0001866226

false

0001866226

2023-09-26

2023-09-26

0001866226

WTMA:UnitsEachConsistingOfOneShareOfCommonStock0.0001ParValueAndOneRightToReceiveOnetenthOfOneShareOfCommonStockMember

2023-09-26

2023-09-26

0001866226

WTMA:CommonStock0.0001ParValuePerShareMember

2023-09-26

2023-09-26

0001866226

WTMA:RightsEachExchangeableIntoOnetenthOfOneShareOfCommonStockMember

2023-09-26

2023-09-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

United States

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

September 26, 2023 (September 26, 2023)

Date of Report (Date of earliest event reported)

Welsbach Technology Metals Acquisition Corp.

(Exact Name of Registrant as Specified in its Charter)

| Delaware |

|

001-41183 |

|

87-1006702 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

160 S Craig Place

Lombard, Illinois 60148 |

| (Address of Principal Executive Offices, including zip code) |

Registrant’s telephone number, including

area code: (217) 615-1216

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Units, each consisting of one share of Common Stock, $0.0001 par value, and one Right to receive one-tenth of one share of Common Stock |

|

WTMAU |

|

The Nasdaq Stock Market LLC |

| Common Stock, $0.0001 par value per share |

|

WTMA |

|

The Nasdaq Stock Market LLC |

| Rights, each exchangeable into one-tenth of one share of Common Stock |

|

WTMAR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation

FD Disclosure

As previously disclosed,

Welsbach Technology Metals Acquisition Corp. (the “Company”, or “WTMA”)

and Welsbach Acquisition Holdings LLC (the “Sponsor”) intend to ask WTMA’s shareholders at a special meeting of the

stockholders of the Company (the “Special Stockholder Meeting”) to approve, amongst other, an extension of time for the Company

to consummate an initial business combination (the “Extension Amendment Proposal”). In connection with such Extension Amendment

Proposal, WTMA plans to discuss with certain of WTMA’s existing shareholders the terms and conditions of a potential non-redemption

incentive that may be offered to WTMA’s existing shareholders (a “Non-Redemption Incentive”), including, but not

limited to, entry into customary non-redemption agreements where, in exchange for a shareholder’s agreement not to redeem certain

shares of WTMA common stock (the “Non-Redeemed Shares”) in connection with the upcoming Special Stockholder Meeting, WTMA

and the Sponsor will agree to cause the surviving entity of any future WTMA initial business combination (“MergeCo”) to issue

to such shareholders a certain number of additional ordinary or common shares of MergeCo immediately following the consummation of an

initial business combination, if they continue to hold such Non-Redeemed Shares through the Special Stockholder Meeting. The Non-Redemption

Incentive is not expected to increase the likelihood that the Extension Amendment Proposal is approved by shareholders, but will increase

the amount of funds that remain in the Company’s trust account following the Special Stockholder Meeting.

The foregoing summary

of the Non-Redemption Incentive does not purport to be complete and is qualified in its entirety by reference to the updated form of non-redemption

agreement attached hereto as Exhibit 10.1 and incorporated herein by reference. The updated form of Non-Redemption Agreement attached

hereto as Exhibit 10.1 is substantially similar to the form attached as Exhibit 10.1 to the Company’s Report on Form 8-K, filed

with the Securities and Exchange Commission on September 25, 2023, except that the Sponsor and the Company have decided to remove the

requirement that the Investor sign a joinder to that certain stock escrow agreement, dated December 27, 2021, by and among the Company,

the Sponsor, the Company’s officers, directors and other insiders and Continental Stock Transfer & Trust Company, as escrow

agent (the “Escrow Agreement”), and therefore such MergeCo shares will not be subject to the contractual lock-up contained

in the Escrow Agreement.

NONE OF WTMA OR THE

SPONSOR HAVE AGREED TO OFFER OR PROVIDE A NON-REDEMPTION-INCENTIVCE ON THE TERMS OUTLINED ABOVE, OR AT ALL, TO ANY SHAREHOLDER, INVESTOR

OR OTHER PERSON. NO ASSURANCES ARE MADE THAT A NON-REDEMPTION INCENTIVE OF ANY KIND WILL BE OFFERED AND THE ACTUAL TERMS OF ANY NON-REDEMPTION INCENTIVE

MAY DIFFER MATERIALLY FROM THE TERMS DESCRIBED HEREIN. NO ASSURANCE CAN BE MADE THAT MODIFICATIONS TO THE BUSINESS COMBINATION AGREEMENT

WILL BE NEGOTIATED, AGREED OR ACCEPTED BY THE PARTIES TO THE BUSINESS COMBINATION.

The information included

in this Current Report on Form 8-K under this Item 7.01 shall not be deemed “filed” for the purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference into any filing made by WTMA under the Exchange Act or the Securities

Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01. Other Events

The Company has determined

that, if the Extension Amendment Proposal is approved and the Extension is implemented, it will not utilize any funds from its trust account

to pay any potential excise taxes that may become due upon a redemption of the Company’s public shares in connection with a liquidation

of the Company if it does not effect a business combination prior to its termination date.

Based on the trust value as

of September 24, 2023, the Company expects the redemption price, net of taxes, to be $10.82 on September 24, 2023.

Cautionary Statement Regarding Forward-Looking

Statements

Certain

statements made in this Current Report on Form 8-K are “forward looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Such “forward-looking statements”

with respect to the proposed transaction between a target and WTMA include statements regarding the benefits of the transaction, the anticipated

timing of the transaction and the products and markets of a target. These forward-looking statements generally are identified by the words

“believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,”

“strategy,” “future,” “opportunity,” “plan,” “may,” “should,”

“will,” “would,” “will be,” “will continue,” “will likely result,” and similar

expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current

expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to

differ materially from the forward-looking statements in this Current Report on Form 8-K, including but not limited to: (i) the risk that

the transaction may not be completed in a timely manner or at all, which may adversely affect the price of WTMA’s securities, (ii)

the risk that the transaction may not be completed by WTMA’s business combination deadline and the potential failure to obtain an

extension of the business combination deadline if sought by WTMA, (iii) the failure to satisfy the conditions to the consummation of the

transaction, including the adoption of a Merger Agreement by the shareholders of WTMA, the satisfaction of the minimum amount in the trust

account, if any, following redemptions by WTMA’s public shareholders and the receipt of certain governmental and regulatory approvals,

(iv) the potential lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the inability

to complete a PIPE investment, (vi) the occurrence of any event, change or other circumstance that could give rise to the termination

of a Merger Agreement, (vii) the effect of the announcement or pendency of the transaction on a target’s business relationships,

operating results, and business generally, (viii) risks that the proposed transaction disrupts current plans and operations of a target

and potential difficulties in employee retention as a result of the transaction, (ix) the outcome of any legal proceedings that may be

instituted against a target or against WTMA related to a Merger Agreement or the proposed transaction, (x) the ability to maintain the

listing of WTMA’s securities on a national securities exchange, (xi) the price of WTMA’s securities may be volatile due to

a variety of factors, including changes in the competitive and regulated industries in which WTMA plans to operate or a target operates,

variations in operating performance across competitors, changes in laws and regulations affecting WTMA’s or a target’s business,

a target’s inability to implement its business plan or meet or exceed its financial projections and changes in the combined capital

structure, (xii) changes in general economic conditions, including as a result of the COVID-19 pandemic, and (xiii) the ability to implement

business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional

opportunities. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks

and uncertainties described in a registration statement on Form S-4 following identification of a target and execution of a Merger Agreement,

the proxy statement/prospectus and other documents filed or that may be filed by WTMA from time to time with the SEC. These filings identify

and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained

in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put

undue reliance on forward-looking statements, and a target and WTMA assume no obligation and do not intend to update or revise these forward-looking

statements, whether as a result of new information, future events, or otherwise. Neither a target nor WTMA gives any assurance that either

a target or WTMA, or the combined company, will achieve its expectations.

BEFORE

MAKING ANY VOTING DECISION, INVESTORS AND SECURITY HOLDERS OF WTMA ARE URGED TO READ THE PROXY STATEMENT AND ALL OTHER RELEVANT DOCUMENTS

FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE EXTENSION AMENDMENT PROPOSAL BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION

ABOUT THE EXTENSION AMENDMENT PROPOSAL.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The Exhibit Index is incorporated by reference

herein.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

Dated: September 26, 2023

Welsbach Technology Metals Acquisition Corp.

| By: |

/s/ Christopher Clower |

|

| Name: |

Christopher Clower |

|

| Title: |

Chief Operating Officer and Director |

|

4

Exhibit 10.1

NON-REDEMPTION AGREEMENT

This Non-Redemption Agreement (this “Agreement”)

is entered as of [●], 2023 by and among Welsbach Technology Metals Acquisition Corp. (“WTMA”), Welsbach Acquisition

Holdings LLC, a Delaware limited liability company (the “Sponsor”) and the undersigned investors (collectively, the

“Investor”).

RECITALS

WHEREAS, the Sponsor currently holds WTMA

ordinary shares, par value $0.0001 per share, initially purchased in a private placement prior to WTMA’s initial public offering

(the “Founder Shares”);

WHEREAS, WTMA expects to hold an extraordinary

general meeting of shareholders (the “Meeting”) for the purpose of approving, among other things, an amendment to WTMA’s

Certificate of Incorporation (the “Charter”) to extend the date by which WTMA must consummate an initial business combination

(the “Initial Business Combination”) by nine additional months until June 30, 2024 (the “Extension”);

WHEREAS, the Charter provides

that a shareholder of WTMA may redeem its ordinary shares, par value $0.0001 per share, initially sold as part of the units in WTMA’s

initial public offering (whether they were purchased in WTMA’s initial public offering or thereafter in the open market) (the “Public

Shares” and together with the Founder Shares, the “Ordinary Shares”) in connection with the Charter amendment,

on the terms set forth in the Charter (“Redemption Rights”);

WHEREAS, during the period of the Extension

the Sponsor intends to cause WTMA to consummate a business combination, with the target company and business combination structure to

be identified, resulting in a surviving operating company being listed on Nasdaq immediately following the Initial Business Combination

(such surviving company, “MergeCo”), with the effect that the Ordinary Shares will either be exchanged for or converted

into ordinary or common shares of MergeCo (the “MergeCo Shares”) with such MergeCo Shares to be issued to the existing

shareholders of the WTMA’s target, at a valuation that is yet to be determined;

WHEREAS, subject to the terms and conditions

of this Agreement, the Sponsor desires to cause MergeCo to issue to Investor, and Investor desires to acquire from MergeCo on such basis,

that number of MergeCo Shares set forth opposite such Investor’s name on Exhibit A (the “Promised Securities”),

to be issued to Investor by MergeCo in connection with WTMA’s completion of its Initial Business Combination.

NOW THEREFORE, in consideration of

the mutual covenants and agreements set forth herein and for good and valuable consideration, the receipt and sufficiency of which are

hereby acknowledged, Investor and the Sponsor hereby agree as follows:

| 1.1. | Upon the terms and subject to the conditions of this Agreement, if

(a) as of 5:30 PM, New York time, on the date of the Meeting, Investor holds the Investor Shares (as defined below), (b) Investor does

not exercise (or exercised and validly rescinds) its Redemption Rights with respect to such Investor Shares in connection with the Meeting,

(c) the Extension is approved at the Meeting and, and (d) the Company implements the Extension, then WTMA and the Sponsor hereby agree

to cause MergeCo to issue to Investor for no additional consideration the Promised Securities set forth on Exhibit A. “Investor

Shares” shall mean an amount of the Public Shares presently held by Investor equal to the lesser of an aggregate amount of (i) [

] Public Shares, and (ii) 9.9% of the Public Shares that are not to be redeemed, including those Public Shares subject to non-redemption

agreements with other WTMA shareholders similar to this Agreement on or about the date of the Meeting. The Sponsor and WTMA agree to provide

Investor with the final number of Investor Shares subject to this Agreement no later than 9:30 a.m. Eastern on the first business day

before the date of the Meeting (and in all cases a sufficient amount of time to allow the Investor to reverse any exercise of Redemption

Rights with regard to any Investor Shares), provided, that such amount shall not exceed [ ] Public Shares. |

| 1.2. | WTMA, the Sponsor and Investor hereby agree that the issue

by MergeCo of the Promised Securities shall be subject to the conditions that (i) the Initial Business Combination is consummated; and

(ii) Investor (or its Permitted Transferees (as such term is defined in section 4.3 of that certain stock escrow agreement, dated December

27, 2021, by and among WTMA, the Sponsor, WTMA’s officers, directors and other insiders and Continental Stock Transfer & Trust

Company, as escrow agent (as it exists on the date hereof, the “Escrow Agreement”) executes the Joinder (as defined

in Section 1.8). |

Upon the satisfaction of the foregoing

conditions, as applicable, WTMA and the Sponsor shall cause MergeCo to promptly issue (and no later than two (2) business days following

the closing of the Initial Business Combination) the Promised Securities to Investor (or its Permitted Transferees) free and clear of

any liens or other encumbrances, other than restrictions on transfer imposed by the securities laws. The Sponsor and WTMA covenant and

agree to cause MergeCo to facilitate such transfer to Investor (or its Permitted Transferees) in accordance with the foregoing.

| 1.3. | Adjustment to Share Amounts. If at any time the number

of outstanding Ordinary Shares are increased or decreased by a consolidation, combination, subdivision or reclassification of the Ordinary

Shares of WTMA or other similar event, then, as of the effective date of such consolidation, combination, subdivision, reclassification

or similar event, all share numbers referenced in this Agreement shall be adjusted in proportion to such increase or decrease in the

Ordinary Shares of WTMA. For the avoidance of doubt, the issuance of MergeCo Shares to the existing shareholders of WTMA’s target

in connection with the Initial Business Combination shall not cause any such adjustment. |

| 1.4. | Merger or Reorganization, etc. If there shall occur

any reorganization, recapitalization, reclassification, consolidation or merger involving WTMA in which its Ordinary Shares are converted

into or exchanged for securities, cash or other property, then, following any such reorganization, recapitalization, reclassification,

consolidation or merger, in lieu of ordinary shares of WTMA, the Sponsor shall transfer, with respect to each MergeCo Share to be issued

hereunder, the kind and amount of securities, cash or other property into which such Promised Securities converted or exchanged. |

| 1.5. | Forfeitures, Transfers, etc. Investor shall not be

subject to forfeiture, surrender, claw-back, transfers, disposals, exchanges or earn-outs for any reason on the Promised Securities. |

| 1.6. | Delivery of Shares; Other Documents. At the time of

the issue of Promised Securities hereunder, WTMA and the Sponsor shall cause MergeCo to deliver the Promised Securities to Investor in

book-entry form effected through MergeCo’s register of members (or other equivalent register) and through WTMA’s transfer

agent. The parties to this Agreement agree to execute, acknowledge and deliver such further instruments and to do all such other acts,

as may be necessary or appropriate to carry out the purposes and intent of this Agreement. |

| 1.7. | Registration Rights. In connection with the issuance

of the Promised Securities, Investor shall be entitled to registration rights set forth in that certain Registration Rights Agreement,

dated December 27, 2021, by and among WTMA, WTMA’s officers, directors and insiders and the Sponsor (as it exists on the date of

the Agreement, the “Registration Rights Agreement”), and MergeCo and Investor shall execute the Joinder (as defined

below). |

| 1.8. | Joinder to Agreements. In connection with the issue of the Promised Securities to Investor, Investor shall execute a joinder

to the Registration Rights Agreement in substantially the form attached here to as Exhibit B (the “Joinder”)

pursuant to which Investor shall agree with MergeCo to be bound by the terms and provisions of the Registration Rights Agreement as a

“holder” thereunder with respect to the Promised Securities (upon acquisition thereof) as “Registrable Securities”

thereunder. |

| 1.9. | Termination. This Agreement and each of the obligations of the undersigned shall terminate on

earlier of (a) the failure of WTMA’s shareholders to approve the Extension at the Meeting, (b) WTMA’s abandonment of the

Extension prior to the implementation thereof, (c) the fulfillment of all obligations of parties hereto, (d) the liquidation or

dissolution of WTMA prior to completing a Business Combination, (e) the mutual written agreement of the parties hereto; or (f) if

Investor exercises its Redemption Rights with respect to any Investor Shares in connection with the Meeting and such Investors

Shares are actually redeemed in connection with the Meeting. Notwithstanding any provision in this Agreement to the contrary, the

Sponsor’s obligation to cause MergeCo to issue the Promised Securities to Investor shall be conditioned on (i) the

satisfaction of the conditions set forth in Section 1.2 and (ii) such Investor Shares not being redeemed in connection with the

Meeting. |

| 3. | Representations and Warranties of Investor. Investor

represents and warrants to, and agrees with, the Sponsor that: |

| 3.1. | No Government Recommendation or Approval. Investor

understands that no federal or state agency has passed upon or made any recommendation or endorsement of the offering of the Promised

Securities. |

| 3.2. | Accredited Investor. Investor is an institutional

“accredited investor” within the meaning of Rule 501(a)(1), (2), (3) or (7) under the Securities Act of 1933, as amended,

(the “Securities Act”) or a “qualified institutional buyer” as defined in Rule 144A under the Securities

Act, and acknowledges that the sale contemplated hereby is being made in reliance, among other things, on a private placement exemption

to “accredited investors” under the Securities Act and similar exemptions under state law. |

| 3.3. | Intent. Investor is acquiring the Promised

Securities solely for investment purposes, for such Investor’s own account (and/or for the account or benefit of its members or

affiliates, as permitted), and not with a view to the distribution thereof in violation of the Securities Act and Investor has no present

arrangement to sell Promised Securities to or through any person or entity except as may be permitted hereunder. |

| 3.4. | Restrictions on Transfer; Trust Account; Redemption Rights. |

| 3.4.2. | Investor acknowledges and agrees that the Promised Securities

are not entitled to, and have no right, interest or claim of any kind in or to, any monies held in the trust account into which the proceeds

of WTMA’s initial public offering were deposited (the “Trust Account”) or distributed as a result of any liquidation

of the Trust Account. |

| 3.4.3. | Investor agrees, solely for the benefit of and, notwithstanding

anything else herein, enforceable only by WTMA, to waive any right that it may have to elect to have WTMA redeem any Investor Shares

in connection with the Extension and agrees not to redeem or otherwise exercise any right to redeem, the Investor Shares in connection

with the Extension and to reverse and revoke any prior redemption elections made with respect to the Investor Shares in connection with

the Extension. For the avoidance of doubt, nothing in this Agreement is intended to restrict or prohibit Investor’s ability to

redeem any Public Shares other than the Investor Shares, or to trade or redeem any Public Shares (other than the Investor Shares) in

its discretion and at any time or trade or redeem any Investor Shares in its discretion and at any time after the date of the Meeting. |

| 3.4.4. | Investor acknowledges and understands the Promised Securities

will be offered by MergeCo in a transaction not involving a public offering in the United States within the meaning of the Securities

Act and have not been registered under the Securities Act and, if in the future Investor decides to offer, resell, pledge or otherwise

transfer Promised Securities, such Promised Securities may be offered, resold, pledged or otherwise transferred only (A) pursuant

to an effective registration statement filed under the Securities Act, (B) pursuant to an exemption from registration under Rule

144 promulgated under the Securities Act, if available, or (C) pursuant to any other available exemption from the registration requirements

of the Securities Act, and in each case in accordance with any applicable securities laws of any state or any other jurisdiction. Investor

agrees that, if any transfer of the Promised Securities or any interest therein is proposed to be made, as a condition precedent to any

such transfer, Investor may be required to deliver to MergeCo an opinion of counsel satisfactory to MergeCo that registration is not

required with respect to the Promised Securities to be transferred. Absent registration or another available exemption from registration,

Investor agrees it will not transfer the Promised Securities. |

| 3.5. | Sophisticated Investor. Investor is sophisticated

in financial matters and able to evaluate the risks and benefits of the investment in the Promised Securities. |

| 3.6. | Risk of Loss.

Investor is aware that an investment in the Promised Securities is highly speculative and

subject to substantial risks. Investor is cognizant of and understands the risks related

to the acquisition of the Promised Securities, including those restrictions described or

provided for in this Agreement pertaining to transferability. Investor is able to bear

the economic risk of its investment in the Promised Securities for an indefinite period of

time and able to sustain a complete loss of such investment. |

| 3.7. | Independent Investigation. Investor has

relied upon an independent investigation of WTMA and has not relied upon any information or representations made by any third parties

or upon any oral or written representations or assurances, express or implied, from the Sponsor or any representatives or agents of the

Sponsor, other than as set forth in this Agreement. Investor is familiar with the business, operations and financial condition of WTMA

and has had an opportunity to ask questions of, and receive answers from WTMA’s management concerning WTMA and the terms and conditions

of the proposed sale of the Promised Securities and has had full access to such other information concerning WTMA as Investor has requested.

Investor confirms that all documents that it has requested have been made available and that Investor has been supplied with all of the

additional information concerning this investment which Investor has requested. |

| 3.8. | Organization and Authority. If an entity,

Investor is duly organized and existing under the laws of the jurisdiction in which it was organized and it possesses all requisite power

and authority to acquire the Promised Securities, enter into this Agreement and perform all the obligations required to be performed

by Investor hereunder. |

| 3.9. | Non-U.S. Investor. If Investor is not a United States

person (as defined by Section 7701(a)(30) of the U.S. Internal Revenue Code of 1986, as amended, and the regulations promulgated thereunder

(collectively, the “Code”)), Investor hereby represents that it has satisfied itself as to the full observance of

the laws of its jurisdiction in connection with any invitation to subscribe for the Promised Securities or any use of this Agreement,

including (i) the legal requirements within its jurisdiction for the acquisition of the Promised Securities, (ii) any foreign exchange

restrictions applicable to such acquisition, (iii) any governmental or other consents that may need to be obtained, and (iv) the income

tax and other tax consequences, if any, that may be relevant to the acquisition, holding, redemption, sale, or transfer of the Promised

Securities. Investor’s subscription and payment for and continued beneficial ownership of the Promised Securities will not violate

any applicable securities or other laws of Investor’s jurisdiction. |

| 3.10. | Authority. This Agreement has been validly authorized,

executed and delivered by Investor and is a valid and binding agreement enforceable in accordance with its terms, except as such enforceability

may be limited by applicable bankruptcy, insolvency, fraudulent conveyance, moratorium, reorganization, or similar laws relating to,

or affecting generally the enforcement of, creditors’ rights and remedies or by equitable principles of general application and

except as enforcement of rights to indemnity and contribution may be limited by federal and state securities laws or principles of public

policy. |

| 3.11. | No Conflicts. The execution, delivery and performance

of this Agreement and the consummation by Investor of the transactions contemplated hereby do not violate, conflict with or constitute

a default under (i) Investor’s organizational documents, (ii) any agreement or instrument to which Investor is a party or

(iii) any law, statute, rule or regulation to which Investor is subject, or any order, judgment or decree to which Investor is subject,

in the case of clauses (ii) and (iii), that would reasonably be expected to prevent Investor from fulfilling its obligations under this

Agreement. |

| 3.12. | No Advice from

Sponsor. Investor has had the opportunity to review this Agreement and the transactions

contemplated by this Agreement with Investor’s own legal counsel and investment and

tax advisors. Except for any statements or representations of the Sponsor explicitly

made in this Agreement, Investor is relying solely on such counsel and advisors and not on

any statements or representations, express or implied, of the Sponsor or any of its representatives

or agents for any reason whatsoever, including without limitation for legal, tax or investment

advice, with respect to this investment, the Sponsor, WTMA, the Promised Securities, the

transactions contemplated by this Agreement or the securities laws of any jurisdiction. |

| 3.13. | Reliance on Representations and Warranties. Investor

understands that the Promised Securities are being offered and sold to Investor in reliance on exemptions from the registration requirements

under the Securities Act, and analogous provisions in the laws and regulations of various states, and that the Sponsor is relying upon

the truth and accuracy of the representations, warranties, agreements, acknowledgments and understandings of Investor set forth in this

Agreement in order to determine the applicability of such provisions. |

| 3.14. | No General Solicitation. Investor is not

subscribing for Promised Securities as a result of or subsequent to any general solicitation or general advertising, including but not

limited to any advertisement, article, notice or other communication published in any newspaper, magazine, or similar media or broadcast

over television or radio or any seminar or meeting whose attendees have been invited by any general solicitation or general advertising. |

| 3.15. | Brokers. No broker, finder or intermediary has

been paid or is entitled to a fee or commission from or by Investor in connection with the acquisition of the Promised Securities nor

is Investor entitled to or will accept any such fee or commission. |

| 4. | Representations and Warranties of Sponsor. The Sponsor

represents and warrants to, and agrees with, the Investor that: |

| 4.1. | Power and Authority. The Sponsor is a limited

liability company duly formed and validly existing and in good standing as a limited liability company under the laws of Delaware and

possesses all requisite limited liability company power and authority to enter into this Agreement and to perform all of the obligations

required to be performed by the Sponsor hereunder, including the assignment, sale and transfer the Promised Securities. |

| 4.2. | Authority. All corporate action on the part of the

Sponsor and its officers, directors and members necessary for the authorization, execution and delivery of this Agreement and the performance

of all obligations of the Sponsor required pursuant hereto has been taken. This Agreement has been duly executed and delivered by the

Sponsor and (assuming due authorization, execution and delivery by Investor) constitutes the Sponsor’s legal, valid and binding

obligation, enforceable against the Sponsor in accordance with its terms, except as such enforceability may be limited by applicable

bankruptcy, insolvency, fraudulent conveyance, moratorium, reorganization, or similar laws relating to, or affecting generally the enforcement

of, creditors’ rights and remedies or by equitable principles of general application and except as enforcement of rights to indemnity

and contribution may be limited by federal and state securities laws or principles of public policy. |

| 4.3. | Title to Securities.

The Sponsor shall cause the Promised Securities to be issued, when issued to Investor by

MergeCo as provided herein, to be free and clear of all liens, pledges, security interests,

charges, claims, encumbrances, agreements, options, voting trusts, proxies and other

arrangements or restrictions of any kind (other than transfer restrictions and other terms

and conditions that apply to the MergeCo Shares generally, under applicable securities laws). |

| 4.4. | No Conflicts. The execution, delivery and performance

of this Agreement and the consummation by the Sponsor of the transactions contemplated hereby do not violate, conflict with or constitute

a default under (i) the certificate of formation or the Sponsor LLC Agreement, (ii) any agreement or instrument to which the Sponsor

is a party or by which it is bound (including the Escrow Agreement and the Sponsor LLC Agreement) or (iii) any law, statute, rule or

regulation to which the Sponsor is subject or any order, judgment or decree to which the Sponsor is subject. The Sponsor is not required

under federal, state or local law, rule or regulation to obtain any consent, authorization or order of, or make any filing or registration

with, any court or governmental agency or self-regulatory entity in order for it to perform any of its obligations under this Agreement. |

| 4.5. | No General Solicitation. The Sponsor has

not offered the Promised Securities by means of any general solicitation or general advertising within the meaning of Regulation D of

the Securities Act, including but not limited to any advertisement, article, notice or other communication published in any newspaper,

magazine, or similar media or broadcast over television or radio or any seminar or meeting whose attendees have been invited by any general

solicitation or general advertising. |

| 4.6. | Brokers. No broker, finder or intermediary has

been paid or is entitled to a fee or commission from or by the Sponsor in connection with the sale of the Promised Securities nor is

the Sponsor entitled to or will accept any such fee or commission. |

| 4.7. | Reliance on Representations and Warranties. The

Sponsor understands and acknowledges that Investor is relying upon the truth and accuracy of the representations, warranties, agreements,

acknowledgments and understandings of the Sponsor set forth in this Agreement. |

| 5. | Trust Account. Until the earlier of (a) the consummation

of WTMA’s initial business combination; (b) the liquidation of the Trust Account; and (c) 33 months from consummation of WTMA’s

initial public offering or such later time as the shareholders of WTMA may approve in accordance with the Charter, WTMA will maintain

the investment of funds held in the Trust Account in interest-bearing United States government securities within the meaning of Section 2(a)(16)

of the Investment Company Act of 1940, as amended, having a maturity of 185 days or less, or in money market funds meeting the conditions

of paragraphs (d)(1), (d)(2), (d)(3) and (d)(4) of Rule 2a-7 promulgated under the Investment Company Act of 1940, as amended, which

invest only in direct U.S. government treasury obligations, or maintain such funds in cash in an interest-bearing demand deposit account

at a bank. WTMA further confirms that it will not utilize any funds from its Trust Account to pay any potential excise taxes that may

become due pursuant to the Inflation Reduction Act of 2022 upon a redemption of the Public Shares, including, but not limited to, in

connection with a liquidation of WTMA if it does not effect a business combination prior to its termination date. |

| 6. | Governing Law; Jurisdiction; Waiver of Jury Trial. This

Agreement shall be governed by and construed and enforced in accordance with the laws of the State of New York, without giving effect

to its principles or rules of conflict of laws to the extent such principles or rules would require or permit the application of the

laws of another jurisdiction. The parties hereto hereby waive any right to a jury trial in connection with any litigation pursuant to

this Agreement and the transactions contemplated hereby. With respect to any suit, action or proceeding relating to the transactions

contemplated hereby, the undersigned irrevocably submit to the jurisdiction of the United States District Court or, if such court does

not have jurisdiction, the New York state courts located in the Borough of Manhattan, State of New York, which submission shall be exclusive. |

| 7. | Assignment; Entire Agreement; Amendment. |

| 7.1. | Assignment. Any assignment of this Agreement or

any right, remedy, obligation or liability arising hereunder by WTMA, the Sponsor or Investor to any person that is not an affiliate

of such party shall require the prior written consent of the other party; provided, that no such consent shall be required for any such

assignment by Investor to one or more affiliates thereof. |

| 7.2. | Entire Agreement. This Agreement sets forth the entire

agreement and understanding between the parties as to the subject matter thereof and merges and supersedes all prior discussions, agreements

and understandings of any and every nature among them relating to the subject matter hereof. |

| 7.3. | Amendment. Except as expressly provided in this Agreement,

neither this Agreement nor any term hereof may be amended, waived, discharged or terminated other than by a written instrument signed

by the party against whom enforcement of any such amendment, waiver, discharge or termination is sought. |

| 7.4. | Binding upon Successors. This Agreement shall be binding

upon and inure to the benefit of the parties hereto and to their respective heirs, legal representatives, successors and permitted assigns. |

| 8. | Notices. Unless

otherwise provided herein, any notice or other communication to a party hereunder shall be

sufficiently given if in writing and personally delivered or sent by email with copy sent

in another manner herein provided or sent by courier (which for all purposes of this Agreement

shall include Federal Express or another recognized overnight courier) or mailed to said

party by certified mail, return receipt requested, at its address provided for herein or

such other address as either may designate for itself in such notice to the other. Communications

shall be deemed to have been received when delivered personally, on the scheduled arrival

date when sent by next day or 2nd-day courier service, or if sent by email upon receipt of

confirmation of transmittal or, if sent by mail, then three days after deposit in the mail.

If given by electronic transmission, such notice shall be deemed to be delivered (a) if

by electronic mail, when directed to an electronic mail address at which the party has provided

to receive notice; and (b) if by any other form of electronic transmission, when directed

to such party. |

| 9. | Counterparts. This

Agreement may be executed in two or more counterparts, all of which when taken together shall

be considered one and the same agreement and shall become effective when counterparts have

been signed by each party and delivered to the other party, it being understood that both

parties need not sign the same counterpart. Counterparts may be delivered via electronic

mail (including any electronic signature covered by the U.S. federal ESIGN Act of 2000, Uniform

Electronic Transactions Act, the Electronic Signatures and Records Act or other applicable

law, e.g., www.docusign.com) or other transmission method and any counterpart so delivered

shall be deemed to have been duly and validly delivered and be valid and effective for all

purposes. |

| 10. | Survival; Severability |

| 10.1. | Survival. The representations, warranties, covenants

and agreements of the parties hereto shall survive the closing of the transactions contemplated hereby. |

| 10.2. | Severability. In the event that any provision of this

Agreement becomes or is declared by a court of competent jurisdiction to be illegal, unenforceable or void, this Agreement shall continue

in full force and effect without said provision; provided that no such severability shall be effective if it materially changes the economic

benefit of this Agreement to any party. |

| 11. | Headings. The titles and subtitles used in this

Agreement are used for convenience only and are not to be considered in construing or interpreting this Agreement. |

| 12. | Disclosure; Waiver. As soon as practicable, but in no

event later than one business day, after execution of this Agreement, WTMA will file (to the extent that it has not already filed) a

Current Report on Form 8-K under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), reporting the material

terms of this Agreement. The parties to this Agreement shall cooperate with one another to assure that such disclosure is accurate. WTMA

agrees that the name of the investor shall not be included in any public disclosures related to this Agreement unless required by applicable

law, regulation or stock exchange rule. Investor (i) acknowledges that the Sponsor

may possess or have access to material non-public information which has not been communicated to the Investor; (ii) hereby waives any

and all claims, whether at law, in equity or otherwise, that he, she, or it may now have or may hereafter acquire, whether presently

known or unknown, against the Sponsor or any of WTMA’s officers, directors, employees, agents, affiliates, subsidiaries, successors

or assigns relating to any failure to disclose any non-public information in connection with the transaction contemplated by this Agreement,

including any potential business combination involving WTMA, including without limitation, any claims arising under Rule 10-b(5) of the

Exchange Act; and (iii) is aware that the Sponsor is relying on the truth of the representations set forth in Section 3 of this Agreement

and the foregoing acknowledgement and waiver in this Section 12, in connection with the transactions contemplated by this Agreement.

WTMA shall, by 9:30 a.m., New York City time, on the first business day immediately following the date of the Meeting, issue one

or more press releases or file with the United States Securities and Exchange Commission a Current Report on Form 8-K (collectively,

the “Disclosure Document”) disclosing, to the extent not

previously publicly disclosed, all material terms of the transactions contemplated hereby and any other material, nonpublic information

that WTMA has provided to Investor at any time prior to the filing of the Disclosure Document. Upon the issuance of the Disclosure Document,

to WTMA’s knowledge, Investor shall not be in possession of any material, nonpublic information received from WTMA or any of its

officers, directors or employees. |

| 13. | Independent Nature of Rights and Obligations. Nothing

contained herein, and no action taken by any party pursuant hereto, shall be deemed to constitute Investor and the Sponsor as, and the

Sponsor acknowledges that Investor and the Sponsor do not so constitute, a partnership, an association, a joint venture or any other

kind of entity, or create a presumption that Investor and the Sponsor are in any way acting in concert or as a group with respect to

such obligations or the transactions contemplated by this Agreement or any matters, and the Sponsor acknowledges that Investor and the

Sponsor are not acting in concert or as a group, and the Sponsor shall not assert any such claim, with respect to such obligations or

the transactions contemplated by this Agreement. |

| 14. | Most Favored Nation. In the event the Sponsor or WTMA

enter one or more other non-redemption agreements before or after the execution of this Agreement in connection with the Meeting, the

Sponsor and WTMA represent that the terms of such other agreements are not materially more favorable to such other investors thereunder

than the terms of this Agreement are in respect of the Investor. In the event that another investor is afforded any such more favorable

terms than the Investor, the Sponsor shall promptly inform the Investor of such more favorable terms in writing, and the Investors shall

have the right to elect to have such more favorable terms included herein, in which case the parties hereto shall promptly amend this

Agreement to effect the same. |

IN WITNESS WHEREOF, the parties

hereto have caused this Agreement to be duly executed as of the date first above written.

| |

INVESTOR |

| |

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

[Signature Page to Non-Redemption Agreement]

| |

COMPANY: |

| |

|

| |

WELSBACH TECHNOLOGY METALS ACQUISITION CORP. |

| |

|

| |

By: |

|

| |

Name: |

Chris Clower |

| |

Title: |

Chief Operating Officer |

[Signature Page to Non-Redemption Agreement]

| |

SPONSOR: |

| |

|

| |

WELSBACH ACQUISITION HOLDIGNS LLC |

| |

|

| |

By: |

|

| |

Name: |

Chris Clower |

| |

Title: |

Managing Member |

[Signature Page to Non-Redemption Agreement]

Exhibit A

| Investor |

Promised Securities |

Number of Public Shares to be Held as Investor Shares |

|

Address:

SSN/EIN: |

_________

MergeCo Shares |

_________

Ordinary Shares |

EXHIBIT B

FORM OF JOINDER

TO

REGISTRATION RIGHTS AGREEMENT

______, 20_

Reference is made to that certain Non-Redemption Agreement dated

as of September , 2023 (the “Agreement”), by and among (“Investor”), Welsbach Technology Metals

Acquisition Corp. (the “Company”) and Welsbach Acquisition Holdings LLC (the “Sponsor”), pursuant

to which Investor acquired securities of the Company from the Sponsor. Capitalized terms used and not otherwise defined herein shall have

the meanings given to such terms in the Agreement.

By executing this joinder, Investor hereby agrees,

as of the date first set forth above, that Investor shall become a party to that certain Registration Rights Agreement, dated December

27, 2021, by and among WTMA, WTMA’s officers, directors and insiders and the Sponsor (as it exists on the date of the Agreement,

the “Registration Rights Agreement”), and shall be bound by the terms and provisions of the Registration Rights Agreement

as a Holder (as defined therein) and entitled to the rights of a Holder under the Registration Rights Agreement and the Promised

Securities (together with any other equity security of MergeCo issued or issuable with respect to any such Promised Securities by way

of a share dividend or share subdivision or in connection with a combination of shares, recapitalization, merger, consolidation or reorganization)

shall be “Registrable Securities” thereunder.

This joinder may be executed in two or more counterparts,

and by facsimile, all of which shall be deemed an original and all of which together shall constitute one instrument.

| |

[INVESTOR] |

| |

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

ACKNOWLEDGED AND AGREED:

WELSBACH TECHNOLOGY METALS ACQUISITION CORP.

| By: |

|

|

| |

Name: |

Chris Clower |

|

| |

Title: |

Chief Operating Officer |

|

15

v3.23.3

Cover

|

Sep. 26, 2023 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Sep. 26, 2023

|

| Entity File Number |

001-41183

|

| Entity Registrant Name |

Welsbach Technology Metals Acquisition Corp.

|

| Entity Central Index Key |

0001866226

|

| Entity Tax Identification Number |

87-1006702

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

160 S Craig Place

|

| Entity Address, City or Town |

Lombard

|

| Entity Address, State or Province |

IL

|

| Entity Address, Postal Zip Code |

60148

|

| City Area Code |

217

|

| Local Phone Number |

615-1216

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one share of Common Stock, $0.0001 par value, and one Right to receive one-tenth of one share of Common Stock |

|

| Title of 12(b) Security |

Units, each consisting of one share of Common Stock, $0.0001 par value, and one Right to receive one-tenth of one share of Common Stock

|

| Trading Symbol |

WTMAU

|

| Security Exchange Name |

NASDAQ

|

| Common Stock, $0.0001 par value per share |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

WTMA

|

| Security Exchange Name |

NASDAQ

|

| Rights, each exchangeable into one-tenth of one share of Common Stock |

|

| Title of 12(b) Security |

Rights, each exchangeable into one-tenth of one share of Common Stock

|

| Trading Symbol |

WTMAR

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WTMA_UnitsEachConsistingOfOneShareOfCommonStock0.0001ParValueAndOneRightToReceiveOnetenthOfOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WTMA_CommonStock0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=WTMA_RightsEachExchangeableIntoOnetenthOfOneShareOfCommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

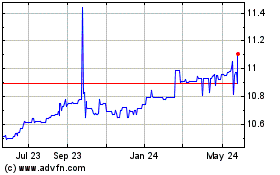

Welsbach Technology Meta... (NASDAQ:WTMA)

Historical Stock Chart

From Jan 2025 to Feb 2025

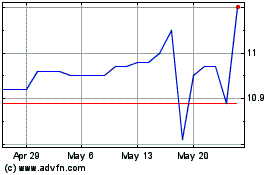

Welsbach Technology Meta... (NASDAQ:WTMA)

Historical Stock Chart

From Feb 2024 to Feb 2025