Aligned with Berry’s strategy to transition the

portfolio toward consumer-focused end markets

Berry Global Group, Inc., (“Berry”) (NYSE:BERY) announced today

it has entered into a definitive agreement to sell its Specialty

Tapes business (“Tapes”) to the private equity firm Nautic

Partners, LLC (“Nautic”) for a headline purchase price of

approximately $540 million, which is subject to a number of closing

adjustments.

The Tapes business is a franchise highly valued by its

industrial customers. As a result, this separation is aligned with

Berry’s broader strategy to transition the portfolio towards more

consistent, higher growth consumer-oriented end markets and

platforms.

Berry plans to use proceeds from the transaction to pay down

outstanding debt at Berry. Adjusted for both the cash distribution

received in November 2024 on close of Berry’s Health, Hygiene and

Specialties Global Nonwovens and Films business (“HHNF”) spin-off,

and the net cash proceeds1 expected on the sale of Tapes, totaling

$1.3 billion, Berry’s pro forma net debt as of September 30, 2024

was approximately $5.9 billion (3.5x LTM net leverage).

as of 30-Sep | US$ in bn

Berry

(as

Reported)

HHNF and

Tapes

Berry

(Pro

Forma)

Debt

$ 8.3

$ 8.3

Cash & Equivalents / Proceeds

(1.1)

(1.3)

(2.4)

Net Debt

$ 7.2

$(1.3)

$ 5.9

EBITDA

2.0

(0.3)

1.7

Net Leverage

3.5 x

3.5 x

Revenue

$ 12.3

$ 2.6

$ 9.7

The transaction is expected to complete by the first half of

calendar 2025, subject to customary closing conditions.

Berry CEO, Kevin Kwilinski, said, “Over the past year, Berry has

undergone a significant transformation, completing the spin-off of

our HHNF business, enhancing our product mix and optimizing our

portfolio. The sale of Tapes further supports these efforts and the

continued focus on our high-growth consumer portfolio.”

Goldman Sachs & Co. LLC is serving as exclusive financial

advisor to Berry, and Bryan Cave Leighton Paisner LLP is serving as

Berry’s legal counsel. McDermott, Will & Emery LLP is serving

as Nautic’s legal counsel and Santander is serving as exclusive

financial advisor to Nautic.

Berry’s Announced Combination with

Amcor

On November 19, 2024, Berry announced an agreement to combine

with Amcor in an all-stock transaction, creating a global leader in

consumer and healthcare packaging solutions.

The combination brings together two highly complementary

businesses to create a global leader in consumer packaging

solutions, with a broader flexible film and converted film offering

for customers, a scaled containers and closures business, and a

unique global healthcare portfolio. The combined company will have

unprecedented innovation capabilities and scale and be uniquely

positioned to accelerate growth, solve customers’ and consumers’

sustainability needs, unlock further portfolio transformation, and

deliver significant value to both sets of shareholders.

________________________________

1 Reflects management estimates for

expected cash proceeds net of taxes of $400 million.

The sale of the Tapes business further reinforces the strategic

rationale for the combination and has no material impact on the

financial profile of the combined entity as detailed below6:

Combined LTM 30-Sep-2024

Amcor Berry

(+)Synergies2 Combined

Revenue

($ in billions)

$13.6

$9.7

$0.3

$23.6

EBITDA ($ in billions)

$2.0

$1.7

$0.6

$4.3

% Margin

15%

18%

-

18%

R&D Investment ($ in

millions)

$100

$80

-

$180

________________________________

2 Includes run-rate synergies by the end

of year 3. Includes $530 million in run-rate cost synergies and $60

million earnings impact from $280 million in incremental growth

synergies. $280 million in growth synergies expected to build to

$400+ million by year 4.

3 Cash flow and Adj. Cash EPS include $60

million in additional financial synergies by year 3.

4 Defined as combined operating cash flow

including run-rate synergies, after interest and tax, before

capital expenditures.

5 Accretion inclusive of run-rate impact

of synergies and is relative to Amcor’s LTM 30-Sep-2024 standalone

EPS.

6 Excludes the HHNF transaction and the

sale of Tapes.

Further details relating to the compelling rationale for this

combination can be found at https://ir.berryglobal.com/financials

under recent events.

About Berry Global

Berry is a global leader in innovative packaging solutions that

we believe make life better for people and the planet. We do this

every day by leveraging our unmatched global capabilities,

sustainability leadership, and deep innovation expertise to serve

customers of all sizes around the world. Harnessing the strength in

our diversity and industry-leading talent of over 34,000 global

employees across more than 200 locations, we partner with customers

to develop, design, and manufacture innovative products with an eye

toward the circular economy. The challenges we solve and the

innovations we pioneer benefit our customers at every stage of

their journey.

About Nautic Partners

Nautic Partners is a Providence, Rhode Island-based

middle-market private equity firm that focuses its expertise and

market knowledge on sub-verticals within three sectors: Healthcare,

Industrials and Services. Nautic has completed over 155 platform

transactions throughout its 38-year history. In pursuing its

thematic and proactive investment strategy, Nautic seeks to partner

with executives and management teams in an effort to accelerate the

growth trajectory of its portfolio companies via acquisitions,

targeted operating initiatives, and increased management team

depth. For more information, please visit www.nautic.com.

Important Information for Investors and Shareholders

This communication does not constitute an offer to sell or the

solicitation of an offer to buy or exchange any securities or a

solicitation of any vote or approval in any jurisdiction, nor shall

there be any sale, issuance or transfer of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. It does not constitute a

prospectus or prospectus equivalent document. No offering or sale

of securities shall be made except by means of a prospectus meeting

the requirements of Section 10 of the US Securities Act of 1933, as

amended, and otherwise in accordance with applicable law.

In connection with the proposed transaction between Berry Global

Group, Inc. (“Berry”) and Amcor plc (“Amcor”), Berry and Amcor

intend to file relevant materials with the Securities and Exchange

Commission (the “SEC”), including, among other filings, an Amcor

registration statement on Form S-4 that will include a joint proxy

statement of Berry and Amcor that also constitutes a prospectus of

Amcor with respect to Amcor’s ordinary shares to be issued in the

proposed transaction, and a definitive joint proxy

statement/prospectus, which will be mailed to shareholders of Berry

and Amcor (the “Joint Proxy Statement/Prospectus”). Berry and Amcor

may also file other documents with the SEC regarding the

proposed transaction. This document is not a substitute for

the Joint Proxy Statement/Prospectus or any other document which

Berry or Amcor may file with the SEC. INVESTORS AND SECURITY

HOLDERS OF BERRY AND AMCOR ARE URGED TO READ THE JOINT PROXY

STATEMENT/PROSPECTUS AND ANY OTHER DOCUMENTS THAT WILL BE FILED

WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE

DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE

PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security

holders will be able to obtain free copies of the registration

statement and the Joint Proxy Statement/Prospectus (when available)

and other documents filed with the SEC by Berry or Amcor through

the website maintained by the SEC at http://www.sec.gov. Copies of

the documents filed with the SEC by Berry will be available free of

charge on Berry’s website at berryglobal.com under the tab

“Investors” and under the heading “Financials” and subheading “SEC

Filings.” Copies of the documents filed with the SEC by Amcor will

be available free of charge on Amcor’s website at amcor.com under

the tab “Investors” and under the heading “Financial Information”

and subheading “SEC Filings.”

Certain Information Regarding Participants

Berry, Amcor and their respective directors and executive

officers may be considered participants in the solicitation of

proxies from the shareholders of Berry and Amcor in connection with

the proposed transaction. Information about the directors and

executive officers of Berry is set forth in its Annual Report on

Form 10-K for the year ended September 30, 2023, which was filed

with the SEC on November 17, 2023, its proxy statement for its 2024

annual meeting, which was filed with the SEC on January 4, 2024,

and its Current Reports on Form 8-K, which were filed with the SEC

on February 12, 2024, April 11, 2024, September 6, 2024 and

November 4, 2024. Information about the directors and executive

officers of Amcor is set forth in its Annual Report on Form 10-K

for the year ended June 30, 2024, which was filed with the SEC on

August 16, 2024 and its proxy statement for its 2024 annual

meeting, which was filed with the SEC on September 24, 2024. To the

extent holdings of Berry’s or Amcor’s securities by its directors

or executive officers have changed since the amounts set forth in

such filings, such changes have been or will be reflected on

Initial Statements of Beneficial Ownership on Form 3 or Statements

of Beneficial Ownership on Form 4 filed with the SEC. Information

about the directors and executive officers of Berry and Amcor,

including a description of their direct or indirect interests, by

security holdings or otherwise, and other information regarding the

potential participants in the proxy solicitations, which may be

different than those of Berry’s stockholders and Amcor’s

shareholders generally, will be contained in the Joint Proxy

Statement/Prospectus and other relevant materials to be filed with

the SEC regarding the proposed transaction. You may obtain these

documents (when they become available) free of charge through the

website maintained by the SEC at http://www.sec.gov and from

Berry’s or Amcor’s website as described above.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains certain statements that are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act and Section 21E of the Exchange Act. Some of

these forward-looking statements can be identified by words like

“anticipate,” “approximately,” “believe,” “continue,” “could,”

“estimate,” “expect,” “forecast,” “intend,” “may,” “outlook,”

“plan,” “potential,” “possible,” “predict,” “project,” “target,”

“seek,” “should,” “will,” or “would,” the negative of these words,

other terms of similar meaning or the use of future dates. Such

statements, including projections as to the anticipated benefits of

the proposed transactions, the impact of the proposed disposition

of Tapes (the “Tapes Transaction”) on Berry and Amcor’s business

and future financial and operating results and prospects, the

amount and timing of synergies from the Berry and Amcor proposed

transaction (the “Combination Transaction”), the estimated amount

of net proceeds to be received in the Tape Transaction, after

giving effect to a number of closing adjustments, the terms and

scope of the expected financing in connection with the proposed

Combination Transaction, the aggregate amount of indebtedness of

Berry following the proposed Tapes Transaction and the combined

company following the closing of the proposed Combination

Transaction and the closing date for the proposed transactions, are

based on the current estimates, assumptions and projections of the

management of Berry with respect to the proposed Tapes Transaction,

and Berry and Amcor with respect to the proposed Combination

Transaction, and are qualified by the inherent risks and

uncertainties surrounding future expectations generally, all of

which are subject to change. Actual results could differ materially

from those currently anticipated due to a number of risks and

uncertainties, many of which are beyond Berry’s control with

respect to the proposed Tapes Transaction and Amcor’s and Berry’s

control with respect to the proposed Combination Transaction. None

of Berry, Amcor or any of their respective directors, executive

officers, or advisors, provide any representation, assurance or

guarantee that the occurrence of the events expressed or implied in

any forward-looking statements will actually occur, or if any of

them do occur, what impact they will have on the business, results

of operations or financial condition of Berry or Amcor. Should any

risks and uncertainties develop into actual events, these

developments could have a material adverse effect on Berry’s and

Amcor’s businesses, the proposed Tape Transaction, the proposed

Combination Transaction and the ability to successfully complete

the proposed transactions and realize their respective expected

benefits. Risks and uncertainties that could cause results to

differ from expectations include, but are not limited to, the

occurrence of any event, change or other circumstance that could

give rise to the termination of the definitive transaction

agreements for each transaction; the risk that the conditions to

the completion of the proposed transactions (including shareholder

approval in the case of the proposed Combination Transaction and

regulatory approvals for both proposed transactions) are not

satisfied in a timely manner or at all; the risks arising from the

integration of the Berry and Amcor businesses in the proposed

Combination Transaction; the risk that the anticipated benefits of

each of the proposed transactions may not be realized when expected

or at all; the risk of unexpected costs or expenses resulting from

each of the proposed transactions; the risk of litigation related

to the proposed Combination Transaction; the risks related to

disruption of management’s time from ongoing business operations as

a result of each of the proposed transactions; the risk that the

proposed Combination Transaction may have an adverse effect on the

ability of Berry and Amcor to retain key personnel and customers;

general economic, market and social developments and conditions;

the evolving legal, regulatory and tax regimes under which Berry

and Amcor operate; potential business uncertainty, including

changes to existing business relationships, during the pendency of

the proposed transaction that could affect Berry’s and/or Amcor’s

financial performance; and other risks and uncertainties identified

from time to time in Berry’s and Amcor’s respective filings with

the SEC, including the Joint Proxy Statement/Prospectus to be filed

with the SEC in connection with the proposed Combination

Transaction. While the list of risks presented here for both

prospective transactions is, and the list of risks presented in the

Joint Proxy Statement/Prospectus for the Combination Transaction

will be, considered representative, no such list should be

considered to be a complete statement of all potential risks and

uncertainties, and other risks may present significant additional

obstacles to the realization of forward-looking statements.

Forward-looking statements included herein are made only as of the

date hereof and neither Berry nor Amcor undertakes any obligation

to update any forward-looking statements, or any other information

in this communication, as a result of new information, future

developments or otherwise, or to correct any inaccuracies or

omissions in them which become apparent. All forward-looking

statements in this communication are qualified in their entirety by

this cautionary statement.

Note Regarding Use of Non-GAAP Financial Measures

In addition to the financial measures presented in accordance

with U.S. generally accepted accounting principles (“U.S. GAAP”),

this communication includes certain non-GAAP financial measures

(collectively, the “Non-GAAP Measures”), such as EBITDA. These

Non-GAAP Measures should not be used in isolation or as a

substitute or alternative to results determined in accordance with

U.S. GAAP. In addition, Berry's and Amcor’s definitions of these

Non-GAAP Measures may not be comparable to similarly titled

non-GAAP financial measures reported by other companies. It should

also be noted that projected financial information for the pro

forma results of Berry following the disposition of Tapes and the

combined businesses of Berry and Amcor following completion of the

Combination Transaction is based on management’s estimates,

assumptions and projections and has not been prepared in

conformance with the applicable accounting requirements of

Regulation S-X relating to pro forma financial information, and the

required pro forma adjustments have not been applied and are not

reflected therein. These measures are provided for illustrative

purposes, are based on an arithmetic sum of the relevant historical

financial measures of Berry and Amcor and do not reflect pro forma

adjustments. None of this information should be considered in

isolation from, or as a substitute for, the historical financial

statements of Berry or Amcor. Important risk factors could cause

actual future results and other future events to differ materially

from those currently estimated by management, including, but not

limited to, the risks that: a condition to the closing of either of

the proposed transactions may not be satisfied; a regulatory

approval that may be required for either of the proposed

transactions is delayed, is not obtained or is obtained subject to

conditions that are not anticipated; with respect to the proposed

Combination Transaction: management’s time and attention is

diverted on transaction related issues; disruption from the

proposed transactions makes it more difficult to maintain business,

contractual and operational relationships; the credit ratings of

the combined company declines following either of the proposed

transaction; legal proceedings are instituted against Berry, Amcor

or the combined company; Berry, Amcor or the combined company is

unable to retain key personnel; and the announcement or the

consummation of either of the proposed transaction has a negative

effect on the market price of the capital stock of Berry and Amcor

or on Berry’s and Amcor’s operating results.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125222548/en/

Dustin Stilwell VP, Head of Investor Relations +1 (812) 306 2964

ir@berryglobal.com

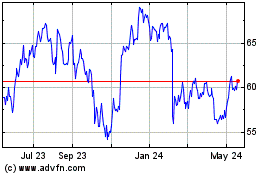

Berry Global (NYSE:BERY)

Historical Stock Chart

From Dec 2024 to Jan 2025

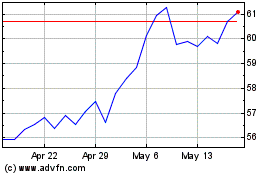

Berry Global (NYSE:BERY)

Historical Stock Chart

From Jan 2024 to Jan 2025