Company Highlights

- Second quarter 2023 net income available to common

stockholders of $344.4 million, or $4.36 per diluted common share

compared to net income of $752.4 million, or $8.06 per diluted

common share for second quarter 2022 restated for the adoption of

Accounting Standards Update 2018-12 — more commonly known as Long

Duration Targeted Improvements or LDTI.

- Non-GAAP operating income available to common stockholders1

for the second quarter 2023 was $127.6 million, or $1.62 per

diluted common share; Notable items2 negatively impacted results in

the quarter by $8.9 million, or $0.11 per share,

after-tax.

- On a trailing twelve-month basis GAAP return on equity of

26.4% and non-GAAP operating return on equity1 of 12.1%

- Total sales4 of $2.0 billion including approximately $1.9

billion of FIA sales reflecting a sequential quarterly FIA sales

increase of 95%

- Private asset deployment ramp continues with over $800

million sourced in the quarter, bringing total portfolio allocation

to 24.9%

- Ceded $821 million of flow reinsurance to reinsurance

partners creating "fee-like" revenues and growing account value

subject to recurring fees under reinsurance agreements to $10.9

billion

American Equity Investment Life Holding Company (NYSE: AEL), a

leading issuer of fixed index annuities (FIAs), today reported its

second quarter 2023 results. Sales momentum accelerated in both the

independent agent channel and bank and broker-dealer channel while

the investment portfolio allocation to private assets continued to

increase.

American Equity's President and CEO, Anant Bhalla stated: "AEL

2.0 is thriving with the business firing on all cylinders or

components of our flywheel. New business sales of $2 billion in the

second quarter is at nearly all-time highs for AEL. Private asset

investments over $12 billion – or 25% of all invested assets on the

balance sheet – and nearly $11 billion of account values ceded to

reinsurance partners to earn “fee-like” revenues are both

significant milestones in our transformation into a capital-light

and more resilient, +12% ROE earning institution for the benefit of

our shareholders. This is the vision that we shared 3 years ago,

and we have delivered on it, ahead of schedule. Our Board of

Directors and Management leadership are proud of the achievements

of the AEL team and our network of business partners."

Bhalla continued: "Looking ahead, we expect our primary focus

for the remainder of 2023 to be on completing our planned merger

transaction with Brookfield Reinsurance (NYSE, TSX: BNRE), which is

currently expected to close by the first half of 2024, while

continuing to excel as the premier provider of Financial Dignity

Solutions to retail clients.”

Non-GAAP operating income available to common stockholders1 for

the second quarter of 2023 was $127.6 million, or $1.62 per diluted

common share, compared to non-GAAP operating income available to

common stockholders1 of $124.3 million, or $1.47 per diluted common

share, for the first quarter of 2023 and $151.2 million, or $1.62

per diluted common share, for the second quarter of 2022, restated

for the adoption of Accounting Standards Update 2018-12 —

more commonly known as Long Duration Targeted Improvements or LDTI.

For the second quarter of 2023, non-GAAP operating income available

to common stockholders1 was negatively affected by $8.9 million, or

$0.11 per share, after taxes, from notable items2. Results in the

first quarter of 2023 included negative notable items2 of $9.6

million, or $0.11 per share after taxes, while there were no

notable items2 affecting results for the second quarter of

2022.

The year-over-year change in quarterly non-GAAP operating income

available to common stockholders1 excluding the impact of notable

items2 reflects increased recurring fee revenue related to

reinsurance and higher surrender charge fee income more than offset

by lower investment spread income.

Compared to the first quarter of 2023, quarterly non-GAAP

operating income available to common stockholders1 excluding the

impact of notable items2 increased slightly reflecting higher

surrender charge fee income, a smaller increase in the Market Risk

Benefit liability and lower tax rate offset by lower investment

spread income. Notable items2 in the first and second quarters of

2023 reflect the special incentive compensation plan put in place

in November 2022.

For the second quarter of 2023, net investment income fell to

$547 million, when adjusted to reflect non-GAAP operating income

available to common stockholders1, from $559 million for the first

quarter of 2023. This $12 million decrease reflects a six-basis

point decline in effective yield on the investment portfolio, lower

invested assets, and a decrease in cash and short-term investments

at the holding company level. The decline in the portfolio yield

resulted from a decrease in the return from partnerships and other

mark-to-market investments which more than offset higher short-term

floating rates and new money investment yields.

Compared to the first quarter of 2023, second quarter surrender

charge income increased $7 million to $34 million, reflecting

increased lapsation associated with higher interest rates

positively affecting yields on bank deposits and new money caps,

participation rates and credited interest rates on annuities

offered by American Equity and its competitors.

Outflows in the second quarter of 2023, including surrenders,

income utilization and partial withdrawals, were nearly flat

compared to the first quarter of 2023, totaling $1.3 billion.

As of June 30, 2023, account value of business ceded subject to

fee income was $10.9 billion, up from $10.2 billion three months

earlier. Flow reinsurance ceded subject to fee income in the second

quarter of 2023 totaled $821 million of account value. Revenue

associated with recurring fees under reinsurance agreements for the

second quarter of 2023 totaled $23 million compared to $22 million

for the first quarter of 2023, each as adjusted to reflect non-GAAP

operating income available to common stockholders1. First quarter

2023 revenue included a positive $1 million true-up associated with

the final settlement of the fourth quarter 2022 reinsurance

transaction.

The cost of money for deferred annuities in the second quarter

increased $4 million from the first quarter of 2023 to $217

million. Cost of money in the second quarter of 2023 benefited from

approximately $4 million in hedging gains.

Compared to the first quarter of 2023, the change in the MRB

liability decreased by $6 million to $41 million when adjusted to

reflect non-GAAP operating income available to common

stockholders1. Second quarter 2023 change in MRB liability adjusted

to reflect non-GAAP operating income available to common

stockholders1 was $5 million less than expected, consisting of a $7

million benefit from reserves released due to higher-than-expected

surrenders, and a $4 million benefit from higher amortization of

net deferred capital market impact due to favorable second quarter

capital market changes, offset by $6 million of other adverse

experience. The change in the modeled expectation for the MRB

liability, adjusted to reflect non-GAAP operating income available

to common stockholders1, for the third quarter of 2023 is $41.5

million, before the effects of potential third quarter actuarial

assumption revisions, based on current in-force. Third quarter 2023

expected change in the MRB liability includes an expected benefit

from the amortization of capital market impacts on the fair value

of market risk benefits of $20 million.

Amortization of deferred policy acquisition and sales inducement

cost was basically flat at $115 million for the second quarter of

2023. Amortization in the quarter included $1 million of expense

associated with new sales. For the third quarter of 2023, the

modeled expectation for deferred acquisition cost and deferred

sales inducement amortization is $117 million before the effect of

new sales, experience variances and potential third quarter

actuarial assumption revisions.

Other operating costs and expenses for the second quarter of

2023 increased to $76 million, up $2 million from the first

quarter. Notable items2 in the second and first quarters of 2023

were $11 million and $12 million, pre-tax, respectively, both

reflecting quarterly expense associated with the strategic

incentive compensation award made in November 2022.

The effective tax rate on pre-tax operating income available for

common stockholders1 for the second quarter of 2023 was 20.8%

compared to the first quarter of 2023 tax rate of 24.4%. Tax

expense in the first quarter included a $6 million true-up related

to 2022 which contributed approximately 300 basis points to the

effective tax rate.

POINT-IN-TIME YIELD INCREASES ON STRONG ORIGINATION OF

PRIVATE ASSETS

American Equity’s investment spread was 2.57% for the second

quarter of 2023 compared to 2.67% for the first quarter of 2023 and

2.64% for the second quarter of 2022. Excluding non-trendable

items3, adjusted investment spread decreased to 2.53% in the second

quarter of 2023 from 2.67% in the first quarter of 2023.

Average yield on invested assets was 4.42% in the second quarter

of 2023 compared to 4.48% in the first quarter of 2023. The average

adjusted yield on invested assets excluding non-trendable items3

was 4.41% in the second quarter of 2023 compared to 4.48% in the

first quarter of 2023.

During the second quarter of 2023, investment asset purchases

totaled $2.3 billion and were made at an average rate of 6.54%,

including approximately $800 million of private assets at

7.14%.

The point-in-time yield on the portfolio at June 30, 2023, was

4.77%. We continue to expect to see positive impacts from higher

short term rates on $7.2 billion of floating rate securities in the

investment portfolio, while we add to our existing cash and cash

equivalents positions to reduce risk in the investment portfolio as

we prepare for the closing of our proposed Merger with Brookfield

Reinsurance. Reflecting these actions, the point-in-time yield at

the end of the third quarter of 2023 is expected to be relatively

flat compared to the end of the previous quarter.

The aggregate cost of money for annuity liabilities of 1.85% in

the second quarter of 2023 was up four basis points compared to the

first quarter of 2023. The cost of money in the second quarter of

2023 reflects a three-basis point benefit from the over-hedging of

index-linked credits compared to a minimal benefit in the first

quarter of 2023. The seven-basis point increase in the adjusted

cost of money compared to the first quarter is in line with

increased market costs.

Cost of options in the second quarter of 2023 averaged 1.93%

compared to 1.79% in the first quarter of 2023, reflecting both

market effects on the cost of options for renewals as well as

higher option costs on new sales due to increases in caps,

participation rates and credited interest rates on our annuity

products over time consistent with the interest rate environment.

Approximately 70% of the increase in the cost of options in the

second quarter was associated with new sales.

Net account balance growth in the second quarter was a positive

$111 million, or 0.2% of account values, compared to a net account

balance decrease of $472 million in the first quarter. Index

credits in the second quarter were generally in-line with modeled

expectations while net flows improved substantially from the first

quarter of the year.

FIA SALES INCREASE 95% FROM PRIOR SEQUENTIAL QUARTER

Second quarter 2023 sales were $2.0 billion, of which 93.9%, or

$1.9 billion, were in fixed index annuities. Total enterprise FIA

sales increased 94.7% and 142.0% compared to the first quarter of

2023 and the second quarter of 2022, respectively. Compared to the

first quarter of 2023, FIA sales at American Equity Life in the

Independent Marketing Organization (IMO) channel doubled, while

Eagle Life FIA sales through banks and broker-dealers rose

77.7%.

Bhalla noted, "Total enterprise sales in July were approximately

$680 million. As interest rates remain volatile, and possibly move

higher, we may see competitors chase rates. In that scenario, we

will likely continue to emphasize building cash on the balance

sheet, with an eye towards even better investment opportunities in

the future, while maintaining the underwriting discipline necessary

to write resilient, double-digit, return on capital business.

Therefore, we expect to manage sales levels through the remainder

of the year to finish 2023 with total FIA sales in the $5 billion

to $6 billion range across our IMO, bank and broker dealer

channels. We expect the bank and broker dealer channels to

contribute approximately 25% of new sales – a meaningful

achievement reflecting the re-building of these channels over the

past three years."

CREDIT AND CAPITAL METRICS LARGELY UNCHANGED

With regard to credit markets, Jim Hamalainen, Chief Investment

Officer, added, "Credit metrics in the investment portfolio remain

largely unchanged from the end of the first quarter, and our fixed

securities portfolio remains A- rated. Total net realized losses

for the quarter of approximately $25 million includes a loss of $44

million on First Republic Bank. Regional bank valuations have

stabilized, and we remain comfortable with our $127 million

exposure, which is heavily slanted towards the large regionals and

has an overall rating in the BBB+ range. We saw very little

deterioration in the commercial mortgage loan portfolio and all

loans are performing. Average loan-to-value of the CML portfolio

remains at 53% and over 80% of the portfolio maintains a debt

service coverage ratio of 1.2x or higher. Looking specifically at

our direct office mortgage loan exposure, we are considerably

underweight relative to our peers at just 8% of the CML portfolio.

The average debt service coverage ratio on the office mortgage loan

portfolio is 1.91x with an average loan-to-value ratio of 61%. We

have only $7 million of loans maturing through the end of 2024 with

just $31 million set to mature in 2025."

Hamalainen continued, "So far through the third quarter, we have

built up a substantial cash position in the investment portfolio of

$5.4 billion funded through sales of the core fixed income

portfolio – primarily corporate bonds, municipal bonds and

structured assets – and we expect our cash position to increase to

between $7 billion and $10 billion over the next few quarters with

cash likely at the low-end of the range by year-end. These actions

will help protect the company if macro-economic trends point to

stubbornly high inflation or growing risks in the economy, while

providing the company with substantial dry powder to take advantage

of opportunities that may emerge in the private asset sector over

the coming year."

Following the announcement of the definitive agreement to merge

with Brookfield Reinsurance, the company terminated its accelerated

share repurchase program having repurchased the 4.8 million shares

delivered to it on March 20, 2023. Given the impending merger

transaction, the previously announced capital return plan for the

company is currently suspended.

As of June 30, total adjusted capital at American Equity Life

Insurance Co. totaled $4.1 billion with estimated excess capital of

over $600 million. Additionally, cash and equivalents at the

holding company level was $390 million at quarter-end and $462

million as of July 31st.

UPDATE ON DEFINITIVE AGREEMENT WITH BROOKFIELD

REINSURANCE

On July 5, 2023, Brookfield Reinsurance and American Equity

announced that they had entered into a definitive agreement whereby

Brookfield Reinsurance will acquire all of the outstanding shares

of common stock of American Equity it does not already own in a

cash and stock transaction that values AEL at approximately $4.3

billion.

The merger is expected to close in the first half of 2024,

subject to approval by American Equity shareholders and other

closing conditions customary for a transaction of this type,

including receipt of insurance regulatory approvals in relevant

jurisdictions and the expiration or termination of the applicable

waiting period under the Hart-Scott-Rodino Antitrust Improvements

Act of 1976.

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

The forward-looking statements in this release such as believe,

build, confident, continue, could, estimate, expect, exposure,

future, grow, likely, maintain, may, might, model, opportunity,

outlook, plan, potential, proposed, risk, scenario, should, trend,

will, would, and their derivative forms and similar words, as well

as any projections of future results, are based on assumptions and

expectations that involve risks and uncertainties, including the

"Risk Factors" the company describes in its U.S. Securities and

Exchange Commission filings. The Company's future results could

differ, and it has no obligation to correct or update any of these

statements.

ABOUT AMERICAN EQUITY

At American Equity Investment Life Holding Company, our

policyholders work with over 40,000 independent agents and advisors

affiliated with independent market organizations (IMOs), banks and

broker-dealers through our wholly-owned operating subsidiaries.

Advisors and agents choose one of our leading annuity products best

suited for their clients' personal needs to create financial

dignity in retirement. To deliver on its promises to policyholders,

American Equity has re-framed its investment focus — building a

stronger emphasis on insurance liability driven asset allocation

and specializing in alternate, private asset management while

partnering with world renowned, public fixed income asset managers.

American Equity is headquartered in West Des Moines, Iowa with

additional offices in Charlotte, NC, New York, NY and Miami, FL.

For more information, please visit www.american-equity.com.

1

Use of non-GAAP financial measures is

discussed in this release in the tables that follow the text of the

release.

2

Notable items reflect the increase

(decrease) to non-GAAP operating income (loss) available to common

stockholders for certain matters where more detail may help

investors better understand, evaluate, and forecast results.

Notable items are further discussed in the tables that follow the

text of the release.

3

Non-trendable items are the impact of

investment yield – additional prepayment income and cost of money

effect of over (under) hedging as shown in our June 30, 2023

financial supplement on page 10, “Spread Results”.

4

For the purposes of this document, all

references to sales are on a gross basis. Gross sales is defined as

sales before the use of reinsurance.

American Equity Investment Life Holding Company

Unaudited (Dollars in thousands)

Consolidated Statements of

Operations

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Revenues:

Premiums and other considerations

$

2,516

$

3,831

$

6,653

$

13,909

Annuity product charges

71,642

55,514

134,233

107,869

Net investment income

542,685

592,308

1,104,008

1,159,731

Change in fair value of derivatives

242,739

(506,181

)

288,629

(983,700

)

Net realized losses on investments

(24,679

)

(33,272

)

(52,466

)

(46,399

)

Other revenue

16,736

9,408

33,130

18,225

Total revenues

851,639

121,608

1,514,187

269,635

Benefits and expenses:

Insurance policy benefits and change in

future policy benefits

5,125

6,998

12,333

20,613

Interest sensitive and index product

benefits

122,387

140,346

180,298

428,263

Market risk benefits (gains) losses

(144,124

)

(299,278

)

39,570

(107,385

)

Amortization of deferred sales

inducements

46,951

44,696

93,552

89,781

Change in fair value of embedded

derivatives

213,764

(885,984

)

618,204

(2,279,633

)

Interest expense on notes and loan

payable

11,227

6,461

22,245

12,886

Interest expense on subordinated

debentures

1,338

1,346

2,674

2,663

Amortization of deferred policy

acquisition costs

68,476

72,485

136,711

145,454

Other operating costs and expenses

75,697

59,872

149,701

117,667

Total benefits and expenses

400,841

(853,058

)

1,255,288

(1,569,691

)

Income before income taxes

450,798

974,666

258,899

1,839,326

Income tax expense

95,652

211,377

59,644

396,572

Net income

355,146

763,289

199,255

1,442,754

Less: Net loss available to noncontrolling

interests

(217

)

(4

)

(114

)

(4

)

Net income available to American Equity

Investment Life Holding Company stockholders

355,363

763,293

199,369

1,442,758

Less: Preferred stock dividends

10,919

10,919

21,838

21,838

Net income available to American Equity

Investment Life Holding Company common stockholders

$

344,444

$

752,374

$

177,531

$

1,420,920

Earnings per common share

$

4.43

$

8.13

$

2.20

$

15.01

Earnings per common share - assuming

dilution

$

4.36

$

8.06

$

2.17

$

14.86

Weighted average common shares outstanding

(in thousands):

Earnings per common share

77,767

92,544

80,576

94,693

Earnings per common share - assuming

dilution

78,928

93,375

81,824

95,652

NON-GAAP FINANCIAL MEASURES

In addition to net income available to common stockholders, we

have consistently utilized non-GAAP operating income available to

common stockholders and non-GAAP operating income available to

common stockholders per common share - assuming dilution, non-GAAP

financial measures commonly used in the life insurance industry, as

economic measures to evaluate our financial performance. Non-GAAP

operating income available to common stockholders equals net income

available to common stockholders adjusted to eliminate the impact

of items that fluctuate from quarter to quarter in a manner

unrelated to core operations, and we believe measures excluding

their impact are useful in analyzing operating trends. The most

significant adjustments to arrive at non-GAAP operating income

available to common stockholders eliminate the impact of fair value

accounting for our fixed index annuity business. These adjustments

are not economic in nature but rather impact the timing of reported

results. We believe the combined presentation and evaluation of

non-GAAP operating income available to common stockholders together

with net income available to common stockholders provides

information that may enhance an investor’s understanding of our

underlying results and profitability.

Reconciliation from Net Income

Available to Common Stockholders to Non-GAAP Operating Income

Available to Common Stockholders

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Net income available to American Equity

Investment Life Holding Company common stockholders

$

344,444

$

752,374

$

177,531

$

1,420,920

Adjustments to arrive at non-GAAP

operating income available to common stockholders:

Net realized losses on financial assets,

including credit losses

22,737

37,054

47,121

50,779

Change in fair value of derivatives and

embedded derivatives

(124,816

)

(470,813

)

81,386

(1,318,020

)

Capital markets impact on the change in

fair value of market risk benefits

(184,700

)

(335,330

)

(47,750

)

(216,417

)

Net investment income

4,609

—

2,118

—

Other revenue

5,969

—

11,938

—

Income taxes

59,373

167,944

(20,392

)

321,034

Non-GAAP operating income available to

common stockholders

$

127,616

$

151,229

$

251,952

$

258,296

Impact of excluding notable items (a)

$

8,892

$

—

$

18,458

$

—

Per common share - assuming dilution:

Net income available to American Equity

Investment Life Holding Company common stockholders

$

4.36

$

8.06

$

2.17

$

14.86

Adjustments to arrive at non-GAAP

operating income available to common stockholders:

Net realized losses on financial assets,

including credit losses

0.29

0.39

0.58

0.53

Change in fair value of derivatives and

embedded derivatives

(1.58

)

(5.04

)

0.99

(13.78

)

Capital markets impact on the change in

fair value of market risk benefits

(2.34

)

(3.59

)

(0.58

)

(2.26

)

Net investment income

0.06

—

0.02

—

Other revenue

0.08

—

0.15

—

Income taxes

0.75

1.80

(0.25

)

3.35

Non-GAAP operating income available to

common stockholders

$

1.62

$

1.62

$

3.08

$

2.70

Impact of excluding notable items (a)

$

0.11

$

—

$

0.23

$

—

Notable Items

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Notable items impacting non-GAAP operating

income available to common stockholders:

Expense associated with strategic

incentive award

8,892

—

$

18,458

$

—

Total notable items (a)

$

8,892

$

—

$

18,458

$

—

(a)

Notable items reflect the after-tax

increase (decrease) to non-GAAP operating income (loss) available

to common stockholders for certain matters where more detail may

help investors better understand, evaluate, and forecast

results.

For the three and six months ended June

30, 2023, non-GAAP operating income available to common

stockholders would increase $8.9 million and $18.5 million,

respectively, if we were to exclude the impact of notable

items.

Book Value per Common

Share

Q2 2023

Total stockholders’ equity attributable

to American Equity Investment Life Holding Company

$

2,571,915

Equity available to preferred stockholders

(a)

(700,000

)

Total common stockholders' equity (b)

1,871,915

Accumulated other comprehensive (income)

loss (AOCI)

3,425,248

Total common stockholders’ equity

excluding AOCI (b)

5,297,163

Net impact of fair value accounting for

derivatives and embedded derivatives

(1,587,599

)

Net capital markets impact on the fair

value of market risk benefits

(638,442

)

Total common stockholders’ equity

excluding AOCI and the net impact of fair value accounting for

fixed index annuities (b)

$

3,071,122

Common shares outstanding

78,047,941

Book Value per Common Share:

(c)

Book value per common share

$

23.98

Book value per common share excluding AOCI

(b)

$

67.87

Book value per common share excluding AOCI

and the net impact of fair value accounting for fixed index

annuities (b)

$

39.35

(a)

Equity available to preferred stockholders

is equal to the redemption value of outstanding preferred stock

plus share dividends declared but not yet issued.

(b)

Total common stockholders' equity, total

common stockholders' equity excluding AOCI and total common

stockholders' equity excluding AOCI and the net impact of fair

value accounting for fixed index annuities, non-GAAP financial

measures, exclude equity available to preferred stockholders. Total

common stockholders’ equity and book value per common share

excluding AOCI, non-GAAP financial measures, are based on common

stockholders’ equity excluding the effect of AOCI. Since AOCI

fluctuates from quarter to quarter due to unrealized changes in the

fair value of available for sale securities, we believe these

non-GAAP financial measures provide useful supplemental

information. Total common stockholders' equity and book value per

common share excluding AOCI and the net impact of fair value

accounting for fixed index annuities, non-GAAP financial measures,

are based on common stockholders' equity excluding AOCI and the net

impact of fair value accounting for fixed index annuities. Since

the net impact of fair value accounting for our fixed index annuity

business is not economic in nature but rather impact the timing of

reported results, we believe these non-GAAP financial measures

provide useful supplemental information.

(c)

Book value per common share including and

excluding AOCI and book value per common share excluding AOCI and

the net impact of fair value accounting for fixed index annuities

are calculated as total common stockholders’ equity, total common

stockholders’ equity excluding AOCI and total common stockholders'

equity excluding AOCI and the net impact of fair value accounting

for fixed index annuities divided by the total number of shares of

common stock outstanding.

NON-GAAP FINANCIAL MEASURES

Average Common Stockholders' Equity and

Return on Average Common Stockholders' Equity

Return on average common stockholders' equity measures how

efficiently we generate profits from the resources provided by our

net assets. Return on average common stockholders' equity is

calculated by dividing net income available to common stockholders,

for the trailing twelve months, by average equity available to

common stockholders. Non-GAAP operating return on average common

stockholders' equity excluding average accumulated other

comprehensive income (AOCI) and average net impact of fair value

accounting for fixed index annuities is calculated by dividing

non-GAAP operating income available to common stockholders, for the

trailing twelve months, by average common stockholders' equity

excluding average AOCI and average net impact of fair value

accounting for fixed index annuities. We exclude AOCI because AOCI

fluctuates from quarter to quarter due to unrealized changes in the

fair value of available for sale investments. We exclude the net

impact of fair value accounting for fixed index annuities as the

amounts are not economic in nature but rather impact the timing of

reported results.

Twelve Months Ended

June 30, 2023

Average Common Stockholders' Equity

Attributable to American Equity Investment Life Holding Company,

Excluding Average AOCI and Average Net Impact of Fair Value

Accounting for Fixed Index Annuities

Average total stockholders’ equity

$

3,098,646

Average equity available to preferred

stockholders

(700,000

)

Average equity available to common

stockholders

2,398,646

Average AOCI

2,828,421

Average common stockholders' equity

excluding average AOCI

5,227,067

Average net impact of fair value

accounting for derivatives and embedded derivatives

(1,502,922

)

Average net capital markets impact on the

fair value of market risk benefits

(550,149

)

Average common stockholders' equity

excluding average AOCI and average net impact of fair value

accounting for fixed index annuities

$

3,173,996

Net income available to American Equity

Investment Life Holding Company common stockholders

$

633,155

Adjustments to arrive at non-GAAP

operating income available to common stockholders:

Net realized losses on financial assets,

including credit losses

44,606

Change in fair value of derivatives and

embedded derivatives

(149,799

)

Capital markets impact on the change in

fair value of market risk benefits

(224,950

)

Net investment income

3,594

Other revenue

17,907

Income taxes

60,412

Non-GAAP operating income available to

common stockholders

$

384,925

Impact of excluding notable items (a)

$

200,348

Return on Average Common Stockholders'

Equity Attributable to American Equity Investment Life Holding

Company

Net income available to common

stockholders

26.4

%

Return on Average Common Stockholders'

Equity Attributable to American Equity Investment Life Holding

Company, Excluding Average AOCI and Average Net Impact of Fair

Value Accounting for Fixed Index Annuities

Non-GAAP operating income available to

common stockholders

12.1

%

Notable

Items

Twelve Months Ended

June 30, 2023

Notable items impacting non-GAAP operating

income available to common stockholders:

Expense associated with strategic

incentive award

$

18,458

Impact of actuarial assumption updates

181,890

Total notable items (a)

$

200,348

(a)

Notable items reflect the after-tax

increase (decrease) to non-GAAP operating income (loss) available

to common stockholders for certain matters where more detail may

help investors better understand, evaluate, and forecast

results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230807814685/en/

Steven D. Schwartz, Head of Investor Relations (515)

273-3763, sschwartz@american-equity.com

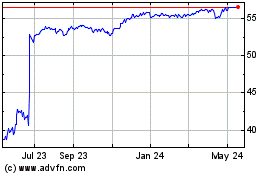

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Feb 2025 to Mar 2025

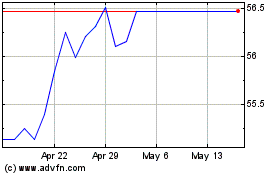

American Equity Investme... (NYSE:AEL)

Historical Stock Chart

From Mar 2024 to Mar 2025