ContextLogic Announces Adjournment of Special Meeting of Stockholders to Allow Additional Time for Stockholders to Vote “FOR” the Transaction with Qoo10

12 April 2024 - 11:20PM

ContextLogic Inc. (d/b/a Wish) (NASDAQ: WISH) (“ContextLogic”

or the “Company”) today announced its Special Meeting of

Stockholders (the “Special Meeting”) being held today will convene

and then adjourn without conducting any business. The Special

Meeting will reconvene at 11:30 a.m. Pacific Time on April 18,

2024. The Special Meeting was being held in connection with the

Company’s proposed asset sale transaction (the “Asset Sale”) to

Qoo10 Pte. Ltd. (“Qoo10”), as described in the Company’s definitive

proxy statement filed with the Securities and Exchange Commission

(the “SEC”) on March 15, 2024.

To realize the benefits of this value-maximizing Asset Sale, the

holders of a majority of ContextLogic outstanding shares must vote

in support of the transaction. Approximately 97% of the shares

voted have been “FOR” the Asset Sale. ContextLogic currently needs

approximately 500,000 additional shares to vote “FOR” the

transaction in order to achieve the necessary threshold. The

adjournment will provide time to solicit additional proxies

necessary to obtain the requisite approval.

Stockholders who have previously submitted their proxy or

otherwise voted do not need to take any action. The proxy card

included with the previously distributed proxy materials will not

be updated to reflect the adjournment and may continue to be used

to vote shares in connection with the Special Meeting.

VOTING TODAY “FOR” THE TRANSACTION IS

EXTREMELY IMPORTANT AND CRITICAL TO THE FUTURE OF YOUR INVESTMENT

IN CONTEXTLOGIC

Upon closing of the transaction, ContextLogic will continue as a

publicly traded company with ~$2.7 billion of net operating

loss (“NOL”) carryforwards. Closing the Asset Sale as soon as

possible will also maximize the Company’s post-closing cash.

The ContextLogic Board of Directors urges all stockholders to

protect the value of your investment, by

voting FOR the

transaction TODAY. All stockholders of record

as of the close of business on March 7, 2024 are entitled to vote

at the Special Meeting.

Each stockholder’s vote matters and is important no matter how

many shares they own. A failure to vote is the same as

voting against the transaction. Every day that stockholder approval

is delayed will very likely result in materially lower post-closing

cash and puts the value of the NOLs at significant

risk.

How to Vote Your Shares

ContextLogic stockholders can vote online or by

telephone by following the easy instructions on the previously

provided proxy card. To ensure your shares are represented at

the Special Meeting, ContextLogic stockholders are urged to vote

online or by telephone by following the easy instructions on the

previously provided proxy card. The new electronic voting deadline

is 11:59 p.m. Eastern Time on April 17, 2024.

If you are a stockholder of record and

have questions or need assistance voting your shares, please

contact the Company's proxy solicitor MacKenzie Partners by calling

toll-free at (800) 322-2885 or via email at

proxy@mackenziepartners.com.

Upon receipt of stockholder approval, the Company expects to

complete the transaction in the days following.

About WishWish brings an

affordable and entertaining shopping experience to millions of

consumers around the world. Since our founding in San Francisco in

2010, we have become one of the largest global ecommerce platforms,

connecting millions of value-conscious consumers to hundreds of

thousands of merchants globally. Wish combines technology and data

science capabilities and an innovative discovery-based mobile

shopping experience to create a highly-visual, entertaining, and

personalized shopping experience for its users. For more

information about the company or to download the Wish mobile app,

visit www.wish.com or follow @Wish on Facebook, Instagram and

TikTok or @WishShopping on X (formerly Twitter) and YouTube.

Additional Information and Where to Find ItIn

connection with the Asset Sale to the acquiring subsidiary

designated by Qoo10 (the “Buyer”), the Company has filed with the

SEC, and has furnished to the Company’s stockholders, a definitive

proxy statement, and other relevant documents pertaining to the

transactions contemplated by the asset purchase agreement with

Qoo10 Inc. and Qoo10 (the “Transactions”). Stockholders of the

Company are urged to read the definitive proxy statement and other

relevant documents carefully and in their entirety because they

contain important information about the Transactions. Stockholders

of the Company may obtain the definitive proxy statement and other

relevant documents filed with the SEC free of charge at the SEC’s

website at www.sec.gov or by directing a request to ContextLogic

Inc., One Sansome Street, 33rd Floor, San Francisco, California

94104, Attention: Ralph Fong.

Forward Looking StatementsExcept for historical

information, all other information in this communication consists

of forward-looking statements within the meaning of Section 27A of

the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. These forward-looking

statements, and related oral statements the Company, Qoo10 or the

Buyer may make, are subject to risks and uncertainties that could

cause actual results to differ materially from those projected,

anticipated or implied. For example, (1) conditions to the closing

of the Transactions may not be satisfied, (2) the timing of

completion of the Transactions is uncertain, (3) the amount of the

purchase price adjustment under the asset purchase agreement with

Qoo10 Inc. and Qoo10 is uncertain and may be material, (4) the

amount of that purchase price adjustment could be adversely

affected by any delays in closing the Transactions, including

delays in obtaining the stockholder vote at the Special Meeting,

(5) there can be no assurance as to the extent to which the

post-closing Company will find opportunities to utilize the NOLs,

and when any such utilization will occur, (6) the business of the

Company may suffer as a result of uncertainty surrounding the

Transactions, (7) events, changes or other circumstances could

occur that could give rise to the termination of the asset purchase

agreement with Qoo10 Inc. and Qoo10, (8) there are risks related to

the disruption of management’s attention from the ongoing business

operations of the Company due to the Transactions, (9) the

announcement or pendency of the Transactions could affect the

relationships of the Company with its clients, operating results

and business generally, including on the ability of the Company to

retain employees, (10) the outcome of any legal proceedings

initiated against the Company, Qoo10 or the Buyer following the

announcement of the Transactions could adversely affect the

Company, Qoo10 or the Buyer, including the ability of each to

consummate the Transactions, and (11) the Company may be adversely

affected by other economic, business, and/or competitive factors,

as well as management’s response to any of the aforementioned

factors.

The foregoing review of important factors should not be

construed as exhaustive and should be read in conjunction with the

other cautionary statements that are included herein and elsewhere,

including the risk factors included in the Company’s most recent

Annual Report on Form 10-K and Quarterly Report on Form 10-Q and

other documents of the Company on file with the SEC. Neither the

Company nor Qoo10 or the Buyer undertakes any obligation to update,

correct or otherwise revise any forward-looking statements. All

subsequent written and oral forward-looking statements are

attributable to the Company, Qoo10 or the Buyer and/or any person

acting on behalf of any of them.

Contacts

Investor Relations:Ralph Fong,

Wishir@wish.com

Media:Carys Comerford-Green,

Wishpress@wish.com

Nick Lamplough / Dan Moore / Jack KelleherCollected Strategies

WISH-CS@collectedstrategies.com

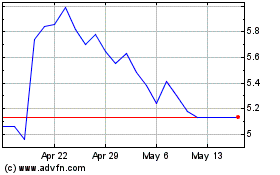

ContextLogic (NASDAQ:WISH)

Historical Stock Chart

From Dec 2024 to Jan 2025

ContextLogic (NASDAQ:WISH)

Historical Stock Chart

From Jan 2024 to Jan 2025