statements. Actual results could differ from

those projected in any forward-looking statements due to numerous

factors. Such factors include, among others: uncertainty whether

the Company’s plan to regain compliance with Nasdaq’s minimum

shareholders’ equity rule submitted to Nasdaq will be accepted or,

if accepted, whether the Company will regain compliance with the

minimum shareholders’ equity rule within the timelines required by

Nasdaq, failing which, the Company’s securities will be delisted by

Nasdaq; uncertainty whether the Company would appeal any delisting

notice or whether any such appeal would be successful, failing

which, the Company’s securities will be delisted by Nasdaq; the

risk that delisting of the Company’s securities may have a material

adverse effect on the Company’s share liquidity and trading price

and on the Company’s ability to obtain financing and continue its

business; whether the Company will realize long-term benefits and

synergies from the partnership with ASPIS; and the risk of changes

in business strategy or plans. Readers should also refer to the

risk disclosures outlined in the Company’s quarterly reports on

Form 10-Q, the Company’s annual reports on Form 10-K, and the

Company’s other disclosure documents filed from time-to-time with

the Securities and Exchange Commission at www.sec.gov and the

Company’s interim and annual filings and other disclosure documents

filed in Canada from time-to-time under the Company's profile on

SEDAR+ at https://www.sedarplus.ca.

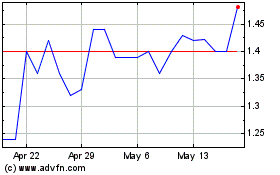

Versus Systems (NASDAQ:VS)

Historical Stock Chart

From Feb 2025 to Mar 2025

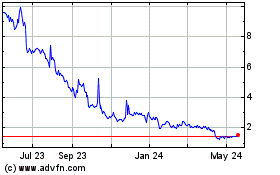

Versus Systems (NASDAQ:VS)

Historical Stock Chart

From Mar 2024 to Mar 2025