Zai Lab Announces Pricing of Public Offering of American Depositary Shares

15 November 2024 - 11:43AM

Business Wire

Zai Lab Limited (“Zai Lab” or the “Company”) (NASDAQ: ZLAB;

HKEX: 9688), an innovative, commercial-stage biopharmaceutical

company, today announced the pricing of its underwritten public

offering of 7,843,137 American depositary shares (“ADSs”), each

representing ten ordinary shares of the Company, at a price of

US$25.50 per ADS.

The gross proceeds to Zai Lab from the offering, before

deducting underwriting discounts and commissions and other offering

expenses, are expected to be approximately $200 million. Subject to

customary closing conditions, the underwriters expect to deliver

the ADSs against payment to the purchasers on or about November 18,

2024, on a “T+2” basis. In addition, Zai Lab has granted the

underwriters a 30-day option to purchase up to an additional

1,176,470 ADSs at the public offering price, less underwriting

discounts and commissions. Zai Lab intends to use the net proceeds

from this offering for general corporate purposes.

Goldman Sachs (Asia) L.L.C., Jefferies and Leerink Partners are

acting as joint book-running managers for the ADS offering.

The ADSs are offered pursuant to a shelf registration statement

on Form S-3ASR, which became automatically effective upon filing

with the U.S. Securities and Exchange Commission (“SEC”) on April

19, 2024 (the “Form S-3ASR”). The offering is being made only by

means of a prospectus supplement and an accompanying base

prospectus included in the Form S-3ASR. A final prospectus

supplement relating to the offering will be filed with the SEC. The

registration statement on Form S-3ASR and the prospectus supplement

are available at the SEC’s website at: http://www.sec.gov. Copies

of the prospectus supplement and the accompanying prospectus may be

obtained from: (i) Goldman Sachs & Co. LLC, c/o Prospectus

Department, 200 West Street, New York, NY, facsimile: 212-902-9316

or by emailing Prospectus-ny@ny.email.gs.com, (ii) Jefferies LLC,

c/o Equity Syndicate Prospectus Department, 520 Madison Avenue, New

York, NY 10022, by telephone at (877) 821-7388, or by email at

Prospectus_Department@Jefferies.com, and (iii) Leerink Partners

LLC, c/o Syndicate Department, 53 State Street, 40th Floor, Boston,

MA 02109, by telephone at (800) 808-7525, ext. 6105, or by email at

syndicate@leerink.com.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy ADSs or any other securities, nor

shall there be any sale of ADSs in any state or jurisdiction in

which such an offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

such state or jurisdiction.

About Zai Lab

Zai Lab (NASDAQ: ZLAB; HKEX: 9688) is an innovative,

research-based, commercial-stage biopharmaceutical company based in

China and the United States. Zai Lab is focused on discovering,

developing, and commercializing innovative products that address

medical conditions with significant unmet needs in the areas of

oncology, immunology, neuroscience, and infectious disease. The

Company’s goal is to leverage its competencies and resources to

positively impact human health in China and worldwide.

Zai Lab Forward-Looking Statements

This press release contains forward-looking statements about

future expectations, plans, and prospects for Zai Lab, including,

without limitation, statements relating to our ability to

successfully complete the offering on the timeline and with the

terms and conditions satisfactory to us, the anticipated use of

proceeds therefrom, the possible adverse impact on the market price

of our ADSs and ordinary shares due to the dilutive effect of the

securities to be sold in the offering, capital market risks, and

the impact of general economic or industry conditions. All

statements, other than statements of historical fact, included in

this press release are forward-looking statements and can be

identified by containing words such as “aim,” “anticipate,”

“believe,” “could,” “estimate,” “expect,” “forecast,” “goal,”

“intend,” “may,” “plan,” “possible,” “potential,” “will,” “would,”

and other similar expressions. Such statements constitute

forward-looking statements within the meaning of U.S. federal

securities laws. Forward-looking statements are not guarantees or

assurances of future performance. There can be no assurance that we

will be able to complete the public offering on the anticipated

terms, or at all. Forward-looking statements are based on our

expectations and assumptions as of the date of this press release

and are subject to inherent uncertainties, risks, and changes in

circumstances that may differ materially from those contemplated by

the forward-looking statements. We may not actually achieve the

plans, carry out the intentions, or meet the expectations or

projections disclosed in our forward-looking statements, and you

should not place undue reliance on these forward-looking

statements. Actual results may differ materially from those

indicated by forward-looking statements as a result of various

important factors, including but not limited to (1) our ability to

successfully commercialize and generate revenue from our approved

products, (2) our ability to obtain funding for our operations and

business initiatives, (3) the results of our clinical and

pre-clinical development of our product candidates, (4) the content

and timing of decisions made by the relevant regulatory authorities

regarding regulatory approvals of our product candidates, (5) risks

related to doing business in China, and (6) other factors

identified in our most recent annual and quarterly reports and in

other reports we have filed with the U.S. Securities and Exchange

Commission, including the registration statement and prospectus

supplement related to the offering, which are available at

www.sec.gov.. We anticipate that subsequent events and developments

will cause our expectations and assumptions to change, and we

undertake no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events,

or otherwise, except as may be required by law. These

forward-looking statements should not be relied upon as

representing our views as of any date subsequent to the date of

this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241114517331/en/

ZAI LAB CONTACTS: Investor Relations: Christine

Chiou / Lina Zhang +1 (917) 886-6929 / +86 136 8257 6943

christine.chiou1@zailaboratory.com / lina.zhang@zailaboratory.com

Media: Shaun Maccoun / Xiaoyu Chen +1 (857) 270-8854 / +86

185 0015 5011 shaun.maccoun@zailaboratory.com /

xiaoyu.chen@zailaboratory.com

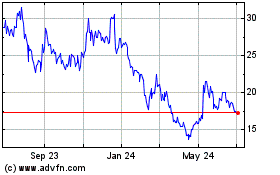

Zai Lab (NASDAQ:ZLAB)

Historical Stock Chart

From Nov 2024 to Dec 2024

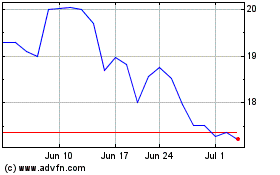

Zai Lab (NASDAQ:ZLAB)

Historical Stock Chart

From Dec 2023 to Dec 2024