UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF

THE SECURITIES

EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ |

Preliminary Proxy Statement |

| |

|

| ¨ |

Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) |

| |

|

| ¨ |

Definitive Proxy Statement |

| |

|

| x |

Definitive Additional Materials |

| |

|

| ¨ |

Soliciting Material under §240.14a-12 |

WiSA Technologies, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x |

No fee required |

| |

|

| ¨ |

Fee paid previously with preliminary materials. |

| |

|

| ¨ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

Data Vault Holdings, Inc. Expands ADIO Market

Reach with CompuSystems Partnership

Expands reach of its ADIO technology to over

1.4M event attendees

NEW YORK, December 12, 2024 — —

Data Vault Holdings, Inc.®, which is under a definitive asset purchase agreement to sell its Datavault® and ADIO® IP and IT

assets to WiSA Technologies, Inc. (NASDAQ: WISA) and is leading the way in data visualization, valuation, and monetization, has partnered

with CompuSystems, Inc. (CSI), a premier provider of registration, data analytics, and lead management services for live events, to embed

ADIO in CSI’s M3 Expo Wallet app.

“Our partnership with CSI expands the market

reach of ADIO to over 125 trade shows in 2025, representing over 1.4 million registrants,” stated Nathaniel Bradley, CEO of Data

Vault Holdings. “By integrating ADIO’s cutting-edge proximity-based engagement with the M3 Expo Wallet, we’re providing

exhibitors with a powerful platform to connect with their audience in more meaningful ways. CSI’s prospect-matching algorithms identify

attendees aligning with an exhibitor’s ideal profile, and highly targeted attendees who opt-in can receive tailored content powered

by our ADIO technology’s inaudible tones to be delivered in real-time.

“With the size and scale of CSI’s

long-established events management business, we are excited about our partnership’s shared monetization opportunities, which are

driven by an ad-based model based on attendee engagement,” added Bradley.

The enhanced M3 Expo Wallet combines the strengths

of both platforms, offering tools to boost sales connections, improve lead quality, and support sustainability. These innovations empower

exhibitors to create lasting connections and maximize their impact at events.

Starting in January 2025, CSI will roll out this

enhanced technology across all events it services, leveraging its best-in-class on-site technologists to ensure seamless implementation

and superior service.

Summary of WiSA Technologies & Datavault

Business Combination

As announced on September 4, 2024, WiSA Technologies,

Inc. (NASDAQ: WISA) entered into a definitive asset purchase agreement to purchase the Datavault® intellectual property and information

technology assets of privately held Data Vault Holdings Inc.® (the “Business Combination”). Subject to customary conditions

and approval by the stockholders of WiSA Technologies, the closing is expected before December 31, 2024. A webcast about the transaction

is accessible under the Investors section of WiSA Technologies’ website.

About Data Vault Holdings, Inc.

Data Vault Holdings Inc. is a technology holding

company that provides a proprietary, cloud-based platform for the delivery of blockchain objects. Data Vault Holdings Inc. provides businesses

with the tools to monetize data assets securely over its Information Data Exchange® (IDE). The company is in the process of finalizing

the consolidation of its affiliates Data Donate Technologies, Inc., ADIO LLC, and Datavault Inc. as wholly owned subsidiaries under one

corporate structure. Learn more about Data Vault Holdings Inc. here.

ADIO has developed a breakthrough ad-driven monetization

platform that enhances user experience through high-frequency audio advertising. ADIO uses its patented pioneering data packet technology

to integrate into an audio file for a more robust user experience. Learn more about ADIO here.

About CompuSystems

CompuSystems is a premier provider of registration,

data analytics, and lead management services for live events, offering cutting-edge solutions and unparalleled customer support to clients

in the trade, association, corporate, and government event markets. With a strong focus on innovation, customer service, and sustainability,

CompuSystems is dedicated to delivering exceptional event experiences for clients and their attendees. Learn more about CompuSystems

here.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking statements include, among others, the Company’s and Datavault’s

expectations with respect to the proposed Business Combination between them, including statements regarding the benefits of the Business

Combination, the anticipated timing of the Business Combination, the implied valuation of Datavault, the products offered by Datavault

and the markets in which it operates, and the Company’s and Datavault’s projected future results. Readers are cautioned not

to place undue reliance on these forward-looking statements. Actual results may differ materially from those indicated by these forward-looking

statements as a result of a variety of factors, including, but are not limited to, risks and uncertainties impacting WiSA’s business

including, risks related to our current liquidity position and the need to obtain additional financing to support ongoing operations,

our ability to continue as a going concern; our ability to maintain the listing of our common stock on Nasdaq and other drivers, our ability

to predict the timing of design wins entering production and the potential future revenue associated with design wins; rate of growth;

the ability to predict customer demand for existing and future products and to secure adequate manufacturing capacity; consumer demand

conditions affecting customers’ end markets; the ability to hire, retain and motivate employees; the effects of competition, including

price competition; technological, regulatory and legal developments; developments in the economy and financial markets; potential harm

caused by software defects, computer viruses and development delays; risks related to our proposed Business Combination, including our

ability to obtain stockholder approval and any regulatory approvals required to consummate the transactions and our ability to realize

some or all of the anticipated benefits therefrom, which may be affected by, among other things, costs related to the Business Combination,

competition and the ability of the post-combination company to grow and manage growth profitability and retain its key employees; the

risk that the Business Combination may not be completed in a timely manner or at all, which may adversely affect the price of the Company’s

securities; the occurrence of any event, change or other circumstance that could give rise to the termination of the Asset Purchase Agreement;

the receipt of an unsolicited offer from another party for an alternative transaction that could interfere with the Business Combination;

the effect of the announcement or pendency of the Business Combination on our and Datavault’s business relationships, performance,

and business generally; the outcome of any legal proceedings that may be instituted against us or Datavault following the announcement

of the proposed Business Combination; the risk of any investigations by the SEC or other regulatory authority relating to any future financing,

the Asset Purchase Agreement or the Business Combination and the impact they may have on consummating the transactions; the ability to

implement business plans, forecasts, and other expectations after the completion of the proposed Business Combination, and identify and

realize additional opportunities; any risks that may adversely affect the business, financial condition and results of operations of Datavault,

including the risk that Datavault is unable to secure or protect its intellectual property; our ability to protect our intellectual property;

the post-combination company’s ability to establish, maintain and enforce effective risk management policies and procedures; the

post-combination company’s ability to protect its systems and data from continually evolving cybersecurity risks, security breaches

and other technological risks; the risk that the post-combination company’s securities will not be approved for listing on Nasdaq

or if approved, maintain the listing; and other risks detailed from time to time in the Company’s filings with the U.S. Securities

and Exchange Commission. The information in this press release is as of the date hereof and neither the Company nor Datavault undertakes

no obligations to update unless required to do so by law. The reader is cautioned not to place under reliance on forward-looking statements.

Neither the Company nor Datavault gives any assurance that either the Company or Datavault, or the post-combination company, will achieve

its expectations.

This press release shall not constitute a solicitation

of a proxy, consent or authorization with respect to any securities or in respect of the proposed Business Combination. This presentation

shall not constitute an offer to sell, or the solicitation of an offer to buy, nor will there be any sale of these securities in any

state or other jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under

the securities laws of such state or jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act, or an exemption therefrom.

Investors Contact for WiSA Technologies and Data Vault Holdings:

David Barnard, LHA Investor Relations, 415-433-3777, wisa@lhai.com

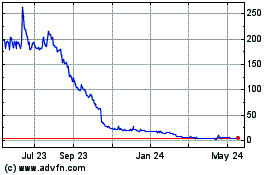

WiSA Technologies (NASDAQ:WISA)

Historical Stock Chart

From Nov 2024 to Dec 2024

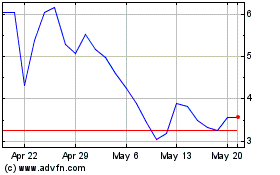

WiSA Technologies (NASDAQ:WISA)

Historical Stock Chart

From Dec 2023 to Dec 2024