false

N-2

N-CSRS

LIBERTY ALL STAR GROWTH FUND INC.

0000786035

0000786035

2024-01-01

2024-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-04537

Liberty All-Star Growth Fund, Inc.

(Exact name of registrant as specified in charter)

1290 Broadway, Suite 1000, Denver, Colorado 80203

(Address of principal executive offices) (Zip code)

Sareena Khwaja-Dixon, Esq.

ALPS Fund Services, Inc.

1290 Broadway, Suite 1000

Denver, Colorado 80203

(Name and address of agent for service)

Registrant’s telephone number, including area

code: 303-623-2577

Date of fiscal year end: December 31

Date of reporting period: January 1, 2024 - June 30, 2024

Item 1. Report to Stockholders.

(a)

Contents

| 1 |

President’s

Letter |

| 5 |

Table

of Distributions, Rights Offerings and Distribution Policy |

| 6 |

Stock

Changes in the Quarter |

| 7 |

Top

20 Holdings and Economic Sectors |

| 8 |

Investment

Managers/Portfolio Characteristics |

| 9 |

Manager

Interview |

| 11 |

Schedule

of Investments |

| 17 |

Statement

of Assets and Liabilities |

| 18 |

Statement

of Operations |

| 19 |

Statements

of Changes in Net Assets |

| 20 |

Financial

Highlights |

| 22 |

Notes

to Financial Statements |

| 31 |

Consideration

of the Advisory Agreement |

| 34 |

Description

of Lipper Benchmark and Market Indices |

| Inside

Back Cover: Fund Information |

A

SINGLE INVESTMENT...

A

DIVERSIFIED GROWTH PORTFOLIO

A

single fund that offers:

| ● | A

diversified, multi-managed portfolio of small-, mid- and large-cap growth stocks |

| ● | Exposure

to many of the industries that make the U.S. economy one of the world’s most dynamic |

| ● | Access

to institutional quality investment managers |

| ● | Objective

and ongoing manager evaluation |

| ● | Active

portfolio rebalancing |

| ● | A

quarterly fixed distribution policy |

| ● | Actively

managed, exchange-traded, closed-end fund listed on the New York Stock Exchange (ticker symbol: ASG) |

LIBERTY

ALL-STAR® GROWTH FUND, INC.

| Liberty

All-Star® Growth Fund |

President’s

Letter |

(Unaudited)

| Fellow

Shareholders: |

July

2024 |

Mega-cap

technology stocks rallied around the Artificial Intelligence (AI) themed names that posted exceptional returns in the second quarter

and first half of 2024. In their wake, they carried the rest of the market higher, but it was the same tale of two markets that

over the past 18 months has seen outsized gains concentrated in a handful of names while the rest of the market delivered middling

or even negative returns. For the second quarter the group of stocks known as the “Magnificent Seven1”

shored up the return of the S&P 500®; NVIDIA led returns with a gain of 36.74 percent for the quarter and 149.50

percent for the first half after rising 239.02 percent in 2023.

Through

the first half of 2024, this extreme concentration grew even more pronounced. Information technology and communication services

were the only two sectors out of the 11 S&P 500® sectors to outperform the overall index. By itself, information

technology accounted for over 50 percent of the first half return for the S&P 500® Index.

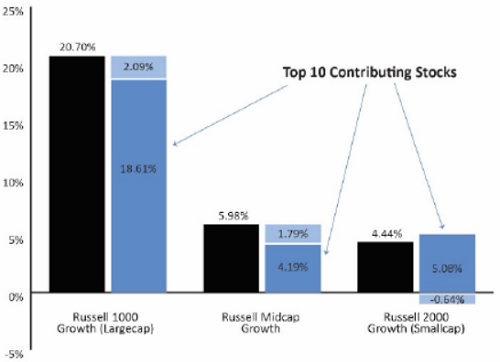

Among

the growth style indexes, there was great disparity across the capitalization range. For the first half, the large-cap Russell

1000® Growth Index returned 20.70 percent while the Russell Midcap® Growth Index returned 5.98 percent

and the small-cap Russell 2000® Growth Index returned 4.44 percent. Underscoring the disparity across the capitalization

range, in the second quarter the midcap and small-cap growth indices declined -3.21 percent and -2.92 percent, respectively. Only

the Russell 1000® Growth showed a positive return (8.33 percent). (Please refer to the chart on page 3 for a visual

display of first half returns.)

One

metric that demonstrates how concentrated even a diversified index like the S&P 500® has become: 74 percent

of stocks in the index underperformed the index as a whole in the second quarter. Further, the S&P 500® Equal

Weight Index actually lost -2.63 percent in the second quarter. (S&P 500® Index returns are usually reported

on a capitalization-weighted basis in which larger stocks are given proportionally more weight; when returns are reported on an

equal-weighted basis every company in the index is treated equally regardless of market capitalization.) Finally, of the 11 S&P

sectors, six actually posted negative returns for the quarter.

While

overall stock market performance was skewed by robust returns from just a few stocks, the overall economic and business backdrop

in the second quarter (and first half) was relatively sound. Perhaps of greatest significance, the ongoing battle against inflation

showed progress. The Federal Reserve’s preferred inflation measure—the core Personal Consumption Expenditure Price

Index (PCE), which strips out volatile food and energy items—declined in May, falling to a yearly increase of 2.6 percent

from 2.9 percent in December and 4.6 percent in May 2023. A strong employment market showed some cooling in May as well, with

recurring applications for U.S. jobless benefits rising to the highest level since the end of 2021, indicating it is beginning

to take longer for the unemployed to find work. Hiring in general has slowed significantly from the pandemic era of labor shortages

and the unemployment rate rose in May to 4 percent for the first time in over two years. Another indicator of a lessening in inflationary

pressure was a meager 0.1 percent increase in retail sales in May, while April sales were revised downward.

| 1 | Those

stocks are Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla. |

| Semi-Annual

Report (Unaudited) | June 30, 2024 |

1 |

| Liberty

All-Star® Growth Fund |

President’s

Letter |

(Unaudited)

These

indicators pointed to a slowing economy and thus heightened the possibility of lower interest rates. Economic data also indicated

the economy was on an even keel and therefore likely to avoid a “hard landing” that could mean recession. The S&P

500® was lower in April, but a key driver was concerns over geopolitical tensions in the Middle East. Spurred by

a 629 percent jump in year-over-year profits for NVIDIA, corporate earnings increased in the first quarter (reported in 2Q), led

by renewed sentiment favoring technology stocks. This sent the S&P 500® and NASDAQ Composite to multiple record

highs leading into the close of the first half.

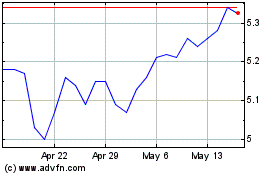

Liberty

All-Star® Growth Fund

Liberty

All-Star® Growth Fund saw moderate losses in the second quarter, returning -1.93 percent when shares are valued

at net asset value (NAV) with dividends reinvested and -0.52 percent when shares are valued at market price with dividends reinvested.

(Fund returns are net of expenses.) Compared with the first quarter, returns were muted not only for the Fund, but for its primary

benchmark and other key indices. That primary benchmark, the Lipper Multi-Cap Growth Mutual Fund Average, returned 1.85 percent.

As noted, the S&P 500® returned 4.28 percent and the DJIA returned -1.27 percent. The NASDAQ Composite posted

the strongest return, 8.47 percent.

For

the first half the Fund returned 5.82 percent when shares are valued at NAV and 5.55 percent when shares are valued at market

price (with dividends reinvested in both instances). The Lipper benchmark gained 13.93 percent. Respective returns for the S&P

500®, DJIA and the NASDAQ Composite were 15.29 percent, 4.79 percent and 18.57 percent.

The

factors that affected Fund performance in the first quarter remained in place in the second. First, in an environment that continued

to reward mega-cap growth stocks, the Fund was hurt by holding stocks in its large-cap allocation with an average weighted market

capitalization that is less than half that of the Russell 1000® Growth Index. Second, as noted in the market commentary,

mid-cap and small-cap stocks trailed large-cap stocks by a considerable margin, a situation exacerbated by the dominance of those

few, select mega-cap names in information technology. Moreover, concentration was also a factor with the mid- and small- cap indexes

driven by the AI move. This condition is illustrated by the chart on the next page.

During

the second quarter the discount at which Fund shares traded relative to their underlying NAV widened to a range of -8.2 percent

to -10.2 percent, ending the quarter at -8.4 percent. For the full first half, the discount ranged from -6.7 percent to -10.2

percent.

In

accordance with the Fund’s distribution policy, the Fund paid a distribution of $0.12 per share in the second quarter, bringing

the total distributed to shareholders since 1997, when the distribution policy commenced, to $17.16 per share for a total of more

than $450 million. The Fund’s distribution policy is a major component of the Fund’s total return, and we continue

to emphasize that shareholders should include these distributions when determining the total return on their investment in the

Fund.

Turning

to Fund news, the Board of Directors has approved the selection of Westfield Capital Management to replace Sustainable Growth

Advisers as the Fund’s large-cap growth manager. This change is subject to shareholder approval at the annual meeting of

shareholders to be held on August 28. Westfield practices a growth at a reasonable price investment approach, which will be used

to manage the large-cap growth portion of this Fund’s portfolio. Additional information on Westfield can be found in the

proxy statement that was sent to shareholders and Westfield will be featured in future shareholder reports.

| Liberty

All-Star® Growth Fund |

President’s

Letter |

(Unaudited)

GROWTH

STOCK RETURNS FOR FIRST HALF 2024

This

chart shows how concentrated growth stock returns were in the first half of 2024. The bar on the extreme left shows the 20.70

percent return of large-cap stocks comprising the Russell 1000® Growth Index. The bar next to it shows the top

10 contributing stocks accounted for 18.61 percentage points of that return, leaving the remaining stocks to generate a return

of just 2.09 percent. The middle set of bars shows the return of the Russell Midcap® Growth Index, 5.98 percent,

and that the top 10 stocks contributed 4.19 percent, meaning that all the remaining stocks returned 1.79 percent. The bars on

the right show returns for small-cap stocks comprising the Russell 2000® Growth Index. In this case, the top 10

returning stocks generated all (100 percent) of the index’s 4.44 percent return because these 10 names returned 5.08 percent

while the rest of index lost -0.64 percent.

There

is an old Wall Street adage that it’s not so much a stock market as it is a market of stocks. Thus far, in 2024, that piece

of Street wisdom is bearing out. The stock market as a whole is posting mediocre results while the market of stocks—and

a very few stocks at that—is soaring and pulling the others along with it. The fact that these stellar performers are large-

and mega-cap stocks only serves to leave behind what ordinarily would be attractive mid- and small-cap stocks. This is an unusual

set of circumstances, but such conditions have been known to persist. Eventually, the sentiment changes—and the change can

be quite dramatic. In the meantime, deviating from proven investment and portfolio construction principles to mirror the present

market invites an unacceptable level of risk. We will stay patient and manage in keeping with fundamentals that have proven effective

not in the moment, but over the years. Thank you for your support of the Fund.

Sincerely,

Mark

T. Haley, CFA

President

Liberty

All-Star® Growth Fund, Inc.

| Semi-Annual

Report (Unaudited) | June 30, 2024 |

3 |

| Liberty

All-Star® Growth Fund |

President’s

Letter |

(Unaudited)

| Fund Statistics (Periods ended June 30, 2024) |

| Net

Asset Value (NAV) |

$5.83 |

| Market

Price |

$5.34 |

| Discount |

-8.4% |

| |

Quarter |

Year-to-Date |

| Distributions* |

$0.12 |

$0.23 |

| Market

Price Trading Range |

$4.97

to $5.52 |

$4.97

to $5.54 |

| Discount

Range |

-8.2%

to -10.2% |

-6.7%

to -10.2% |

| Performance (Periods ended June 30, 2024) |

| Shares

Valued at NAV with Dividends Reinvested |

-1.93% |

5.82% |

| Shares

Valued at Market Price with Dividends Reinvested |

-0.52% |

5.55% |

| Dow

Jones Industrial Average |

-1.27% |

4.79% |

| Lipper

Multi-Cap Growth Mutual Fund Average |

1.85% |

13.93% |

| NASDAQ

Composite Index |

8.47% |

18.57% |

| Russell

Growth Average |

1.30% |

11.11% |

| S&P

500® Index |

4.28% |

15.29% |

| S&P

500® Equal Weight Index |

-2.63% |

5.08% |

| * | Sources

of distributions to shareholders may include ordinary dividends, long-term capital gains and return of capital. The final determination

of the source of all distributions in 2024 for tax reporting purposes will be made after year end. The actual amounts and sources

of the amounts for tax reporting purposes will depend upon the Fund’s investment experience during its fiscal year and may

be subject to changes based on tax regulations. Based on current estimates a portion of the distributions consist of a return

of capital. Pursuant to Section 852 of the Internal Revenue Code, the taxability of these distributions will be reported on Form

1099-DIV for 2024. |

Performance

returns for the Fund are total returns, which include dividends. Returns are net of management fees and other Fund expenses. The

returns shown for the Lipper Multi-Cap Growth Mutual Fund Average are based on open -end mutual funds’ total returns, which

include dividends, and are net of fund expenses. Returns for the unmanaged Dow Jones Industrial Average, NASDAQ Composite Index,

the Russell Growth Benchmark and the S&P 500® Indices are total returns, including dividends. A description

of the Lipper benchmark and the market indices can be found on page 34.

Past

performance cannot predict future results. Performance will fluctuate with market conditions. Current performance may be lower

or higher than the performance data shown. Performance information does not reflect the deduction of taxes that shareholders would

pay on Fund distributions or the sale of Fund shares. An investment in the Fund involves risk, including loss of principal. Closed-end

funds raise money in an initial public offering and shares are listed and traded on an exchange. Open-end mutual funds continuously

issue and redeem shares at net asset value. Shares of closed-end funds frequently trade at a discount to net asset value. The

price of the Fund’s shares is determined by a number of factors, several of which are beyond the control of the Fund. Therefore,

the Fund cannot predict whether its shares will trade at, below or above net asset value.

The

views expressed in the President’s letter and the Manager Interview reflect the views of the President and Manager as of

July 2024 and may not reflect their views on the date this report is first published or anytime thereafter. These views are not

guarantees of future performance and involve certain risks, uncertainties and assumptions that are difficult to predict so actual

outcomes and results may differ significantly from the views expressed. These views are subject to change at any time based upon

economic, market or other conditions and the Fund disclaims any responsibility to update such views. These views may not be relied

on as investment advice and, because investment decisions for the Fund are based on numerous factors, may not be relied on as

an indication of trading intent.

| Liberty

All-Star® Growth Fund |

Table

of Distributions,

Rights Offerings and Distribution Policy |

(Unaudited)

| |

|

Rights Offerings |

Year |

Per Share

Distributions |

Month

Completed |

Shares Needed to Purchase

One Additional Share |

Subscription

Price |

| 1997 |

$1.24 |

|

|

|

| 1998 |

1.35 |

July |

10 |

$12.41 |

| 1999 |

1.23 |

|

|

|

| 2000 |

1.34 |

|

|

|

| 2001 |

0.92 |

September |

8 |

6.64 |

| 2002 |

0.67 |

|

|

|

| 2003 |

0.58 |

September |

81 |

5.72 |

| 2004 |

0.63 |

|

|

|

| 2005 |

0.58 |

|

|

|

| 2006 |

0.59 |

|

|

|

| 2007 |

0.61 |

|

|

|

| 2008 |

0.47 |

|

|

|

| 20092 |

0.24 |

|

|

|

| 2010 |

0.25 |

|

|

|

| 2011 |

0.27 |

|

|

|

| 2012 |

0.27 |

|

|

|

| 2013 |

0.31 |

|

|

|

| 2014 |

0.33 |

|

|

|

| 20153 |

0.77 |

|

|

|

| 2016 |

0.36 |

|

|

|

| 2017 |

0.42 |

|

|

|

| 2018 |

0.46 |

November |

3 |

4.81 |

| 2019 |

0.46 |

|

|

|

| 2020 |

0.63 |

March |

5 |

4.34 |

| 2021 |

1.02 |

June |

51 |

8.21 |

| 2022 |

0.50 |

|

|

|

| 2023 |

0.43 |

|

|

|

| 2024 |

|

|

|

|

| 1st

Quarter |

0.11 |

|

|

|

| 2nd

Quarter |

0.12 |

|

|

|

| Total |

$17.16 |

|

|

|

| 1 | The

number of shares offered was increased by an additional 25 percent to cover a portion of the over-subscription requests. |

| 2 | Effective

with the second quarter distribution, the annual distribution rate was changed from 10 percent to 6 percent. |

| 3 | Effective

with the second quarter distribution, the annual distribution rate was changed from 6 percent to 8 percent. |

DISTRIBUTION

POLICY

The

current policy is to pay distributions on its shares totaling approximately 8 percent of its net asset value per year, payable

in four quarterly installments of 2 percent of the Fund’s net asset value at the close of the New York Stock Exchange on

the Friday prior to each quarterly declaration date. Sources of distributions to shareholders may include ordinary dividends,

long-term capital gains and return of capital. The final determination of the source of all distributions in 2024 for tax reporting

purposes will be made after year end. The actual amounts and sources of the amounts for tax reporting purposes will depend upon

the Fund’s investment experience during the remainder of its fiscal year and may be subject to changes based on tax regulations.

If a distribution includes anything other than net investment income, the Fund provides a Section 19(a) notice of the best estimate

of its distribution sources at that time. These estimates may not match the final tax characterization (for the full year’s

distributions) contained in shareholder 1099-DIV forms after the end of the year. If the Fund’s ordinary dividends and long-term

capital gains for any year exceed the amount distributed under the distribution policy, the Fund may, in its discretion, retain

and not distribute capital gains and pay income tax thereon to the extent of such excess.

| Semi-Annual

Report (Unaudited) | June 30, 2024 |

5 |

| Liberty All-Star® Growth Fund |

Stock Changes in the Quarter |

(Unaudited)

The

following are the largest ($2 million or more) stock changes - both purchases and sales - that were made in the Fund’s portfolio

during the second quarter of 2024.

| |

SHARES |

| Security

Name |

Purchases

(Sales) |

Held

as of 6/30/24 |

| Purchases |

|

|

| Apple, Inc. |

17,842 |

17,842 |

| Descartes Systems

Group, Inc. |

30,000 |

30,000 |

| Gartner, Inc. |

5,443 |

5,443 |

| Meta Platforms, Inc. |

7,498 |

7,498 |

| Penumbra, Inc. |

15,500 |

15,500 |

| Pure Storage, Inc. |

55,000 |

55,000 |

| Synopsys, Inc. |

4,508 |

4,508 |

| Weatherford International

PLC |

26,000 |

26,000 |

| Sales |

|

|

| Ball Corp. |

(41,432) |

0 |

| Bruker Corp. |

(35,000) |

0 |

| ChampionX Corp. |

(95,000) |

0 |

| Equinix, Inc. |

(3,291) |

0 |

| IQVIA Holdings, Inc. |

(13,863) |

0 |

| Mettler-Toledo International,

Inc. |

(2,150) |

0 |

| Paycom Software, Inc. |

(12,500) |

0 |

| Sherwin-Williams Co. |

(9,406) |

0 |

| Liberty

All-Star® Growth Fund |

Top

20 Holdings & Economic Sectors |

| |

June

30, 2024 (Unaudited) |

| Top

20 Holdings* |

Percent

of Net Assets |

| Microsoft

Corp. |

2.38% |

| Amazon.com,

Inc. |

2.31 |

| SPS

Commerce, Inc. |

2.26 |

| Glaukos

Corp. |

1.87 |

| Natera,

Inc. |

1.86 |

| Vertex,

Inc. |

1.81 |

| Casella

Waste Systems, Inc. |

1.80 |

| FirstService

Corp. |

1.70 |

| StepStone

Group, Inc. |

1.63 |

| Visa,

Inc. |

1.63 |

| UnitedHealth

Group, Inc. |

1.58 |

| Hamilton

Lane, Inc. |

1.41 |

| Crane

Co. |

1.34 |

| S&P

Global, Inc. |

1.34 |

| Novo

Nordisk A/S |

1.30 |

| Monolithic

Power Systems, Inc. |

1.29 |

| Transcat,

Inc. |

1.25 |

| NVIDIA

Corp. |

1.24 |

| Workday,

Inc. |

1.23 |

| Danaher

Corp. |

1.19 |

| |

32.42% |

| Economic

Sectors* |

Percent

of Net Assets |

| Information

Technology |

26.61% |

| Health

Care |

19.79 |

| Industrials |

17.06 |

| Financials |

13.40 |

| Consumer

Discretionary |

10.18 |

| Communication

Services |

3.93 |

| Consumer

Staples |

1.93 |

| Materials |

1.89 |

| Real

Estate |

1.70 |

| Energy |

1.09 |

| Other

Net Assets |

2.42 |

| |

100.00% |

| * | Because

the Fund is actively managed, there can be no guarantee that the Fund will continue to

hold securities of the indicated issuers and sectors in the future. |

| Semi-Annual Report (Unaudited)

| June 30, 2024 |

7 |

| Liberty All-Star®

Growth Fund |

|

Investment

Managers/

Portfolio Characteristics |

(Unaudited)

THE

FUND’S THREE GROWTH INVESTMENT MANAGERS

AND THE MARKET CAPITALIZATION ON WHICH EACH FOCUSES:

ALPS

Advisors, Inc., the investment advisor to the Fund, has the ultimate authority (subject to oversight by the Board of Directors)

to oversee the investment managers and recommend their hiring, termination and replacement.

MANAGERS’

DIFFERING INVESTMENT STRATEGIES

ARE

REFLECTED IN PORTFOLIO CHARACTERISTICS

The

portfolio characteristics table below is a regular feature of the Fund’s shareholder reports. It serves as a useful tool

for understanding the value of the Fund’s multi-managed portfolio. The characteristics are different for each of the Fund’s

three investment managers. These differences are a reflection of the fact that each has a different capitalization focus and investment

strategy. The shaded column highlights the characteristics of the Fund as a whole, while the first three columns show portfolio

characteristics for the Russell Smallcap, Midcap and Largecap Growth indices. See page 34 for a description of these indices.

PORTFOLIO

CHARACTERISTICS As of June 30, 2024 (Unaudited)

| |

RUSSELL

GROWTH |

Market

Capitalization Spectrum |

|

| |

Small |

|

Large |

Total |

| |

Smallcap |

Midcap |

Largecap |

|

| |

Index |

Index |

Index |

Weatherbie |

Congress |

Sustainable |

Fund |

| Number

of Holdings |

1,054 |

330 |

440 |

50 |

39 |

29 |

117* |

| Percent

of Holdings in Top 10 |

11% |

16% |

57% |

51% |

33% |

46% |

20% |

| Weighted

Average Market Capitalization

(billions) |

$6.0 |

$32.8 |

$1,528.5 |

$4.8 |

$17.6 |

$849.7 |

$300.0 |

| Average Five-Year

Earnings Per

Share Growth |

21% |

18% |

21% |

7% |

17% |

17% |

15% |

| Average Five-Year

Sales Per

Share Growth |

11% |

14% |

18% |

12% |

13% |

15% |

13% |

| Price/Sales

Ratio |

2.1x |

3.5x |

5.4x |

3.3x |

3.3x |

5.5x |

3.8x |

| Price/Book

Value Ratio |

4.3x |

9.4x |

9.9x |

5.4x |

5.7x |

7.9x |

6.2x |

| * | Certain

holdings are held by more than one manager. |

| Liberty All-Star® Growth Fund |

Manager Interview |

(Unaudited)

|

|

Todd

Solomon, CFA

Senior

Vice President, Portfolio Manager

Congress

Asset Management Company, LLP

|

CONGRESS’

PORTFOLIO OF 40 MID-CAP NAMES BALANCES PROPER DIVERSIFICATION AND DEEP INSIGHT INTO EACH HOLDING

Congress

Asset Management is the Fund’s mid-cap growth manager. Congress employs a strategy focused on established, high-quality

companies that are growing earnings and generating attractive levels of free cash flow. The firm also strives to construct portfolios

with relatively low levels of volatility. We recently had the chance to talk with Todd Solomon, CFA, Senior Vice President and

Portfolio Manager at Congress. The Fund’s Investment Advisor, ALPS Advisors, Inc., conducted the interview.

How

is Congress’ actively managed mid-cap portfolio different than the relevant passive index, in this case the Russell Midcap

Growth® Index? Is this primarily a product of Congress’ strategy and the research behind it? Or other factors?

Our

portfolio is more focused with approximately 40 stocks versus over 300 for the Russell Midcap Growth® Index. Also,

our portfolio is closer to equal-weighted than the benchmark’s allocation, which is capitalization weighted and thus tilted

toward companies at the larger end of the mid-cap range.

“We

believe that a portfolio of 40 names can give us proper diversification while maintaining a strong knowledge base of our current

investments and their main competitors.”

We

believe that a portfolio of 40 names can give us proper diversification while maintaining a strong knowledge base of our current

investments and their main competitors. Since the inception of the portfolio, our process and philosophy have maintained that

having the best ideas in the portfolio in similar position sizes is more important than focusing on relative conviction to determine

allocation.

What

are the factors—quantitative and qualitative—that you consider first and foremost when you are researching candidates

for inclusion in the mid-cap portfolio?

A

“good company” doesn’t always equate to a “good stock.” We employ a four-part process outlined

as follows: First, we seek to identify a successful company with the following attributes: increasing margins and free cash

flow; positive, consistent growth; increasing market share; strong balance sheet; and shareholder consciousness. Second, we

want to determine if this success is likely to continue. In this regard, the primary characteristics we assess are whether

the company operates

in a growing industry; the uniqueness of its business model; how defensible its market position is; and whether its business is

sustainable through market cycles. Next, we want to understand the “bear” case for the company to assess if there

is anything we may have overlooked including a different viewpoint of the business risks and valuation. Finally, we want to understand

how adding this name will affect the current portfolio if it’s purchased. For instance, will we be maintaining the current

portfolio diversification? Does the company depend on similar drivers of growth as current holdings, or different? Two additional

primary considerations are how correlated/uncorrelated the stock under consideration is with the rest of the portfolio and whether

it changes the portfolio’s overall risk profile.

| Semi-Annual Report (Unaudited)

| June 30, 2024 |

9 |

| Liberty All-Star® Growth Fund |

Manager Interview |

(Unaudited)

Large-cap

growth, driven by AI/information technology, has been posting exceptional returns and capturing the lion’s share of media

attention. Is AI the realm of large- and mega-cap companies or have you identified mid-cap growth companies that are already participating

in AI directly or those that are positioned to benefit downstream? What are some examples?

“We

have been able to identify several mid-cap companies that have exposure to AI trends, but do not solely rely on the theme.”

We

have been able to identify several mid-cap companies that have exposure to AI trends, but do not solely rely on the theme. Investments

in, and acceptance of, AI may be too volatile to successfully invest in a “pure play” in the mid-cap space, where

profitability and consistency of results may be elusive.

Turning

to examples, nVent Electric (NVT), first purchased in August 2023, is a manufacturer of cable management products, racks and cabinets,

and liquid cooling equipment. The company expects approximately 14 percent of 2024 sales to come from its Data Solutions segment,

which is growing strong double digits. In its most recent earnings release, the company said they “continue to see great

demand for Data Solutions, growing with the acceleration of AI and high-performance computing.” nVent is also well positioned

in other “electrification, sustainability and digitization trends,” which may allow the company to offset any possible

receding of AI spending.

A

more recent investment, Fabrinet (FN), purchased in December 2023, provides advanced precision optical, electronic and mechanical

manufacturing services. It produces equipment for telecom and datacom optical communications, which are the “pipelines”

for data movement. The company reported continued strong demand for high-data-rate products in its most recent earnings release.

However, the company has exposure to the automotive industry, industrial lasers, and medical and other components and subsystems.

Such diversification should improve the consistency of reported results in the future.

Thank

you, Todd. The market has shown some broadening recently. We will hope that investors continue to recognize the value of mid-cap

stocks in a diversified growth portfolio.

| Liberty All-Star®

Growth Fund |

Schedule

of Investments |

June

30, 2024 (Unaudited)

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (97.58%) | |

| | | |

| | |

| COMMUNICATION SERVICES (3.93%) | |

| | | |

| | |

| Entertainment (1.81%) | |

| | | |

| | |

| Netflix, Inc.(a) | |

| 5,377 | | |

$ | 3,628,830 | |

| Take-Two Interactive Software, Inc.(a) | |

| 17,500 | | |

| 2,721,075 | |

| | |

| | | |

| 6,349,905 | |

| Interactive Media & Services (2.12%) | |

| | | |

| | |

| Alphabet, Inc., Class C | |

| 19,875 | | |

| 3,645,472 | |

| Meta Platforms, Inc., Class A | |

| 7,498 | | |

| 3,780,642 | |

| | |

| | | |

| 7,426,114 | |

| CONSUMER DISCRETIONARY (10.18%) | |

| | | |

| | |

| Broadline Retail (3.55%) | |

| | | |

| | |

| Amazon.com, Inc.(a) | |

| 41,887 | | |

| 8,094,663 | |

| Ollie's Bargain Outlet Holdings, Inc.(a) | |

| 41,643 | | |

| 4,088,093 | |

| Savers Value Village, Inc.(a) | |

| 21,730 | | |

| 265,975 | |

| | |

| | | |

| 12,448,731 | |

| Distributors (0.61%) | |

| | | |

| | |

| Pool Corp. | |

| 7,000 | | |

| 2,151,310 | |

| | |

| | | |

| | |

| Hotels, Restaurants & Leisure (3.56%) | |

| | | |

| | |

| Darden Restaurants, Inc. | |

| 19,500 | | |

| 2,950,740 | |

| Planet Fitness, Inc., Class A(a) | |

| 17,484 | | |

| 1,286,648 | |

| Starbucks Corp. | |

| 36,540 | | |

| 2,844,639 | |

| Wingstop, Inc. | |

| 3,634 | | |

| 1,535,946 | |

| Yum! Brands, Inc. | |

| 29,206 | | |

| 3,868,627 | |

| | |

| | | |

| 12,486,600 | |

| Specialty Retail (1.49%) | |

| | | |

| | |

| Ulta Beauty, Inc.(a) | |

| 6,250 | | |

| 2,411,688 | |

| Valvoline, Inc.(a) | |

| 65,000 | | |

| 2,808,000 | |

| | |

| | | |

| 5,219,688 | |

| Textiles, Apparel & Luxury Goods (0.97%) | |

| | | |

| | |

| Deckers Outdoor Corp.(a) | |

| 3,500 | | |

| 3,387,825 | |

| | |

| | | |

| | |

| CONSUMER STAPLES (1.93%) | |

| | | |

| | |

| Consumer Staples Distribution & Retail (1.09%) | |

| | | |

| | |

| Casey's General Stores, Inc. | |

| 10,000 | | |

| 3,815,600 | |

| | |

| | | |

| | |

| Household Products (0.81%) | |

| | | |

| | |

| Church & Dwight Co., Inc. | |

| 27,500 | | |

| 2,851,200 | |

See

Notes to Financial Statements.

| Semi-Annual Report (Unaudited)

| June 30, 2024 |

11 |

| Liberty All-Star®

Growth Fund |

Schedule

of Investments |

June

30, 2024 (Unaudited)

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Personal Care Products (0.03%) | |

| | | |

| | |

| Oddity Tech, Ltd.(a) | |

| 2,827 | | |

$ | 110,988 | |

| | |

| | | |

| | |

| ENERGY (1.09%) | |

| | | |

| | |

| Energy Equipment & Services (1.09%) | |

| | | |

| | |

| Core Laboratories, Inc. | |

| 31,812 | | |

| 645,465 | |

| Weatherford International PLC(a) | |

| 26,000 | | |

| 3,183,700 | |

| | |

| | | |

| 3,829,165 | |

| FINANCIALS (13.40%) | |

| | | |

| | |

| Capital Markets (6.98%) | |

| | | |

| | |

| FactSet Research Systems, Inc. | |

| 7,000 | | |

| 2,857,890 | |

| Hamilton Lane, Inc., Class A | |

| 40,005 | | |

| 4,943,818 | |

| MSCI, Inc. | |

| 7,178 | | |

| 3,458,002 | |

| Raymond James Financial, Inc. | |

| 22,500 | | |

| 2,781,225 | |

| S&P Global, Inc. | |

| 10,556 | | |

| 4,707,976 | |

| StepStone Group, Inc., Class A | |

| 124,696 | | |

| 5,722,299 | |

| | |

| | | |

| 24,471,210 | |

| Consumer Finance (1.33%) | |

| | | |

| | |

| American Express Co. | |

| 17,090 | | |

| 3,957,189 | |

| Upstart Holdings, Inc.(a)(b) | |

| 30,440 | | |

| 718,080 | |

| | |

| | | |

| 4,675,269 | |

| Financial Services (2.68%) | |

| | | |

| | |

| Corpay, Inc.(a) | |

| 9,939 | | |

| 2,647,849 | |

| Flywire Corp.(a) | |

| 63,446 | | |

| 1,039,880 | |

| Visa, Inc., Class A | |

| 21,717 | | |

| 5,700,061 | |

| | |

| | | |

| 9,387,790 | |

| Insurance (2.41%) | |

| | | |

| | |

| Aon PLC, Class A | |

| 12,845 | | |

| 3,771,035 | |

| Brown & Brown, Inc. | |

| 36,000 | | |

| 3,218,760 | |

| Palomar Holdings, Inc.(a) | |

| 17,990 | | |

| 1,459,888 | |

| | |

| | | |

| 8,449,683 | |

| HEALTH CARE (19.79%) | |

| | | |

| | |

| Biotechnology (3.05%) | |

| | | |

| | |

| ACADIA Pharmaceuticals, Inc.(a) | |

| 167,222 | | |

| 2,717,358 | |

| Natera, Inc.(a) | |

| 60,173 | | |

| 6,516,134 | |

| Ultragenyx Pharmaceutical, Inc.(a) | |

| 35,660 | | |

| 1,465,626 | |

| | |

| | | |

| 10,699,118 | |

| Health Care Equipment & Supplies (8.36%) | |

| | | |

| | |

| Cooper Cos., Inc. | |

| 30,000 | | |

| 2,619,000 | |

| Glaukos Corp.(a) | |

| 55,337 | | |

| 6,549,134 | |

| Hologic, Inc.(a) | |

| 32,500 | | |

| 2,413,125 | |

See

Notes to Financial Statements.

| Liberty All-Star®

Growth Fund |

Schedule

of Investments |

June

30, 2024 (Unaudited)

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Health Care Equipment & Supplies (continued) | |

| | | |

| | |

| Inmode, Ltd.(a) | |

| 26,918 | | |

$ | 490,984 | |

| Inogen, Inc.(a) | |

| 41,696 | | |

| 338,989 | |

| Inspire Medical Systems, Inc.(a) | |

| 8,465 | | |

| 1,132,871 | |

| iRhythm Technologies, Inc.(a) | |

| 15,560 | | |

| 1,674,878 | |

| Neogen Corp.(a) | |

| 106,041 | | |

| 1,657,421 | |

| Nevro Corp.(a) | |

| 124,271 | | |

| 1,046,362 | |

| Penumbra, Inc.(a) | |

| 15,500 | | |

| 2,789,535 | |

| ResMed, Inc. | |

| 14,000 | | |

| 2,679,880 | |

| STERIS PLC | |

| 12,500 | | |

| 2,744,250 | |

| Tandem Diabetes Care, Inc.(a) | |

| 79,000 | | |

| 3,182,910 | |

| | |

| | | |

| 29,319,339 | |

| Health Care Providers & Services (3.42%) | |

| | | |

| | |

| NeoGenomics, Inc.(a) | |

| 110,945 | | |

| 1,538,807 | |

| Progyny, Inc.(a) | |

| 132,399 | | |

| 3,787,936 | |

| UnitedHealth Group, Inc. | |

| 10,874 | | |

| 5,537,693 | |

| US Physical Therapy, Inc. | |

| 12,148 | | |

| 1,122,718 | |

| | |

| | | |

| 11,987,154 | |

| Health Care Technology (0.17%) | |

| | | |

| | |

| Definitive Healthcare Corp.(a) | |

| 108,603 | | |

| 592,972 | |

| | |

| | | |

| | |

| Life Sciences Tools & Services (3.49%) | |

| | | |

| | |

| Charles River Laboratories International, Inc.(a) | |

| 10,500 | | |

| 2,169,090 | |

| Danaher Corp. | |

| 16,638 | | |

| 4,157,004 | |

| Thermo Fisher Scientific, Inc. | |

| 6,249 | | |

| 3,455,697 | |

| West Pharmaceutical Services, Inc. | |

| 7,500 | | |

| 2,470,425 | |

| | |

| | | |

| 12,252,216 | |

| Pharmaceuticals (1.30%) | |

| | | |

| | |

| Novo Nordisk A/S(c) | |

| 31,850 | | |

| 4,546,269 | |

| | |

| | | |

| | |

| INDUSTRIALS (17.06%) | |

| | | |

| | |

| Aerospace & Defense (1.52%) | |

| | | |

| | |

| AAR Corp.(a) | |

| 31,952 | | |

| 2,322,910 | |

| Cadre Holdings, Inc. | |

| 24,213 | | |

| 812,588 | |

| Kratos Defense & Security Solutions, Inc.(a) | |

| 73,621 | | |

| 1,473,156 | |

| Loar Holdings, Inc.(a) | |

| 13,111 | | |

| 700,259 | |

| | |

| | | |

| 5,308,913 | |

| Commercial Services & Supplies (4.55%) | |

| | | |

| | |

| Casella Waste Systems, Inc., Class A(a) | |

| 63,768 | | |

| 6,327,061 | |

| CECO Environmental Corp.(a) | |

| 3,731 | | |

| 107,640 | |

| Copart, Inc. | |

| 60,000 | | |

| 3,249,600 | |

| Montrose Environmental Group, Inc.(a) | |

| 82,547 | | |

| 3,678,294 | |

See

Notes to Financial Statements.

| Semi-Annual Report (Unaudited)

| June 30, 2024 |

13 |

| Liberty All-Star®

Growth Fund |

Schedule

of Investments |

June

30, 2024 (Unaudited)

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Commercial Services & Supplies (continued) | |

| | | |

| | |

| Waste Management, Inc. | |

| 12,168 | | |

$ | 2,595,921 | |

| | |

| | | |

| 15,958,516 | |

| Construction & Engineering (1.63%) | |

| | | |

| | |

| EMCOR Group, Inc. | |

| 10,000 | | |

| 3,650,800 | |

| WillScot Mobile Mini Holdings Corp.(a) | |

| 55,000 | | |

| 2,070,200 | |

| | |

| | | |

| 5,721,000 | |

| Electrical Equipment (1.15%) | |

| | | |

| | |

| nVent Electric PLC | |

| 52,500 | | |

| 4,022,025 | |

| | |

| | | |

| | |

| Ground Transportation (2.67%) | |

| | | |

| | |

| Canadian Pacific Kansas City, Ltd. | |

| 51,083 | | |

| 4,021,765 | |

| RXO, Inc.(a) | |

| 77,253 | | |

| 2,020,166 | |

| Saia, Inc.(a) | |

| 7,000 | | |

| 3,320,030 | |

| | |

| | | |

| 9,361,961 | |

| Machinery (2.13%) | |

| | | |

| | |

| Crane Co. | |

| 32,500 | | |

| 4,711,850 | |

| Watts Water Technologies, Inc., Class A | |

| 15,000 | | |

| 2,750,550 | |

| | |

| | | |

| 7,462,400 | |

| Professional Services (1.24%) | |

| | | |

| | |

| Booz Allen Hamilton Holding Corp. | |

| 23,500 | | |

| 3,616,650 | |

| First Advantage Corp. | |

| 45,444 | | |

| 730,285 | |

| | |

| | | |

| 4,346,935 | |

| Trading Companies & Distributors (2.17%) | |

| | | |

| | |

| SiteOne Landscape Supply, Inc.(a) | |

| 25,164 | | |

| 3,055,161 | |

| Transcat, Inc.(a) | |

| 36,703 | | |

| 4,392,615 | |

| Xometry, Inc., Class A(a) | |

| 14,974 | | |

| 173,100 | |

| | |

| | | |

| 7,620,876 | |

| INFORMATION TECHNOLOGY (26.61%) | |

| | | |

| | |

| Electronic Equipment, Instruments & Components (2.61%) | |

| | | |

| | |

| Fabrinet | |

| 13,000 | | |

| 3,182,270 | |

| Keysight Technologies, Inc.(a) | |

| 15,000 | | |

| 2,051,250 | |

| Novanta, Inc.(a) | |

| 8,578 | | |

| 1,399,158 | |

| Teledyne Technologies, Inc.(a) | |

| 6,500 | | |

| 2,521,870 | |

| | |

| | | |

| 9,154,548 | |

| IT Services (0.70%) | |

| | | |

| | |

| Gartner, Inc.(a) | |

| 5,443 | | |

| 2,444,234 | |

| | |

| | | |

| | |

| Semiconductors & Semiconductor Equipment (4.15%) | |

| | | |

| | |

| Entegris, Inc. | |

| 20,000 | | |

| 2,708,000 | |

| Impinj, Inc.(a) | |

| 6,451 | | |

| 1,011,323 | |

See

Notes to Financial Statements.

| Liberty

All-Star® Growth Fund |

Schedule

of Investments |

|

June

30, 2024 (Unaudited)

| | |

| SHARES | | |

| VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| Semiconductors & Semiconductor Equipment (continued) | |

| | | |

| | |

| Monolithic Power Systems, Inc. | |

| 5,500 | | |

$ | 4,519,240 | |

| NVIDIA Corp. | |

| 35,290 | | |

| 4,359,727 | |

| Semtech Corp.(a) | |

| 28,321 | | |

| 846,231 | |

| SiTime Corp.(a) | |

| 8,873 | | |

| 1,103,624 | |

| | |

| | | |

| 14,548,145 | |

| Software (17.07%) | |

| | | |

| | |

| Agilysys, Inc.(a) | |

| 27,729 | | |

| 2,887,698 | |

| Autodesk, Inc.(a) | |

| 12,365 | | |

| 3,059,719 | |

| Descartes Systems Group, Inc.(a) | |

| 30,000 | | |

| 2,905,200 | |

| DoubleVerify Holdings, Inc.(a) | |

| 90,000 | | |

| 1,752,300 | |

| Dynatrace, Inc.(a) | |

| 45,000 | | |

| 2,013,300 | |

| Intapp, Inc.(a) | |

| 10,700 | | |

| 392,369 | |

| Intuit, Inc. | |

| 5,532 | | |

| 3,635,686 | |

| Microsoft Corp. | |

| 18,710 | | |

| 8,362,434 | |

| nCino, Inc.(a) | |

| 47,023 | | |

| 1,478,873 | |

| PROS Holdings, Inc.(a) | |

| 38,838 | | |

| 1,112,709 | |

| Qualys, Inc.(a) | |

| 18,000 | | |

| 2,566,800 | |

| Salesforce, Inc. | |

| 14,954 | | |

| 3,844,673 | |

| ServiceNow, Inc.(a) | |

| 4,410 | | |

| 3,469,215 | |

| Sprout Social, Inc.(a) | |

| 31,709 | | |

| 1,131,377 | |

| SPS Commerce, Inc.(a) | |

| 42,147 | | |

| 7,930,380 | |

| Synopsys, Inc.(a) | |

| 4,508 | | |

| 2,682,530 | |

| Vertex, Inc., Class A(a) | |

| 175,653 | | |

| 6,332,291 | |

| Workday, Inc., Class A(a) | |

| 19,227 | | |

| 4,298,388 | |

| | |

| | | |

| 59,855,942 | |

| Technology Hardware, Storage & Peripherals (2.08%) | |

| | | |

| | |

| Apple, Inc. | |

| 17,842 | | |

| 3,757,882 | |

| Pure Storage, Inc.(a) | |

| 55,000 | | |

| 3,531,550 | |

| | |

| | | |

| 7,289,432 | |

| MATERIALS (1.89%) | |

| | | |

| | |

| Chemicals (1.02%) | |

| | | |

| | |

| Ecolab, Inc. | |

| 15,002 | | |

| 3,570,476 | |

| | |

| | | |

| | |

| Containers & Packaging (0.87%) | |

| | | |

| | |

| Avery Dennison Corp. | |

| 14,000 | | |

| 3,061,100 | |

See

Notes to Financial Statements.

| Semi-Annual Report (Unaudited)

| June 30, 2024 |

15 |

| Liberty All-Star®

Growth Fund |

Schedule of Investments |

June

30, 2024 (Unaudited)

| | |

SHARES | | |

VALUE | |

| COMMON STOCKS (continued) | |

| | | |

| | |

| REAL

ESTATE (1.70%) | |

| | | |

| | |

| Real

Estate Management & Development (1.70%) | |

| | | |

| | |

| FirstService

Corp. | |

| 39,143 | | |

$ | 5,964,219 | |

| | |

| | | |

| | |

| TOTAL

COMMON STOCKS | |

| | | |

| | |

| (COST OF $230,270,813) | |

| | | |

| 342,148,868 | |

| | |

| | | |

| | |

| SHORT TERM INVESTMENTS

(2.55%) | |

| | | |

| | |

| MONEY MARKET FUND

(2.51%) | |

| | | |

| | |

| State

Street Institutional US Government Money Market Fund, Premier Class, 5.27%(d) | |

| | | |

| | |

| (COST OF $8,818,062) | |

| 8,818,062 | | |

| 8,818,062 | |

| | |

| | | |

| | |

| INVESTMENTS

PURCHASED WITH COLLATERAL FROM | |

| | | |

| | |

| SECURITIES

LOANED (0.04%) | |

| | | |

| | |

| State

Street Navigator Securities Lending Government Money Market Portfolio, 5.33% | |

| | | |

| | |

| (COST OF $146,082) | |

| 146,082 | | |

| 146,082 | |

| | |

| | | |

| | |

| TOTAL

SHORT TERM INVESTMENTS | |

| | | |

| | |

| (COST OF $8,964,144) | |

| | | |

| 8,964,144 | |

| | |

| | | |

| | |

| TOTAL

INVESTMENTS (100.13%) | |

| | | |

| | |

| (COST OF $239,234,957) | |

| | | |

| 351,113,012 | |

| | |

| | | |

| | |

| LIABILITIES

IN EXCESS OF OTHER ASSETS (-0.13%) | |

| | | |

| (454,045 | ) |

| | |

| | | |

| | |

| NET

ASSETS (100.00%) | |

| | | |

$ | 350,658,967 | |

| | |

| | | |

| | |

| NET ASSET VALUE PER

SHARE | |

| | | |

| | |

| (60,155,589 SHARES

OUTSTANDING) | |

| | | |

$ | 5.83 | |

| (a) | Non-income

producing security. |

| (b) | Security,

or a portion of the security position, is currently on loan. The total market value of

securities on loan is $142,106. |

| (c) | American

Depositary Receipt. |

| (d) | Rate

reflects seven-day effective yield on June 30, 2024. |

See

Notes to Financial Statements.

| Liberty All-Star® Growth Fund |

Statement

of Assets and Liabilities |

June

30, 2024 (Unaudited)

| ASSETS: | |

|

| Investments at value (Cost $239,234,957)(a) | |

$ | 351,113,012 | |

| Dividends and interest receivable | |

| 90,446 | |

| Tax reclaim receivable | |

| 6,106 | |

| Prepaid and other assets | |

| 39,665 | |

| TOTAL ASSETS | |

| 351,249,229 | |

| | |

| | |

| LIABILITIES: | |

| | |

| Investment advisory fee payable | |

| 224,678 | |

| Payable for administration, pricing and bookkeeping fees | |

| 116,950 | |

| Payable for collateral upon return of securities loaned | |

| 146,082 | |

| Accrued Directors' fees payable | |

| 6,892 | |

| Accrued expenses | |

| 95,660 | |

| TOTAL LIABILITIES | |

| 590,262 | |

| NET ASSETS | |

$ | 350,658,967 | |

| | |

| | |

| NET ASSETS REPRESENTED BY: | |

| | |

| Paid-in capital | |

$ | 280,801,274 | |

| Total distributable earnings | |

| 69,857,693 | |

| NET ASSETS | |

$ | 350,658,967 | |

| | |

| | |

| Shares of common stock outstanding

(authorized 200,000,000 shares at $0.10 Par) | |

| 60,155,589 | |

| NET ASSET VALUE PER SHARE | |

$ | 5.83 | |

| (a) |

Includes securities

on loan of $142,106. |

See

Notes to Financial Statements.

| Semi-Annual Report (Unaudited)

| June 30, 2024 |

17 |

| Liberty All-Star® Growth Fund |

Statement of Operations |

For the Six Months Ended June 30, 2024 (Unaudited)

| INVESTMENT INCOME: | |

|

| Dividends (Net of foreign taxes withheld at source which amounted to $9,979) | |

$ | 1,019,669 | |

| Securities lending income | |

| 3,135 | |

| TOTAL INVESTMENT INCOME | |

| 1,022,804 | |

| | |

| | |

| EXPENSES: | |

| | |

| Investment advisory fee | |

| 1,356,679 | |

| Administration, pricing and bookkeeping fees | |

| 340,913 | |

| Audit fee | |

| 10,050 | |

| Custodian fee | |

| 19,338 | |

| Directors' fees and expenses | |

| 92,988 | |

| Insurance expense | |

| 7,883 | |

| Legal fees | |

| 18,208 | |

| NYSE fee | |

| 32,541 | |

| Proxy fees | |

| 15,671 | |

| Shareholder communication expenses | |

| 15,510 | |

| Transfer agent fees | |

| 39,410 | |

| Miscellaneous expenses | |

| 5,350 | |

| TOTAL EXPENSES | |

| 1,954,541 | |

| NET INVESTMENT LOSS | |

| (931,737 | ) |

| | |

| | |

| REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | |

| | |

| Net realized gain on investments | |

| 9,083,798 | |

| Net realized loss on foreign currency transactions | |

| (151 | ) |

| Net change in unrealized appreciation on investments | |

| 10,743,972 | |

| Net change in unrealized appreciation on foreign currency transactions | |

| 11 | |

| NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS | |

| 19,827,630 | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | |

$ | 18,895,893 | |

See

Notes to Financial Statements.

| Liberty All-Star® Growth Fund |

Statements of Changes in Net Assets |

| | |

For the Six Months Ended June 30, 2024 (Unaudited) |

| |

For the Year Ended December 31, 2023 |

|

| FROM OPERATIONS: | |

| | | |

| | |

| Net investment loss | |

$ | (931,737 | ) | |

$ | (1,548,156 | ) |

| Net realized gain/(loss) on investments | |

| 9,083,647 | | |

| (8,850,848 | ) |

| Net change in unrealized appreciation on investments | |

| 10,743,983 | | |

| 66,429,106 | |

| Net Increase in Net Assets From Operations | |

| 18,895,893 | | |

| 56,030,102 | |

| | |

| | | |

| | |

| DISTRIBUTIONS TO SHAREHOLDERS: | |

| | | |

| | |

| From distributable earnings | |

| (13,675,253 | ) | |

| (1,404,630 | ) |

| Return of capital | |

| – | | |

| (23,519,102 | ) |

| Total Distributions | |

| (13,675,253 | ) | |

| (24,923,732 | ) |

| | |

| | | |

| | |

| CAPITAL SHARE TRANSACTIONS: | |

| | | |

| | |

| Dividend reinvestments | |

| 4,988,323 | | |

| 10,391,899 | |

| Net increase resulting from Capital

Share Transactions | |

| 4,988,323 | | |

| 10,391,899 | |

| Total Increase in Net Assets | |

| 10,208,963 | | |

| 41,498,269 | |

| | |

| | | |

| | |

| NET ASSETS: | |

| | | |

| | |

| Beginning of period | |

| 340,450,004 | | |

| 298,951,735 | |

| End of period | |

$ | 350,658,967 | | |

$ | 340,450,004 | |

See

Notes to Financial Statements.

| Semi-Annual Report (Unaudited)

| June 30, 2024 |

19 |

Liberty

All-Star® Growth Fund

Financial

Highlights

| PER

SHARE OPERATING PERFORMANCE: |

| Net

asset value at beginning of period |

| INCOME

FROM INVESTMENT OPERATIONS: |

| Net

investment loss(a) |

| Net

realized and unrealized gain/(loss) on investments |

| Total

from Investment Operations |

| |

| LESS

DISTRIBUTIONS TO SHAREHOLDERS: |

| Net

investment income |

| Net

realized gain on investments |

| Return

of capital |

| Total

Distributions |

| Change

due to rights offering(b) |

| Net

asset value at end of period |

| Market

price at end of period |

| |

| TOTAL

INVESTMENT RETURN FOR SHAREHOLDERS:(c) |

| Based

on net asset value |

| Based

on market price |

| |

| RATIOS

AND SUPPLEMENTAL DATA: |

| Net

assets at end of period (millions) |

| Ratio

of expenses to average net assets |

| Ratio

of net investment loss to average net assets |

| Portfolio

turnover rate |

| (a) | Calculated

using average shares outstanding during the period. |

| (b) | Effect

of Fund's rights offering for shares at a price below net asset value, net of costs. |

| (c) | Calculated

assuming all distributions are reinvested at actual reinvestment prices and all primary

rights in the Fund's rights offering were exercised. The net asset value and market price

returns will differ depending upon the level of any discount from or premium to net asset

value at which the Fund's shares traded during the period. Past performance is not a

guarantee of future results. |

| (d) | Not

annualized. |

| (e) | Annualized. |

See

Notes to Financial Statements.

Financial

Highlights

| For the Six Months Ended June 30, 2024 |

| |

For the Year Ended December 31, |

|

| (Unaudited) |

| |

2023 |

| |

2022 |

| |

2021 |

| |

2020 |

| |

2019 |

|

| $ | 5.75 | | |

$ | 5.23 | | |

$ | 8.25 | | |

$ | 7.98 | | |

$ | 6.19 | | |

$ | 4.94 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | (0.02 | ) | |

| (0.03 | ) | |

| (0.04 | ) | |

| (0.06 | ) | |

| (0.05 | ) | |

| (0.03 | ) |

| | 0.33 | | |

| 0.98 | | |

| (2.48 | ) | |

| 1.46 | | |

| 2.51 | | |

| 1.74 | |

| | 0.31 | | |

| 0.95 | | |

| (2.52 | ) | |

| 1.40 | | |

| 2.46 | | |

| 1.71 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | (0.23 | ) | |

| (0.02 | ) | |

| – | | |

| – | | |

| – | | |

| – | |

| | – | | |

| – | | |

| (0.50 | ) | |

| (1.02 | ) | |

| (0.63 | ) | |

| (0.46 | ) |

| | – | | |

| (0.41 | ) | |

| – | | |

| – | | |

| – | | |

| – | |

| | (0.23 | ) | |

| (0.43 | ) | |

| (0.50 | ) | |

| (1.02 | ) | |

| (0.63 | ) | |

| (0.46 | ) |

| | – | | |

| – | | |

| – | | |

| (0.11 | ) | |

| (0.04 | ) | |

| – | |

| $ | 5.83 | | |

$ | 5.75 | | |

$ | 5.23 | | |

$ | 8.25 | | |

$ | 7.98 | | |

$ | 6.19 | |

| $ | 5.34 | | |

$ | 5.28 | | |

$ | 4.93 | | |

$ | 9.00 | | |

$ | 8.20 | | |

$ | 6.50 | |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | 5.8 | %(d) | |

| 19.4 | % | |

| (31.0 | %) | |

| 18.1 | % | |

| 42.4 | % | |

| 35.8 | % |

| | 5.6 | %(d) | |

| 16.3 | % | |

| (40.4 | %) | |

| 25.4 | % | |

| 39.4 | % | |

| 60.5 | % |

| | | | |

| | | |

| | | |

| | | |

| | | |

| | |

| $ | 351 | | |

$ | 340 | | |

$ | 299 | | |

$ | 456 | | |

$ | 338 | | |

$ | 235 | |

| | 1.14 | %(e) | |

| 1.13 | % | |

| 1.14 | % | |

| 1.12 | % | |

| 1.20 | % | |

| 1.22 | % |

| | (0.54 | %)(e) | |

| (0.49 | %) | |

| (0.60 | %) | |

| (0.66 | %) | |

| (0.69 | %) | |

| (0.57 | %) |

| | 19 | %(d) | |

| 39 | % | |

| 31 | % | |

| 42 | % | |

| 55 | % | |

| 34 | % |

| Semi-Annual Report (Unaudited)

| June 30, 2024 |

21 |

| Liberty

All-Star® Growth Fund |

Notes

to Financial Statements |

June

30, 2024 (Unaudited)

NOTE

1. ORGANIZATION

Liberty

All-Star® Growth Fund, Inc. (the “Fund”) is a Maryland corporation registered under the Investment

Company Act of 1940 (the “1940 Act”), as amended, as a diversified, closed-end management investment company.

Investment

Goal

The

Fund seeks long-term capital appreciation.

Fund

Shares

The

Fund may issue 200,000,000 shares of common stock at $0.10 par.

NOTE

2. SIGNIFICANT ACCOUNTING POLICIES

The

following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its financial

statements. The Fund is considered an investment company under U.S. generally accepted accounting principles (“GAAP”)

and follows the accounting and reporting guidance applicable to investment companies in the Financial Accounting Standards Board

Accounting Standards Codification Topic 946 Financial Services - Investment Companies.

Use

of Estimates

The

preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the financial

statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual

results could differ from these estimates.

Security

Valuation

Equity

securities are valued at the last sale price at the close of the principal exchange on which they trade, except for securities

listed on the NASDAQ Stock Market LLC (“NASDAQ”), which are valued at the NASDAQ official closing price. Unlisted

securities or listed securities for which there were no sales during the day are valued at the closing bid price on such exchanges

or over-the-counter markets.

Cash

collateral from securities lending activity is reinvested in the State Street Navigator Securities Lending Government Money Market

Portfolio (“State Street Navigator”), a registered investment company under the 1940 Act, which operates as a money

market fund in compliance with Rule 2a-7 under the 1940 Act. Shares of registered investment companies are valued daily at that

investment company’s net asset value ("NAV") per share.

The

Fund’s investments are valued at market value or, in the absence of market value with respect to any portfolio securities,

at fair value according to procedures adopted by the Fund's Board of Directors (the "Board"). The Board has designated

ALPS Advisors, Inc. (the “Advisor”) as the Fund’s Valuation Designee (as defined in Rule 2a-5 under the 1940

Act). The Valuation Designee is responsible for determining fair value in good faith for all Fund investments, subject to oversight

by the Board. When market quotations are not readily available, or in management’s judgment they do not accurately reflect

fair value of a security, or an event occurs after the market close but before the Fund is priced that materially affects the

value of a security, the security will be valued by the Advisor's Valuation Committee, using fair valuation procedures established

by the Valuation Designee. Examples of potentially significant events that could materially impact a Fund’s net asset value

include, but are not limited to: single issuer events such as corporate actions, reorganizations, mergers, spin-offs, liquidations,

acquisitions and buyouts; corporate announcements on earnings or product offerings; regulatory news; and litigation and multiple

issuer events such as governmental actions; natural disasters or armed conflicts that affect a country or a region; or significant

market fluctuations. Potential significant events are monitored by the Advisor, Sub-Advisers and/or the Valuation Committee through

independent reviews of market indicators, general news sources and communications from the Fund’s custodian.

| Liberty

All-Star® Growth Fund |

Notes

to Financial Statements |

June

30, 2024 (Unaudited)

Security

Transactions

Security

transactions are recorded on trade date. Cost is determined and gains/(losses) are based upon the specific identification method

for both financial statement and federal income tax purposes.

Income

Recognition

Interest

income is recorded on the accrual basis. Corporate actions are recorded on the ex-date.

Dividend

income is recognized on the ex-dividend date, or for certain foreign securities, as soon as information is available to the Fund.

Withholding taxes on foreign dividends are paid (a portion of which may be reclaimable) or provided for in accordance with the

applicable country’s tax rules and rates and are disclosed in the Statement of Operations.

The

Fund estimates components of distributions from real estate investment trusts (“REITs”). Distributions received in

excess of income are recorded as a reduction of the cost of the related investments. Once the REIT reports annually the tax character

of its distributions, the Fund revises its estimates. If the Fund no longer owns the applicable securities, any distributions

received in excess of income are recorded as realized gains.

Lending

of Portfolio Securities

The

Fund may lend its portfolio securities only to borrowers that are approved by the Fund’s securities lending agent, State

Street Bank & Trust Co. (“SSB”). The Fund will limit such lending to not more than 20% of the value of its total

assets. The borrower pledges and maintains with the Fund collateral consisting of cash (U.S. Dollar only), securities issued or

guaranteed by the U.S. government or its agencies or instrumentalities, or by irrevocable bank letters of credit issued by a person

other than the borrower or an affiliate of the borrower. The initial collateral received by the Fund is required to have a value

of no less than 102% of the market value of the loaned securities for securities traded on U.S. exchanges and a value of no less

than 105% of the market value for all other securities. The collateral is maintained thereafter, at a market value equal to no

less than 100% of the current value of the securities on loan. The market value of the loaned securities is determined at the

close of each business day and any additional required collateral is delivered to the Fund on the next business day. During the

term of the loan, the Fund is entitled to all distributions made on or in respect of the loaned securities. Loans of securities

are terminable at any time and the borrower, after notice, is required to return borrowed securities within the standard time

period for settlement of securities transactions.

Any

cash collateral received is reinvested in State Street Navigator. Non-cash collateral, in the form of securities issued or guaranteed

by the U.S. government or its agencies or instrumentalities, is not disclosed in the Fund’s Schedule of Investments as it

is held by the lending agent on behalf of the Fund, and the Fund does not have the ability to re-hypothecate these securities.

Income earned by the Fund from securities lending activity is disclosed in the Statement of Operations.

| Semi-Annual

Report (Unaudited) | June 30, 2024 |

23 |

| Liberty

All-Star® Growth Fund |

Notes

to Financial Statements |

June

30, 2024 (Unaudited)

The

following is a summary of the Fund's securities lending positions and related cash and non-cash collateral received as of June

30, 2024:

Market Value of

Securities on Loan | | |

Cash Collateral

Received | | |

Non-Cash Collateral

Received | | |

Total Collateral

Received | |

| $ | 142,106 | | |

$ | 146,082 | | |

$ | – | | |

$ | 146,082 | |

The

risks of securities lending include the risk that the borrower may not provide additional collateral when required or may not

return the securities when due. To mitigate these risks, the Fund benefits from a borrower default indemnity provided by SSB.

SSB’s indemnity allows for full replacement of securities lent wherein SSB will purchase the unreturned loaned securities

on the open market by applying the proceeds of the collateral or to the extent such proceeds are insufficient or the collateral

is unavailable, SSB will purchase the unreturned loan securities at SSB’s expense. However, the Fund could suffer a loss

if the value of the investments purchased with cash collateral falls below the value of the cash collateral received.

The

following table reflects a breakdown of transactions accounted for as secured borrowings, the gross obligation by the type of

collateral pledged or securities loaned, and the remaining contractual maturity of those transactions as of June 30, 2024:

| | |

| | |

Remaining contractual maturity of the agreements | |

| |

| | |

| | |

| |

| |

Securities Lending

Transactions | |

Overnight &

Continuous | | |

Up to 30

days |

|

|

30-90

days | | |

Greater

than 90

days | | |

Total | |

| State Street Navigator | |

$ | 146,082 | | |

$ |

– |

|

|

$ | – | | |

$ | – | | |

$ | 146,082 | |

| Total Borrowings | |

| | | |

|

|

|

| | | |

| | | |

$ | 146,082 | |

| Gross amount of recognized liabilities for securities lending (collateral received) | | |

$ | 146,082 | |

Fair

Value Measurements

The

Fund discloses the classification of its fair value measurements following a three-tier hierarchy based on the inputs used to

measure fair value. Inputs refer broadly to the assumptions that market participants would use in pricing the asset or liability,

including assumptions about risk. Inputs may be observable or unobservable. Observable inputs reflect the assumptions market participants

would use in pricing the asset or liability that are developed based on market data obtained from sources independent of the reporting

entity. Unobservable inputs reflect the reporting entity’s own assumptions about the assumptions market participants would

use in pricing the asset or liability that are developed based on the best information available.

| Liberty

All-Star® Growth Fund |

Notes

to Financial Statements |

June

30, 2024 (Unaudited)

Valuation

techniques used to value the Fund's investments by major category are as follows:

Equity

securities that are valued based on unadjusted quoted prices in active markets are categorized as Level 1 in the hierarchy. In

the event there were no sales during the day or closing prices are not available, securities are valued at the mean of the most

recent quoted bid and ask prices on such day and are generally categorized as Level 2 in the hierarchy. Investments in open-end

mutual funds are valued at their closing NAV each business day and are categorized as Level 1 in the hierarchy.

Various

inputs are used in determining the value of the Fund’s investments as of the end of the reporting period. When inputs used

fall into different levels of the fair value hierarchy, the level in the hierarchy within which the fair value measurement falls

is determined based on the lowest level input that is significant to the fair value measurement in its entirety. The designated

input levels are not necessarily an indication of the risk or liquidity associated with these investments.

These

inputs are categorized in the following hierarchy under applicable financial accounting standards:

| Level

1 |

– |

Unadjusted

quoted prices in active markets for identical investments, unrestricted assets or liabilities that a Fund has the ability

to access at the measurement date; |

| |

|

|

| Level

2 |

– |

Quoted

prices which are not active, quoted prices for similar assets or liabilities in active markets or inputs other than quoted

prices that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and |

| |

|

|

| Level

3 |

– |

Significant

unobservable prices or inputs (including the Fund’s own assumptions in determining the fair value of investments) where

there is little or no market activity for the asset or liability at the measurement date. |

The

following is a summary of the inputs used to value the Fund’s investments as of June 30, 2024:

| |

Valuation Inputs | | |

| | |

| Investments in Securities at Value | |

| Level 1 | | |

| Level 2 | | |

| Level 3 | | |

| Total | |

| Common Stocks* | |

$ | 342,148,868 | | |

$ | – | | |

$ | – | | |

$ | 342,148,868 | |

| Short Term Investments | |

| 8,964,144 | | |

| – | | |

| – | | |

| 8,964,144 | |

| Total | |

$ | 351,113,012 | | |

$ | – | | |

$ | – | | |

$ | 351,113,012 | |

| * | See

Schedule of Investments for industry classifications. |

The

Fund did not have any securities that used significant unobservable inputs (Level 3) in determining fair value during the period.

There were no transfers into or out of Level 3 during the six months ended June 30, 2024.

| Semi-Annual

Report (Unaudited) | June 30, 2024 |

25 |

| Liberty

All-Star® Growth Fund |

Notes

to Financial Statements |

June

30, 2024 (Unaudited)

Distributions

to Shareholders

The

Fund currently has a policy of paying distributions on its common shares totaling approximately 8% of its net asset value per

year. The distributions are payable in four quarterly distributions of 2% of the Fund’s net asset value at the close of

the New York Stock Exchange on the Friday prior to each quarterly declaration date. Distributions to shareholders are recorded

on ex-date.

NOTE

3. RISKS

Investment

and Market Risk

An

investment in shares is subject to investment risk, including the possible loss of the entire amount invested. An investment in

shares represents an indirect investment in the securities owned by the Fund, most of which are anticipated to be traded on a

national securities exchange or in the over-the-counter markets. The value of these securities, like other market investments,

may move up or down, sometimes rapidly and unpredictably. Shares at any point in time may be worth less than their original cost,

even after taking into account the reinvestment of dividends and other distributions.

Common

Stock Risk

The

Fund is not limited in the percentage of its assets that may be invested in common stocks and other equity securities, and therefore

a risk of investing in the Fund is common stock or equity risk. Equity risk is the risk that the market value of securities held

by the Fund will fall due to general market or economic conditions, perceptions regarding the industries in which the issuers

of securities held by the Fund participate, and the particular circumstances and performance of particular companies whose securities

the Fund holds. In addition, common stock of an issuer in the Fund’s portfolio may decline in price if the issuer fails

to make anticipated dividend payments because, among other reasons, the issuer of the security experiences a decline in its financial

condition. Common equity securities in which the Fund will invest are structurally subordinated to preferred stocks, bonds and