0000079282false00000792822025-02-232025-02-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): February 23, 2025 |

BROWN & BROWN, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Florida |

001-13619 |

59-0864469 |

(State or other jurisdiction

of incorporation) |

(Commission File Number) |

(IRS Employer

Identification Number) |

|

|

|

|

|

300 North Beach Street |

|

Daytona Beach, Florida |

|

32114 |

(Address of principal executive offices) |

|

(Zip Code) |

|

Registrant’s telephone number, including area code: (386) 252-9601 |

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.10 Par Value |

|

BRO |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

(b) (c)

Appointment of Chief Operating Officer

On February 23, 2025, Brown & Brown, Inc. (the "Company") entered into an agreement with Stephen P. Hearn (the "Service Agreement"), under which Mr. Hearn will become the Company's Executive Vice President and Chief Operating Officer, effective March 3, 2025. In connection with his entry into the Service Agreement, Mr. Hearn resigned from the Company’s Board of Directors (the “Board”), effective as of February 23, 2025. Mr. Hearn was not a member of any standing committees of the Board.

Mr. Hearn, age 58, began his insurance career in 1989, most recently holding roles with The Ardonagh Group from November 2021 until July 2024. During his time with The Ardonagh Group, he served as chief executive officer of Ardonagh Specialty Holdings Limited from November 2021 until September 2022; as chief executive officer of Ardonagh Capital Solutions Holdings, The Ardonagh Group’s holding company for its reinsurance broking, captives and MGA businesses, from February 2023 until July 2024; and as chief executive officer of Inver Re, The Ardonagh Group’s dedicated reinsurance broking unit, from November 2021 until July 2024. He also served as a director of Ardonagh International from May 2023 to July 2024. Previously, he served as chief executive officer of Corant Global, a subsidiary of BGC Partners, Inc. (“BGC”), from February 2019 until the sale of BGC’s insurance brokerage division to The Ardonagh Group in November 2021 and as the chief executive officer of Ed Broking Group Limited from 2015 until its acquisition by BGC in February 2019. Mr. Hearn held roles with Willis Group Holdings plc and its businesses from 2008 until 2015, including president and deputy chief executive officer of Willis Group Holdings plc, chief executive officer of Willis Re, chairman and chief executive officer of Willis Global and chief executive officer of Willis Limited. Prior to that, he held senior leadership positions with Hilb, Rogal & Hobbs; Glencairn Limited; Marsh Affinity Europe & Middle East; Marsh Affinity UK and Sedgwick Affinity Group Services.

Under the Service Agreement, Mr. Hearn will: (1) receive an annual salary of £588,800; (2) be eligible to receive a cash incentive payment with an estimated target cash incentive amount of £1,213,000 for calendar year 2025 (pro-rated for time employed in 2025 and subject to reduction in the event of unexpectedly poor financial performance of the Company or the commission of acts of malfeasance by recipient), payable in the first quarter of 2026; (3) upon approval by the Compensation Committee of the Board, which is expected to occur before March 31, 2025, receive long-term equity incentives grants of £1,213,000 (based on the value of the Company’s stock on the last business day preceding the date of grant) under the Brown & Brown, Inc. 2019 Stock Incentive Plan (“2019 SIP”) that will fully vest five years after the date of grant, subject to certain conditions, including the achievement of certain performance targets applicable to 75% of the grants; (4) beginning in 2026, be eligible to receive annual long-term equity incentive grants, which, for 2026 are expected to be £646,000 (based on the value of the Company’s stock on the last business day preceding the date of grant), under the 2019 SIP that will fully vest five years after the date of grant, subject to certain conditions, including the achievement of certain performance targets applicable to 75% of the grants; and (5) will be auto-enrolled into a pension scheme on a salary sacrifice arrangement to meet the requirements of applicable law, or (if the Mr. Hearn opts-out in his own discretion, as provided by applicable law) in the alternative provided with an allowance in lieu thereof (being 10% per year of his annual salary), to be paid monthly via payroll, subject to tax and National Insurance (NI) contributions. In addition, Mr. Hearn will be eligible to participate in, among other things, the Company's private medical cover scheme for the benefit of him and his family, death in service scheme, group income protection scheme, save-as-you-earn plan, stock incentive plan and UK pension scheme.

There is no familial relationship between Mr. Hearn and any other executive officer or director of the Company, and there are no arrangements or understandings between Mr. Hearn and any other persons pursuant to which he was appointed. There are no transactions in which the Company was or is to be a participant and in which Mr. Hearn had or will have a direct or indirect material interest that are required to be reported pursuant to Item 404(a) of Regulation S-K.

(e)

Annual Cash Incentive for 2025

On February 24, 2025, the Compensation Committee of the Board of Directors (the “Compensation Committee”) of Brown & Brown, Inc. (the “Company”) adopted the annual cash incentive for 2025 for certain of the Company’s executive officers, including certain of the named executive officers, pursuant to which they are eligible to receive a cash incentive payment based on the achievement of certain performance objectives in 2025. The terms of the annual cash incentive are not contained in a formal written document.

The named executive officer’s annual cash incentive payment amount will consist of three components (the calculation of which may be adjusted by the Compensation Committee, at its discretion, to exclude the effect of items that are unusual in nature or infrequently occurring), which are as follows:

•The first component, which will affect 40% of the 2025 cash incentive amount, is based on specified organic revenue growth targets, which, for named executive officers whose responsibilities encompass the Company as a whole rather than being tied to a particular segment, will be calculated based upon the organic revenue growth of the Company as a whole, and for named executive officers with segment operational responsibilities, will be calculated based upon the organic revenue growth of the segment for which each such executive officer has oversight responsibility.

•The second component, which will affect 40% of the 2025 cash incentive amount, will be determined based upon performance of the Company’s adjusted EBITDAC margin (“EBITDAC Margin - Adjusted”), which is (i) the Company’s income before income taxes less amortization, depreciation, interest and the change in estimated acquisition earn-out payables, adjusted to exclude the (gain)/loss on disposal, divided by (ii) total revenues.

•The third component, which will affect 20% of the 2025 cash incentive amount, will be linked to the achievement of personal objectives of the named executive officer as determined by the Compensation Committee.

Each of the components described above contemplates a minimum payout of 0% of each named executive officer’s target cash incentive amount and a maximum payout of 200% of each named executive officer’s target cash incentive amount. The target cash incentive amounts for our named executive officers for 2025 are as follows: J. Powell Brown – $3,750,000; P. Barrett Brown – $1,800,000; R. Andrew Watts – $1,000,000; J. Scott Penny – $1,000,000; and Chris L. Walker - $1,400,000.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

BROWN & BROWN, INC.

(Registrant) |

|

|

|

|

Date: |

February 25, 2025 |

By: |

/s/ Anthony M. Robinson |

|

|

|

Anthony M. Robinson

Secretary |

v3.25.0.1

Document And Entity Information

|

Feb. 23, 2025 |

| Cover [Abstract] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000079282

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 23, 2025

|

| Entity Registrant Name |

BROWN & BROWN, INC.

|

| Entity Incorporation, State or Country Code |

FL

|

| Securities Act File Number |

001-13619

|

| Entity Tax Identification Number |

59-0864469

|

| Entity Address, Address Line One |

300 North Beach Street

|

| Entity Address, City or Town |

Daytona Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

32114

|

| City Area Code |

(386)

|

| Local Phone Number |

252-9601

|

| Entity Information, Former Legal or Registered Name |

N/A

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common Stock, $0.10 Par Value

|

| Trading Symbol |

BRO

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

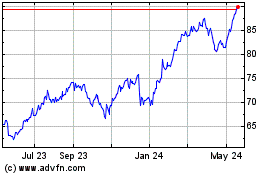

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Feb 2025 to Mar 2025

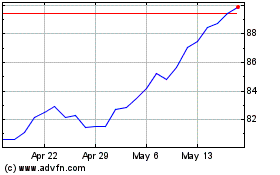

Brown and Brown (NYSE:BRO)

Historical Stock Chart

From Mar 2024 to Mar 2025