Babylon Holdings Limited (NYSE: BBLN) (including its

subsidiaries, “Babylon”) is pleased to announce that it has

entered into an amendment and restatement of its senior secured

term loan facility with AlbaCore Capital LLP and certain of its

affiliates (“AlbaCore”), dated March 9, 2023 (the “Bridge

Facility Agreement”), for up to an additional $34.5 million in

funding (the “Interim Funding”). This investment

demonstrates AlbaCore's ongoing support to Babylon. The Interim

Funding will be provided on similar pricing terms to the original

Bridge Facility Agreement.

The Interim Funding will provide liquidity to support Babylon's

operations and enable Babylon to proceed with a proposed

longer-term funding and take-private solution under a framework

implementation agreement (the “Framework Agreement”) entered

into between Babylon and AlbaCore. Under the Framework Agreement,

Babylon and AlbaCore expect to proceed with a restructuring and

recapitalization that will strengthen Babylon’s balance sheet and

provide additional liquidity to deliver on Babylon’s strategic

plan. The Framework Agreement contemplates that core operating

subsidiaries of Babylon Holdings Limited (the “Go-Forward

Business”) will return to private ownership (the “Take

Private Proposal”) and is expected to provide, subject to

specified terms and conditions and definitive documentation, for:

(i) additional funding for the Go-Forward Business; (ii) an

amendment of the existing aggregate debt under the original $300

million principal amount of AlbaCore notes due 2026, the notes

issued under the Bridge Facility Agreement, and the Interim Funding

(collectively, the “Debt”), including an extension of the

maturity of the Debt; and (iii) a new long-term employee incentive

plan.

Babylon's Board of Directors has approved the Interim Funding

and the Take Private Proposal as a constructive step to deliver a

longer-term solution to support the Go-Forward Business’s continued

path toward profitability, upon consideration of the results of

Babylon’s previously announced efforts to explore strategic

alternatives, including additional financing and a possible sale of

the Meritage Medical Network/Independent Physician Association

business (the “IPA Business”).

The Interim Funding will be made available to Babylon in May and

early June 2023, subject to the satisfaction of certain conditions

precedent. Babylon and AlbaCore plan to implement the Take Private

Proposal during June in the absence of other acceptable transaction

proposals from third parties in the interim period. It is expected

that as part of the implementation of the Take Private Proposal,

Babylon Holdings Limited will sell Babylon Group Holdings Limited,

which owns Babylon’s core operating subsidiaries that will comprise

the Go-Forward Business, to a newly formed entity capitalized by

AlbaCore and other investors. This sale will occur without the

approval of or any payment to Babylon Holdings Limited’s Class A

ordinary shareholders or other equity instrument holders, as

AlbaCore will be exercising rights under its debt agreements with

Babylon.

Babylon remains focused on its day-to-day operations and patient

care, as well as its ongoing and future commercial relationships,

and on ensuring stability for Babylon’s key stakeholders. Babylon

remains entirely committed to its employees, customers and patients

alike, and will proactively seek to maintain and strengthen its

partnerships while continuing to provide high-quality, accessible

and affordable healthcare through its innovative digital-first

platform as Babylon positions itself for its future.

About Babylon

At Babylon, our mission is to make quality healthcare accessible

and affordable for every person on Earth. To this end, we are

building an integrated digital first primary care service that can

manage population health at scale.

Founded in 2013, we are reengineering how people engage with

their care at every step of the healthcare continuum. By flipping

the model from reactive sick care to proactive healthcare through

the devices people already own, we offer millions of people

globally, ongoing, always-on care. And, we have already shown that

in environments as diverse as the developed UK or developing

Rwanda, urban New York or rural Missouri, for people of all ages,

it is possible to achieve our mission by leveraging our highly

scalable, digital-first platform combined with high quality,

virtual clinical operations to provide integrated, personalized

healthcare.

Today, we support a global patient network across 15 countries,

and operate in 16 languages. In 2021 alone, Babylon helped a

patient every 6 seconds, with approximately 5.2 million

consultations and AI interactions. Importantly, this was achieved

with a 93% user retention rate in our NHS GP at Hand service and 4

or 5-star ratings from more than 90% of our users across all of our

geographies. We are working to demonstrate how our model of digital

first integrated primary care can be applied to manage the health

of the population in different settings across Medicare, Medicaid,

and commercial value-based care contracts in the US and our primary

care services in the UK.

Babylon is also working with governments, health providers,

employers and insurers across the globe to provide them with a new

digital-first platform that any partner can use to deliver

high-quality healthcare with lower costs and better outcomes. For

more information, please visit www.babylonhealth.com.

Forward-Looking

Statements

This press release contains “forward-looking statements” as

defined in the Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally relate to future events or our

future financial or operating performance. When used in this press

release, the words “estimates,” “projected,” “expects,”

“anticipates,” “forecasts,” “plans,” “intends,” “believes,”

“seeks,” “may,” “will,” “should,” “future,” “propose” and

variations of these words or similar expressions (or the negative

versions of such words or expressions) are intended to identify

forward-looking statements. These forward-looking statements

include, without limitation, information concerning Babylon’s

ability to receive available funding from the Interim Funding in

full and its ability to successfully implement the Framework

Agreement, possible or assumed future results of operations,

business strategies, debt levels, competitive position, industry

environment and potential growth opportunities.

These forward-looking statements are not guarantees of future

performance, conditions, or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside of Babylon’s management’s

control, that could cause actual results to differ materially from

the results discussed in the forward-looking statements. These

risks, uncertainties, assumptions and other important factors

include, but are not limited to: our ability to continue as a going

concern over the next twelve months; risks associated with our debt

financing agreements with AlbaCore, including our ability to

receive available funding from the Interim Funding in full and the

impact of the restrictive covenants on our operations; risks

associated with the implementation of the Take Private Proposal

pursuant to the Framework Agreement; that we may require additional

financing and our ability to obtain additional financing on

favorable terms; our ability to timely identify and execute

strategic alternatives on favorable terms, including restructuring,

refinancing, an asset sale such as the proposed sale of the IPA

Business, a take private transaction, and/or putting Babylon

Holdings Limited into administration under UK law or obtaining

relief under the U.S. Bankruptcy Code; risks and uncertainties

associated with such administration or bankruptcy proceedings; the

diversion of our senior management team’s attention from our

business to pursuing strategic alternatives; the impact on our

share price as a result of announcements related to a potential

take private transaction; turnover in our senior management team

and other key talent; our future financial and operating results,

ability to generate profits in the future, and timeline to

profitability for Babylon as a whole and in our lines of business;

the impact of our recently completed reverse share split on the

price and trading market for our Class A ordinary shares; if we

fail to comply with the NYSE’s continued listing standards and

rules, the NYSE may delist our Class A ordinary shares;

uncertainties related to our ability to continue as a going

concern; our ability to successfully execute our planned cost

reduction actions and realize the expected cost savings; the growth

of our business and organization; risks associated with impairment

of goodwill and other intangible assets; our failure to compete

successfully; our ability to renew contracts with existing

customers, and risks of contract renewals at lower fee levels, or

significant reductions in members, pricing or premiums under our

contracts due to factors outside our control; our dependence on our

relationships with physician-owned entities; our ability to

maintain and expand a network of qualified providers; our ability

to increase engagement of individual members or realize the member

healthcare cost savings that we expect; a significant portion of

our revenue comes from a limited number of customers; the

uncertainty and potential inadequacy of our claims liability

estimates for medical costs and expenses; risks associated with

estimating the amount and timing of revenue recognized under our

licensing agreements and value-based care agreements with health

plans; risks associated with our physician partners’ failure to

accurately, timely and sufficiently document their services; risks

associated with inaccurate or unsupportable information regarding

risk adjustment scores of members in records and submissions to

health plans; risks associated with reduction of reimbursement

rates paid by third-party payers or federal or state healthcare

programs; risks associated with regulatory proposals directed at

containing or lowering the cost of healthcare, including the ACO

REACH model; immaturity and volatility of the market for

telemedicine and our unproven digital-first approach; our ability

to develop and release new solutions and services; difficulty in

hiring and retaining talent to operate our business; risks

associated with our international operations, economic uncertainty,

or downturns; the impact of COVID-19 or any other pandemic,

epidemic or outbreak of an infectious disease in the United States

or worldwide on our business; risks associated with foreign

currency exchange rate fluctuations and restrictions; and the other

risks and uncertainties identified in Babylon’s Form 10-K filed

with the SEC on March 16, 2023 and Form 10-Q to be filed with the

SEC on May 10, 2023, and in other documents filed or to be filed by

Babylon with the SEC and available at the SEC’s website at

www.sec.gov.

Babylon cautions that the foregoing list of factors is not

exclusive and cautions readers not to place undue reliance upon any

forward-looking statements, which speak only as of the date made.

Except as required by law, Babylon does not undertake any

obligation to update or revise its forward-looking statements to

reflect events or circumstances after the date of this press

release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230510005399/en/

Media press@babylonhealth.com

Investors investors@babylonhealth.com

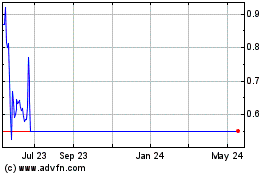

Babylon (NYSE:BBLN)

Historical Stock Chart

From Feb 2025 to Mar 2025

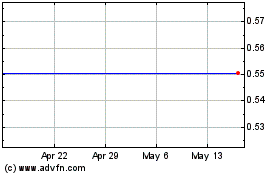

Babylon (NYSE:BBLN)

Historical Stock Chart

From Mar 2024 to Mar 2025