0001865107FALSE00018651072023-11-072023-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2023

a.k.a. Brands Holding Corp.

(Exact Name of Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 001-40828 | 87-0970919 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer

Identification No.) |

100 Montgomery Street, Suite 1600

San Francisco, California 94104

(Address of Principal Executive Offices, including Zip Code)

415-295-6085

(Registrant’s Telephone Number, Including Area Code)

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class: | | Trading Symbol(s): | | Name of each exchange on which registered: |

| Common Stock, par value $0.001 per share | | AKA | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

| | | | | |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

As previously announced, Jill Ramsey, the Company’s Chief Executive Officer, and the Board of Directors (the “Board”) of a.k.a. Brands Holding Corp. (the “Company”) determined that Ms. Ramsey would take time to work through unforeseen medical issues. On November 7, 2023, Ms. Ramsey and the Board determined that Ms. Ramsey will no longer serve as the Chief Executive Officer of the Company, effective November 7, 2023. Ms. Ramsey will become the Advisor to the Chief Executive Officer and will remain a director of the Company. As previously announced, Ciaran Long, the Company’s Interim Chief Executive Officer and Chief Financial Officer, will continue to serve as the Company’s Interim Chief Executive Officer. The Board has initiated a search for a permanent Chief Executive Officer.

In connection with Ms. Ramsey’s transition, the Company and Ms. Ramsey entered into an offer letter, dated as of November 7, 2023 (the “Offer Letter”), which supersedes the employment agreement between the Company and Ms. Ramsey dated April 21, 2020. Pursuant to the Offer Letter, Ms. Ramsey will remain employed, on an at-will basis, in the role of Advisor to the Chief Executive Officer until November 7, 2024 (the “Anticipated Settlement Date”), or such other date as mutually agreed upon by the parties. Under the terms of the Offer Letter, Ms. Ramsey will be entitled to receive an annual base salary of $150,000. Ms. Ramsey will continue to be eligible to receive an annual bonus under the Company’s bonus program as determined by the Company at its discretion. Ms. Ramsey will also be eligible to participate in the Company’s annual equity program based on a target percentage to be determined by the Company at its discretion. Ms. Ramsey will retain her rights in any vested incentive units in Excelerate, L.P., which will continue to be subject to the applicable award agreements. Ms. Ramsey will continue to be entitled to participate in the employee and fringe benefit plans and programs that are generally available to the senior management of the Company. In the event of termination without cause (as defined in the Offer Letter), Ms. Ramsey will be entitled to severance pay equal to her pro-rated base salary for the period from her last day of employment to the Anticipated Separation Date, subject to the terms of the Offer Letter.

In connection with Ms. Ramsey’s continued service as a director of the Company, the Company entered into an indemnification agreement with Ms. Ramsey in the same form as the Company’s other directors have entered. The form of indemnification agreement is filed as Exhibit 10.3 to the Company’s Registration Statement on Form S-1 (File No. 333-259028), originally filed with the U.S. Securities and Exchange Commission on August 24, 2021, as amended.

The foregoing summary of the terms of the Offer Letter is qualified in its entirety by the terms of the Offer Letter, a copy of which is attached as Exhibit 10.1 to this Report on Form 8-K.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits

| | | | | |

| Exhibit No. | Description |

| 10.1 | |

| 104 | Cover page interactive data file (embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| | a.k.a. Brands Holding Corp. |

| | | |

| Date: November 9, 2023 | By: | /s/ Ciaran Long |

| | Name: | Ciaran Long |

| | Title: | Interim Chief Executive Officer and Chief Financial Officer |

November 7, 2023

PERSONAL & CONFIDENTIAL

Ms. Jill Ramsey

65 Shore View Ave.

San Francisco, CA 94121

Via Email Only:

Dear Jill,

It is with great pleasure that we extend you an opportunity to continue working with a.k.a. Brands (Excelerate US, Inc. or the “Company”) team in the new position of Strategic Advisor to the CEO. You will report directly to the CEO based at 100 Montgomery, Suite 2270, San Francisco, CA 94104. Your position as Strategic Advisor will be banded at the same level as the C-level executives of the Company for purposes of your eligibility under benefits programs of the Company.

The following sections provide additional details regarding your employment with a.k.a. Brands. While this information is provided as a courtesy to you, it does not constitute a guarantee of continuous employment or an employment contract. Please note that employment with a.k.a. Brands is considered “employment-at-will.” As such, employment may be terminated at any time, by either you or a.k.a. Brands, with or without cause, with or without notice, subject to the terms of this letter agreement.

Your role is expected to end on November 7, 2024; provided that, unless you or the Company has provided, at least 30 days’ prior to the Anticipated Separation Date, written notice to the other of your or its election not to renew the term hereunder, the term of your employment hereunder shall be automatically extended for successive one-year periods on November 7, 2024 and each anniversary thereof thereafter (such last date of your employment hereunder, the “Anticipated Separation Date”).

COMPENSATION, HOURS & PAYDAYS

Your gross annual base compensation will be $150,000 ($5,769.23 bi-weekly). Paychecks are distributed biweekly, every other Friday for the previous two-week pay period. Your gross bi-weekly compensation is subject to all applicable taxes, withholdings, and any voluntary deductions you elect. Your position will be classified as an exempt position and will not be eligible for overtime.

ANNUAL BONUS

You will continue to be eligible to participate in a.k.a. Brands bonus program. Bonuses are generally awarded following the close of the fiscal year in March of every year. a.k.a. Brands awards are discretionary in nature based on the overall performance of the business and your individual performance. Bonus awards are never guaranteed. Bonus payouts are subject to all applicable taxes, withholdings, and any voluntary deductions you elect.

EQUITY

You will retain your rights in any incentive units in Excelerate, L.P., which will continue to be subject to any applicable award agreements or equity plans and shall continue vesting (uninterrupted) during your employment in accordance with the terms of those applicable award agreements and equity plans. Your position is currently eligible for participation in our annual equity program. Your annual incentive equity award target will be determined by a.k.a. Brands at its sole discretion, as approved by the Compensation Committee, based on Company and individual performance. Our Board of Directors, the Compensation Committee of the Board of Directors, and the Company, reserve the right to change or alter the Company’s incentive equity program at any time, with or without notice, with or without cause; provided that your rights to any incentive units in the Excelerate, L.P. shall continue to be subject to the applicable award agreements and equity plans.

SEVERANCE If your at-will employment with a.k.a. Brands is terminated before the Anticipated Separation Date without Cause (as defined below), the Company will provide you with severance pay equal to (i) your pro-rated base salary for the period from your last day of employment to the Anticipated Separation Date, (ii) if you (or your eligible dependents) elect COBRA, an amount equal to the Company portion of your monthly COBRA premiums through the Anticipated Separation Date, and (iii) vesting of all equity and incentive awards that have vested as of your last day of employment with the Company. Your severance package, if eligible, will be paid in a lump sum in accordance with the Company’s normal payroll practices. The receipt of any severance will be contingent upon you signing a customary Severance Agreement provided by and satisfactory to the Company, which will include at the minimum, a full waiver and release of all claims by you against the Company and any provisions needed to ensure compliance with the tax code applicable to severance benefits.

For purposes of this offer letter, “Cause” for termination shall mean that you have engaged in any of the following: (i) material breach of any covenant or condition under this offer letter, any surviving provisions of your Employment Agreement (as defined below), or any other material agreement between the parties; (ii) any act constituting dishonesty or fraud; (iii) any conduct which constitutes a felony under applicable law (excluding minor traffic violations, which do not include driving under the influence); (iv) material violation of any Company policy, including (without limitation) the Company’s policies prohibiting harassment or discrimination, or any act of misconduct that is harmful to the Company; (v) refusal to follow or implement a clear and reasonable directive of the CEO or the Board of Directors; (vi) negligence in the performance of your duties or repeated failure to perform such duties; or (vii) breach of your fiduciary duty to the Company. In the case of (i), (iv), (v), or (vi), if curable, you will have 10 days from delivery of written notice by the Company within which to cure any such acts constituting cause.

EXPENSES

a.k.a. Brands will reimburse you the cost of all reasonable and business-related expenses incurred in the execution of your duties, including any required travel. In addition, we will provide you with a bi-weekly stipend in the amount of $75.00 for both the use of your personal cell phone and the installation/use of any necessary high-speed internet service ($37.50 for each service).

BENEFITS

We are pleased to offer a generous benefits package to all employees who work more than twenty (20) hours a week on average during their employment with a.k.a. Brands. You will continue to be eligible for all Company benefits that you received immediately prior to your transition to Strategic Advisor. In addition, a.k.a. Brands will use its reasonable best efforts to continue your life insurance and long-term disability benefit coverage at the same levels and on the same basis as in effect immediately prior to your transition to Strategic Advisor.

WORKERS’ COMPENSATION COVERAGE

Keeping you safe at work is of the utmost importance to us. However, in the unlikely event of a workplace related illness or injury, a.k.a. Brands carries workers’ compensation insurance to cover medical and expenses related to a workplace illness or injury. If you experience a workplace related illness or injury, please inform your manager or the Human Resources team as soon as possible so that we can assist you in finding and receiving appropriate care. For your reference, our workers’ compensation policy is provided by:

Federal Insurance Co. (Chubb)

202B Hall’s Mill Road

P.O. Box 1600

Whitehouse Station, NJ 08889-1600

Claims: (800) 699-9916

Policy#

401(K) RETIREMENT PROGRAM

a.k.a. Brands sponsors a Safe-Harbor 401(k) retirement program via ADP Retirement Services. a.k.a. Brands will match 100% of your contribution’s dollar-for-dollar on up to 5% of your pay and subject to IRS limits. All your contributions and a.k.a. Brands matching contributions are immediately vested.

COMPANY PAID LIFE INSURANCE

a.k.a. Brands provides a 1x salary (up to $225,000.00) company paid life and accidental death and dismemberment insurance policy for all full-time employees through MetLife. Eligibility for these benefits will remain in force during the length of your employment.

SHORT-TERM DISABILITY (STD) AND LONG-TERM DISABILITY (LTD)

a.k.a. Brands provides a supplemental short-term disability (STD) and long-term disability (LTD) benefit that provides financial assistance in the event of a qualified absence through MetLife. Eligibility for these benefits will remain in force during the length of your employment.

VACATION TIME

a.k.a. Brands cares about your personal well-being and time-off from work to recharge. As a result, you will continue accruing paid vacation time at a rate equal to fifteen (15) days per calendar year (approximately 4.615 hours per biweekly pay period). You can begin to take paid vacation time as soon as it is accrued in increments of one (1) hour or greater. Any time requested for which you do not have a sufficient paid vacation balance will be considered unpaid. You can accrue a maximum of and carryover over up to one-and-a-half-times (1.75x) your annual accrual.

SICK TIME

Taking time off to rest and recuperate from a personal injury/illness is important at a.k.a. Brands. a.k.a. Brands provides employees with a lump sum balance equal to ten (10) days per calendar year in accordance with the “front-loading method” as described in California’s “Healthy Workplaces, Healthy Families Act of 2014.” Your sick time balance will reset each calendar year. Any unused time from year to year is forfeited at the time your balance resets. Sick time may be used in increments of one (1) hour for the diagnosis, care, or treatment of an existing health condition, or preventative care, for yourself or a family member. Additionally, sick time may be used if you are a victim of domestic violence, sexual assault, or stalking, or as part of an applicable leave of absence.

COMPANY HOLIDAYS

a.k.a. Brands recognizes several holidays throughout the year. As some holidays change the day of the week in which they are celebrated from year to year, a.k.a. Brands modifies its holiday calendar on an annual basis. As a quick reference, our office is traditionally closed (except for key positions like Customer Service) on the following days:

New Year’s Day

Labor Day

Presidents Day

Veterans Day

Memorial Day

Thanksgiving Day

Juneteenth

Christmas Day

Independence Day

PERSONAL HOLIDAY

In addition to the designated company holidays, we will provide up to 8-hours (1 day) of personal holiday time to use throughout the year to recognize the holidays, events, or days that are most important to your and family. You can have a maximum balance of and carryover over up to one-and-a-half-times (1.75x) your annual accrual.

TAX ADVICE

You are encouraged to obtain your own tax advice regarding your compensation and the package presented by a.k.a. Brands. Accepting our offer of employment denotes your understanding that a.k.a. Brands does not have a duty to design its compensation policies and/or programs in a manner that minimizes your personal tax liabilities arising from your compensation or participation in any or all of our programs.

Entire Agreement/Modification

This letter sets forth the entire agreement and understanding between you and the Company relating to the subject matter herein and supersedes all prior or contemporaneous discussions, understandings and agreements, whether oral or written, between you and the Company relating to the subject matter hereof, including without limitation the Employment Agreement dated May 4, 2020

between you and the Company (the “Employment Agreement”); provided that Sections 4(h), 5, 6, 7, 8, 11, 12, and 14-18, and 21-24 of the Employment Agreement shall survive and remain in full force and effect. This letter agreement is a binding contract and may not be modified or amended except by a written agreement, signed by the Company and by you.

ACCEPTANCE & GETTING STARTED

If you wish to accept the offer, please sign in the place provided below and return it via email or mail within the prescribed time.

If you have any questions, please feel free to contact our Chief Legal Officer & Head of People directly at kc@aka-brands.com or by phone.

Sincerely,

a.k.a. Brands

Excelerate US, Inc

K.C. White

Chief Legal Officer & Head of People – a.k.a. Brands

CANDIDATE ACKNOWLEDGEMENT OF OFFER LETTER TERMS

I, Jill Ramsey, accept this offer of employment with a.k.a. Brands (the “Company”) and agree to the terms and conditions outlined in this offer. I understand and agree that my employment with a.k.a. Brands is considered “at-will.” As such, I understand that my employment may be terminated by the Company at any time, with or without cause, and with or without notice, at either the option of the Company or myself, in each case, in accordance with the terms of my offer letter agreement. I further understand that the Company’s “at-will” employment policy cannot be amended, altered, or modified in any way by oral statements in any other way. The Company’s “at-will” employment policy can only be amended in a written amendment signed by the Company’s Chief Executive Officer or their designee.

| | | | | | | | |

/s/ Jill Ramsey | | 11/7/2023 |

Jill Ramsey | | Date |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

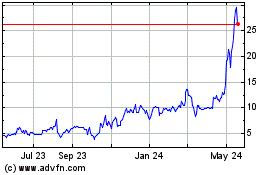

aka Brands (NYSE:AKA)

Historical Stock Chart

From Nov 2024 to Dec 2024

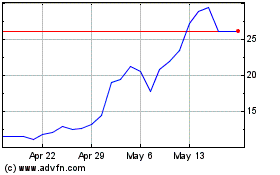

aka Brands (NYSE:AKA)

Historical Stock Chart

From Dec 2023 to Dec 2024