Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

26 April 2023 - 8:50PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE

13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2023

Commission File Number: 001-39742

17 Education & Technology Group Inc.

(Translation of registrant’s name into English)

16/F, Block B, Wangjing Greenland Center

Chaoyang District, Beijing 100102

People’s Republic of China

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F. Form 20-F x Form 40-F ¨

Supplemental Submission pursuant to Item 16I(a) of Form 20-F

17 Education & Technology Group Inc. (the “Company”) is submitting via EDGAR the following information as required under Item 16I(a) of Form 20-F in relation to the Holding Foreign Companies Accountable Act (“HFCAA”).

On May 26, 2022, the Company was conclusively identified by the U.S. Securities and Exchange Commission (the “SEC”) as a Commission-Identified Issuer pursuant to the HFCAA because it filed an annual report on Form 20-F for the year ended December 31, 2021 with the SEC on April 27, 2022 with an audit report issued by Deloitte Touche Tohmatsu Certified Public Accountants LLP, a registered public accounting firm retained by the Company, for the preparation of the audit report on the Company’s financial statements included therein. Deloitte Touche Tohmatsu Certified Public Accountants LLP is a registered public accounting firm headquartered in mainland China, a jurisdiction where the Public Company Accounting Oversight Board (the “PCAOB”) determined that it had been unable to inspect or investigate completely registered public accounting firms headquartered there until December 2022 when the PCAOB vacated its previous determination.

In response to Item 16I(a) of Form 20-F, based on the following information, the Company believes it is not owned or controlled by a governmental entity in mainland China.

To the Company’s knowledge based on its register of members and public EDGAR filings made by its shareholders, no shareholder, other than (i) Fluency Holding Ltd., (ii) H Capital Entities (as defined below), (iii) CL Lion Investment III Limited, (iv) Esta Investment Pte. Ltd., and (v) Walden Investments Entities (as defined below) owns more than 5% of the Company’s outstanding shares as of February 28, 2023.

•Fluency Holding Ltd. held 12.0% of the Company’s total outstanding shares and 80.4% of the Company’s aggregate voting power as of February 28, 2023. Fluency Holding Ltd. is a private company incorporated in the British Virgin Islands. It is indirectly wholly-owned by Vistra Trust (Singapore) Pte. Limited, the trustee of Sunny Trust. Mr. Andy Chang Liu is the settler of Sunny Trust and Mr. Andy Chang Liu and his family members are the beneficiaries of Sunny Trust. Fluency Holding Ltd. is not a governmental entity of China.

•H Capital I, L.P., H Capital II, L.P., H Capital IV, L.P. and H Capital V, L.P. (collectively, “H Capital Entities”) in the aggregate held 11.9% of the Company’s total outstanding shares and 2.7% of the Company’s aggregate voting power as of February 28, 2023. The H Capital Entities were incorporated in Cayman Islands. They are investing entities ultimately controlled by Mr. Xiaohong Chen and are not governmental entities of China.

•CL Lion Investment III Limited held 9.4% of the Company’s total outstanding shares and 2.1% of the Company’s aggregate voting power as of February 28, 2023. CL Lion Investment III Limited is a British Virgin Islands company. It is indirectly wholly owned by CITICPE Holdings Limited, whose largest shareholder beneficially owns 35% of its equity interest and is a indirectly wholly owned subsidiary of CITIC Securities Company Limited, a company incorporated in the PRC. CL Lion Investment III Limited is not a governmental entity of China.

•Esta Investment Pte. Ltd. held 9.1% of the Company’s total outstanding shares and 2.1% of the Company’s aggregate voting power as of February 28, 2023. Esta Investments Pte. Ltd. is indirectly wholly-owned by the Minister of Finance in Singapore. Esta Investment Pte. Ltd. is not a governmental entity of China.

•Mr. Sunwei Chen, Walden Investments Group Limited and Success Tycoon Limited (collectively, “Walden Investments Entities”) collectively held 7.3% of the Company’s total outstanding shares and 1.6% of the Company’s aggregate voting power as of February 28, 2023. Walden Investments Group Limited is a British Virgin Islands limited liability company indirectly wholly-owned by Mr. Sunwei Chen. Success Tycoon Limited is a British Virgin Islands limited liability company wholly-owned by Mr. Sunwei Chen. The Walden Investments Entities are not governmental entities of China.

The above-mentioned entities hold a substantial majority of the Company’s total voting power on a combined basis.

Please refer to “Item 6. Directors, Senior Management and Employees—E. Share Ownership” of the Company’s annual report on Form 20-F for the year ended December 31, 2022 filed with the SEC on April 26, 2023 for more details.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

|

17 Education & Technology Group Inc. |

|

|

By: |

|

/s/ Michael Chao Du |

Name: |

|

Michael Chao Du |

Title: |

|

Chief Financial Officer |

Date: April 26, 2023

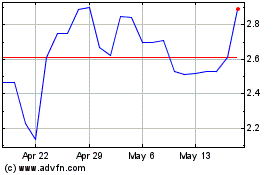

17 Education and Technol... (NASDAQ:YQ)

Historical Stock Chart

From May 2024 to Jun 2024

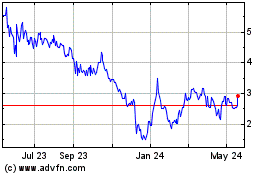

17 Education and Technol... (NASDAQ:YQ)

Historical Stock Chart

From Jun 2023 to Jun 2024