Barnes & Noble Sets Buyback Plan

21 October 2015 - 12:40AM

Dow Jones News

Barnes & Noble Inc., fresh off the spinoff of its education

business, on Tuesday said its board authorized a $50 million

stock-buyback program.

The repurchase program doesn't have an expiration date. As of

Monday's closing price, the company had a total market value of

about $1 billion.

Shares of Barnes & Noble, down 13% this year, ticked up 0.3%

in premarket trading.

Barnes & Noble completed the spinoff of its college

bookstore group into a new publicly traded company, Barnes &

Noble Education Inc., in August.

But the country's largest bookstore chain continues to struggle,

and in September, the company reported a wider loss as sales in its

retail segment slipped and the company's Nook business continued to

drag.

In July, the company approved an annual dividend of 60 cents a

share.

Write to Chelsey Dulaney at Chelsey.Dulaney@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

October 20, 2015 09:25 ET (13:25 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

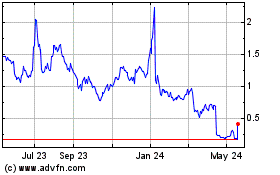

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Jun 2024 to Jul 2024

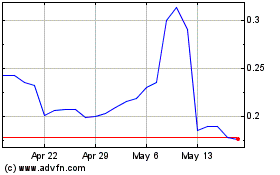

Barnes and Noble Education (NYSE:BNED)

Historical Stock Chart

From Jul 2023 to Jul 2024