DENTSPLY SIRONA Inc. (“Dentsply Sirona” or the "Company") (Nasdaq:

XRAY) today announced its financial results for the third quarter

of 2024.

Third quarter net sales of $951 million increased 0.5% (organic

sales increased 1.3%) compared to the third quarter of 2023.

Foreign currency changes negatively impacted third quarter 2024 net

sales by ($8) million. Net loss was ($494) million, or ($2.46) per

share, compared to a net loss of ($266) million, or ($1.25) per

share in the third quarter of 2023. Non-cash charges for the

impairment of goodwill were ($495) million net of tax, or ($2.46)

per share in the third quarter of 2024, versus ($302) million net

of tax, or ($1.42) per share in the third quarter of 2023. Adjusted

earnings per diluted share were $0.50, compared to $0.49 in the

third quarter of 2023. A reconciliation of Non-GAAP measures

(including organic sales, adjusted EBITDA and margin, adjusted EPS,

adjusted free cash flow conversion, and segment adjusted operating

income) to GAAP measures is provided below.

“Third quarter organic growth was driven by favorable timing in

Essential Dental Solutions of approximately $20 million related to

stocking orders in anticipation of U.S. ERP deployment, and higher

sales in CAD/CAM, which benefited from the launch of our new

scanner, Primescan 2. Due to ongoing market pressures impacting

equipment in the U.S., as well as the evolving landscape with Byte,

we are lowering our full year organic sales outlook.” said Simon

Campion, President and Chief Executive Officer. “We continue to

transform Dentsply Sirona and pivot quickly where needed. While we

have more work to do, we now have multiple initiatives contributing

positively to profitability and strengthening our Company’s

foundation for the long term.”

Q3 24 Summary Results (GAAP)

|

(in millions, except per share amount and

percentages) |

|

Q3 24 |

|

Q3 23 |

|

YoY |

|

Net Sales |

|

$951 |

|

$947 |

|

0.5% |

| Gross Profit |

|

$495 |

|

$495 |

|

0.2% |

| Gross Margin |

|

52.1% |

|

52.2% |

|

|

| Net Loss Attributable to

Dentsply Sirona |

|

($494) |

|

($266) |

|

NM |

| Diluted Loss Per Share

[1] |

|

($2.46) |

|

($1.25) |

|

NM |

| |

Q3 24 Summary Results (Non-GAAP)[2]

|

(in millions, except per share amount and

percentages) |

|

Q3 24 |

|

Q3 23 |

|

YoY |

|

Net Sales |

|

$951 |

|

$947 |

|

0.5% |

| Organic Sales Growth % |

|

|

|

|

|

1.3% |

| Adjusted EBITDA |

|

$170 |

|

$171 |

|

(1.8%) |

| Adjusted EBITDA Margin |

|

17.9% |

|

18.3% |

|

|

| Adjusted EPS |

|

$0.50 |

|

$0.49 |

|

3.0% |

NM - not meaningfulPercentages are based on actual values and

may not reconcile due to rounding.[1] Because the Company recorded

net losses in the third quarter of 2024 and 2023, no potential

dilutive common shares were used in the computation of diluted loss

per common share as the effect would have been antidilutive.[2]

Organic sales growth, adjusted EBITDA, and adjusted EPS are

Non-GAAP financial measures which exclude certain items. Please

refer to "Non-GAAP Financial Measures" below for a description of

these measures and to the tables at the end of this release for a

reconciliation between GAAP and Non-GAAP measures.

Q3 24 Segment Results

|

|

|

Net Sales Growth % |

|

Organic Sales Growth % |

|

|

|

|

|

|

| Connected Technology

Solutions |

|

(2.3%) |

|

(1.4%) |

| Essential Dental

Solutions |

|

6.6% |

|

7.5% |

| Orthodontic and Implant

Solutions |

|

(4.6%) |

|

(3.9%) |

|

Wellspect Healthcare |

|

(0.4%) |

|

—% |

|

Total |

|

0.5% |

|

1.3% |

| |

|

|

|

|

Q3 24 Geographic Results

|

|

|

Net Sales Growth % |

|

Organic Sales Growth % |

|

|

|

|

|

|

| United States |

|

5.0% |

|

5.1% |

| Europe |

|

(1.8%) |

|

(2.0%) |

| Rest of

World |

|

(3.0%) |

|

0.6% |

|

Total |

|

0.5% |

|

1.3% |

| |

|

|

|

|

Cash Flow and Liquidity

Operating cash flow in the third quarter of 2024 was $141

million, compared to $134 million in the prior year, primarily as a

result of the favorable timing of accounts payable and improved

inventory management. In the third quarter of 2024, the Company

paid $33 million in dividends and executed share repurchases of

$100 million, resulting in a total of $345 million returned to

shareholders through dividends and share repurchases in the first

nine months of 2024. The Company had $296 million of cash and cash

equivalents as of September 30, 2024.

Goodwill Impairment

In the third quarter of 2024, the Company recorded a non-cash

charge for the impairment of goodwill of ($495) million net of tax

within the Orthodontic and Implant Solutions segment. The decline

in fair value for this reporting unit was driven by sustained

macroeconomic pressures, legislative trends impacting Byte,

weakened demand and competitive pressures in implants, and lower

expected volumes of lab materials.

2024 Outlook

The Company is revising its 2024 outlook due to market pressures

impacting U.S. equipment, legislative changes affecting the

direct-to-consumer aligner business model, and the voluntary

suspension of sales, marketing, and shipments of Byte Aligners and

Impression Kits. The revised outlook includes expected net sales in

the range of $3.79 billion to $3.83 billion, and organic sales are

expected to be in the range of (3.5%) to (2.5%) year-over-year.

Adjusted EPS is expected to be in the range of $1.82 to $1.86. The

outlook does not include potential adjustments or impacts of

additional Byte remediation measures or decisions made by the

Company.

Other 2024 outlook assumptions are included in the third quarter

2024 earnings presentation posted on the Investors section of the

Dentsply Sirona website at https://investor.dentsplysirona.com. The

Company does not provide forward-looking estimates on a GAAP basis

as certain information, which may include, but is not limited to,

restructuring charges, transformation-related costs, impairment

charges, certain tax adjustments, and other significant items, is

not available without unreasonable effort and cannot be reasonably

estimated. The exact amounts of these charges or credits are not

currently determinable but may be significant.

Conference Call/Webcast InformationDentsply

Sirona’s management team will host an investor conference call and

live webcast on November 7, 2024, at 8:30 am ET. A live webcast of

the investor conference call and a presentation related to the call

will be available on the Investors section of the Company’s website

at https://investor.dentsplysirona.com.

For those planning to participate on the call, please register

at

https://register.vevent.com/register/BI2ff7dbae32e04372ac0f7b84f2806925.

A webcast replay of the conference call will be available on the

Investors section of the Company’s website following the call.

About Dentsply SironaDentsply Sirona is the

world’s largest manufacturer of professional dental products and

technologies, with over a century of innovation and service to the

dental industry and patients worldwide. Dentsply Sirona develops,

manufactures, and markets a comprehensive solutions offering

including dental and oral health products as well as other

consumable medical devices under a strong portfolio of world-class

brands. Dentsply Sirona’s products provide innovative, high-quality

and effective solutions to advance patient care and deliver better

and safer dental care. Dentsply Sirona’s headquarters is located in

Charlotte, North Carolina. The Company’s shares are listed in the

United States on Nasdaq under the symbol XRAY. Visit

www.dentsplysirona.com for more information about Dentsply Sirona

and its products.

Contact

Information:Investors:Andrea DaleyVice President, Investor

Relations+1-704-591-8631InvestorRelations@dentsplysirona.com

Press:Marion Par-WeixlbergerVice President,

Public Relations & Corporate Communications+43 676

848414588marion.par-weixlberger@dentsplysirona.com

Forward-Looking Statements and

Associated Risks

All statements in this Press Release that do not directly and

exclusively relate to historical facts constitute “forward-looking

statements.” Such statements are subject to numerous assumptions,

risks, uncertainties and other factors that could cause actual

results to differ materially from those described in such

statements, many of which are outside of our control, including

those described in Part I, Item 1A, “Risk Factors” of the Company's

Annual Report on Form 10-K for the fiscal year ended December 31,

2023 and Part II, Item 1A, "Risk Factors" of the Company's

Quarterly Report on Form 10-Q for the fiscal quarter ended

September 30, 2024, and other factors which may be described in the

Company’s other filings with the Securities and Exchange Commission

(the “SEC”). No assurance can be given that any expectation,

belief, goal or plan set forth in any forward-looking statement can

or will be achieved, and readers are cautioned not to place undue

reliance on such statements which speak only as of the date they

are made. We do not undertake any obligation to update or release

any revisions to any forward-looking statement or to report any

events or circumstances after the date of this Press Release or to

reflect the occurrence of unanticipated events. Investors should

understand it is not possible to predict or identify all such

factors or risks. As such, you should not consider the risks

identified in the Company’s SEC filings to be a complete discussion

of all potential risks or uncertainties associated with an

investment in the Company.

DENTSPLY SIRONA INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF

OPERATIONS(in millions, except per share

amounts)(unaudited)

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net sales |

$ |

951 |

|

|

$ |

947 |

|

|

$ |

2,888 |

|

|

$ |

2,953 |

|

| Cost of products sold |

|

456 |

|

|

|

452 |

|

|

|

1,376 |

|

|

|

1,389 |

|

| |

|

|

|

|

|

|

|

| Gross profit |

|

495 |

|

|

|

495 |

|

|

|

1,512 |

|

|

|

1,564 |

|

| |

|

|

|

|

|

|

|

| Selling, general, and

administrative expenses |

|

390 |

|

|

|

372 |

|

|

|

1,204 |

|

|

|

1,204 |

|

| Research and development

expenses |

|

40 |

|

|

|

46 |

|

|

|

123 |

|

|

|

141 |

|

| Goodwill and intangible asset

impairments |

|

504 |

|

|

|

307 |

|

|

|

510 |

|

|

|

307 |

|

| Restructuring and other

costs |

|

23 |

|

|

|

6 |

|

|

|

45 |

|

|

|

70 |

|

| |

|

|

|

|

|

|

|

| Operating loss |

|

(462 |

) |

|

|

(236 |

) |

|

|

(370 |

) |

|

|

(158 |

) |

| |

|

|

|

|

|

|

|

| Other income and

expenses: |

|

|

|

|

|

|

|

|

Interest expense, net |

|

18 |

|

|

|

19 |

|

|

|

53 |

|

|

|

61 |

|

|

Other (income) expense, net |

|

(2 |

) |

|

|

(5 |

) |

|

|

(10 |

) |

|

|

13 |

|

| |

|

|

|

|

|

|

|

| Loss before income taxes |

|

(478 |

) |

|

|

(250 |

) |

|

|

(413 |

) |

|

|

(232 |

) |

| Provision (benefit) for income

taxes |

|

17 |

|

|

|

16 |

|

|

|

69 |

|

|

|

(28 |

) |

| |

|

|

|

|

|

|

|

| Net loss |

|

(495 |

) |

|

|

(266 |

) |

|

|

(482 |

) |

|

|

(204 |

) |

| |

|

|

|

|

|

|

|

| Less: Net loss attributable to

noncontrolling interest |

|

(1 |

) |

|

|

— |

|

|

|

(2 |

) |

|

|

(5 |

) |

| |

|

|

|

|

|

|

|

| Net loss attributable to

Dentsply Sirona |

$ |

(494 |

) |

|

$ |

(266 |

) |

|

$ |

(480 |

) |

|

$ |

(199 |

) |

| |

|

|

|

|

|

|

|

| Loss per common share

attributable to Dentsply Sirona: |

|

|

|

|

|

|

|

|

Basic |

$ |

(2.46 |

) |

|

$ |

(1.25 |

) |

|

$ |

(2.35 |

) |

|

$ |

(0.94 |

) |

|

Diluted |

$ |

(2.46 |

) |

|

$ |

(1.25 |

) |

|

$ |

(2.35 |

) |

|

$ |

(0.94 |

) |

| |

|

|

|

|

|

|

|

| Weighted average common shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

201.0 |

|

|

|

211.8 |

|

|

|

204.7 |

|

|

|

212.7 |

|

|

Diluted |

|

201.0 |

|

|

|

211.8 |

|

|

|

204.7 |

|

|

|

212.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DENTSPLY SIRONA INC. AND

SUBSIDIARIESCONDENSED CONSOLIDATED BALANCE

SHEETS(in millions)(unaudited)

| |

September 30, 2024 |

|

December 31, 2023 |

| |

|

|

|

| Assets |

|

|

|

|

Current Assets: |

|

|

|

|

Cash and cash equivalents |

$ |

296 |

|

$ |

334 |

|

Accounts and notes receivable-trade, net |

|

671 |

|

|

695 |

|

Inventories, net |

|

619 |

|

|

624 |

|

Prepaid expenses and other current assets |

|

335 |

|

|

320 |

|

Total Current Assets |

|

1,921 |

|

|

1,973 |

| |

|

|

|

|

Property, plant, and equipment, net |

|

817 |

|

|

800 |

|

Operating lease right-of-use assets, net |

|

150 |

|

|

178 |

|

Identifiable intangible assets, net |

|

1,538 |

|

|

1,705 |

|

Goodwill |

|

1,937 |

|

|

2,438 |

|

Other noncurrent assets |

|

263 |

|

|

276 |

| Total Assets |

$ |

6,626 |

|

$ |

7,370 |

| |

|

|

|

| Liabilities and

Equity |

|

|

|

|

Current Liabilities: |

|

|

|

|

Accounts payable |

$ |

297 |

|

$ |

305 |

|

Accrued liabilities |

|

798 |

|

|

749 |

|

Income taxes payable |

|

25 |

|

|

49 |

|

Notes payable and current portion of long-term debt |

|

422 |

|

|

322 |

|

Total Current Liabilities |

|

1,542 |

|

|

1,425 |

| |

|

|

|

|

Long-term debt |

|

1,795 |

|

|

1,796 |

|

Operating lease liabilities |

|

103 |

|

|

125 |

|

Deferred income taxes |

|

193 |

|

|

228 |

|

Other noncurrent liabilities |

|

503 |

|

|

502 |

| Total Liabilities |

|

4,136 |

|

|

4,076 |

| |

|

|

|

| Total Equity |

|

2,490 |

|

|

3,294 |

| |

|

|

|

| Total Liabilities and

Equity |

$ |

6,626 |

|

$ |

7,370 |

| |

|

|

|

DENTSPLY SIRONA INC. AND

SUBSIDIARIESCONSOLIDATED STATEMENTS OF CASH

FLOWS(in millions)(unaudited)

| |

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

| Cash flows from

operating activities: |

|

|

|

| Net loss |

$ |

(482 |

) |

|

$ |

(204 |

) |

| |

|

|

|

| Adjustments to reconcile net

loss to net cash provided by operating activities: |

|

|

|

|

Depreciation |

|

99 |

|

|

|

99 |

|

|

Amortization of intangible assets |

|

162 |

|

|

|

159 |

|

|

Goodwill and intangible asset impairments |

|

510 |

|

|

|

307 |

|

|

Deferred income taxes |

|

(20 |

) |

|

|

(107 |

) |

|

Stock-based compensation expense |

|

35 |

|

|

|

33 |

|

|

Other non-cash expense |

|

36 |

|

|

|

29 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts and notes receivable-trade, net |

|

19 |

|

|

|

(31 |

) |

|

Inventories, net |

|

2 |

|

|

|

(45 |

) |

|

Prepaid expenses and other current assets |

|

61 |

|

|

|

(52 |

) |

|

Other noncurrent assets |

|

(6 |

) |

|

|

(4 |

) |

|

Accounts payable |

|

(6 |

) |

|

|

(10 |

) |

|

Accrued liabilities |

|

(17 |

) |

|

|

16 |

|

|

Income taxes |

|

(15 |

) |

|

|

(6 |

) |

|

Other noncurrent liabilities |

|

(4 |

) |

|

|

33 |

|

| Net cash provided by

operating activities |

|

374 |

|

|

|

217 |

|

| |

|

|

|

| Cash flows from

investing activities: |

|

|

|

| Capital expenditures |

|

(129 |

) |

|

|

(109 |

) |

| Cash received on derivative

contracts |

|

— |

|

|

|

39 |

|

| Cash paid on derivative

contracts |

|

(12 |

) |

|

|

— |

|

| Other investing

activities |

|

1 |

|

|

|

1 |

|

| Net cash used in

investing activities |

|

(140 |

) |

|

|

(69 |

) |

| |

|

|

|

| Cash flows from

financing activities: |

|

|

|

| Cash paid for treasury

stock |

|

(250 |

) |

|

|

(150 |

) |

| Proceeds on short-term

borrowings |

|

99 |

|

|

|

68 |

|

| Cash dividends paid |

|

(95 |

) |

|

|

(86 |

) |

| Proceeds from long-term

borrowings |

|

— |

|

|

|

2 |

|

| Repayments on long-term

borrowings |

|

(8 |

) |

|

|

(6 |

) |

| Other financing activities,

net |

|

(10 |

) |

|

|

(7 |

) |

| Net cash used in

financing activities |

|

(264 |

) |

|

|

(179 |

) |

| Effect of exchange rate

changes on cash and cash equivalents |

|

(8 |

) |

|

|

(25 |

) |

| Net decrease in cash and cash

equivalents |

|

(38 |

) |

|

|

(56 |

) |

| Cash and cash equivalents at

beginning of period |

|

334 |

|

|

|

365 |

|

| Cash and cash equivalents at

end of period |

$ |

296 |

|

|

$ |

309 |

|

| |

Non-GAAP Financial Measures

In addition to results determined in accordance with U.S.

generally accepted accounting principles (“US GAAP”), the Company

provides certain measures in this press release, described below,

which are not calculated in accordance with US GAAP and therefore

represent Non-GAAP measures. These Non-GAAP measures may differ

from those used by other companies and should not be considered in

isolation from, or as a substitute for, measures of financial

performance prepared in accordance with US GAAP. These Non-GAAP

measures are used by the Company to measure its performance and may

differ from those used by other companies.

Management believes that these Non-GAAP measures are helpful as

they provide a measure of the results of operations, and are

frequently used by investors and analysts to evaluate the Company’s

performance exclusive of certain items that impact the

comparability of results from period to period, and which may not

be indicative of past or future performance of the Company.

Organic Sales

The Company defines "organic sales" as the reported net sales

adjusted for: (1) net sales from acquired businesses recorded prior

to the first anniversary of the acquisition; (2) net sales

attributable to disposed businesses or discontinued product lines

in both the current and prior year periods; and (3) the impact of

foreign currency changes, which is calculated by translating

current period net sales using the comparable prior period's

foreign currency exchange rates.

Adjusted Operating Income and Margin

Adjusted operating income is computed by excluding the following

items from operating income (loss) as reported in accordance with

US GAAP:

(1) Business combination-related

costs and fair value adjustments. These adjustments include costs

related to consummating and integrating acquired businesses, as

well as net gains and losses related to disposed businesses. In

addition, this category includes the post-acquisition roll-off of

fair value adjustments recorded related to business combinations,

except for amortization expense of purchased intangible assets

noted below. Although the Company is regularly engaged in

activities to find and act on opportunities for strategic growth

and enhancement of product offerings, the costs associated with

these activities may vary significantly between periods based on

the timing, size and complexity of acquisitions and as such may not

be indicative of past and future performance of the Company.

(2) Restructuring-related charges and

other costs. These adjustments include costs related to the

implementation of restructuring initiatives, including but not

limited to, severance costs, facility closure costs, and lease and

contract termination costs, as well as related professional service

costs associated with these restructuring initiatives and global

transformation activity. The Company is continually seeking to take

actions that could enhance its efficiency; consequently,

restructuring charges may recur but are subject to significant

fluctuations from period to period due to the varying levels of

restructuring activity, and as such may not be indicative of past

and future performance of the Company. Other costs include gains

and losses on the sale of property, legal settlements, executive

separation costs, write-offs of inventory as a result of product

rationalization, and changes in accounting principles recorded

within the period. This category also includes costs related to

investigations, related ongoing legal matters and associated

remediation activities which primarily include legal, accounting

and other professional service fees, as well as turnover and other

employee-related costs.

(3) Goodwill and intangible asset

impairments. These adjustments include charges related to goodwill

and intangible asset impairments.

(4) Amortization of purchased

intangible assets. This adjustment excludes the periodic

amortization expense related to purchased intangible assets, which

are recorded at fair value. Although these costs contribute to

revenue generation and will recur in future periods, their amounts

are significantly impacted by the timing and size of acquisitions,

and as such may not be indicative of the future performance of the

Company.

(5) Fair value and credit risk

adjustments. These adjustments include the non-cash mark-to-market

changes in fair value associated with pension assets and

obligations, and equity-method investments. Although these

adjustments are recurring in nature, they are subject to

significant fluctuations from period to period due to changes in

the underlying assumptions and market conditions. The non-service

component of pension expense is a recurring item, however it is

subject to significant fluctuations from period to period due to

changes in actuarial assumptions, interest rates, plan changes,

settlements, curtailments, and other changes in facts and

circumstances. As such, these items may not be indicative of past

and future performance of the Company.

Adjusted operating income margin is calculated by dividing

adjusted operating income by net sales.

Adjusted Gross Profit

Adjusted gross profit is computed by excluding from gross profit

the impact of any of the above adjustments on either sales or cost

of sales.

Adjusted Net Income (Loss)

Adjusted net income (loss) consists of net income (loss) as

reported in accordance with US GAAP, adjusted to exclude the items

identified above, as well as the related income tax impacts of

those items. Additionally, net income is adjusted for other

tax-related adjustments such as: discrete adjustments to valuation

allowances and other uncertain tax positions, final settlement of

income tax audits, discrete tax items resulting from the

implementation of restructuring initiatives and the windfall or

shortfall relating to exercise of employee share-based

compensation, any difference between the interim and annual

effective tax rate, and adjustments relating to prior periods.

These adjustments are irregular in timing, and the variability

in amounts may not be indicative of past and future performance of

the Company and therefore are excluded for comparability

purposes.

Adjusted EBITDA and Margin

In addition to the adjustments described above in arriving at

adjusted net income, adjusted EBITDA is computed by further

excluding any remaining interest expense, net, income tax expense,

depreciation and amortization.

Adjusted EBITDA margin is calculated by dividing adjusted EBITDA

by net sales.

Adjusted Earnings (Loss) Per Diluted Share

Adjusted earnings (loss) per diluted share (adjusted EPS) is

computed by dividing adjusted earnings (loss) attributable to

Dentsply Sirona shareholders by the diluted weighted average number

of common shares outstanding.

Adjusted Free Cash Flow and Conversion

The Company defines adjusted free cash flow as net cash provided

by operating activities minus capital expenditures during the same

period, and adjusted free cash flow conversion is defined as

adjusted free cash flow divided by adjusted net income (loss).

Management believes this Non-GAAP measure is important for use in

evaluating the Company’s financial performance as it measures our

ability to efficiently generate cash from our business operations

relative to earnings. It should be considered in addition to,

rather than as a substitute for, net income (loss) as a measure of

our performance or net cash provided by operating activities as a

measure of our liquidity.

|

DENTSPLY SIRONA INC. AND SUBSIDIARIES(In millions,

except percentages)(unaudited) |

| |

| A reconciliation

of reported net sales to organic sales by geographic region is as

follows: |

| |

| |

|

Three Months Ended September 30, 2024 |

|

Q3 2024 Change |

|

Three Months Ended September 30, 2023 |

| (in

millions, except percentages) |

|

U.S. |

Europe |

ROW |

Total |

|

U.S. |

Europe |

ROW |

Total |

|

U.S. |

Europe |

ROW |

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

374 |

$ |

347 |

$ |

230 |

$ |

951 |

|

5.0 |

% |

(1.8 |

%) |

(3.0 |

%) |

0.5 |

% |

|

$ |

356 |

$ |

354 |

$ |

237 |

$ |

947 |

|

Foreign exchange impact |

|

|

|

|

|

|

(0.1 |

%) |

0.2 |

% |

(3.6 |

%) |

(0.8 |

%) |

|

|

|

|

|

| Organic

sales |

|

|

|

|

|

|

5.1 |

% |

(2.0 |

%) |

0.6 |

% |

1.3 |

% |

|

|

|

|

|

Percentages are based on actual values and may

not reconcile due to rounding.

| A reconciliation

of reported net sales to organic sales by segment is as

follows: |

| |

| |

|

Three Months Ended September 30, 2024 |

|

Q3 2024 Change |

|

Three Months Ended September 30, 2023 |

| (in

millions, except percentages) |

|

Connected Technology Solutions |

Essential Dental Solutions |

Orthodontic and Implant Solutions |

Wellspect Healthcare |

Total |

|

Connected Technology Solutions |

Essential Dental Solutions |

Orthodontic and Implant Solutions |

Wellspect Healthcare |

Total |

|

Connected Technology Solutions |

Essential Dental Solutions |

Orthodontic and Implant Solutions |

Wellspect Healthcare |

Total |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

|

$ |

269 |

$ |

369 |

$ |

241 |

$ |

72 |

$ |

951 |

|

(2.3 |

%) |

6.6 |

% |

(4.6 |

%) |

(0.4 |

%) |

0.5 |

% |

|

$ |

276 |

$ |

347 |

$ |

252 |

$ |

72 |

$ |

947 |

|

Foreign exchange impact |

|

|

|

|

|

|

|

(0.9 |

%) |

(0.9 |

%) |

(0.7 |

%) |

(0.4 |

%) |

(0.8 |

%) |

|

|

|

|

|

|

| Organic

sales |

|

|

|

|

|

|

|

(1.4 |

%) |

7.5 |

% |

(3.9 |

%) |

— |

% |

1.3 |

% |

|

|

|

|

|

|

Percentages are based on actual values and may

not reconcile due to rounding.

|

DENTSPLY SIRONA INC. AND SUBSIDIARIES(In millions,

except percentages)(unaudited) |

| |

| The Company’s

segment adjusted operating income for the three and nine months

ended September 30, 2024 and 2023 was as follows: |

| |

| |

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

(in millions) |

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

| Connected Technology

Solutions |

|

$ |

16 |

|

|

$ |

22 |

|

|

$ |

21 |

|

|

$ |

54 |

|

| Essential Dental

Solutions |

|

|

132 |

|

|

|

115 |

|

|

|

372 |

|

|

|

365 |

|

| Orthodontic and Implant

Solutions |

|

|

24 |

|

|

|

31 |

|

|

|

108 |

|

|

|

129 |

|

| Wellspect Healthcare |

|

|

26 |

|

|

|

26 |

|

|

|

73 |

|

|

|

65 |

|

|

Segment adjusted operating income |

|

|

198 |

|

|

|

194 |

|

|

|

574 |

|

|

|

613 |

|

| |

|

|

|

|

|

|

|

|

| Reconciling items

expense (income): |

|

|

|

|

|

|

|

|

|

All other (a) |

|

|

79 |

|

|

|

64 |

|

|

|

227 |

|

|

|

235 |

|

|

Goodwill and intangible asset impairments |

|

|

504 |

|

|

|

307 |

|

|

|

510 |

|

|

|

307 |

|

|

Restructuring and other costs |

|

|

23 |

|

|

|

6 |

|

|

|

45 |

|

|

|

70 |

|

|

Interest expense, net |

|

|

18 |

|

|

|

19 |

|

|

|

53 |

|

|

|

61 |

|

|

Other (income) expense, net |

|

|

(2 |

) |

|

|

(5 |

) |

|

|

(10 |

) |

|

|

13 |

|

|

Amortization of intangible assets |

|

|

54 |

|

|

|

53 |

|

|

|

162 |

|

|

|

159 |

|

| Loss before income taxes |

|

$ |

(478 |

) |

|

$ |

(250 |

) |

|

$ |

(413 |

) |

|

$ |

(232 |

) |

(a) Includes unassigned corporate headquarters

costs.

|

DENTSPLY SIRONA INC. AND SUBSIDIARIES(In millions,

except percentages)(unaudited) |

| |

| For the three

months ended September 30, 2024, a reconciliation of selected items

as reported in the Condensed Consolidated Statements of Operations

to adjusted Non-GAAP items is as follows: |

| |

| (in

millions, except percentages and per share data) |

|

Gross Profit |

|

Operating (Loss) Income |

|

Net (Loss) Income Attributable to Dentsply Sirona (a) |

|

Diluted EPS |

|

GAAP |

|

$ |

495 |

|

$ |

(462 |

) |

|

$ |

(494 |

) |

|

$ |

(2.46 |

) |

| Non-GAAP Adjustments: |

|

|

|

|

|

|

|

|

|

Amortization of Purchased Intangible Assets |

|

|

31 |

|

|

54 |

|

|

|

40 |

|

|

|

0.20 |

|

|

Restructuring-Related Charges and Other Costs |

|

|

— |

|

|

39 |

|

|

|

29 |

|

|

|

0.15 |

|

|

Goodwill and Intangible Asset Impairments |

|

|

— |

|

|

504 |

|

|

|

495 |

|

|

|

2.46 |

|

|

Business Combination-Related Costs and Fair Value Adjustments |

|

|

1 |

|

|

1 |

|

|

|

1 |

|

|

|

— |

|

|

Income Tax-Related Adjustments |

|

|

— |

|

|

— |

|

|

|

30 |

|

|

|

0.15 |

|

| Adjusted

Non-GAAP |

|

$ |

527 |

|

$ |

136 |

|

|

$ |

101 |

|

|

$ |

0.50 |

|

| GAAP Margin |

|

|

|

|

(48.5 |

%) |

|

|

|

|

| Adjusted Non-GAAP Margin |

|

|

|

|

14.3 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Weighted average

common shares outstanding used in calculating diluted GAAP net loss

per common share |

|

|

201.0 |

|

| Weighted average

common shares outstanding used in calculating diluted Non-GAAP net

income per common share |

|

|

201.5 |

|

| (a) The tax

expense on the Non-GAAP adjustments totals $3 million which is

inclusive of the $30 million income tax-related adjustment

above. |

|

|

Percentages are based on actual values and may

not reconcile due to rounding.

|

DENTSPLY SIRONA INC. AND SUBSIDIARIES(In millions,

except percentages)(unaudited) |

| |

| For the three

months ended September 30, 2023, a reconciliation of selected items

as reported in the Condensed Consolidated Statements of Operations

to adjusted Non-GAAP items is as follows: |

| |

| (in

millions, except percentages and per share data) |

|

Gross Profit |

|

Operating (Loss) Income |

|

Net (Loss) Income Attributable to Dentsply Sirona (a) |

|

Diluted EPS |

|

GAAP |

|

$ |

495 |

|

$ |

(236 |

) |

|

$ |

(266 |

) |

|

$ |

(1.25 |

) |

| Non-GAAP Adjustments: |

|

|

|

|

|

|

|

|

|

Amortization of Purchased Intangible Assets |

|

|

30 |

|

|

53 |

|

|

|

40 |

|

|

|

0.19 |

|

|

Restructuring-Related Charges and Other Costs |

|

|

6 |

|

|

8 |

|

|

|

6 |

|

|

|

0.03 |

|

|

Goodwill and Intangible Asset Impairments |

|

|

— |

|

|

307 |

|

|

|

302 |

|

|

|

1.42 |

|

|

Business Combination-Related Costs and Fair Value Adjustments |

|

|

— |

|

|

3 |

|

|

|

2 |

|

|

|

0.01 |

|

|

Income Tax-Related Adjustments |

|

|

— |

|

|

— |

|

|

|

20 |

|

|

|

0.09 |

|

| Adjusted

Non-GAAP |

|

$ |

531 |

|

$ |

135 |

|

|

$ |

104 |

|

|

$ |

0.49 |

|

| GAAP Margin |

|

|

|

|

(24.9 |

%) |

|

|

|

|

| Adjusted Non-GAAP Margin |

|

|

|

|

14.2 |

% |

|

|

|

|

| |

|

|

|

|

|

|

|

|

| Weighted average

common shares outstanding used in calculating diluted GAAP net loss

per common share |

|

|

211.8 |

|

| Weighted average

common shares outstanding used in calculating diluted Non-GAAP net

income per common share |

|

|

213.0 |

|

| (a) The tax

expense on the Non-GAAP adjustments totals $1 million, which is

inclusive of the $20 million income tax-related adjustment

above. |

|

|

Percentages are based on actual values and may not reconcile due

to rounding.

|

DENTSPLY SIRONA INC. AND SUBSIDIARIES(In millions,

except percentages)(unaudited) |

| |

| A reconciliation

of reported net (loss) income attributable to Dentsply Sirona to

adjusted EBITDA and margin for the three months ended

September 30, 2024 and 2023 is as follows: |

| |

| |

|

Three Months Ended September 30, |

|

(in millions, except percentages) |

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

| Net loss attributable

to Dentsply Sirona |

|

$ |

(494 |

) |

|

$ |

(266 |

) |

|

Interest expense, net |

|

|

18 |

|

|

|

19 |

|

|

Income tax expense |

|

|

17 |

|

|

|

16 |

|

|

Depreciation(1) |

|

|

31 |

|

|

|

31 |

|

|

Amortization of purchased intangible assets |

|

|

54 |

|

|

|

53 |

|

|

Restructuring-related charges and other costs |

|

|

39 |

|

|

|

8 |

|

|

Goodwill and intangible asset impairments |

|

|

504 |

|

|

|

307 |

|

|

Business combination-related costs and fair value adjustments |

|

|

1 |

|

|

|

3 |

|

|

Fair value and credit risk adjustments |

|

|

— |

|

|

|

— |

|

| Adjusted

EBITDA(2) |

|

$ |

170 |

|

|

$ |

171 |

|

| |

|

|

|

|

| Net sales |

|

$ |

951 |

|

|

$ |

947 |

|

| Adjusted EBITDA

margin |

|

|

17.9 |

% |

|

|

18.3 |

% |

(1) Excludes those depreciation-related amounts which were

included as part of the business combination-related adjustments

and Restructuring-related charges and other costs.(2) Adjusted

EBITDA for 2023 has been updated to reflect the reclassification of

$1 million in certain gains from hedging instruments from Interest

expense to Other expense (income) in order to conform with current

year presentation.Percentages are based on actual values and may

not reconcile due to rounding.

| A reconciliation

of adjusted free cash flow conversion for the three months ended

September 30, 2024 and 2023 is as follows: |

| |

| |

|

Three Months Ended September 30, |

|

(in millions, except percentages) |

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

| Net cash provided by operating

activities |

|

$ |

141 |

|

|

$ |

134 |

|

| Capital expenditures |

|

|

(43 |

) |

|

|

(37 |

) |

| Adjusted free cash flow |

|

$ |

98 |

|

|

$ |

97 |

|

| |

|

|

|

|

| Adjusted net income |

|

$ |

101 |

|

|

$ |

104 |

|

| Adjusted free cash

flow conversion |

|

|

97 |

% |

|

|

93 |

% |

Percentages are based on actual values and may not reconcile due

to rounding.

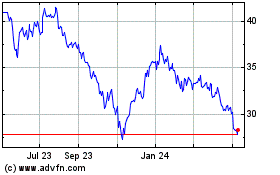

DENTSPLY SIRONA (NASDAQ:XRAY)

Historical Stock Chart

From Nov 2024 to Dec 2024

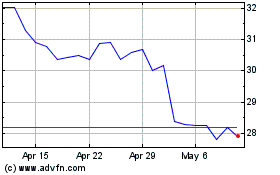

DENTSPLY SIRONA (NASDAQ:XRAY)

Historical Stock Chart

From Dec 2023 to Dec 2024