000082531312/312024Q3falsexbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pure00008253132024-01-012024-09-3000008253132024-09-3000008253132023-12-3100008253132024-07-012024-09-3000008253132023-07-012023-09-3000008253132023-01-012023-09-300000825313us-gaap:GeneralPartnerMember2024-06-300000825313us-gaap:GeneralPartnerMember2023-06-300000825313us-gaap:GeneralPartnerMember2023-12-310000825313us-gaap:GeneralPartnerMember2022-12-310000825313us-gaap:GeneralPartnerMember2024-07-012024-09-300000825313us-gaap:GeneralPartnerMember2023-07-012023-09-300000825313us-gaap:GeneralPartnerMember2024-01-012024-09-300000825313us-gaap:GeneralPartnerMember2023-01-012023-09-300000825313us-gaap:GeneralPartnerMember2024-09-300000825313us-gaap:GeneralPartnerMember2023-09-300000825313us-gaap:LimitedPartnerMember2024-06-300000825313us-gaap:LimitedPartnerMember2023-06-300000825313us-gaap:LimitedPartnerMember2023-12-310000825313us-gaap:LimitedPartnerMember2022-12-310000825313us-gaap:LimitedPartnerMember2024-07-012024-09-300000825313us-gaap:LimitedPartnerMember2023-07-012023-09-300000825313us-gaap:LimitedPartnerMember2024-01-012024-09-300000825313us-gaap:LimitedPartnerMember2023-01-012023-09-300000825313us-gaap:LimitedPartnerMember2024-09-300000825313us-gaap:LimitedPartnerMember2023-09-300000825313us-gaap:DeferredCompensationShareBasedPaymentsMember2024-06-300000825313us-gaap:DeferredCompensationShareBasedPaymentsMember2023-06-300000825313us-gaap:DeferredCompensationShareBasedPaymentsMember2023-12-310000825313us-gaap:DeferredCompensationShareBasedPaymentsMember2022-12-310000825313us-gaap:DeferredCompensationShareBasedPaymentsMember2024-07-012024-09-300000825313us-gaap:DeferredCompensationShareBasedPaymentsMember2023-07-012023-09-300000825313us-gaap:DeferredCompensationShareBasedPaymentsMember2024-01-012024-09-300000825313us-gaap:DeferredCompensationShareBasedPaymentsMember2023-01-012023-09-300000825313us-gaap:DeferredCompensationShareBasedPaymentsMember2024-09-300000825313us-gaap:DeferredCompensationShareBasedPaymentsMember2023-09-300000825313us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000825313us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000825313us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000825313us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000825313us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300000825313us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000825313us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-09-300000825313us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300000825313us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300000825313us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-3000008253132023-09-3000008253132022-12-310000825313ab:ABHoldingMemberab:EQHMember2024-01-012024-09-300000825313ab:ABHoldingMemberab:AllianceBernsteinCorporationMember2024-09-300000825313ab:ABHoldingMemberab:AllianceBernsteinCorporationMember2024-01-012024-09-300000825313ab:EQHAndItsSubsidiariesMemberab:AllianceBernsteinCorporationMember2024-01-012024-09-300000825313ab:UnaffiliatedHoldersMemberab:AllianceBernsteinCorporationMember2024-01-012024-09-300000825313ab:AllianceBernsteinL.P.Memberab:AllianceBernsteinCorporationMember2024-01-012024-09-300000825313ab:AllianceBernsteinL.P.Memberab:EQHAndItsSubsidiariesMember2024-01-012024-09-300000825313us-gaap:SubsequentEventMember2024-10-242024-10-240000825313ab:ABHoldingUnitsMemberab:EmployeesAndEligibleDirectorsMember2024-01-012024-09-300000825313ab:ABHoldingUnitsMemberab:EmployeesAndEligibleDirectorsMember2023-01-012023-09-300000825313us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-07-012024-09-300000825313us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-07-012023-09-300000825313us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2024-01-012024-09-300000825313us-gaap:VariableInterestEntityPrimaryBeneficiaryMember2023-01-012023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 10-Q

(Mark One)

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File No. 001-09818

ALLIANCEBERNSTEIN HOLDING L.P.

(Exact name of registrant as specified in its charter)

| | | | | |

| Delaware | 13-3434400 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

501 Commerce Street, Nashville, TN 37203

(Address of principal executive offices)

(Zip Code)

(615) 622-0000

(Registrant’s telephone number, including area code)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | |

Large accelerated filer | ☒ | Accelerated filer | ☐ |

| | | |

Non-accelerated filer | ☐ | Smaller reporting company | ☐ |

| | | |

| | Emerging growth company | ☐ |

| | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act):

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Units Rep. Assignments of Beneficial Ownership of LP Interests in AB Holding ("Units") | | AB | | New York Stock Exchange |

The number of units representing assignments of beneficial ownership of limited partnership interests outstanding as of September 30, 2024 was 113,435,357.*

*includes 100,000 units of general partnership interest having economic interests equivalent to the economic interests of the units representing assignments of beneficial ownership of limited partnership interests.

ALLIANCEBERNSTEIN HOLDING L.P.

Index to Form 10-Q

| | | | | | | | |

| | | Page |

| | | |

| | Part I | |

| | | |

| | FINANCIAL INFORMATION | |

| | | |

| Item 1. | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| | | |

| | Part II | |

| | | |

| | OTHER INFORMATION | |

| | | |

| Item 1. | | |

| | | |

| Item 1A. | | |

| | | |

| Item 2. | | |

| | | |

| Item 3. | | |

| | | |

| Item 4. | | |

| | | |

| Item 5. | | |

| | | |

| Item 6. | | |

| | | |

| |

Part I

FINANCIAL INFORMATION

Item 1. Financial Statements

ALLIANCEBERNSTEIN HOLDING L.P.

Condensed Statements of Financial Condition

(in thousands, except unit amounts)

(unaudited)

| | | | | | | | | | | |

| September 30,

2024 | | December 31,

2023 |

| ASSETS | | | |

| Investment in AB | $ | 2,098,703 | | | $ | 2,077,540 | |

| | | |

| Other assets | 147 | | | — | |

| Total assets | $ | 2,098,850 | | | $ | 2,077,540 | |

| | | |

| LIABILITIES AND PARTNERS’ CAPITAL | | | |

| Liabilities: | | | |

| | | |

| Other liabilities | $ | 719 | | | $ | 1,295 | |

| Total liabilities | 719 | | | 1,295 | |

| | | |

Commitments and contingencies (See Note 8) | | | |

| | | |

| Partners’ capital: | | | |

General Partner: 100,000 general partnership units issued and outstanding | 1,384 | | | 1,327 | |

Limited partners: 113,335,357 and 114,336,091 limited partnership units issued and outstanding | 2,165,060 | | | 2,147,147 | |

| AB Holding Units held by AB to fund long-term incentive compensation plans | (33,390) | | | (30,185) | |

| Accumulated other comprehensive (loss) | (34,923) | | | (42,044) | |

| Total partners’ capital | 2,098,131 | | | 2,076,245 | |

| Total liabilities and partners’ capital | $ | 2,098,850 | | | $ | 2,077,540 | |

See Accompanying Notes to Condensed Financial Statements.

ALLIANCEBERNSTEIN HOLDING L.P.

Condensed Statements of Income

(in thousands, except per unit amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Equity in net income attributable to AB Unitholders | | $ | 136,374 | | | $ | 65,761 | | | $ | 345,360 | | | $ | 211,264 | |

| | | | | | | | |

| Income taxes | | 9,179 | | | 8,770 | | | 27,420 | | | 26,278 | |

| | | | | | | | |

| Net income | | $ | 127,195 | | | $ | 56,991 | | | $ | 317,940 | | | $ | 184,986 | |

| | | | | | | | |

| Net income per unit: | | | | | | | | |

| Basic | | $ | 1.12 | | | $ | 0.50 | | | $ | 2.77 | | | $ | 1.63 | |

| Diluted | | $ | 1.12 | | | $ | 0.50 | | | $ | 2.77 | | | $ | 1.63 | |

See Accompanying Notes to Condensed Financial Statements.

ALLIANCEBERNSTEIN HOLDING L.P.

Condensed Statements of Comprehensive Income

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Net income | $ | 127,195 | | | $ | 56,991 | | | $ | 317,940 | | | $ | 184,986 | |

| Other comprehensive income (loss): | | | | | | | |

| Foreign currency translation adjustments, before reclassification and tax: | 7,521 | | | (5,816) | | | 2,785 | | | (1,580) | |

| Less: reclassification adjustment for (losses) in net income upon liquidation | — | | | — | | | (4,039) | | | — | |

| Foreign currency translation adjustment, before tax | 7,521 | | | (5,816) | | | 6,824 | | | (1,580) | |

| | | | | | | |

| | | | | | | |

| Income tax (expense) | (48) | | | (85) | | | (29) | | | (57) | |

| Foreign currency translation adjustments, net of tax | 7,473 | | | (5,901) | | | 6,795 | | | (1,637) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Changes in employee benefit related items: | | | | | | | |

| Amortization of prior service cost | 3 | | | 5 | | | 8 | | | 10 | |

| Recognized actuarial gain | 111 | | | 254 | | | 320 | | | 508 | |

| Changes in employee benefit related items | 114 | | | 259 | | | 328 | | | 518 | |

| Income tax benefit (expense) | 1 | | | (1) | | | (2) | | | (3) | |

| Employee benefit related items, net of tax | 115 | | | 258 | | | 326 | | | 515 | |

| | | | | | | |

| Other comprehensive income (loss) | 7,588 | | | (5,643) | | | 7,121 | | | (1,122) | |

| Comprehensive income | $ | 134,783 | | | $ | 51,348 | | | $ | 325,061 | | | $ | 183,864 | |

See Accompanying Notes to Condensed Financial Statements.

ALLIANCEBERNSTEIN HOLDING L.P.

Condensed Statements of Changes in Partners’ Capital

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| General Partner’s Capital | | | | | | | |

| Balance, beginning of period | $ | 1,343 | | | $ | 1,332 | | | $ | 1,327 | | | $ | 1,355 | |

| Net income | 112 | | | 51 | | | 278 | | | 163 | |

| Cash distributions to Unitholders | (71) | | | (62) | | | (221) | | | (197) | |

| | | | | | | |

| Balance, end of period | 1,384 | | | 1,321 | | | 1,384 | | | 1,321 | |

| Limited Partners’ Capital | | | | | | | |

| Balance, beginning of period | 2,162,868 | | | 2,124,142 | | | 2,147,147 | | | 2,160,207 | |

| Net income | 127,083 | | | 56,940 | | | 317,662 | | | 184,823 | |

| Cash distributions to Unitholders | (81,141) | | | (69,271) | | | (253,702) | | | (223,482) | |

| Retirement of AB Holding Units | (44,063) | | | (55,168) | | | (66,477) | | | (72,592) | |

| Issuance of AB Holding Units to fund long-term incentive compensation plan awards | 313 | | | 318 | | | 20,430 | | | 8,005 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Balance, end of period | 2,165,060 | | | 2,056,961 | | | 2,165,060 | | | 2,056,961 | |

| AB Holding Units held by AB to fund long-term incentive compensation plans | | | | | | | |

| Balance, beginning of period | (36,646) | | | (35,152) | | | (30,185) | | | (37,551) | |

| Change in AB Holding Units held by AB to fund long-term incentive compensation plans | 3,256 | | | 1,494 | | | (3,205) | | | 3,893 | |

| Balance, end of period | (33,390) | | | (33,658) | | | (33,390) | | | (33,658) | |

| Accumulated Other Comprehensive (Loss) | | | | | | | |

| Balance, beginning of period | (42,511) | | | (46,487) | | | (42,044) | | | (51,008) | |

| | | | | | | |

| Foreign currency translation adjustment, net of tax | 7,473 | | | (5,901) | | | 6,795 | | | (1,637) | |

| Changes in employee benefit related items, net of tax | 115 | | | 258 | | | 326 | | | 515 | |

| | | | | | | |

| Balance, end of period | (34,923) | | | (52,130) | | | (34,923) | | | (52,130) | |

| Total Partners’ Capital | $ | 2,098,131 | | | $ | 1,972,494 | | | $ | 2,098,131 | | | $ | 1,972,494 | |

See Accompanying Notes to Condensed Financial Statements.

ALLIANCEBERNSTEIN HOLDING L.P.

Condensed Statements of Cash Flows

(in thousands)

(unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 317,940 | | | $ | 184,986 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Equity in net income attributable to AB Unitholders | (345,360) | | | (211,264) | |

| Cash distributions received from AB | 281,164 | | | 248,529 | |

| Changes in assets and liabilities: | | | |

| (Increase) in other assets | (147) | | | — | |

| (Decrease) in other liabilities | (576) | | | (1,071) | |

| Net cash provided by operating activities | 253,021 | | | 221,180 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| Cash flows from financing activities: | | | |

| Cash distributions to Unitholders | (253,923) | | | (223,679) | |

| Capital contributions from AB | 902 | | | 2,499 | |

| | | |

| Net cash used in financing activities | (253,021) | | | (221,180) | |

| | | |

| Change in cash and cash equivalents | — | | | — | |

| Cash and cash equivalents as of beginning of period | — | | | — | |

| Cash and cash equivalents as of end of period | $ | — | | | $ | — | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

See Accompanying Notes to Condensed Financial Statements.

ALLIANCEBERNSTEIN HOLDING L.P.

Notes to Condensed Financial Statements

September 30, 2024

(unaudited)

The words “we” and “our” refer collectively to AllianceBernstein Holding L.P. (“AB Holding”) and AllianceBernstein L.P. and its subsidiaries (“AB”), or to their officers and employees. Similarly, the word “company” refers to both AB Holding and AB. Where the context requires distinguishing between AB Holding and AB, we identify which of them is being discussed. These statements should be read in conjunction with the audited consolidated financial statements included in the Form 10-K for the year ended December 31, 2023.

1. Business Description, Organization and Basis of Presentation

Business Description (1)

AB Holding’s principal source of income and cash flow is attributable to its investment in AB limited partnership interests. The condensed financial statements and notes of AB Holding should be read in conjunction with the condensed consolidated financial statements and notes of AB included as an exhibit to this quarterly report on Form 10-Q and with AB Holding’s and AB’s audited financial statements included in AB Holding’s Form 10-K for the year ended December 31, 2023.

AB provides diversified investment management and related services globally to a broad range of clients. Its principal services include:

•Institutional Services – servicing its institutional clients, including private and public pension plans, foundations and endowments, insurance companies, central banks and governments worldwide, and affiliates such as Equitable Holdings, Inc. ("EQH") and its subsidiaries, by means of separately managed accounts, sub-advisory relationships, structured products, collective investment trusts, mutual funds, hedge funds and other investment vehicles.

•Retail Services – servicing its retail clients, primarily by means of retail mutual funds sponsored by AB or an affiliated company, sub-advisory relationships with mutual funds sponsored by third parties, separately managed account programs sponsored by financial intermediaries worldwide and other investment vehicles.

•Private Wealth Services – servicing its private clients, including high-net-worth individuals and families, trusts and estates, charitable foundations, partnerships, private and family corporations, and other entities, by means of separately managed accounts, hedge funds, mutual funds and other investment vehicles.

AB also provides distribution, shareholder servicing, transfer agency services and administrative services to certain of the mutual funds it sponsors.

AB’s high-quality, in-depth research is the foundation of its asset management and private wealth management businesses. AB’s research disciplines include economic, fundamental equity, fixed income and quantitative research. AB has expertise in multi-asset strategies, wealth management, environmental, social and corporate governance ("ESG"), and alternative investments.

AB provides a broad range of investment services with expertise in:

•Actively managed equity strategies across global and regional universes, as well as capitalization ranges, concentration ranges and investment strategies, including value, growth and core equities;

•Actively-managed traditional and unconstrained fixed income strategies, including taxable and tax-exempt strategies;

•Actively-managed alternative investments, including fundamental and systematically-driven hedge funds, fund of hedge funds and direct assets (e.g., direct lending, real estate and private equity);

•Portfolios with Purpose, including Sustainable, Impact and Responsible+ (Climate-Conscious and ESG leaders) equity, fixed income and multi-asset strategies that address our clients' desire to invest their capital with a dedicated ESG focus, while pursuing strong investment returns;

•Multi-asset services and solutions, including dynamic asset allocation, customized target-date funds and target-risk funds; and

•Passively managed equity and fixed income strategies, including index, ESG index and enhanced index strategies.

Organization

As of September 30, 2024, EQH owned approximately 4.0% of the issued and outstanding units representing assignments of beneficial ownership of limited partnership interests in AB Holding (“AB Holding Units”). AllianceBernstein Corporation (an indirect wholly-owned subsidiary of EQH, “General Partner”) is the general partner of both AB Holding and AB. AllianceBernstein Corporation owns 100,000 general partnership units in AB Holding and a 1.0% general partnership interest in AB.

As of September 30, 2024, the ownership structure of AB, expressed as a percentage of general and limited partnership interests, was as follows:

| | | | | |

| EQH and its subsidiaries | 60.0 | % |

| AB Holding | 39.3 | |

| Unaffiliated holders | 0.7 | |

| 100.0 | % |

Including both the general partnership and limited partnership interests in AB Holding and AB, EQH and its subsidiaries had an approximate 61.6% economic interest in AB as of September 30, 2024.

Basis of Presentation

The interim condensed financial statements have been prepared in accordance with the instructions to Form 10-Q pursuant to the rules and regulations of the U.S. Securities and Exchange Commission (“SEC”). In the opinion of management, all adjustments, consisting only of normal recurring adjustments, necessary for a fair statement of the interim results, have been made. The preparation of the condensed financial statements requires management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the dates of the condensed financial statements and the reported amounts of revenues and expenses during the interim reporting periods. Actual results could differ from those estimates. The condensed statement of financial condition as of December 31, 2023 was derived from audited financial statements. Certain disclosures included in the annual financial statements have been condensed or omitted from these financial statements as they are not required for interim financial statements under principles generally accepted in the United States of America ("GAAP") and the rules of the SEC.

AB Holding records its investment in AB using the equity method of accounting. AB Holding’s investment is increased to reflect its proportionate share of income of AB and decreased to reflect its proportionate share of losses of AB and cash distributions made by AB to its Unitholders. In addition, AB Holding's investment is adjusted to reflect its proportionate share of certain capital transactions of AB.

Subsequent Events

We have evaluated subsequent events through the date that these financial statements were filed with the SEC and did not identify any subsequent events that would require disclosure in these financial statements.

(1) On April 1, 2024 AB and Societe Generale, a leading European bank, completed their transaction to form a jointly owned equity research provider and cash equity trading partner for institutional investors. AB contributed the Bernstein Research Services cash equities business to the joint venture. For further discussion, see Note 17 Divestiture to AB's condensed consolidated financial statements attached hereto as Exhibit 99.1.

2. Cash Distributions

AB Holding is required to distribute all of its Available Cash Flow, as defined in the Amended and Restated Agreement of Limited Partnership of AB Holding (“AB Holding Partnership Agreement”), to its Unitholders pro rata in accordance with their percentage interests in AB Holding. Available Cash Flow is defined as the cash distributions AB Holding receives from AB minus such amounts as the General Partner determines, in its sole discretion, should be retained by AB Holding for use in its business (such as the payment of taxes) or plus such amounts as the General Partner determines, in its sole discretion, should be released from previously retained cash flow.

On October 24, 2024, the General Partner declared a distribution of $0.77 per unit, representing a distribution of Available Cash Flow for the three months ended September 30, 2024. Each general partnership unit in AB Holding is entitled to receive distributions equal to those received by each AB Holding Unit. The distribution is payable on November 21, 2024 to holders of record at the close of business on November 4, 2024.

3. Long-term Incentive Compensation Plans

AB maintains several unfunded, non-qualified long-term incentive compensation plans, under which the company grants awards of restricted AB Holding Units to its employees and members of the Board of Directors, who are not employed by AB or by any of AB’s affiliates (“Eligible Directors”).

AB funds its restricted AB Holding Unit awards either by purchasing AB Holding Units on the open market or purchasing newly-issued AB Holding Units from AB Holding, and then keeping these AB Holding Units in a consolidated rabbi trust until delivering them or retiring them. In accordance with the AB Holding Partnership Agreement, when AB purchases newly-issued AB Holding Units from AB Holding, AB Holding is required to use the proceeds it receives from AB to purchase the equivalent number of newly-issued AB Units, thus increasing its percentage ownership interest in AB. AB Holding Units held in the consolidated rabbi trust are corporate assets in the name of the trust and are available to the general creditors of AB.

Repurchases of AB Holding Units for the three and nine months ended September 30, 2024 and 2023 consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (in millions) |

Total amount of AB Holding Units Purchased (1) | | 1.1 | | | 1.8 | | | 2.1 | | | 2.3 | |

Total Cash Paid for AB Holding Units Purchased (1) | | $ | 38.6 | | | $ | 56.9 | | | $ | 71.7 | | | $ | 75.7 | |

Open Market Purchases of AB Holding Units Purchased (1) | | 1.1 | | | 1.8 | | | 1.8 | | | 1.8 | |

Total Cash Paid for Open Market Purchases of AB Holding Units (1) | | $ | 38.6 | | | $ | 56.9 | | | $ | 60.1 | | | $ | 56.9 | |

(1) Purchased on a trade date basis. The difference between open-market purchases and units retained reflects the retention of AB Holding Units from employees to fulfill statutory tax withholding requirements at the time of delivery of long-term incentive compensation awards.

Each quarter, AB considers whether to implement a plan to repurchase AB Holding Units pursuant to Rules 10b5-1 and 10b-18 under the Securities Exchange Act of 1934, as amended (“Exchange Act”). A plan of this type allows a company to repurchase its shares at times when it otherwise might be prevented from doing so because of self-imposed trading blackout periods or because it possesses material non-public information. Each broker selected by AB has the authority under the terms and limitations specified in the plan to repurchase AB Holding Units on AB’s behalf. Repurchases are subject to regulations promulgated by the SEC as well as certain price, market volume and timing constraints specified in the plan. The plan adopted during the third quarter of 2024 expired at the close of business on October 23, 2024. AB may adopt plans in the future to engage in open-market purchases of AB Holding Units to help fund anticipated obligations under its incentive compensation award program and for other corporate purposes.

During the first nine months of 2024 and 2023, AB awarded to employees and Eligible Directors 1.2 million and 0.4 million restricted AB Holding Unit awards, respectively. AB used AB Holding Units repurchased during the applicable period and newly-issued AB Holding Units to fund these restricted AB Holding Unit awards.

4. Net Income per Unit

Basic net income per unit is derived by dividing net income by the basic weighted average number of units outstanding for each period. Diluted net income per unit is derived by adjusting net income for the assumed dilutive effect of compensatory options (“Net income – diluted”) and dividing by the diluted weighted average number of units outstanding for each period.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended

September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| | | (in thousands, except per unit amounts) |

| | | | | | | | |

| Net income – basic | | $ | 127,195 | | | $ | 56,991 | | | $ | 317,940 | | | $ | 184,986 | |

| | | | | | | | |

| Net income – diluted | | $ | 127,195 | | | $ | 56,991 | | | $ | 317,940 | | | $ | 184,986 | |

| | | | | | | | |

| Weighted average units outstanding – basic | | 114,042 | | | 113,185 | | | 114,592 | | | 113,407 | |

| | | | | | | | |

| Weighted average units outstanding – diluted | | 114,042 | | | 113,185 | | | 114,592 | | | 113,407 | |

| | | | | | | | |

| Basic net income per unit | | $ | 1.12 | | | $ | 0.50 | | | $ | 2.77 | | | $ | 1.63 | |

| Diluted net income per unit | | $ | 1.12 | | | $ | 0.50 | | | $ | 2.77 | | | $ | 1.63 | |

There were no anti-dilutive options excluded from diluted net income in the three and nine months ended September 30, 2024 or 2023.

5. Investment in AB

Changes in AB Holding’s investment in AB during the nine-month period ended September 30, 2024 are as follows (in thousands):

| | | | | |

| Investment in AB as of December 31, 2023 | $ | 2,077,540 | |

| Equity in net income attributable to AB Unitholders | 345,360 | |

| Changes in accumulated other comprehensive income | 7,121 | |

| Cash distributions received from AB | (281,164) | |

| |

| |

| Capital contributions (from) AB | (902) | |

| AB Holding Units retired | (66,477) | |

| AB Holding Units issued to fund long-term incentive compensation plans | 20,430 | |

| |

| Change in AB Holding Units held by AB for long-term incentive compensation plans | (3,205) | |

| |

| |

| Investment in AB as of September 30, 2024 | $ | 2,098,703 | |

6. Units Outstanding

Changes in AB Holding Units outstanding during the nine-month period ended September 30, 2024 are as follows:

| | | | | |

| Outstanding as of December 31, 2023 | 114,436,091 | |

| |

| Units issued | 859,586 | |

| Units retired | (1,860,320) | |

| Outstanding as of September 30, 2024 | 113,435,357 | |

7. Income Taxes

AB Holding is a publicly-traded partnership (“PTP”) for federal tax purposes and, accordingly, is not subject to federal or state corporate income taxes. However, AB Holding is subject to the 4.0% New York City unincorporated business tax (“UBT”), net of credits for UBT paid by AB, and to a 3.5% federal tax on partnership gross income from the active conduct of a trade or business. AB Holding’s partnership gross income is derived from its interest in AB.

AB Holding’s federal income tax is computed by multiplying certain AB qualifying revenues by AB Holding’s ownership interest in AB, multiplied by the 3.5% tax rate. Certain AB qualifying revenues are primarily U.S. investment advisory fees, research payments and brokerage commissions. AB Holding Units in AB’s consolidated rabbi trust are not considered outstanding for purposes of calculating AB Holding’s ownership interest in AB.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | | | Nine Months Ended

September 30, | | |

| | 2024 | | 2023 | | % Change | | 2024 | | 2023 | | % Change |

| | (in thousands) | | | | (in thousands) | | |

| Net income attributable to AB Unitholders | | $ | 345,972 | | | $ | 167,404 | | | 106.7 | % | | $ | 873,471 | | | $ | 537,292 | | | 62.6 | % |

| Multiplied by: weighted average equity ownership interest | | 39.4 | % | | 39.3 | % | | | | 39.5 | % | | 39.3 | % | | |

| Equity in net income attributable to AB Unitholders | | $ | 136,374 | | | $ | 65,761 | | | 107.4 | | | $ | 345,360 | | | $ | 211,264 | | | 63.5 | |

| | | | | | | | | | | | |

| AB qualifying revenues | | $ | 713,242 | | | $ | 689,323 | | | 3.5 | | | $ | 2,099,807 | | | $ | 2,059,866 | | | 1.9 | |

Multiplied by: weighted average equity ownership interest for calculating tax | | 35.7 | % | | 35.6 | % | | | | 36.4 | % | | 35.7 | % | | |

| Multiplied by: federal tax | | 3.5 | % | | 3.5 | % | | | | 3.5 | % | | 3.5 | % | | |

| Federal income taxes | | 8,924 | | | 8,593 | | | | | 26,728 | | | 25,713 | | | |

| State income taxes | | 255 | | | 177 | | | | | 692 | | | 565 | | | |

| Total income taxes | | $ | 9,179 | | | $ | 8,770 | | | 4.7 | % | | $ | 27,420 | | | $ | 26,278 | | | 4.3 | % |

| | | | | | | | | | | | |

| Effective tax rate | | 6.7 | % | | 13.3 | % | | | | 7.9 | % | | 12.4 | % | | |

In order to preserve AB Holding’s status as a PTP for federal income tax purposes, management ensures that AB Holding does not directly or indirectly (through AB) engage in a substantial new line of business. If AB Holding were to lose its status as a PTP, it would be subject to corporate income tax, which would reduce materially AB Holding’s net income and its quarterly distributions to AB Holding Unitholders.

8. Commitments and Contingencies

Legal and regulatory matters described below pertain to AB and are included here due to their potential significance to AB Holding’s investment in AB.

With respect to all significant litigation matters, we consider the likelihood of a negative outcome. If we determine the likelihood of a negative outcome is probable and the amount of the loss can be reasonably estimated, we record an estimated loss for the expected outcome of the litigation. If the likelihood of a negative outcome is reasonably possible and we are able to determine an estimate of the possible loss or range of loss in excess of amounts already accrued, if any, we disclose that fact together with the estimate of the possible loss or range of loss. However, it is often difficult to predict the outcome or estimate a possible loss or range of loss because litigation is subject to inherent uncertainties, particularly when plaintiffs allege substantial or indeterminate damages. Such is also the case when the litigation is in its early stages or when the litigation is highly complex or broad in scope. In these cases, we disclose that we are unable to predict the outcome or estimate a possible loss or range of loss.

AB may be involved in various matters, including regulatory inquiries, administrative proceedings and litigation, some of which may allege significant damages. It is reasonably possible that we could incur losses pertaining to these other matters, but we cannot currently estimate any such losses, or a range of reasonably possible losses. Management, after consultation

with legal counsel, currently believes that the outcome of any other individual matter that is pending or threatened, or all of them combined, will not have a material adverse effect on our results of operations, financial condition or liquidity. However, any inquiry, proceeding or litigation has an element of uncertainty; management cannot determine whether further developments relating to any other individual matter that is pending or threatened, or all of them combined, will have a material adverse effect on our results of operation, financial condition or liquidity in any future reporting period.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations

AB Holding’s principal source of income and cash flow is attributable to its investment in AB Units. AB Holding’s interim condensed financial statements and notes and management’s discussion and analysis of financial condition and results of operations (“MD&A”) should be read in conjunction with those of AB included as an exhibit to this Form 10-Q. They also should be read in conjunction with AB’s audited financial statements and notes and MD&A included in AB Holding’s Form 10-K for the year ended December 31, 2023.

Results of Operations

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | | Nine Months Ended September 30, | | |

| | 2024 | | 2023 | | % Change | 2024 | | 2023 | | % Change |

| | (in thousands, except per unit amounts) |

| | | | | | | | | | | |

| Net income attributable to AB Unitholders | | $ | 345,972 | | | $ | 167,404 | | | 106.7 | % | $ | 873,471 | | | $ | 537,292 | | | 62.6 | % |

| Weighted average equity ownership interest | | 39.4 | % | | 39.3 | % | | | 39.5 | % | | 39.3 | % | | |

| Equity in net income attributable to AB Unitholders | | 136,374 | | | 65,761 | | | 107.4 | | 345,360 | | | 211,264 | | | 63.5 | |

| Income taxes | | 9,179 | | | 8,770 | | | 4.7 | | 27,420 | | | 26,278 | | | 4.3 | |

| Net income of AB Holding | | $ | 127,195 | | | $ | 56,991 | | | 123.2 | | $ | 317,940 | | | $ | 184,986 | | | 71.9 | |

| Diluted net income per AB Holding Unit | | $ | 1.12 | | | $ | 0.50 | | | 124.0 | | $ | 2.77 | | | $ | 1.63 | | | 69.9 | |

Distribution per AB Holding Unit(1) | | $ | 0.77 | | | $ | 0.65 | | | 18.5 | % | $ | 2.21 | | | $ | 1.92 | | | 15.1 | % |

________________________

(1)Distributions reflect the impact of AB’s non-GAAP adjustments.

AB Holding's net income for the three and nine months ended September 30, 2024 increased $70.2 million and $133.0 million, respectively, as compared to the corresponding periods in 2023 primarily due to higher net income attributable to AB Unitholders.

AB Holding’s partnership gross income is derived from its interest in AB. AB Holding’s income taxes, which reflect a 3.5% federal tax on its partnership gross income from the active conduct of a trade or business, are computed by multiplying certain AB qualifying revenues by AB Holding’s ownership interest in AB, multiplied by the 3.5% tax rate. Certain AB qualifying revenues are primarily U.S. investment advisory fees, research payments and brokerage commissions. AB Holding's effective tax rate was 6.7% during the three months ended September 30, 2024, compared to 13.3% during the three months ended September 30, 2023. AB Holding's effective tax rate was 7.9% during the nine months ended September 30, 2024, compared to 12.4% during the nine months ended September 30, 2023. See Note 7 to the condensed financial statements in Item 1 for the calculation of income tax expense.

Management Operating Metrics

As supplemental information, AB provides the performance measures “adjusted net revenues,” “adjusted operating income” and “adjusted operating margin,” which are the principal metrics management uses in evaluating and comparing the period-to-period operating performance of AB. Management principally uses these metrics in evaluating performance because they present a clearer picture of AB's operating performance and allow management to see long-term trends without the distortion primarily caused by long-term incentive compensation-related mark-to-market adjustments, acquisition-related expenses, interest expense and other adjustment items. Similarly, management believes that these management operating metrics help investors better understand the underlying trends in AB's results and, accordingly, provide a valuable perspective for investors. Such measures are not based on generally accepted accounting principles (“non-GAAP measures”).

We provide the non-GAAP measures "adjusted net income" and "adjusted diluted net income per unit" because our quarterly distribution per unit is typically our adjusted diluted net income per unit (which is derived from adjusted net income).

These non-GAAP measures are provided in addition to, and not as substitutes for, net revenues, operating income and operating margin, and they may not be comparable to non-GAAP measures presented by other companies. Management uses both GAAP and non-GAAP measures in evaluating the company’s financial performance. The non-GAAP measures alone may pose limitations because they do not include all of AB’s revenues and expenses. Further, adjusted diluted net income per AB

Holding Unit is not a liquidity measure and should not be used in place of cash flow measures. See AB’s MD&A contained in Exhibit 99.1.

The impact of these adjustments on AB Holding’s net income and diluted net income per AB Holding Unit is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2024 | | 2023 | | 2024 | | 2023 |

| | (in thousands, except per Unit amounts) |

| | | | | | | | |

| AB non-GAAP adjustments 1 | | $ | (104,529) | | | $ | 46,231 | | | $ | (175,233) | | | $ | 87,185 | |

| AB income tax benefit (expense) on non-GAAP adjustments | | 4,282 | | | (2,761) | | | 10,337 | | | (4,156) | |

| AB non-GAAP adjustments, after taxes | | (100,247) | | | 43,470 | | | (164,896) | | | 83,029 | |

| AB Holding’s weighted average equity ownership interest in AB | | 39.4 | % | | 39.3 | % | | 39.5 | % | | 39.3 | % |

| Impact on AB Holding’s net income of AB non-GAAP adjustments | | $ | (39,515) | | | $ | 17,077 | | | $ | (65,198) | | | $ | 32,647 | |

| | | | | | | | |

| Net income – diluted, GAAP basis | | $ | 127,195 | | | $ | 56,991 | | | $ | 317,940 | | | $ | 184,986 | |

| Impact on AB Holding’s net income of AB non-GAAP adjustments | | (39,515) | | | 17,077 | | | (65,198) | | | 32,647 | |

| Adjusted net income – diluted | | $ | 87,680 | | | $ | 74,068 | | | $ | 252,742 | | | $ | 217,633 | |

| | | | | | | | |

| | | | | | | | |

| Diluted net income per AB Holding Unit, GAAP basis | | $ | 1.12 | | | $ | 0.50 | | | $ | 2.77 | | | $ | 1.63 | |

| Impact of AB non-GAAP adjustments | | (0.35) | | | 0.15 | | | (0.56) | | | 0.29 | |

| Adjusted diluted net income per AB Holding Unit | | $ | 0.77 | | | $ | 0.65 | | | $ | 2.21 | | | $ | 1.92 | |

The degree to which AB's non-GAAP adjustments impact AB Holding's net income fluctuates based on AB Holding's ownership percentage in AB.

Cash Distributions

AB Holding is required to distribute all of its Available Cash Flow, as defined in the AB Holding Partnership Agreement, to its Unitholders (including the General Partner). Available Cash Flow typically is the adjusted diluted net income per unit for the quarter multiplied by the number of units outstanding at the end of the quarter. Management anticipates that Available Cash Flow will continue to be based on adjusted diluted net income per unit, unless management determines, with concurrence of the Board of Directors, that one or more adjustments made to adjusted net income should not be made with respect to the Available Cash Flow calculation. See Note 2 to the condensed financial statements in Item 1 for a description of Available Cash Flow.

Capital Resources and Liquidity

During the nine months ended September 30, 2024, net cash provided by operating activities was $253.0 million, compared to $221.2 million during the corresponding 2023 period. The increase primarily resulted from higher distributions received from AB of $32.6 million.

During the nine months ended September 30, 2024, net cash used in financing activities was $253.0 million, compared to $221.2 million during the corresponding 2023 period. The increase was primarily due to higher cash distributions to Unitholders of $30.2 million.

Management believes that AB Holding will have the resources it needs to meet its financial obligations as a result of the cash flow AB Holding realizes from its investment in AB. AB Holding’s cash inflow is comprised entirely of distributions from AB. These distributions are subsequently distributed (net of taxes paid) in their entirety to AB Holding’s Unitholders. As a result,

1 Includes all AB non-GAAP adjustments to pre-tax income which includes the gain on divestiture.

AB Holding has no liquidity risk as it only pays distributions to AB Holding’s Unitholders to the extent of distributions received from AB (net of taxes paid).

Commitments and Contingencies

See Note 8 to the condensed financial statements in Item 1.

CAUTIONS REGARDING FORWARD-LOOKING STATEMENTS

Certain statements provided by management in this report and in the portion of AB’s Form 10-Q attached hereto as Exhibit 99.1 are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are subject to risks, uncertainties and other factors that could cause actual results to differ materially from future results expressed or implied by such forward-looking statements. The most significant of these factors include, but are not limited to, the following: the performance of financial markets, the investment performance of sponsored investment products and separately managed accounts, general economic conditions, industry trends, future acquisitions, integration of acquired companies, competitive conditions and government regulations, including changes in tax regulations and rates and the manner in which the earnings of publicly-traded partnerships are taxed. We caution readers to carefully consider such factors. Further, these forward-looking statements speak only as of the date on which such statements are made; we undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of such statements. For further information regarding these forward-looking statements and the factors that could cause actual results to differ, see “Risk Factors” in Part I, Item 1A of our Form 10-K for the year ended December 31, 2023 and Part II, Item 1A in this Form 10-Q. Any or all of the forward-looking statements that we make in our Form 10-K, this Form 10-Q, other documents we file with or furnish to the SEC, and any other public statements we issue, may turn out to be wrong. It is important to remember that other factors besides those listed in “Risk Factors” and those listed below could also adversely impact our revenues, financial condition, results of operations and business prospects.

The forward-looking statements referred to in the preceding paragraph, most of which directly affect AB but also affect AB Holding because AB Holding’s principal source of income and cash flow is attributable to its investment in AB, include statements regarding:

•Our belief that the cash flow AB Holding realizes from its investment in AB will provide AB Holding with the resources it needs to meet its financial obligations: AB Holding’s cash flow is dependent on the quarterly cash distributions it receives from AB. Accordingly, AB Holding’s ability to meet its financial obligations is dependent on AB’s cash flow from its operations, which is subject to the performance of the capital markets and other factors beyond our control.

•Our financial condition and ability to access the public and private capital markets providing adequate liquidity for our general business needs: Our financial condition is dependent on our cash flow from operations, which is subject to the performance of the capital markets, our ability to maintain and grow client assets under management and other factors beyond our control. Our ability to access public and private capital markets on reasonable terms may be limited by adverse market conditions, our firm’s credit ratings, our profitability and changes in government regulations, including tax rates and interest rates.

•The outcome of litigation: Litigation is inherently unpredictable, and excessive damage awards do occur. Though we have stated that we do not expect any pending legal proceedings to have a material adverse effect on our results of operations, financial condition or liquidity, any settlement or judgment with respect to a legal proceeding could be significant and could have such an effect.

•The possibility that we will engage in open market purchases of AB Holding Units to help fund anticipated obligations under our incentive compensation award program: The number of AB Holding Units AB may decide to buy in future periods, if any, to help fund incentive compensation awards depends on various factors, some of which are beyond our control, including the fluctuation in the price of an AB Holding Unit (NYSE: AB) and the availability of cash to make these purchases.

•Our determination that adjusted employee compensation expense, excluding the impact of performance-based fees, generally should not exceed 50% of our adjusted net revenues on an annual basis: Aggregate employee compensation reflects employee performance and competitive compensation levels. Fluctuations in our revenues and/or changes in competitive compensation levels could result in adjusted employee compensation expense exceeding 50% of our adjusted net revenues.

Item 3. Quantitative and Qualitative Disclosures About Market Risk

There have been no material changes in AB Holding’s market risk from the information provided under “Quantitative and Qualitative Disclosures About Market Risk” in Part II, Item 7A of AB Holding's Form 10-K for the year ended December 31, 2023.

Item 4. Controls and Procedures

Disclosure Controls and Procedures

Each of AB Holding and AB maintains a system of disclosure controls and procedures that is designed to ensure that information required to be disclosed in our reports under the Exchange Act is (i) recorded, processed, summarized and reported in a timely manner, and (ii) accumulated and communicated to management, including the Chief Executive Officer ("CEO") and the Chief Financial Officer ("CFO"), to permit timely decisions regarding our disclosure.

As of the end of the period covered by this report, management carried out an evaluation, under the supervision and with the participation of the CEO and the CFO, of the effectiveness of the design and operation of the disclosure controls and procedures. Based on this evaluation, the CEO and the CFO concluded that the disclosure controls and procedures are effective.

Changes in Internal Control over Financial Reporting

No change in our internal control over financial reporting occurred during the third quarter of 2024 that materially affected, or is reasonably likely to materially affect, our internal control over financial reporting.

Part II

OTHER INFORMATION

Item 1. Legal Proceedings

See Note 8 to the condensed financial statements contained in Part I, Item 1.

Item 1A. Risk Factors

There have been no material changes to the risk factors from those appearing in AB Holding's Annual Report on Form 10-K for the fiscal year ended December 31, 2023.

Item 2. Unregistered Sales of Equity Securities and Use of Proceeds

There were no AB Holding Units sold by AB Holding in the period covered by this report that were not registered under the Securities Act.

Each quarter, AB considers whether to implement a plan to repurchase AB Holding Units pursuant to Rules 10b5-1 and 10b-18 under the Securities Exchange Act of 1934 ("Exchange Act"). The plan adopted during the third quarter of 2024 expired at the close of business on October 23, 2024. AB may adopt additional plans in the future to engage in open-market purchases of AB Holding Units to help fund anticipated obligations under the firm's incentive compensation award program and for other corporate purposes. See Note 3 to the condensed financial statements contained in Part 1, Item 1.

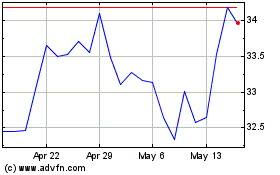

AB Holding Units bought by us or one of our affiliates during the third quarter of 2024 are as follows:

ISSUER PURCHASES OF EQUITY SECURITIES

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Period | | Total Number

of AB Holding Units

Purchased | | Average Price Paid Per AB Holding Unit, net of Commissions | | Total Number of

AB Holding Units Purchased as

Part of Publicly

Announced Plans

or Programs | | Maximum Number

(or Approximate

Dollar Value) of

AB Holding Units that May Yet

Be Purchased Under

the Plans or

Programs |

7/1/24 - 7/31/24(1)(2) | | 337,602 | | | $ | 33.94 | | | — | | | — | |

8/1/24 - 8/31/24(1)(2) | | 477,941 | | | 33.34 | | | — | | | — | |

9/1/24 - 9/30/24(1)(2) | | 322,550 | | | 34.17 | | | — | | | — | |

| Total | | 1,138,093 | | | $ | 33.76 | | | — | | | — | |

(1)During the third quarter of 2024, AB retained from employees 4,919 AB Holding Units to allow them to fulfill statutory withholding tax requirements at the time of distribution of long-term incentive compensation awards.

(2)During the third quarter of 2024, AB purchased 1,133,174 AB Holding Units on the open market pursuant to a Rule 10b5-1 plan to help fund anticipated obligations under our incentive compensation award program.

AB Units bought by us or one of our affiliates during the third quarter of 2024 are as follows:

ISSUER PURCHASES OF EQUITY SECURITIES

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Period | | Total Number

of AB Units

Purchased | | Average Price Paid Per AB Unit, net of Commissions | | Total Number of

AB Units Purchased as

Part of Publicly

Announced Plans

or Programs | | Maximum Number

(or Approximate

Dollar Value) of

AB Units that May Yet

Be Purchased Under

the Plans or

Programs |

| 7/1/24 - 7/31/24 | | — | | | — | | | — | | | — | |

| 8/1/24 - 8/31/24 | | — | | | — | | | — | | | — | |

9/1/24 - 9/30/24(1) | | 2,950 | | | 34.01 | | | — | | | — | |

| Total | | 2,950 | | | $ | 34.01 | | | — | | | — | |

(1)During third quarter of 2024, AB purchased 2,950 AB Units in private transactions and retired them.

Item 3. Defaults Upon Senior Securities

None.

Item 4. Mine Safety Disclosures

None.

Item 5. Other Information

Pursuant to item 408(a) of Regulation S-K there were no directors or officers that had adopted or terminated a 10b5-1 plan or other trading arrangement during the third quarter of 2024.

Item 6. Exhibits

| | | | | |

| 31.1 | |

| | |

| 31.2 | |

| |

| 32.1 | |

| | |

| 32.2 | |

| |

| 99.1 | |

| | |

| 101.INS | XBRL Instance Document - the instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. |

| | |

| 101.SCH | XBRL Taxonomy Extension Schema. |

| | |

| 101.CAL | XBRL Taxonomy Extension Calculation Linkbase. |

| | |

| 101.LAB | XBRL Taxonomy Extension Label Linkbase. |

| | |

| 101.PRE | XBRL Taxonomy Extension Presentation Linkbase. |

| |

| 101.DEF | XBRL Taxonomy Extension Definition Linkbase. |

| |

| 104 | The cover page from the Company’s Quarterly Report on Form 10-Q for the quarter ended September 30, 2024, formatted in Inline XBRL (included in Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | | | | |

| Date: October 24, 2024 | ALLIANCEBERNSTEIN HOLDING L.P. |

| | | |

| By: | /s/ Jackie Marks | |

| | Jackie Marks | |

| | Chief Financial Officer |

| | | |

| By: | /s/ Thomas Simeone | |

| | Thomas Simeone | |

| | Controller & Chief Accounting Officer |

| | | |

| | | |

Exhibit 31.1

I, Seth Bernstein, certify that:

1.I have reviewed this quarterly report on Form 10-Q of AllianceBernstein Holding L.P.;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a)Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b)Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c)Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d)Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

(a)All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b)Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| | | | | | | | |

| Date: October 24, 2024 | /s/ Seth Bernstein | |

| Seth Bernstein | |

| President & Chief Executive Officer |

| AllianceBernstein Holding L.P. |

Exhibit 31.2

I, Jackie Marks, certify that:

1.I have reviewed this quarterly report on Form 10-Q of AllianceBernstein Holding L.P.;

2.Based on my knowledge, this report does not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the period covered by this report;

3.Based on my knowledge, the financial statements, and other financial information included in this report, fairly present in all material respects the financial condition, results of operations and cash flows of the registrant as of, and for, the periods presented in this report;

4.The registrant’s other certifying officer and I are responsible for establishing and maintaining disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) and internal control over financial reporting (as defined in Exchange Act Rules 13a-15(f) and 15d-15(f)) for the registrant and have:

(a)Designed such disclosure controls and procedures, or caused such disclosure controls and procedures to be designed under our supervision, to ensure that material information relating to the registrant, including its consolidated subsidiaries, is made known to us by others within those entities, particularly during the period in which this report is being prepared;

(b)Designed such internal control over financial reporting, or caused such internal control over financial reporting to be designed under our supervision, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles;

(c)Evaluated the effectiveness of the registrant’s disclosure controls and procedures and presented in this report our conclusions about the effectiveness of the disclosure controls and procedures, as of the end of the period covered by this report based on such evaluation; and

(d)Disclosed in this report any change in the registrant’s internal control over financial reporting that occurred during the registrant’s most recent fiscal quarter (the registrant’s fourth fiscal quarter in the case of an annual report) that has materially affected, or is reasonably likely to materially affect, the registrant’s internal control over financial reporting; and

5.The registrant’s other certifying officer and I have disclosed, based on our most recent evaluation of internal control over financial reporting, to the registrant’s auditors and the audit committee of the registrant’s board of directors (or persons performing the equivalent functions):

(a)All significant deficiencies and material weaknesses in the design or operation of internal control over financial reporting which are reasonably likely to adversely affect the registrant’s ability to record, process, summarize and report financial information; and

(b)Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant’s internal control over financial reporting.

| | | | | | | | |

| Date: October 24, 2024 | /s/ Jackie Marks | |

| | Jackie Marks | |

| | Chief Financial Officer |

| | AllianceBernstein Holding L.P. | |

Exhibit 32.1

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of AllianceBernstein Holding L.P. (the “Company”) on Form 10-Q for the period ending September 30, 2024 to be filed with the Securities and Exchange Commission on or about October 24, 2024 (the “Report”), I, Seth Bernstein, President and Chief Executive Officer of the Company, certify, for the purpose of complying with Rule 13a-14(b) or Rule 15d-14(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and 18 U.S.C. § 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

(1)The Report fully complies with the requirements of section 13(a) or 15(d) of the Exchange Act; and

(2)The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| | | | | | | | |

| Date: October 24, 2024 | /s/ Seth Bernstein | |

| | Seth Bernstein | |

| | President & Chief Executive Officer | |

| | AllianceBernstein Holding L.P. | |

Exhibit 32.2

CERTIFICATION PURSUANT TO

18 U.S.C. SECTION 1350,

AS ADOPTED PURSUANT TO

SECTION 906 OF THE SARBANES-OXLEY ACT OF 2002

In connection with the Quarterly Report of AllianceBernstein Holding L.P. (the “Company”) on Form 10-Q for the period ending September 30, 2024 to be filed with the Securities and Exchange Commission on or about October 24, 2024 (the “Report”), I, Jackie Marks, Chief Financial Officer of the Company, certify, for the purpose of complying with Rule 13a-14(b) or 15d-14(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and 18 U.S.C. § 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002, that:

(1)The Report fully complies with the requirements of section 13(a) or 15(d) of the Exchange Act; and

(2)The information contained in the Report fairly presents, in all material respects, the financial condition and results of operations of the Company.

| | | | | | | | |

| Date: October 24, 2024 | /s/ Jackie Marks | |

| Jackie Marks | |

| Chief Financial Officer |

| AllianceBernstein Holding L.P. | |

Exhibit 99.1

Part I

FINANCIAL INFORMATION

Item 1. Financial Statements

ALLIANCEBERNSTEIN L.P.

AND SUBSIDIARIES

Condensed Consolidated Statements of Financial Condition

(in thousands, except unit amounts)

(unaudited)

| | | | | | | | | | | |

| | September 30,

2024 | | December 31,

2023 |

| ASSETS |

| Cash and cash equivalents | $ | 665,465 | | | $ | 1,000,103 | |

Cash and securities segregated, at fair value (cost: $542,166 and $859,448) | 546,769 | | | 867,680 | |

| Receivables, net: | | | |

| Brokers and dealers | 48,933 | | | 53,144 | |

| Brokerage clients | 1,411,383 | | | 1,314,656 | |

| AB funds fees | 373,691 | | | 343,334 | |

| Other fees | 131,171 | | | 125,500 | |

| Investments: | | | |

| Joint ventures | 287,829 | | | — | |

| Other | 245,755 | | | 243,554 | |

| Assets of consolidated company-sponsored investment funds: | | | |

| Cash and cash equivalents | 5,813 | | | 7,739 | |

| Investments | 267,029 | | | 397,174 | |

| Other assets | 4,735 | | | 25,299 | |

| Furniture, equipment and leasehold improvements, net | 239,499 | | | 176,348 | |

| Goodwill | 3,598,591 | | | 3,598,591 | |

| Intangible assets, net | 228,973 | | | 264,555 | |

| Deferred sales commissions, net | 157,864 | | | 87,374 | |

| Right-of-use assets | 467,045 | | | 323,766 | |

| Assets held for sale | — | | | 564,776 | |

| Other assets | 251,629 | | | 216,213 | |

| Total assets | $ | 8,932,174 | | | $ | 9,609,806 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | | | | | |

| | September 30,

2024 | | December 31,

2023 |

| | | |

| LIABILITIES, REDEEMABLE NON-CONTROLLING INTEREST AND CAPITAL |

| Liabilities: | | | |

| Payables: | | | |

| Brokers and dealers | $ | 186,480 | | | $ | 259,175 | |

| | | |

| Brokerage clients | 1,795,116 | | | 2,200,835 | |

| AB mutual funds | 762 | | | 644 | |

| | | |

| Contingent consideration liability | 129,219 | | | 252,690 | |

| Accounts payable and accrued expenses | 305,630 | | | 172,163 | |

| Lease liabilities | 537,856 | | | 369,017 | |

| Liabilities of consolidated company-sponsored investment funds | 4,933 | | | 12,537 | |

| Accrued compensation and benefits | 756,827 | | | 372,305 | |

| Debt | 500,000 | | | 1,154,316 | |

| Liabilities held for sale | — | | | 153,342 | |

| Total liabilities | 4,216,823 | | | 4,947,024 | |

| | | |

| | | |

Commitments and contingencies (See Note 12) | | | |

| | | |

| Redeemable non-controlling interest of consolidated entities | 127,217 | | | 209,420 | |

| | | |

| Capital: | | | |

| General Partner | 46,645 | | | 45,388 | |

Limited partners: 285,586,728 and 286,609,212 units issued and outstanding | 4,714,973 | | | 4,590,619 | |

| Receivables from affiliates | (3,492) | | | (4,490) | |

| AB Holding Units held for long-term incentive compensation plans | (84,913) | | | (76,363) | |

| Accumulated other comprehensive (loss) | (88,812) | | | (106,364) | |

| Partners’ capital attributable to AB Unitholders | 4,584,401 | | | 4,448,790 | |

| Non-redeemable non-controlling interests in consolidated entities | 3,733 | | | 4,572 | |

| Total capital | 4,588,134 | | | 4,453,362 | |

| Total liabilities, non-controlling interest and capital | $ | 8,932,174 | | | $ | 9,609,806 | |

See Accompanying Notes to Condensed Consolidated Financial Statements.

ALLIANCEBERNSTEIN L.P.

AND SUBSIDIARIES

Condensed Consolidated Statements of Income

(in thousands, except per unit amounts)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | | |

| Investment advisory and services fees | | $ | 842,386 | | | $ | 748,951 | | | $ | 2,444,118 | | | $ | 2,199,536 | |

| Bernstein research services | | — | | | 93,875 | | | 96,222 | | | 285,760 | |

| Distribution revenues | | 189,216 | | | 149,049 | | | 527,811 | | | 434,925 | |

| Dividend and interest income | | 38,940 | | | 49,889 | | | 127,441 | | | 150,761 | |

| Investment (losses) | | (3,512) | | | (6,694) | | | (15,398) | | | (760) | |

| Other revenues | | 39,673 | | | 24,484 | | | 104,133 | | | 75,349 | |

| Total revenues | | 1,106,703 | | | 1,059,554 | | | 3,284,327 | | | 3,145,571 | |

| Less: Broker-dealer related interest expense | | 21,214 | | | 27,498 | | | 66,744 | | | 80,968 | |

| Net revenues | | 1,085,489 | | | 1,032,056 | | | 3,217,583 | | | 3,064,603 | |

| | | | | | | | |

| Expenses: | | | | | | | | |

| Employee compensation and benefits | | 424,893 | | | 453,619 | | | 1,300,989 | | | 1,315,861 | |

| Promotion and servicing: | | | | | | | | |

| Distribution-related payments | | 192,230 | | | 155,620 | | | 545,120 | | | 454,039 | |

| Amortization of deferred sales commissions | | 15,005 | | | 9,585 | | | 40,152 | | | 26,506 | |

| Trade execution, marketing, T&E and other | | 38,312 | | | 52,289 | | | 134,243 | | | 157,057 | |

| | | | | | | | |

| | | | | | | | |

| General and administrative | | 155,808 | | | 145,388 | | | 439,450 | | | 434,976 | |

| | | | | | | | |

| | | | | | | | |

| Contingent payment arrangements | | (125,947) | | | 15,364 | | | (120,831) | | | 20,251 | |

| Interest on borrowings | | 8,456 | | | 13,209 | | | 37,139 | | | 41,594 | |

| Amortization of intangible assets | | 11,451 | | | 11,732 | | | 34,754 | | | 35,148 | |

| Total expenses | | 720,208 | | | 856,806 | | | 2,411,016 | | | 2,485,432 | |

| | | | | | | | |

| Operating income | | 365,281 | | | 175,250 | | | 806,567 | | | 579,171 | |

| | | | | | | | |

| Gain on divestiture | | — | | | — | | | 134,555 | | | — | |

| Non-operating income | | — | | | — | | | 134,555 | | | — | |

| | | | | | | | |

| Pre-tax income | | 365,281 | | | 175,250 | | | 941,122 | | | 579,171 | |

| | | | | | | | |

| Income taxes | | 14,255 | | | 10,010 | | | 50,389 | | | 31,253 | |

| | | | | | | | |

| Net income | | 351,026 | | | 165,240 | | | 890,733 | | | 547,918 | |

| | | | | | | | |

| Net income of consolidated entities attributable to non-controlling interests | | 5,054 | | | (2,164) | | | 17,262 | | | 10,626 | |

| | | | | | | | |

| Net income attributable to AB Unitholders | | $ | 345,972 | | | $ | 167,404 | | | $ | 873,471 | | | $ | 537,292 | |

| | | | | | | | |

| Net income per AB Unit: | | | | | | | | |

| Basic | | $ | 1.20 | | | $ | 0.58 | | | $ | 3.02 | | | $ | 1.86 | |

| Diluted | | $ | 1.20 | | | $ | 0.58 | | | $ | 3.02 | | | $ | 1.86 | |

See Accompanying Notes to Condensed Consolidated Financial Statements.

ALLIANCEBERNSTEIN L.P.

AND SUBSIDIARIES

Condensed Consolidated Statements of Comprehensive Income

(in thousands)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | | |

| Net income | | $ | 351,026 | | | $ | 165,240 | | | $ | 890,733 | | | $ | 547,918 | |

| Other comprehensive income (loss): | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Foreign currency translation adjustments, before reclassification and tax: | | 18,677 | | | (15,627) | | | 6,789 | | | (4,971) | |

| Less: reclassification adjustment for (losses) in net income upon liquidation | | — | | | — | | | (10,197) | | | — | |

| Foreign currency translation adjustments, before tax | | 18,677 | | | (15,627) | | | 16,986 | | | (4,971) | |

| Income tax (expense) | | (163) | | | (274) | | | (108) | | | (211) | |

| Foreign currency translation adjustments, net of tax | | 18,514 | | | (15,901) | | | 16,878 | | | (5,182) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Changes in employee benefit related items: | | | | | | | | |

| Amortization of prior service cost | | 6 | | | 6 | | | 18 | | | 18 | |

| Recognized actuarial gain | | 105 | | | 298 | | | 664 | | | 894 | |

| Changes in employee benefit related items | | 111 | | | 304 | | | 682 | | | 912 | |

| Income tax (expense) | | (1) | | | (1) | | | (8) | | | (5) | |

| Employee benefit related items, net of tax | | 110 | | | 303 | | | 674 | | | 907 | |

| | | | | | | | |

| Other comprehensive income (loss) | | 18,624 | | | (15,598) | | | 17,552 | | | (4,275) | |

| Less: Comprehensive income in consolidated entities attributable to non-controlling interests | | 5,054 | | | (2,164) | | | 17,262 | | | 10,626 | |

| Comprehensive income attributable to AB Unitholders | | $ | 364,596 | | | $ | 151,806 | | | $ | 891,023 | | | $ | 533,017 | |

See Accompanying Notes to Condensed Consolidated Financial Statements.

ALLIANCEBERNSTEIN L.P.

AND SUBSIDIARIES

Condensed Consolidated Statements of Changes in Partners' Capital

(in thousands)

(unaudited) | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| General Partner’s Capital | | | | | | | |

| Balance, beginning of period | $ | 45,880 | | | $ | 45,233 | | | $ | 45,388 | | | $ | 45,985 | |

| Net income | 3,460 | | | 1,674 | | | 8,735 | | | 5,373 | |

| Cash distributions to General Partner | (2,285) | | | (1,962) | | | (7,101) | | | (6,319) | |

| Long-term incentive compensation plans activity | 27 | | | 31 | | | 83 | | | 34 | |

| (Retirement) of AB Units, net | (437) | | | (549) | | | (460) | | | (646) | |

| | | | | | | |

| | | | | | | |

| Balance, end of period | 46,645 | | | 44,427 | | | 46,645 | | | 44,427 | |

| Limited Partners' Capital | | | | | | | |

| Balance, beginning of period | 4,639,147 | | | 4,573,989 | | | 4,590,619 | | | 4,648,113 | |

| Net income | 342,512 | | | 165,730 | | | 864,736 | | | 531,919 | |

| Cash distributions to Unitholders | (226,031) | | | (193,614) | | | (702,324) | | | (624,470) | |

| Long-term incentive compensation plans activity | 2,759 | | | 3,025 | | | 8,256 | | | 3,352 | |

| (Retirement) of AB Units, net | (43,414) | | | (54,308) | | | (46,314) | | | (64,092) | |

| | | | | | | |

| | | | | | | |

| Balance, end of period | 4,714,973 | | | 4,494,822 | | | 4,714,973 | | | 4,494,822 | |

| Receivables from Affiliates | | | | | | | |

| Balance, beginning of period | (3,822) | | | (5,148) | | | (4,490) | | | (4,270) | |

| | | | | | | |

| | | | | | | |

| Long-term incentive compensation awards expense | 291 | | | 142 | | | 797 | | | 548 | |

| Capital contributions from (to) AB Holding | 39 | | | (234) | | | 201 | | | (1,518) | |

| Balance, end of period | (3,492) | | | (5,240) | | | (3,492) | | | (5,240) | |

| AB Holding Units held for Long-term Incentive Compensation Plans | | | | | | | |

| Balance, beginning of period | (92,612) | | | (89,343) | | | (76,363) | | | (95,318) | |

| Purchases of AB Holding Units to fund long-term compensation plans, net | (39,342) | | | (52,175) | | | (73,131) | | | (70,837) | |

| Retirement of AB Units, net | 43,751 | | | 54,851 | | | 47,378 | | | 65,607 | |

| Long-term incentive compensation awards expense | 6,266 | | | 3,600 | | | 26,645 | | | 18,561 | |

| Re-valuation of AB Holding Units held in rabbi trust | (2,976) | | | (3,291) | | | (9,442) | | | (4,371) | |

| Balance, end of period | (84,913) | | | (86,358) | | | (84,913) | | | (86,358) | |

| Accumulated Other Comprehensive (Loss) | | | | | | | |

| Balance, beginning of period | (107,436) | | | (118,154) | | | (106,364) | | | (129,477) | |

| | | | | | | |

| Foreign currency translation adjustment, net of tax | 18,514 | | | (15,901) | | | 16,878 | | | (5,182) | |

| Changes in employee benefit related items, net of tax | 110 | | | 303 | | | 674 | | | 907 | |

| | | | | | | |

| Balance, end of period | (88,812) | | | (133,752) | | | (88,812) | | | (133,752) | |

| Total Partners' Capital attributable to AB Unitholders | 4,584,401 | | | 4,313,899 | | | 4,584,401 | | | 4,313,899 | |

| Non-redeemable Non-controlling Interests in Consolidated Entities | | | | | | | |

| Balance, beginning of period | 3,540 | | | 10,385 | | | 4,572 | | | 12,607 | |

| Net income | 195 | | | 108 | | | 1,763 | | | 623 | |

| | | | | | | |

| | | | | | | |