Filed by Amcor plc

Pursuant to Rule 425 under the Securities Act

of 1933,

as amended, and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Berry Global Group, Inc.

Commission File No.: 333-284248

Explanatory Note: The following is a communication issued

by Amcor plc to CDI holders.

SUBJECT: REMINDER TO VOTE – Amcor plc Extraordinary General Meeting

If you have recently voted, please ignore this email

REMINDER TO VOTE – AMCOR PLC EXTRAORDINARY

GENERAL MEETING (EGM)

THE AMCOR BOARD UNANIMOUSLY RECOMMENDS THAT

AMCOR CDI HOLDERS VOTE IN

FAVOUR OF BOTH AMCOR PROPOSALS AT THE EGM. YOU ARE ENCOURAGED TO READ

THE ENTIRE JOINT PROXY STATEMENT / PROSPECTUS

FOR A MORE COMPLETE

UNDERSTANDING OF THE MERGER AND THE AMCOR PROPOSALS YOU ARE BEING

REQUESTED TO VOTE ON.

Dear Amcor CDI holder,

As announced on 19 November 2024, Amcor plc and Berry Global Group,

Inc. entered into a Merger Agreement under which Amcor will acquire Berry in an all-stock transaction.

The proposed Amcor and Berry Merger is required to have shareholder

and CDI holder approval at the Amcor Extraordinary General Meeting to be held at the offices of Kirkland & Ellis International, LLP,

30 St. Mary Axe, London, EC3A 8AF, United Kingdom at 8:00 am (AEDT) Wednesday, 26 February 2025.

If the Merger is successful, each Amcor CDI holder will hold the same

number of Amcor CDIs, as they held immediately prior to the Effective Time of the Merger. Berry stockholders will receive 7.25 Amcor Ordinary

Shares for each share of Berry Common Stock held.

Your vote is very important. The Amcor Board unanimously recommends

that Amcor CDI holders vote in favour of the Share Issuance in connection with the Merger.

MAKE YOUR VOTE COUNT

How to vote

To lodge your voting instruction, click on the “Vote here” button below. This will take you to InvestorVote where

you will be able to view the Notice of Meeting and direct CHESS Depositary Nominees Pty Ltd how to vote at the meeting.

“Vote here”

Please carefully consider the information contained

in the joint proxy statement / prospectus. Amcor encourages you to vote as soon as possible to ensure your vote counts at the EGM.

To be effective, CDI votes must be received no later than 10:00

am (AEDT) Friday, 21 February 2025.

Further information

For more information, please refer to the joint proxy statement / prospectus

which can be found on the ASX website. You can also access additional information about Amcor on the Investor Home page of their website,

located here: Amcor Investors Home page | Amcor.

If you have any questions in relation to the joint proxy statement

/ prospectus, please feel free to contact the Amcor Information Line at any time should you have any questions.

1300 158 729 within Australia or + 61 2 9066 4058 outside Australia

between 8.30 am and 5.30 pm (Sydney time) Monday to Friday (excluding public holidays).

Yours faithfully,

The Board of Directors

Amcor plc

Important Information for Investors and Shareholders

This communication does not constitute an offer

to sell or the solicitation of an offer to buy or exchange any securities or a solicitation of any vote or approval in any jurisdiction.

It does not constitute a prospectus or prospectus equivalent document. No offering of securities shall be made except by means of a prospectus

meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

In connection with the proposed transaction between

Amcor plc (“Amcor”) and Berry Global Group (“Berry”), on January 13, 2025, Amcor filed with the

Securities and Exchange Commission (the “SEC”) a registration statement on Form S-4, as amended on January 21, 2025,

containing a joint proxy statement of Amcor and Berry that also constitutes a prospectus of Amcor. The registration statement was declared

effective by the SEC on January 23, 2025 and Amcor and Berry commenced mailing the definitive joint proxy statement/prospectus to their

respective shareholders on or about January 23, 2025. INVESTORS AND SECURITY HOLDERS OF AMCOR AND BERRY ARE URGED TO READ THE DEFINITIVE

JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY BECAUSE

THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of the registration statement

and the definitive joint proxy statement/prospectus and other documents filed with the SEC by Amcor or Berry through the website maintained

by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by Amcor are available free of charge on Amcor’s website

at amcor.com under the tab “Investors” and under the heading “Financial Information” and subheading “SEC

Filings.” Copies of the documents filed with the SEC by Berry are available free of charge on Berry’s website at berryglobal.com

under the tab “Investors” and under the heading “Financials” and subheading “SEC Filings.”

Certain Information Regarding Participants

Amcor, Berry, and their respective directors and

executive officers may be considered participants in the solicitation of proxies from the shareholders of Amcor and Berry in connection

with the proposed transaction. Information about the directors and executive officers of Amcor is set forth in its Annual Report on Form

10-K for the year ended June 30, 2024, which was filed with the SEC on August 16, 2024, its proxy statement for its 2024 annual meeting,

which was filed with the SEC on September 24, 2024, and its Current Report on Form 8-K, which was filed with the SEC on January 6, 2025.

Information about the directors and executive officers of Berry is set forth in its Annual Report on Form 10-K for the year ended September

28, 2024, which was filed with the SEC on November 26, 2024, and its proxy statement for its 2025 annual meeting, which was filed with

the SEC on January 7, 2025. Information about the directors and executive officers of Amcor and Berry and other information regarding

the potential participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or

otherwise, are contained in the definitive joint proxy statement/prospectus filed with the SEC and other relevant materials filed with

or to be filed with the SEC regarding the proposed transaction when they become available. To the extent holdings of Amcor’s or

Berry’s securities by its directors or executive officers have changed since the amounts set forth in the definitive joint proxy

statement/prospectus, such changes have been or will be reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements

of Beneficial Ownership on Form 4 filed with the SEC. You may obtain these documents (when they become available) free of charge through

the website maintained by the SEC at http://www.sec.gov and from Amcor’s or Berry’s website as described above.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains certain

statements that are “forward-looking statements” within the meaning of Section 27A of the Securities Act and

Section 21E of the Exchange Act. Some of these forward-looking statements can be identified by words like

“anticipate,” “approximately,” “believe,” “continue,” “could,”

“estimate,” “expect,” “forecast,” “intend,” “may,”

“outlook,” “plan,” “potential,” “possible,” “predict,”

“project,” “target,” “seek,” “should,” “will,” or “would,”

the negative of these words, other terms of similar meaning or the use of future dates. Such statements, including projections as to

the anticipated benefits of the proposed transaction, the impact of the proposed transaction on Amcor’s and Berry’s

business and future financial and operating results and prospects, the amount and timing of synergies from the proposed transaction,

the terms and scope of the expected financing in connection with the proposed transaction, the aggregate amount of indebtedness of

the combined company following the closing of the proposed transaction and the closing date for the proposed transaction, are based

on the current estimates, assumptions and projections of the management of Amcor and Berry, and are qualified by the inherent risks

and uncertainties surrounding future expectations generally. Actual results could differ materially from those currently anticipated

due to a number of risks and uncertainties, many of which are beyond Amcor’s and Berry’s control. None of Amcor, Berry

or any of their respective directors, executive officers, or advisors, provide any representation, assurance or guarantee that the

occurrence of the events expressed or implied in any forward-looking statements will actually occur, or if any of them do occur,

what impact they will have on the business, results of operations or financial condition of Amcor or Berry. Should any risks

and uncertainties develop into actual events, these developments could have a material adverse effect on Amcor’s and

Berry’s businesses, the proposed transaction and the ability to successfully complete the proposed transaction and realize its

expected benefits. Risks and uncertainties that could cause results to differ from expectations include, but are not limited to, the

occurrence of any event, change or other circumstance that could give rise to the termination of the merger agreement; the risk that

the conditions to the completion of the proposed transaction (including shareholder and regulatory approvals) are not satisfied in a

timely manner or at all; the risks arising from the integration of the Amcor and Berry businesses; the risk that the anticipated

benefits of the proposed transaction may not be realized when expected or at all; the risk of unexpected costs or expenses resulting

from the proposed transaction; the risk of litigation related to the proposed transaction; the risks related to disruption of

management’s time from ongoing business operations as a result of the proposed transaction; the risk that the proposed

transaction may have an adverse effect on the ability of Amcor and Berry to retain key personnel and customers; and those risks

discussed in Amcor’s and Berry’s respective filings with the SEC. Forward looking statements included herein are made

only as of the date hereof and neither Amcor nor Berry undertakes any obligation to update any forward-looking statements, or any

other information in this communication, as a result of new information, future developments or otherwise, or to correct any

inaccuracies or omissions in them which become apparent. All forward-looking statements in this communication are qualified in their

entirety by this cautionary statement.

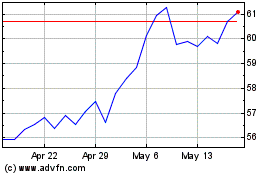

Berry Global (NYSE:BERY)

Historical Stock Chart

From Jan 2025 to Feb 2025

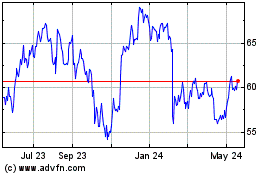

Berry Global (NYSE:BERY)

Historical Stock Chart

From Feb 2024 to Feb 2025