Form SCHEDULE 13D/A - General Statement of Acquisition of Beneficial Ownership: [Amend]

12 February 2025 - 1:10AM

Edgar (US Regulatory)

TAFE Comments on AGCO’s Disappointing Results

and Botched PTx Trimble Integration

Notes that Seth Crawford, Senior Vice President

and General Manager of PTx Trimble, Appears to Have Left AGCO Following ~$354 Million Goodwill Impairment Charges

Withdraws 14a-8 Shareholder Proposal Due to

TAFE’s Belief that Stronger Action Is Needed to Enhance AGCO’s Governance and Protect Shareholder Value

CHENNAI--(BUSINESS WIRE)--Tractors and Farm Equipment

Limited (together with certain of its affiliates, “TAFE” or “we”), the largest shareholder of AGCO Corporation

(NYSE: AGCO) (“AGCO” or the “Company”) with a 16.3% long-term, strategic equity stake in the Company, today issued

the following statement regarding AGCO’s recently reported fourth quarter and 2024 full year results. TAFE also disclosed that it

has withdrawn its 14a-8 shareholder proposal from the agenda for the 2025 Annual Meeting of Shareholders (the “Annual Meeting”)

following AGCO’s ill-conceived efforts to exclude the proposal, reaffirming TAFE’s belief that more substantial action must

be taken to enhance the Company’s governance and turn around its struggling operational performance.

“AGCO’s revenue and operating margin

have trailed peers for more than a decade – even as leadership has poured significant capital into numerous acquisitions. The Company’s

recent Analyst Day and financial results have only deepened our concerns regarding AGCO’s strategic direction and the Board’s

inadequate oversight of all areas of the business.

After spending $2 billion to acquire PTx Trimble

technology assets, the Company has not disclosed key metrics related to the joint venture, including its 2024 performance, 2025 outlook

and the impact of layoffs. We are extremely concerned by PTx’s approximately $354 million goodwill impairment charges – an

unexpected write-off of roughly 17% of its price tag that comes less than one year after the deal.1 We also note that PTx

Senior Vice President and General Manager Seth Crawford has recently been removed from AGCO’s website, deepening concerns about

a venture that was pitched by management as a significant growth driver for the Company’s precision ag business.2 The

apparent departure of the executive tasked with generating value from AGCO’s largest acquisition to date – less than two months

after he presented to investors at the Company’s Analyst Day – is a stunning admission of the serious integration issues at

Trimble.

We believe AGCO is holding onto a niche strategy

that does not address structural readiness for downcycles and has proven ineffective over the long-term. We were particularly disappointed

to see AGCO once again deliver worse-than-expected dealer inventory levels in the fourth quarter, which we believe demonstrates leadership’s

inability to effectively forecast and navigate the industry downturn. AGCO cannot keep kicking the can down the road by attempting to

divert shareholders’ attention from these critical issues by promoting 2029 targets without providing a clear path to achieving

them.

____________________

1 For the fourth quarter of 2024,

the Company disclosed goodwill impairment charges of $354.1 million related to the North America operating segment and stated that the

majority of the impairment charges related to the PTx Trimble North America reporting unit.

2 Mr. Crawford appeared on AGCO’s

Executive Leadership webpage as recently as December 2024 (https://www.agcocorp.com/us/en/home/about-us/executive-leadership.html). However,

he no longer appears on the page. Additionally, Mr. Crawford’s biography on AGCO’s website appears to have been removed (https://www.agcocorp.com/us/en/home/about-us/executive-leadership/leadership-seth-crawford.html).

Despite mounting pressure to deliver

improved results for investors, the Board has chosen to repeatedly ignore its largest shareholder’s ideas and disenfranchise

TAFE, including by making efforts to exclude our 14a-8 shareholder proposal from the Company’s proxy statement for the 2025

Annual Meeting. Disappointed by the Board’s attempt to deny shareholders a vote on this governance improvement, TAFE has

withdrawn our 14a-8 shareholder proposal as we believe that stronger action must be taken to strengthen the Board’s oversight

of management and ensure a focus on shareholder value creation.

TAFE continues to engage with the Company in good

faith and remains open to a constructive solution that would benefit all stakeholders. We reserve all rights to take whatever steps we

believe are necessary to enhance the Company’s governance practices and protect shareholder value at the upcoming Annual Meeting.”

About TAFE

TAFE - Tractors and Farm Equipment Limited, is

an Indian tractor major incorporated in 1960 at Chennai, India. One of the largest tractor manufacturers in the world and the second largest

in India, TAFE sells over 180,000 tractors annually.

TAFE has earned the trust of customers with its

range of high-quality products, low cost of operation and a strong distribution network of over 1600+ dealers. TAFE exports tractors to

over 80 countries, powering farms in Asia, Africa, Europe, the Americas, and Russia.

Besides tractors, TAFE and its subsidiaries have

diverse business interests in areas such as farm-machinery, diesel engines and gensets, agro-industrial engines, engineering plastics,

gears and transmission components, hydraulic pumps and cylinders, vehicle franchises and plantations.

TAFE is committed to Total Quality Management

(TQM). In the recent past, various manufacturing plants of TAFE have garnered numerous ‘TPM Excellence’ awards from the Japan

Institute of Plant Maintenance (JIPM), as well as a number of other regional awards for TPM excellence. TAFE's tractor plants are certified

under international standards ISO 9001 for efficient quality management systems and under ISO 14001 for environment-friendly operations.

In 2013, TAFE was presented the coveted ‘Agriculture Leadership Award' by Agriculture Today Magazine and the ‘Corporate Citizen

of the Year Award’ by Public Relations Council of India (PRCI). TAFE was also named the ‘Best Employer in India 2013’

by Aon Hewitt and has the distinction of receiving commendation for ‘Significant Achievement on the Journey Towards Business Excellence’

by the CII-EXIM Bank - Business Excellence Award jury in 2012.

Contacts

Longacre Square Partners

Charlotte Kiaie / Bela Kirpalani, (646) 386-0091

TAFE@longacresquare.com

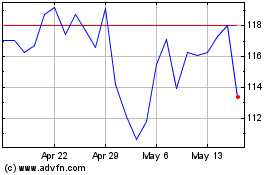

AGCO (NYSE:AGCO)

Historical Stock Chart

From Jan 2025 to Feb 2025

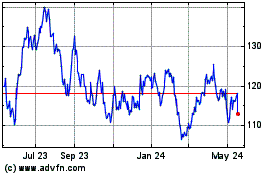

AGCO (NYSE:AGCO)

Historical Stock Chart

From Feb 2024 to Feb 2025