AM Best Revises Outlooks to Positive for Southern Pioneer Property and Casualty Insurance Company

28 October 2023 - 1:58AM

Business Wire

AM Best has revised the outlooks to positive from stable

and affirmed the Financial Strength Rating of B++ (Good) and the

Long-Term Issuer Credit Rating of “bbb+” (Good) of Southern Pioneer

Property and Casualty Insurance Company (Southern Pioneer)

(Jonesboro, AR).

The Credit Ratings (ratings) reflect Southern Pioneer’s balance

sheet strength, which AM Best assesses as very strong, as well as

its adequate operating performance, limited business profile and

appropriate enterprise risk management (ERM).

The revised outlooks to positive from stable reflect Southern

Pioneer’s ability to maintain favorable balance sheet strength

positions including the strongest level of risk-adjusted

capitalization, as measured by Best’s Credit Adequacy Ratio (BCAR),

a generally conservative investment portfolio with solid liquidity

and operating cash flows, below average leverage metrics, and

consistently favorable calendar-year loss reserve development. The

company’s balance sheet strength further benefits from increased

financial flexibility from its parent company, Biglari Holdings

Inc. [NYSE: BH]. Southern Pioneer reported surplus growth in four

of the past five years, driven primarily by underwriting income.

Net losses developed in 2022, which were marked by elevated weather

losses and coupled with unrealized capital losses, cumulatively led

to a decline in surplus that year. Capital rebounded in 2023

reflecting improvement in investment performance and a return to

net profit. In an effort to fortify operating results, the company

increased rates, tightened underwriting guidelines, and enhanced

homeowner pricing models. AM Best expect these efforts to benefit

prospective results and future capital growth.

The limited business profile reflects geographical

concentrations and niche focus on non-franchised auto dealerships.

AM Best assesses Southern Pioneer’s ERM program as appropriate for

its size and complexity, which includes stress testing for

catastrophe risks. The company further employs a comprehensive

reinsurance program that protects surplus against shock losses.

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent Rating

Activity web page. For additional information regarding the use and

limitations of Credit Rating opinions, please view Guide to Best's

Credit Ratings. For information on the proper use of Best’s Credit

Ratings, Best’s Performance Assessments, Best’s Preliminary Credit

Assessments and AM Best press releases, please view Guide to Proper

Use of Best’s Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2023 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231027752372/en/

Quentin Harris Senior Financial Analyst +1 908 882 1816

quentin.harris@ambest.com

Christopher Draghi Associate Director + 1 908 882 1749

chris.draghi@ambest.com

Christopher Sharkey Associate Director, Public Relations +1

908 882 2310 christopher.sharkey@ambest.com

Al Slavin Senior Public Relations Specialist +1 908 882

2318 al.slavin@ambest.com

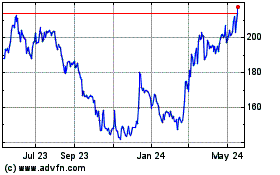

Biglari (NYSE:BH)

Historical Stock Chart

From Feb 2025 to Mar 2025

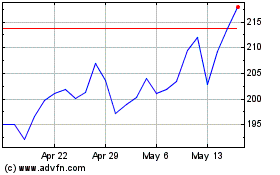

Biglari (NYSE:BH)

Historical Stock Chart

From Mar 2024 to Mar 2025