Berkshire Hathaway Inc. News Release

23 February 2025 - 12:00AM

Business Wire

(BRK.A; BRK.B) –

Berkshire’s operating results for the fourth quarter and full

year of 2024 and 2023 are summarized in the following paragraphs.

However, we urge investors and reporters to read our 2024 Annual

Report, which has been posted at www.berkshirehathaway.com. The

limited information that follows in this press release is not

adequate for making an informed investment judgment.

Earnings of Berkshire Hathaway Inc. and its consolidated

subsidiaries for the fourth quarter and full year of 2024 and 2023

are summarized below. Earnings are stated on an after-tax basis.

(Dollar amounts are in millions, except for per share amounts).

Fourth

Quarter

Full

Year

2024

2023

2024

2023

Net earnings attributable to Berkshire

shareholders

$

19,694

$

37,574

$

88,995

$

96,223

Net earnings includes:

Investment gains/losses

5,167

29,093

41,558

58,873

Operating earnings

14,527

8,481

47,437

37,350

Net earnings attributable to Berkshire

shareholders

$

19,694

$

37,574

$

88,995

$

96,223

Net earnings per average equivalent Class

A Share

$

13,695

$

26,043

$

61,900

$

66,412

Net earnings per average equivalent Class

B Share

$

9.13

$

17.36

$

41.27

$

44.27

Average equivalent Class A shares

outstanding

1,438,022

1,442,785

1,437,720

1,448,880

Average equivalent Class B shares

outstanding

2,157,034,121

2,164,177,636

2,156,580,296

2,173,319,709

Note: Per share amounts for the

Class B shares are 1/1,500th of those shown for the Class A.

Generally Accepted Accounting Principles (“GAAP”) require that

we include the changes in unrealized gains/losses of our equity

security investments as a component of investment gains/losses in

our earnings statements. In the table above, investment

gains/losses in 2024 include after-tax gains of $2.1 billion in the

fourth quarter and after-tax losses of $38.1 billion in the full

year and in 2023 include after-tax gains of $29.5 billion in the

fourth quarter and $53.0 billion in the full year due to changes

during the fourth quarter and the full year in the unrealized gains

that existed in our equity security investment holdings. Investment

gains/losses in 2024 include after-tax realized gains of $3.1

billion in the fourth quarter and $79.6 billion for the full year

and in 2023 include after-tax realized losses on sales of

investments of $330 million in the fourth quarter and after-tax

realized gains of $3.6 billion in the full year. In 2023 investment

gains also include a net remeasurement gain of approximately $2.4

billion related to Berkshire’s acquisition of an additional 41.4%

interest in Pilot Travel Centers.

The amount of investment gains/losses in any given quarter is

usually meaningless and delivers figures for net earnings per share

that can be extremely misleading to investors who have little or no

knowledge of accounting rules.

An analysis of Berkshire’s operating earnings follows (dollar

amounts are in millions).

Fourth

Quarter

Full

Year

2024

2023

2024

2023

Insurance-underwriting

$

3,409

$

848

$

9,020

$

5,428

Insurance-investment income

4,088

2,759

13,670

9,567

BNSF

1,278

1,355

5,031

5,087

Berkshire Hathaway Energy Company

729

632

3,730

2,331

Other controlled businesses

3,262

3,270

13,072

13,362

Non-controlled businesses

695

421

1,519

1,750

Other*

1,066

(804

)

1,395

(175

)

Operating earnings

$

14,527

$

8,481

$

47,437

$

37,350

* Includes foreign currency exchange gains

related to non-U.S. Dollar denominated debt of approximately $1.2

billion in the fourth quarter and $1.1 billion in the full year

2024 and in 2023 includes foreign currency exchange losses of

approximately $684 million in the fourth quarter and gains of

approximately $211 million in the full year.

Berkshire used approximately $2.9 billion to repurchase

Berkshire shares during 2024. On December 31, 2024 there were

1,438,223 Class A equivalent shares outstanding. At December 31,

2024, insurance float (the net liabilities we assume under

insurance contracts) was approximately $171 billion, an increase of

$2 billion since yearend 2023.

Use of Non-GAAP Financial Measures

This press release includes certain non-GAAP financial measures.

The reconciliations of such measures to the most comparable GAAP

figures in accordance with Regulation G are included herein.

Berkshire presents its results in the way it believes will be

most meaningful and useful, as well as most transparent, to the

investing public and others who use Berkshire’s financial

information. That presentation includes the use of certain non-GAAP

financial measures. In addition to the GAAP presentations of net

earnings, Berkshire shows operating earnings defined as net

earnings exclusive of investment gains/losses.

Although the investment of insurance and reinsurance premiums to

generate investment income and investment gains or losses is an

integral part of Berkshire’s operations, the generation of

investment gains or losses is independent of the insurance

underwriting process. Moreover, as previously described, under

applicable GAAP accounting requirements, we are required to include

the changes in unrealized gains/losses of our equity security

investments as a component of investment gains/losses in our

periodic earnings statements. In sum, investment gains/losses for

any particular period are not indicative of quarterly business

performance.

About Berkshire

Berkshire Hathaway and its subsidiaries engage in diverse

business activities including insurance and reinsurance, utilities

and energy, freight rail transportation, manufacturing, services

and retailing. Common stock of the company is listed on the New

York Stock Exchange, trading symbols BRK.A and BRK.B.

Cautionary Statement

Certain statements contained in this press release are “forward

looking” statements within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements are not guaranties

of future performance and actual results may differ materially from

those forecasted.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250222845036/en/

Marc D. Hamburg 402-346-1400

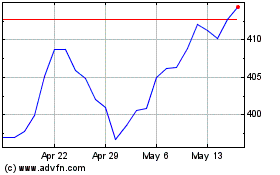

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Jan 2025 to Feb 2025

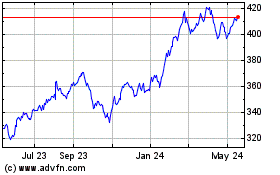

Berkshire Hathaway (NYSE:BRK.B)

Historical Stock Chart

From Feb 2024 to Feb 2025