| | | | | | | | | | | | | | | | | |

| As filed with the Securities and Exchange Commission on May 16, 2024 |

| Registration No. 333- |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION |

| WASHINGTON, D.C. 20549 |

| _________________________ |

| FORM S-8 |

| REGISTRATION STATEMENT |

| UNDER |

| THE SECURITIES ACT OF 1933 |

| _________________________ |

|

| THE AARON’S COMPANY, INC. |

| (Exact name of registrant as specified in its charter) |

| Georgia

(State or other jurisdiction of

incorporation or organization) | | 85-2483376

(I.R.S. Employer

Identification No.) | | |

400 Galleria Parkway SE, Suite 300 Atlanta, Georgia 30339-3182

(Address, including zip code, of Principal Executive Offices) |

| _________________________ |

| The Aaron’s Company, Inc. Amended and Restated 2020 Equity and Incentive Plan |

| (Full title of the plan) |

C. Kelly Wall Chief Financial Officer The Aaron’s Company, Inc. 400 Galleria Parkway SE, Suite 300 Atlanta, Georgia 30339-3182 | |

| (Names and address of agent for service) |

(678) 402-3000

(Telephone number, including area code, of agent for service) |

| Copy to: |

Joel T. May Jones Day 1221 Peachtree St., NE Suite 400 Atlanta, Georgia 30361 (404) 521-3939 |

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large Accelerated Filer ☐

| Accelerated Filer ☒ | |

Non-Accelerated Filer ☐

| Smaller Reporting Company ☐ | |

| Emerging Growth Company ☐ | | |

| | | | | | | | | | | | | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐ | |

|

EXPLANATORY NOTE

Pursuant to General Instruction E of Form S-8, The Aaron's Company, Inc. (the "Registrant") is filing this Registration Statement on Form S-8 to register an additional 1,527,000 shares of common stock, par value $0.50 per share, of the Registrant ("Common Stock") issuable under The Aaron's Company, Inc. Amended and Restated 2020 Equity and Incentive Plan, which are securities of the same class and relate to the same employee benefit plan as those shares of Common Stock registered on the Registrant’s registration statements on Form S-8 previously filed with the Securities and Exchange Commission (the "Commission") on August 25, 2021 (Registration No. 333-259062) and November 19, 2020 (Registration No. 333-250900), all of which are hereby incorporated by reference.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 8. Exhibits.

| | | | | | | | |

| Exhibit Number | | DESCRIPTION OF EXHIBIT |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| | |

| *Filed herewith. |

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Atlanta, State of Georgia, on May 16, 2024.

| | |

| THE AARON’S COMPANY, INC. |

By: /s/ C. Kelly Wall Name: C. Kelly Wall Title: Chief Financial Officer |

POWER OF ATTORNEY

Each of the undersigned officers and directors of The Aaron’s Company, Inc. hereby constitutes and appoints Douglas A. Lindsay and C. Kelly Wall as his or her true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, in his or her name and on his or her behalf, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement, including any subsequent registration statement for the same offering which may be filed under Rule 462(b) under the Securities Act of 1933, and to file the same, with all exhibits thereto and all documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorney-in-fact and agent full power of authority to do and perform each and every act and thing requisite or necessary to be done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, thereby ratifying and confirming all that said attorney-in-fact and agent, or his or her substitute, may lawfully do or cause to be done.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | |

| Signature | Title | Date |

| | |

/s/ Douglas A. Lindsay Douglas A. Lindsay | Chief Executive Officer and Director (Principal Executive Officer) | May 16, 2024 |

| | |

/s/ C. Kelly Wall C. Kelly Wall | Chief Financial Officer (Principal Financial Officer) | May 16, 2024 |

| | |

/s/ Douglass L. Noe Douglass L. Noe | Vice President and Corporate Controller (Principal Accounting Officer) | May 16, 2024 |

| | |

/s/ Wangdali C. Bacdayan Wangdali C. Bacdayan | Director | May 16, 2024 |

| | |

/s/ Laura N. Bailey Laura N. Bailey | Director | May 16, 2024 |

| | |

/s/ Kelly H. Barrett Kelly H. Barrett | Director | May 16, 2024 |

| | |

/s/ Walter G. Ehmer Walter G. Ehmer | Director | May 16, 2024 |

| | |

/s/ Hubert L. Harris, Jr. Hubert L. Harris, Jr. | Director | May 16, 2024 |

| | |

/s/ Timothy A. Johnson Timothy A. Johnson | Director | May 16, 2024 |

| | |

/s/ Kristine K. Malkoski Kristine K. Malkoski | Director | May 16, 2024 |

| | |

/s/ Marvonia P. Moore Marvonia P. Moore | Director | May 16, 2024 |

| | |

| | | | | | | | |

/s/ John W. Robinson III John W. Robinson III | Director | May 16, 2024 |

| | |

Calculation of Filing Fee Table

Form S-8

(Form Type)

THE AARON’S COMPANY, INC.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered (1) | Proposed Maximum Offering Price Per Share | Maximum Aggregate Offering Price | Fee Rate | Amount of Registration Fee |

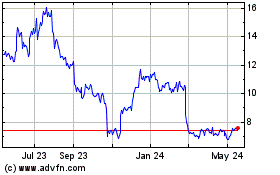

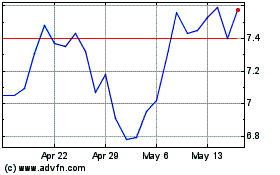

| Equity | Common stock, par value $0.50 per share | Other (2) | 1,527,000 (3) | $7.44 (2) | $11,360,880 (2) | $147.60 per $1,000,000 | $1,676.87 |

| Total Offering Amounts | | $11,360,880 | | $1,676.87 |

| Total Fee Offsets | | | | – |

| Net Fee Due | | | | $1,676.87 |

(1) Pursuant to Rule 416(a) under the Securities Act of 1933 (the “Securities Act”), this Registration Statement shall also cover any additional shares of the Registrant’s common stock that become issuable under The Aaron's Company, Inc. Amended and Restated 2020 Equity and Incentive Plan (the “Plan”), by reason of any stock dividend, stock split, recapitalization or any other similar transaction effected that results in an increase to the number of outstanding shares of the Registrant’s common stock.

(2) Estimated in accordance with Rule 457(c) and Rule 457(h) under the Securities Act, solely for the purpose of calculating the filing fee, based on the average of the high ($7.56) and low ($7.32) sales prices of the Registrant’s common stock as reported on The New York Stock Exchange on May 10, 2024, which date is within five business days prior to the date of filing of this Registration Statement.

(3) Represents an additional 1,527,000 shares of the Registrant’s common stock issuable pursuant to the Plan.

THE AARON’S COMPANY, INC.

AMENDED AND RESTATED 2020 EQUITY AND INCENTIVE PLAN

(Amended and Restated Effective May 15, 2024)

Article 1. PURPOSE AND GENERAL PROVISIONS

1.1Adoption of Amended and Restated Plan. The Aaron’s Company, Inc., a Georgia corporation (the “Company”), hereby adopts The Aaron’s Company, Inc. Amended and Restated 2020 Equity and Incentive Plan (Amended and Restated Effective May 15, 2024), as may be amended or amended and restated from time to time (the “Plan”). The Plan amends and restates in its entirety The Aaron’s Company, Inc. 2020 Equity and Incentive Plan, which was originally effective November 30, 2020, and which was previously amended and restated in its entirety effective August 25, 2021. The Plan was approved by the Company’s Board of Directors on May 15, 2024, and will be effective as of the date it is approved by the Company’s shareholders (the “Effective Date”).

1.2Purpose of Plan. The purpose of the Plan is to promote the long-term growth and profitability of the Company and its Subsidiaries by (i) providing certain employees, directors, consultants, advisors and other persons who perform services for the Company and its Subsidiaries with incentives to contribute to the success of the Company, and (ii) enabling the Company to attract, retain and reward individuals to serve as directors, officers and employees.

1.3Types of Awards. Awards under the Plan may be made to eligible Participants in the form of Incentive Stock Options, Nonqualified Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, Performance Shares, Performance Units, Other Awards, Annual Incentive Awards, or any combination thereof. In connection with the Spin-Off and pursuant to the terms of the Employee Matters Agreement between the Company and Holdings entered into in connection with the Spin-Off (the “Employee Matters Agreement”), certain employees and directors of the Company, Holdings and their respective subsidiaries received Assumed Spin-Off Awards.

1.4Termination of the Plan. No awards shall be granted under the Plan on or after the tenth (10th) anniversary of the Effective Date. Awards granted under the Plan prior to the tenth (10th) anniversary of the Effective Date shall remain outstanding beyond that date in accordance with the terms and conditions of the Plan and the Agreements corresponding to such Awards.

Article 2. DEFINITIONS

Except where the context otherwise indicates, the following definitions apply:

“409A AWARD” means an Award that is not exempt from Code Section 409A.

“AGREEMENT” means the written or electronic agreement evidencing an Award granted to a Participant under the Plan. As determined by the Committee, each Agreement shall consist of either (i) a written agreement in a form approved by the Committee and executed on

behalf of the Company by an officer duly authorized to act on its behalf, or (ii) an electronic notice of Award in a form approved by the Committee and recorded by the Company (or its designee) in an electronic recordkeeping system used for the purpose of tracking Awards, and if required by the Committee, executed or otherwise electronically accepted by the recipient of the Award in such form and manner as the Committee may require. The Committee may authorize any officer of the Company (other than the particular Award recipient) to execute any or all Agreements on behalf of the Company.

“ANNUAL INCENTIVE AWARD” mean an Award under Article 10 that entitles the Participant to receive a payment in cash or other property specified by the Committee to the extent performance goals are achieved.

“ASSUMED SPIN-OFF AWARD” means an award previously issued under this Plan in accordance with the terms of the Employee Matters Agreement, as an adjustment to, in substitution of, or in accordance with, a stock option, restricted stock, restricted or deferred stock unit, or performance share unit that was granted to certain employees and directors of the Company, Holdings and their respective subsidiaries under an equity plan of Holdings, which Assumed Spin-Off Award was issued upon the effective time of the Spin-Off.

“AWARD” means an award granted to a Participant under the Plan that consists of one or more Incentive Stock Options, Nonqualified Stock Options, Stock Appreciation Rights, Restricted Stock, Restricted Stock Units, Performance Shares, Performance Units, Other Awards, Annual Incentive Awards, Assumed Spin-Off Awards or a combination of these.

“BOARD” means the Board of Directors of the Company.

“CAUSE” means, unless provided otherwise in the applicable Agreement, (i) the Participant’s material fraud, malfeasance, gross negligence, or willful misconduct with respect to business affairs of the Employer, which is, or is reasonably likely to be if such action were to become known by others, directly or materially harmful to the business or reputation of the Employer; (ii) the Participant’s conviction of or failure to contest prosecution for a felony or a crime involving fraud, embezzlement, theft or moral turpitude; (iii) the Participant’s breach of the Agreement (including, without limitation, any provisions relating to maintaining confidential information and not soliciting the Employer’s employees and customers); or (iv) the willful and continued failure or habitual neglect by the Participant to perform his duties with the Employer substantially in accordance with the operating and personnel policies and procedures of the Employer. “Cause” shall be determined by the Committee in its sole discretion. Notwithstanding the foregoing, if the Participant has entered into an employment agreement with the Employer that is binding as of the date of employment termination, and if such employment agreement defines “Cause,” then the definition of “Cause” in such agreement shall apply to the Participant for Awards under this Plan.

“CHANGE IN CONTROL” means the occurrence of one of the following events:

(a) The acquisition (other than from the Company) by any Person of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act (but without

regard to any time period specified in Rule 13d-3(d)(l)(i))), of thirty-five percent (35%) or more of the combined voting power of then outstanding securities of the Company entitled to vote generally in the election of directors (the “Outstanding Company Voting Securities”); excluding, however, (1) any acquisition by the Company or (2) any acquisition by an employee benefit plan (or related trust) sponsored or maintained by the Company or any corporation controlled by the Company;

(b) A majority of the members of the Board is replaced during any 12-month period by directors whose appointment or election is not endorsed by a majority of the members of the Board before the date of the appointment or election; or

(c) Consummation by the Company of a reorganization, merger, or consolidation or sale of all or substantially all of the assets of the Company (a “Transaction”); excluding, however, a Transaction pursuant to which all or substantially all of the individuals or entities who are the beneficial owners, respectively, of the Outstanding Company Voting Securities immediately prior to such Transaction will beneficially own, directly or indirectly, more than fifty percent (50%) of the combined voting power of the outstanding securities of such corporation entitled to vote generally in the election of directors of the corporation resulting from such Transaction (including, without limitation, a corporation which as a result of such transaction owns the Company or all or substantially all of the Company’s assets either directly or indirectly) in substantially the same proportions relative to each other as their ownership, immediately prior to such Transaction, of the Outstanding Company Voting Securities.

Notwithstanding the foregoing, for purposes of any 409A Award, if that Award provides for a change in the time or form of payment upon a Change in Control, then (solely for purposes of determining the time and form of payment) no Change in Control shall be deemed to have occurred upon an event described above unless the event would also constitute a change in ownership of the Company, a change in effective control of the Company, or a change in ownership of a substantial portion of the Company’s assets under Code Section 409A.

“CODE” means the Internal Revenue Code of 1986, as now in effect and as hereafter amended from time to time. Any reference to a particular section of the Code includes any applicable regulations promulgated under that section. All citations to sections of the Code are to such sections as they may from time to time be amended or renumbered.

“COMMITTEE” means the Compensation Committee of the Board or such other committee consisting of two or more members of the Board as may be appointed by the Board from time to time to administer this Plan pursuant to Article 3. If the Common Stock is traded on the NASDAQ or the NYSE, all of the members of the Committee shall be independent directors within the meaning of the NASDAQ’s or NYSE’s listing standards (as applicable). If any member of the Committee does not qualify as a “Non-Employee Director” within the meaning of Rule 16b-3 under the Exchange Act, the Board shall appoint a subcommittee of the Committee, consisting of at least two Non-Employee Directors to grant Awards to Insiders; each member of such subcommittee shall be a Non-Employee Director. References to the Committee in the Plan shall include and, as appropriate, apply to any such subcommittee.

“COMMON STOCK” means the Common Stock, par value $0.50 per share, of the Company, and any security into which such stock may be changed by reason of a recapitalization, reorganization, merger, consolidation or any other change in the corporate structure or capital stock of the Company.

“COMPANY” means The Aaron’s Company, Inc., a Georgia corporation, and its successors and assigns.

“DISABILITY” means, with respect to any Incentive Stock Option, a disability as determined under Code Section 22(e)(3), and with respect to any other Award, unless provided otherwise in an applicable Agreement (in which case such definition shall apply for purposes of the Plan with respect to that particular Award), (i) with respect to a Participant who is eligible to participate in a program of long-term disability insurance maintained by the Employer, the date on which the insurer or administrator under such program of long-term disability insurance determines that the Participant is eligible to commence benefits under such program, and (ii) with respect to any Participant (including a Participant who is eligible to participate in a program of long-term disability insurance maintained by the Employer), the Participant’s inability, due to physical or mental injury or illness, to perform the essential functions of his position with or without reasonable accommodation for a period of one hundred eighty (180) days, whether or not consecutive, occurring within any period of twelve (12) consecutive months, subject to any limitation imposed by federal, state or local laws, including, without limitation, the American with Disabilities Act.

Notwithstanding the preceding provisions of this definition or anything in any Agreement to the contrary, to the extent any provision of this Plan or an Agreement would cause a payment of a 409A Award to be made because of the Participant’s Disability, then there shall not be a Disability that triggers payment until the date (if any) that the Participant is disabled within the meaning of Code Section 409A(a)(2)(C). Any payment that would have been made except for the application of the preceding sentence shall be made in accordance with the payment schedule that would have applied in the absence of a Disability (and other Participant rights that are tied to a Disability, such as vesting, shall not be affected by the prior sentence).

“EFFECTIVE DATE” shall have the meaning ascribed to such term in Section 1.1 hereof.

“EMPLOYEE” means any individual whom the Employer treats as a common law employee for payroll tax purposes, either within or outside the United States.

“EMPLOYER” means the Company and the Subsidiaries.

“EXCHANGE ACT” means the Securities Exchange Act of 1934, as now in effect and as hereafter amended from time to time. Any reference to a particular section of the Exchange Act includes any applicable regulations promulgated under that section. All citations to sections of the Exchange Act or rules thereunder are to such sections or rules as they may from time to time be amended or renumbered.

“FAIR MARKET VALUE” of a share of Common Stock of the Company means, as of the date in question,

(a) if the Common Stock is listed for trading on the NASDAQ, the closing sale price of a share of Common Stock on such date, as reported by the NASDAQ or such other source as the Committee deems reliable, or if no such reported sale of the Common Stock shall have occurred on such date, on the last day prior to such date on which there was such a reported sale;

(b) if the Common Stock is listed for trading on the NYSE, the closing sale price of a share of Common Stock on such date, as reported by the NYSE or such other source as the Committee deems reliable, or if no such reported sale of the Common Stock shall have occurred on such date, on the last day prior to such date on which there was such a reported sale;

(c) if the Common Stock is not listed for trading on the NASDAQ or the NYSE but is listed for trading on another national securities exchange, the closing sale price of a share of Common Stock on such date as reported on such exchange, or if no such reported sale of the Common Stock shall have occurred on such date, on the last day prior to such date on which there was such a reported sale;

(d) if the Common Stock is not listed for trading on a national securities exchange but nevertheless is publicly traded and reported (through the OTC Bulletin Board or otherwise), the closing sale price of a share of Common Stock on such date, or if no such reported sale of the Common Stock shall have occurred on such date, on the last day prior to such date on which there was such a reported sale; or

(e) if the Common Stock is not publicly traded and reported, the fair market value as established in good faith by the Committee or the Board.

For purposes of subsection (c) above, if the Common Stock is not traded on the NASDAQ or the NYSE but is traded on more than one other securities exchange on the given date, then the largest exchange on which the Common Stock is traded shall be referenced to determine Fair Market Value.

Notwithstanding the foregoing but subject to the next paragraph, if the Committee determines in its discretion that an alternative definition of Fair Market Value should be used in connection with the grant, exercise, vesting, settlement or payout of any Award, it may specify such alternative definition in the Agreement applicable to the Award. Such alternative definition may include a price that is based on the opening, actual, high, low, or average selling prices of a share of Common Stock on the NASDAQ or other securities exchange on the given date, the trading date preceding the given date, the trading date next succeeding the given date, or an average of trading days.

Notwithstanding the foregoing, (i) in the case of an Option or SAR, Fair Market Value shall be determined in accordance with a definition of fair market value that permits the Award to be exempt from Code Section 409A; and (ii) in the case of an Option that is intended to

qualify as an ISO under Code Section 422, Fair Market Value shall be determined by the Committee in accordance with the requirements of Code Section 422.

“HOLDINGS” means PROG Holdings, Inc. (formerly known as Aaron’s Holdings Company, Inc.), a Georgia corporation.

“INCENTIVE STOCK OPTION” or “ISO” means an Option that is designated as an “incentive stock option” and intended to meet the requirements of Code Section 422.

“INSIDER” shall mean an individual who is, on the relevant date, subject to the reporting requirements of Exchange Act Section 16(a).

“NASDAQ” means The NASDAQ Stock Market LLC or its successor.

“NON-EMPLOYEE” means any consultant or advisor, other than an Employee or Non-Employee Director, who is a natural person that provides bona fide services to the Employer that are not in connection with the offer or sale of securities in a capital raising transaction and do not directly or indirectly promote or maintain a market for the Company’s securities.

“NON-EMPLOYEE DIRECTOR” means any individual who is a member of the Board and who is not also employed by the Employer.

“NONQUALIFIED STOCK OPTION” or “NQSO” means any Option that is not designated as an “incentive stock option” or that otherwise does not meet the requirements of Code Section 422.

“NYSE” means the New York Stock Exchange or its successor.

“OPTION” means an Award granted under Article 5 that is either an Incentive Stock Option or a Nonqualified Stock Option. An Option shall be designated as either an Incentive Stock Option or a Nonqualified Stock Option, and in the absence of such designation, shall be treated as a Nonqualified Stock Option.

“OPTION EXERCISE PRICE” means the price at which a share of Common Stock may be purchased by a Participant pursuant to the exercise of an Option.

“OTHER AWARD” means any form of equity-based or equity-related award, other than an Option, a Stock Appreciation Right, Restricted Stock, a Restricted Stock Unit, a Performance Share, a Performance Unit or an Annual Incentive Award, that is granted pursuant to Article 9.

“PARTICIPANT” means (i) an Employee, Non-Employee or Non-Employee Director who is selected by the Committee to receive (or who has received) an Award under this Plan and (ii) each person who, as of the Spin-Off, has an outstanding Assumed Spin-Off Award.

“PERFORMANCE PERIOD” shall have the meaning ascribed to such term in Section 8.3.

“PERFORMANCE SHARE” means an Award under Article 8 of the Plan that is valued by reference to a share of Common Stock, which value may be paid to the Participant by delivery of Common Stock, cash or other property as the Committee shall determine upon achievement of such performance objectives during the relevant Performance Period as the Committee shall establish at the time of such Award or thereafter.

“PERFORMANCE UNIT” means an Award under Article 8 of the Plan that has a value set by the Committee (or that is determined by reference to a valuation formula specified by the Committee), which value may be paid to the Participant by delivery of Common Stock, cash or other property as the Committee shall determine upon achievement of such performance objectives during the relevant Performance Period as the Committee shall establish at the time of such Award or thereafter.

“PERMITTED TRANSFEREE” means any members of the immediate family of the Participant (i.e., spouse, children, and grandchildren), any trusts for the benefit of such family members or any partnerships whose only partners are such family members.

“PERSON” means any “person” or “group” as those terms are used in Exchange Act Sections 13(d) and 14(d).

“PLAN” means The Aaron’s Company, Inc. Amended and Restated 2020 Equity and Incentive Plan (Amended and Restated Effective May 15, 2024) set forth in this document and as it may be amended from time to time.

“RESTRICTED STOCK” means an Award of shares of Common Stock under Article 7 of the Plan, which shares are issued with such restrictions as the Committee, in its sole discretion, may impose.

“RESTRICTED STOCK UNIT” or “RSU” means an Award under Article 7 of the Plan that is valued by reference to a share of Common Stock, which value may be paid to the Participant by delivery of Common Stock, cash or other property as the Committee shall determine and that has such restrictions as the Committee, in its sole discretion, may impose.

“RESTRICTION PERIOD” means the period commencing on the date an Award of Restricted Stock or an RSU is granted and ending on such date as the Committee shall determine, during which time the Award is subject to forfeiture as provided in the Agreement.

“SHARE POOL” shall have the meaning ascribed to such term in in Section 4.1.

“SPIN-OFF” means the distribution of shares of Common Stock to the shareholders of Holdings, pursuant to the Separation and Distribution Agreement between the Company and Holdings, entered into in connection with such distribution.

“STOCK APPRECIATION RIGHT” or “SAR” means an Award granted under Article 6 that provides for delivery of cash or other property as the Committee shall determine with a

value equal to the excess of the Fair Market Value of a share of Common Stock on the day the Stock Appreciation Right is exercised over the specified exercise price.

“SUBSIDIARY” means a corporation or other entity of which outstanding shares or ownership interests representing fifty percent (50%) or more of the combined voting power of such corporation or other entity entitled to elect the management thereof are owned directly or indirectly by the Company. With respect to all purposes of the Plan, including but not limited to, the establishment, amendment, termination, operation and administration of the Plan, the Company and the Committee shall be authorized to act on behalf of all other entities included within the definition of “Subsidiary.”

Article 3. ADMINISTRATION; POWERS OF THE COMMITTEE

3.1General. This Plan shall be administered by the Committee.

3.2Authority of the Committee.

a.Subject to the provisions of the Plan, the Committee shall have the full and discretionary authority to (i) select the Employees, Non-Employees and Non-Employee Directors who are eligible to receive Awards under the Plan, (ii) determine the form and substance of Awards made under the Plan and the conditions and restrictions, if any, subject to which such Awards will be made, (iii) modify the terms of Awards made under the Plan, (iv) interpret, construe and administer the Plan and Awards granted thereunder, (v) make any adjustments necessary or desirable in connection with Awards made under the Plan to eligible Participants located outside the United States, and (vi) adopt, amend, or rescind such rules and regulations, and make such other determinations, for carrying out the Plan as it may deem appropriate.

b.The Committee may correct any defect, supply any omission or reconcile any inconsistency in the Plan or any Agreement in the manner and to the extent it shall deem desirable to carry it into effect.

c.Decisions of the Committee on all matters relating to the Plan shall be in the Committee’s sole discretion and shall be conclusive, final and binding on all parties. The validity, construction, and effect of the Plan and any rules and regulations relating to the Plan shall be determined in accordance with applicable federal and state laws and rules and regulations promulgated pursuant thereto.

d.In the event the Company shall assume outstanding equity awards or the right or obligation to make such awards in connection with the acquisition of another corporation or business entity, the Committee may, in its discretion, make such adjustments in the terms of Awards as it shall deem equitable and appropriate to prevent dilution or enlargement of benefits intended to be made under the Plan.

e.In making any determination or in taking or not taking any action under the Plan, the Committee may obtain and may rely on the advice of experts, including but not limited to employees of the Company and professional advisors.

3.3Rules for Foreign Jurisdictions. Notwithstanding anything in the Plan to the contrary, the Committee may, in its sole discretion, but subject to shareholder approval to the extent required by Code Section 422, other applicable law, or any listing standards applicable to the Common Stock, (i) amend or vary the terms of the Plan in order to conform such terms with the requirements of each non-U.S. jurisdiction where a Participant works or resides or to meet the goals and objectives of the Plan; (ii) establish one or more sub-plans for these purposes; and (iii) establish administrative rules and procedures to facilitate the operation of the Plan in such non-U.S. jurisdictions. For purposes of clarity, the terms and conditions contained herein that are subject to variation in a non-U.S. jurisdiction shall be reflected in a written addendum to the Plan with respect to each Participant or group of Participants affected by such non-U.S. jurisdiction.

3.4Delegation of Authority. The Committee may, in its discretion, at any time and from time to time, delegate to one or more of its members such of its authority as it deems appropriate (provided that any such delegation shall be to at least two members of the Committee with respect to Awards to Insiders). The Committee may, at any time and from time to time, delegate to one or more other members of the Board such of its authority as it deems appropriate. To the extent permitted by law and applicable stock exchange rules, the Committee may also delegate its authority to one or more persons who are not members of the Board, except that no such delegation will be permitted with respect to Awards to Insiders.

3.5Agreements. Each Award granted under the Plan shall be evidenced by an Agreement. Each Agreement shall be subject to and incorporate, by reference or otherwise, the applicable terms and conditions of the Plan, and any other terms and conditions, not inconsistent with the Plan, as may be imposed by the Committee, including without limitation, provisions related to the consequences of termination of employment. Each Agreement shall specify the period over which the Award will vest or with respect to which any risk of substantial forfeiture will lapse. A copy of the Agreement shall be made available to the Participant, and the Committee may, but need not, require that the Participant sign (or otherwise acknowledge receipt of) a copy of the Agreement or a copy of a notice of grant. Each Participant may be required, as a condition to receiving an Award under this Plan, to enter into an agreement with the Company containing such non-compete, confidentiality, and/or non-solicitation provisions as the Committee may adopt and approve from time to time (as so modified or amended, the “Non-Compete Agreement”). The provisions of the Non-Compete Agreement may also be included in, or incorporated by reference in, the Agreement.

3.6Indemnification. No member or former member of the Committee or the Board or person to whom the Committee has delegated responsibility under the Plan shall be liable for any action or determination made in good faith with respect to the Plan or any Award granted under it. The Company shall indemnify and hold harmless each member and former member of the Committee and the Board against all cost or expense (including counsel fees and expenses) or liability (including any sum paid in settlement of a claim with the approval of the Board) arising

out of any act or omission to act in connection with the Plan, unless arising out of such member’s or former member’s own willful misconduct, fraud, bad faith or as expressly prohibited by statute. Such indemnification shall be in addition (without duplication) to any rights to indemnification or insurance the member or former member may have as a director or under the by-laws of the Company or otherwise.

Article 4. SHARES AVAILABLE UNDER THE PLAN

4.1Number of Shares. Subject to adjustment as provided in this Section 4.1 and in Section 4.3, the aggregate number of shares of Common Stock that are available for issuance pursuant to Awards granted under the Plan is 8,302,000 shares of Common Stock (the “Share Pool”) (consisting of 3,300,000 shares that were approved by the Company’s sole shareholder in 2020, plus 3,475,000 shares that were approved by the Company’s shareholders in 2021, plus 1,527,000 shares to be approved by the Company’s shareholders in 2024), which includes shares of Common Stock subject to all Assumed Spin-Off Awards. All of the Share Pool may, but is not required to, be issued pursuant to Incentive Stock Options. If Awards are granted in substitution or assumption of awards of an entity acquired, by merger or otherwise, by the Company (or any Subsidiary), to the extent such grant shall not be inconsistent with the terms, limitations and conditions of Code Section 422, Exchange Act Rule 16b-3 or applicable NASDAQ or NYSE rules, the number of shares subject to such substitute or assumed Awards shall not increase or decrease the Share Pool (the awards described in this sentence, “Substitute Awards”).

The shares issued pursuant to Awards under the Plan shall be made available from shares currently authorized but unissued or shares currently held (or subsequently acquired) by the Company as treasury shares, including shares purchased in the open market or in private transactions.

The following rules shall apply for purposes of the determination of the number of shares of Common Stock available for grants of Awards under the Plan:

a.Each share subject to an Option shall be counted as one share subject to an Award and deducted from the Share Pool.

b.Each share of Restricted Stock, each Restricted Stock Unit that may be settled in shares of Common Stock, and each share subject to an Other Award that may be settled in shares of Common Stock shall be counted as one share subject to an Award and deducted from the Share Pool. Restricted Stock Units and Other Awards that may not be settled in shares of Common Stock shall not result in a deduction from the Share Pool.

c.Each Performance Share that may be settled in shares of Common Stock shall be counted as one share subject to an Award, based on the number of shares that would be paid under the Performance Share for achievement of target performance, and deducted from the Share Pool. Each Annual Incentive Award and each Performance Unit that may be settled in shares of Common Stock shall be counted as a number of shares subject to an Award, based on the number of shares that would be paid under the Annual Incentive Award or Performance Unit for achievement of target performance, with the

number determined by dividing the value of the Annual Incentive Award or Performance Unit at the time of grant by the Fair Market Value of a share of Common Stock at the time of grant, and this number shall be deducted from the Share Pool. In the event that the Award (of Performance Shares, Performance Units or an Annual Incentive Award) is later settled for a greater number of shares than the number previously deducted from the Share Pool for such Award, such additional number of shares of Common Stock actually settled in respect of such Award shall be deducted from the Share Pool at the time of such settlement; in the event that the Award is later settled for a lesser number of shares than the number previously deducted from the Share Pool for such Award, the difference between the number of shares of Common Stock actually settled in respect of such Award and the number previously deducted from the Share Pool shall be added back to the Share Pool. Annual Incentive Awards, Performance Shares and Performance Units that may not be settled in shares of Common Stock shall not result in a deduction from the Share Pool.

d.Each share subject to a Stock Appreciation Right that may be settled in shares of Common Stock shall be counted as one share subject to an Award and deducted from the Share Pool. Stock Appreciation Rights that may not be settled in shares of Common Stock shall not result in a reduction from the Share Pool.

e.If, for any reason, any shares subject to an Award under the Plan are not issued or are returned to the Company, for reasons including, but not limited to, a forfeiture of Restricted Stock or a Restricted Stock Unit, or the termination, expiration or cancellation of an Option, Stock Appreciation Right, Restricted Stock, Restricted Stock Unit, Performance Share, Performance Unit, or Other Award, or settlement of any Award in cash rather than shares, such shares shall again be available for Awards under the Plan and, if originally deducted from the Share Pool, shall be added back to the Share Pool.

f.Notwithstanding anything to contrary contained herein, if the Option Exercise Price, purchase price and/or tax withholding obligation under an Award is satisfied by the Company retaining shares or by the Participant tendering or otherwise using shares (either by actual delivery or attestation), the number of shares so retained, tendered or otherwise used shall be deemed delivered for purposes of determining the Share Pool and shall not be available for further Awards under the Plan. To the extent an SAR that may be settled in shares of Common Stock is, in fact, settled in shares of Common Stock, the gross number of shares subject to such Stock Appreciation Right shall be deemed delivered for purposes of determining the Share Pool and shall not be available for further Awards under the Plan. Shares reacquired by the Company on the open market or otherwise using cash proceeds from the exercise of Options shall not be added back to the Share Pool.

4.2Option and SAR Limit. Subject to adjustment as provided in Section 4.3, the maximum number of Options and Stock Appreciation Rights that, in the aggregate, may be granted in any one fiscal year of the Company to any one Participant shall be one million (1,000,000); provided, however, that such limit shall not apply to Assumed Spin-Off Awards.

The share counting rules specified in subsections (a) through (f) of Section 4.1 shall not apply for purposes of applying the foregoing individual limitation of this Section 4.2.

4.3Adjustment of Shares. If any change in corporate capitalization, such as a stock split, reverse stock split, stock dividend, or any corporate transaction such as a reorganization, reclassification, merger or consolidation or separation, including a spin-off, of the Company or sale or other disposition by the Company of all or a portion of its assets, any other change in the Company’s corporate structure, or any distribution to shareholders (other than an ordinary cash dividend) results in the outstanding shares of Common Stock, or any securities exchanged therefor or received in their place, being exchanged for a different number or class of shares or other securities of the Company, or for shares of stock or other securities of any other corporation (or new, different or additional shares or other securities of the Company or of any other corporation being received by the holders of outstanding shares of Common Stock), or a material change in the value of the outstanding shares of Common Stock as a result of the change, transaction or distribution, then the Committee shall make adjustments, as it determines are equitably required to prevent the enlargement or dilution of benefits intended to be made available under the Plan, in:

a.the number and class of stock or other securities that comprise the Share Pool as set forth in Section 4.1, including, without limitation, with respect to Incentive Stock Options;

b.the limitations on the aggregate number of shares of Common Stock that may be awarded to any one Participant under Options and SARs as set forth in Section 4.2;

c.the number and class of stock or other securities subject to outstanding Awards, and which have not been issued or transferred under an outstanding Award;

d.the Option Exercise Price under outstanding Options, the exercise price under outstanding Stock Appreciation Rights, and the number of shares of Common Stock to be transferred in settlement of outstanding Awards; and

e.the terms, conditions or restrictions of any Award and Agreement, including but not limited to the price payable for the acquisition of shares of Common Stock.

It is intended that, if possible, any adjustment contemplated above shall be made in a manner that satisfies applicable legal requirements as well as applicable requirements with respect to taxation (including, without limitation and as applicable in the circumstances, Code Section 424, and Code Section 409A) and accounting (so as to not trigger any charge to earnings with respect to such adjustment).

Without limiting the generality of the above, any good faith determination by the Committee as to whether an adjustment is required in the circumstances and the extent and nature of any such adjustment shall be final, conclusive and binding on all persons.

4.4Minimum Vesting Requirement. Notwithstanding any other provision of this Plan (outside of this Section 4.4) to the contrary, Awards granted under this Plan (other than cash-based awards) shall vest no earlier than the first anniversary of the applicable grant date; provided, however, that the following Awards shall not be subject to the foregoing minimum vesting requirement: any (a) Substitute Awards; (b) Common Stock delivered in lieu of fully vested cash obligations; and (c) additional Awards the Committee may grant, up to a maximum of five percent (5%) of the available share reserve authorized for issuance under the Plan pursuant to Section 4.1 (subject to adjustment under Section 4.3). Nothing in this Section 4.4 or otherwise in this Plan, however, shall preclude the Committee, in is sole discretion, from providing for continued vesting or accelerated vesting for any Award under this Plan upon certain events, including in connection with or following a Participant’s death, disability, or termination of service or a Change in Control.

4.5Non-Employee Director Compensation Limit. Notwithstanding anything to the contrary contained in this Plan, in no event shall the aggregate dollar value of any form of cash compensation (including retainer fees) and/or grants of RSUs or other types of equity awards made under this Plan or otherwise, earned by any Non-Employee Director in any fiscal year of the Company exceed $750,000. Reimbursement of expenses incurred by Non-Employee Directors in connection with carrying out their duties as a Non-Employee Director of the Company shall not be included in the determination of whether the compensation earned by any Non-Employee Director exceeds the aforementioned limit on Non-Employee Director compensation.

Article 5. STOCK OPTIONS

5.1Grant of Options. Subject to the terms and provisions of the Plan, the Committee may from time to time grant Options to eligible Participants. The Committee shall have sole discretion in determining the number of shares subject to Options granted to each Participant. The Committee may grant a Participant ISOs, NQSOs or a combination thereof, and may vary such Awards among Participants; provided that the Committee may grant Incentive Stock Options only to individuals who are employees (within the meaning of Code Section 3401(c)) of the Company or its subsidiaries (as defined for this purpose in Code Section 424(f)). Notwithstanding anything in this Article 5 to the contrary, except for Options that are specifically designated as intended to be subject to Code Section 409A, the Committee may only grant Options to individuals who provide direct services on the date of grant of the Options to the Company or another entity in a chain of entities in which the Company or another such entity has a controlling interest (within the meaning of Treasury Regulation section 1.409A-1(b)(5)(iii)(e)) in each entity in the chain.

5.2Agreement. Each Option grant shall be evidenced by an Agreement that shall specify the Option Exercise Price, the duration of the Option, the number of shares of Common Stock to which the Option pertains, the conditions upon which the Option shall become vested and exercisable and such other provisions as the Committee shall determine. The Option Agreement shall further specify whether the Award is intended to be an ISO or an NQSO. Any portion of an Option that is not designated in the Agreement as an ISO or otherwise fails or is not

qualified as an ISO (even if designated as an ISO) shall be an NQSO. Neither dividends nor dividend equivalents shall be paid with respect to Options.

5.3Option Exercise Price. The per share Option Exercise Price for each Option shall not be less than one hundred percent (100%) of the Fair Market Value of a share of Common Stock on the date the Option is granted (except with respect to Assumed Spin-Off Awards). Notwithstanding the foregoing, an Option may be granted with an Option Exercise Price lower than set forth in the preceding sentence if such Option is granted pursuant to an assumption or substitution for another Option in a manner satisfying the provisions of Code Section 424(a) relating to a corporate merger, consolidation, acquisition of property or stock, separation, reorganization, spin off, or liquidation; provided that the Committee determines that such Option Exercise Price is appropriate to preserve the economic benefit of the replaced award and will not impair the exemption of the Option from Code Section 409A (unless the Committee clearly and expressly foregoes such exemption at the time the Option is granted).

5.4Duration of Options. Each Option shall expire at such time as the Committee shall determine at the time of grant; provided, however, that no Option shall be exercisable later than the tenth (10th) anniversary of its grant date. If an Agreement does not specify an expiration date, the Option’s expiration date shall be the tenth (10th) anniversary of its grant date.

5.5Exercise of Options. Options shall be exercisable at such times and be subject to such restrictions and conditions as the Committee shall specify, including conditions related to the employment of the Participant with the Employer or provision of services by the Participant to the Employer, which need not be the same for each grant or for each Participant. The Committee may provide in the Agreement for automatic exercise on a certain date and/or for accelerated or continued vesting and other rights upon the occurrence of events specified in the Agreement.

5.6Payment. Options shall be exercised, in whole or in part, by the delivery of a written or electronic notice of exercise to the Company or its designated representative in the form prescribed by the Company, setting forth the number of shares of Common Stock with respect to which the Option is to be exercised and satisfying any requirements that the Committee may apply from time to time. Full payment of the Option Exercise Price for such shares (less any amount previously paid by the Participant to acquire the Option) must be made on or prior to the Payment Date, as defined below. The Option Exercise Price shall be paid to the Company in United States dollars either: (a) in cash, (b) by check, bank draft, money order or other cash equivalent approved by the Committee, (c) unless not permitted by the Committee, by tendering previously acquired shares of Common Stock (or delivering a certification or attestation of ownership of such shares) having an aggregate Fair Market Value at the time of exercise equal to the total Option Exercise Price (provided that the tendered shares must have been held by the Participant for any period required by the Committee), (d) unless not permitted by the Committee, by cashless exercise as permitted under Federal Reserve Board’s Regulation T, subject to applicable securities law restrictions, (e) by any other means which the Committee determines to be consistent with the Plan’s purpose and applicable law, including a net exercise; or (f) by a combination of the foregoing. “Payment Date” shall mean the date on which a sale

transaction in connection with a cashless exercise (whether or not payment is actually made pursuant to a cashless exercise) would have settled in connection with the Option exercise. No certificate or cash representing a share of Common Stock shall be delivered until the full Option Exercise Price has been paid.

5.7Special Rules for ISOs. The following rules apply notwithstanding any other terms of the Plan.

a.No ISOs may be granted under the Plan after the tenth (10th) anniversary of the date the Plan was approved by the Board.

b.In no event shall any Participant who owns (within the meaning of Code Section 424(d)) stock of the Company possessing more than ten percent (10%) of the total combined voting power of all classes of stock of the Company or any “parent” or “subsidiary” (within the meaning of Code Section 424(e) or (f), respectively) be eligible to receive an ISO (i) at an Option Exercise Price less than one hundred ten percent (110%) of the Fair Market Value of a share of Common Stock on the date the ISO is granted, or (ii) that is exercisable later than the fifth (5th) anniversary date of its grant date.

c.The aggregate Fair Market Value of shares of Common Stock with respect to which ISOs (within the meaning of Code Section 422) granted to a Participant are first exercisable in any calendar year under the Plan and all other incentive stock option plans of the Employer shall not exceed One Hundred Thousand Dollars ($100,000). For this purpose, Fair Market Value shall be determined with respect to a particular ISO on the date on which such ISO is granted. In the event that this One Hundred Thousand Dollar ($100,000) limit is exceeded with respect to a Participant, then ISOs granted under this Plan to such Participant shall, to the extent and in the order required by Treasury Regulations under Code Section 422, automatically become NQSOs granted under this Plan.

d.Solely for purposes of determining the limit on ISOs that may be granted under the Plan, the provisions of Section 4.1 that replenish the Share Pool shall only be applied to the extent permitted by Code Section 422 and the regulations promulgated thereunder.

Article 6. STOCK APPRECIATION RIGHTS

6.1Grant of SARs. Subject to the terms and provisions of the Plan, the Committee may grant SARs to Participants in such amounts and upon such terms, and at any time and from time to time, as the Committee shall determine. A Stock Appreciation Right shall entitle the holder, within a specified period (which may not exceed 10 years), to exercise the SAR and receive in exchange therefor a payment having an aggregate value equal to the amount by which the Fair Market Value of a share of Common Stock on the exercise date exceeds the specified exercise price, times the number of shares with respect to which the SAR is exercised. The Committee may provide in the Agreement for automatic exercise on a certain date, for payment

of the proceeds on a certain date, and/or for accelerated or continued vesting and other rights upon the occurrence of events specified in the Agreement. Notwithstanding anything in this Article 6 to the contrary, except for SARs that are specifically designated as intended to be subject to Code Section 409A, the Committee may only grant SARs to individuals who provide direct services on the date of grant of the SARs to the Company or another entity in a chain of entities in which the Company or another such entity has a controlling interest (within the meaning of Treasury Regulation section 1.409A-l(b)(5)(iii)(e)) in each entity in the chain.

6.2Agreement. Each SAR grant shall be evidenced by an Agreement that shall specify the exercise price, the duration of the SAR, the number of shares of Common Stock to which the SAR pertains, the conditions upon which the SAR shall become vested and exercisable and such other provisions as the Committee shall determine. Neither dividends nor dividend equivalents shall be paid with respect to SARs.

6.3Duration of SARs. Each SAR shall expire at such time as the Committee shall determine at the time of grant; provided, however, that no SAR shall be exercisable later than the tenth (10th) anniversary of its grant date. If an Agreement does not specify an expiration date, the SAR’s expiration date shall be the tenth (10th) anniversary of its grant date.

6.4Payment. The Committee shall have sole discretion to determine in each Agreement whether the payment with respect to the exercise of a Stock Appreciation Right will be in the form of all cash, all shares of Common Stock, or any combination thereof. Unless and to the extent the Committee specifies otherwise, such payment will be in the form of shares of Common Stock. If payment is to be made in shares, the number of shares shall be determined based on the Fair Market Value of a share on the date of exercise. The Committee shall have sole discretion to determine and set forth in the Agreement the timing of any payment made in cash or shares, or a combination thereof, upon exercise of SARs.

6.5Exercise Price. The exercise price for each Stock Appreciation Right shall be determined by the Committee and shall not be less than one hundred percent (100%) of the Fair Market Value of a share of Common Stock on the date the SAR is granted. Notwithstanding the foregoing, an SAR may be granted with an exercise price lower than set forth in the preceding sentence if such SAR is granted pursuant to an assumption or substitution for another SAR in a manner satisfying the provisions of Code Section 424(a) relating to a corporate merger, consolidation, acquisition of property or stock, separation, reorganization, or liquidation; provided that the Committee determines that such SAR exercise price is appropriate to preserve the economic benefit of the replaced award and will not impair the exemption of the SAR from Code Section 409A (unless the Committee clearly and expressly foregoes such exemption at the time the SAR is granted).

6.6Exercise of SARs. SARs shall be exercisable at such times and be subject to such restrictions and conditions as the Committee shall specify, including conditions related to the employment of the Participant with the Employer or provision of services by the Participant to the Employer, which need not be the same for each grant or for each Participant. The Committee may provide in the Agreement for automatic accelerated or continued vesting and other rights upon the occurrence of events specified in the Agreement.

Article 7. RESTRICTED STOCK AND RESTRICTED STOCK UNITS

7.1Grant of Restricted Stock and Restricted Stock Units. Subject to provisions of the Plan, the Committee may from time to time grant Awards of Restricted Stock and RSUs to Participants. Awards of Restricted Stock and RSUs may be made either alone or in addition to or in tandem with other Awards granted under the Plan.

7.2Agreement. The Restricted Stock or RSU Agreement shall set forth the terms of the Award, as determined by the Committee, including, without limitation, the number of shares of Restricted Stock or the number of RSUs granted; the purchase price, if any, to be paid for such Restricted Stock or RSUs, which may be equal to or less than Fair Market Value of a share and may be zero, subject to such minimum consideration as may be required by applicable law; any restrictions applicable to the Restricted Stock or RSU such as continued service or achievement of performance objectives; the length of the Restriction Period, if any, and any circumstances that will shorten or terminate the Restriction Period; and rights of the Participant to vote Restricted Stock or receive dividends or dividend equivalents with respect to Restricted Stock or RSUs during the Restriction Period (subject to Section 7.4). The Restriction Period may be of any duration and the Agreement may provide for lapse of the Restriction Period in installments over the course of the Restriction Period, as determined by the Committee. The Committee shall have sole discretion to determine and specify in each RSU Agreement whether the RSUs will be settled in the form of all cash, all shares of Common Stock, or any combination thereof. Unless and to the extent the Committee specifies otherwise, such settlement will be in the form of shares of Common Stock.

7.3Certificates. Upon an Award of Restricted Stock to a Participant, shares of restricted Common Stock shall be registered in the Participant’s name. Certificates, if issued, may either (i) be held in custody by the Company until the Restriction Period expires or until restrictions thereon otherwise lapse, and/or (ii) be issued to the Participant and registered in the name of the Participant, bearing an appropriate restrictive legend and remaining subject to appropriate stop-transfer orders. If required by the Committee, the Participant shall deliver to the Company one or more stock powers endorsed in blank relating to the Restricted Stock. Upon settlement of an RSU in shares, and, with respect to Restricted Stock, if and when the Restriction Period expires without a prior forfeiture of the Restricted Stock subject to such Restriction Period, unrestricted certificates for such shares shall be delivered to the Participant or registered in the Participant’s name on the Company’s or transfer agent’s records; provided, however, that the Committee may cause such legend or legends to be placed on any such certificates as it may deem advisable under the terms of the Plan and the rules, regulations and other requirements of the Securities and Exchange Commission and any applicable federal or state law. Concurrently with the settlement of RSUs by the delivery of shares and with the lapse of any risk of forfeiture applicable to the Restricted Stock, the Participant shall be required to satisfy any applicable federal, state and local tax requirements as set out in Article 16 below.

7.4Dividends and Other Distributions. Except as provided in this Article 7 or in the applicable Agreement, a Participant who receives a Restricted Stock Award shall have (during and after the Restriction Period), with respect to such Restricted Stock Award, all of the rights of

a shareholder of the Company, including the right to vote the shares and the right to receive dividends and other distributions to the extent, if any, such shares possess such rights; provided, however, that any dividends or distributions on such shares of Restricted Stock (during the Restriction Period) shall either be automatically deferred and reinvested in additional Restricted Stock subject to the same restrictions as the underlying Award or be paid to the Company for the account of the Participant and held pending and subject to the same restrictions on vesting as the underlying Award, as set forth in the applicable Agreement; provided that, for the avoidance, doubt, payment with respect to any such amounts will not occur until, and will be contingent upon, the vesting of the Restricted Stock to which they relate. The Committee shall determine whether interest shall be paid on such amounts, the rate of any such interest, and the other terms applicable to such amounts (provided that all such terms shall, to the extent required, comply with Code Section 409A). A Participant receiving a Restricted Stock Unit Award shall not possess voting rights and shall accrue dividend equivalents on such Restricted Stock Units only to the extent provided in the Agreement relating to the Award; provided, however, that rights to dividend equivalents shall only be allowed to the extent they comply with, or are exempt from, Code Section 409A. Dividend equivalents on RSUs shall be subject to the same restrictions on vesting and payment as the underlying Award.

Article 8. PERFORMANCE SHARES AND UNITS

8.1Grant of Performance Shares and Performance Units. The Committee may grant Performance Shares and Performance Units to Participants in such amounts and upon such terms, and at any time and from time to time, as the Committee shall determine.

8.2Agreement. The Performance Share or Performance Unit Agreement shall set forth the terms of the Award, as determined by the Committee, including, without limitation, the number of Performance Shares or Performance Units granted; the purchase price, if any, to be paid for such Performance Shares or Performance Units, which may be equal to or less than Fair Market Value of a share and may be zero, subject to such minimum consideration as may be required by applicable law; the performance objectives applicable to the Performance Shares or Performance Units; and any additional restrictions applicable to the Performance Shares or Performance Units such as continued service. The Committee shall have sole discretion to determine and specify in each Performance Shares or Performance Units Agreement whether the Award will be settled in the form of all cash, all shares of Common Stock, or any combination thereof. Unless and to the extent the Committee specifics otherwise, such settlement will be in the form of shares of Common Stock. Any such shares may be granted subject to any restrictions deemed appropriate by the Committee.

8.3Value of Performance Shares and Performance Units. Each Performance Unit shall have an initial value that is established by the Committee at the time of grant. Each Performance Share shall have an initial value equal to the Fair Market Value of a share of Common Stock on the date of grant. In addition to any non-performance terms applicable to the Award, the Committee shall set performance objectives in its discretion which, depending on the extent to which they are met, will determine the number and/or value of Performance Shares, Performance Units or both, as applicable, that will be paid out to the Participant. For purposes of

this Article 8, the time period during which the performance objectives must be met shall be called a “Performance Period.”

8.4Earning of Performance Shares and Performance Units. Subject to the terms of this Plan, after the applicable Performance Period has ended, the holder of the Performance Shares or Performance Units shall be entitled to receive a payout of the number and value of Performance Shares or Performance Units, as applicable, earned by the Participant over the Performance Period, if any, to be determined as a function of the extent to which the corresponding performance objectives have been achieved and any applicable nonperformance terms have been met.

8.5Dividends and Other Distributions. A Participant receiving Performance Shares or Performance Units shall not possess voting rights. A Participant receiving Performance Shares or Performance Units or any other Award that is subject to performance conditions shall accrue dividend equivalents on such Award only to the extent provided in the Agreement relating to the Award; provided, however, that rights to dividend equivalents shall only be allowed to the extent they comply with, or are exempt from, Code Section 409A. Any rights to dividends or dividend equivalents on Performance Shares or Performance Units or any other Award subject to performance conditions shall be subject to the same restrictions on vesting and payment as the underlying Award.

Article 9. OTHER AWARDS

The Committee shall have the authority to specify the terms and provisions of other forms of equity-based or equity-related awards to Participants not described in Articles 5 through 8 or Article 10 of this Plan that the Committee determines to be consistent with the purpose of the Plan and the interests of the Company (“Other Awards”). Subject to Section 4.4, Other Awards may include awards of, or the right to acquire, shares of Common Stock that are not subject to forfeiture or other restrictions, which may be awarded in payment of Non-Employee Director fees, in lieu of cash compensation, in exchange for cancellation of a compensation right, as a bonus, or upon the attainment of a performance goal, or otherwise. Other Awards may also provide for cash payments based in whole or in part on the value or future value of shares of Common Stock, for the acquisition or future acquisition of shares of Common Stock, or any combination of the foregoing. Notwithstanding the foregoing, where the value of an Other Award is based on the difference in the value of a share of Common Stock at different points in time, the grant or exercise price shall not be less than one hundred percent (100%) of the Fair Market Value of a share of Common Stock on the date of grant unless the Other Award is granted in replacement for an award previously granted by an entity that is assumed by the Company in a business combination, provided that the Committee determines that the Other Award preserves the economic benefit of the replaced award and is either exempt from or in compliance with the requirements of Code Section 409A. The Committee may authorize the payment of dividends or dividend equivalents on Other Awards on a deferred and contingent basis, either in cash or in additional Common Stock; provided, however, that dividend equivalents or other distributions on Common Stock underlying Other Awards shall be deferred until, and paid contingent upon, the earning and vesting of such Other Awards.

Article 10. ANNUAL INCENTIVE AWARDS

The Committee may grant Annual Incentive Awards to Participants in such amounts and upon such terms as the Committee shall determine. The Committee may specify the terms and conditions of Annual Incentive Awards in individual Agreements or through the timely adoption of plan rules or other Annual Incentive Award plan documentation. Unless provided otherwise at the time of grant, Annual Incentive Awards shall have a Performance Period of one fiscal year except that, if any Annual Incentive Award is made at the time of the Participant’s commencement of employment with the Employer or on the occasion of a promotion, then the Performance Period may be less than one fiscal year. Unless provided otherwise at the time of grant, Annual Incentive Awards (i) shall be payable in cash, and (ii) are intended to be exempt from Code Section 409A as short-term deferrals, and, thus, will be payable no later than 2½ months after the end of the Company’s fiscal year to which the Award relates.

Article 11. PERFORMANCE MEASURES

11.1In General. The Committee may, in its discretion, include performance objectives in any Award. The performance objectives may include, but are not limited to, levels of, or growth or changes in, or other objective specification of performance with respect to one or more of the following performance criteria: earnings, earnings before income taxes; earnings before interest and taxes (EBIT); earnings before interest, taxes, depreciation and amortization (EBITDA); earnings before interest, taxes, depreciation, amortization and rent (EBITDAR); gross margin; operating margin; profit margin; market value added; market share; revenue; revenue growth; return measures (including but not limited to return on equity, return on shareholders’ equity, return on investment, return on assets, return on net assets, return on capital, return on sales, and return on invested capital); total shareholder return (either in absolute terms or relative to that of a peer group determined by the Committee); profit; economic profit; capitalized economic profit; operating profit; after-tax profit; net operating profit after tax (NOPAT); pre-tax profit; cash; cash flow measures (including but not limited to operating cash flow; free cash flow; cash flow return; cash flow per share; and free cash flow per share); earnings per share (EPS); consolidated pre-tax earnings; net earnings; operating earnings; segment income; economic value added; net income; net income from continuing operations available to common shareholders excluding special items; operating income; adjusted operating income; assets; sales; net sales; sales volume; sales growth; net sales growth; comparable store sales; sales per square foot; inventory turnover; inventory turnover ratio; productivity ratios; number of active stores/sites (including but not limited to Company-owned stores, franchised stores, and/or retail or merchant stores at which the Company has entered into lease-to-own arrangements during a specified time period); number of customers; invoice volume; debt/capital ratio; return on total capital; cost; unit cost; cost control; expense targets or ratios, charge off levels; operating efficiency; operating expenses; customer satisfaction; improvement in or attainment of expense levels; working capital; working capital targets; improvement in or attainment of working capital levels; debt; debt to equity ratio; debt reduction; capital targets; capital expenditures; price/earnings growth ratio; acquisitions, dispositions, projects or other specific events, transactions or strategic milestones; the Company’s common stock price (and

stock price appreciation, either in absolute terms or in relationship to the appreciation among members of a peer group determined by the Committee); and book value per share.

All criteria may be measured on a Generally Accepted Accounting Principles (“GAAP”) basis, adjusted GAAP basis, or non-GAAP basis. The Committee may provide for a threshold level of performance below which no amount of compensation will be paid, and it may provide for the payment of differing amounts of compensation for different levels of performance. The performance objective for an Award may be described in terms of Company-wide objectives or objectives that are related to a specific division, subsidiary, Employer, department, region, or function in which the participant is employed or as some combination of these (as alternatives or otherwise). A performance objective may be measured on an absolute basis or relative to a pre-established target, results for a previous year, the performance of other corporations, or a stock market or other index. If the Committee specifies more than one individual performance objective for a particular Award, the Committee shall also specify, in writing, whether one, all or some other number of such objectives must be attained.

The Committee may specify such other conditions and criteria as it chooses, and may specify that it can us its negative discretion to decrease the amount that would otherwise be payable under an Award based on the attainment or failure to attain such other conditions and criteria.

11.2Determinations of Performance. For each Award that has been made subject to a performance objective, within ninety (90) days following the end of each Performance Period, the Committee shall determine whether the performance objective for such Performance Period has been satisfied. When applicable, prior to paying out an Award, the Committee shall also determine whether any performance objective or other conditions or criteria specified to guide the exercise of its negative discretion were satisfied, and thereby make a final determination with respect to the Award. If a performance objective applicable for a Performance Period is not achieved, the Committee in its sole discretion may pay all or a portion of that Award based on such criteria as the Committee deems appropriate, including without limitation individual performance, Company-wide performance or the performance of the specific division, subsidiary, Employer, department, region, or function employing the Participant.

11.3Adjustments and Exclusions. In determining whether any performance objective has been satisfied, the Committee may include or exclude the effect of any or all extraordinary items and/or other items that are unusual or non-recurring, including but not limited to (i) charges, costs, benefits, gains or income associated with reorganizations or restructurings of the Employer, discontinued operations, goodwill, other intangible assets, long-lived assets (non-cash), real estate strategy (e.g., costs related to lease terminations or facility closure obligations), litigation or the resolution of litigation (e.g., attorneys’ fees, settlements or judgments), or currency or commodity fluctuations; and (ii) the effects of changes in applicable laws, regulations or accounting principles. In addition, the Committee may adjust any performance objective for a Performance Period as it deems equitable to recognize unusual or non-recurring events affecting the Employer, changes in tax laws or regulations or accounting procedures, mergers, acquisitions and divestitures, or any other factors as the Committee may determine. To

the extent that a performance objective is based on the price of the Common Stock, then in the event of any stock dividend, stock split, combination of shares, recapitalization or other change in the capital structure of the Company, any merger, consolidation, spin-off, reorganization, partial or complete liquidation or other distribution of assets (other than a normal cash dividend), issuance of rights or warrants to purchase securities or any other corporate transaction having an effect similar to any of the foregoing, the Committee shall make or provide for such adjustments in such performance objective as the Committee in its sole discretion may in good faith determine to be equitably required in order to prevent dilution or enlargement of the rights of Participants.

Article 12. ASSUMED SPIN-OFF AWARDS

12.1Effective on the Spin-Off, the Company issued Assumed Spin-Off Awards under the Plan, as provided in the Employee Matters Agreement. Notwithstanding anything in this Plan to the contrary, each Assumed Spin-Off Award is subject to the terms and conditions of the equity compensation plan and award agreement to which such Assumed Spin-Off Award was subject immediately prior to the Spin-Off, subject to the adjustment of such Award by the Compensation Committee of Holdings and the terms of the Employee Matters Agreement, provided that following the date of the Spin-Off, each Assumed Spin-Off Award relates solely to shares of Common Stock and be administered by the Committee in accordance with the administrative procedures in effect under this Plan.

Article 13. CHANGE IN CONTROL